444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Peru container glass market represents a dynamic and evolving sector within the country’s packaging industry, driven by increasing demand from beverage, food, pharmaceutical, and cosmetic sectors. Container glass manufacturing in Peru has experienced substantial growth as consumer preferences shift toward sustainable and recyclable packaging solutions. The market encompasses various glass container types including bottles, jars, vials, and specialty containers designed for different industrial applications.

Market dynamics indicate robust expansion with the sector experiencing a 6.2% CAGR over recent years, reflecting strong domestic consumption and export opportunities. The beverage industry remains the largest consumer segment, accounting for approximately 68% of total container glass demand in Peru. This growth trajectory is supported by urbanization trends, rising disposable incomes, and increasing awareness of environmental sustainability among Peruvian consumers.

Manufacturing capabilities within Peru have strengthened significantly, with local producers investing in advanced furnace technologies and automated production lines. The market benefits from abundant raw material availability, including high-quality silica sand deposits and strategic access to recycled glass feedstock. Export potential continues to expand as Peruvian glass manufacturers target regional markets throughout Latin America, leveraging competitive production costs and improving quality standards.

The Peru container glass market refers to the comprehensive ecosystem of glass container manufacturing, distribution, and consumption within Peru’s borders, encompassing all activities related to the production and supply of glass packaging solutions for various industries. This market includes primary glass manufacturing facilities, secondary processing operations, distribution networks, and end-user applications across multiple sectors including beverages, food processing, pharmaceuticals, cosmetics, and industrial chemicals.

Container glass specifically denotes hollow glass products designed for packaging and storage applications, manufactured through processes including melting, forming, annealing, and finishing. The Peruvian market encompasses both clear and colored glass containers, ranging from small pharmaceutical vials to large industrial containers, each designed to meet specific performance requirements including chemical resistance, thermal stability, and barrier properties.

Strategic positioning of Peru’s container glass market reflects the country’s growing industrial base and expanding consumer markets. The sector demonstrates resilience through diversified end-user applications and increasing integration with regional supply chains. Key growth drivers include rising beverage consumption, expanding food processing industry, and growing pharmaceutical sector demand, collectively contributing to sustained market expansion.

Competitive landscape features both established international players and emerging local manufacturers, creating a dynamic market environment that fosters innovation and competitive pricing. The market benefits from government support for manufacturing sector development and environmental initiatives promoting recyclable packaging solutions. Investment flows into modernization projects and capacity expansion indicate strong confidence in long-term market prospects.

Market challenges include energy cost fluctuations, raw material price volatility, and increasing competition from alternative packaging materials. However, the inherent advantages of glass packaging, including recyclability, chemical inertness, and premium product positioning, continue to support market growth. Future outlook remains positive with projected expansion driven by demographic trends and evolving consumer preferences toward sustainable packaging solutions.

Market intelligence reveals several critical insights shaping the Peru container glass landscape. Consumer behavior analysis indicates growing preference for glass packaging among health-conscious consumers, particularly in food and beverage categories. This trend supports premium product positioning and enables manufacturers to command higher margins compared to alternative packaging materials.

Primary growth drivers propelling the Peru container glass market include expanding beverage industry consumption, rising health consciousness among consumers, and increasing adoption of sustainable packaging practices. The beverage sector expansion particularly benefits from growing demand for premium alcoholic beverages, craft beer production, and health-focused non-alcoholic drinks, all of which prefer glass packaging for quality preservation and brand positioning.

Economic development across Peru creates favorable conditions for market growth through increased disposable income, urbanization trends, and expanding middle-class population. These demographic shifts translate into higher consumption of packaged goods and premium products that utilize glass containers. Government initiatives supporting manufacturing sector development and environmental sustainability further reinforce market growth momentum.

Technological advancement in glass manufacturing processes enables improved production efficiency, reduced energy consumption, and enhanced product quality. Modern furnace technologies and automated production systems allow Peruvian manufacturers to compete effectively in regional markets while meeting international quality standards. Supply chain optimization through improved logistics infrastructure reduces distribution costs and expands market reach throughout Peru and neighboring countries.

