444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Slovakia road freight transport market represents a vital component of Central Europe’s logistics infrastructure, serving as a crucial gateway between Western and Eastern European trade routes. Slovakia’s strategic location at the heart of Europe has positioned the country as a significant hub for international freight movement, with road transport accounting for approximately 75% of total freight transport within the country. The market demonstrates robust growth potential driven by increasing e-commerce activities, manufacturing expansion, and enhanced cross-border trade relationships.

Market dynamics indicate strong performance across multiple sectors, with the automotive industry, manufacturing, and retail sectors driving substantial demand for road freight services. The country’s well-developed highway network and strategic positioning along major European transport corridors contribute to its attractiveness as a logistics destination. Digital transformation initiatives and sustainability requirements are reshaping operational frameworks, with companies increasingly adopting advanced fleet management systems and eco-friendly transport solutions.

Regional connectivity remains a key strength, with Slovakia serving major trade routes connecting Germany, Austria, Poland, Hungary, and other neighboring countries. The market benefits from EU membership advantages, including streamlined customs procedures and standardized regulations that facilitate seamless cross-border operations. Infrastructure investments and technological advancements continue to enhance the sector’s efficiency and competitiveness in the broader European logistics landscape.

The Slovakia road freight transport market refers to the comprehensive ecosystem of commercial vehicle operations, logistics services, and freight movement activities conducted via road networks throughout Slovakia and its international connections. This market encompasses domestic freight distribution, international haulage services, last-mile delivery operations, and specialized transport solutions serving various industry sectors.

Core components include trucking companies, logistics service providers, freight forwarders, and technology solution providers that collectively facilitate the movement of goods across road networks. The market integrates traditional transport services with modern digital platforms, route optimization systems, and sustainable transport technologies to meet evolving customer demands and regulatory requirements.

Operational scope extends from local distribution networks serving Slovak cities and regions to international corridors connecting major European markets. The market serves diverse cargo types including automotive components, consumer goods, industrial materials, and agricultural products, with specialized segments addressing temperature-controlled transport, hazardous materials, and oversized cargo requirements.

Strategic positioning within Central Europe continues to drive growth in Slovakia’s road freight transport sector, with the market experiencing steady expansion supported by increased trade volumes and industrial development. Key performance indicators demonstrate positive trends across freight volumes, fleet modernization, and service diversification, with companies adapting to digital transformation requirements and sustainability mandates.

Market leaders are investing significantly in fleet upgrades, technology integration, and service expansion to maintain competitive advantages in an increasingly dynamic environment. Cross-border operations represent approximately 60% of total freight activity, highlighting Slovakia’s role as a transit hub for European trade. Domestic distribution networks are simultaneously strengthening to support growing e-commerce and retail sectors.

Regulatory developments and environmental standards are shaping operational strategies, with companies implementing cleaner technologies and optimized routing systems. Future growth prospects remain positive, supported by continued industrial expansion, infrastructure improvements, and increasing integration with broader European logistics networks. Digital adoption rates are accelerating, with approximately 45% of operators implementing advanced fleet management and tracking systems.

Fundamental market characteristics reveal several critical insights that define the Slovakia road freight transport landscape:

Economic expansion across Slovakia continues to generate substantial demand for road freight services, with manufacturing growth and increased consumer spending driving freight volumes. Automotive industry development remains a primary catalyst, with major manufacturers establishing production facilities and supply chain networks that require sophisticated logistics support. E-commerce growth is creating new demand patterns for last-mile delivery services and flexible distribution networks.

EU integration benefits facilitate seamless cross-border operations, with standardized regulations and customs procedures reducing operational complexity and costs. Infrastructure investments in highway networks and logistics facilities enhance transport efficiency and capacity, supporting market expansion. Digital transformation initiatives enable improved route optimization, real-time tracking, and enhanced customer service capabilities.

Trade volume increases with neighboring countries and broader European markets create sustained demand for international freight services. Industrial diversification beyond traditional sectors generates new freight categories and specialized transport requirements. Supply chain optimization trends encourage companies to consolidate logistics operations and seek comprehensive transport solutions, benefiting integrated service providers.

