444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany electric vehicle battery manufacturing market represents one of Europe’s most dynamic and strategically important industrial sectors, driven by the nation’s commitment to sustainable mobility and automotive excellence. Germany’s position as a global automotive powerhouse has naturally extended into the electric vehicle battery manufacturing domain, where the country is establishing itself as a key production hub for advanced battery technologies. The market encompasses a comprehensive ecosystem of battery cell production, module assembly, pack integration, and recycling operations that support both domestic automotive manufacturers and international electric vehicle producers.

Market dynamics indicate robust expansion across multiple battery chemistries, including lithium-ion, solid-state, and next-generation battery technologies. The sector benefits from Germany’s strong industrial infrastructure, skilled workforce, and strategic location within the European Union, making it an attractive destination for battery manufacturing investments. Growth trajectories show the market expanding at a compound annual growth rate of 18.2%, reflecting the accelerating transition toward electric mobility and the increasing localization of battery production within Europe.

Manufacturing capabilities span from raw material processing to finished battery system production, with significant investments in gigafactory-scale facilities across multiple German states. The market serves diverse applications including passenger electric vehicles, commercial electric vehicles, energy storage systems, and industrial applications, positioning Germany as a comprehensive battery manufacturing ecosystem within the global supply chain.

The Germany electric vehicle battery manufacturing market refers to the comprehensive industrial sector encompassing the design, production, assembly, and distribution of battery systems specifically engineered for electric vehicles within German territory. This market includes all stages of battery manufacturing from cell production and module assembly to complete battery pack integration and quality assurance processes.

Manufacturing scope covers various battery technologies including lithium-ion cells, battery management systems, thermal management components, and structural integration elements that comprise modern electric vehicle battery systems. The market encompasses both original equipment manufacturer production facilities and specialized battery manufacturing companies that supply components and complete systems to automotive manufacturers globally.

Strategic significance extends beyond mere production activities to include research and development initiatives, supply chain management, recycling operations, and the development of next-generation battery technologies that will define the future of electric mobility in Germany and throughout Europe.

Germany’s electric vehicle battery manufacturing market has emerged as a cornerstone of the country’s industrial transformation toward sustainable mobility solutions. The sector demonstrates exceptional growth momentum, supported by substantial investments from both domestic and international manufacturers seeking to establish European production capabilities. Manufacturing capacity expansion reflects the strategic importance of localizing battery production to reduce supply chain dependencies and meet growing European electric vehicle demand.

Key market characteristics include the establishment of multiple gigafactory-scale facilities, significant government support through various incentive programs, and strong collaboration between automotive manufacturers and battery technology companies. The market benefits from Germany’s advanced manufacturing expertise, robust research and development infrastructure, and strategic position within the European automotive supply chain.

Technological advancement remains a primary focus, with 72% of manufacturing facilities investing in next-generation battery technologies including solid-state batteries, silicon anodes, and advanced battery management systems. The market’s evolution reflects broader trends toward higher energy density, faster charging capabilities, and improved safety standards that define modern electric vehicle battery requirements.

Future prospects indicate continued expansion driven by European Union regulations promoting electric vehicle adoption, increasing consumer acceptance of electric mobility, and ongoing investments in manufacturing infrastructure that position Germany as a leading European battery production hub.

Strategic positioning within the global battery manufacturing landscape reveals Germany’s competitive advantages in precision manufacturing, quality control, and technological innovation. The market demonstrates strong integration between traditional automotive expertise and emerging battery technologies, creating synergies that enhance overall manufacturing efficiency and product quality.

Regulatory frameworks serve as primary catalysts for Germany’s electric vehicle battery manufacturing market expansion. The European Union’s stringent emissions regulations and Germany’s national climate protection goals create compelling demand for electric vehicle adoption, directly translating into increased battery manufacturing requirements. Government initiatives including substantial subsidies for electric vehicle purchases and infrastructure development generate sustained market momentum.

Automotive industry transformation represents another fundamental driver, as traditional German automotive manufacturers including BMW, Mercedes-Benz, and Volkswagen Group accelerate their electric vehicle strategies. These manufacturers’ commitments to electric mobility create guaranteed demand for locally produced battery systems, encouraging significant investments in domestic manufacturing capabilities.

