444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada bunker fuel market represents a critical component of the nation’s maritime energy infrastructure, serving as the primary fuel source for commercial shipping, naval operations, and offshore activities across Canadian waters. Bunker fuel, also known as marine fuel oil, encompasses various grades of heavy fuel oil specifically designed for marine engines and propulsion systems. The Canadian market demonstrates steady growth patterns with increasing demand driven by expanding international trade routes, Arctic shipping developments, and enhanced port infrastructure investments.

Market dynamics indicate that Canada’s strategic position as a major trading nation significantly influences bunker fuel consumption patterns. The country’s extensive coastline spanning three oceans creates substantial demand for marine fuel supplies across multiple regional hubs including Vancouver, Halifax, Montreal, and emerging Arctic ports. Environmental regulations are reshaping the market landscape, with the International Maritime Organization’s sulfur content restrictions driving demand for cleaner fuel alternatives and advanced fuel treatment technologies.

Growth projections suggest the market will expand at a compound annual growth rate of 4.2% through the forecast period, supported by increasing container traffic, bulk commodity exports, and cruise ship operations. The market benefits from Canada’s position as a major oil producer and refiner, providing domestic supply security and competitive pricing advantages for marine fuel distribution networks.

The Canada bunker fuel market refers to the comprehensive ecosystem of marine fuel oil production, distribution, and consumption specifically serving vessels operating in Canadian territorial waters and ports. Bunker fuel encompasses various petroleum-based products including heavy fuel oil, marine gas oil, and intermediate fuel oil grades designed to meet specific marine engine requirements and international maritime standards.

Market participants include oil refineries, fuel suppliers, shipping companies, port authorities, and regulatory bodies working together to ensure reliable fuel supply chains for maritime operations. The market covers both domestic coastal shipping and international vessel bunkering services, with specialized infrastructure including fuel storage terminals, pipeline networks, and marine fuel delivery systems positioned at strategic port locations across Canada’s coastline.

Regulatory framework governing the market includes federal maritime fuel standards, environmental protection requirements, and international compliance measures such as MARPOL conventions and IMO sulfur regulations. The market’s scope extends beyond simple fuel transactions to include fuel quality testing, supply chain logistics, environmental monitoring, and emerging alternative fuel technologies supporting Canada’s maritime decarbonization objectives.

Canada’s bunker fuel market demonstrates resilient growth characteristics supported by the country’s strategic maritime position and robust shipping industry fundamentals. The market serves diverse vessel categories including container ships, bulk carriers, tankers, cruise ships, and offshore support vessels operating across Atlantic, Pacific, and Arctic regions. Supply infrastructure benefits from Canada’s domestic refining capacity and established petroleum distribution networks, ensuring competitive fuel availability and pricing stability.

Key market drivers include expanding international trade volumes, with container traffic growth of 6.8% annually across major Canadian ports, and increasing Arctic shipping activities as ice-free navigation periods extend. The market faces transformation pressure from environmental regulations, particularly the IMO 2020 sulfur cap requiring marine fuels with maximum 0.5% sulfur content, driving demand for compliant fuel grades and scrubber technologies.

Competitive landscape features established petroleum companies, specialized marine fuel suppliers, and integrated shipping service providers. Market consolidation trends are evident as companies seek operational efficiencies and regulatory compliance capabilities. Technology adoption focuses on fuel quality monitoring systems, automated bunkering processes, and alternative fuel infrastructure development supporting long-term sustainability objectives.

Strategic market insights reveal several critical factors shaping Canada’s bunker fuel landscape. The following key insights provide comprehensive understanding of market dynamics and growth opportunities:

International trade expansion serves as the primary driver for Canada’s bunker fuel market growth, with increasing cargo volumes requiring reliable marine fuel supplies across major shipping routes. The country’s position as a significant exporter of natural resources, agricultural products, and manufactured goods generates consistent demand for vessel bunkering services. Container shipping growth particularly influences fuel consumption patterns, with major ports experiencing sustained traffic increases supporting long-term market expansion.

Arctic shipping development creates emerging opportunities as climate change extends ice-free navigation seasons, opening new shipping corridors through Canadian Arctic waters. This development requires specialized fuel supply infrastructure and cold-weather fuel formulations, driving investment in northern port facilities and fuel storage capabilities. Government initiatives supporting Arctic sovereignty and economic development further accelerate infrastructure investments benefiting the bunker fuel market.

Port infrastructure modernization enhances fuel handling capabilities and operational efficiency, attracting larger vessels and increasing bunkering volumes. Automated fuel delivery systems, expanded storage capacity, and improved quality control facilities strengthen Canada’s competitive position in the global marine fuel market. Cruise industry recovery following pandemic disruptions contributes additional demand, with Canadian ports serving as key destinations for international cruise operations requiring substantial fuel supplies.

