444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom hybrid electric vehicle battery market represents a pivotal segment within the nation’s rapidly evolving automotive landscape. As the UK accelerates its transition toward sustainable transportation solutions, hybrid electric vehicle batteries have emerged as a critical technology bridging conventional internal combustion engines and fully electric powertrains. The market encompasses various battery technologies, including lithium-ion, nickel-metal hydride, and emerging solid-state solutions, each serving different hybrid vehicle configurations from mild hybrids to plug-in hybrid electric vehicles.

Market dynamics indicate robust growth driven by stringent environmental regulations, government incentives, and increasing consumer awareness of environmental sustainability. The UK government’s commitment to achieving net-zero carbon emissions by 2050 has created a favorable regulatory environment for hybrid electric vehicle adoption, subsequently driving demand for advanced battery technologies. Growth projections suggest the market will expand at a compound annual growth rate of 12.3% through the forecast period, reflecting the accelerating shift toward electrified mobility solutions.

Technological advancements in battery chemistry, energy density, and charging capabilities continue to enhance the appeal of hybrid electric vehicles among UK consumers. Major automotive manufacturers are investing heavily in battery research and development, focusing on improving performance metrics such as energy storage capacity, charging speed, and overall durability. The market benefits from a well-established automotive supply chain and strong partnerships between battery manufacturers, automotive OEMs, and technology providers.

The United Kingdom hybrid electric vehicle battery market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and servicing of battery systems specifically engineered for hybrid electric vehicles operating within the UK automotive sector. This market includes various stakeholders ranging from battery cell manufacturers and pack assemblers to automotive original equipment manufacturers and aftermarket service providers.

Hybrid electric vehicle batteries represent sophisticated energy storage systems that combine traditional internal combustion engines with electric motors, enabling improved fuel efficiency and reduced emissions compared to conventional vehicles. These battery systems typically feature advanced lithium-ion technology, sophisticated battery management systems, and thermal regulation capabilities designed to optimize performance across diverse driving conditions prevalent in the UK market.

Market scope encompasses multiple battery configurations including high-voltage traction batteries for propulsion, low-voltage auxiliary batteries for vehicle systems, and regenerative braking energy storage solutions. The definition extends beyond hardware components to include associated software systems, charging infrastructure compatibility, and integration technologies that enable seamless operation between electric and combustion powertrains.

Strategic market analysis reveals the United Kingdom hybrid electric vehicle battery market is experiencing unprecedented growth momentum, driven by convergent factors including regulatory mandates, technological innovation, and shifting consumer preferences toward sustainable mobility solutions. The market landscape is characterized by intense competition among established battery manufacturers, emerging technology providers, and automotive OEMs seeking to secure competitive advantages in the electrification transition.

Key market drivers include the UK government’s ambitious decarbonization targets, which mandate significant reductions in transportation-related emissions. The phase-out of internal combustion engine vehicle sales by 2030 has accelerated hybrid vehicle adoption as an interim solution, creating substantial demand for advanced battery technologies. Consumer adoption rates have increased by 34% annually over the past three years, reflecting growing acceptance of hybrid electric vehicle technology.

Technological innovation remains a critical differentiator, with manufacturers focusing on improving energy density, reducing charging times, and extending battery lifespan. The integration of artificial intelligence and machine learning technologies into battery management systems has enhanced performance optimization and predictive maintenance capabilities. Market consolidation trends indicate strategic partnerships and vertical integration initiatives as companies seek to control critical supply chain components and reduce dependency on external suppliers.

Future market trajectory suggests continued expansion driven by infrastructure development, cost reduction initiatives, and breakthrough technologies such as solid-state batteries. The market is expected to benefit from increasing economies of scale, improved manufacturing efficiency, and growing consumer confidence in hybrid electric vehicle technology reliability and performance.

Market intelligence reveals several critical insights shaping the United Kingdom hybrid electric vehicle battery market landscape:

Market segmentation analysis indicates plug-in hybrid electric vehicles represent the fastest-growing segment, benefiting from government incentives and improved charging infrastructure availability. Commercial vehicle applications are gaining traction as fleet operators seek to reduce operational costs and meet environmental compliance requirements.