Driver shortage challenges continue to impact operational capacity, with aging workforce demographics and competitive labor markets creating recruitment difficulties. Regulatory compliance costs associated with environmental standards, safety requirements, and digital tachograph systems increase operational expenses for transport companies. Fuel price volatility affects profit margins and requires sophisticated pricing strategies to maintain competitiveness.

Infrastructure limitations in certain regions and during peak traffic periods can cause delays and reduce operational efficiency. Administrative complexities related to international operations, despite EU integration, still require significant resources and expertise. Competition intensity from both domestic and international operators pressures pricing and service margins.

Technology investment requirements for fleet management systems, tracking technologies, and compliance monitoring create financial burdens, particularly for smaller operators. Environmental regulations necessitate fleet upgrades and operational modifications that require substantial capital investments. Economic uncertainty and potential trade disruptions can impact freight volumes and long-term planning capabilities.

Digital logistics platforms present significant opportunities for service enhancement and operational optimization, with companies able to leverage technology for competitive advantage. Sustainable transport solutions create new market segments as customers increasingly prioritize environmental responsibility in their supply chain decisions. Value-added services including warehousing, packaging, and inventory management offer revenue diversification opportunities.

Regional expansion into emerging Central and Eastern European markets provides growth potential for established Slovak operators. Specialized transport segments such as temperature-controlled logistics, pharmaceutical distribution, and hazardous materials transport offer higher-margin opportunities. Last-mile delivery services for e-commerce and urban distribution represent rapidly growing market segments.

Partnership opportunities with international logistics providers and technology companies can enhance service capabilities and market reach. Government infrastructure projects and EU funding initiatives support sector development and modernization efforts. Industry consolidation trends create opportunities for strategic acquisitions and market share expansion for well-positioned companies.

Competitive landscape evolution reflects increasing consolidation among transport operators, with larger companies acquiring smaller regional players to expand service capabilities and geographic coverage. Technology integration is becoming a key differentiator, with companies investing in fleet management systems, route optimization software, and customer portal technologies to enhance service quality and operational efficiency.

Customer expectations are driving service innovation, with demands for real-time tracking, flexible delivery options, and integrated logistics solutions reshaping service offerings. Regulatory environment changes continue to influence operational strategies, with environmental standards and safety requirements driving fleet modernization and process improvements. Market fragmentation remains significant, with numerous small and medium-sized operators serving local and regional markets alongside larger international players.

Pricing dynamics reflect competitive pressures and operational cost fluctuations, with companies developing sophisticated pricing models to maintain profitability while meeting customer expectations. Service differentiation increasingly focuses on reliability, flexibility, and value-added capabilities rather than purely cost-based competition. International market integration continues to deepen, with Slovak operators expanding their European network coverage and service capabilities.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Slovakia road freight transport market. Primary research activities include structured interviews with industry executives, transport operators, logistics managers, and regulatory officials to gather firsthand market intelligence and operational insights.

Secondary research components encompass analysis of government statistics, industry reports, regulatory documents, and company financial statements to establish market baselines and trend patterns. Data validation processes involve cross-referencing multiple sources and conducting follow-up interviews to verify key findings and market assessments.

Quantitative analysis incorporates statistical modeling techniques to project market trends and assess growth patterns across different segments and regions. Qualitative research methods provide deeper understanding of market dynamics, competitive strategies, and customer requirements through detailed case studies and expert consultations. Market segmentation analysis examines various categories including service types, customer sectors, and geographic regions to identify specific growth opportunities and market characteristics.

Bratislava region dominates freight transport activity, accounting for approximately 40% of total market volume due to its concentration of industrial facilities, logistics centers, and international gateway functions. Western Slovakia benefits from proximity to Austrian and Czech markets, with strong automotive and manufacturing sectors driving consistent freight demand. Highway infrastructure quality in this region supports efficient operations and attracts international logistics investments.

