444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany rechargeable battery market represents one of Europe’s most dynamic and technologically advanced energy storage sectors, driven by the country’s ambitious renewable energy transition and robust automotive industry transformation. Germany’s commitment to achieving carbon neutrality by 2045 has positioned rechargeable batteries as a critical component in the nation’s energy infrastructure, spanning applications from electric vehicles to grid-scale energy storage systems.

Market dynamics in Germany reflect the country’s leadership in industrial innovation and environmental sustainability. The rechargeable battery sector encompasses lithium-ion, nickel-metal hydride, and emerging solid-state technologies, with lithium-ion batteries commanding approximately 78% market share across all applications. Electric vehicle adoption continues to accelerate, with battery electric vehicles representing 17.7% of new car registrations in recent periods, significantly driving demand for high-performance automotive batteries.

Industrial applications constitute another major growth driver, as German manufacturers increasingly adopt battery-powered equipment and automated systems to enhance operational efficiency and reduce carbon footprints. The country’s renewable energy sector, particularly wind and solar installations, requires sophisticated energy storage solutions to manage grid stability and optimize power distribution, creating substantial opportunities for stationary battery systems.

Technological advancement remains a cornerstone of Germany’s rechargeable battery market, with significant investments in research and development focusing on improving energy density, charging speeds, and battery lifecycle management. The market benefits from strong government support through various incentive programs and regulatory frameworks that promote clean energy adoption and sustainable transportation solutions.

The Germany rechargeable battery market refers to the comprehensive ecosystem of secondary battery technologies, manufacturing, distribution, and application sectors within the German economy that can be recharged and reused multiple times through electrical energy input. This market encompasses various battery chemistries including lithium-ion, nickel-metal hydride, lead-acid, and emerging technologies such as solid-state and sodium-ion batteries designed for diverse applications ranging from consumer electronics to industrial energy storage systems.

Rechargeable batteries in the German context serve as critical enablers of the country’s energy transition strategy, supporting applications in electric mobility, renewable energy integration, industrial automation, and consumer electronics. The market includes battery cells, modules, packs, and complete energy storage systems, along with associated services such as battery management systems, recycling, and lifecycle optimization solutions.

Key characteristics of Germany’s rechargeable battery market include advanced manufacturing capabilities, stringent quality standards, environmental sustainability focus, and integration with the country’s broader industrial and energy infrastructure. The market operates within a regulatory framework that emphasizes safety, environmental protection, and circular economy principles, reflecting Germany’s commitment to sustainable development and technological innovation.

Germany’s rechargeable battery market demonstrates exceptional growth momentum, driven by the convergence of automotive electrification, renewable energy expansion, and industrial digitalization trends. The market exhibits robust fundamentals supported by strong domestic demand, advanced manufacturing capabilities, and comprehensive government policy support for clean energy technologies.

Electric vehicle adoption serves as the primary market catalyst, with German automotive manufacturers investing heavily in battery technology development and local production capabilities. Major players including BMW, Mercedes-Benz, and Volkswagen Group are establishing comprehensive battery value chains, from raw material sourcing to recycling, creating substantial market opportunities for battery suppliers and technology providers.

Energy storage applications represent another significant growth vector, as Germany’s renewable energy capacity continues expanding. Grid-scale battery installations are becoming increasingly important for managing intermittent renewable generation and maintaining grid stability, with utility-scale projects showing 45% annual growth in deployment rates.

Market challenges include raw material supply chain dependencies, particularly for lithium, cobalt, and rare earth elements, along with intense global competition and evolving regulatory requirements. However, Germany’s strong industrial base, research capabilities, and commitment to sustainability position the market favorably for continued expansion and technological leadership in the rechargeable battery sector.

Strategic market insights reveal several critical trends shaping Germany’s rechargeable battery landscape:

Primary market drivers propelling Germany’s rechargeable battery sector include the country’s comprehensive approach to energy transition and industrial modernization. Government policy initiatives play a crucial role, with substantial financial incentives for electric vehicle purchases, renewable energy installations, and industrial decarbonization projects creating sustained demand for advanced battery technologies.

Automotive industry transformation represents the most significant driver, as German car manufacturers commit to electrifying their vehicle portfolios in response to stringent emissions regulations and changing consumer preferences. The phase-out of internal combustion engines and transition to electric powertrains necessitates massive battery capacity deployment, with automotive applications showing 35% annual growth in battery demand.

