444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America rechargeable battery market represents a dynamic and rapidly evolving sector that has gained significant momentum across the region. This market encompasses various battery technologies including lithium-ion, nickel-metal hydride, lead-acid, and emerging solid-state solutions that power everything from consumer electronics to electric vehicles and renewable energy storage systems. Market dynamics in South America are particularly influenced by the region’s abundant natural resources, including substantial lithium reserves in countries like Chile and Argentina, which positions the continent as a critical player in the global battery supply chain.

Regional growth patterns indicate that the South American rechargeable battery market is experiencing robust expansion, driven by increasing adoption of electric vehicles, growing renewable energy installations, and rising consumer electronics penetration. The market demonstrates a compound annual growth rate (CAGR) of approximately 8.2%, reflecting strong underlying demand across multiple application segments. Brazil and Argentina emerge as the largest markets within the region, collectively accounting for over 65% of regional demand, while countries like Chile and Colombia show promising growth trajectories in specific battery technology segments.

Technological advancement across the region has accelerated significantly, with local manufacturers and international companies establishing production facilities and research centers. The market benefits from government initiatives promoting clean energy adoption and electric mobility, creating favorable conditions for sustained growth. Investment flows into battery manufacturing and recycling infrastructure have increased substantially, indicating strong confidence in the region’s long-term market potential and strategic importance in global battery value chains.

The South America rechargeable battery market refers to the comprehensive ecosystem of rechargeable energy storage solutions manufactured, distributed, and consumed across South American countries, encompassing various battery chemistries and applications that can be recharged multiple times throughout their operational lifecycle.

Market scope includes primary battery technologies such as lithium-ion batteries used in smartphones, laptops, and electric vehicles, nickel-metal hydride batteries commonly found in hybrid vehicles and power tools, and advanced lead-acid batteries utilized in automotive and industrial applications. The market also encompasses emerging technologies like solid-state batteries and sodium-ion alternatives that represent the next generation of energy storage solutions. Application diversity spans consumer electronics, automotive systems, industrial equipment, renewable energy storage, telecommunications infrastructure, and grid-scale energy storage projects.

Geographic coverage extends across all South American nations, with particular concentration in Brazil, Argentina, Chile, Colombia, and Peru, where industrial development and consumer adoption rates drive primary demand. The market includes both imported battery products and locally manufactured solutions, reflecting the region’s evolving position from primarily an import-dependent market to an increasingly integrated part of global battery manufacturing networks.

Market performance in South America’s rechargeable battery sector demonstrates exceptional resilience and growth potential, supported by favorable resource endowments and increasing technological adoption across diverse application segments. The region’s strategic position as a major lithium producer, combined with growing domestic demand for energy storage solutions, creates unique opportunities for market expansion and value chain integration.

Key growth drivers include accelerating electric vehicle adoption, expanding renewable energy installations requiring storage solutions, and increasing penetration of consumer electronics across urban and rural populations. Government policies promoting clean energy transitions and electric mobility contribute significantly to market momentum, with several countries implementing incentive programs that boost battery demand. Infrastructure development projects, particularly in telecommunications and grid modernization, generate additional demand for reliable energy storage systems.

Competitive landscape features a mix of international battery manufacturers establishing regional operations and emerging local companies developing specialized solutions for regional market needs. Strategic partnerships between mining companies, battery manufacturers, and technology firms are reshaping the industry structure, creating integrated value chains that span from raw material extraction to end-user applications. Investment activity remains robust, with both private and public sector funding supporting capacity expansion and technological advancement initiatives across the region.

Market segmentation reveals distinct patterns across different battery technologies and application areas, with lithium-ion batteries commanding the largest share due to their superior energy density and declining costs. The following insights highlight critical market characteristics:

Market maturity varies significantly across countries and applications, with established segments like consumer electronics showing steady growth while emerging areas like grid storage demonstrate explosive expansion potential. MarkWide Research analysis indicates that the market is transitioning from an import-dependent structure to a more balanced ecosystem featuring local production capabilities and regional supply chain integration.

