444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Ecuador container glass market represents a dynamic and evolving sector within the country’s manufacturing landscape, driven by increasing demand from beverage, pharmaceutical, and food packaging industries. Container glass manufacturing in Ecuador has experienced steady growth, supported by the nation’s expanding consumer goods sector and rising environmental consciousness among businesses and consumers alike. The market encompasses various glass packaging solutions including bottles, jars, and specialty containers designed for diverse applications across multiple industries.

Market dynamics indicate robust expansion potential, with the sector benefiting from Ecuador’s strategic geographic location and growing industrial base. The container glass industry serves both domestic consumption needs and export opportunities throughout Latin America. Recent developments show increasing adoption of sustainable packaging solutions, with glass containers gaining preference due to their recyclability and premium positioning in consumer markets. Manufacturing capabilities have expanded significantly, with local producers investing in advanced furnace technologies and automated production systems to enhance efficiency and product quality.

Regional distribution shows concentration in key industrial zones, particularly around Quito and Guayaquil, where major manufacturing facilities operate. The market demonstrates strong correlation with Ecuador’s beverage industry growth, pharmaceutical sector expansion, and increasing consumer preference for premium packaging solutions. Technology adoption rates have accelerated, with manufacturers implementing energy-efficient melting systems and quality control technologies to meet international standards and reduce production costs.

The Ecuador container glass market refers to the comprehensive ecosystem of glass packaging manufacturing, distribution, and consumption within Ecuador’s borders, encompassing all aspects of container glass production from raw material processing to finished product delivery. This market includes manufacturers who produce glass bottles, jars, and containers for various industries, distributors who facilitate product movement throughout the supply chain, and end-users across beverage, pharmaceutical, food, and cosmetic sectors.

Container glass specifically denotes hollow glass products designed for packaging and storage applications, manufactured through high-temperature melting processes using silica sand, soda ash, limestone, and recycled glass cullet. The market encompasses both clear and colored glass containers, ranging from small pharmaceutical vials to large industrial bottles. Manufacturing processes involve sophisticated furnace operations, forming techniques, and quality control systems that ensure product integrity and compliance with industry standards.

Market scope extends beyond simple manufacturing to include recycling systems, supply chain logistics, and technological innovation in glass production. The Ecuador container glass market represents a critical component of the country’s circular economy initiatives, with emphasis on sustainable production practices and waste reduction strategies that align with global environmental standards.

Ecuador’s container glass market demonstrates significant growth momentum driven by expanding beverage consumption, pharmaceutical industry development, and increasing environmental awareness among consumers and businesses. The market benefits from strong domestic demand coupled with export opportunities to neighboring countries, creating a robust foundation for sustained expansion. Key market drivers include rising disposable income, urbanization trends, and growing preference for premium packaging solutions across multiple consumer segments.

Manufacturing infrastructure has undergone substantial modernization, with leading producers investing in energy-efficient technologies and automated production systems. The sector shows particular strength in beverage container production, accounting for approximately 65% of total container glass demand. Pharmaceutical applications represent the fastest-growing segment, driven by Ecuador’s expanding healthcare sector and increasing pharmaceutical manufacturing activities.

Competitive landscape features both established local manufacturers and international players, creating a dynamic market environment that fosters innovation and quality improvements. Sustainability initiatives have gained prominence, with manufacturers implementing comprehensive recycling programs and energy reduction strategies. The market outlook remains positive, supported by favorable demographic trends, industrial growth, and increasing integration with regional supply chains throughout Latin America.

Strategic analysis reveals several critical insights that define the Ecuador container glass market’s current position and future trajectory. The market demonstrates strong resilience and adaptability, with manufacturers successfully navigating economic fluctuations while maintaining production quality and customer satisfaction levels.

Primary growth drivers propelling the Ecuador container glass market forward encompass both demand-side factors and supply-side improvements that create favorable conditions for sustained expansion. These drivers reflect broader economic trends, consumer behavior changes, and technological advancements that collectively support market growth.

Consumer preference shifts toward premium packaging solutions significantly boost demand for glass containers across multiple industries. The beverage sector particularly benefits from this trend, as consumers increasingly associate glass packaging with product quality and environmental responsibility. Pharmaceutical industry expansion creates substantial demand for specialized glass containers, driven by Ecuador’s growing healthcare sector and increasing pharmaceutical manufacturing activities.

Environmental consciousness among consumers and businesses drives preference for recyclable packaging materials, positioning glass containers favorably against plastic alternatives. Government initiatives supporting sustainable manufacturing practices and circular economy principles provide regulatory backing for glass container adoption. The tourism industry growth in Ecuador creates additional demand for premium beverage packaging, particularly in the alcoholic beverage segment.

