444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China Logic Integrated Circuits Market represents one of the most dynamic and rapidly evolving segments within the global semiconductor industry. As the world’s largest consumer electronics manufacturing hub, China has emerged as a critical player in the development and production of logic integrated circuits, which serve as the fundamental building blocks for digital systems across numerous applications. The market encompasses a comprehensive range of products including microprocessors, microcontrollers, digital signal processors, field-programmable gate arrays, and application-specific integrated circuits.

Market dynamics indicate robust growth driven by increasing demand from consumer electronics, automotive, telecommunications, and industrial automation sectors. The Chinese government’s strategic initiatives to achieve semiconductor self-sufficiency have significantly accelerated domestic research and development activities, fostering innovation and technological advancement. With growing at a substantial CAGR of 8.2%, the market demonstrates resilience and adaptability in addressing evolving technological requirements.

Regional distribution shows concentration in key manufacturing hubs including Shenzhen, Shanghai, Beijing, and Suzhou, where major semiconductor companies have established production facilities and research centers. The market benefits from strong government support through policies such as the National Integrated Circuit Industry Development Guidelines and substantial investment in semiconductor infrastructure development.

The China Logic Integrated Circuits Market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and application of digital semiconductor devices within Chinese territory. These circuits perform logical operations by processing binary data through various gate configurations, enabling complex computational tasks essential for modern electronic systems.

Logic integrated circuits fundamentally differ from analog circuits by operating with discrete voltage levels representing digital states, making them ideal for data processing, storage, and transmission applications. The market includes both domestic Chinese companies and international manufacturers operating within China, serving local demand while contributing to global supply chains.

Technological scope encompasses various logic families including complementary metal-oxide-semiconductor technology, transistor-transistor logic, and emerging technologies such as gallium arsenide and silicon carbide-based devices. The market addresses applications ranging from simple logic gates to complex system-on-chip solutions integrating multiple functional blocks.

Strategic positioning of China’s logic integrated circuits market reflects the nation’s commitment to technological independence and innovation leadership in semiconductor technologies. The market demonstrates exceptional growth potential driven by domestic demand surge and government-backed initiatives promoting indigenous semiconductor development capabilities.

Key market drivers include rapid digitalization across industries, expanding 5G infrastructure deployment, growing electric vehicle adoption, and increasing automation in manufacturing processes. The market benefits from 65% domestic consumption of locally produced logic circuits, indicating strong internal demand and reduced dependency on imports.

Competitive landscape features a mix of established international players and emerging Chinese companies, with domestic firms gaining significant market share through technological advancement and cost-effective solutions. Investment in research and development has increased by 23% annually, demonstrating commitment to innovation and technological capability enhancement.

Future prospects remain highly favorable with anticipated growth in artificial intelligence, Internet of Things applications, and smart city initiatives driving sustained demand for advanced logic integrated circuits across multiple application segments.

Market segmentation reveals diverse application areas with consumer electronics representing the largest segment, followed by telecommunications, automotive, and industrial applications. The following insights highlight critical market characteristics:

Digital transformation across Chinese industries serves as the primary catalyst for logic integrated circuits demand growth. The rapid adoption of digital technologies in manufacturing, finance, healthcare, and education sectors creates substantial opportunities for semiconductor suppliers.

Government support through strategic policies and financial incentives significantly accelerates market development. The “Made in China 2025” initiative specifically targets semiconductor industry advancement, providing funding for research and development, manufacturing facility construction, and talent acquisition programs.

5G infrastructure deployment generates substantial demand for high-performance logic circuits capable of handling increased data processing requirements. Base station equipment, network infrastructure, and consumer devices require advanced semiconductor solutions supporting next-generation connectivity standards.

Automotive electrification drives demand for specialized logic circuits supporting electric vehicle systems, autonomous driving technologies, and advanced driver assistance systems. The automotive semiconductor content per vehicle continues increasing, creating sustained growth opportunities.

Consumer electronics innovation fuels continuous demand for more powerful and efficient logic circuits. Smartphones, tablets, laptops, and smart home devices require increasingly sophisticated semiconductor solutions to deliver enhanced user experiences and functionality.