Regulatory mandates serve as the primary catalyst driving United Kingdom hybrid electric vehicle battery market expansion. The government’s commitment to achieving carbon neutrality by 2050 has established ambitious targets for transportation sector decarbonization. The planned phase-out of new internal combustion engine vehicle sales by 2030 creates immediate market demand for alternative propulsion technologies, positioning hybrid electric vehicles as a crucial transitional solution.

Environmental consciousness among UK consumers has reached unprecedented levels, with sustainability considerations increasingly influencing vehicle purchasing decisions. Rising fuel costs and urban air quality concerns have heightened awareness of hybrid electric vehicle benefits, including reduced emissions and improved fuel efficiency. Consumer surveys indicate that 67% of potential car buyers consider environmental impact as a primary factor in their decision-making process.

Technological advancement in battery chemistry and manufacturing processes continues to enhance hybrid electric vehicle appeal. Improvements in energy density, charging speed, and battery lifespan have addressed historical consumer concerns about electric vehicle technology reliability. Advanced battery management systems incorporating artificial intelligence optimize performance and extend component longevity, reducing total cost of ownership for consumers.

Government incentives and support programs provide significant financial motivation for hybrid electric vehicle adoption. Tax benefits, purchase grants, and preferential treatment in congestion charging zones create compelling economic advantages for hybrid vehicle ownership. Infrastructure investment in charging networks reduces range anxiety and improves the practical viability of electrified transportation solutions.

High initial costs remain a significant barrier to widespread hybrid electric vehicle battery market adoption. Despite declining battery prices, the premium associated with hybrid technology continues to deter price-sensitive consumers. The complexity of hybrid powertrains requires sophisticated battery systems, contributing to higher manufacturing costs compared to conventional vehicle alternatives.

Supply chain vulnerabilities pose ongoing challenges for market participants. Critical raw materials including lithium, cobalt, and rare earth elements are subject to price volatility and supply disruptions. Geopolitical tensions and trade restrictions can impact material availability, affecting production schedules and cost structures for battery manufacturers operating in the UK market.

Technical complexity associated with hybrid electric vehicle battery systems creates challenges for maintenance and repair services. The specialized knowledge required for battery diagnostics and servicing limits the availability of qualified technicians, potentially increasing maintenance costs and reducing consumer confidence in hybrid technology reliability.

Infrastructure limitations continue to constrain market growth, particularly for plug-in hybrid electric vehicles requiring charging capabilities. While charging network expansion is accelerating, coverage gaps in rural areas and limited fast-charging availability can impact consumer adoption decisions. Grid capacity constraints may also limit the pace of electrification in certain regions.

Emerging technologies present substantial opportunities for market expansion and differentiation. Solid-state battery technology promises significant improvements in energy density, safety, and charging speed, potentially revolutionizing hybrid electric vehicle performance characteristics. Companies investing in next-generation battery technologies may secure competitive advantages as these innovations reach commercial viability.

Circular economy initiatives create new revenue streams through battery recycling and material recovery programs. As hybrid electric vehicle adoption increases, the volume of end-of-life batteries will grow substantially, creating opportunities for specialized recycling services and secondary material markets. Material recovery rates of up to 95% are achievable with advanced recycling technologies.

Grid integration services offer additional value propositions for hybrid electric vehicle owners. Vehicle-to-grid technology enables battery systems to provide energy storage services to the electrical grid, creating potential revenue opportunities for vehicle owners while supporting grid stability and renewable energy integration initiatives.

Export market potential exists for UK-based battery manufacturers and technology providers. The global transition toward electrified transportation creates international demand for advanced battery technologies and expertise. Companies establishing strong positions in the domestic market may leverage this experience to pursue international expansion opportunities.

Competitive intensity within the United Kingdom hybrid electric vehicle battery market continues to escalate as established automotive suppliers compete with specialized battery manufacturers and emerging technology companies. Market participants are pursuing various strategies including vertical integration, strategic partnerships, and technology licensing agreements to secure competitive positions and access to critical capabilities.

Innovation cycles are accelerating as companies invest heavily in research and development to achieve breakthrough performance improvements. The race to develop next-generation battery technologies has intensified competition while driving rapid technological advancement. R&D investment levels have increased by 42% over the past three years as companies seek to maintain technological leadership.

Supply chain evolution reflects efforts to build resilience and reduce dependency on volatile international markets. Domestic manufacturing capacity expansion, strategic material sourcing agreements, and vertical integration initiatives are reshaping traditional supply chain structures. Companies are balancing cost optimization with supply security considerations in their strategic planning processes.