Technological advancements in glass manufacturing enable producers to offer improved product quality while reducing production costs. Export market opportunities throughout Latin America provide growth avenues beyond domestic consumption, supported by competitive manufacturing costs and strategic geographic positioning.

Significant challenges facing the Ecuador container glass market include various operational, economic, and competitive factors that may limit growth potential or create barriers to market expansion. Understanding these restraints enables stakeholders to develop appropriate mitigation strategies and maintain competitive positioning.

High energy costs represent a primary constraint for glass manufacturers, as container glass production requires intensive energy consumption for furnace operations and forming processes. Raw material price volatility affects production costs and profit margins, particularly for silica sand, soda ash, and other essential materials. Transportation costs for both raw materials and finished products impact overall competitiveness, especially for export markets.

Competition from alternative packaging materials, particularly plastic containers, poses ongoing challenges in price-sensitive market segments. Limited recycling infrastructure in some regions restricts the circular economy benefits that could enhance glass container attractiveness. Technical expertise requirements for advanced manufacturing processes create workforce development challenges and increase operational complexity.

Regulatory compliance costs associated with environmental standards and quality certifications require ongoing investment in monitoring and control systems. Economic fluctuations in Ecuador’s broader economy can impact consumer spending patterns and industrial demand for container glass products.

Emerging opportunities within the Ecuador container glass market present significant potential for growth and expansion across multiple dimensions. These opportunities arise from evolving market conditions, technological innovations, and changing consumer preferences that create new avenues for business development and market penetration.

Pharmaceutical sector expansion offers substantial growth potential, driven by Ecuador’s increasing healthcare investments and pharmaceutical manufacturing development. Specialty glass applications in cosmetics and personal care products represent untapped market segments with premium pricing potential. Export market development throughout Latin America provides opportunities to leverage Ecuador’s competitive manufacturing advantages and strategic location.

Sustainable packaging initiatives create opportunities for glass container manufacturers to position their products as environmentally responsible alternatives to plastic packaging. Technology partnerships with international equipment suppliers enable access to advanced manufacturing technologies and process improvements. Value-added services such as custom labeling, decorative treatments, and specialized coatings offer differentiation opportunities and higher profit margins.

E-commerce growth creates new packaging requirements and distribution channels that favor durable glass containers. Premium beverage market expansion supports demand for high-quality glass bottles with distinctive designs and superior product protection. Recycling program development offers opportunities to create closed-loop systems that reduce raw material costs while enhancing environmental credentials.

Complex market dynamics shape the Ecuador container glass market through interconnected factors that influence supply, demand, pricing, and competitive positioning. These dynamics create a constantly evolving marketplace where success depends on understanding and adapting to changing conditions across multiple dimensions.

Supply chain integration has become increasingly important, with manufacturers developing closer relationships with both raw material suppliers and end-user customers. Demand fluctuations across different industry segments require flexible production capabilities and inventory management strategies. The market shows strong seasonality in beverage applications, with peak demand during holiday periods and summer months driving production planning requirements.

Price competition remains intense, particularly in commodity glass container segments, while premium applications offer better margin opportunities. Quality requirements continue to increase across all market segments, driven by consumer expectations and regulatory standards. Innovation cycles in container design and functionality create opportunities for differentiation while requiring ongoing investment in research and development capabilities.

Regional market variations within Ecuador reflect different industrial concentrations and consumer preferences, requiring tailored marketing and distribution strategies. International market influences from global glass manufacturers and packaging trends affect local market conditions and competitive dynamics. MarkWide Research analysis indicates that successful market participants demonstrate strong adaptability to these dynamic conditions while maintaining operational efficiency and customer satisfaction.

Comprehensive research methodology employed for analyzing the Ecuador container glass market incorporates multiple data collection approaches and analytical techniques to ensure accuracy, reliability, and depth of market insights. The methodology combines quantitative analysis with qualitative assessment to provide a complete market perspective.

Primary research activities include structured interviews with key industry stakeholders, including manufacturers, distributors, end-users, and regulatory officials. Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements. Market observation through facility visits and trade show participation provides firsthand insights into operational practices and technological developments.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Statistical analysis employs advanced modeling techniques to identify trends, correlations, and market projections. Industry expert consultations provide context and interpretation for quantitative findings, ensuring practical relevance and actionable insights.