Supply chain security concerns drive strategic decisions to localize battery production within Europe, reducing dependencies on Asian suppliers and enhancing supply chain resilience. The market benefits from geopolitical considerations that favor regional production capabilities, particularly in light of global supply chain disruptions and trade tensions affecting international battery supply networks.

Technological advancement in battery chemistry and manufacturing processes creates opportunities for German companies to leverage their engineering expertise and precision manufacturing capabilities. Innovation drivers include the development of higher energy density batteries, faster charging technologies, and improved safety standards that align with German quality expectations and automotive industry requirements.

Capital intensity represents a significant barrier to market entry, as battery manufacturing facilities require substantial upfront investments in specialized equipment, clean room facilities, and quality control systems. The financial requirements for establishing competitive manufacturing operations can exceed hundreds of millions of euros, limiting market participation to well-capitalized companies and creating high barriers for new entrants.

Raw material dependencies pose ongoing challenges, as critical battery materials including lithium, cobalt, and rare earth elements are primarily sourced from limited global suppliers. Supply chain vulnerabilities related to material availability and price volatility can significantly impact manufacturing costs and production schedules, requiring sophisticated supply chain management strategies.

Technical complexity in battery manufacturing processes demands highly specialized knowledge and expertise that may not be readily available in traditional manufacturing sectors. The learning curve associated with battery production technologies, quality control requirements, and safety standards requires significant time and resource investments to achieve competitive manufacturing capabilities.

Competitive pressures from established Asian battery manufacturers with significant scale advantages and cost efficiencies create challenging market dynamics for German manufacturers. International competition particularly from Chinese and South Korean companies with extensive manufacturing experience and established supply chains requires German manufacturers to differentiate through quality, innovation, and customer service excellence.

Next-generation battery technologies present substantial opportunities for German manufacturers to establish leadership positions in emerging battery chemistries and manufacturing processes. Solid-state batteries, advanced lithium-metal technologies, and innovative manufacturing techniques offer potential competitive advantages that align with Germany’s reputation for technological innovation and precision manufacturing.

Circular economy initiatives create opportunities for integrated battery lifecycle management, including recycling operations that recover valuable materials from end-of-life batteries. The development of comprehensive recycling capabilities not only addresses environmental concerns but also provides alternative sources of critical materials, reducing supply chain dependencies and creating additional revenue streams.

Export market potential extends beyond European boundaries, as German-manufactured batteries can serve global markets seeking high-quality, reliable battery systems. International expansion opportunities include partnerships with automotive manufacturers in emerging markets and supply agreements with global electric vehicle producers seeking diversified supply chains.

Energy storage applications beyond automotive markets offer significant growth opportunities, including stationary energy storage systems for renewable energy integration, industrial applications, and grid stabilization projects. Market diversification into energy storage sectors provides additional demand sources and reduces dependence on automotive market fluctuations.

Competitive landscape evolution reflects the dynamic interplay between established automotive manufacturers, specialized battery companies, and new market entrants seeking to capitalize on electric vehicle market growth. Strategic partnerships between automotive manufacturers and battery technology companies create integrated value chains that enhance manufacturing efficiency and technological advancement capabilities.

Technology convergence drives innovation across multiple dimensions including battery chemistry optimization, manufacturing process automation, and quality control systems integration. The market demonstrates rapid technological evolution with manufacturing efficiency improvements of 25% achieved through advanced automation and process optimization initiatives.

Investment patterns show significant capital flows into manufacturing infrastructure, research and development activities, and supply chain development projects. Financial commitments from both private companies and government entities create a supportive environment for market expansion and technological advancement initiatives.

Market consolidation trends indicate increasing collaboration between companies seeking to achieve scale economies and technological synergies. Strategic alliances and joint venture formations enable participants to share development costs, access complementary technologies, and accelerate market entry timelines while managing financial risks associated with large-scale manufacturing investments.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights for the Germany electric vehicle battery manufacturing sector. Primary research includes extensive interviews with industry executives, manufacturing specialists, technology developers, and market participants to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government publications, company financial statements, patent filings, and regulatory documents to establish comprehensive market understanding. Data triangulation methods ensure information accuracy through cross-verification of multiple sources and validation of key market metrics and trends.

Quantitative analysis utilizes statistical modeling techniques to project market trends, growth rates, and competitive dynamics based on historical data and identified market drivers. Qualitative assessment incorporates expert opinions, industry insights, and strategic analysis to provide context and interpretation for quantitative findings.

