444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States logic integrated circuits market represents a cornerstone of the nation’s semiconductor industry, driving innovation across diverse technological applications from consumer electronics to advanced computing systems. Logic integrated circuits serve as the fundamental building blocks for digital processing, enabling complex computational operations in everything from smartphones and laptops to automotive systems and industrial automation equipment.

Market dynamics indicate robust growth momentum, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% driven by increasing demand for high-performance computing solutions and the proliferation of Internet of Things (IoT) devices. The market encompasses various technology nodes, from mature processes used in cost-sensitive applications to cutting-edge sub-10nm technologies powering the latest processors and graphics units.

Regional concentration within the United States shows significant activity in technology hubs including Silicon Valley, Austin, and the Research Triangle, where major semiconductor companies maintain design centers and fabrication facilities. The market benefits from strong domestic demand across multiple sectors, including telecommunications, automotive, aerospace, and consumer electronics, with data center applications representing approximately 35% of total demand.

Technology advancement continues to drive market evolution, with artificial intelligence and machine learning applications creating new opportunities for specialized logic circuits. The integration of advanced packaging technologies and the development of chiplet architectures are reshaping traditional approaches to logic circuit design and manufacturing.

The United States logic integrated circuits market refers to the domestic ecosystem encompassing the design, manufacturing, and distribution of digital semiconductor devices that perform logical operations and data processing functions. These circuits form the computational core of electronic systems, executing binary operations that enable modern digital technology.

Logic integrated circuits include microprocessors, microcontrollers, digital signal processors, field-programmable gate arrays (FPGAs), and application-specific integrated circuits (ASICs). These components process digital signals through Boolean logic operations, arithmetic calculations, and data manipulation functions that power contemporary electronic devices and systems.

Market scope encompasses the entire value chain from semiconductor design and intellectual property development to wafer fabrication, assembly, testing, and final product distribution. The market includes both fabless companies that focus on design and integrated device manufacturers that maintain their own production facilities.

Strategic positioning of the United States logic integrated circuits market reflects the nation’s leadership in semiconductor innovation and design capabilities. The market demonstrates resilience and adaptability, responding effectively to evolving technological demands while maintaining competitive advantages in high-performance computing and specialized applications.

Key growth drivers include the accelerating digital transformation across industries, with cloud computing adoption contributing to 42% of market expansion. The proliferation of edge computing devices and the increasing sophistication of automotive electronics create substantial opportunities for logic circuit manufacturers and designers.

Market structure reveals a diverse ecosystem combining established industry leaders with innovative startups and specialized design houses. This competitive landscape fosters continuous innovation while ensuring supply chain resilience and technological advancement across multiple application segments.

Investment trends show significant capital allocation toward research and development, with companies dedicating substantial resources to next-generation process technologies and novel circuit architectures. Government initiatives supporting domestic semiconductor manufacturing further strengthen the market’s foundation and long-term growth prospects.

Technological evolution within the United States logic integrated circuits market reveals several critical insights that shape industry direction and investment strategies:

Digital transformation initiatives across industries serve as the primary catalyst for logic integrated circuits market growth. Organizations increasingly rely on sophisticated computing systems to process vast amounts of data, automate operations, and enable intelligent decision-making capabilities.

Artificial intelligence adoption creates unprecedented demand for specialized logic circuits optimized for machine learning workloads. Data centers and edge computing installations require high-performance processors capable of handling complex AI algorithms with exceptional efficiency and speed.

Internet of Things expansion drives substantial growth in demand for low-power, cost-effective logic circuits. Smart devices, sensors, and connected systems require embedded processing capabilities that balance performance requirements with power consumption constraints and cost considerations.

Automotive electrification represents a significant growth driver as electric vehicles incorporate sophisticated electronic control systems. Advanced driver assistance systems, battery management, and autonomous driving capabilities require reliable, high-performance logic circuits designed for automotive environments.

5G network deployment necessitates advanced signal processing capabilities enabled by cutting-edge logic circuits. Base stations, network infrastructure, and mobile devices require sophisticated processing power to handle increased data throughput and reduced latency requirements.