Market segmentation analysis utilizes detailed categorization by application, product type, and geographic region to identify specific growth opportunities and competitive dynamics. Competitive intelligence gathering includes analysis of company strategies, market positioning, and performance metrics across key market participants.

Geographic distribution of the Ecuador container glass market reveals distinct regional characteristics that influence production, consumption, and growth patterns across different areas of the country. Understanding these regional dynamics enables targeted strategies and optimal resource allocation for market participants.

Guayas Province dominates the market landscape, accounting for approximately 45% of total container glass production, driven by the presence of major manufacturing facilities and proximity to the Port of Guayaquil for export activities. Industrial infrastructure in this region supports both large-scale production and efficient distribution networks throughout Ecuador and neighboring countries. The region benefits from established supply chains for raw materials and skilled workforce availability.

Pichincha Province, centered around Quito, represents approximately 30% of market activity, with strong focus on pharmaceutical and specialty glass applications. Manufacturing capabilities in this region emphasize quality and precision, serving high-value market segments that require stringent quality control and regulatory compliance. The region’s elevation and climate conditions present unique operational considerations for glass manufacturing processes.

Other regions including Azuay, Manabí, and El Oro collectively account for the remaining 25% of market share, with emerging opportunities in regional beverage production and agricultural packaging applications. Regional development initiatives support industrial diversification and infrastructure improvements that enhance market accessibility and growth potential.

Competitive environment within the Ecuador container glass market features a mix of established local manufacturers and international players, creating dynamic market conditions that drive innovation, quality improvements, and competitive pricing strategies. The landscape continues to evolve as companies adapt to changing market demands and technological opportunities.

Market positioning strategies vary among competitors, with some emphasizing cost leadership while others focus on differentiation through quality, innovation, or specialized applications. Capacity utilization rates remain high across major manufacturers, indicating strong demand conditions and limited excess capacity in the market. Investment patterns show continued commitment to technology upgrades and facility expansion among leading players.

Competitive advantages include factors such as energy efficiency, product quality, customer service capabilities, and geographic positioning for market access. Strategic partnerships between manufacturers and key customers create competitive barriers and ensure stable demand relationships.

Market segmentation analysis reveals distinct categories within the Ecuador container glass market, each characterized by specific demand drivers, growth patterns, and competitive dynamics. Understanding these segments enables targeted strategies and optimal resource allocation for market participants.

By Application:

By Product Type:

By Capacity:

Detailed category analysis provides specific insights into the performance, trends, and opportunities within each major segment of the Ecuador container glass market. These insights enable stakeholders to understand segment-specific dynamics and develop targeted strategies for optimal market positioning.

Beverage Container Category demonstrates robust growth driven by expanding beer production, wine industry development, and premium soft drink packaging trends. Market share distribution shows beer bottles accounting for approximately 40% of beverage container demand, while wine bottles represent 25% of the segment. Innovation trends include lightweight bottle designs, unique shapes for brand differentiation, and enhanced barrier properties for product protection.

Pharmaceutical Packaging Category exhibits the highest growth rates, supported by Ecuador’s expanding pharmaceutical manufacturing sector and increasing healthcare investments. Quality requirements in this category demand advanced manufacturing capabilities and comprehensive quality control systems. Regulatory compliance drives continuous improvement in production processes and documentation systems.

Food Packaging Category shows steady growth potential, particularly in premium food products and artisanal food manufacturing. Consumer preferences for glass packaging in food applications reflect concerns about product safety and environmental sustainability. Seasonal variations in this category align with agricultural production cycles and food processing activities.

Cosmetic and Personal Care Category represents the smallest but fastest-growing segment, driven by increasing consumer spending on beauty products and preference for premium packaging. Design innovation plays a critical role in this category, with emphasis on aesthetic appeal and brand differentiation.

Comprehensive benefits accrue to various stakeholders within the Ecuador container glass market ecosystem, creating value propositions that support sustained participation and investment in the sector. These benefits extend beyond immediate financial returns to include strategic advantages and long-term positioning opportunities.

For Manufacturers:

For End Users:

For Investors:

Strategic assessment through SWOT analysis reveals the internal strengths and weaknesses of the Ecuador container glass market alongside external opportunities and threats that influence market dynamics and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends within the Ecuador container glass market reflect broader industry developments, technological innovations, and changing consumer preferences that shape market evolution and create new opportunities for growth and differentiation.

Sustainability Integration has become a dominant trend, with manufacturers implementing comprehensive environmental management systems and circular economy principles. Recycling programs are expanding throughout the supply chain, with some manufacturers achieving recycled content rates exceeding 30% in their production processes. Energy efficiency initiatives include adoption of advanced furnace technologies and waste heat recovery systems that reduce environmental impact while lowering operational costs.