Environmental regulations present significant challenges for the bunker fuel market, requiring substantial investments in cleaner fuel production and compliance infrastructure. The IMO sulfur content restrictions necessitate costly refinery modifications and fuel treatment systems, increasing operational expenses for market participants. Regulatory complexity across federal, provincial, and international jurisdictions creates compliance burdens that smaller suppliers struggle to manage effectively.

Price volatility in global crude oil markets directly impacts bunker fuel pricing and profitability, creating uncertainty for both suppliers and consumers. Fluctuating fuel costs complicate long-term shipping contracts and operational planning, potentially reducing demand during periods of extreme price increases. Economic downturns affecting international trade volumes can significantly reduce bunker fuel consumption, as shipping companies optimize routes and reduce vessel operations to manage costs.

Infrastructure limitations at certain ports restrict fuel handling capacity and vessel accessibility, constraining market growth potential. Aging fuel storage facilities and limited pipeline connections create bottlenecks during peak demand periods. Competition from alternative transportation modes, including rail and pipeline systems for bulk commodities, may reduce shipping volumes and corresponding fuel demand in specific market segments.

Alternative fuel development presents substantial opportunities as the maritime industry seeks sustainable solutions to meet environmental targets. Biofuel blending programs, hydrogen fuel cell technologies, and ammonia-based marine fuels offer potential market expansion areas for forward-thinking suppliers. Canadian companies can leverage domestic renewable energy resources and agricultural feedstocks to develop competitive alternative fuel offerings.

Digital transformation initiatives create opportunities for enhanced fuel management systems, predictive maintenance solutions, and automated bunkering operations. Blockchain technology applications for fuel quality tracking and supply chain transparency can differentiate Canadian suppliers in competitive international markets. Smart port technologies and IoT-enabled fuel monitoring systems improve operational efficiency and customer service capabilities.

Arctic shipping expansion offers significant growth potential as new shipping routes become viable through Canadian Arctic waters. This development requires specialized fuel supply infrastructure and cold-weather operational capabilities, creating opportunities for companies willing to invest in northern operations. Government support for Arctic development and sovereignty initiatives provides favorable conditions for infrastructure investment and market expansion in these emerging regions.

Supply-demand equilibrium in Canada’s bunker fuel market reflects the complex interplay between domestic refining capacity, international trade patterns, and seasonal shipping variations. The market demonstrates supply flexibility through established refinery networks and strategic fuel storage facilities positioned at major ports. Demand patterns show strong correlation with global commodity prices, trade agreement impacts, and seasonal shipping schedules affecting fuel consumption timing and volumes.

Competitive dynamics feature both established petroleum companies and specialized marine fuel suppliers competing on price, service quality, and regulatory compliance capabilities. Market consolidation trends emerge as companies seek operational efficiencies and enhanced compliance infrastructure to meet evolving regulatory requirements. Strategic partnerships between fuel suppliers and shipping companies create long-term supply agreements providing market stability and predictable revenue streams.

Technological advancement drives operational improvements across the value chain, from refinery optimization to fuel delivery automation. Quality management systems ensure consistent fuel specifications and regulatory compliance, while digital platforms enhance customer service and supply chain visibility. Environmental considerations increasingly influence market dynamics as stakeholders prioritize sustainable operations and carbon footprint reduction initiatives.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Canada’s bunker fuel market dynamics. Primary research includes extensive interviews with industry executives, port authorities, shipping companies, and regulatory officials to gather firsthand market intelligence and trend analysis. Survey methodologies capture quantitative data on fuel consumption patterns, pricing trends, and operational challenges across different market segments.

Secondary research incorporates analysis of government statistics, industry reports, trade publications, and regulatory filings to establish market baselines and historical trend analysis. Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification procedures. Statistical modeling techniques project future market scenarios based on identified trends and driving factors.

Market segmentation analysis examines fuel consumption patterns across vessel types, geographic regions, and seasonal variations to identify growth opportunities and market dynamics. Competitive intelligence gathering includes analysis of company financial reports, strategic announcements, and market positioning strategies. Regulatory impact assessment evaluates current and proposed environmental regulations affecting market development and operational requirements.

Pacific Coast Region dominates Canada’s bunker fuel market with Vancouver and Prince Rupert ports serving as major bunkering hubs for Asian trade routes. This region benefits from proximity to Alberta oil sands production and established refinery infrastructure supporting competitive fuel pricing. Container shipping volumes drive consistent demand, while cruise ship operations and bulk commodity exports contribute additional fuel consumption. The region accounts for approximately 45% of national bunker fuel volumes.