Eastern Slovakia regions demonstrate growing freight activity supported by industrial development and improved infrastructure connections. Central Slovakia serves as an important distribution hub for domestic freight movements, with developing logistics capabilities and strategic positioning for national distribution networks. Cross-border corridors through various regions handle significant international transit volumes, with border efficiency improvements enhancing operational performance.

Urban areas across all regions show increasing demand for last-mile delivery services and specialized urban logistics solutions. Rural regions maintain steady freight activity related to agricultural products and local manufacturing, though with different service requirements and operational characteristics. Regional development initiatives and EU funding programs continue to improve infrastructure and logistics capabilities across all areas of Slovakia.

Market leadership is distributed among several categories of operators, each serving different market segments and customer requirements:

Competitive strategies focus on service differentiation, technology adoption, and geographic expansion to maintain market position. Partnership arrangements between local and international operators create comprehensive service networks and enhanced customer value propositions.

By Service Type:

By Customer Sector:

By Geographic Scope:

Full Truckload services represent the largest market segment, driven by automotive industry requirements and manufacturing sector demand for dedicated transport capacity. Service reliability and route optimization capabilities distinguish leading providers in this segment. Technology integration enables real-time tracking and enhanced customer communication, creating competitive advantages.

Less Than Truckload operations demonstrate strong growth potential as companies seek cost-effective transport solutions for smaller shipments. Network optimization and consolidation capabilities become critical success factors in this segment. Digital platforms facilitate booking processes and shipment management for LTL customers.

Express services show increasing demand from e-commerce and time-sensitive business requirements. Premium pricing models support higher margins while requiring exceptional service reliability and performance. Last-mile capabilities become increasingly important for express service providers serving urban markets.

Specialized transport segments offer higher-margin opportunities but require significant investment in specialized equipment and expertise. Regulatory compliance and safety standards create barriers to entry while protecting established operators. Customer relationships in specialized segments tend to be longer-term and more strategic in nature.

Transport operators benefit from Slovakia’s strategic location and well-developed infrastructure, enabling efficient operations and access to multiple European markets. Regulatory stability within the EU framework provides predictable operating conditions and facilitates long-term planning. Technology adoption opportunities enable operational improvements and competitive differentiation.

Customers and shippers gain access to comprehensive transport networks, competitive pricing, and improving service quality through market competition. Supply chain integration capabilities offered by leading providers enhance operational efficiency and reduce logistics complexity. Sustainability initiatives help customers meet environmental objectives and corporate responsibility requirements.

Economic stakeholders benefit from job creation, tax revenues, and economic multiplier effects generated by the transport sector. Infrastructure utilization maximizes returns on public investment in highway networks and logistics facilities. Trade facilitation supports broader economic development and international competitiveness.

Technology providers find growing market opportunities for fleet management systems, tracking technologies, and logistics optimization solutions. Equipment manufacturers benefit from fleet modernization trends and regulatory requirements for cleaner, safer vehicles. Service providers in related sectors such as maintenance, insurance, and finance gain from sector growth and development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization acceleration continues to reshape operational practices, with companies implementing advanced fleet management systems, route optimization software, and customer portal technologies. Real-time tracking capabilities have become standard customer expectations, driving investment in GPS and communication technologies. Data analytics applications enable predictive maintenance, fuel optimization, and performance monitoring across fleet operations.

Sustainability initiatives are gaining momentum as companies respond to environmental regulations and customer demands for greener logistics solutions. Alternative fuel adoption including electric and hybrid vehicles is beginning to influence fleet composition decisions. Carbon footprint reduction programs incorporate route optimization, load consolidation, and fuel-efficient driving practices.

Service integration trends see transport companies expanding into warehousing, distribution, and value-added logistics services to provide comprehensive solutions. Customer-centric approaches emphasize flexibility, reliability, and customized service offerings tailored to specific industry requirements. Partnership strategies enable smaller operators to access advanced technologies and expanded service capabilities through collaboration arrangements.

Automation technologies are gradually being introduced in logistics operations, with automated sorting systems and robotic handling equipment improving efficiency in distribution centers. Autonomous vehicle development represents a long-term trend that could significantly impact the industry, though widespread adoption remains years away.