Market segmentation analysis examines various market dimensions including technology types, application areas, company profiles, and regional distributions to provide detailed market understanding. Validation processes include peer review, expert consultation, and data verification procedures to ensure research quality and reliability standards are maintained throughout the analysis process.

Geographic distribution of battery manufacturing activities across Germany reveals strategic clustering in regions with strong automotive industry presence and advanced manufacturing infrastructure. North Rhine-Westphalia emerges as a leading region, accounting for approximately 35% of manufacturing capacity, benefiting from its industrial heritage and proximity to major automotive production facilities.

Bavaria represents another significant manufacturing hub, leveraging its automotive industry concentration and research institutions to attract battery manufacturing investments. The region’s technological ecosystem supports innovation initiatives and provides access to skilled workforce resources essential for advanced battery manufacturing operations.

Lower Saxony demonstrates growing importance in the battery manufacturing landscape, with major investments from international companies seeking to establish European production capabilities. The region offers competitive manufacturing costs, available industrial sites, and supportive local government policies that facilitate large-scale manufacturing operations.

Eastern German states including Saxony and Thuringia attract battery manufacturing investments through competitive labor costs, available industrial infrastructure, and government incentive programs. These regions contribute approximately 20% of national manufacturing capacity and demonstrate rapid growth in battery-related industrial activities.

Regional specialization patterns emerge with different areas focusing on specific aspects of battery manufacturing, from cell production and module assembly to recycling operations and research activities. This geographic specialization creates efficiency advantages and supports the development of specialized supply chains and expertise clusters.

Market leadership reflects a diverse ecosystem of companies ranging from traditional automotive manufacturers expanding into battery production to specialized battery technology companies and international manufacturers establishing German operations. Competitive positioning varies based on technological capabilities, manufacturing scale, and strategic partnerships within the automotive industry.

Strategic differentiation among competitors focuses on technological innovation, manufacturing efficiency, sustainability practices, and customer service excellence. Competitive advantages include proprietary battery chemistries, advanced manufacturing processes, integrated supply chains, and strong relationships with automotive manufacturers.

Technology-based segmentation reveals diverse battery chemistries and manufacturing approaches serving different market requirements and applications. Lithium-ion batteries dominate current production with 85% market share, encompassing various chemistries including NCM, NCA, and LFP formulations optimized for different performance characteristics and cost requirements.

By Battery Type:

By Application Segment:

By Manufacturing Process:

Passenger vehicle batteries represent the largest and most dynamic market category, driven by accelerating electric vehicle adoption and automotive manufacturer commitments to electrification strategies. This segment demonstrates rapid growth with increasing energy density requirements and cost reduction pressures that drive manufacturing innovation and scale economies.

Commercial vehicle applications show emerging importance as logistics companies and public transportation operators transition to electric powertrains. Commercial batteries require different performance characteristics including higher durability, faster charging capabilities, and extended operational life cycles that create specialized manufacturing requirements and opportunities.

Energy storage systems represent a growing market category as Germany expands renewable energy capacity and requires grid stabilization solutions. Stationary storage applications offer different performance requirements compared to automotive applications, creating opportunities for specialized battery designs and manufacturing processes.

Premium battery technologies including solid-state and advanced lithium-metal systems target high-performance applications where superior energy density and safety characteristics justify higher costs. These advanced categories represent future growth opportunities for manufacturers capable of developing and scaling next-generation technologies.

Recycling and circular economy categories gain increasing importance as battery volumes grow and environmental regulations emphasize sustainable lifecycle management. Material recovery operations create new value streams while addressing supply chain sustainability requirements and reducing raw material dependencies.

Automotive manufacturers benefit from localized battery supply chains that reduce transportation costs, improve supply chain reliability, and enable closer collaboration on battery system integration and optimization. Strategic advantages include reduced inventory requirements, faster response times to design changes, and enhanced quality control through direct manufacturing oversight.

Battery manufacturers gain access to Europe’s largest automotive market while benefiting from Germany’s advanced manufacturing infrastructure, skilled workforce, and supportive regulatory environment. Operational benefits include proximity to major customers, access to research institutions, and integration into established automotive supply chains.

Technology companies find opportunities to commercialize advanced battery technologies through partnerships with established manufacturers and access to automotive industry expertise. Innovation benefits include collaborative research opportunities, access to testing facilities, and integration into large-scale manufacturing operations.