Atlantic Region encompasses major ports including Halifax, Saint John, and Montreal, serving European and eastern seaboard trade routes. Seasonal variations significantly impact fuel demand due to St. Lawrence Seaway operations and winter shipping constraints. The region benefits from established petroleum infrastructure and strategic location for transatlantic shipping operations. Offshore energy activities contribute specialized fuel demand for support vessels and drilling operations.

Arctic Region represents an emerging market segment with growing importance as ice-free navigation periods extend. Specialized fuel requirements for cold-weather operations create unique market opportunities, while government initiatives supporting Arctic development drive infrastructure investment. The region currently represents 12% of total market volume but shows strong growth potential as shipping routes through Arctic waters become more viable and economically attractive.

Market leadership in Canada’s bunker fuel sector features a combination of integrated oil companies, specialized marine fuel suppliers, and regional distributors competing across different market segments. The competitive environment emphasizes service reliability, fuel quality, and regulatory compliance capabilities as key differentiating factors.

Fuel Type Segmentation reveals distinct market preferences and regulatory influences across different marine fuel categories. Heavy Fuel Oil (HFO) maintains the largest market share despite environmental pressures, preferred for its cost-effectiveness in large vessel operations. Marine Gas Oil (MGO) experiences growing demand due to environmental regulations and operational flexibility requirements.

By Fuel Type:

By Vessel Type:

Container Shipping Category represents the most dynamic segment of Canada’s bunker fuel market, driven by increasing international trade volumes and regular shipping schedules. Fuel consumption patterns in this category show strong correlation with global economic conditions and trade agreement impacts. Container operators prioritize fuel cost optimization and supply reliability, creating opportunities for long-term supply contracts and volume-based pricing arrangements.

Bulk Carrier Operations demonstrate seasonal demand variations aligned with agricultural export cycles and commodity market conditions. Grain exports during harvest seasons create peak fuel demand periods, while mineral and energy exports provide consistent baseline consumption. This category benefits from Canada’s position as a major commodity exporter, ensuring steady fuel demand despite global economic fluctuations.

Cruise Ship Operations require premium fuel quality and environmental compliance, driving demand for cleaner fuel alternatives and advanced fuel treatment systems. Seasonal concentration during summer months creates operational challenges for fuel suppliers managing storage and delivery capacity. The category’s focus on passenger safety and environmental responsibility influences fuel specification requirements and quality control procedures.

Offshore Support Vessels serving Canada’s offshore energy industry require specialized fuel formulations and reliable supply chains for remote operations. Arctic operations demand cold-weather fuel specifications and specialized handling procedures, creating niche market opportunities for suppliers with appropriate capabilities and infrastructure investments.

Shipping Companies benefit from Canada’s competitive fuel pricing, reliable supply infrastructure, and strategic port locations serving major international trade routes. Operational advantages include reduced fuel costs, improved supply chain efficiency, and access to high-quality fuel products meeting international specifications. Canadian ports offer comprehensive bunkering services with advanced fuel handling capabilities and quality assurance programs.

Fuel Suppliers gain access to a stable market with consistent demand patterns and opportunities for long-term customer relationships. Infrastructure advantages include established refinery networks, strategic storage locations, and efficient distribution systems. The market offers opportunities for value-added services including fuel quality testing, supply chain optimization, and environmental compliance support.

Port Authorities benefit from increased vessel traffic and extended port stays during bunkering operations, generating additional revenue through port fees and service charges. Economic development opportunities include job creation, infrastructure investment, and enhanced regional competitiveness in attracting shipping business. Bunker fuel operations support port diversification strategies and long-term sustainability planning.

Government Stakeholders benefit from tax revenue generation, employment creation, and enhanced energy security through domestic fuel production capabilities. Strategic advantages include reduced dependence on fuel imports, improved balance of trade, and strengthened maritime industry competitiveness. Environmental benefits emerge through advanced fuel standards and clean technology adoption initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Environmental Compliance Acceleration represents the most significant trend reshaping Canada’s bunker fuel market, with suppliers investing heavily in cleaner fuel production and advanced treatment technologies. Low-sulfur fuel adoption continues expanding beyond regulatory requirements as shipping companies prioritize environmental responsibility and operational efficiency. This trend drives innovation in fuel blending, quality control, and alternative fuel development initiatives.

