444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America pharmaceutical blister packaging market represents a rapidly expanding segment within the region’s healthcare and packaging industries. This specialized packaging solution has become increasingly vital for pharmaceutical companies seeking to ensure product integrity, enhance patient safety, and comply with stringent regulatory requirements across Latin American countries. The market encompasses various blister packaging technologies, materials, and applications designed specifically for pharmaceutical products including tablets, capsules, and other solid dosage forms.

Market dynamics in Latin America are driven by several key factors including rising healthcare expenditure, growing pharmaceutical manufacturing capabilities, and increasing demand for advanced packaging solutions. The region’s pharmaceutical sector has experienced substantial growth, with blister packaging adoption rates reaching approximately 68% among major pharmaceutical manufacturers. This growth trajectory reflects the region’s commitment to modernizing its pharmaceutical supply chain and improving patient outcomes through better packaging technologies.

Regional variations across Latin America create diverse market opportunities, with countries like Brazil, Mexico, and Argentina leading in pharmaceutical production and packaging innovation. The market benefits from increasing foreign direct investment in pharmaceutical manufacturing facilities, which has accelerated the adoption of advanced blister packaging technologies. Manufacturing efficiency improvements of up to 35% have been reported by companies implementing modern blister packaging solutions, highlighting the technology’s operational benefits.

The Latin America pharmaceutical blister packaging market refers to the comprehensive ecosystem of companies, technologies, and services involved in producing specialized packaging solutions for pharmaceutical products across Latin American countries. This market encompasses the design, manufacturing, and distribution of blister packs that provide individual compartments for pharmaceutical products, ensuring protection from environmental factors while maintaining product efficacy and safety.

Blister packaging technology involves creating formed cavities or pockets from thermoplastic materials, typically sealed with aluminum foil or other barrier materials. This packaging method offers superior protection against moisture, oxygen, light, and contamination while providing tamper-evident features essential for pharmaceutical applications. The technology enables precise dosing, extends shelf life, and enhances patient compliance through clear product identification and easy access.

Market scope includes various packaging formats such as unit-dose blisters, multi-dose packaging, child-resistant designs, and specialized packaging for controlled substances. The sector serves diverse pharmaceutical segments including generic drugs, branded medications, over-the-counter products, and specialty pharmaceuticals, each requiring specific packaging characteristics and regulatory compliance standards.

Strategic positioning of the Latin America pharmaceutical blister packaging market reflects robust growth potential driven by expanding pharmaceutical manufacturing, regulatory modernization, and increasing healthcare access across the region. The market demonstrates strong fundamentals with consistent demand from both domestic pharmaceutical companies and international manufacturers establishing regional operations.

Key growth drivers include rising chronic disease prevalence, aging population demographics, and government initiatives to improve healthcare infrastructure. The market benefits from pharmaceutical production growth rates exceeding 12% annually in several key countries, creating sustained demand for advanced packaging solutions. Additionally, regulatory harmonization efforts across Latin American countries are standardizing packaging requirements, facilitating market expansion.

Technology advancement remains a critical factor, with manufacturers increasingly adopting smart packaging features, sustainable materials, and automated production processes. The integration of digital technologies and serialization capabilities addresses growing anti-counterfeiting requirements while enhancing supply chain visibility. Investment in packaging innovation has increased by approximately 28% over recent years, indicating strong industry commitment to technological advancement.

Market challenges include economic volatility in certain countries, complex regulatory environments, and competition from alternative packaging formats. However, the overall outlook remains positive, supported by fundamental healthcare trends and continued pharmaceutical sector expansion across the region.

Market segmentation reveals distinct patterns across different pharmaceutical categories and geographic regions within Latin America. The following key insights highlight critical market dynamics:

Regional leadership patterns show Brazil and Mexico as primary markets, while emerging opportunities exist in Colombia, Chile, and Peru. The market demonstrates resilience against economic fluctuations due to essential nature of pharmaceutical products and continuous healthcare demand.

Healthcare expansion across Latin America serves as the primary catalyst for pharmaceutical blister packaging market growth. Government initiatives to improve healthcare access, expand insurance coverage, and modernize medical infrastructure create sustained demand for pharmaceutical products and their associated packaging requirements. The region’s commitment to achieving universal healthcare coverage drives consistent market expansion.