Renewable energy expansion creates substantial opportunities for energy storage systems, as Germany continues increasing wind and solar capacity while addressing grid stability challenges. Battery storage systems enable optimal utilization of renewable generation, providing grid services and supporting the integration of variable energy sources into the national power system.

Industrial digitalization and automation trends drive demand for reliable battery solutions in manufacturing, logistics, and infrastructure applications. German industries increasingly adopt battery-powered equipment, autonomous systems, and backup power solutions to enhance operational efficiency and reduce environmental impact, creating diverse market opportunities beyond traditional automotive and consumer electronics applications.

Market restraints affecting Germany’s rechargeable battery sector include supply chain vulnerabilities and raw material dependencies that create cost volatility and availability challenges. Critical material sourcing, particularly for lithium, cobalt, nickel, and rare earth elements, remains concentrated in geographically limited regions, exposing German battery manufacturers to supply disruptions and price fluctuations.

High capital requirements for battery manufacturing facilities and research and development activities present barriers to market entry and expansion. The substantial investments needed for gigafactory construction, equipment procurement, and technology development limit the number of companies capable of competing effectively in the market, potentially constraining supply capacity growth.

Technical challenges related to battery performance, safety, and lifecycle management continue to influence market development. Issues such as thermal management, charging infrastructure compatibility, and end-of-life recycling require ongoing technological advancement and regulatory compliance, adding complexity and costs to battery system deployment.

Regulatory complexity and evolving safety standards create compliance challenges for battery manufacturers and system integrators. The need to meet stringent European Union regulations regarding battery performance, environmental impact, and recycling requirements increases operational costs and development timelines, particularly for companies introducing new battery technologies or entering new application markets.

Significant market opportunities emerge from Germany’s leadership in industrial innovation and commitment to sustainable technology development. Next-generation battery technologies, including solid-state batteries, sodium-ion systems, and advanced lithium-ion chemistries, present substantial growth potential as German research institutions and companies advance these technologies toward commercial viability.

Circular economy initiatives create new business models around battery recycling, refurbishment, and second-life applications. The development of comprehensive battery lifecycle management services, from initial deployment through multiple use phases to final material recovery, offers opportunities for specialized service providers and technology companies to capture additional value from battery investments.

Grid modernization projects and smart city initiatives provide expanding markets for stationary energy storage systems. As German utilities and municipalities invest in grid infrastructure upgrades and renewable energy integration, demand for utility-scale battery systems, distributed energy storage, and microgrid solutions continues growing, creating opportunities for system integrators and technology providers.

Export market potential leverages Germany’s technological expertise and manufacturing capabilities to serve international markets. German battery companies can capitalize on their advanced technology development and quality reputation to expand into emerging markets and support global electrification trends, particularly in automotive and industrial applications where German engineering excellence is highly valued.

Market dynamics in Germany’s rechargeable battery sector reflect the complex interplay between technological advancement, regulatory evolution, and industrial transformation. Supply and demand balance continues shifting as automotive electrification accelerates faster than initially projected, creating temporary capacity constraints while spurring investment in new manufacturing facilities and production technologies.

Competitive dynamics intensify as traditional automotive suppliers, technology companies, and new market entrants compete for market share across different application segments. The convergence of automotive, energy, and technology sectors creates both collaboration opportunities and competitive pressures, with companies forming strategic partnerships to leverage complementary capabilities and market access.

Technology evolution drives continuous market transformation, with battery performance improvements enabling new applications and business models. Energy density increases of 8-12% annually and cost reductions support broader market adoption while creating opportunities for existing applications to upgrade to more advanced battery solutions.

Regulatory dynamics shape market development through evolving standards, incentive programs, and environmental requirements. The implementation of battery passport systems, extended producer responsibility frameworks, and carbon footprint regulations influences product development strategies and market positioning for battery manufacturers and system integrators operating in the German market.

Comprehensive research methodology employed for analyzing Germany’s rechargeable battery market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights. Primary research activities include structured interviews with industry executives, technology experts, and market participants across the battery value chain, from raw material suppliers to end-user applications.

Secondary research encompasses analysis of government publications, industry reports, patent filings, and regulatory documents to understand market trends, policy impacts, and technological developments. Financial analysis of public companies, investment flows, and merger and acquisition activities provides insights into market dynamics and competitive positioning.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to project market development under different assumptions regarding technology adoption, regulatory changes, and economic conditions. Cross-validation of findings through multiple analytical approaches ensures robustness of market projections and strategic recommendations.

