444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific government and security biometrics market represents one of the most dynamic and rapidly evolving sectors in the global security technology landscape. This region has emerged as a frontrunner in adopting advanced biometric solutions for government applications, border security, law enforcement, and national identification programs. The market encompasses a comprehensive range of biometric technologies including fingerprint recognition, facial recognition, iris scanning, voice recognition, and multimodal biometric systems specifically designed for government and security applications.

Government initiatives across the Asia-Pacific region have been instrumental in driving market expansion, with countries like India, China, Japan, and South Korea leading massive digital identity projects. The market is experiencing robust growth driven by increasing security concerns, rising terrorist threats, growing need for secure border control, and the digitization of government services. Technological advancements in artificial intelligence and machine learning have significantly enhanced the accuracy and speed of biometric systems, making them more attractive for large-scale government deployments.

Regional dynamics show that the Asia-Pacific market is characterized by diverse adoption patterns, with developed economies focusing on upgrading existing systems while emerging markets are implementing comprehensive biometric infrastructure from the ground up. The market growth trajectory indicates a compound annual growth rate (CAGR) of approximately 18.5%, reflecting the strong momentum in government biometric initiatives across the region.

The Asia-Pacific government and security biometrics market refers to the comprehensive ecosystem of biometric technologies, solutions, and services specifically deployed by government agencies and security organizations across the Asia-Pacific region for identity verification, access control, surveillance, and law enforcement applications. This market encompasses the development, manufacturing, integration, and maintenance of biometric systems designed to meet the stringent security and operational requirements of government entities.

Biometric technologies in this context include physiological characteristics such as fingerprints, facial features, iris patterns, and palm prints, as well as behavioral characteristics like voice patterns and gait recognition. These systems are deployed across various government touchpoints including border control checkpoints, government buildings, law enforcement agencies, military installations, and citizen service centers. The market also includes the supporting infrastructure such as databases, networking equipment, and software platforms that enable large-scale biometric operations.

Security applications within this market span from national identification programs and e-passport systems to criminal identification databases and counter-terrorism initiatives. The integration of biometric systems with existing government IT infrastructure and the development of interoperable solutions that can work across different agencies and jurisdictions are key components of this market definition.

Market momentum in the Asia-Pacific government and security biometrics sector continues to accelerate, driven by unprecedented government investments in digital identity infrastructure and national security systems. The region has established itself as a global leader in biometric technology adoption, with several countries implementing some of the world’s largest biometric identification programs. Technology integration has reached new levels of sophistication, with artificial intelligence and cloud computing enhancing the capabilities of traditional biometric systems.

Key growth drivers include increasing urbanization, rising security threats, government digitization initiatives, and the need for efficient citizen service delivery. The market has witnessed significant technological evolution, with multimodal biometric systems gaining prominence due to their enhanced accuracy and security features. Border security applications represent approximately 35% of the total market demand, followed by national identification programs and law enforcement applications.

Regional leadership is evident in countries like India with its Aadhaar program, China’s social credit system integration, and Japan’s advanced immigration control systems. The market is characterized by strong public-private partnerships, with government agencies collaborating closely with technology providers to develop customized solutions. Future prospects remain highly positive, with emerging technologies like behavioral biometrics and contactless identification systems expected to drive the next wave of market growth.

Strategic insights reveal that the Asia-Pacific government and security biometrics market is undergoing a fundamental transformation driven by technological innovation and evolving security requirements. The following key insights highlight the most significant market developments:

Market maturity varies significantly across the region, with developed economies focusing on system upgrades and emerging markets investing in foundational biometric infrastructure. Government procurement patterns show increasing preference for comprehensive solutions that include hardware, software, and long-term support services.

Security imperatives represent the primary driving force behind the rapid expansion of government and security biometrics in the Asia-Pacific region. Rising concerns about terrorism, cross-border crime, and identity fraud have compelled governments to invest heavily in advanced biometric identification systems. National security considerations have become paramount, with countries implementing comprehensive biometric databases to track and monitor potential security threats.

Digital government initiatives across the region are accelerating biometric adoption as governments seek to modernize citizen services and improve operational efficiency. The push toward paperless governance and digital identity systems has created substantial demand for reliable biometric authentication solutions. Border control modernization programs are particularly significant, with countries upgrading their immigration and customs systems to handle increasing passenger volumes while maintaining security standards.