Electric vehicle adoption serves as the primary catalyst for rechargeable battery market expansion across South America, with governments implementing policies that encourage electric mobility and reduce dependence on fossil fuels. Countries like Colombia and Chile have established ambitious electric vehicle targets, creating substantial demand for high-performance lithium-ion battery systems. Infrastructure development supporting electric vehicle charging networks further accelerates market growth by addressing range anxiety and improving consumer confidence in electric mobility solutions.

Renewable energy expansion drives significant demand for energy storage systems that can manage intermittent power generation from solar and wind installations. South America’s abundant renewable energy resources require sophisticated battery storage solutions to ensure grid stability and maximize energy utilization efficiency. Grid modernization projects across the region incorporate advanced battery storage systems that improve power quality, reduce transmission losses, and enhance overall system reliability.

Consumer electronics penetration continues expanding across urban and rural markets, driven by increasing smartphone adoption, laptop usage, and portable device proliferation. Rising disposable incomes and improving telecommunications infrastructure support sustained growth in consumer electronics markets, directly translating to higher rechargeable battery demand. Industrial automation and digitalization trends create additional demand for reliable battery-powered systems in manufacturing, logistics, and service sectors.

Resource availability provides South America with unique competitive advantages in battery manufacturing, particularly given the region’s substantial lithium reserves and growing mining operations. Local resource access reduces supply chain risks and transportation costs while supporting the development of integrated battery manufacturing ecosystems. Government support through policy incentives, tax benefits, and infrastructure investments creates favorable conditions for market expansion and technological advancement.

High initial costs associated with advanced battery technologies, particularly lithium-ion systems, create barriers to adoption in price-sensitive market segments and applications. Many consumers and businesses in South America remain cost-conscious, leading to slower adoption rates for premium battery solutions despite their superior performance characteristics. Economic volatility in several regional markets affects purchasing power and investment decisions, creating uncertainty for battery manufacturers and distributors planning capacity expansion.

Infrastructure limitations in certain countries and regions constrain market development, particularly for applications requiring sophisticated charging systems or grid integration capabilities. Limited electrical grid reliability and capacity in some areas reduce the effectiveness of battery storage systems and slow adoption rates. Technical expertise shortages in battery system design, installation, and maintenance create operational challenges that limit market penetration in specialized applications.

Regulatory complexity across different countries creates compliance challenges for manufacturers and distributors operating in multiple markets, increasing operational costs and slowing market entry processes. Varying safety standards, environmental regulations, and import requirements complicate supply chain management and product development strategies. Environmental concerns related to battery disposal and recycling create additional regulatory pressures that require significant investment in waste management infrastructure.

Supply chain dependencies on imported components and materials, despite local lithium resources, create vulnerability to global supply disruptions and price volatility. Limited local manufacturing capabilities for certain battery components require continued reliance on international suppliers, affecting cost competitiveness and supply security. Currency fluctuations impact import costs and pricing strategies, creating additional complexity for market participants operating across multiple countries.

Lithium mining integration presents exceptional opportunities for South American companies to develop vertically integrated battery value chains that leverage local resource advantages. Countries like Chile, Argentina, and Bolivia possess substantial lithium reserves that can support large-scale battery manufacturing operations, creating opportunities for value-added processing and export. Strategic partnerships between mining companies and battery manufacturers can establish competitive advantages in global markets while supporting local economic development.

Electric vehicle manufacturing expansion across the region creates opportunities for battery suppliers to establish local production facilities and develop specialized solutions for regional automotive markets. Growing interest from international automakers in South American manufacturing locations presents opportunities for battery companies to secure long-term supply contracts and participate in automotive ecosystem development. Public transportation electrification initiatives in major cities create substantial opportunities for large-format battery systems in buses and rail applications.

Grid storage deployment opportunities emerge as countries modernize electrical infrastructure and integrate higher percentages of renewable energy generation. Utility-scale battery storage projects require sophisticated energy management systems that can provide grid stabilization services while maximizing renewable energy utilization. Distributed energy storage applications in commercial and residential sectors create additional market opportunities as energy costs rise and grid reliability concerns increase.

Technology development initiatives supported by government funding and international partnerships create opportunities for local companies to participate in next-generation battery research and development. Recycling infrastructure development presents opportunities to establish circular economy business models that recover valuable materials from used batteries while addressing environmental concerns. Export opportunities to other regions leverage South America’s resource advantages and growing manufacturing capabilities.