Expert validation processes involve review of findings with industry specialists, academic researchers, and policy experts to verify assumptions, validate conclusions, and incorporate additional insights. This collaborative approach ensures that research outcomes reflect current market realities and provide actionable intelligence for market participants and stakeholders.

Regional analysis of Germany’s rechargeable battery market reveals distinct geographical patterns reflecting industrial concentration, infrastructure development, and policy implementation variations across different states and metropolitan areas. Baden-Württemberg emerges as the dominant region, accounting for approximately 35% of national battery demand, driven by the concentration of automotive manufacturers and suppliers in the Stuttgart region.

Bavaria represents another significant market region, with BMW’s electric vehicle production and extensive automotive supply chain creating substantial battery demand. The region benefits from strong research institutions and technology companies that support battery innovation and development activities, contributing approximately 28% of total market activity.

North Rhine-Westphalia demonstrates growing importance in the rechargeable battery sector, particularly in industrial applications and energy storage systems. The region’s manufacturing base and renewable energy installations drive demand for battery solutions, while its strategic location supports distribution and logistics activities for the broader European market.

Northern German states, including Lower Saxony and Schleswig-Holstein, show increasing battery market activity related to wind energy installations and grid storage applications. The region’s renewable energy leadership creates opportunities for utility-scale battery deployments and grid integration projects, supporting the national energy transition objectives.

Competitive landscape analysis reveals a diverse ecosystem of international battery manufacturers, German automotive suppliers, and specialized technology companies competing across different market segments. Market leadership varies by application, with different companies dominating automotive, industrial, and energy storage segments based on their technological capabilities and market positioning.

Key market participants include:

Competitive strategies focus on technology differentiation, local manufacturing capabilities, and strategic partnerships with German automotive and industrial companies. Companies invest heavily in research and development, production capacity expansion, and supply chain localization to strengthen their competitive positions in the German market.

Market segmentation analysis provides detailed insights into the diverse applications and technology categories within Germany’s rechargeable battery market. By Technology:

By Application:

By End-User:

Automotive category dominates Germany’s rechargeable battery market, driven by aggressive electrification timelines from German car manufacturers. Battery electric vehicles require high-energy-density lithium-ion batteries with advanced thermal management and fast-charging capabilities, creating demand for premium battery solutions with energy densities exceeding 250 Wh/kg.

Energy storage systems category shows rapid growth as Germany expands renewable energy capacity and modernizes grid infrastructure. Utility-scale installations typically utilize lithium iron phosphate (LFP) batteries for their safety characteristics and long cycle life, while residential systems often employ nickel manganese cobalt (NMC) batteries for higher energy density in space-constrained applications.

Industrial applications encompass diverse battery requirements ranging from high-power applications in automated guided vehicles to long-duration backup power systems. Manufacturing facilities increasingly adopt battery-powered equipment to reduce emissions and improve operational flexibility, driving demand for robust industrial-grade battery solutions.

Consumer electronics category maintains steady demand for compact, high-performance batteries in smartphones, laptops, and portable devices. German consumers demonstrate strong preference for premium products with extended battery life and fast-charging capabilities, supporting demand for advanced lithium-ion technologies and emerging solid-state solutions.

Industry participants in Germany’s rechargeable battery market benefit from the country’s strong industrial ecosystem, advanced research capabilities, and supportive regulatory environment. Battery manufacturers gain access to sophisticated automotive and industrial customers with demanding performance requirements, driving continuous innovation and technology advancement.

Automotive companies benefit from local battery supply chains that reduce logistics costs, improve supply security, and enable closer collaboration on battery technology development. German automotive manufacturers leverage their engineering expertise to develop integrated battery systems that optimize vehicle performance and differentiate their electric vehicle offerings.

Energy companies and utilities capitalize on battery storage systems to optimize renewable energy integration, provide grid services, and develop new revenue streams. Grid-scale battery installations enable utilities to manage peak demand, provide frequency regulation services, and defer traditional infrastructure investments while supporting Germany’s renewable energy transition.