Government stakeholders achieve strategic objectives including industrial competitiveness, environmental sustainability, and energy security through domestic battery manufacturing capabilities. Economic benefits include job creation, tax revenue generation, and reduced dependence on imported battery technologies.

Environmental stakeholders benefit from improved battery recycling capabilities, reduced transportation emissions, and sustainable manufacturing practices that support circular economy objectives. Sustainability advantages include local material recovery, reduced supply chain carbon footprints, and enhanced environmental compliance.

Strengths:

Weaknesses:

Opportunities:

Threats:

Gigafactory development represents the most significant trend shaping Germany’s battery manufacturing landscape, with multiple large-scale facilities under construction or planned across various regions. These massive manufacturing complexes achieve economies of scale essential for cost-competitive battery production while creating integrated supply chain ecosystems that enhance operational efficiency.

Sustainability integration drives manufacturing process innovation as companies implement renewable energy systems, waste reduction initiatives, and circular economy principles throughout their operations. Environmental considerations increasingly influence facility design, material selection, and production processes, with 60% of new facilities targeting carbon-neutral operations within their first decade of operation.

Technology convergence accelerates as traditional automotive expertise combines with advanced battery technologies to create innovative manufacturing approaches and product designs. Cross-industry collaboration generates synergies between automotive engineering, chemical processing, and electronics manufacturing that enhance overall system performance and manufacturing efficiency.

Supply chain localization intensifies as manufacturers seek to reduce dependencies on distant suppliers and improve supply chain resilience. Regional supply networks develop around major manufacturing hubs, creating clusters of component suppliers, raw material processors, and support services that enhance overall ecosystem competitiveness.

Automation advancement transforms manufacturing processes through artificial intelligence, robotics, and advanced process control systems that improve quality consistency and reduce production costs. Smart manufacturing implementations achieve productivity improvements of 30% while enhancing quality control and reducing manufacturing defects.

Major investment announcements continue to reshape the German battery manufacturing landscape as international companies commit substantial resources to establishing European production capabilities. Recent developments include multiple gigafactory projects representing billions of euros in manufacturing infrastructure investments across various German regions.

Technology partnerships between automotive manufacturers and battery companies accelerate innovation in battery chemistry, manufacturing processes, and system integration approaches. Collaborative initiatives focus on developing next-generation technologies including solid-state batteries, advanced thermal management systems, and integrated battery-vehicle architectures.

Regulatory framework evolution includes new standards for battery performance, safety, and environmental impact that influence manufacturing requirements and market dynamics. Policy developments encompass battery passport initiatives, recycling mandates, and sustainability reporting requirements that create new compliance obligations and market opportunities.

Research and development initiatives expand through increased funding for battery technology research, establishment of new testing facilities, and collaboration between industry and academic institutions. Innovation programs target breakthrough technologies that could provide competitive advantages for German manufacturers in global markets.

Supply chain developments include new raw material processing facilities, component manufacturing operations, and logistics infrastructure that support the growing battery manufacturing ecosystem. Infrastructure investments create comprehensive supply networks that enhance manufacturing efficiency and reduce operational costs.

Strategic positioning recommendations emphasize the importance of technological differentiation and manufacturing excellence to compete effectively against established Asian manufacturers. MarkWide Research analysis suggests that German manufacturers should focus on premium market segments where quality, innovation, and customer service provide competitive advantages over cost-focused competitors.

Investment prioritization should target next-generation battery technologies including solid-state systems and advanced manufacturing processes that align with Germany’s technological strengths. Technology development investments in areas such as silicon anodes, advanced electrolytes, and innovative manufacturing techniques offer opportunities for sustainable competitive advantages.

Partnership strategies prove essential for accessing complementary technologies, sharing development costs, and accelerating market entry timelines. Collaborative approaches with automotive manufacturers, research institutions, and technology companies create synergies that enhance overall competitiveness and market positioning.

Sustainability leadership represents a critical differentiator as environmental considerations increasingly influence purchasing decisions and regulatory requirements. Environmental initiatives including renewable energy adoption, recycling capabilities, and sustainable manufacturing practices provide market advantages and regulatory compliance benefits.

Market diversification beyond automotive applications reduces dependence on single market segments and creates additional revenue opportunities. Application expansion into energy storage systems, industrial applications, and specialized markets provides growth opportunities and risk mitigation benefits.