Technology gaps between domestic Chinese companies and international leaders in advanced process technologies create competitive challenges. While significant progress has been made, achieving parity in cutting-edge manufacturing processes requires continued investment and time.

Supply chain dependencies on critical materials and equipment from international suppliers pose potential risks to production continuity. Raw materials, specialized chemicals, and manufacturing equipment sourcing remains partially dependent on global supply networks.

Intellectual property concerns and licensing requirements for certain technologies may limit access to advanced design methodologies and manufacturing processes. Navigating complex intellectual property landscapes requires careful strategic planning and legal expertise.

Talent shortage in specialized semiconductor engineering disciplines constrains rapid expansion capabilities. Despite educational initiatives, the industry faces challenges in recruiting and retaining qualified professionals with advanced technical expertise.

Capital intensity of semiconductor manufacturing requires substantial financial investment for facility construction, equipment procurement, and technology development. High capital requirements may limit the number of companies capable of competing effectively in advanced technology segments.

Artificial intelligence applications present significant growth opportunities for specialized logic circuits designed for machine learning and neural network processing. AI accelerators, edge computing devices, and intelligent sensors require advanced semiconductor solutions.

Internet of Things expansion creates demand for low-power, cost-effective logic circuits supporting connected device ecosystems. Smart city initiatives, industrial IoT applications, and consumer IoT devices drive sustained market growth.

Export potential to international markets offers substantial revenue opportunities as Chinese manufacturers achieve competitive parity in quality and performance. Belt and Road Initiative countries represent particularly attractive export destinations.

Emerging technologies including quantum computing, advanced robotics, and augmented reality applications require innovative logic circuit solutions. Early positioning in these growth areas provides competitive advantages and market leadership opportunities.

Vertical integration opportunities allow companies to capture additional value by expanding into complementary business segments such as packaging, testing, and system integration services.

Competitive intensity continues increasing as domestic Chinese companies enhance technological capabilities and international players strengthen local presence. Market dynamics reflect ongoing shifts in competitive positioning and strategic alliances.

Technology evolution drives continuous product development cycles with shorter innovation timelines and increased performance requirements. Companies must balance investment in current technologies while preparing for next-generation solutions.

Customer relationships become increasingly important as system integrators and original equipment manufacturers seek reliable, long-term semiconductor partners. Technical support, customization capabilities, and supply chain reliability influence purchasing decisions.

Regulatory environment impacts market operations through quality standards, environmental regulations, and trade policies. Companies must navigate complex regulatory requirements while maintaining operational efficiency and competitiveness.

Investment flows from both government and private sources continue supporting market expansion and technological advancement. Strategic investments in research and development, manufacturing capacity, and talent development drive long-term growth.

Comprehensive analysis of the China Logic Integrated Circuits Market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, technical experts, and market participants across the semiconductor value chain.

Secondary research encompasses analysis of company financial reports, government publications, industry associations data, and technical literature. Patent analysis provides insights into technological trends and innovation directions among key market participants.

Market modeling utilizes quantitative techniques to project market trends, segment growth rates, and competitive dynamics. Statistical analysis of historical data combined with forward-looking indicators enables accurate forecasting and trend identification.

Expert validation ensures research findings accuracy through consultation with semiconductor industry specialists, academic researchers, and technology analysts. Cross-verification of data sources and methodologies enhances research credibility and reliability.

Continuous monitoring of market developments, technological advances, and regulatory changes ensures research remains current and relevant. Regular updates incorporate new information and emerging trends affecting market dynamics.

Eastern China dominates the logic integrated circuits market with 45% regional market share, led by Shanghai and Jiangsu provinces. The region benefits from established semiconductor manufacturing infrastructure, proximity to major customers, and strong government support for industry development.

Southern China represents 32% market share with Shenzhen serving as a major hub for consumer electronics and telecommunications equipment manufacturing. The region’s strength lies in system integration capabilities and close relationships with global technology companies.

Northern China accounts for 18% market share with Beijing leading in research and development activities. The region hosts major universities, research institutes, and government agencies supporting semiconductor industry advancement.

Western China holds 5% market share but demonstrates rapid growth potential driven by government initiatives to develop inland technology centers. Cities like Chengdu and Xi’an are emerging as important semiconductor manufacturing locations.