Supply and demand dynamics in the South American rechargeable battery market reflect the complex interplay between growing local demand, expanding production capabilities, and global supply chain integration. Demand growth consistently outpaces local production capacity in most segments, creating opportunities for both imports and domestic manufacturing expansion. Price dynamics demonstrate gradual decline trends for established technologies like lithium-ion batteries, while emerging technologies command premium pricing that reflects their advanced capabilities and limited availability.

Competitive dynamics feature increasing rivalry between international manufacturers establishing regional operations and emerging local companies developing specialized market solutions. Market consolidation trends appear in certain segments as companies seek scale advantages and supply chain integration benefits. Innovation cycles accelerate as companies invest in research and development to maintain competitive positioning and address evolving customer requirements across diverse application segments.

Regulatory dynamics evolve rapidly as governments implement policies supporting clean energy transitions and electric mobility adoption. Environmental regulations become increasingly stringent, requiring companies to invest in sustainable manufacturing processes and end-of-life battery management systems. Trade dynamics reflect changing global supply chain patterns and regional integration initiatives that affect import/export flows and manufacturing location decisions.

Investment dynamics show robust capital flows into battery manufacturing facilities, research centers, and supporting infrastructure projects. Private equity and venture capital investment in battery technology companies increases substantially, supporting innovation and capacity expansion initiatives. Partnership dynamics feature growing collaboration between companies across the battery value chain, from raw material suppliers to end-user applications, creating integrated business models that improve efficiency and market responsiveness.

Primary research methodologies employed in analyzing the South American rechargeable battery market include comprehensive surveys of industry participants, in-depth interviews with key market stakeholders, and direct observation of manufacturing facilities and distribution networks. Research teams conduct structured interviews with battery manufacturers, distributors, end-users, and industry experts to gather firsthand insights into market trends, challenges, and opportunities. Field research activities include facility visits, trade show participation, and regional market assessments that provide direct exposure to market conditions and competitive dynamics.

Secondary research incorporates extensive analysis of industry publications, government statistics, trade association reports, and academic research to establish comprehensive market context and validate primary research findings. Data sources include national statistical offices, industry trade organizations, regulatory agencies, and specialized market research databases. Quantitative analysis employs statistical modeling techniques to identify market trends, forecast future developments, and assess the impact of various market drivers and restraints.

Data validation processes ensure research accuracy through triangulation of multiple data sources, expert review panels, and cross-verification of key findings across different research methodologies. Quality control measures include peer review processes, data consistency checks, and validation of statistical models through historical performance analysis. Market segmentation analysis employs both top-down and bottom-up approaches to ensure comprehensive coverage of all relevant market segments and applications.

Analytical frameworks incorporate industry-standard methodologies for market sizing, competitive analysis, and trend identification while adapting to the specific characteristics of South American markets. Research protocols account for regional variations in market development, regulatory environments, and competitive structures to ensure accurate representation of local market conditions.

Brazil dominates the South American rechargeable battery market, representing approximately 45% of regional demand due to its large population, industrial base, and growing consumer electronics market. The country’s automotive industry drives significant demand for automotive batteries, while expanding renewable energy installations create opportunities for grid storage applications. Manufacturing capabilities in Brazil include both local production facilities and assembly operations for international battery companies, supported by government incentives and industrial development policies.

Argentina emerges as the second-largest market, accounting for roughly 18% of regional demand, with particular strength in lithium mining and processing capabilities that support battery manufacturing value chains. The country’s strategic position in the lithium triangle provides competitive advantages for battery production, while growing electric vehicle adoption creates domestic demand for advanced battery systems. Investment activity in Argentina focuses on developing integrated lithium-to-battery value chains that leverage local resource advantages.

Chile demonstrates exceptional growth potential despite representing approximately 12% of current market demand, driven by its position as a leading lithium producer and growing renewable energy sector. The country’s stable regulatory environment and strong mining industry create favorable conditions for battery manufacturing investment. Government initiatives promoting electric mobility and renewable energy storage support sustained market expansion and technology development.