Cloud computing infrastructure expansion drives demand for server-grade logic circuits optimized for data center applications. Hyperscale cloud providers require high-performance processors that deliver exceptional computational density while maintaining energy efficiency.

Manufacturing complexity presents significant challenges as logic circuits advance to smaller process nodes. The technical difficulties and substantial capital requirements associated with cutting-edge semiconductor fabrication create barriers to entry and limit production capacity.

Supply chain vulnerabilities impact market stability, particularly regarding specialized materials and manufacturing equipment. Global dependencies and geopolitical tensions can disrupt production schedules and increase costs for logic circuit manufacturers.

Design complexity escalation increases development costs and time-to-market for new logic circuits. Advanced process technologies require sophisticated design tools, extensive verification processes, and specialized expertise that may not be readily available.

Talent shortage in semiconductor engineering and design limits industry growth potential. The specialized skills required for logic circuit development are in high demand, creating competitive pressures for qualified professionals and increasing development costs.

Regulatory compliance requirements add complexity and cost to logic circuit development and manufacturing. Export controls, environmental regulations, and safety standards require substantial investment in compliance infrastructure and processes.

Market cyclicality creates uncertainty for long-term planning and investment decisions. The semiconductor industry’s inherent boom-bust cycles can impact demand forecasting and capacity planning for logic circuit manufacturers.

Emerging applications in quantum computing, neuromorphic processing, and advanced robotics create substantial opportunities for innovative logic circuit designs. These cutting-edge technologies require specialized processing capabilities that traditional circuits cannot efficiently provide.

Government initiatives supporting domestic semiconductor manufacturing present significant opportunities for market expansion. Federal funding programs and policy incentives encourage investment in advanced manufacturing capabilities and research and development activities.

Sustainability trends drive demand for energy-efficient logic circuits that reduce power consumption and environmental impact. Green computing initiatives create opportunities for companies developing low-power circuit architectures and sustainable manufacturing processes.

Edge AI deployment represents a rapidly growing opportunity as organizations seek to process data closer to its source. This trend requires specialized logic circuits optimized for artificial intelligence workloads while maintaining low power consumption and compact form factors.

Healthcare technology advancement creates opportunities for medical-grade logic circuits supporting diagnostic equipment, patient monitoring systems, and therapeutic devices. The aging population and increasing healthcare digitization drive sustained demand growth.

Space and defense applications offer opportunities for radiation-hardened and high-reliability logic circuits. Increasing space exploration activities and defense modernization programs require specialized semiconductor solutions with exceptional performance and reliability characteristics.

Competitive intensity within the United States logic integrated circuits market continues to intensify as companies compete for market share across diverse application segments. Innovation cycles accelerate as firms invest heavily in research and development to maintain technological leadership and differentiate their product offerings.

Technology convergence creates new market dynamics as traditional boundaries between different types of logic circuits blur. System-on-chip solutions integrate multiple functions, while chiplet architectures enable modular approaches to complex system design and manufacturing.

Customer consolidation influences market dynamics as large technology companies acquire smaller firms and integrate vertically. This trend affects supplier relationships and creates opportunities for specialized logic circuit providers serving niche applications.

Investment patterns show increasing focus on advanced packaging technologies and heterogeneous integration capabilities. Companies recognize that future competitive advantages will depend on system-level optimization rather than individual component performance alone.

Collaboration trends emerge as companies form strategic partnerships to share development costs and risks associated with advanced technology nodes. Industry consortiums and joint ventures become increasingly important for accessing cutting-edge manufacturing capabilities.

Market timing becomes critical as product lifecycles shorten and customer requirements evolve rapidly. Companies must balance the risks of early technology adoption with the competitive advantages of being first to market with innovative solutions.

Comprehensive analysis of the United States logic integrated circuits market employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research includes extensive interviews with industry executives, technology leaders, and market participants across the semiconductor value chain.

Secondary research incorporates analysis of industry reports, financial statements, patent filings, and technical publications to understand technology trends and competitive positioning. Government databases and trade association statistics provide additional context for market sizing and growth projections.

Market modeling utilizes sophisticated analytical frameworks to project future market trends and identify growth opportunities. Quantitative models incorporate historical data, current market conditions, and forward-looking indicators to generate reliable forecasts.