Technology companies and research institutions benefit from Germany’s strong innovation ecosystem, with opportunities to collaborate on advanced battery technologies, participate in government-funded research programs, and access skilled technical talent. Startup companies can leverage Germany’s supportive business environment and access to capital markets to scale innovative battery technologies and business models.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Germany’s rechargeable battery sector reflect broader technological, environmental, and economic developments. Battery technology evolution continues advancing toward higher energy densities, faster charging capabilities, and improved safety characteristics, with solid-state batteries emerging as the next major technological breakthrough.

Sustainability focus intensifies across the battery value chain, with companies implementing comprehensive environmental, social, and governance (ESG) strategies. Circular economy principles drive development of battery recycling technologies, second-life applications, and sustainable material sourcing practices, with recycling rates targeting 95% material recovery by 2030.

Manufacturing localization accelerates as companies establish European production facilities to reduce supply chain risks and support regional demand. German battery manufacturing capacity expansion includes both international companies establishing local operations and domestic companies scaling production capabilities to serve automotive and energy storage markets.

Digital integration transforms battery systems through advanced battery management systems, predictive analytics, and cloud-based monitoring services. Smart battery technologies enable optimized performance, predictive maintenance, and integration with digital energy management platforms, creating new service opportunities and business models.

Recent industry developments demonstrate the dynamic nature of Germany’s rechargeable battery market and the rapid pace of technological and business model innovation. Major automotive manufacturers continue announcing substantial investments in battery technology development and production capacity, with several companies establishing dedicated battery divisions and research centers.

Strategic partnerships between German companies and international battery manufacturers create new supply chain relationships and technology transfer opportunities. Joint ventures and licensing agreements enable German companies to access advanced battery technologies while providing international partners with market access and local manufacturing capabilities.

Government initiatives include substantial funding for battery research and development, manufacturing incentives, and infrastructure development programs. Public-private partnerships support the establishment of battery gigafactories, recycling facilities, and charging infrastructure networks, creating comprehensive ecosystem support for market development.

Regulatory developments include implementation of battery passport systems, extended producer responsibility frameworks, and carbon footprint requirements that influence product development and market strategies. European Union regulations regarding battery performance, safety, and environmental impact create standardized requirements that shape technology development and competitive positioning.

Strategic recommendations for market participants focus on building resilient supply chains, investing in next-generation technologies, and developing comprehensive sustainability strategies. MarkWide Research analysis indicates that companies should prioritize vertical integration opportunities and strategic partnerships to secure critical material access and reduce supply chain vulnerabilities.

Technology investment priorities should emphasize solid-state battery development, advanced manufacturing processes, and digital integration capabilities. Companies should allocate significant resources toward research and development activities that advance battery performance characteristics while reducing production costs and environmental impact.

Market positioning strategies should leverage Germany’s strengths in engineering excellence, quality manufacturing, and sustainability leadership. Differentiation opportunities exist in premium applications requiring advanced performance characteristics, comprehensive lifecycle services, and integrated system solutions that address specific customer requirements.

Partnership strategies should focus on building collaborative relationships across the battery value chain, from raw material suppliers to end-user applications. Strategic alliances with automotive manufacturers, energy companies, and technology providers can create competitive advantages and accelerate market penetration in key application segments.

Future outlook for Germany’s rechargeable battery market indicates continued robust growth driven by accelerating electrification trends and expanding energy storage applications. Market projections suggest sustained growth momentum with annual expansion rates of 25-30% across key application segments, supported by favorable policy environments and technological advancement.

Technology evolution will continue driving market transformation, with solid-state batteries expected to achieve commercial viability within the next decade and alternative chemistries gaining market share in specific applications. Performance improvements in energy density, charging speed, and cycle life will enable new applications and business models while reducing total cost of ownership for existing applications.

Market structure evolution will likely see increased consolidation as companies seek scale advantages and vertical integration opportunities. MWR analysis suggests that successful market participants will be those that can combine technological innovation with manufacturing excellence and comprehensive customer service capabilities.

Sustainability requirements will become increasingly important competitive factors, with companies needing to demonstrate comprehensive environmental stewardship throughout the battery lifecycle. Circular economy principles will drive new business models around battery recycling, refurbishment, and material recovery, creating additional value streams and competitive differentiation opportunities.

Germany’s rechargeable battery market stands at the forefront of the global energy transition, driven by the country’s commitment to sustainable development and technological innovation. The market demonstrates exceptional growth potential across automotive, energy storage, and industrial applications, supported by strong policy frameworks, advanced research capabilities, and robust industrial infrastructure.