Demographic transitions significantly influence market dynamics, with aging populations and changing disease patterns increasing pharmaceutical consumption. Rising prevalence of chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders requires long-term medication management, directly benefiting blister packaging solutions that enhance patient compliance and medication safety.

Regulatory modernization efforts across Latin American countries align packaging standards with international best practices, creating opportunities for advanced blister packaging technologies. Implementation of serialization requirements, anti-counterfeiting measures, and quality assurance standards drives demand for sophisticated packaging solutions capable of meeting complex regulatory demands.

Manufacturing localization trends encourage pharmaceutical companies to establish regional production facilities, reducing import dependencies and improving supply chain efficiency. This localization strategy increases demand for local packaging suppliers and creates opportunities for technology transfer and capacity building within the region.

Economic development in key Latin American countries supports increased healthcare spending and pharmaceutical market expansion. Growing middle-class populations with enhanced purchasing power drive demand for quality pharmaceutical products and premium packaging solutions that ensure product integrity and safety.

Economic volatility in several Latin American countries creates challenges for pharmaceutical blister packaging market growth. Currency fluctuations, inflation pressures, and political instability can impact investment decisions and delay infrastructure development projects. These economic uncertainties affect both domestic and international companies’ expansion plans within the region.

Regulatory complexity across different countries creates compliance challenges for packaging manufacturers and pharmaceutical companies. Varying standards, approval processes, and documentation requirements increase operational costs and complexity, particularly for companies operating across multiple Latin American markets. Harmonization efforts, while progressing, remain incomplete in many areas.

Infrastructure limitations in certain regions restrict market development and technology adoption. Inadequate transportation networks, unreliable power supply, and limited technical expertise can hinder the establishment of modern packaging facilities and affect supply chain efficiency. These infrastructure gaps particularly impact smaller countries and rural areas.

Cost sensitivity within healthcare systems and among consumers creates pressure for cost-effective packaging solutions. While blister packaging offers superior protection and compliance benefits, its higher cost compared to traditional packaging formats can limit adoption, particularly in price-sensitive market segments and government procurement programs.

Environmental concerns regarding plastic waste and packaging sustainability create challenges for traditional blister packaging materials. Increasing environmental awareness and potential regulatory restrictions on certain packaging materials require industry adaptation and investment in sustainable alternatives, which may increase costs and complexity.

Digital integration presents significant opportunities for pharmaceutical blister packaging innovation. Implementation of smart packaging technologies, QR codes, and digital authentication features can enhance patient engagement, improve medication adherence, and provide valuable data for pharmaceutical companies. These technologies address growing demands for personalized healthcare and digital health solutions.

Sustainability initiatives create opportunities for developing eco-friendly blister packaging solutions using biodegradable materials, recyclable components, and reduced environmental impact manufacturing processes. Companies investing in sustainable packaging technologies can differentiate themselves and capture environmentally conscious market segments while meeting evolving regulatory requirements.

Export market development offers growth opportunities for Latin American packaging manufacturers to serve international markets. The region’s competitive manufacturing costs, improving quality standards, and strategic geographic location create advantages for exporting pharmaceutical packaging products to North America, Europe, and other regions.

Specialty pharmaceutical growth in areas such as biologics, personalized medicine, and orphan drugs creates demand for specialized packaging solutions. These high-value pharmaceutical segments require advanced packaging technologies with enhanced protection, stability, and traceability features, offering premium market opportunities for innovative packaging suppliers.

Public-private partnerships in healthcare infrastructure development create opportunities for packaging companies to participate in large-scale projects and establish long-term relationships with government healthcare programs. These partnerships can provide stable demand and support market expansion in underserved regions.

Supply chain evolution within the Latin America pharmaceutical blister packaging market reflects increasing sophistication and integration. Manufacturers are developing more resilient supply chains that can adapt to regional challenges while maintaining consistent quality and delivery performance. Supply chain efficiency improvements of approximately 22% have been achieved through better coordination and technology adoption.

Technology adoption patterns show accelerating implementation of advanced manufacturing technologies, quality control systems, and digital integration capabilities. Companies investing in modern equipment and processes gain competitive advantages through improved productivity, quality consistency, and operational flexibility. The integration of Industry 4.0 concepts is transforming traditional packaging operations.