Expert validation ensures research findings accurately reflect market realities through consultation with industry specialists and technical experts. This validation process helps identify potential blind spots and confirms the accuracy of key conclusions.

Data triangulation cross-references multiple information sources to verify market insights and eliminate potential biases. This approach enhances the reliability and credibility of research findings and recommendations.

Silicon Valley maintains its position as the epicenter of logic integrated circuits innovation, hosting major semiconductor companies and numerous startups focused on cutting-edge circuit design. The region benefits from exceptional talent concentration, venture capital availability, and proximity to major technology customers, capturing approximately 28% of domestic market activity.

Texas technology corridor represents a significant manufacturing and design hub, with Austin serving as a major center for semiconductor operations. The region’s favorable business climate, skilled workforce, and established infrastructure support both established companies and emerging players in the logic circuits market.

Pacific Northwest demonstrates growing importance in logic circuit design and development, particularly for applications in cloud computing and artificial intelligence. The region’s technology ecosystem and research universities contribute to innovation in specialized circuit architectures and advanced computing systems.

East Coast markets including the Research Triangle and Boston area focus on specialized applications such as defense, aerospace, and medical electronics. These regions leverage strong university partnerships and government research facilities to develop advanced logic circuit technologies for critical applications.

Manufacturing distribution shows concentration in states with established semiconductor fabrication facilities, with Arizona and Oregon representing significant production centers. These regions benefit from substantial capital investment in advanced manufacturing capabilities and skilled technical workforce development.

Emerging clusters in states like Colorado, Utah, and Florida demonstrate growing activity in logic circuit design and specialized applications. These regions attract companies seeking cost advantages while maintaining access to technical talent and customer proximity.

Market leadership in the United States logic integrated circuits sector reflects a diverse ecosystem of established industry giants and innovative emerging companies. The competitive landscape demonstrates both horizontal and vertical integration strategies as companies seek to optimize their market positioning.

Competitive strategies emphasize technological differentiation, customer intimacy, and ecosystem development. Companies invest heavily in research and development while building comprehensive solution portfolios that address evolving customer requirements across multiple market segments.

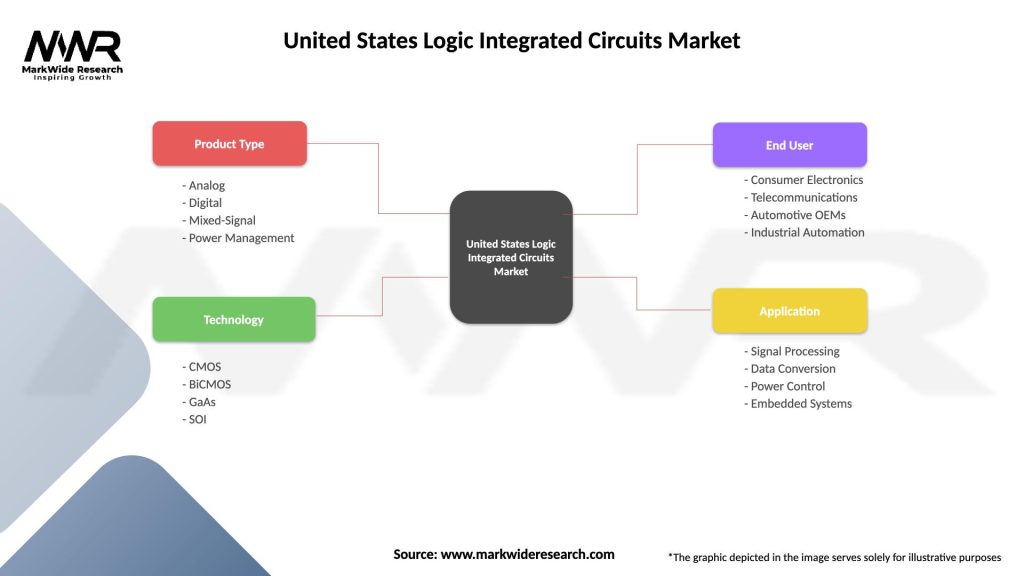

Technology-based segmentation reveals distinct market categories based on manufacturing process nodes and architectural approaches:

Application-based segmentation demonstrates diverse market opportunities across multiple end-use sectors:

Product type segmentation encompasses various logic circuit categories serving different functional requirements:

High-performance computing category demonstrates exceptional growth momentum, driven by artificial intelligence workloads and data center modernization initiatives. This segment requires cutting-edge process technologies and innovative architectural approaches to deliver the computational density and energy efficiency demanded by hyperscale applications.