Regional specialization reflects different competitive advantages with eastern regions focusing on advanced manufacturing, southern regions emphasizing system integration, northern regions leading in research and development, and western regions developing cost-effective production capabilities.

Market leadership reflects a diverse ecosystem of domestic and international companies competing across different technology segments and application areas. The competitive landscape continues evolving as Chinese companies enhance capabilities and global players adapt strategies.

Strategic partnerships between domestic and international companies facilitate technology transfer, market access, and capability development. Joint ventures and licensing agreements enable knowledge sharing and competitive positioning enhancement.

By Technology:

By Product Type:

By Application:

Consumer Electronics Segment maintains market leadership driven by continuous innovation in smartphones, tablets, and smart home devices. The segment benefits from rapid product refresh cycles and increasing semiconductor content per device, with 42% segment growth rate reflecting strong consumer demand.

Telecommunications Infrastructure experiences robust growth due to 5G network deployment and fiber optic expansion. Base station equipment, network switches, and optical communication systems require high-performance logic circuits supporting increased data throughput and reduced latency requirements.

Automotive Applications demonstrate exceptional growth potential as vehicle electrification and autonomous driving technologies advance. Electric vehicle power management, battery monitoring, and sensor fusion systems create substantial opportunities for specialized logic integrated circuits.

Industrial Automation drives demand for reliable, high-performance logic circuits supporting manufacturing process optimization and quality control systems. Industry 4.0 initiatives and smart factory implementations require advanced semiconductor solutions enabling connectivity and data processing capabilities.

Healthcare Technology represents an emerging growth segment with increasing adoption of digital health solutions, medical imaging equipment, and patient monitoring systems. Regulatory compliance and reliability requirements create opportunities for specialized semiconductor suppliers.

Manufacturers benefit from access to the world’s largest consumer electronics market, enabling economies of scale and rapid product development cycles. Local manufacturing capabilities reduce supply chain risks and transportation costs while improving customer responsiveness.

System Integrators gain advantages through close collaboration with semiconductor suppliers, enabling customized solutions and technical support. Proximity to manufacturing facilities facilitates rapid prototyping and design optimization processes.

End Users benefit from competitive pricing, improved product availability, and enhanced technical support services. Local manufacturing reduces lead times and enables faster time-to-market for new product introductions.

Government Stakeholders achieve strategic objectives including technology independence, economic development, and job creation. The semiconductor industry contributes significantly to export revenues and technological advancement initiatives.

Investors access high-growth market opportunities with strong government support and favorable regulatory environment. The market offers diversified investment options across different technology segments and application areas.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration drives development of specialized logic circuits optimized for machine learning workloads. AI accelerators, neural processing units, and edge computing devices require innovative semiconductor architectures supporting parallel processing and low-power operation.

Advanced Process Technologies adoption accelerates as Chinese manufacturers invest in cutting-edge fabrication capabilities. The transition to smaller process nodes enables higher performance, reduced power consumption, and increased integration density for next-generation applications.

System-on-Chip Solutions gain prominence as customers seek integrated solutions combining multiple functions in single packages. SoC designs reduce system complexity, improve reliability, and enable cost-effective implementation of sophisticated functionality.

Sustainability Focus influences product development with emphasis on energy-efficient designs and environmentally friendly manufacturing processes. Green semiconductor initiatives align with broader environmental goals and regulatory requirements.

Customization Demand increases as customers seek application-specific solutions optimized for particular use cases. Flexible design methodologies and rapid prototyping capabilities become competitive differentiators in serving diverse market segments.

Manufacturing Capacity Expansion continues with multiple new fabrication facilities under construction across China. Major investments in 12-inch wafer fabs and advanced packaging facilities enhance production capabilities and technology competitiveness.

Research and Development Initiatives accelerate through collaboration between companies, universities, and government research institutes. Joint research programs focus on next-generation technologies including quantum computing, neuromorphic computing, and advanced materials.

Strategic Partnerships between domestic and international companies facilitate technology transfer and market development. Joint ventures, licensing agreements, and technical collaboration programs enhance competitive positioning and capability development.

Talent Development Programs expand through university partnerships, professional training initiatives, and international recruitment efforts. Semiconductor engineering programs and specialized training centers address industry talent requirements.