Competitive dynamics involve both international packaging companies and regional specialists competing for market share. International companies bring advanced technologies and global expertise, while regional players offer local market knowledge, competitive pricing, and responsive customer service. This competition drives innovation and improves overall market standards.

Customer relationship evolution shows pharmaceutical companies seeking more strategic partnerships with packaging suppliers rather than transactional relationships. These partnerships involve collaborative product development, supply chain optimization, and shared risk management, creating stronger business relationships and mutual growth opportunities.

Regulatory influence continues shaping market dynamics through evolving standards, compliance requirements, and quality expectations. Companies that proactively adapt to regulatory changes and exceed minimum requirements position themselves advantageously for future market opportunities and customer relationships.

Comprehensive market analysis for the Latin America pharmaceutical blister packaging market employs multiple research methodologies to ensure accuracy and reliability. Primary research involves direct engagement with industry stakeholders including packaging manufacturers, pharmaceutical companies, regulatory officials, and healthcare professionals across key Latin American countries.

Data collection approaches include structured interviews with industry executives, technical experts, and market participants to gather insights on market trends, challenges, and opportunities. Survey methodologies capture quantitative data on market preferences, adoption rates, and growth projections from representative samples of market participants.

Secondary research integration incorporates analysis of industry reports, regulatory documents, trade publications, and academic studies to provide comprehensive market context. Government statistics, trade association data, and international organization reports contribute to understanding market size, growth patterns, and regulatory environments across different countries.

Market validation processes ensure data accuracy through cross-referencing multiple sources, expert review panels, and statistical validation techniques. MarkWide Research employs rigorous quality control measures to verify findings and eliminate potential biases or inconsistencies in market analysis.

Analytical frameworks utilize both quantitative and qualitative assessment methods to evaluate market dynamics, competitive positioning, and future growth potential. Advanced analytical tools and modeling techniques support accurate market projections and strategic recommendations for industry stakeholders.

Brazil dominance in the Latin America pharmaceutical blister packaging market reflects the country’s large pharmaceutical sector, advanced manufacturing capabilities, and substantial domestic market demand. Brazil accounts for approximately 42% of regional market share, driven by strong generic drug production, international pharmaceutical investments, and comprehensive healthcare programs. The country’s regulatory framework and quality standards align closely with international requirements, facilitating market development.

Mexico’s strategic position as a manufacturing hub for North American pharmaceutical companies creates significant opportunities for blister packaging suppliers. The country benefits from proximity to the United States market, competitive manufacturing costs, and established pharmaceutical infrastructure. Cross-border pharmaceutical trade represents approximately 31% of Mexico’s packaging market activity, highlighting the importance of international market integration.

Argentina’s market characteristics include strong domestic pharmaceutical production capabilities and growing export activities. The country’s pharmaceutical sector focuses on both generic and branded medications, creating diverse packaging requirements. Economic challenges have impacted growth rates, but fundamental market demand remains strong due to essential healthcare needs.

Colombia’s emerging market status reflects improving economic conditions, healthcare system modernization, and increasing pharmaceutical investments. The country’s strategic location and trade agreements facilitate regional market access, creating opportunities for packaging companies serving multiple Latin American markets.

Chile and Peru represent smaller but growing markets with increasing pharmaceutical consumption and improving regulatory standards. These countries offer opportunities for specialized packaging solutions and serve as potential platforms for regional expansion strategies.

Market leadership in the Latin America pharmaceutical blister packaging sector involves a combination of international packaging companies and regional specialists, each bringing distinct competitive advantages and market positioning strategies.

Competitive strategies include technology innovation, capacity expansion, strategic partnerships, and market-specific product development. Companies differentiate themselves through quality certifications, regulatory compliance expertise, and comprehensive service offerings that address diverse customer requirements across Latin American markets.

By Material Type:

By Product Type:

By Application:

Generic pharmaceuticals represent the dominant category within the Latin America pharmaceutical blister packaging market, driven by cost-conscious healthcare systems and government procurement programs. This segment emphasizes cost-effective packaging solutions while maintaining quality and regulatory compliance standards. Generic drug packaging accounts for approximately 58% of total market volume, reflecting the region’s focus on affordable healthcare access.