Digital Transformation revolutionizes fuel supply chain management through IoT sensors, blockchain tracking, and automated delivery systems. Predictive analytics optimize fuel inventory management and delivery scheduling, reducing costs and improving service reliability. Digital platforms enhance customer experience through real-time fuel tracking, quality monitoring, and automated billing systems.

Arctic Market Development accelerates as climate change extends ice-free navigation periods and government initiatives support northern infrastructure development. Specialized fuel requirements for cold-weather operations create niche market opportunities, while new shipping routes through Arctic waters increase fuel demand in northern regions. This trend requires significant infrastructure investment and operational expertise development.

Supply Chain Integration increases as fuel suppliers develop closer relationships with shipping companies, port operators, and logistics providers. Vertical integration strategies help companies control costs and ensure supply reliability, while strategic partnerships create competitive advantages through enhanced service offerings and operational efficiency improvements.

Regulatory Implementation of IMO 2020 sulfur regulations fundamentally transformed fuel specifications and supplier capabilities across Canada’s bunker fuel market. Infrastructure upgrades at major ports included advanced fuel blending facilities, enhanced quality testing laboratories, and expanded storage capacity for compliant fuel grades. These developments required substantial capital investment but positioned Canadian suppliers competitively in the global market.

Technology Adoption accelerated during recent years with implementation of automated fuel delivery systems, digital quality monitoring, and blockchain-based supply chain tracking. MarkWide Research analysis indicates these technological improvements enhanced operational efficiency by 18% while reducing fuel quality incidents and customer complaints significantly.

Alternative Fuel Initiatives gained momentum with several Canadian ports launching biofuel blending programs and hydrogen fuel pilot projects. Government support for clean technology development includes funding for research and development, infrastructure grants, and regulatory framework development supporting alternative fuel adoption in marine applications.

Market Consolidation activities included strategic acquisitions and partnership agreements as companies sought operational scale and enhanced service capabilities. Infrastructure sharing agreements between competitors improved fuel supply reliability while reducing individual company investment requirements for storage and distribution facilities.

Strategic Investment Focus should prioritize environmental compliance infrastructure and alternative fuel development capabilities to position companies for long-term market success. Technology integration offers significant competitive advantages through operational efficiency improvements and enhanced customer service capabilities. Companies should evaluate digital transformation opportunities including automated systems, predictive analytics, and customer portal development.

Market Expansion Strategies should consider Arctic region development as ice-free navigation periods extend and government initiatives support northern infrastructure investment. Specialized capabilities for cold-weather operations and remote fuel delivery create competitive differentiation opportunities. Partnership strategies with shipping companies and port authorities can secure long-term market access and revenue stability.

Regulatory Preparation requires proactive planning for evolving environmental standards and fuel specifications. Compliance infrastructure investment should anticipate future regulatory requirements rather than reactive implementation. Companies should engage actively in industry associations and regulatory consultation processes to influence policy development and ensure operational readiness.

Innovation Investment in alternative fuel technologies and sustainable operations will become increasingly important for market competitiveness. Research and development partnerships with technology companies, universities, and government agencies can accelerate innovation while sharing development costs and risks. Customer education and market development for alternative fuels require coordinated industry efforts and government support.

Market Growth Projections indicate sustained expansion driven by increasing international trade volumes, Arctic shipping development, and infrastructure modernization investments. MWR analysis suggests the market will maintain steady growth momentum with annual expansion rates of 4.5% through the next decade, supported by Canada’s strategic position in global shipping networks and domestic energy production capabilities.

Technology Evolution will fundamentally transform bunker fuel operations through automation, digitalization, and alternative fuel integration. Smart port technologies will enhance fuel delivery efficiency and quality control, while blockchain systems improve supply chain transparency and regulatory compliance. Artificial intelligence applications will optimize fuel blending, inventory management, and predictive maintenance operations.

Environmental Transformation will accelerate as the maritime industry pursues decarbonization objectives and regulatory requirements become more stringent. Alternative fuel adoption will expand significantly, with biofuels, hydrogen, and ammonia-based marine fuels gaining market share. Carbon pricing mechanisms and environmental regulations will influence fuel selection decisions and operational strategies.

Arctic Development represents the most significant long-term growth opportunity as climate change and government initiatives open new shipping corridors through Canadian Arctic waters. Infrastructure investment in northern ports and fuel supply systems will create substantial market expansion potential, requiring specialized capabilities and significant capital commitment from industry participants.

Canada’s bunker fuel market demonstrates strong fundamentals supported by the country’s strategic maritime position, domestic energy production capabilities, and robust shipping industry infrastructure. The market benefits from established supply chains, competitive pricing, and comprehensive regulatory frameworks ensuring operational stability and growth potential. Environmental transformation presents both challenges and opportunities as the industry adapts to cleaner fuel requirements and sustainable operational practices.