Mobile computing category emphasizes power efficiency and integration density as primary design criteria. Smartphone and tablet applications drive demand for system-on-chip solutions that combine multiple functions while minimizing power consumption and physical footprint requirements.

Automotive electronics category prioritizes reliability and functional safety as critical design parameters. Vehicle applications require logic circuits that operate reliably across extreme temperature ranges while meeting stringent automotive quality and safety standards.

Industrial automation category focuses on robustness and long-term availability as key selection criteria. Manufacturing and process control applications require logic circuits with proven reliability and extended product lifecycles to support equipment operating for decades.

Communications infrastructure category demands high-speed processing capabilities and low latency performance. Network equipment and telecommunications systems require logic circuits optimized for packet processing and signal routing with exceptional throughput characteristics.

Internet of Things category emphasizes ultra-low power consumption and cost optimization. Connected devices and sensor applications require logic circuits that operate efficiently on battery power while maintaining connectivity and processing capabilities.

Technology companies benefit from access to advanced logic circuits that enable innovative product development and competitive differentiation. High-performance processing capabilities allow companies to implement sophisticated features and functionalities that enhance user experiences and market positioning.

Original equipment manufacturers gain advantages through partnerships with logic circuit suppliers that provide comprehensive design support and system-level optimization. These relationships enable faster time-to-market and reduced development costs while ensuring product reliability and performance.

System integrators benefit from standardized logic circuit platforms that simplify design processes and reduce integration complexity. Proven circuit architectures and development tools accelerate project timelines while minimizing technical risks and validation requirements.

End users experience improved performance, functionality, and reliability in electronic devices and systems powered by advanced logic circuits. Enhanced processing capabilities enable new applications and use cases while improving overall user satisfaction and productivity.

Investors find opportunities in a market characterized by consistent growth, technological innovation, and diverse application segments. The logic circuits market offers exposure to multiple technology trends and end-use markets with varying growth trajectories and risk profiles.

Research institutions benefit from collaboration opportunities with industry participants developing next-generation logic circuit technologies. These partnerships provide access to funding, real-world applications, and commercialization pathways for academic research initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend shaping the logic circuits market, with companies developing specialized architectures optimized for machine learning workloads. AI-specific logic circuits demonstrate performance improvements of 60% compared to traditional general-purpose processors for neural network applications.

Chiplet architecture adoption transforms traditional monolithic chip design approaches by enabling modular system construction. This trend allows companies to optimize individual components while reducing development costs and improving manufacturing yields through proven building blocks.

Edge computing proliferation drives demand for logic circuits optimized for distributed processing applications. These solutions must balance performance requirements with power consumption constraints while maintaining connectivity and security capabilities for edge deployment scenarios.

Quantum-classical hybrid systems create opportunities for logic circuits that interface between traditional computing architectures and quantum processors. This emerging trend requires specialized interface circuits and control systems that bridge different computational paradigms.

Sustainability initiatives influence logic circuit design priorities, with companies focusing on energy efficiency and environmental impact reduction. Green computing trends drive development of low-power architectures and sustainable manufacturing processes throughout the industry.

Automotive electrification accelerates demand for automotive-grade logic circuits supporting electric vehicle systems and autonomous driving capabilities. Vehicle electronics content continues expanding, with semiconductor content per vehicle growing at 12% annually.

Advanced packaging innovations enable new approaches to logic circuit integration and system optimization. Three-dimensional packaging technologies and advanced interconnect solutions allow companies to achieve higher performance density while managing thermal and electrical challenges.

Manufacturing capacity expansion addresses growing demand for logic circuits across multiple application segments. Major companies announce substantial capital investments in domestic fabrication facilities, supported by government incentives and strategic initiatives promoting supply chain resilience.