Branded pharmaceuticals require premium packaging solutions that enhance product differentiation and brand recognition. This category demands advanced packaging technologies, superior aesthetics, and innovative features that support marketing objectives while ensuring product integrity. Companies in this segment invest in specialized packaging capabilities and custom design services.

Over-the-counter medications create opportunities for consumer-friendly packaging designs that facilitate self-medication and improve patient experience. This category emphasizes clear labeling, easy opening mechanisms, and attractive presentation to support retail sales and consumer confidence.

Controlled substances require specialized packaging solutions that meet stringent security and regulatory requirements. This category demands tamper-evident features, serialization capabilities, and enhanced tracking systems to prevent diversion and ensure compliance with controlled substance regulations.

Specialty pharmaceuticals including biologics and high-value medications require advanced packaging technologies that provide superior protection, stability, and traceability. This growing category offers premium pricing opportunities for packaging suppliers capable of meeting complex technical requirements.

Pharmaceutical manufacturers benefit from blister packaging through enhanced product protection, improved shelf life, and reduced contamination risks. The technology enables precise inventory management, supports regulatory compliance, and facilitates efficient distribution processes. Product integrity improvements of up to 89% have been documented through proper blister packaging implementation.

Healthcare providers gain advantages through improved medication management, reduced dispensing errors, and enhanced patient safety. Blister packaging facilitates accurate dosing, supports medication adherence programs, and provides clear product identification that reduces medication errors in clinical settings.

Patients and consumers benefit from user-friendly packaging designs that improve medication adherence, provide clear dosing instructions, and ensure product freshness. The tamper-evident features enhance confidence in medication safety while convenient packaging formats support treatment compliance.

Regulatory authorities appreciate blister packaging’s contribution to pharmaceutical safety, traceability, and anti-counterfeiting efforts. The technology supports serialization requirements, facilitates product recalls when necessary, and provides clear evidence of tampering or contamination.

Packaging suppliers benefit from growing market demand, opportunities for technology innovation, and potential for long-term customer relationships. The sector offers attractive margins for companies providing specialized solutions and comprehensive service offerings that address diverse customer requirements.

Supply chain partners gain advantages through improved inventory management, reduced product damage, and enhanced distribution efficiency. Blister packaging’s standardized formats facilitate automated handling, reduce storage space requirements, and support efficient logistics operations throughout the supply chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents a fundamental shift in the Latin America pharmaceutical blister packaging market, with manufacturers increasingly adopting eco-friendly materials and production processes. This trend responds to environmental concerns, regulatory pressures, and corporate sustainability commitments. Companies are investing in biodegradable materials, recyclable designs, and reduced environmental impact manufacturing processes.

Digital integration advancement involves incorporating smart technologies into traditional blister packaging formats. This includes QR codes for product authentication, NFC chips for patient engagement, and digital tracking systems for supply chain visibility. MarkWide Research indicates that digital packaging adoption rates are increasing rapidly across the region.

Automation acceleration in manufacturing processes improves efficiency, quality consistency, and cost competitiveness. Companies are implementing advanced production equipment, quality control systems, and integrated manufacturing processes that reduce labor requirements while enhancing output quality and reliability.

Customization expansion reflects growing demand for specialized packaging solutions tailored to specific pharmaceutical products, patient populations, and market requirements. This trend includes personalized packaging designs, patient-specific dosing formats, and culturally adapted packaging solutions for diverse Latin American markets.

Regulatory harmonization across Latin American countries is standardizing packaging requirements and facilitating regional market integration. This trend reduces compliance complexity, enables economies of scale, and supports cross-border pharmaceutical trade and distribution.

Supply chain localization involves establishing regional manufacturing capabilities and supplier networks to reduce import dependencies and improve supply chain resilience. This trend supports economic development objectives while enhancing market responsiveness and customer service capabilities.

Manufacturing capacity expansion across Latin America reflects growing market confidence and demand projections. Major packaging companies are investing in new production facilities, equipment upgrades, and technology implementations to serve expanding pharmaceutical markets. These investments demonstrate long-term commitment to regional market development.