Colombia shows promising market development with approximately 8% of regional demand, supported by growing consumer electronics penetration and government policies promoting electric vehicle adoption. The country’s improving telecommunications infrastructure drives demand for backup power systems and portable energy storage solutions. Peru and other markets collectively represent the remaining 17% of regional demand, with varying growth rates and market characteristics that reflect different stages of economic development and technology adoption.

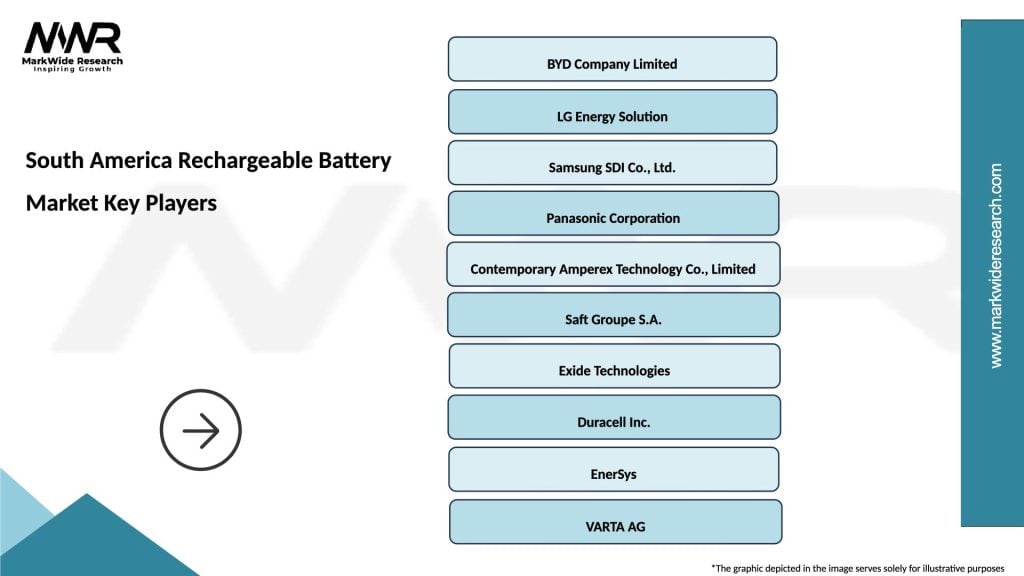

Market leadership in the South American rechargeable battery market features a diverse mix of international manufacturers, regional companies, and emerging local players that compete across different technology segments and applications. The competitive environment reflects the market’s evolution from import dependence toward local manufacturing capabilities and regional supply chain integration.

Competitive strategies emphasize local manufacturing capabilities, supply chain integration, and specialized solutions for regional market requirements. Companies increasingly focus on developing partnerships with local mining companies, automotive manufacturers, and renewable energy developers to secure market position and growth opportunities. Innovation competition drives investment in research and development facilities, technology licensing agreements, and collaborative development programs that address specific regional market needs.

By Technology: The South American rechargeable battery market demonstrates clear segmentation patterns across different battery technologies, with lithium-ion batteries commanding the largest market share due to their superior performance characteristics and declining costs. Lithium-ion batteries dominate consumer electronics, electric vehicle, and energy storage applications, while nickel-metal hydride batteries maintain strong positions in hybrid vehicles and power tools. Lead-acid batteries continue serving automotive and industrial applications where cost considerations outweigh performance requirements.

By Application: Market segmentation by application reveals consumer electronics as the largest segment, driven by smartphone, laptop, and portable device proliferation across the region. Automotive applications show the fastest growth rates as electric vehicle adoption accelerates and hybrid vehicle penetration increases. Industrial applications include backup power systems, material handling equipment, and telecommunications infrastructure that require reliable energy storage solutions.

By Capacity: Battery capacity segmentation spans from small-format cells used in consumer electronics to large-format systems employed in electric vehicles and grid storage applications. Medium-capacity batteries serve power tools, e-bikes, and portable equipment markets, while high-capacity systems support electric buses, energy storage installations, and industrial equipment applications.

By End-User: End-user segmentation includes individual consumers, automotive manufacturers, industrial companies, utilities, and telecommunications providers. Consumer segment drives volume demand through electronics purchases, while commercial and industrial segments generate higher value applications requiring specialized battery solutions and support services.

