444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Ukraine container glass market represents a vital segment of the country’s manufacturing and packaging industry, serving diverse sectors including food and beverage, pharmaceuticals, cosmetics, and chemicals. Despite facing significant challenges due to ongoing geopolitical tensions and economic disruptions, the Ukrainian container glass industry demonstrates remarkable resilience and adaptation capabilities. The market encompasses various glass packaging solutions, from traditional bottles and jars to specialized containers designed for specific industrial applications.

Market dynamics in Ukraine’s container glass sector reflect both historical strengths and contemporary challenges. The country’s rich industrial heritage in glass manufacturing, combined with abundant raw material resources and skilled workforce, provides a solid foundation for market development. However, current market conditions require strategic adaptation and innovative approaches to maintain operational continuity and competitive positioning.

Regional distribution shows concentration in western and central Ukraine, where manufacturing facilities have maintained better operational stability. The market serves both domestic consumption needs and export opportunities to neighboring European markets, with growth rates showing moderate recovery patterns in accessible regions. Industry participants focus on maintaining production capabilities while exploring new market opportunities and technological upgrades.

The Ukraine container glass market refers to the comprehensive ecosystem of glass packaging manufacturing, distribution, and consumption within Ukrainian territory, encompassing production facilities, supply chain networks, and end-user applications across multiple industries. This market includes various glass container types such as bottles, jars, vials, and specialized packaging solutions designed for food preservation, beverage storage, pharmaceutical applications, and industrial use.

Container glass manufacturing in Ukraine involves sophisticated production processes utilizing locally sourced raw materials including silica sand, soda ash, and limestone. The market structure includes both large-scale industrial producers and smaller specialized manufacturers, creating a diverse supply base capable of serving different market segments and customer requirements.

Market scope extends beyond simple packaging solutions to include value-added services such as custom design, specialized coatings, and integrated supply chain management. The Ukrainian container glass market plays a crucial role in supporting domestic industries while contributing to the country’s export economy through both finished products and raw glass materials.

Strategic positioning of Ukraine’s container glass market reflects a complex interplay of traditional manufacturing strengths and contemporary market challenges. The industry maintains significant production capacity in operational regions, with manufacturers adapting to changed market conditions through flexible production strategies and diversified customer bases. Key market segments include food and beverage packaging, which accounts for approximately 60% of total demand, followed by pharmaceutical and cosmetic applications.

Operational resilience has become a defining characteristic of the Ukrainian container glass market, with companies implementing innovative solutions to maintain production continuity. Supply chain adaptations include alternative sourcing strategies, modified distribution networks, and enhanced inventory management practices. The market demonstrates particular strength in serving essential industries such as food processing and pharmaceutical manufacturing.

Growth opportunities emerge from increased demand for sustainable packaging solutions and import substitution initiatives. Domestic manufacturers benefit from reduced competition from traditional import sources, creating opportunities for market share expansion. Export potential remains significant for western Ukrainian producers with access to European markets, particularly in specialized glass container segments.

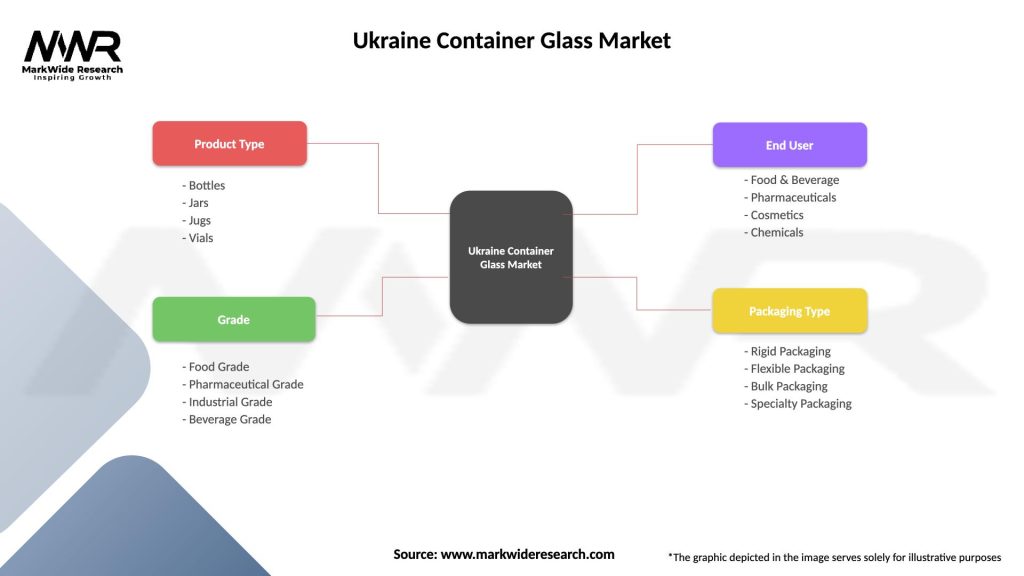

Market segmentation reveals distinct patterns in demand and supply dynamics across different container glass categories:

Production capabilities vary significantly across different regions, with western Ukrainian facilities maintaining higher operational rates compared to other areas. Manufacturing efficiency improvements of approximately 15-20% have been achieved through process optimization and resource management strategies.

Domestic demand sustainability serves as a primary market driver, with essential industries maintaining consistent requirements for glass packaging solutions. Food processing companies, pharmaceutical manufacturers, and beverage producers continue operations in accessible regions, creating stable demand patterns for container glass products. The emphasis on food security and domestic production capabilities strengthens demand for locally manufactured packaging solutions.

Import substitution initiatives provide significant growth opportunities for Ukrainian container glass manufacturers. Reduced availability of imported glass containers creates market space for domestic producers to expand their customer base and increase production volumes. Government policies supporting local manufacturing and supply chain resilience further enhance these opportunities.

Sustainability trends drive increased preference for glass packaging over alternative materials. Environmental consciousness among consumers and businesses promotes glass containers as recyclable and environmentally friendly packaging solutions. The circular economy approach supports glass recycling initiatives and sustainable manufacturing practices.

Export market access through western Ukrainian facilities provides additional growth drivers. European market demand for glass containers, combined with competitive production costs, creates export opportunities for manufacturers with operational capabilities and logistics access. Specialized glass products command premium pricing in international markets.

Operational disruptions represent the most significant constraint affecting the Ukrainian container glass market. Infrastructure damage, power supply interruptions, and transportation challenges limit production capabilities and market reach. Manufacturing facilities in affected regions face reduced operational capacity and increased production costs.

Supply chain complications create ongoing challenges for raw material procurement and finished product distribution. Traditional supply routes have been disrupted, requiring alternative sourcing strategies and modified logistics networks. Increased transportation costs and longer delivery times affect overall market competitiveness and customer service capabilities.

Energy cost volatility significantly impacts glass manufacturing operations, which require substantial energy inputs for melting and forming processes. Fluctuating energy prices and supply reliability concerns affect production planning and cost management strategies. Manufacturers must implement energy efficiency measures and alternative energy solutions to maintain operational viability.

Workforce availability challenges affect production capacity and operational continuity. Skilled labor shortages in certain regions, combined with population displacement, create staffing difficulties for manufacturing facilities. Training and retention programs become essential for maintaining production capabilities and technical expertise.

Reconstruction market potential presents substantial long-term opportunities for container glass manufacturers. Future rebuilding efforts will require significant glass packaging supplies for food processing, beverage production, and pharmaceutical manufacturing facilities. Early positioning in reconstruction supply chains could provide competitive advantages for established manufacturers.

European market integration offers expanded opportunities for Ukrainian glass container producers. EU market access preferences and trade agreements create favorable conditions for export growth. Specialized glass products and custom manufacturing capabilities can command premium pricing in European markets, particularly for pharmaceutical and cosmetic applications.

Technology modernization opportunities arise from the need to rebuild and upgrade manufacturing capabilities. Investment in advanced glass forming technologies, energy-efficient furnaces, and automated production systems can improve competitiveness and operational efficiency. Government and international support programs may provide funding for technological upgrades.

Sustainable packaging leadership positions Ukrainian manufacturers to capitalize on growing environmental consciousness. Development of eco-friendly glass containers, recycling programs, and sustainable manufacturing practices can differentiate Ukrainian products in both domestic and international markets. Green technology adoption supports long-term market positioning.

Competitive landscape in the Ukrainian container glass market has evolved significantly, with operational manufacturers gaining market share through continued production capabilities. Regional concentration of manufacturing activities creates localized competitive dynamics, while supply chain disruptions affect traditional competitive relationships. Companies with flexible production capabilities and diversified customer bases demonstrate stronger market positions.

Pricing dynamics reflect increased production costs and supply chain complexities. Raw material price volatility, energy cost fluctuations, and transportation expense increases contribute to upward pressure on container glass pricing. However, reduced import competition provides opportunities for domestic manufacturers to maintain profitable pricing structures while serving essential market needs.