Strategic partnerships between international packaging companies and regional pharmaceutical manufacturers are creating integrated supply chain solutions and technology transfer opportunities. These collaborations combine global expertise with local market knowledge to develop optimized packaging solutions for Latin American markets.

Regulatory compliance initiatives involve implementing serialization systems, track-and-trace capabilities, and anti-counterfeiting technologies to meet evolving regulatory requirements. Companies are investing in compliance infrastructure and validation processes to ensure market access and regulatory approval.

Sustainability programs include development of recyclable packaging materials, waste reduction initiatives, and environmental impact assessment programs. Industry participants are collaborating with environmental organizations and regulatory authorities to develop sustainable packaging standards and practices.

Technology innovation projects focus on developing next-generation packaging solutions that integrate digital technologies, enhance patient experience, and improve supply chain efficiency. These initiatives involve research and development investments, pilot programs, and market testing activities.

Market consolidation activities include mergers, acquisitions, and strategic alliances that create larger, more capable packaging companies with enhanced service offerings and geographic coverage. These developments reshape competitive dynamics and market structure across the region.

Strategic positioning recommendations emphasize the importance of developing comprehensive market strategies that address diverse regional requirements while leveraging economies of scale. Companies should focus on building flexible manufacturing capabilities that can adapt to varying market conditions and customer requirements across different Latin American countries.

Technology investment priorities should focus on automation, digitalization, and sustainability initiatives that enhance competitive positioning and operational efficiency. Companies investing in advanced manufacturing technologies and digital integration capabilities will be better positioned for long-term market success and customer relationship development.

Partnership development strategies should emphasize building strong relationships with pharmaceutical manufacturers, regulatory authorities, and supply chain partners. Collaborative approaches that provide comprehensive solutions and shared value creation will be more successful than transactional business models.

Market expansion approaches should consider both geographic expansion within Latin America and vertical integration opportunities that enhance service offerings. Companies should evaluate market entry strategies that balance growth potential with risk management and resource requirements.

Sustainability integration should be treated as a strategic imperative rather than a compliance requirement. Companies that proactively develop sustainable packaging solutions and environmental management programs will gain competitive advantages and meet evolving market expectations.

Quality assurance emphasis remains critical for market success, with companies needing to maintain rigorous quality standards and regulatory compliance capabilities. Investment in quality systems, validation processes, and continuous improvement programs supports long-term market positioning and customer confidence.

Growth trajectory projections for the Latin America pharmaceutical blister packaging market indicate sustained expansion driven by fundamental healthcare trends, pharmaceutical sector development, and technology advancement. The market is expected to maintain robust growth rates exceeding 8% annually over the forecast period, supported by increasing pharmaceutical consumption and packaging technology adoption.

Technology evolution will continue transforming the market through digital integration, sustainable materials development, and advanced manufacturing processes. Companies that successfully adapt to technological changes and customer requirements will capture disproportionate market share and profitability growth.

Regional integration trends will facilitate cross-border trade, standardize regulatory requirements, and create larger addressable markets for packaging companies. This integration supports economies of scale, reduces compliance complexity, and enhances competitive dynamics across the region.

Market maturation in developed Latin American countries will create opportunities for premium packaging solutions and specialized applications, while emerging markets offer volume growth potential through basic packaging adoption and healthcare system development.

Sustainability transformation will accelerate as environmental concerns, regulatory requirements, and corporate commitments drive adoption of eco-friendly packaging solutions. Companies leading in sustainability innovation will gain competitive advantages and market positioning benefits.

Investment opportunities will continue attracting both domestic and international capital, supporting market expansion, technology development, and capacity building initiatives. MWR analysis suggests that strategic investments in technology and market development will generate attractive returns for well-positioned companies.

Market assessment of the Latin America pharmaceutical blister packaging sector reveals a dynamic and growing market with substantial opportunities for industry participants. The combination of expanding pharmaceutical markets, regulatory modernization, and technology advancement creates favorable conditions for sustained growth and development across the region.

Strategic imperatives for market success include technology innovation, sustainability integration, quality excellence, and customer relationship development. Companies that excel in these areas while maintaining operational efficiency and cost competitiveness will be best positioned for long-term market leadership and profitability growth.