Operational challenges facing the Peru container glass market include high energy costs associated with glass melting processes, which can account for 35-40% of total production costs. Energy price volatility creates uncertainty in production planning and affects overall profitability, particularly for smaller manufacturers with limited hedging capabilities. Raw material costs also present ongoing challenges, especially for specialized glass compositions requiring imported additives.

Competition from alternatives poses significant market pressure as plastic containers, aluminum cans, and flexible packaging solutions offer cost advantages and lighter weight benefits. These alternative materials continue to gain market share in price-sensitive segments, forcing glass manufacturers to focus on premium applications and value-added services. Transportation costs for glass containers remain higher than alternatives due to weight considerations and breakage risks.

Environmental regulations while generally supportive of glass packaging, create compliance costs and operational complexities for manufacturers. Emissions control requirements, waste management protocols, and energy efficiency standards require ongoing investment in environmental management systems. Market fragmentation across different end-user segments creates challenges in achieving economies of scale and optimizing production schedules.

Emerging opportunities within the Peru container glass market center on expanding pharmaceutical and cosmetic sectors, which demand high-quality glass packaging for product protection and premium positioning. The pharmaceutical industry growth creates demand for specialized containers including vials, ampoules, and bottles designed for drug storage and administration. Cosmetic sector expansion offers opportunities for decorative glass containers that enhance product appeal and brand differentiation.

Export market development presents substantial growth potential as Peruvian manufacturers leverage competitive production costs and improving quality standards to access regional markets. Trade agreements with neighboring countries facilitate market entry and create opportunities for long-term supply relationships. The growing craft beverage industry throughout Latin America provides niche market opportunities for specialized glass containers.

Sustainability initiatives create competitive advantages for glass packaging as consumers and businesses increasingly prioritize environmental responsibility. Circular economy principles favor glass containers due to infinite recyclability and reduced environmental impact compared to single-use alternatives. Innovation opportunities in lightweight glass designs, smart packaging integration, and specialized coatings enable product differentiation and premium pricing strategies.

Market dynamics within Peru’s container glass sector reflect complex interactions between supply-side capabilities, demand-side requirements, and external economic factors. Supply chain integration has improved significantly as manufacturers develop closer relationships with raw material suppliers and end-user customers, creating more stable business relationships and predictable demand patterns.

Competitive intensity varies across different market segments, with commodity glass containers experiencing price pressure while specialized applications maintain higher margins. Innovation cycles in glass manufacturing technology create opportunities for efficiency improvements and product differentiation, though require substantial capital investment and technical expertise. Regulatory environment continues evolving with increasing focus on environmental sustainability and product safety standards.

Economic cycles significantly influence market performance as glass container demand correlates strongly with overall economic activity and consumer spending patterns. Currency fluctuations affect both raw material costs and export competitiveness, creating ongoing financial management challenges for manufacturers. Seasonal variations in beverage consumption create capacity utilization challenges and require flexible production planning approaches.

Comprehensive research approach employed in analyzing the Peru container glass market combines primary data collection, secondary research analysis, and industry expert consultations to provide accurate market insights. Primary research includes structured interviews with key industry participants including manufacturers, distributors, end-users, and regulatory officials to gather firsthand market intelligence and validate secondary research findings.

Secondary research methodology encompasses analysis of government statistics, industry publications, trade association reports, and company financial statements to establish market baselines and identify trends. Data triangulation techniques ensure accuracy and reliability of market estimates through cross-validation of multiple information sources. Statistical analysis employs appropriate methodologies for market sizing, growth projections, and trend identification.

Market segmentation analysis utilizes both top-down and bottom-up approaches to ensure comprehensive coverage of all market segments and applications. Competitive analysis includes detailed evaluation of market participants, their strategies, capabilities, and market positioning. Quality assurance protocols ensure data accuracy and analytical rigor throughout the research process, providing reliable foundation for strategic decision-making.

Geographic distribution of Peru’s container glass market shows concentration in major industrial centers including Lima, Arequipa, and Trujillo, where manufacturing facilities benefit from infrastructure advantages and proximity to key markets. Lima metropolitan area represents approximately 45% of total market demand due to population concentration and industrial activity, making it the primary focus for manufacturers and distributors.

Coastal regions demonstrate strong market performance driven by port access for raw material imports and finished product exports, as well as established industrial base supporting various end-user industries. Mining regions create specialized demand for industrial glass containers used in chemical processing and laboratory applications. Agricultural areas generate demand for food processing applications, particularly in regions with significant fruit and vegetable production.