Research collaborations between industry participants and academic institutions accelerate development of next-generation logic circuit technologies. These partnerships focus on emerging applications such as neuromorphic computing, quantum interfaces, and advanced AI architectures.

Acquisition activities reshape the competitive landscape as companies seek to acquire specialized capabilities and market access. Strategic acquisitions enable firms to expand their technology portfolios and enter new application segments more rapidly than organic development.

Standards development initiatives establish common frameworks for emerging logic circuit applications and interfaces. Industry organizations work to define standards for AI acceleration, edge computing, and automotive applications that facilitate interoperability and market adoption.

Talent development programs address workforce challenges through partnerships with universities and training institutions. Companies invest in education initiatives and internship programs to develop the specialized skills required for advanced logic circuit design and manufacturing.

MarkWide Research recommends that industry participants focus on developing comprehensive ecosystem strategies that extend beyond individual product offerings. Companies should invest in software tools, development platforms, and customer support capabilities that differentiate their logic circuit solutions and create competitive moats.

Strategic partnerships with key customers and technology providers offer opportunities to accelerate innovation and market penetration. Companies should prioritize relationships that provide early access to emerging application requirements and enable collaborative development of optimized solutions.

Diversification strategies across multiple application segments and technology nodes help mitigate market cyclicality and concentration risks. Balanced portfolios spanning high-performance computing, automotive, industrial, and IoT applications provide stability and growth opportunities.

Investment priorities should emphasize advanced packaging technologies and system-level integration capabilities. These competencies become increasingly important as performance improvements from process scaling diminish and system optimization gains prominence.

Talent acquisition and retention strategies require significant attention as competition for qualified engineers intensifies. Companies should develop comprehensive programs that combine competitive compensation with meaningful technical challenges and career development opportunities.

Sustainability initiatives should be integrated into product development and manufacturing processes to address growing customer and regulatory requirements. Environmental considerations increasingly influence purchasing decisions and competitive positioning in the logic circuits market.

Market trajectory for the United States logic integrated circuits sector indicates sustained growth driven by digital transformation initiatives and emerging technology applications. MWR analysis projects continued expansion across multiple application segments, with artificial intelligence and edge computing representing the fastest-growing opportunities.

Technology evolution will focus on architectural innovations and system-level optimization as traditional scaling approaches face physical limitations. Chiplet architectures, advanced packaging, and heterogeneous integration become critical differentiators for logic circuit providers seeking competitive advantages.

Application diversification creates opportunities beyond traditional computing markets as logic circuits enable new use cases in healthcare, transportation, energy, and industrial automation. These emerging applications often require specialized performance characteristics and reliability standards that favor innovative circuit designs.

Manufacturing landscape transformation includes substantial investment in domestic production capabilities supported by government initiatives and strategic imperatives for supply chain resilience. This trend strengthens the United States position in advanced logic circuit manufacturing while reducing dependence on overseas facilities.

Innovation acceleration continues as companies invest heavily in research and development to maintain technological leadership. Breakthrough technologies in quantum computing, neuromorphic processing, and advanced AI architectures create new market categories and competitive dynamics.

Market consolidation may accelerate as companies seek scale advantages and complementary capabilities through strategic acquisitions. This trend could reshape competitive dynamics while creating opportunities for specialized players serving niche applications and emerging technologies.

The United States logic integrated circuits market stands at a pivotal juncture characterized by unprecedented technological innovation and expanding application opportunities. Market fundamentals remain robust, supported by strong domestic demand, world-class design capabilities, and substantial investment in advanced manufacturing infrastructure.

Growth prospects appear exceptionally favorable as digital transformation initiatives accelerate across industries and emerging technologies create new market categories. Artificial intelligence, edge computing, automotive electrification, and 5G deployment represent significant growth drivers that will sustain market expansion for the foreseeable future.

Competitive dynamics continue evolving as companies adapt to changing customer requirements and technological possibilities. Success increasingly depends on system-level thinking, ecosystem development, and the ability to deliver comprehensive solutions rather than individual components.