Technological maturity has reached a point where biometric systems offer the reliability and accuracy required for large-scale government deployments. Improvements in sensor technology, processing power, and algorithm sophistication have made biometric systems more cost-effective and user-friendly. Population growth and urbanization trends are creating additional pressure on government systems, driving the need for automated identity verification solutions that can handle high transaction volumes efficiently.

Economic factors also play a crucial role, with governments recognizing the long-term cost benefits of biometric systems in reducing fraud, improving service delivery, and enhancing operational efficiency. The availability of government funding and international development assistance for digital infrastructure projects has further accelerated market growth.

Implementation challenges pose significant constraints to market growth, particularly in terms of the complexity and scale of government biometric deployments. Large-scale biometric systems require substantial technical expertise, robust infrastructure, and careful project management to ensure successful implementation. Integration difficulties with existing government IT systems often lead to project delays and cost overruns, creating hesitation among government decision-makers.

Privacy concerns and data protection issues have become increasingly prominent, with citizens and advocacy groups raising questions about government surveillance and the potential misuse of biometric data. Regulatory compliance requirements are becoming more stringent, requiring additional investments in security measures and data protection protocols. The lack of comprehensive legal frameworks for biometric data handling in some countries creates uncertainty for both government agencies and technology providers.

Cost considerations remain a significant barrier, particularly for developing countries with limited government budgets. The high initial investment required for biometric infrastructure, combined with ongoing maintenance and upgrade costs, can strain government resources. Technical limitations of current biometric technologies, including accuracy issues in certain demographic groups and environmental conditions, continue to pose challenges for universal deployment.

Interoperability issues between different biometric systems and vendors create additional complexity and costs for government agencies seeking to integrate multiple solutions. The lack of standardized protocols and data formats can limit the effectiveness of cross-agency collaboration and data sharing initiatives.

Emerging technologies present substantial opportunities for market expansion, particularly in areas such as behavioral biometrics, contactless identification, and AI-powered analytics. The integration of blockchain technology with biometric systems offers new possibilities for secure and decentralized identity management, addressing privacy concerns while maintaining security standards. 5G connectivity is enabling new applications for mobile and remote biometric authentication, expanding the potential use cases for government services.

Smart city initiatives across the Asia-Pacific region are creating new demand for integrated biometric solutions that can support various urban services including transportation, healthcare, and public safety. Cross-border cooperation programs are driving demand for interoperable biometric systems that can facilitate secure travel and trade while maintaining security standards. The growing focus on digital inclusion is creating opportunities for biometric solutions that can serve underserved populations and remote areas.

Public-private partnerships are opening new avenues for market growth, with governments increasingly willing to collaborate with private sector partners to develop and deploy biometric solutions. Export opportunities are expanding as countries with advanced biometric capabilities share their expertise and technology with neighboring nations. The development of specialized applications for specific government use cases, such as voter registration, healthcare delivery, and social welfare distribution, presents additional growth opportunities.

Cybersecurity integration represents a significant opportunity as governments seek comprehensive security solutions that combine biometric authentication with advanced threat detection and response capabilities. The increasing adoption of cloud-based services is creating demand for scalable biometric platforms that can support growing government operations.

Competitive dynamics in the Asia-Pacific government and security biometrics market are characterized by intense competition between global technology leaders and regional specialists. Market consolidation trends are evident as larger companies acquire specialized biometric firms to expand their capabilities and market reach. The competitive landscape is shaped by factors such as technological innovation, government relationships, local presence, and the ability to deliver large-scale implementations.

Technology evolution continues to reshape market dynamics, with artificial intelligence and machine learning becoming standard components of modern biometric systems. Accuracy improvements of up to 99.7% in facial recognition systems have made these technologies suitable for critical government applications. The shift toward multimodal biometric systems is changing vendor strategies, with companies investing in comprehensive solution portfolios rather than single-technology offerings.

Government procurement processes are evolving to favor vendors that can demonstrate long-term partnership capabilities, local support infrastructure, and compliance with data sovereignty requirements. Regional preferences for domestic technology providers are influencing market dynamics, with some countries implementing policies that favor local companies or require technology transfer agreements.