Long-term growth prospects for Germany’s electric vehicle battery manufacturing market remain exceptionally positive, driven by accelerating electric vehicle adoption, supportive government policies, and ongoing technological advancement. Market expansion projections indicate continued growth at compound annual rates exceeding 15% through the next decade as manufacturing capacity scales to meet increasing demand.

Technology evolution will fundamentally transform the market as next-generation battery technologies achieve commercial viability and manufacturing scale. Solid-state batteries and advanced lithium-metal systems represent particular opportunities for German manufacturers to establish leadership positions in premium market segments requiring superior performance characteristics.

Manufacturing scale development will continue as additional gigafactory facilities become operational and existing facilities expand capacity to meet growing demand. Production capacity projections suggest Germany could achieve manufacturing capabilities serving 40% of European electric vehicle demand by the end of the decade through current and planned facility developments.

Supply chain maturation will create increasingly sophisticated and efficient manufacturing ecosystems as component suppliers, raw material processors, and support services develop around major production hubs. Integrated supply networks will enhance overall competitiveness and reduce manufacturing costs through improved logistics and coordination.

Sustainability leadership will become increasingly important as environmental regulations tighten and consumer preferences shift toward sustainable products. Circular economy implementations including comprehensive recycling capabilities and sustainable manufacturing practices will provide competitive advantages and regulatory compliance benefits that support long-term market success.

Germany’s electric vehicle battery manufacturing market represents a transformative industrial opportunity that leverages the country’s manufacturing excellence, technological innovation capabilities, and strategic position within the European automotive ecosystem. The market demonstrates exceptional growth potential driven by accelerating electric vehicle adoption, supportive government policies, and substantial investments in manufacturing infrastructure that position Germany as a leading European battery production hub.

Strategic advantages including advanced manufacturing capabilities, strong automotive industry relationships, and technological innovation expertise provide German manufacturers with competitive positioning opportunities in global markets. The market’s evolution reflects broader trends toward supply chain localization, sustainability leadership, and technological advancement that align with Germany’s industrial strengths and strategic objectives.

Future success will depend on continued investment in next-generation technologies, sustainable manufacturing practices, and strategic partnerships that enhance competitiveness and market positioning. The market’s trajectory indicates sustained growth opportunities for participants capable of leveraging Germany’s industrial advantages while addressing challenges related to cost competitiveness and supply chain management in an increasingly dynamic global marketplace.

What is Electric Vehicle Battery Manufacturing?

Electric Vehicle Battery Manufacturing refers to the process of producing batteries specifically designed for electric vehicles, which includes various technologies such as lithium-ion and solid-state batteries. This sector is crucial for the automotive industry as it supports the transition to sustainable transportation.

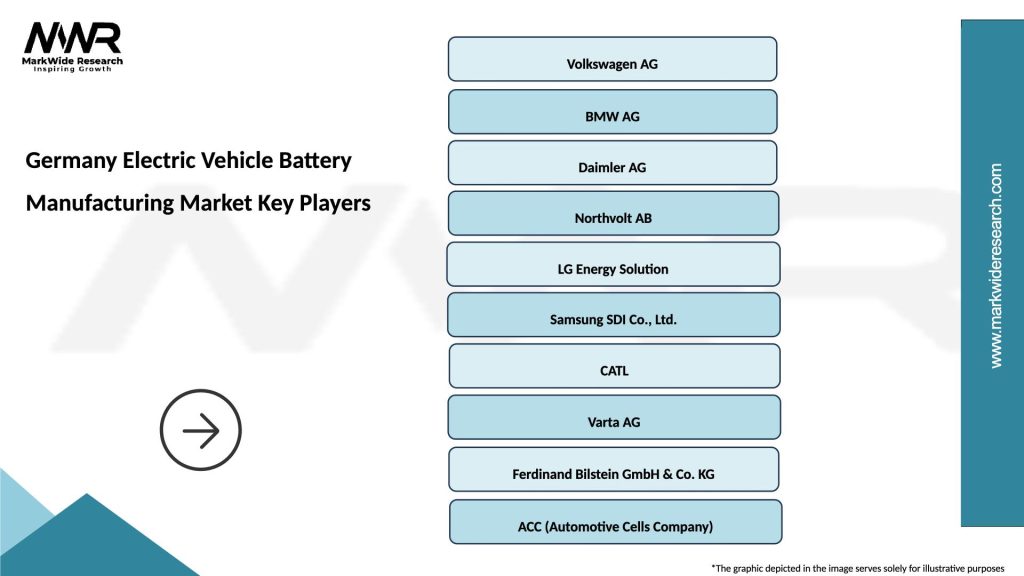

What are the key players in the Germany Electric Vehicle Battery Manufacturing Market?