Digital Transformation is reshaping manufacturing operations through implementation of Industry 4.0 technologies, including automated quality control systems, predictive maintenance capabilities, and real-time production monitoring. Smart manufacturing approaches enable improved efficiency, reduced waste, and enhanced product consistency across production runs.

Premium Packaging Demand continues to grow across multiple market segments, driven by consumer preferences for high-quality packaging that reflects product value and brand positioning. Customization capabilities are expanding, with manufacturers offering specialized designs, colors, and surface treatments to meet specific customer requirements. Lightweight innovations reduce material usage and transportation costs while maintaining container strength and functionality.

Regional Integration trends show increasing collaboration between Ecuador and neighboring countries in supply chain development and market access initiatives. MWR data indicates growing cross-border trade in container glass products, supported by improved logistics infrastructure and trade facilitation measures.

Recent industry developments demonstrate the dynamic nature of the Ecuador container glass market, with significant investments, technological advances, and strategic initiatives that influence market structure and competitive positioning.

Manufacturing Expansion Projects have gained momentum, with major producers investing in new production lines and facility upgrades to meet growing demand. Technology partnerships with international equipment suppliers enable access to advanced manufacturing systems and process improvements. Capacity additions focus on high-growth segments including pharmaceutical packaging and premium beverage containers.

Sustainability Initiatives include implementation of closed-loop recycling systems, renewable energy adoption, and waste reduction programs that align with global environmental standards. Certification achievements in environmental management and quality systems enhance market credibility and export opportunities. Circular economy projects create value from waste streams while reducing raw material requirements.

Market Consolidation Activities show strategic acquisitions and partnerships that strengthen competitive positioning and market access capabilities. Vertical integration initiatives include backward integration into raw material supply and forward integration into distribution and customer service capabilities. International collaborations provide access to global markets and advanced technologies.

Innovation Developments encompass new product launches, process improvements, and technology adoptions that enhance competitiveness and market differentiation. Research and development investments focus on lightweight designs, enhanced barrier properties, and specialized applications for emerging market segments.

Strategic recommendations for Ecuador container glass market participants emphasize the importance of adapting to evolving market conditions while building sustainable competitive advantages through operational excellence and market positioning strategies.

Investment Priorities should focus on energy efficiency improvements and automation technologies that reduce operational costs while enhancing product quality and consistency. Technology adoption in areas such as furnace optimization, forming process control, and quality management systems provides immediate benefits and long-term competitive advantages. Sustainability investments in recycling infrastructure and renewable energy systems align with market trends while reducing operational costs.

Market Development Strategies should emphasize export market expansion, particularly to Colombia and Peru, where demand for high-quality glass containers continues to grow. Product diversification into pharmaceutical and specialty applications offers higher margins and growth potential compared to commodity beverage containers. Customer relationship development through value-added services and technical support capabilities creates competitive differentiation and customer loyalty.

Operational Excellence initiatives should target production efficiency improvements, waste reduction, and quality enhancement programs that strengthen competitive positioning. Supply chain optimization through strategic sourcing and logistics improvements reduces costs while ensuring reliable material availability. Workforce development programs in technical skills and quality management support operational improvements and innovation capabilities.

Risk Management strategies should address energy cost volatility, raw material price fluctuations, and competitive pressures through diversification and operational flexibility. Financial planning should account for cyclical demand patterns and investment requirements for technology upgrades and capacity expansion.

Long-term prospects for the Ecuador container glass market remain positive, supported by favorable demographic trends, industrial development, and increasing integration with regional markets throughout Latin America. Growth projections indicate sustained expansion across multiple market segments, with pharmaceutical applications showing the strongest growth potential at projected rates of 8-10% annually.

Market evolution will be shaped by continued technological advancement, sustainability initiatives, and changing consumer preferences that favor premium packaging solutions. Industry consolidation may accelerate as manufacturers seek scale advantages and market positioning benefits through strategic combinations and partnerships. Export market development provides significant growth opportunities, with regional demand expected to support 15-20% of total production within the next five years.

Technology integration will continue transforming manufacturing operations, with advanced automation, artificial intelligence, and data analytics becoming standard capabilities across leading manufacturers. Sustainability requirements will drive continued investment in circular economy initiatives and environmental management systems. MarkWide Research analysis suggests that successful market participants will be those who effectively balance operational efficiency, product quality, and environmental responsibility.