Quality Certification achievements demonstrate commitment to international standards and customer requirements. ISO certifications, automotive quality standards, and reliability testing capabilities enhance market credibility and customer confidence.

MarkWide Research recommends that companies focus on developing differentiated technology capabilities in emerging application areas such as artificial intelligence, automotive electronics, and industrial automation. Specialization in specific market segments enables competitive advantages and premium pricing opportunities.

Investment prioritization should emphasize research and development capabilities, advanced manufacturing equipment, and talent acquisition programs. Long-term competitiveness requires sustained investment in technology advancement and human capital development.

Strategic partnerships with international technology leaders can accelerate capability development and market access. Collaborative relationships enable knowledge transfer, technology licensing, and joint product development initiatives.

Market diversification across multiple application segments reduces dependency on single markets and provides growth stability. Balanced portfolio approaches enable companies to capitalize on different growth opportunities while managing market risks.

Supply chain resilience development through domestic sourcing initiatives and strategic inventory management reduces external dependencies and improves operational stability. Vertical integration opportunities should be evaluated for critical components and materials.

Technology advancement will continue driving market evolution with emphasis on artificial intelligence, 5G communications, and automotive electronics applications. The market is projected to maintain robust growth trajectory supported by strong domestic demand and expanding export opportunities.

Competitive landscape evolution will feature increased capabilities among Chinese companies and continued international collaboration. Domestic firms are expected to achieve 55% market share within the next five years through technology advancement and competitive positioning improvements.

Innovation focus will shift toward emerging technologies including quantum computing, neuromorphic processing, and advanced sensor integration. Early positioning in these growth areas provides opportunities for market leadership and premium positioning.

Sustainability initiatives will become increasingly important with emphasis on energy-efficient designs, circular economy principles, and environmental responsibility. Green semiconductor manufacturing practices will influence competitive positioning and customer preferences.

Global integration will continue despite trade tensions, with Chinese companies expanding international presence and foreign companies maintaining significant Chinese operations. Market dynamics will reflect ongoing globalization trends and technological collaboration requirements.

The China Logic Integrated Circuits Market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by technological advancement, government support, and strong domestic demand. The market demonstrates resilience and adaptability in addressing complex challenges while capitalizing on emerging opportunities across multiple application segments.

Strategic positioning of Chinese companies continues improving through sustained investment in research and development, manufacturing capability enhancement, and talent development initiatives. The combination of domestic market advantages and expanding international opportunities creates favorable conditions for long-term growth and competitiveness.

Future success will depend on continued innovation, strategic partnerships, and effective navigation of global market dynamics. Companies that focus on differentiated technology development, customer-centric solutions, and operational excellence will be best positioned to capitalize on the substantial opportunities ahead in this critical technology sector.

What is Logic Integrated Circuits?

Logic Integrated Circuits are electronic components that perform logical operations on binary data. They are essential in various applications, including computing, telecommunications, and consumer electronics.

