444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France electric vehicle battery separator market represents a critical component of the nation’s rapidly expanding electric mobility ecosystem. As France accelerates its transition toward sustainable transportation, the demand for high-performance battery separators has experienced unprecedented growth. These specialized materials serve as the crucial barrier between positive and negative electrodes in lithium-ion batteries, ensuring optimal performance and safety in electric vehicles.

Market dynamics indicate that France’s commitment to achieving carbon neutrality by 2050 has created substantial opportunities for battery separator manufacturers. The automotive industry’s shift toward electrification, supported by government incentives and regulatory frameworks, has positioned France as a key market for advanced battery technologies. Current trends show that the market is experiencing robust expansion, driven by increasing electric vehicle adoption rates of approximately 12% annually and growing investments in domestic battery manufacturing capabilities.

Technological advancements in separator materials, including ceramic-coated separators and advanced polymer compositions, are reshaping the competitive landscape. French automotive manufacturers and battery producers are increasingly prioritizing separators that offer enhanced thermal stability, improved ionic conductivity, and superior mechanical strength to meet the demanding requirements of next-generation electric vehicles.

The France electric vehicle battery separator market refers to the specialized segment focused on manufacturing, distributing, and utilizing microporous membrane materials that physically separate the anode and cathode in lithium-ion batteries used in electric vehicles throughout France. These separators play a fundamental role in battery safety and performance by preventing electrical short circuits while allowing ionic transport.

Battery separators are typically made from polyethylene, polypropylene, or ceramic-coated materials, each offering distinct advantages for specific applications. In the context of electric vehicles, these components must withstand extreme temperatures, maintain structural integrity under mechanical stress, and provide consistent electrochemical performance throughout the battery’s operational lifecycle.

Market scope encompasses various separator types, including single-layer and multi-layer configurations, wet-process and dry-process separators, and specialized coated variants designed for high-performance applications. The French market specifically focuses on separators that meet stringent European safety standards and support the country’s ambitious electric vehicle deployment targets.

France’s electric vehicle battery separator market is experiencing transformative growth as the nation positions itself as a leader in European electric mobility. The market benefits from strong government support, including substantial investments in battery manufacturing infrastructure and comprehensive policies promoting electric vehicle adoption. Key market participants are establishing production facilities and research centers to capitalize on growing demand from automotive manufacturers.

Strategic developments include partnerships between French automotive companies and international separator manufacturers, aimed at securing reliable supply chains and advancing separator technology. The market is characterized by increasing demand for high-performance separators that can support fast-charging capabilities and extended battery life, with adoption rates for advanced separator technologies reaching approximately 35% growth year-over-year.

Investment trends show significant capital allocation toward domestic separator production capabilities, reducing dependence on imports and strengthening France’s position in the global electric vehicle supply chain. The market outlook remains highly positive, supported by expanding electric vehicle production capacity and growing consumer acceptance of electric mobility solutions.

Critical market insights reveal several key factors driving the France electric vehicle battery separator market:

Market intelligence indicates that France’s strategic position within the European Union provides significant advantages for separator manufacturers, including access to broader European markets and participation in collaborative research initiatives focused on battery technology advancement.

Primary market drivers propelling the France electric vehicle battery separator market include comprehensive government initiatives supporting electric mobility transition. The French government’s commitment to banning internal combustion engine vehicles by 2040 has created substantial demand for electric vehicle components, including high-performance battery separators.

Automotive industry transformation represents another crucial driver, with major French manufacturers like Renault and Peugeot investing heavily in electric vehicle platforms. These companies require reliable supplies of advanced separator materials to meet production targets and performance specifications for their electric vehicle models.

Technological advancement in battery chemistry and design continues to drive demand for specialized separator materials. The push toward higher energy density batteries and faster charging capabilities requires separators with enhanced properties, creating opportunities for innovative material solutions.

Environmental regulations and sustainability mandates are compelling automotive manufacturers to adopt cleaner technologies, directly benefiting the electric vehicle battery separator market. Consumer awareness of environmental issues and growing acceptance of electric vehicles further amplify market demand.

Infrastructure development including expanding charging networks and government support for electric vehicle adoption creates a positive feedback loop, increasing confidence in electric mobility and driving demand for battery components including separators.

Significant market restraints include the high cost of advanced separator materials, which can impact the overall economics of electric vehicle battery production. Manufacturing costs for specialized separators, particularly ceramic-coated variants, remain elevated compared to conventional materials, potentially limiting widespread adoption.