Innovation cycles are accelerating, with new biometric modalities and applications emerging regularly. The market is experiencing a shift toward software-centric solutions that can be deployed on standard hardware platforms, reducing costs and improving flexibility. Service-oriented business models are gaining traction, with vendors offering biometric capabilities as managed services rather than traditional product sales.

Comprehensive research approach employed for analyzing the Asia-Pacific government and security biometrics market combines primary and secondary research methodologies to ensure accurate and reliable market insights. Primary research activities include extensive interviews with government officials, technology vendors, system integrators, and industry experts across key markets in the region. These interviews provide firsthand insights into market trends, challenges, and opportunities from multiple stakeholder perspectives.

Secondary research encompasses analysis of government procurement data, industry reports, technology patents, regulatory documents, and financial statements of key market participants. Data triangulation methods are employed to validate findings across multiple sources and ensure consistency in market analysis. The research methodology includes both quantitative analysis of market trends and qualitative assessment of strategic factors influencing market development.

Market segmentation analysis is conducted using multiple criteria including technology type, application area, end-user category, and geographic region. Competitive intelligence gathering involves analysis of vendor capabilities, market positioning, strategic partnerships, and technology roadmaps. The methodology includes scenario analysis to assess potential market developments under different economic and regulatory conditions.

Quality assurance processes ensure data accuracy and reliability through multiple validation steps and expert review. The research approach incorporates feedback from industry stakeholders to refine analysis and ensure practical relevance of findings. Continuous monitoring of market developments ensures that insights remain current and actionable for market participants.

China dominates the regional market with approximately 42% market share, driven by massive government investments in social credit systems, surveillance infrastructure, and border security applications. The country’s advanced facial recognition capabilities and large-scale deployment experience have established it as a technology leader in the region. Government initiatives including the national ID card system and comprehensive surveillance networks have created substantial demand for biometric solutions.

India represents the second-largest market with 28% regional share, primarily due to the Aadhaar biometric identification program, which covers over one billion citizens. The country’s focus on digital governance and financial inclusion has driven extensive adoption of biometric authentication across government services. Border security concerns with neighboring countries have also contributed to significant investments in biometric border control systems.

Japan and South Korea together account for approximately 15% of the regional market, with both countries focusing on advanced immigration control systems and smart city initiatives. Technological sophistication in these markets drives demand for cutting-edge biometric solutions with high accuracy and reliability requirements. The preparation for major international events has accelerated biometric system deployments in both countries.

Southeast Asian markets including Thailand, Malaysia, Singapore, and Indonesia represent 12% of regional demand, with growing investments in national identification programs and border security systems. ASEAN integration initiatives are driving demand for interoperable biometric systems that can facilitate cross-border travel and trade. Australia and New Zealand comprise the remaining 3% of the market, focusing primarily on immigration control and law enforcement applications.

Market leadership in the Asia-Pacific government and security biometrics sector is characterized by a mix of global technology giants and specialized regional players. The competitive environment is shaped by technological capabilities, government relationships, local presence, and the ability to deliver large-scale implementations.

Strategic partnerships between international technology providers and local system integrators are common, enabling global companies to navigate complex government procurement processes and local regulatory requirements. Innovation focus areas include AI-powered analytics, contactless biometrics, and cloud-based platforms that can support large-scale government operations.

Technology-based segmentation reveals distinct market preferences across different biometric modalities. Facial recognition systems dominate the market due to their non-intrusive nature and suitability for surveillance applications, while fingerprint recognition remains popular for access control and identity verification applications. Iris recognition technology is gaining traction in high-security government applications due to its exceptional accuracy and stability.

Application segmentation shows that border control represents the largest segment, followed by national identification programs and law enforcement applications. Access control for government facilities and time and attendance systems constitute smaller but growing segments. Voter registration and social welfare applications are emerging as significant growth areas.

End-user segmentation includes immigration and border control agencies, law enforcement organizations, defense and military, civil identification authorities, and other government agencies. Each segment has distinct requirements in terms of accuracy, speed, scalability, and integration capabilities.