Regional development patterns indicate expanding market opportunities in secondary cities as economic development spreads beyond traditional industrial centers. Infrastructure improvements including road networks and logistics facilities enhance market accessibility and reduce distribution costs. Regional trade dynamics with neighboring countries create cross-border opportunities for market expansion and supply chain optimization.

Market structure within Peru’s container glass industry features a mix of established international companies and growing domestic manufacturers, creating competitive dynamics that drive innovation and efficiency improvements. Leading market participants have invested significantly in modern manufacturing facilities and quality management systems to meet international standards and compete effectively in regional markets.

Competitive strategies emphasize operational excellence, customer service, and product innovation to differentiate offerings and maintain market position. Market consolidation trends indicate potential for mergers and acquisitions as companies seek scale advantages and market expansion opportunities. Technology adoption varies among competitors, with larger players investing in advanced manufacturing systems while smaller companies focus on specialized market segments.

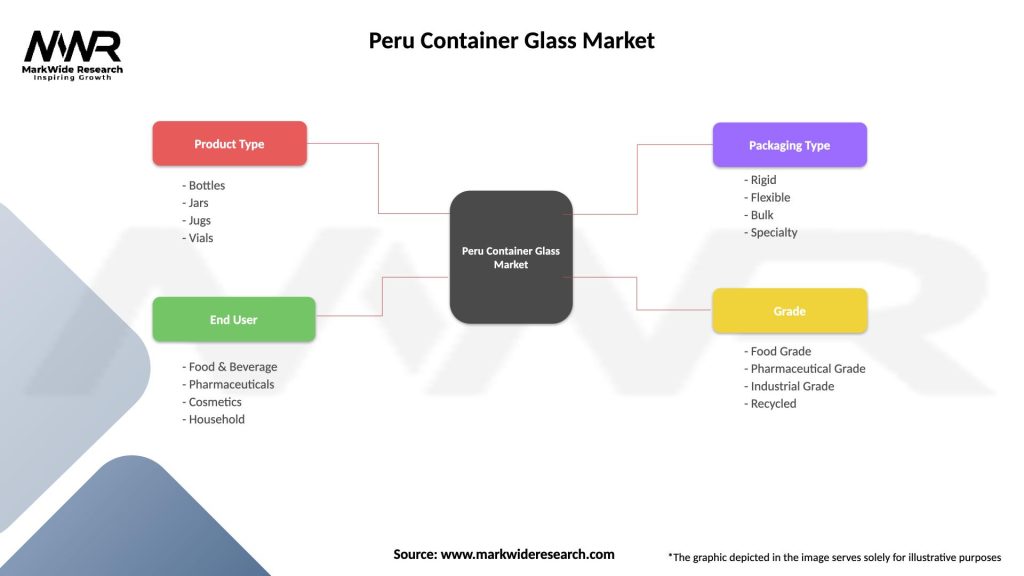

Market segmentation analysis reveals distinct categories based on product type, end-user application, and distribution channels, each with unique characteristics and growth dynamics. Product-based segmentation includes bottles, jars, vials, and specialty containers, with bottles representing the largest segment due to beverage industry demand.

By Product Type:

By End-User Application:

Beverage containers maintain market leadership with approximately 68% market share, driven by strong demand from beer, wine, spirits, and non-alcoholic beverage producers. This category benefits from consumer preference for glass packaging in premium beverage segments and growing craft beverage industry. Innovation trends include lightweight designs, unique shapes, and integrated closure systems that enhance functionality and brand differentiation.

Food packaging applications demonstrate steady growth as processed food consumption increases and consumers seek premium packaging solutions. Jar applications particularly benefit from artisanal food trends and premium condiment markets. Pharmaceutical containers represent the highest-value segment with stringent quality requirements and specialized manufacturing processes, creating barriers to entry and supporting premium pricing.

Industrial applications provide stable demand base for specialized glass containers used in chemical processing, laboratory applications, and industrial storage. Cosmetic packaging offers growth opportunities as beauty and personal care markets expand, with emphasis on premium positioning and aesthetic appeal. Export categories focus on products where Peru maintains competitive advantages through cost structure and quality capabilities.