Supply chain dependencies present ongoing challenges, as many separator materials and manufacturing technologies originate from Asian markets. This dependence creates potential vulnerabilities in supply security and cost volatility, particularly during periods of geopolitical tension or trade disruptions.

Technical complexity associated with separator manufacturing requires specialized equipment and expertise, creating barriers to entry for new market participants. The stringent quality requirements for automotive applications demand significant investments in manufacturing capabilities and quality control systems.

Competition from alternative technologies including solid-state batteries and other next-generation battery chemistries may potentially reduce long-term demand for traditional separator materials. While these technologies are still in development, they represent potential future challenges to the conventional separator market.

Regulatory compliance requirements add complexity and cost to separator manufacturing and distribution, particularly as safety standards continue to evolve and become more stringent across European markets.

Substantial market opportunities exist in developing next-generation separator materials specifically designed for high-performance electric vehicle applications. The growing demand for fast-charging capabilities and extended battery life creates opportunities for innovative separator solutions that can support these advanced requirements.

Domestic manufacturing expansion presents significant opportunities as France seeks to reduce dependence on imported battery components. Government support for establishing local separator production facilities creates favorable conditions for both domestic and international companies to invest in French manufacturing capabilities.

Research and development partnerships between separator manufacturers, automotive companies, and research institutions offer opportunities to develop breakthrough technologies. France’s strong academic and research infrastructure provides an excellent foundation for collaborative innovation in separator materials and manufacturing processes.

Export market potential exists as France can leverage its position within the European Union to serve broader European electric vehicle markets. The country’s reputation for quality manufacturing and innovation creates opportunities to export advanced separator technologies to neighboring countries.

Sustainability initiatives create opportunities for developing environmentally friendly separator materials and recycling technologies. As circular economy principles gain importance, companies that can offer sustainable separator solutions will have competitive advantages.

Market dynamics in the France electric vehicle battery separator market are characterized by rapid technological evolution and increasing integration between automotive manufacturers and separator suppliers. The traditional supplier-customer relationship is evolving toward strategic partnerships focused on co-developing advanced separator technologies.

Competitive intensity is increasing as both established separator manufacturers and new entrants compete for market share. This competition is driving innovation and cost optimization, benefiting end users through improved product performance and competitive pricing.

Supply chain evolution shows a clear trend toward localization and vertical integration, with automotive manufacturers seeking greater control over critical battery components. This trend is creating opportunities for separator manufacturers to establish closer relationships with end users and participate in long-term supply agreements.

Technology convergence between separator materials and battery design is creating new opportunities for integrated solutions. Separator manufacturers are increasingly working directly with battery designers to optimize separator properties for specific applications and performance requirements.

Market maturation is evident in the development of standardized testing protocols and quality specifications, which helps reduce uncertainty and supports market growth by providing clear performance benchmarks for separator materials.

Comprehensive research methodology employed in analyzing the France electric vehicle battery separator market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes direct interviews with industry participants, including separator manufacturers, automotive companies, and battery producers operating in the French market.

Secondary research encompasses analysis of industry reports, government publications, patent filings, and academic research related to separator technologies and electric vehicle market trends. This approach provides comprehensive coverage of market dynamics, technological developments, and regulatory influences affecting the market.

Data validation processes include cross-referencing information from multiple sources and conducting follow-up interviews to verify key findings. Quantitative analysis focuses on market trends, adoption rates, and performance metrics, while qualitative analysis examines strategic implications and future market directions.

Market modeling techniques incorporate various scenarios and assumptions to project future market developments. These models consider factors such as electric vehicle adoption rates, technological advancement timelines, and policy implementation schedules to provide realistic market projections.

Expert consultation with industry specialists and academic researchers provides additional insights into emerging technologies and market trends that may not be captured through traditional data sources.

Regional analysis reveals that the France electric vehicle battery separator market exhibits distinct geographical patterns influenced by automotive manufacturing concentrations and government policy implementation. The Île-de-France region leads in research and development activities, hosting major automotive headquarters and research institutions focused on electric vehicle technologies.

Northern France demonstrates strong market activity, particularly in the Hauts-de-France region, where automotive manufacturing facilities are increasingly focusing on electric vehicle production. This region accounts for approximately 28% of national electric vehicle component manufacturing activity, creating substantial demand for battery separators.

Eastern regions including Grand Est benefit from proximity to German automotive markets and established manufacturing infrastructure. Cross-border collaboration and supply chain integration create opportunities for separator manufacturers to serve both French and German markets efficiently.