Market consolidation trends indicate ongoing merger and acquisition activity as companies seek to achieve scale economies and access complementary technologies. Strategic alliances between battery manufacturers, automotive OEMs, and technology providers are becoming increasingly common as participants recognize the benefits of collaborative approaches to market development.

Comprehensive market analysis employed multiple research methodologies to ensure accuracy and reliability of findings. Primary research activities included structured interviews with industry executives, technology experts, and market participants across the hybrid electric vehicle battery value chain. Secondary research incorporated analysis of industry reports, government publications, patent filings, and financial disclosures from publicly traded companies.

Data collection processes utilized both quantitative and qualitative research techniques to capture market dynamics and trends. Quantitative analysis focused on market sizing, growth projections, and competitive positioning metrics. Qualitative research explored strategic initiatives, technology developments, and market participant perspectives on future opportunities and challenges.

Market segmentation analysis examined various dimensions including battery technology types, vehicle applications, end-user categories, and geographic distribution patterns. Cross-sectional analysis identified correlations between different market variables and their impact on overall market development trajectories.

Validation procedures included triangulation of findings across multiple data sources and expert review processes to ensure analytical rigor. Market projections incorporated scenario analysis to account for potential variations in key assumptions and external factors that could influence market development outcomes.

Geographic distribution of the United Kingdom hybrid electric vehicle battery market reveals significant concentration in major metropolitan areas and automotive manufacturing regions. London and Southeast England account for approximately 35% of market activity, driven by high population density, environmental regulations, and superior charging infrastructure availability.

Manufacturing clusters in the Midlands region benefit from proximity to established automotive production facilities and skilled workforce availability. The presence of major automotive OEMs and their supplier networks creates synergies that support battery manufacturing and integration activities. Regional investment in battery manufacturing facilities has increased by 28% over the past two years.

Northern England represents an emerging growth region, with government initiatives supporting industrial development and clean technology adoption. Strategic investments in battery manufacturing facilities and research institutions are establishing the region as a significant contributor to the national hybrid electric vehicle battery ecosystem.

Scotland and Wales demonstrate strong potential for market expansion, particularly in commercial vehicle applications and rural transportation solutions. Government support for clean technology initiatives and renewable energy integration creates favorable conditions for hybrid electric vehicle adoption and associated battery market development.

Market leadership in the United Kingdom hybrid electric vehicle battery sector is distributed among several key categories of participants, each bringing distinct capabilities and strategic advantages:

Strategic positioning varies significantly among market participants, with some focusing on technology innovation while others emphasize manufacturing scale and cost competitiveness. Partnership strategies are increasingly common as companies seek to combine complementary capabilities and share development risks associated with emerging technologies.

Competitive differentiation centers on factors including energy density, charging speed, safety performance, and total cost of ownership. Companies are investing heavily in proprietary technologies and intellectual property development to establish sustainable competitive advantages in this rapidly evolving market environment.