Consumer Electronics Category represents the most mature and stable segment of the South American rechargeable battery market, with consistent demand driven by smartphone replacement cycles, laptop adoption, and expanding portable device usage. This category benefits from established distribution networks, standardized product specifications, and competitive pricing that makes advanced battery technology accessible to broad consumer markets. Growth patterns in this category reflect economic development trends and increasing digital connectivity across urban and rural populations.

Automotive Category demonstrates the highest growth potential and strategic importance, driven by accelerating electric vehicle adoption and government policies promoting clean transportation. This category requires sophisticated battery management systems, safety certifications, and performance standards that create barriers to entry while supporting premium pricing. Supply chain requirements in automotive applications demand close collaboration between battery manufacturers and vehicle producers to ensure integration and performance optimization.

Industrial Category encompasses diverse applications including backup power systems, material handling equipment, telecommunications infrastructure, and renewable energy storage. This category values reliability, durability, and total cost of ownership over initial purchase price, creating opportunities for premium battery solutions. Customization requirements in industrial applications often require specialized engineering and support services that strengthen customer relationships and improve profitability.

Energy Storage Category emerges as a high-growth segment driven by renewable energy expansion and grid modernization initiatives. This category requires large-scale battery systems with sophisticated control systems and grid integration capabilities. Project-based sales in energy storage applications involve longer sales cycles but generate substantial revenue opportunities and long-term service contracts.

Manufacturers benefit from expanding market opportunities across diverse application segments, with particular advantages for companies that can leverage South America’s lithium resources and develop integrated value chains. Local manufacturing capabilities provide cost advantages, reduced supply chain risks, and improved customer responsiveness while supporting compliance with local content requirements and trade preferences. Technology development opportunities allow manufacturers to create specialized solutions for regional market needs while building intellectual property and competitive advantages.

Distributors and Retailers gain from growing market demand across multiple product categories, with opportunities to develop specialized expertise in emerging segments like electric vehicle batteries and energy storage systems. Strong distribution networks become increasingly valuable as market complexity increases and customers require technical support and service capabilities. Value-added services including installation, maintenance, and recycling create additional revenue streams and strengthen customer relationships.

End Users benefit from improving battery performance, declining costs, and expanding product availability that enables adoption of advanced technologies across various applications. Total cost of ownership improvements through longer battery life, higher efficiency, and reduced maintenance requirements provide economic benefits that justify investment in premium battery solutions. Environmental benefits from cleaner energy storage and reduced emissions support corporate sustainability objectives and regulatory compliance.

Investors find attractive opportunities in a growing market supported by favorable demographic trends, government policies, and resource advantages. MWR analysis indicates that the market offers diverse investment opportunities across the value chain, from raw material extraction to manufacturing, distribution, and recycling operations. Strategic partnerships and joint ventures provide access to local market knowledge and regulatory compliance while sharing investment risks and capital requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electric Vehicle Integration represents the most significant trend shaping the South American rechargeable battery market, with governments implementing ambitious electrification targets and automotive manufacturers announcing electric vehicle production plans. This trend drives demand for high-performance lithium-ion batteries while creating opportunities for local battery manufacturing and supply chain development. Charging infrastructure expansion supports electric vehicle adoption while creating additional demand for energy storage systems that can manage grid loads and provide fast-charging capabilities.

Renewable Energy Storage emerges as a critical trend driven by the region’s abundant solar and wind resources and the need for grid stability solutions. Large-scale battery storage projects become essential for maximizing renewable energy utilization and ensuring reliable power supply. Distributed energy storage applications in commercial and residential sectors create additional market opportunities as energy costs rise and grid reliability concerns increase.

Circular Economy Development gains momentum as companies and governments focus on sustainable battery lifecycle management, including recycling and material recovery programs. This trend creates opportunities for specialized recycling operations while addressing environmental concerns and resource security issues. Second-life applications for automotive batteries in stationary storage applications extend battery lifecycle and improve economic returns.

Technology Advancement continues accelerating with development of solid-state batteries, improved lithium-ion chemistries, and alternative battery technologies that offer enhanced performance characteristics. Manufacturing innovation includes automated production processes, quality control systems, and supply chain optimization that reduce costs and improve product reliability.