Southern France shows growing importance in electric vehicle battery research and development, with several major research institutions and technology companies establishing facilities focused on advanced battery technologies. The region’s emphasis on renewable energy integration aligns well with electric vehicle adoption trends.

Western regions demonstrate increasing electric vehicle adoption rates, driven by urban centers and progressive environmental policies. This creates growing demand for battery separators as charging infrastructure expands and consumer acceptance increases.

Competitive landscape in the France electric vehicle battery separator market features a mix of international separator manufacturers and emerging domestic players. Key market participants include:

Strategic positioning among competitors emphasizes technological differentiation, with companies investing heavily in research and development to create separator materials with superior performance characteristics. Competition focuses on thermal stability, mechanical strength, and electrochemical properties.

Market consolidation trends include strategic partnerships between separator manufacturers and automotive companies, aimed at securing long-term supply relationships and co-developing next-generation separator technologies tailored to specific electric vehicle applications.

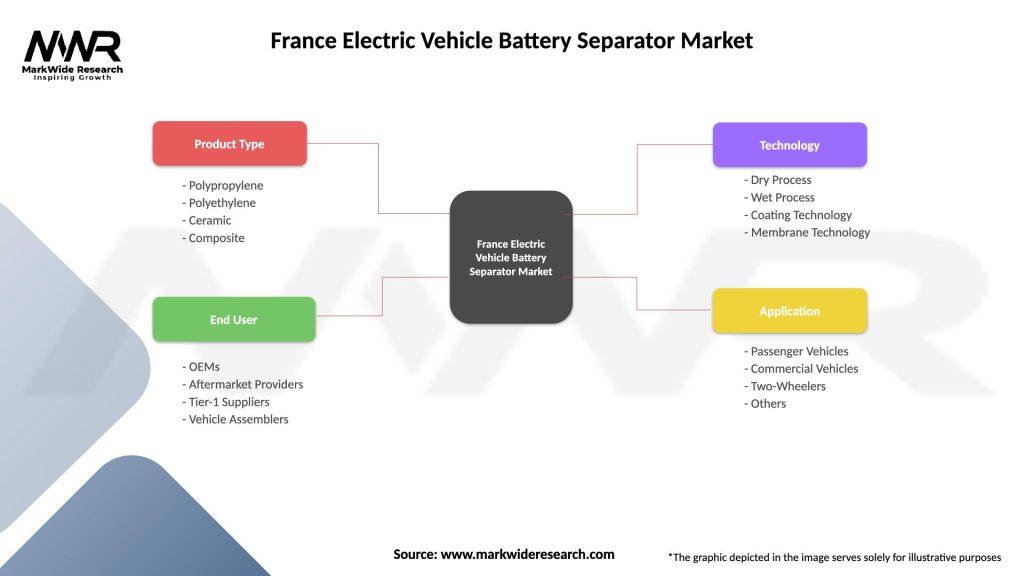

Market segmentation of the France electric vehicle battery separator market reveals distinct categories based on material type, manufacturing process, and application requirements. Understanding these segments provides insights into market dynamics and growth opportunities.

By Material Type:

By Manufacturing Process:

By Application:

Polyethylene separator category maintains market leadership due to its excellent balance of performance and cost-effectiveness. This segment benefits from mature manufacturing processes and widespread acceptance among battery manufacturers. Recent innovations focus on improving porosity and reducing thickness while maintaining mechanical integrity.

Ceramic-coated separator category represents the fastest-growing segment, driven by increasing safety requirements and demand for high-performance applications. These separators offer superior thermal stability and shutdown characteristics, making them ideal for fast-charging electric vehicle applications. Market penetration rates for ceramic-coated separators show 42% annual growth in premium electric vehicle segments.

Multi-layer separator category demonstrates strong potential for future growth as battery manufacturers seek optimized solutions combining the benefits of different materials. These separators can be engineered to provide specific properties for different regions within the battery, optimizing overall performance.

Wet process separator category continues to gain market share due to superior performance characteristics, particularly in high-energy density applications. The manufacturing process allows for better control of pore structure and uniformity, resulting in improved battery performance and safety.

Commercial vehicle application category shows promising growth prospects as fleet operators increasingly adopt electric vehicles. This segment requires separators with enhanced durability and performance consistency to meet the demanding operational requirements of commercial applications.

Automotive manufacturers benefit from access to advanced separator technologies that enable the development of high-performance electric vehicle batteries. Reliable separator supply chains support production planning and quality consistency, while innovative separator materials enable differentiation in electric vehicle performance and safety.