Deployment model segmentation encompasses on-premises solutions, cloud-based systems, and hybrid deployments. Government agencies are increasingly adopting cloud-based solutions for their scalability and cost-effectiveness, while maintaining on-premises systems for highly sensitive applications.

By Technology: Facial recognition systems lead the market due to their versatility and non-contact operation, making them ideal for surveillance and mass screening applications. These systems have achieved accuracy rates exceeding 99.5% in controlled environments, making them suitable for critical government applications. Fingerprint recognition maintains strong demand for access control and identity verification, particularly in applications requiring physical contact verification.

Multimodal biometric systems are experiencing rapid growth as government agencies seek enhanced security and accuracy. These systems combine multiple biometric modalities to reduce false acceptance rates and improve overall system reliability. Iris recognition technology is gaining adoption in high-security applications due to its exceptional accuracy and stability over time.

By Application: Border control applications dominate market demand, driven by increasing international travel and security concerns. These systems require high-speed processing capabilities and integration with international databases. National identification programs represent substantial long-term opportunities, with several countries planning comprehensive biometric ID systems.

Law enforcement applications are growing rapidly, with police agencies adopting mobile biometric devices and automated fingerprint identification systems. Access control for government facilities continues to evolve toward more sophisticated systems that can handle large numbers of users while maintaining security standards.

By Deployment: Cloud-based deployments are gaining momentum as government agencies recognize the benefits of scalability and reduced infrastructure costs. However, on-premises solutions remain important for highly sensitive applications where data sovereignty is critical.

Government agencies benefit from enhanced security capabilities, improved operational efficiency, and better citizen service delivery through biometric system implementations. Cost reduction opportunities include decreased fraud, streamlined processes, and reduced manual verification requirements. Data-driven insights from biometric systems enable better resource allocation and strategic planning for government operations.

Technology vendors gain access to substantial government contracts with long-term revenue potential and opportunities for technology advancement through challenging deployment requirements. Market expansion opportunities exist through successful reference implementations that can be leveraged for additional government contracts. Innovation drivers from government requirements push vendors to develop more advanced and capable biometric solutions.

System integrators benefit from complex project opportunities that require specialized expertise in government procurement, security requirements, and large-scale system deployment. Partnership opportunities with technology vendors create additional revenue streams and market access. Long-term support contracts provide stable revenue and ongoing customer relationships.

Citizens experience improved service delivery, reduced waiting times, and enhanced security in government interactions. Digital inclusion initiatives enabled by biometric systems provide access to government services for previously underserved populations. Fraud protection benefits include reduced identity theft and improved security of personal information.

Economic benefits for the broader economy include job creation in technology sectors, improved government efficiency, and enhanced security that supports business confidence and investment.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming biometric systems from simple pattern matching tools to intelligent security platforms capable of behavioral analysis and threat detection. Machine learning algorithms are improving accuracy rates and reducing false positives, making biometric systems more reliable for critical government applications. Deep learning techniques are enabling more sophisticated facial recognition capabilities that can work effectively in challenging lighting and environmental conditions.

Contactless biometric technologies are gaining significant traction, accelerated by health concerns and the need for hygienic identification solutions. Touchless fingerprint scanning and remote iris recognition are becoming more prevalent in government facilities and border control applications. The trend toward contactless solutions is driving innovation in sensor technology and processing algorithms.

Cloud-based biometric platforms are emerging as preferred solutions for government agencies seeking scalability and cost-effectiveness. Hybrid cloud deployments allow agencies to maintain sensitive data on-premises while leveraging cloud computing for processing and analytics. Edge computing integration is enabling real-time biometric processing in remote locations with limited connectivity.

Mobile biometric applications are expanding rapidly, with law enforcement and field service personnel using smartphone-based biometric devices for identity verification. Wearable biometric sensors are being explored for continuous authentication and monitoring applications. The integration of blockchain technology with biometric systems is creating new possibilities for secure and decentralized identity management.

Major contract awards across the region continue to drive market growth, with several countries announcing large-scale biometric identification programs. India’s expansion of the Aadhaar system to include additional biometric modalities and applications represents a significant market development. China’s integration of biometric systems with social credit and surveillance infrastructure demonstrates the potential scale of government biometric deployments.