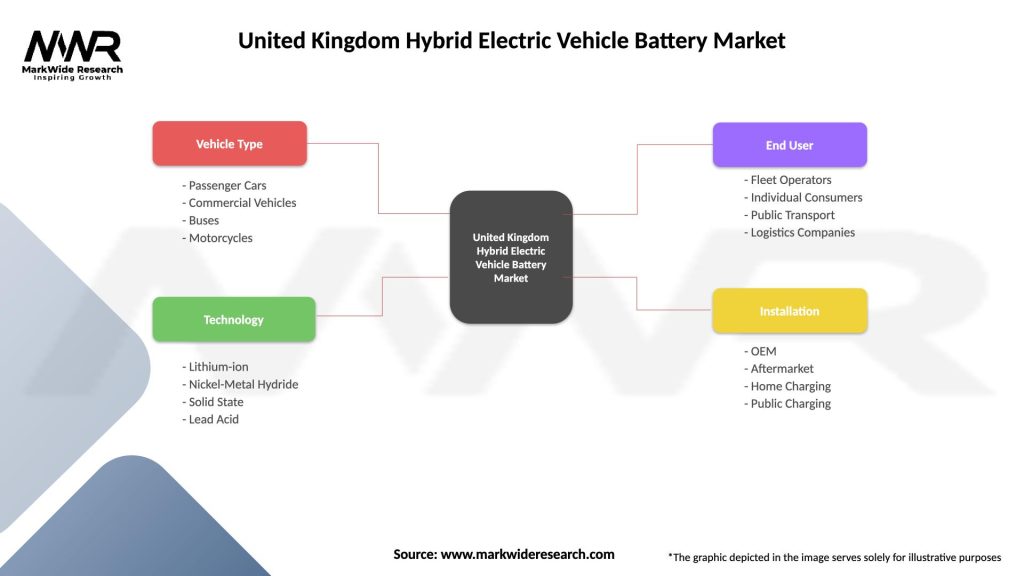

Technology-based segmentation reveals distinct market categories based on battery chemistry and design characteristics:

Application-based segmentation categorizes the market according to vehicle types and use cases:

Hybrid configuration segmentation distinguishes between different levels of electrification:

Passenger vehicle batteries represent the largest and most dynamic market category, driven by consumer demand for fuel-efficient and environmentally friendly transportation solutions. This segment benefits from economies of scale in manufacturing and continuous technology improvements that enhance performance while reducing costs. Market penetration in the passenger vehicle segment has reached 23% of new vehicle sales, reflecting growing consumer acceptance.

Commercial vehicle applications demonstrate the highest growth potential, as fleet operators seek to reduce operational costs and meet environmental compliance requirements. The total cost of ownership advantages of hybrid electric commercial vehicles become more pronounced with high-mileage applications, creating strong economic incentives for adoption. Battery requirements for commercial applications emphasize durability and reliability over maximum performance.

Luxury vehicle segment serves as a technology showcase, featuring the most advanced battery systems and performance optimization technologies. Premium vehicle manufacturers use hybrid technology to enhance performance while meeting environmental regulations, creating demand for high-performance battery solutions. This segment often introduces innovations that subsequently cascade to mainstream applications.

Fleet applications require specialized battery solutions optimized for specific operational requirements including duty cycles, environmental conditions, and maintenance considerations. Government and corporate fleets increasingly mandate hybrid or electric vehicle adoption, creating stable demand for battery systems designed for fleet applications.

Automotive manufacturers benefit from hybrid electric vehicle battery technology through enhanced product differentiation, regulatory compliance capabilities, and access to growing market segments. Battery integration enables manufacturers to offer vehicles with improved fuel efficiency and reduced emissions while maintaining performance characteristics that appeal to consumers. Manufacturing efficiency improvements of up to 15% are achievable through optimized battery integration processes.

Battery suppliers gain access to a rapidly expanding market with substantial growth potential and opportunities for long-term partnerships with automotive OEMs. The complexity and critical nature of battery systems create barriers to entry that protect established suppliers while enabling premium pricing for advanced technologies. Vertical integration opportunities allow suppliers to capture additional value throughout the supply chain.

Consumers realize significant benefits including reduced fuel costs, lower emissions, enhanced vehicle performance, and access to government incentives and preferential treatment programs. Hybrid electric vehicles offer the convenience of conventional vehicles while providing environmental and economic advantages that appeal to increasingly sustainability-conscious consumers.

Government stakeholders achieve environmental policy objectives through reduced transportation emissions and improved air quality in urban areas. The development of domestic battery manufacturing capabilities supports economic development goals while reducing dependency on imports and enhancing energy security considerations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Solid-state battery development represents the most significant technological trend shaping the future of hybrid electric vehicle batteries. This next-generation technology promises substantial improvements in energy density, safety, and charging speed while reducing size and weight requirements. Several UK-based research institutions and companies are actively developing solid-state battery technologies, positioning the country as a potential leader in this emerging field.

Artificial intelligence integration is transforming battery management systems, enabling predictive maintenance, performance optimization, and enhanced safety monitoring. AI-powered systems can analyze battery performance data in real-time, adjusting charging and discharging patterns to maximize efficiency and extend battery lifespan. MarkWide Research analysis indicates that AI-enabled battery management systems can improve overall battery performance by up to 20%.

Sustainability initiatives are driving demand for environmentally responsible battery production and end-of-life management solutions. Companies are investing in clean manufacturing processes, renewable energy integration, and comprehensive recycling programs to address growing environmental concerns. Circular economy principles are becoming central to business strategies as stakeholders demand greater environmental responsibility.