Battery manufacturers gain competitive advantages through partnerships with separator suppliers, accessing cutting-edge materials and technical support. Long-term supply agreements provide cost predictability and supply security, while collaborative development programs enable customized separator solutions for specific applications.

Separator manufacturers benefit from growing market demand and opportunities for technological innovation. The expanding electric vehicle market provides substantial growth potential, while partnerships with automotive and battery companies create stable revenue streams and market positioning advantages.

Government stakeholders achieve policy objectives related to electric vehicle adoption and environmental sustainability. Domestic separator manufacturing capabilities support strategic autonomy and economic development goals, while advanced separator technologies contribute to overall electric vehicle performance and consumer acceptance.

Research institutions benefit from collaboration opportunities with industry participants, accessing real-world application requirements and funding for advanced research programs. These partnerships accelerate technology development and provide pathways for commercializing innovative separator materials.

Investors gain exposure to a rapidly growing market with strong government support and clear long-term growth drivers. The separator market offers opportunities for both established companies and innovative startups developing next-generation materials and manufacturing technologies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological advancement trends show increasing focus on developing separators with enhanced thermal stability and safety characteristics. MarkWide Research analysis indicates that next-generation separator materials incorporating ceramic coatings and advanced polymer compositions are gaining significant market traction, with adoption rates reaching 38% growth annually.

Sustainability trends are driving demand for recyclable separator materials and environmentally friendly manufacturing processes. Companies are investing in developing bio-based separator materials and closed-loop recycling systems to meet growing environmental requirements and consumer expectations.

Supply chain localization trends reflect strategic initiatives to reduce dependence on imported separator materials. French companies are establishing domestic manufacturing capabilities and forming partnerships with European suppliers to create more resilient supply chains.

Performance optimization trends focus on developing separators that can support fast-charging capabilities and extended battery life. Advanced separator designs incorporating gradient porosity and multi-functional coatings are emerging to meet these demanding requirements.

Integration trends show increasing collaboration between separator manufacturers and battery designers to develop integrated solutions. This approach enables optimization of separator properties for specific battery chemistries and applications, improving overall system performance.

Digitalization trends include implementation of advanced manufacturing technologies and quality control systems. Smart manufacturing processes and real-time monitoring capabilities are improving separator quality consistency and production efficiency.

Recent industry developments highlight significant investments in separator manufacturing capabilities within France. Major automotive companies are establishing strategic partnerships with separator manufacturers to secure supply chains and co-develop advanced materials for next-generation electric vehicles.

Technology breakthroughs include development of ultra-thin separators with enhanced mechanical strength and improved ionic conductivity. These innovations enable higher energy density batteries while maintaining safety and reliability standards required for automotive applications.

Manufacturing expansion initiatives include establishment of new separator production facilities by both domestic and international companies. These investments reflect confidence in the French market and commitment to serving growing European demand for electric vehicle components.

Research collaborations between French research institutions and industry participants are yielding innovative separator materials and manufacturing processes. These partnerships leverage France’s strong academic infrastructure to accelerate technology development and commercialization.

Regulatory developments include updated safety standards and performance requirements for electric vehicle batteries, driving demand for advanced separator materials that can meet these stringent specifications.

Strategic acquisitions and partnerships are reshaping the competitive landscape, with companies seeking to strengthen their technological capabilities and market positions through strategic alliances and targeted investments.

Strategic recommendations for market participants include prioritizing investments in advanced separator technologies that can support next-generation electric vehicle requirements. Companies should focus on developing materials with superior thermal stability, enhanced safety characteristics, and improved performance consistency.

Supply chain optimization should emphasize establishing domestic manufacturing capabilities and diversifying supplier relationships to reduce dependence on single-source suppliers. Strategic partnerships with European suppliers can provide supply security while supporting regional economic development objectives.

Technology development efforts should concentrate on ceramic-coated separators and multi-layer configurations that offer superior performance characteristics. Investment in research and development capabilities will be crucial for maintaining competitive positioning in this rapidly evolving market.

Market positioning strategies should emphasize quality, reliability, and technical support capabilities rather than competing solely on price. Building strong relationships with automotive and battery manufacturers through collaborative development programs can create sustainable competitive advantages.

Sustainability initiatives should be integrated into product development and manufacturing processes to meet growing environmental requirements. Companies that can offer environmentally friendly separator solutions will have significant competitive advantages in the evolving market.

Geographic expansion opportunities should be evaluated carefully, with focus on markets that offer strong growth potential and favorable regulatory environments. The European Union market provides excellent opportunities for companies with strong technological capabilities and quality credentials.