Manufacturers benefit from growing domestic demand, export opportunities, and favorable raw material availability that supports competitive cost structures. Operational advantages include access to high-quality silica sand deposits, improving energy infrastructure, and skilled workforce development programs. Market positioning opportunities exist in premium segments where glass packaging commands higher margins and stronger customer loyalty.

End-users gain from reliable supply chains, improving product quality, and competitive pricing as market competition intensifies. Beverage producers particularly benefit from glass packaging’s ability to preserve product quality and enhance brand positioning. Pharmaceutical companies access specialized containers that meet regulatory requirements and ensure product integrity throughout distribution chains.

Investors find attractive opportunities in a growing market supported by favorable demographics and economic development trends. Government stakeholders benefit from industrial development, employment creation, and export revenue generation. Environmental benefits include promotion of recyclable packaging solutions and reduced dependence on imported packaging materials, supporting sustainability objectives and trade balance improvements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability trends increasingly influence packaging decisions as consumers and businesses prioritize environmental responsibility. Circular economy principles favor glass containers due to infinite recyclability and reduced environmental impact compared to single-use alternatives. This trend creates competitive advantages for glass manufacturers and supports premium positioning strategies across multiple market segments.

Premiumization trends in consumer goods drive demand for high-quality glass packaging that enhances product appeal and brand differentiation. Craft beverage growth particularly benefits glass container manufacturers as producers seek distinctive packaging solutions. Health consciousness among consumers supports glass packaging preference due to chemical inertness and food safety advantages.

Technology integration trends include smart packaging solutions, lightweight designs, and advanced manufacturing processes that improve efficiency and product performance. Customization demands increase as brands seek unique packaging solutions for market differentiation. Supply chain optimization trends focus on reducing costs and improving service levels through better logistics and inventory management systems.

Recent industry developments include significant investments in manufacturing capacity expansion and technology upgrades by major market participants. Facility modernization projects focus on energy efficiency improvements, automated production systems, and quality management enhancements that strengthen competitive positioning. Strategic partnerships between manufacturers and end-users create more stable business relationships and enable customized product development.

Regulatory developments include updated environmental standards and product safety requirements that influence manufacturing processes and market dynamics. Trade policy changes affect import/export opportunities and competitive landscape evolution. Investment announcements by both domestic and international companies indicate continued confidence in market growth prospects and long-term viability.

Innovation initiatives focus on sustainable manufacturing processes, product design improvements, and customer service enhancements. Market consolidation activities include mergers, acquisitions, and strategic alliances that reshape competitive dynamics. Infrastructure developments in transportation and logistics improve market accessibility and reduce distribution costs throughout Peru.

Strategic recommendations for market participants emphasize the importance of operational excellence, customer relationship management, and innovation investment to maintain competitive advantages. Manufacturing efficiency improvements through technology adoption and process optimization enable cost reduction and quality enhancement. Market diversification across multiple end-user segments reduces risk and creates growth opportunities.

Investment priorities should focus on energy efficiency improvements, automation technologies, and quality management systems that support long-term competitiveness. Partnership development with key customers creates stable demand base and enables collaborative product development initiatives. Export market development requires systematic approach including market research, relationship building, and quality certification processes.

Risk management strategies should address energy cost volatility, raw material price fluctuations, and currency exposure through appropriate hedging and operational flexibility measures. Sustainability initiatives including recycling programs and environmental management systems create competitive advantages and support regulatory compliance. Talent development programs ensure availability of skilled workforce needed for technology adoption and operational excellence.

Long-term prospects for Peru’s container glass market remain positive, supported by favorable demographic trends, economic development, and increasing consumer preference for sustainable packaging solutions. MarkWide Research analysis indicates continued market expansion driven by beverage industry growth, pharmaceutical sector development, and export opportunities throughout Latin America. Market maturation will likely result in increased competition and emphasis on operational efficiency.

Growth projections suggest sustained expansion with annual growth rates expected to remain robust across most market segments. Technology adoption will accelerate as manufacturers seek competitive advantages through improved efficiency and product quality. Sustainability focus will intensify as environmental regulations strengthen and consumer awareness increases, creating additional opportunities for glass packaging solutions.