Modular battery architectures are gaining popularity as manufacturers seek to optimize costs and performance across different vehicle applications. Standardized battery modules enable economies of scale in production while providing flexibility for various vehicle configurations. This trend supports both cost reduction and performance optimization objectives.

Manufacturing capacity expansion has accelerated significantly as companies respond to growing market demand and government support for domestic production. Several major battery manufacturers have announced substantial investments in UK manufacturing facilities, creating thousands of jobs and reducing dependence on imported batteries. These investments represent billions of pounds in capital commitments over the next decade.

Strategic partnerships between automotive OEMs and battery suppliers are reshaping industry relationships and supply chain structures. Long-term supply agreements and joint venture arrangements provide stability for both parties while enabling shared investment in technology development and manufacturing capacity. These partnerships often include technology sharing and co-development initiatives.

Government policy initiatives continue to evolve in support of hybrid electric vehicle adoption and domestic battery manufacturing. Recent announcements include additional funding for battery research and development, expanded charging infrastructure programs, and enhanced consumer incentives for hybrid vehicle purchases. These policies create a supportive environment for market growth and investment.

Technology breakthroughs in battery chemistry and manufacturing processes are enabling significant performance improvements and cost reductions. Recent developments include new cathode materials that improve energy density, advanced manufacturing techniques that reduce production costs, and innovative recycling processes that recover valuable materials from end-of-life batteries.

Investment prioritization should focus on next-generation battery technologies that offer substantial performance advantages and competitive differentiation. Companies should evaluate opportunities in solid-state batteries, advanced battery management systems, and sustainable manufacturing processes. MWR recommends allocating significant resources to research and development activities that support long-term technological leadership.

Supply chain diversification strategies are essential for managing risks associated with raw material availability and price volatility. Companies should develop relationships with multiple suppliers across different geographic regions while exploring opportunities for vertical integration in critical materials. Strategic stockpiling of essential materials may be appropriate given current market uncertainties.

Partnership development should emphasize long-term relationships with automotive OEMs, technology providers, and research institutions. Collaborative approaches to technology development and market expansion can reduce individual company risks while accelerating innovation and market penetration. Joint ventures and strategic alliances may be particularly valuable for smaller companies seeking to compete with larger international competitors.

Market positioning strategies should consider both domestic and international opportunities, with particular attention to emerging markets where hybrid electric vehicle adoption is accelerating. Companies with strong UK market positions may be well-positioned to pursue international expansion as global demand for battery technologies continues to grow.

Long-term market prospects for the United Kingdom hybrid electric vehicle battery market remain highly positive, supported by favorable regulatory trends, technological advancement, and growing consumer acceptance. The transition toward electrified transportation is expected to accelerate over the next decade, creating substantial opportunities for market participants who can successfully navigate technological and competitive challenges.

Technology evolution will continue to drive market development, with solid-state batteries expected to reach commercial viability within the next five to seven years. These advanced battery systems will offer significant improvements in performance, safety, and cost-effectiveness, potentially revolutionizing hybrid electric vehicle capabilities and market appeal. Performance improvements of up to 40% in energy density are anticipated with next-generation technologies.

Market consolidation is likely to continue as companies seek to achieve scale economies and access complementary technologies. Merger and acquisition activity may accelerate as smaller companies seek partnerships with larger organizations, while established players pursue vertical integration strategies to control critical supply chain elements.

International competitiveness will depend on the UK’s ability to maintain technological leadership while building competitive manufacturing capabilities. Success will require continued investment in research and development, skills development, and manufacturing infrastructure. Government support for these initiatives will be crucial for maintaining the country’s position in the global battery market.

The United Kingdom hybrid electric vehicle battery market stands at a critical juncture, with substantial growth opportunities balanced against significant competitive and technological challenges. The convergence of regulatory mandates, technological innovation, and changing consumer preferences has created favorable conditions for market expansion, while international competition and supply chain complexities present ongoing risks that require careful management.

Strategic success in this dynamic market will require companies to balance multiple priorities including technology development, manufacturing efficiency, supply chain resilience, and market positioning. Organizations that can successfully navigate these challenges while maintaining focus on innovation and customer value creation are likely to achieve sustainable competitive advantages in the evolving electrified transportation ecosystem.