Future market outlook for the France electric vehicle battery separator market remains highly positive, supported by strong government commitment to electric mobility and substantial investments in domestic battery manufacturing capabilities. MWR projections indicate sustained growth driven by increasing electric vehicle adoption and advancing separator technologies.

Technology evolution will continue driving market development, with next-generation separator materials offering enhanced performance characteristics becoming increasingly important. Solid-state battery development may create new opportunities for specialized separator materials, while traditional lithium-ion applications will continue growing substantially.

Market expansion is expected to accelerate as French automotive manufacturers ramp up electric vehicle production and new market entrants establish operations. The market will benefit from economies of scale and continued technology advancement, improving cost competitiveness and performance capabilities.

Supply chain development will focus on establishing robust domestic manufacturing capabilities and reducing dependence on imported materials. Strategic partnerships and investments in local production facilities will strengthen France’s position in the global electric vehicle supply chain.

Innovation acceleration will be driven by collaborative research programs and increasing investment in separator technology development. The convergence of materials science, battery technology, and automotive engineering will create new opportunities for breakthrough innovations.

Market maturation will bring standardization of performance requirements and quality specifications, facilitating broader adoption and reducing market uncertainty. This maturation will support sustained growth while enabling new market entrants to compete effectively.

The France electric vehicle battery separator market represents a dynamic and rapidly expanding segment within the broader electric mobility ecosystem. Strong government support, established automotive industry presence, and growing consumer acceptance of electric vehicles create favorable conditions for sustained market growth and technological advancement.

Market fundamentals remain robust, with increasing demand for high-performance separator materials driven by advancing electric vehicle technologies and expanding production capabilities. The trend toward supply chain localization and strategic partnerships between automotive manufacturers and separator suppliers will continue shaping market development.

Technological innovation will remain a key differentiator, with companies investing in advanced separator materials and manufacturing processes gaining competitive advantages. The focus on safety, performance, and sustainability will drive continued evolution in separator technologies and applications.

Strategic opportunities exist for both established companies and new market entrants willing to invest in advanced technologies and build strong relationships with automotive and battery manufacturers. The market’s growth trajectory and technological advancement potential make it an attractive opportunity for companies seeking exposure to the electric vehicle revolution.

Long-term prospects for the France electric vehicle battery separator market remain exceptionally positive, supported by clear policy direction, industry commitment, and technological advancement. As France continues its transition toward sustainable transportation, the battery separator market will play an increasingly important role in enabling this transformation and supporting the nation’s environmental and economic objectives.

What is Electric Vehicle Battery Separator?

Electric Vehicle Battery Separator refers to a critical component used in lithium-ion batteries that prevents short circuits between the anode and cathode while allowing the flow of ions. This separator plays a vital role in enhancing battery performance, safety, and longevity.

What are the key players in the France Electric Vehicle Battery Separator Market?

Key players in the France Electric Vehicle Battery Separator Market include companies such as Asahi Kasei, Toray Industries, and Celgard, which are known for their advanced separator technologies and contributions to the electric vehicle industry, among others.

What are the growth factors driving the France Electric Vehicle Battery Separator Market?

The France Electric Vehicle Battery Separator Market is driven by the increasing demand for electric vehicles, advancements in battery technology, and the growing emphasis on sustainable transportation solutions. Additionally, government incentives for EV adoption further boost market growth.

What challenges does the France Electric Vehicle Battery Separator Market face?

Challenges in the France Electric Vehicle Battery Separator Market include the high cost of advanced materials, competition from alternative battery technologies, and regulatory hurdles related to manufacturing processes. These factors can impact the overall market dynamics.

What opportunities exist in the France Electric Vehicle Battery Separator Market?

Opportunities in the France Electric Vehicle Battery Separator Market include the potential for innovation in separator materials, the expansion of EV infrastructure, and partnerships between battery manufacturers and automotive companies. These factors can lead to enhanced product offerings and market growth.

What trends are shaping the France Electric Vehicle Battery Separator Market?

Trends in the France Electric Vehicle Battery Separator Market include the development of high-performance separators, the integration of nanotechnology, and a focus on recycling and sustainability. These trends are crucial for meeting the evolving demands of the electric vehicle sector.

France Electric Vehicle Battery Separator Market

| Segmentation Details | Description |

|---|---|

| Product Type | Polypropylene, Polyethylene, Ceramic, Composite |

| End User | OEMs, Aftermarket Providers, Tier-1 Suppliers, Vehicle Assemblers |

| Technology | Dry Process, Wet Process, Coating Technology, Membrane Technology |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Electric Vehicle Battery Separator Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at