Infrastructure improvements continue with ongoing highway expansion projects and logistics facility developments supported by EU funding programs. Border crossing efficiency enhancements reduce transit times and operational costs for international transport operations. Digital customs procedures streamline administrative processes and improve cross-border freight flow.

Regulatory updates include revised driver working time regulations, enhanced vehicle safety standards, and updated environmental requirements that influence operational practices. Professional qualification frameworks establish standardized training requirements for transport professionals and improve service quality standards. Market liberalization measures continue to reduce barriers and enhance competition within the sector.

Technology partnerships between transport companies and software providers accelerate digital transformation initiatives. MarkWide Research analysis indicates that strategic alliances and joint ventures are becoming more common as companies seek to expand capabilities and market reach. Investment activities in fleet modernization and facility upgrades demonstrate sector confidence and growth expectations.

Sustainability programs launched by major operators include fleet electrification pilots, carbon offset initiatives, and green logistics certification programs. Industry associations are developing best practice guidelines and promoting professional standards across the sector.

Strategic recommendations for market participants emphasize the importance of technology adoption and service differentiation to maintain competitive advantage. Investment priorities should focus on fleet management systems, customer service technologies, and driver training programs to address current market challenges and opportunities.

Market positioning strategies should leverage Slovakia’s geographic advantages while developing specialized capabilities in high-growth segments such as e-commerce logistics and sustainable transport solutions. Partnership development with international logistics providers can enhance service capabilities and market reach for domestic operators.

Operational excellence initiatives including route optimization, fuel management, and maintenance programs can improve efficiency and profitability in competitive market conditions. Customer relationship management systems and service quality programs help differentiate providers and build long-term business relationships.

Risk management approaches should address driver shortage challenges through recruitment programs, competitive compensation packages, and workplace improvement initiatives. Financial planning must account for regulatory compliance costs, technology investments, and potential market volatility impacts on operations.

Growth projections for the Slovakia road freight transport market remain positive, supported by continued economic development, industrial expansion, and increasing trade volumes. MWR analysis suggests that the market will experience steady growth driven by e-commerce expansion, manufacturing sector development, and enhanced regional connectivity. Technology adoption rates are expected to accelerate, with approximately 70% of operators implementing advanced fleet management systems within the next five years.

Industry consolidation trends are likely to continue as larger operators acquire smaller companies to achieve economies of scale and expand service capabilities. Service innovation will focus on integrated logistics solutions, sustainable transport options, and customer-centric service models. International market integration will deepen as Slovak operators expand their European network coverage and service offerings.

Regulatory developments will continue to shape operational practices, with environmental standards becoming increasingly stringent and safety requirements evolving. Infrastructure investments in highway networks and logistics facilities will support market growth and operational efficiency improvements. Workforce development initiatives will be critical to address driver shortage challenges and maintain service quality standards.

Sustainability transformation will accelerate as companies adopt cleaner technologies, optimize operations for environmental efficiency, and respond to customer demands for responsible logistics solutions. Digital innovation will continue to drive operational improvements and create new service possibilities for market participants.

Slovakia’s road freight transport market demonstrates strong fundamentals and positive growth prospects, supported by strategic geographic positioning, well-developed infrastructure, and diverse industrial demand. Market dynamics reflect increasing sophistication in service offerings, technology adoption, and operational practices as companies respond to evolving customer requirements and competitive pressures.

Key success factors for market participants include strategic technology investments, service differentiation capabilities, and effective management of operational challenges such as driver shortages and regulatory compliance. Growth opportunities in e-commerce logistics, sustainable transport solutions, and specialized services provide pathways for market expansion and profitability improvement.

Future market development will be shaped by continued digitalization, sustainability requirements, and regional integration trends that create both opportunities and challenges for industry participants. Strategic positioning and operational excellence will remain critical for success in an increasingly competitive and sophisticated market environment. The Slovakia road freight transport market is well-positioned to capitalize on Central Europe’s economic growth and evolving logistics requirements, offering substantial opportunities for companies that can effectively navigate market dynamics and customer expectations.