Key success factors for market participants include technological excellence, supply chain resilience, and comprehensive sustainability strategies that address evolving customer requirements and regulatory expectations. The convergence of automotive electrification, renewable energy expansion, and industrial digitalization creates unprecedented opportunities for companies that can deliver innovative battery solutions and integrated system capabilities.

Future market development will be characterized by continued technological advancement, increasing sustainability requirements, and expanding application diversity. Companies that invest in next-generation technologies, build strategic partnerships, and develop comprehensive value chain capabilities will be best positioned to capitalize on the substantial growth opportunities in Germany’s dynamic rechargeable battery market.

What is Rechargeable Battery?

Rechargeable batteries are energy storage devices that can be charged and discharged multiple times. They are commonly used in various applications, including consumer electronics, electric vehicles, and renewable energy systems.

What are the key players in the Germany Rechargeable Battery Market?

Key players in the Germany Rechargeable Battery Market include companies like BASF, Varta AG, and Samsung SDI, which are involved in the production and development of advanced battery technologies, among others.

What are the main drivers of the Germany Rechargeable Battery Market?

The main drivers of the Germany Rechargeable Battery Market include the increasing demand for electric vehicles, the growth of renewable energy storage solutions, and advancements in battery technology that enhance performance and efficiency.

What challenges does the Germany Rechargeable Battery Market face?

Challenges in the Germany Rechargeable Battery Market include supply chain issues for raw materials, environmental concerns related to battery disposal, and competition from alternative energy storage technologies.

What opportunities exist in the Germany Rechargeable Battery Market?

Opportunities in the Germany Rechargeable Battery Market include the expansion of electric vehicle infrastructure, innovations in battery recycling technologies, and the increasing integration of batteries in smart grid applications.

What trends are shaping the Germany Rechargeable Battery Market?

Trends shaping the Germany Rechargeable Battery Market include the shift towards solid-state batteries, the rise of battery-as-a-service models, and the growing focus on sustainability and eco-friendly battery production methods.

Germany Rechargeable Battery Market

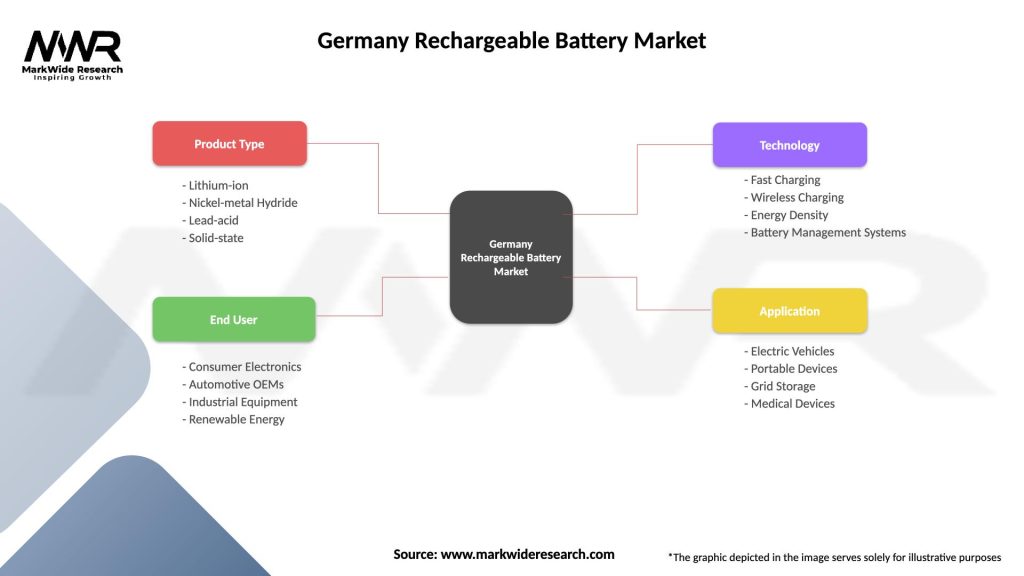

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-metal Hydride, Lead-acid, Solid-state |

| End User | Consumer Electronics, Automotive OEMs, Industrial Equipment, Renewable Energy |

| Technology | Fast Charging, Wireless Charging, Energy Density, Battery Management Systems |

| Application | Electric Vehicles, Portable Devices, Grid Storage, Medical Devices |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Rechargeable Battery Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at