Future market development will be shaped by breakthrough technologies, evolving regulatory frameworks, and changing consumer expectations. The companies and stakeholders who can anticipate and adapt to these changes while building robust operational capabilities will be best positioned to capitalize on the substantial opportunities presented by the United Kingdom’s transition toward sustainable transportation solutions.

What is Hybrid Electric Vehicle Battery?

Hybrid Electric Vehicle Battery refers to the energy storage systems used in hybrid vehicles, which combine an internal combustion engine with an electric propulsion system. These batteries are crucial for improving fuel efficiency and reducing emissions in the automotive sector.

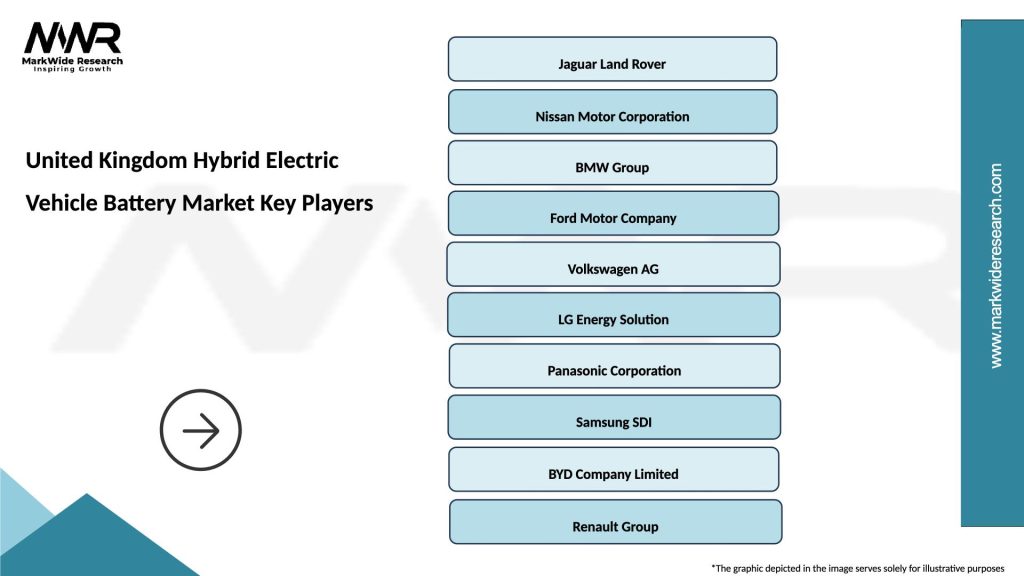

What are the key players in the United Kingdom Hybrid Electric Vehicle Battery Market?

Key players in the United Kingdom Hybrid Electric Vehicle Battery Market include companies like Nissan, BMW, and LG Chem, which are actively involved in the development and production of advanced battery technologies for hybrid vehicles, among others.

What are the main drivers of the United Kingdom Hybrid Electric Vehicle Battery Market?

The main drivers of the United Kingdom Hybrid Electric Vehicle Battery Market include the increasing demand for fuel-efficient vehicles, government incentives for electric mobility, and advancements in battery technology that enhance performance and reduce costs.

What challenges does the United Kingdom Hybrid Electric Vehicle Battery Market face?

Challenges in the United Kingdom Hybrid Electric Vehicle Battery Market include high production costs, limited charging infrastructure, and concerns regarding battery disposal and recycling, which can hinder market growth.

What opportunities exist in the United Kingdom Hybrid Electric Vehicle Battery Market?

Opportunities in the United Kingdom Hybrid Electric Vehicle Battery Market include the potential for innovation in battery technology, the expansion of charging networks, and increasing consumer awareness of sustainable transportation options.

What trends are shaping the United Kingdom Hybrid Electric Vehicle Battery Market?

Trends shaping the United Kingdom Hybrid Electric Vehicle Battery Market include the shift towards solid-state batteries, the integration of renewable energy sources for charging, and the growing focus on sustainability and environmental impact in automotive manufacturing.

United Kingdom Hybrid Electric Vehicle Battery Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Passenger Cars, Commercial Vehicles, Buses, Motorcycles |

| Technology | Lithium-ion, Nickel-Metal Hydride, Solid State, Lead Acid |

| End User | Fleet Operators, Individual Consumers, Public Transport, Logistics Companies |

| Installation | OEM, Aftermarket, Home Charging, Public Charging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Hybrid Electric Vehicle Battery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at