What is Slovakia Road Freight Transport?

Slovakia Road Freight Transport refers to the movement of goods and cargo via road networks within Slovakia. This sector plays a crucial role in the logistics and supply chain management, facilitating trade and commerce across various industries.

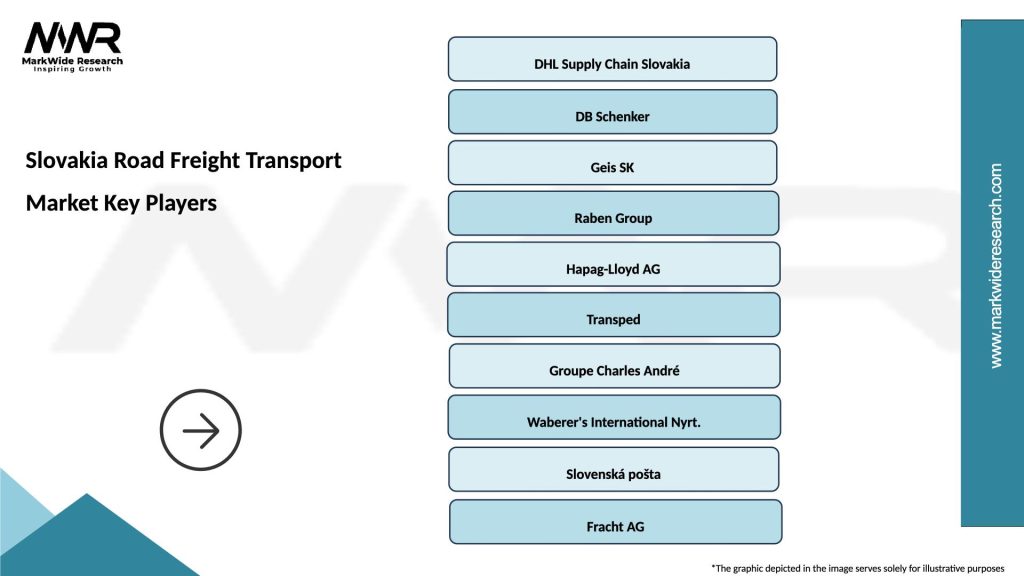

What are the key players in the Slovakia Road Freight Transport Market?

Key players in the Slovakia Road Freight Transport Market include companies like DPDgroup, Slovenská pošta, and Geis SK. These companies provide a range of logistics services, including parcel delivery, freight forwarding, and supply chain solutions, among others.

What are the growth factors driving the Slovakia Road Freight Transport Market?

The growth of the Slovakia Road Freight Transport Market is driven by increasing e-commerce activities, the expansion of manufacturing sectors, and the need for efficient logistics solutions. Additionally, improvements in road infrastructure contribute to enhanced transport efficiency.

What challenges does the Slovakia Road Freight Transport Market face?

The Slovakia Road Freight Transport Market faces challenges such as rising fuel costs, regulatory compliance issues, and traffic congestion. These factors can impact operational efficiency and increase transportation costs for logistics providers.

What opportunities exist in the Slovakia Road Freight Transport Market?

Opportunities in the Slovakia Road Freight Transport Market include the adoption of green logistics practices, investment in technology for route optimization, and the growth of cross-border trade. These factors can enhance service offerings and operational efficiency.

What trends are shaping the Slovakia Road Freight Transport Market?

Trends shaping the Slovakia Road Freight Transport Market include the increasing use of digital platforms for logistics management, the rise of sustainable transport solutions, and the integration of automation in freight operations. These trends are transforming how goods are transported and managed.

Slovakia Road Freight Transport Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Trucks, Vans, Trailers, Tankers |

| Service Type | Full Truck Load, Less Than Truck Load, Intermodal, Expedited |

| End User | Manufacturers, Retailers, Distributors, E-commerce |

| Fuel Type | Diesel, Gasoline, Electric, Hybrid |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Slovakia Road Freight Transport Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at