Innovation drivers focus on operational efficiency and product differentiation. Manufacturers invest in process improvements, quality enhancements, and specialized product development to maintain competitive advantages. Efficiency gains of approximately 12-18% have been achieved through optimized production scheduling and resource management strategies.

Customer relationship evolution emphasizes partnership approaches and supply chain collaboration. Long-term contracts and strategic partnerships provide stability for both manufacturers and customers. Value-added services including inventory management, custom packaging design, and logistics support strengthen customer relationships and market positioning.

Data collection approaches for analyzing the Ukrainian container glass market utilize multiple sources and methodologies to ensure comprehensive market understanding. Primary research includes direct engagement with industry participants, including manufacturers, suppliers, distributors, and end-users across accessible regions. Survey methodologies and structured interviews provide insights into current market conditions, operational challenges, and future expectations.

Secondary research integration incorporates industry reports, government statistics, trade association data, and international market analysis to provide broader context and historical perspective. MarkWide Research analytical frameworks ensure systematic evaluation of market trends, competitive dynamics, and growth opportunities while accounting for unique market conditions and operational constraints.

Regional analysis methodology recognizes varying market conditions across different Ukrainian regions. Segmented analysis approaches account for operational capabilities, supply chain access, and market demand patterns in different geographic areas. This methodology provides nuanced understanding of regional market dynamics and localized opportunities.

Validation processes include cross-referencing multiple data sources, expert consultation, and industry participant feedback to ensure accuracy and relevance of market insights. Continuous monitoring and analysis updates reflect rapidly changing market conditions and emerging trends affecting the container glass industry.

Western Ukraine maintains the strongest market position with approximately 45% of operational capacity concentrated in this region. Manufacturing facilities in Lviv, Ivano-Frankivsk, and surrounding areas demonstrate higher operational stability and better access to European export markets. Supply chain connectivity and infrastructure reliability support continued production activities and customer service capabilities.

Central Ukraine represents approximately 30% of market activity with mixed operational conditions across different areas. Kyiv region facilities face varying challenges but maintain significant production capabilities for serving domestic market needs. Strategic location advantages support distribution to multiple market segments and customer bases.

Northern regions account for roughly 15% of market presence with limited operational activities due to proximity to conflict areas. Some facilities maintain reduced production schedules while others focus on equipment preservation and future restart planning. Market potential remains significant for post-conflict recovery periods.

Southern and Eastern regions represent the remaining 10% of current market activity with severely constrained operations. Facilities in these areas face significant operational challenges but maintain strategic importance for future market development. Alternative production arrangements and partnership strategies help maintain market presence and customer relationships.

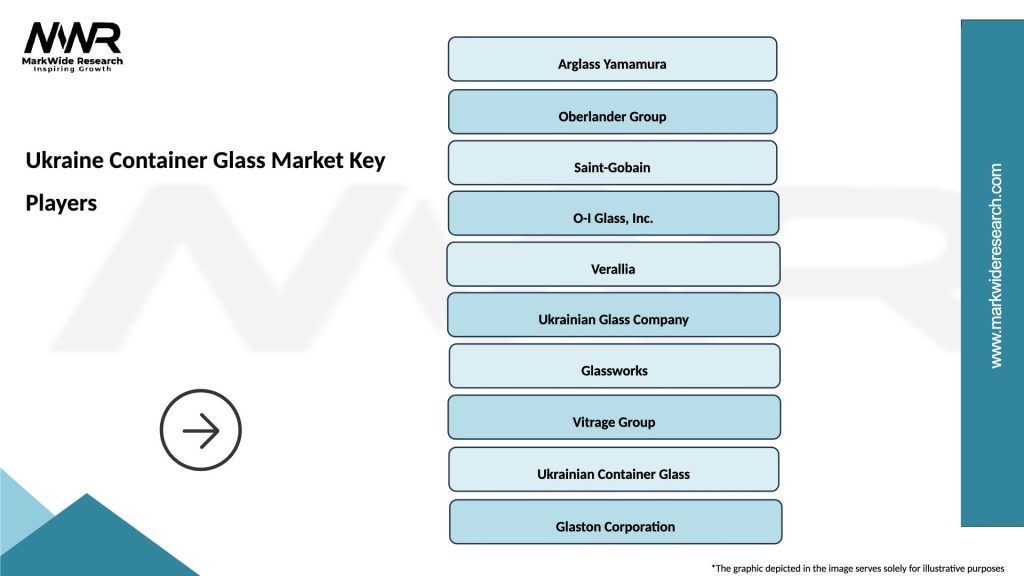

Market leadership in the Ukrainian container glass sector reflects operational capabilities and regional positioning rather than traditional market share metrics. Key industry participants include:

Competitive strategies emphasize operational continuity, customer service excellence, and product quality maintenance. Companies with diversified production capabilities and flexible manufacturing systems demonstrate stronger competitive positions. Strategic partnerships and supply chain collaboration become increasingly important competitive differentiators.