Growth prospects remain positive driven by expanding international trade, Arctic shipping development, and continued infrastructure investment across major port facilities. Technology adoption and digital transformation initiatives will enhance operational efficiency and competitive positioning, while alternative fuel development creates new market segments and revenue opportunities. Strategic positioning for environmental compliance and sustainable operations will determine long-term market success as regulatory requirements evolve and customer preferences shift toward cleaner fuel alternatives.

The Canada bunker fuel market represents a dynamic and evolving industry segment with substantial opportunities for companies willing to invest in infrastructure modernization, technology adoption, and environmental compliance capabilities. Success in this market requires strategic planning, operational excellence, and proactive adaptation to changing regulatory and customer requirements in the global maritime industry.

What is Bunker Fuel?

Bunker fuel refers to the fuel used in ships and vessels for propulsion and power generation. It is a crucial component in the maritime industry, particularly for commercial shipping and fishing operations.

What are the key players in the Canada Bunker Fuel Market?

Key players in the Canada Bunker Fuel Market include companies like Imperial Oil, Shell Canada, and Suncor Energy, which are involved in the production and distribution of bunker fuels, among others.

What are the growth factors driving the Canada Bunker Fuel Market?

The Canada Bunker Fuel Market is driven by factors such as the increasing demand for maritime transportation, the growth of the shipping industry, and the need for efficient fuel solutions in commercial shipping.

What challenges does the Canada Bunker Fuel Market face?

Challenges in the Canada Bunker Fuel Market include stringent environmental regulations, fluctuations in crude oil prices, and the transition to cleaner fuel alternatives, which can impact traditional bunker fuel demand.

What opportunities exist in the Canada Bunker Fuel Market?

Opportunities in the Canada Bunker Fuel Market include the development of low-sulfur fuels to meet regulatory standards, advancements in fuel technology, and the potential for increased shipping activities in Arctic routes.

What trends are shaping the Canada Bunker Fuel Market?

Trends in the Canada Bunker Fuel Market include a shift towards more sustainable fuel options, the adoption of digital technologies for fuel management, and increased focus on reducing greenhouse gas emissions in the shipping sector.

Canada Bunker Fuel Market

| Segmentation Details | Description |

|---|---|

| Fuel Type | IFO 180, IFO 380, MGO, MDO |

| Application | Shipping, Fishing, Offshore, Power Generation |

| End User | Commercial Vessels, Tankers, Fishing Fleets, Power Plants |

| Distribution Channel | Direct Supply, Bunker Stations, Brokers, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

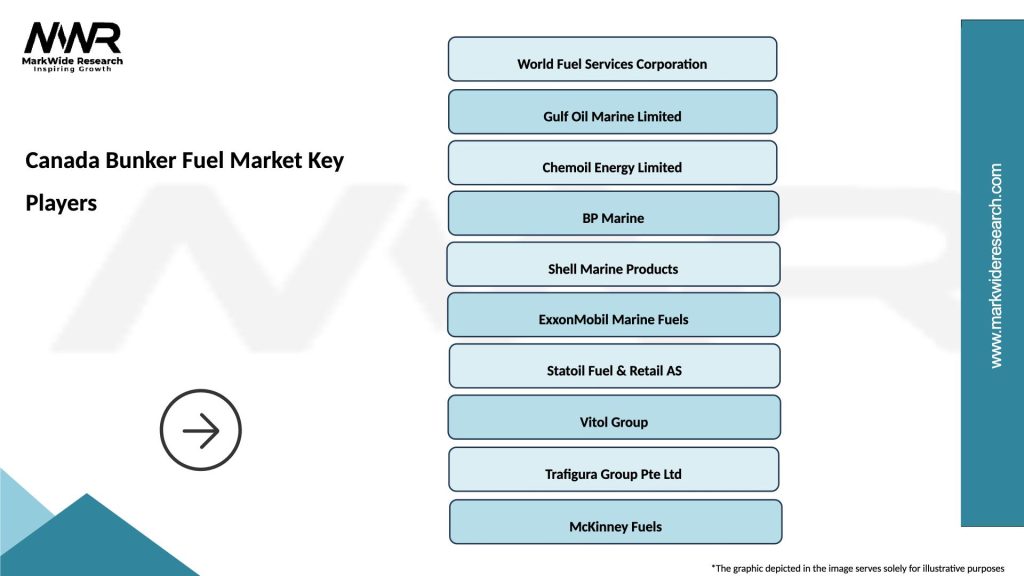

Leading companies in the Canada Bunker Fuel Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at