Manufacturing Expansion initiatives across the region include new battery production facilities, capacity expansion projects, and technology transfer agreements that strengthen local manufacturing capabilities. Several international battery manufacturers have announced plans to establish regional operations, while local companies invest in production capacity and technology development. Strategic partnerships between mining companies and battery manufacturers create integrated value chains that leverage South America’s lithium resources.

Government Policy developments include electric vehicle incentive programs, renewable energy mandates, and industrial development policies that support battery manufacturing investment. Countries like Chile and Colombia have implemented comprehensive electric mobility strategies that create long-term demand visibility for battery suppliers. Regulatory frameworks for battery safety, environmental compliance, and recycling establish market standards while ensuring sustainable industry development.

Technology Innovation projects include research and development centers, university partnerships, and collaborative development programs that advance battery technology and manufacturing processes. MarkWide Research indicates that innovation investment in South America focuses on applications that address specific regional market needs while building competitive advantages in global markets.

Infrastructure Development encompasses charging station networks, grid modernization projects, and recycling facilities that support battery market expansion. Public and private sector investment in supporting infrastructure creates favorable conditions for sustained market growth while addressing key adoption barriers.

Market Entry Strategies should prioritize partnerships with local companies that possess market knowledge, distribution networks, and regulatory expertise. International companies entering South American markets benefit from joint ventures or strategic alliances that provide access to local resources while sharing investment risks and regulatory compliance requirements. Localization strategies including local manufacturing, sourcing, and technical support capabilities improve competitiveness and customer relationships.

Technology Focus recommendations emphasize lithium-ion battery technologies that serve multiple application segments while building capabilities in emerging technologies like solid-state batteries that offer future competitive advantages. Companies should invest in research and development capabilities that address specific regional market needs while building intellectual property portfolios. Application diversification across consumer electronics, automotive, and energy storage segments reduces market risk while maximizing growth opportunities.

Supply Chain Development should emphasize integration with local lithium mining operations and development of regional component sourcing capabilities that reduce dependence on imports. Companies benefit from establishing relationships with multiple suppliers while investing in supply chain visibility and risk management systems. Sustainability initiatives including recycling capabilities and environmental compliance programs become increasingly important for market access and customer acceptance.

Investment Priorities should focus on manufacturing capabilities, technology development, and market development activities that build long-term competitive advantages. Companies should consider the timing of capacity investments to align with market demand growth while avoiding overcapacity situations. Partnership development with automotive manufacturers, renewable energy developers, and industrial customers creates stable demand and revenue visibility.

Market trajectory for the South American rechargeable battery market indicates sustained growth driven by electric vehicle adoption, renewable energy expansion, and continued consumer electronics penetration. The market is expected to maintain robust growth rates exceeding 8% annually over the next decade, with particular strength in automotive and energy storage applications. Technology evolution will continue driving performance improvements and cost reductions that expand market opportunities across diverse applications.

Manufacturing development prospects include significant expansion of local production capabilities as companies invest in regional facilities to serve growing demand and leverage resource advantages. South America’s position in global battery supply chains will strengthen as integrated lithium-to-battery value chains develop and mature. Export opportunities will emerge as regional manufacturing capabilities reach scale and cost competitiveness in global markets.

Application evolution will see continued diversification beyond traditional consumer electronics into automotive, industrial, and energy storage segments that offer higher growth rates and value creation opportunities. Grid storage applications will experience particularly rapid growth as renewable energy penetration increases and grid modernization accelerates across the region.

Competitive dynamics will intensify as market opportunities attract additional participants while existing companies expand their regional presence and capabilities. Market consolidation may occur in certain segments as companies seek scale advantages and supply chain integration benefits. Innovation competition will drive continued investment in research and development while creating opportunities for technology leadership and differentiation.

The South America rechargeable battery market represents a compelling growth opportunity characterized by strong demand drivers, favorable resource endowments, and supportive government policies that create conditions for sustained expansion. The market’s evolution from import dependence toward integrated manufacturing capabilities reflects the region’s strategic importance in global battery value chains and its potential to become a major supplier of battery products and materials.