Future prospects remain positive despite regional challenges, with fundamental healthcare trends, demographic changes, and economic development supporting continued market expansion. The sector’s essential role in pharmaceutical supply chains and patient safety ensures sustained demand and investment attractiveness for qualified industry participants.

What is Pharmaceutical Blister Packaging?

Pharmaceutical blister packaging refers to a type of packaging that uses a pre-formed plastic cavity or pocket to securely hold individual doses of medication. This method is widely used in the pharmaceutical industry to enhance product protection and improve patient compliance.

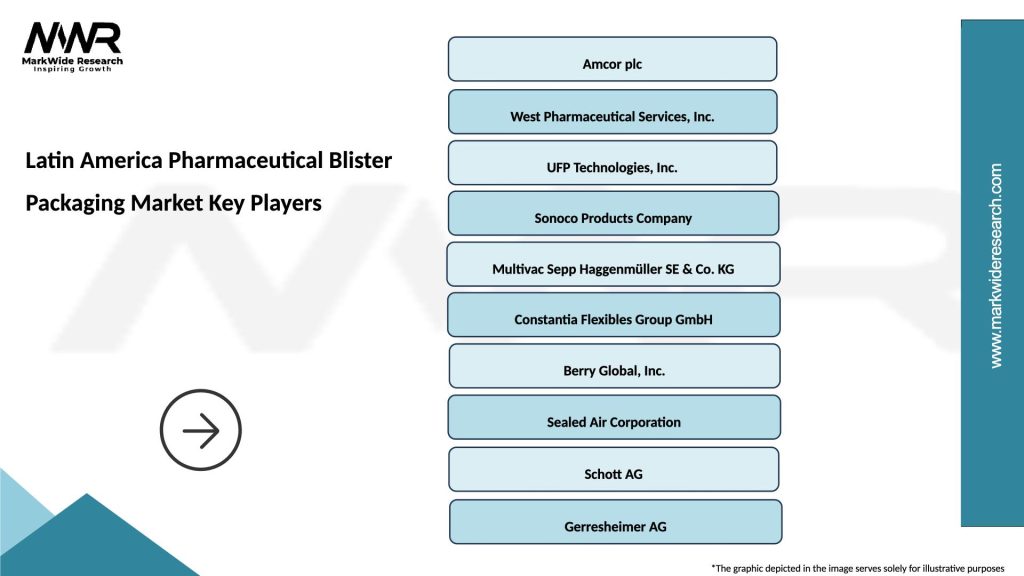

What are the key companies in the Latin America Pharmaceutical Blister Packaging Market?

Key companies in the Latin America Pharmaceutical Blister Packaging Market include Amcor, West Pharmaceutical Services, and UFP Technologies, among others.

What are the growth factors driving the Latin America Pharmaceutical Blister Packaging Market?

The growth of the Latin America Pharmaceutical Blister Packaging Market is driven by increasing demand for unit dose packaging, rising healthcare expenditures, and the growing prevalence of chronic diseases requiring medication adherence.

What challenges does the Latin America Pharmaceutical Blister Packaging Market face?

Challenges in the Latin America Pharmaceutical Blister Packaging Market include regulatory compliance issues, high production costs, and competition from alternative packaging solutions that may offer lower costs or different functionalities.

What opportunities exist in the Latin America Pharmaceutical Blister Packaging Market?

Opportunities in the Latin America Pharmaceutical Blister Packaging Market include advancements in sustainable packaging materials, the rise of e-commerce in pharmaceuticals, and increasing investments in healthcare infrastructure.

What trends are shaping the Latin America Pharmaceutical Blister Packaging Market?

Trends in the Latin America Pharmaceutical Blister Packaging Market include the adoption of smart packaging technologies, increased focus on child-resistant packaging, and the integration of digital printing for enhanced branding and information dissemination.

Latin America Pharmaceutical Blister Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cold Formed, PVC, PVDC, Aluminum |

| Packaging Type | Blister Packs, Strip Packs, Sachets, Pouches |

| End User | Pharmacies, Hospitals, Clinics, Research Labs |

| Technology | Thermoforming, Cold Forming, High-Speed, Automation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Pharmaceutical Blister Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at