Technology partnerships between global vendors and regional system integrators are creating new market opportunities and capabilities. Strategic acquisitions in the biometric technology sector are consolidating market capabilities and creating more comprehensive solution providers. Research and development investments are accelerating, with companies focusing on next-generation biometric technologies and applications.

Regulatory developments including new data protection laws and biometric usage guidelines are shaping market requirements and vendor strategies. Standardization initiatives for biometric data formats and interoperability protocols are facilitating cross-border cooperation and system integration. International cooperation agreements for sharing biometric data and best practices are expanding market opportunities.

According to MarkWide Research analysis, the market is witnessing increased focus on privacy-preserving biometric technologies that can provide security benefits while addressing data protection concerns. Innovation accelerators and government-sponsored research programs are driving development of advanced biometric capabilities tailored to regional requirements.

Strategic recommendations for market participants emphasize the importance of developing comprehensive solution portfolios that address the full spectrum of government biometric requirements. Technology vendors should focus on creating interoperable systems that can integrate with existing government infrastructure while providing upgrade paths for future enhancements. Investment priorities should include AI and machine learning capabilities, cloud-based platforms, and mobile integration technologies.

Government agencies are advised to develop comprehensive biometric strategies that consider long-term scalability, interoperability requirements, and citizen privacy concerns. Pilot programs and phased implementations are recommended to validate technology performance and user acceptance before large-scale deployments. Vendor selection should prioritize companies with proven track records in government implementations and strong local support capabilities.

Partnership strategies between international technology providers and local system integrators are essential for navigating complex government procurement processes and regulatory requirements. Compliance frameworks should be established early in project planning to ensure adherence to data protection and privacy regulations. Training and change management programs are critical for successful biometric system adoption by government personnel.

Market entry strategies for new participants should focus on specialized applications or underserved market segments where established competitors may have less presence. Innovation focus areas include behavioral biometrics, contactless identification, and privacy-preserving technologies that address emerging market requirements.

Long-term market prospects for the Asia-Pacific government and security biometrics sector remain highly positive, with continued government investments in digital infrastructure and security systems expected to drive sustained growth. Technology evolution will continue to expand the capabilities and applications of biometric systems, creating new market opportunities and use cases. Regional integration initiatives will drive demand for interoperable biometric systems that can support cross-border cooperation and trade facilitation.

Emerging applications including healthcare delivery, social welfare distribution, and disaster response are expected to create additional growth opportunities for biometric technology providers. Smart city development across the region will integrate biometric systems with urban infrastructure, creating comprehensive identity management ecosystems. MWR projections indicate that the market will continue growing at a robust CAGR of approximately 17.2% over the next five years.

Technology trends suggest that future biometric systems will be more intelligent, autonomous, and capable of continuous learning and adaptation. Quantum computing developments may eventually impact biometric security and processing capabilities, requiring ongoing technology evolution. Sustainability considerations are expected to influence system design and deployment decisions, with energy-efficient solutions gaining preference.

Market consolidation is likely to continue as larger technology companies acquire specialized biometric firms to expand their capabilities and market reach. Government policies supporting digital transformation and national security will continue to provide favorable market conditions for biometric technology adoption. The integration of biometric systems with broader digital government initiatives will create comprehensive citizen service platforms that transform government-citizen interactions.

The Asia-Pacific government and security biometrics market represents one of the most dynamic and promising sectors in the global security technology landscape. With strong government support, technological advancement, and growing security requirements driving sustained demand, the market is positioned for continued robust growth. Regional leadership in biometric technology adoption and implementation has established the Asia-Pacific as a global center of excellence for government biometric solutions.

Market evolution continues to be shaped by technological innovation, regulatory developments, and changing security requirements. The integration of artificial intelligence, cloud computing, and mobile technologies is creating more capable and accessible biometric solutions that can address the diverse needs of government agencies across the region. Future success in this market will depend on the ability to balance security requirements with privacy concerns while delivering cost-effective and user-friendly solutions.