Market evolution will likely include increased consolidation, technology integration, and specialization in high-value segments. Regional integration opportunities will expand as trade relationships strengthen and logistics infrastructure improves. Innovation cycles in manufacturing technology and product design will create new opportunities for differentiation and market expansion throughout the forecast period.

Peru’s container glass market presents compelling opportunities for growth and development, supported by strong domestic demand, favorable raw material availability, and expanding export potential. Market fundamentals remain solid with diversified end-user base, improving manufacturing capabilities, and alignment with sustainability trends that favor glass packaging solutions. Strategic positioning of market participants will determine success in capturing growth opportunities while managing operational challenges.

Competitive dynamics will continue evolving as technology adoption accelerates and market consolidation progresses. Success factors include operational excellence, customer relationship management, innovation investment, and strategic market positioning. Long-term outlook remains positive with sustained growth expected across multiple market segments, driven by demographic trends, economic development, and increasing preference for premium packaging solutions that glass containers uniquely provide.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

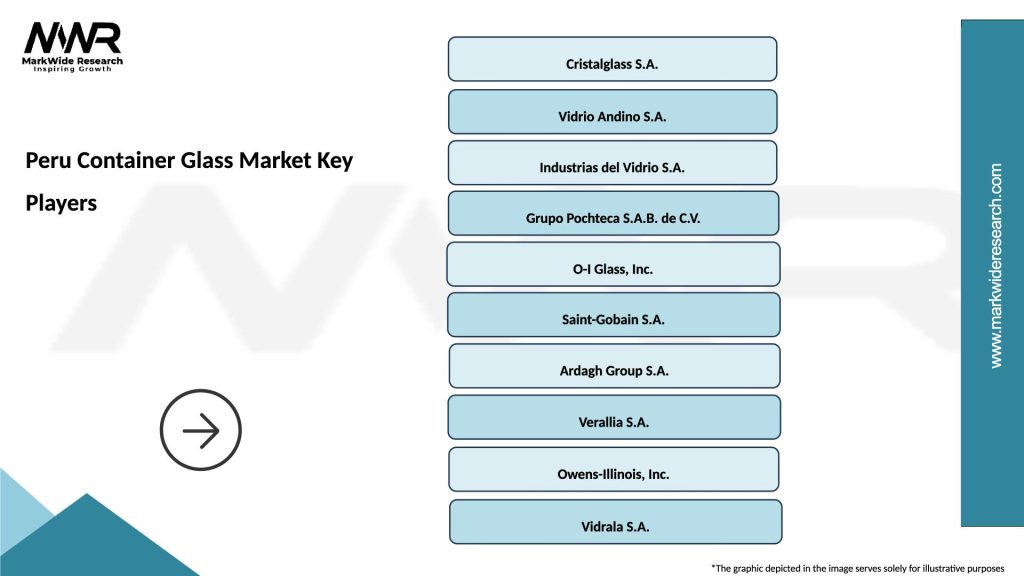

What are the key players in the Peru Container Glass Market?

Key players in the Peru Container Glass Market include companies like Cristalglass, Vidrio Andino, and O-I Glass, which are known for their production of high-quality glass containers for various industries, among others.

What are the growth factors driving the Peru Container Glass Market?

The growth of the Peru Container Glass Market is driven by increasing demand for sustainable packaging solutions, the rise in the beverage industry, and consumer preferences for glass over plastic due to health and environmental concerns.

What challenges does the Peru Container Glass Market face?

The Peru Container Glass Market faces challenges such as high production costs, competition from alternative packaging materials, and the need for advanced recycling technologies to meet sustainability goals.

What opportunities exist in the Peru Container Glass Market?

Opportunities in the Peru Container Glass Market include expanding into emerging sectors like craft beverages, increasing exports, and developing innovative glass designs that cater to changing consumer preferences.

What trends are shaping the Peru Container Glass Market?

Trends in the Peru Container Glass Market include a growing emphasis on eco-friendly packaging, advancements in glass manufacturing technologies, and the increasing popularity of personalized and decorative glass containers.

Peru Container Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Jugs, Vials |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Household |

| Packaging Type | Rigid, Flexible, Bulk, Specialty |

| Grade | Food Grade, Pharmaceutical Grade, Industrial Grade, Recycled |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Peru Container Glass Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at