Market consolidation trends emerge as operational manufacturers gain market share from disrupted competitors. Acquisition opportunities and partnership arrangements create potential for industry restructuring and capacity optimization. International partnerships provide access to technology, financing, and export market opportunities.

By Product Type:

By Application:

By Manufacturing Process:

Food packaging containers demonstrate the strongest market resilience with consistent demand from essential food processing industries. Preservation jar production maintains steady volumes supporting domestic food security initiatives. Growth rates in this category show stable performance despite overall market challenges, with manufacturers focusing on quality improvements and supply chain reliability.

Beverage bottle production adapts to changing consumption patterns and distribution challenges. Alcoholic beverage containers maintain demand from domestic producers, while non-alcoholic beverage packaging serves both local and export markets. Specialized bottle designs for premium products create differentiation opportunities and higher value positioning.

Pharmaceutical glass containers represent the highest value segment with stringent quality requirements and regulatory compliance needs. Vial and ampoule production requires specialized equipment and quality control systems. This segment shows growth potential as domestic pharmaceutical production increases and export opportunities develop.

Industrial glass containers serve specialized applications in chemical processing, laboratory use, and technical applications. Custom manufacturing capabilities and specialized coatings provide competitive advantages. Market demand correlates with industrial activity levels and infrastructure development projects.

Manufacturers benefit from reduced import competition and increased domestic market opportunities. Operational facilities gain market share through continued production capabilities and customer service excellence. Investment in efficiency improvements and technology upgrades provides long-term competitive advantages and operational cost reductions.

Customers receive improved supply chain reliability and closer supplier relationships. Local sourcing reduces transportation costs and delivery risks while supporting supply chain resilience. Custom manufacturing capabilities and technical support services enhance product development and market positioning for end-users.

Suppliers gain from increased demand for raw materials and manufacturing equipment. Local sourcing preferences create opportunities for domestic suppliers to expand market presence. Long-term supply agreements provide stability and growth opportunities for material suppliers and service providers.

Government stakeholders benefit from maintained industrial capacity and employment opportunities. Tax revenue generation and export earnings support economic stability. Industrial self-sufficiency in essential packaging materials contributes to national security and economic resilience objectives.

International partners find opportunities for technology transfer, investment, and market development. European market integration creates mutual benefits through trade relationships and industrial cooperation. Technical assistance and financing programs support industry modernization and capacity expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability focus drives increased emphasis on glass recycling and circular economy principles. Manufacturers implement recycling programs and sustainable production practices to meet environmental requirements and customer preferences. Recycled content integration reaches approximately 25-30% in many product lines, supporting cost reduction and environmental objectives.

Digitalization adoption accelerates as manufacturers implement digital technologies for production optimization and customer service enhancement. Smart manufacturing systems, predictive maintenance, and digital quality control improve operational efficiency and product consistency. Digital customer interfaces and e-commerce capabilities expand market reach and service delivery.

Customization demand increases as customers seek differentiated packaging solutions and brand positioning advantages. Custom bottle designs, specialized coatings, and unique container shapes create value-added opportunities. Premium packaging segments show growth rates exceeding traditional commodity glass containers.

Supply chain localization becomes a strategic priority for both manufacturers and customers. Regional supply networks and local sourcing preferences support supply chain resilience and cost management. Partnership approaches and long-term agreements strengthen supplier-customer relationships and market stability.

Production capacity adaptations include facility modifications and process optimizations to maintain operational efficiency under challenging conditions. Manufacturers implement flexible production scheduling and multi-product capabilities to maximize facility utilization. Capacity utilization rates in operational facilities reach approximately 75-85% through optimized production planning.

Technology investments focus on energy efficiency improvements and production automation. Advanced furnace technologies and heat recovery systems reduce energy consumption and operational costs. Quality control automation and digital monitoring systems enhance product consistency and reduce waste generation.

Market expansion initiatives include new customer development and product line diversification. Manufacturers explore opportunities in pharmaceutical packaging, specialty containers, and export markets. Strategic partnerships with international companies provide access to technology, financing, and market development resources.