Key players in the Germany Electric Vehicle Battery Manufacturing Market include companies like Volkswagen, BMW, and Northvolt, which are heavily investing in battery production facilities and technology. These companies are focusing on enhancing battery efficiency and sustainability, among others.

What are the main drivers of the Germany Electric Vehicle Battery Manufacturing Market?

The main drivers of the Germany Electric Vehicle Battery Manufacturing Market include the increasing demand for electric vehicles, government incentives for clean energy, and advancements in battery technology. Additionally, the push for reduced carbon emissions is propelling growth in this sector.

What challenges does the Germany Electric Vehicle Battery Manufacturing Market face?

The Germany Electric Vehicle Battery Manufacturing Market faces challenges such as supply chain disruptions, high production costs, and competition from established battery manufacturers in Asia. These factors can hinder the growth and scalability of local manufacturers.

What opportunities exist in the Germany Electric Vehicle Battery Manufacturing Market?

Opportunities in the Germany Electric Vehicle Battery Manufacturing Market include the potential for innovation in battery technologies, partnerships with automotive manufacturers, and the expansion of recycling initiatives. These factors can enhance sustainability and efficiency in battery production.

What trends are shaping the Germany Electric Vehicle Battery Manufacturing Market?

Trends shaping the Germany Electric Vehicle Battery Manufacturing Market include the shift towards solid-state batteries, increased investment in battery recycling technologies, and the development of local supply chains for raw materials. These trends are crucial for meeting future demand and sustainability goals.

Germany Electric Vehicle Battery Manufacturing Market

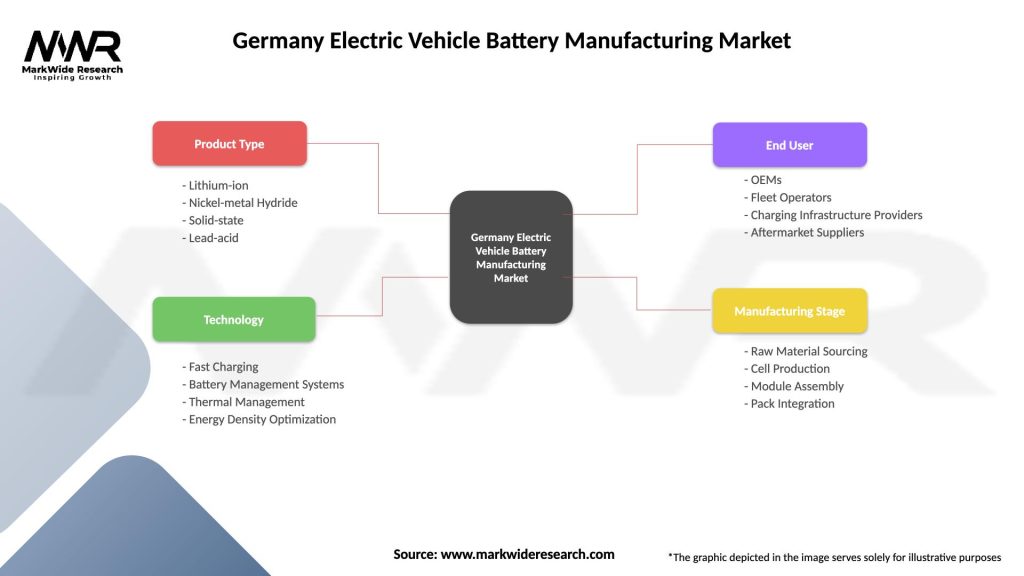

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-metal Hydride, Solid-state, Lead-acid |

| Technology | Fast Charging, Battery Management Systems, Thermal Management, Energy Density Optimization |

| End User | OEMs, Fleet Operators, Charging Infrastructure Providers, Aftermarket Suppliers |

| Manufacturing Stage | Raw Material Sourcing, Cell Production, Module Assembly, Pack Integration |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Electric Vehicle Battery Manufacturing Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at