Regulatory developments may influence market structure through environmental standards, quality requirements, and trade policies that affect both domestic operations and export opportunities. Innovation cycles in container design and functionality will create new market segments and differentiation opportunities for forward-thinking manufacturers.

The Ecuador container glass market presents a compelling combination of established demand, growth opportunities, and strategic advantages that position it favorably for sustained expansion and development. Market fundamentals remain strong, supported by diverse end-user industries, favorable geographic positioning, and increasing consumer preference for sustainable packaging solutions.

Key success factors for market participants include operational excellence, technology adoption, sustainability integration, and strategic market positioning that leverages Ecuador’s competitive advantages. Growth potential across pharmaceutical, premium beverage, and export market segments provides multiple avenues for expansion and value creation. The market’s evolution toward higher-value applications and sustainable practices aligns with global trends while supporting improved profitability and competitive positioning.

Strategic imperatives emphasize the importance of continued investment in manufacturing capabilities, technology advancement, and market development initiatives that strengthen competitive positioning and capture emerging opportunities. Long-term success will depend on the ability to balance operational efficiency with innovation, sustainability, and customer service excellence in an increasingly competitive and dynamic market environment.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

What are the key players in the Ecuador Container Glass Market?

Key players in the Ecuador Container Glass Market include O-I Glass, Inc., Verallia, and Grupo Vitro, among others. These companies are involved in the production and distribution of container glass products for various industries.

What are the growth factors driving the Ecuador Container Glass Market?

The Ecuador Container Glass Market is driven by increasing consumer demand for sustainable packaging solutions, the growth of the beverage industry, and rising health consciousness among consumers. Additionally, the trend towards eco-friendly materials is boosting the use of glass containers.

What challenges does the Ecuador Container Glass Market face?

The Ecuador Container Glass Market faces challenges such as high production costs, competition from alternative packaging materials like plastics, and the need for advanced recycling technologies. These factors can impact the market’s growth and sustainability efforts.

What opportunities exist in the Ecuador Container Glass Market?

Opportunities in the Ecuador Container Glass Market include the expansion of the craft beverage sector, increasing investments in recycling infrastructure, and the development of innovative glass designs. These factors can enhance market growth and attract new consumers.

What trends are shaping the Ecuador Container Glass Market?

Trends in the Ecuador Container Glass Market include a shift towards lightweight glass packaging, the adoption of smart packaging technologies, and a growing emphasis on circular economy practices. These trends are influencing consumer preferences and industry standards.

Ecuador Container Glass Market

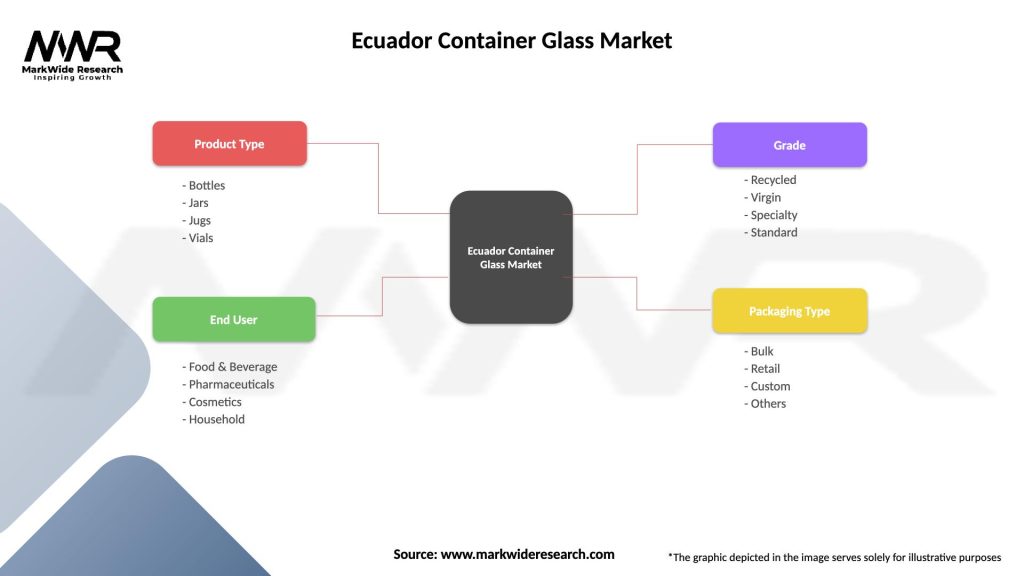

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Jugs, Vials |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Household |

| Grade | Recycled, Virgin, Specialty, Standard |

| Packaging Type | Bulk, Retail, Custom, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Ecuador Container Glass Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at