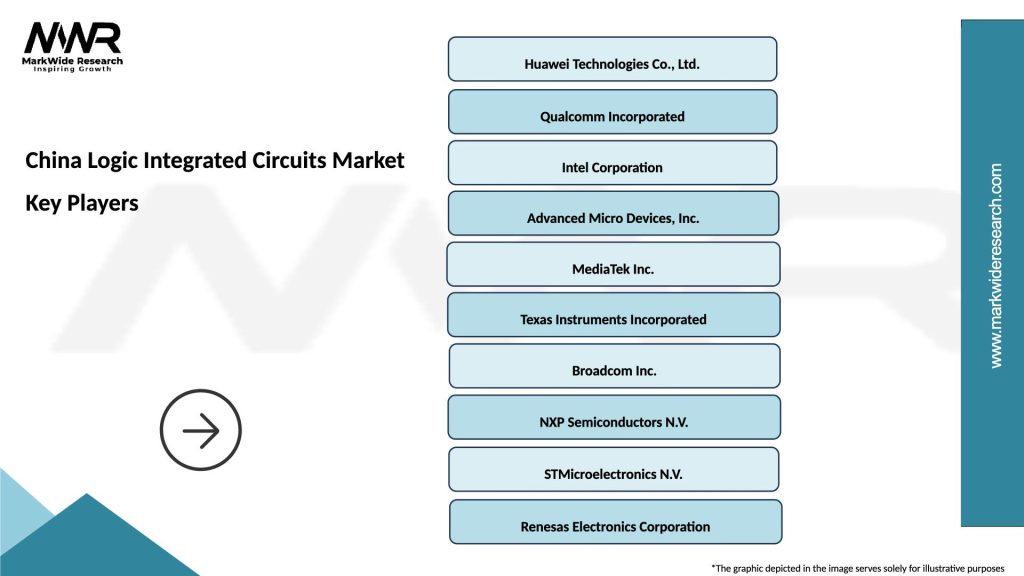

What are the key players in the China Logic Integrated Circuits Market?

Key players in the China Logic Integrated Circuits Market include companies like Huawei, ZTE, and Semiconductor Manufacturing International Corporation (SMIC), among others.

What are the growth factors driving the China Logic Integrated Circuits Market?

The growth of the China Logic Integrated Circuits Market is driven by the increasing demand for consumer electronics, advancements in telecommunications, and the rise of artificial intelligence applications.

What challenges does the China Logic Integrated Circuits Market face?

The China Logic Integrated Circuits Market faces challenges such as supply chain disruptions, intense competition, and regulatory hurdles that can impact production and innovation.

What opportunities exist in the China Logic Integrated Circuits Market?

Opportunities in the China Logic Integrated Circuits Market include the expansion of the Internet of Things (IoT), the growth of smart devices, and increasing investments in research and development.

What trends are shaping the China Logic Integrated Circuits Market?

Trends shaping the China Logic Integrated Circuits Market include the miniaturization of components, the integration of AI capabilities, and the shift towards more energy-efficient designs.

China Logic Integrated Circuits Market

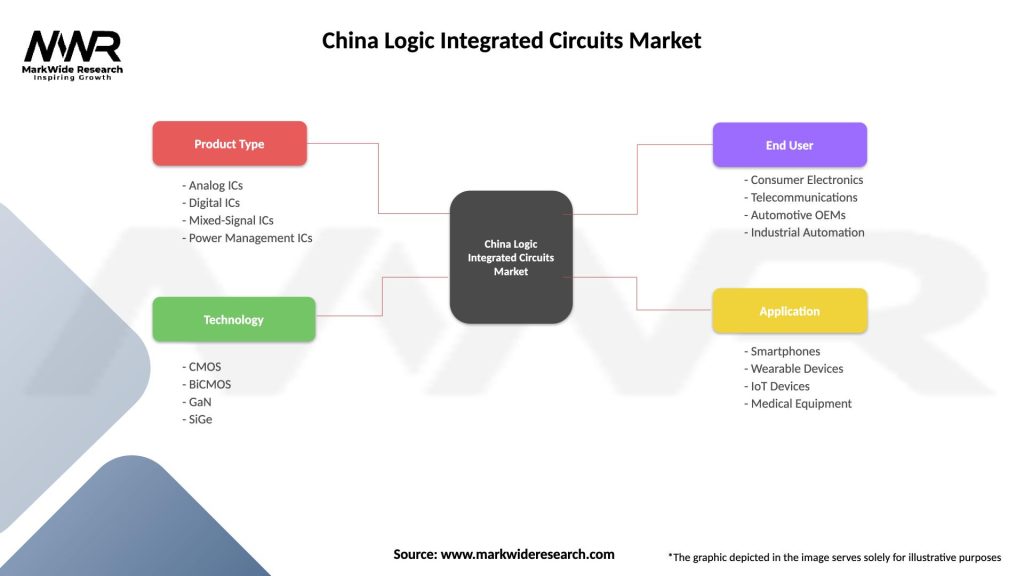

| Segmentation Details | Description |

|---|---|

| Product Type | Analog ICs, Digital ICs, Mixed-Signal ICs, Power Management ICs |

| Technology | CMOS, BiCMOS, GaN, SiGe |

| End User | Consumer Electronics, Telecommunications, Automotive OEMs, Industrial Automation |

| Application | Smartphones, Wearable Devices, IoT Devices, Medical Equipment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Logic Integrated Circuits Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at