Strategic imperatives for market participants include maintaining technological leadership, developing sustainable competitive advantages, and building resilient supply chains. Companies that successfully navigate these challenges while capitalizing on emerging opportunities will be well-positioned for long-term success in this dynamic and critical market sector.

What is Logic Integrated Circuits?

Logic Integrated Circuits are electronic components that perform logical operations on binary data. They are fundamental building blocks in digital circuits, used in applications such as computers, smartphones, and various consumer electronics.

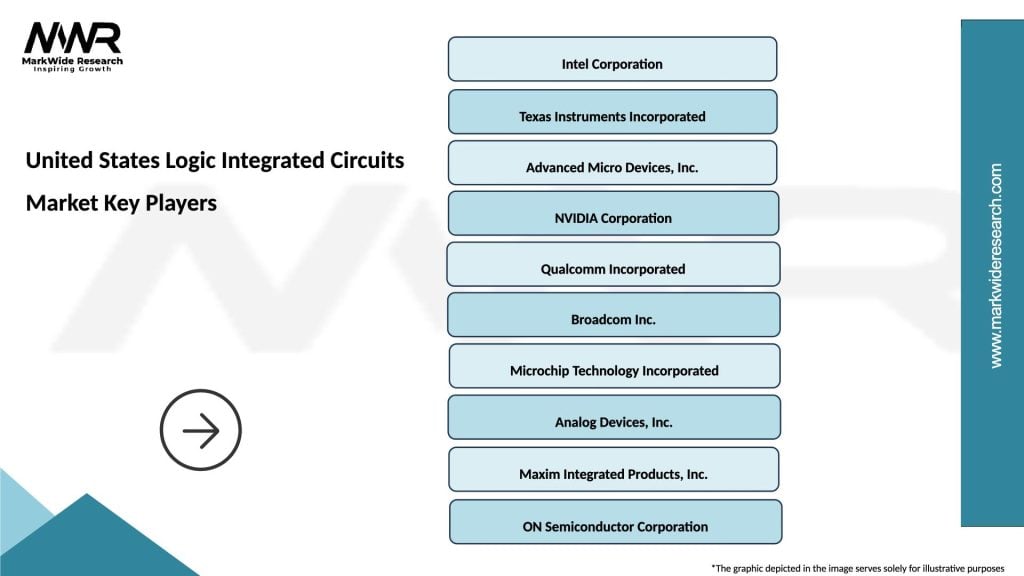

What are the key players in the United States Logic Integrated Circuits Market?

Key players in the United States Logic Integrated Circuits Market include Intel Corporation, Texas Instruments, and Analog Devices, among others. These companies are known for their innovative products and significant market presence.

What are the growth factors driving the United States Logic Integrated Circuits Market?

The growth of the United States Logic Integrated Circuits Market is driven by the increasing demand for consumer electronics, advancements in automation technologies, and the rise of the Internet of Things (IoT). These factors contribute to the expanding applications of logic integrated circuits across various industries.

What challenges does the United States Logic Integrated Circuits Market face?

The United States Logic Integrated Circuits Market faces challenges such as supply chain disruptions, rapid technological changes, and intense competition among manufacturers. These factors can impact production efficiency and market stability.

What opportunities exist in the United States Logic Integrated Circuits Market?

Opportunities in the United States Logic Integrated Circuits Market include the growing demand for artificial intelligence applications, the expansion of electric vehicles, and the development of smart home technologies. These trends are expected to create new avenues for growth.

What trends are shaping the United States Logic Integrated Circuits Market?

Trends shaping the United States Logic Integrated Circuits Market include the miniaturization of electronic components, the integration of advanced functionalities into single chips, and the increasing focus on energy-efficient designs. These trends are influencing product development and consumer preferences.

United States Logic Integrated Circuits Market

| Segmentation Details | Description |

|---|---|

| Product Type | Analog, Digital, Mixed-Signal, Power Management |

| Technology | CMOS, BiCMOS, GaAs, SOI |

| End User | Consumer Electronics, Telecommunications, Automotive OEMs, Industrial Automation |

| Application | Signal Processing, Data Conversion, Power Control, Embedded Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Logic Integrated Circuits Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at