Sustainability programs encompass recycling initiatives, energy efficiency projects, and environmental compliance improvements. MWR analysis indicates that environmental performance becomes increasingly important for customer selection and market positioning. Green manufacturing practices support both cost reduction and market differentiation objectives.

Operational excellence should remain the primary focus for Ukrainian container glass manufacturers. Maintaining production capabilities, ensuring product quality, and providing reliable customer service create competitive advantages in current market conditions. Investment in maintenance, training, and process improvements supports long-term operational sustainability.

Market diversification strategies help reduce dependence on single customer segments or geographic markets. Developing capabilities in pharmaceutical packaging, specialty containers, and export markets provides revenue stability and growth opportunities. Customer relationship management and service excellence become critical success factors.

Supply chain optimization requires continuous attention to raw material sourcing, logistics efficiency, and inventory management. Alternative supplier development and regional sourcing strategies support operational continuity. Partnership approaches with suppliers and customers strengthen supply chain resilience and market positioning.

Technology planning should focus on energy efficiency, production automation, and quality improvements. Phased investment approaches allow for gradual modernization while maintaining operational capabilities. Government and international support programs may provide financing opportunities for technology upgrades and capacity expansion.

Market recovery prospects depend on broader economic stabilization and infrastructure restoration. Reconstruction efforts will create substantial demand for glass packaging across multiple industries. Early positioning in recovery supply chains and customer relationships provides competitive advantages for established manufacturers.

Growth projections indicate potential for significant market expansion as normal economic activities resume. Domestic demand recovery combined with export market development could drive growth rates of 8-12% annually in post-stabilization periods. Investment in production capacity and technology will be essential for capturing growth opportunities.

Industry transformation may result from current challenges and adaptation requirements. Manufacturers with operational continuity and customer relationship maintenance will be positioned for market leadership. Consolidation opportunities and strategic partnerships could reshape competitive dynamics and market structure.

International integration prospects include deeper European market participation and technology partnerships. EU market access preferences and reconstruction support programs create opportunities for Ukrainian glass manufacturers. MarkWide Research projections suggest that export market development could account for 30-40% of production volumes in recovered market conditions.

The Ukraine container glass market demonstrates remarkable resilience and adaptation capabilities despite facing unprecedented challenges. Operational manufacturers maintain essential production capabilities while serving domestic market needs and exploring export opportunities. Market dynamics reflect both immediate operational constraints and significant long-term growth potential.

Strategic positioning for market participants requires focus on operational excellence, customer relationship management, and supply chain optimization. Companies with flexible production capabilities and diversified market presence show stronger competitive positions. Investment in technology, sustainability, and market development supports long-term success in evolving market conditions.

Future opportunities in reconstruction demand, import substitution, and European market integration provide substantial growth potential for Ukrainian container glass manufacturers. Success will depend on maintaining operational capabilities, building strategic partnerships, and investing in modernization and capacity expansion. The industry’s traditional strengths in manufacturing expertise and raw material access provide solid foundations for future market development and competitive positioning.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. This type of glass is known for its durability, recyclability, and ability to preserve the quality of its contents.

What are the key players in the Ukraine Container Glass Market?

Key players in the Ukraine Container Glass Market include companies like Stirol, OJSC Dniproglass, and OJSC Kharkiv Glass Factory, which are known for their production of glass containers for various industries, among others.

What are the growth factors driving the Ukraine Container Glass Market?

The growth of the Ukraine Container Glass Market is driven by increasing demand for sustainable packaging solutions, the rise in the beverage industry, and a growing preference for glass over plastic due to health and environmental concerns.

What challenges does the Ukraine Container Glass Market face?

The Ukraine Container Glass Market faces challenges such as high production costs, competition from alternative packaging materials, and fluctuations in raw material availability, which can impact overall market stability.

What opportunities exist in the Ukraine Container Glass Market?

Opportunities in the Ukraine Container Glass Market include the expansion of the food and beverage sector, increasing investments in recycling technologies, and the potential for innovation in glass design and functionality.

What trends are shaping the Ukraine Container Glass Market?

Trends in the Ukraine Container Glass Market include a shift towards eco-friendly packaging, advancements in glass manufacturing technologies, and a growing consumer preference for premium glass packaging in the food and beverage sectors.

Ukraine Container Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Jugs, Vials |

| Grade | Food Grade, Pharmaceutical Grade, Industrial Grade, Beverage Grade |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Chemicals |

| Packaging Type | Rigid Packaging, Flexible Packaging, Bulk Packaging, Specialty Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Ukraine Container Glass Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at