Key success factors for market participants include developing local partnerships, investing in appropriate technologies, and building supply chain capabilities that leverage South America’s competitive advantages while addressing specific regional market needs. The market’s diversity across countries, applications, and technologies requires sophisticated strategies that account for varying market conditions and regulatory environments while maintaining operational efficiency and cost competitiveness.

Long-term prospects remain highly favorable as electric vehicle adoption accelerates, renewable energy installations expand, and consumer electronics penetration continues growing across the region. The market’s strategic importance will increase as global battery demand grows and supply chain security becomes a critical consideration for international manufacturers and end users seeking reliable, cost-effective energy storage solutions.

What is Rechargeable Battery?

Rechargeable batteries are energy storage devices that can be charged and discharged multiple times. They are commonly used in various applications, including consumer electronics, electric vehicles, and renewable energy systems.

What are the key players in the South America Rechargeable Battery Market?

Key players in the South America Rechargeable Battery Market include companies like BYD Company Limited, LG Chem, Panasonic Corporation, and Samsung SDI, among others.

What are the main drivers of the South America Rechargeable Battery Market?

The main drivers of the South America Rechargeable Battery Market include the increasing demand for electric vehicles, the growth of renewable energy sources, and the rising need for portable electronic devices.

What challenges does the South America Rechargeable Battery Market face?

Challenges in the South America Rechargeable Battery Market include supply chain disruptions, high production costs, and environmental concerns related to battery disposal and recycling.

What opportunities exist in the South America Rechargeable Battery Market?

Opportunities in the South America Rechargeable Battery Market include advancements in battery technology, the expansion of electric vehicle infrastructure, and increasing investments in renewable energy projects.

What trends are shaping the South America Rechargeable Battery Market?

Trends shaping the South America Rechargeable Battery Market include the development of solid-state batteries, the integration of smart technologies in battery management systems, and a growing focus on sustainability and recycling initiatives.

South America Rechargeable Battery Market

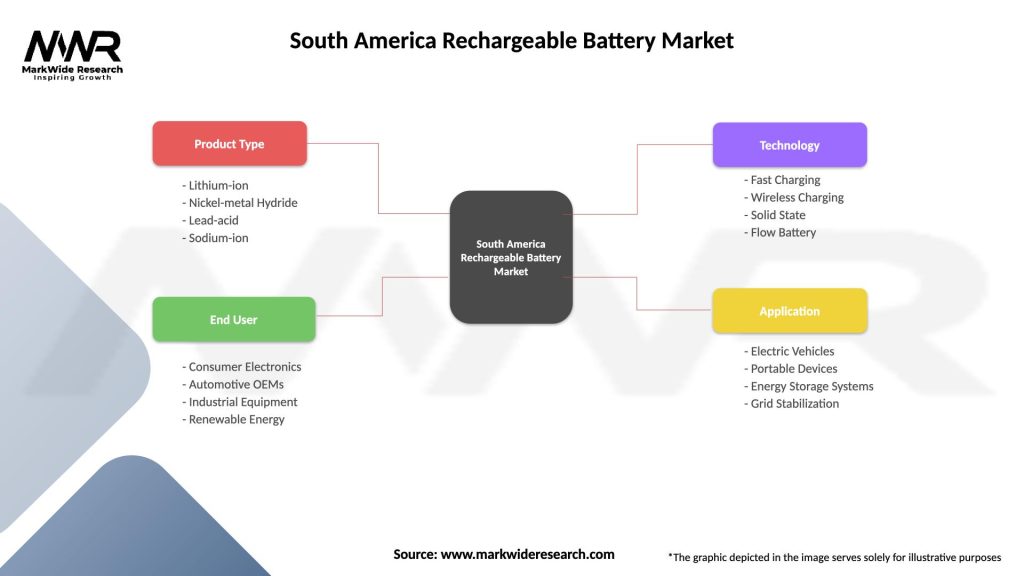

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-metal Hydride, Lead-acid, Sodium-ion |

| End User | Consumer Electronics, Automotive OEMs, Industrial Equipment, Renewable Energy |

| Technology | Fast Charging, Wireless Charging, Solid State, Flow Battery |

| Application | Electric Vehicles, Portable Devices, Energy Storage Systems, Grid Stabilization |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Rechargeable Battery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at