Strategic opportunities abound for technology vendors, system integrators, and government agencies willing to invest in advanced biometric capabilities and comprehensive implementation strategies. The market’s continued expansion will be supported by ongoing digital transformation initiatives, cross-border cooperation programs, and the growing recognition of biometric technology as an essential component of modern government operations. Long-term prospects remain highly favorable, with the Asia-Pacific government and security biometrics market expected to maintain its position as a global leader in biometric technology adoption and innovation.

What is Government And Security Biometrics?

Government and security biometrics refer to the use of biometric technologies, such as fingerprint recognition, facial recognition, and iris scanning, for identification and verification purposes in governmental and security applications.

What are the key players in the Asia-Pacific Government And Security Biometrics Market?

Key players in the Asia-Pacific Government And Security Biometrics Market include NEC Corporation, Thales Group, Gemalto, and HID Global, among others.

What are the main drivers of the Asia-Pacific Government And Security Biometrics Market?

The main drivers of the Asia-Pacific Government And Security Biometrics Market include the increasing need for enhanced security measures, the rise in identity theft cases, and the growing adoption of biometric systems in law enforcement and border control.

What challenges does the Asia-Pacific Government And Security Biometrics Market face?

Challenges in the Asia-Pacific Government And Security Biometrics Market include concerns over privacy and data security, high implementation costs, and the need for interoperability among different biometric systems.

What opportunities exist in the Asia-Pacific Government And Security Biometrics Market?

Opportunities in the Asia-Pacific Government And Security Biometrics Market include advancements in biometric technology, increasing government investments in security infrastructure, and the potential for integration with emerging technologies like AI and IoT.

What trends are shaping the Asia-Pacific Government And Security Biometrics Market?

Trends shaping the Asia-Pacific Government And Security Biometrics Market include the growing use of mobile biometrics, the integration of biometric systems with cloud computing, and the increasing focus on multi-modal biometric systems for improved accuracy.

Asia-Pacific Government And Security Biometrics Market

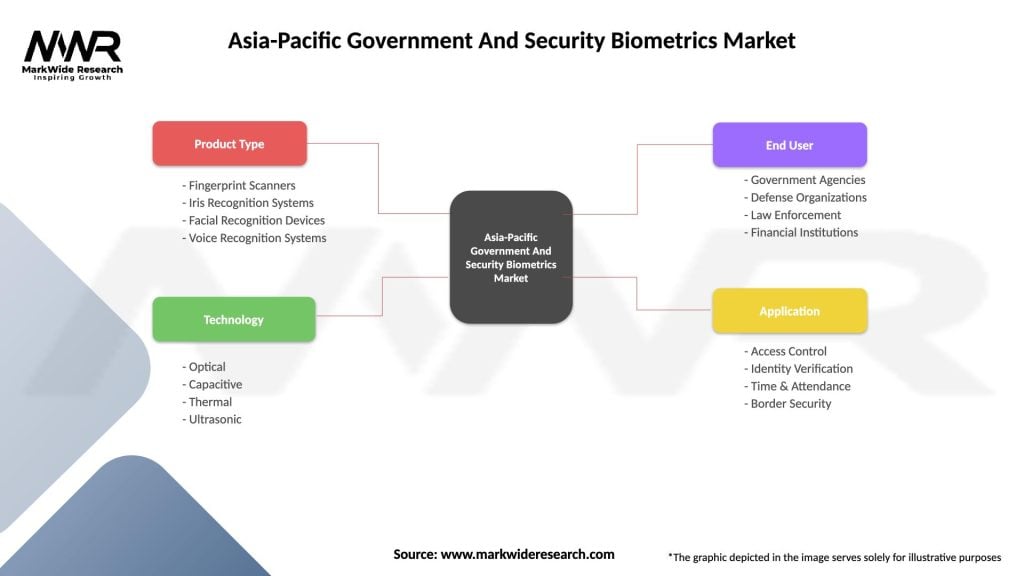

| Segmentation Details | Description |

|---|---|

| Product Type | Fingerprint Scanners, Iris Recognition Systems, Facial Recognition Devices, Voice Recognition Systems |

| Technology | Optical, Capacitive, Thermal, Ultrasonic |

| End User | Government Agencies, Defense Organizations, Law Enforcement, Financial Institutions |

| Application | Access Control, Identity Verification, Time & Attendance, Border Security |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Government And Security Biometrics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at