444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom container glass market represents a vital segment of the nation’s packaging industry, serving diverse sectors including beverages, food, pharmaceuticals, and cosmetics. This mature market demonstrates remarkable resilience and adaptability, driven by increasing consumer preference for sustainable packaging solutions and the growing emphasis on circular economy principles. The market encompasses various glass container types, from traditional bottles and jars to specialized pharmaceutical vials and premium cosmetic packaging.

Market dynamics in the UK container glass sector are influenced by stringent environmental regulations, evolving consumer preferences, and technological advancements in glass manufacturing processes. The industry has experienced steady growth, with production facilities across England, Scotland, and Wales contributing to a robust domestic supply chain. Recent developments indicate a 4.2% annual growth rate in sustainable glass packaging adoption, reflecting the market’s alignment with environmental consciousness.

Key market characteristics include strong demand from the beverage industry, particularly for wine, spirits, and craft beer packaging, alongside growing requirements from the food preservation sector. The market benefits from the UK’s position as a major consumer of premium alcoholic beverages and the increasing trend toward artisanal food products that require high-quality glass packaging solutions.

The United Kingdom container glass market refers to the comprehensive ecosystem encompassing the production, distribution, and utilization of glass containers designed for packaging various products across multiple industries within the UK territory. This market includes all forms of glass packaging solutions, from beverage bottles and food jars to pharmaceutical containers and cosmetic packaging, manufactured through traditional and advanced glass-forming technologies.

Container glass specifically denotes hollow glass products designed to contain, protect, and preserve various substances while maintaining product integrity and extending shelf life. The market encompasses both clear and colored glass containers, with varying sizes, shapes, and functional specifications tailored to meet specific industry requirements and consumer preferences.

Market scope extends beyond mere manufacturing to include recycling processes, supply chain management, and innovative packaging solutions that address sustainability concerns while meeting regulatory compliance standards established by UK and European authorities.

Strategic market positioning reveals the UK container glass market as a mature yet dynamic sector characterized by steady demand growth and increasing focus on environmental sustainability. The market demonstrates strong performance across multiple application segments, with beverage packaging maintaining the largest market share at approximately 68% of total demand.

Innovation drivers include advanced manufacturing technologies, lightweight glass solutions, and enhanced recycling capabilities that support circular economy objectives. The market benefits from established infrastructure, skilled workforce, and proximity to major European markets, creating competitive advantages for UK-based manufacturers and suppliers.

Growth trajectories indicate sustained expansion driven by premiumization trends in alcoholic beverages, increasing demand for sustainable packaging alternatives, and growing pharmaceutical sector requirements. The market’s resilience during economic uncertainties demonstrates its essential role in the UK’s packaging ecosystem.

Future prospects remain positive, supported by government initiatives promoting sustainable packaging, consumer preference shifts toward environmentally friendly solutions, and continuous technological improvements in glass manufacturing processes that enhance efficiency and reduce environmental impact.

Market intelligence reveals several critical insights that define the current landscape of the UK container glass market:

Environmental sustainability stands as the primary driver propelling the UK container glass market forward. Growing consumer awareness regarding environmental impact and government initiatives promoting sustainable packaging solutions create substantial demand for glass containers. The material’s infinite recyclability and reduced carbon footprint compared to alternative packaging materials position glass favorably in the evolving packaging landscape.

Premium product trends significantly influence market growth, particularly in the alcoholic beverage sector where glass packaging enhances perceived product value and brand positioning. Craft breweries, artisanal spirits producers, and premium wine brands increasingly prefer glass containers to communicate quality and sophistication to discerning consumers.

Regulatory compliance requirements drive demand for specialized glass containers in pharmaceutical and food industries. Stringent safety standards and quality regulations necessitate high-grade glass packaging solutions that ensure product integrity and consumer safety throughout the supply chain.

Technological advancements in glass manufacturing enable production of innovative container designs with improved functionality, reduced weight, and enhanced aesthetic appeal. These developments expand application possibilities and create new market opportunities across various industry segments.

High production costs represent a significant challenge for the UK container glass market, particularly when competing with alternative packaging materials such as plastic and aluminum. Energy-intensive manufacturing processes and raw material expenses contribute to elevated production costs that can impact market competitiveness.

Transportation limitations pose logistical challenges due to glass containers’ weight and fragility characteristics. Higher shipping costs and increased risk of breakage during transportation can limit market expansion opportunities and affect overall supply chain efficiency.

Competition from alternatives intensifies as plastic and metal packaging solutions offer lightweight, cost-effective options for certain applications. Some market segments may migrate toward alternative materials based on economic considerations and specific functional requirements.

Manufacturing capacity constraints occasionally limit market growth potential, particularly during peak demand periods or when specialized container requirements exceed available production capabilities. Investment in additional manufacturing infrastructure requires substantial capital commitments and long-term planning.

Sustainable packaging initiatives create substantial opportunities for market expansion as businesses and consumers increasingly prioritize environmental responsibility. Government policies supporting circular economy principles and plastic reduction targets favor glass packaging adoption across multiple industry sectors.

Innovation in lightweight glass presents opportunities to address traditional weight-related limitations while maintaining glass’s inherent benefits. Advanced manufacturing techniques enable production of thinner, lighter containers that reduce transportation costs and environmental impact without compromising quality or safety.

Pharmaceutical sector growth offers significant expansion potential as the UK’s pharmaceutical industry continues developing and manufacturing various medications requiring specialized glass packaging. Increasing demand for biologics, vaccines, and specialty drugs creates opportunities for high-value glass container applications.

Export market development leverages the UK’s reputation for quality manufacturing to access international markets seeking premium glass packaging solutions. Strategic partnerships and trade relationships can facilitate market expansion beyond domestic boundaries.

Customization and personalization trends create opportunities for specialized glass container production tailored to specific brand requirements and consumer preferences. Advanced decoration techniques and unique container designs enable differentiation in competitive markets.

Supply chain integration characterizes the UK container glass market, with manufacturers, suppliers, and end-users developing collaborative relationships to optimize efficiency and reduce costs. Vertical integration strategies enable better control over quality, delivery schedules, and pricing structures while enhancing overall market stability.

Demand fluctuations reflect seasonal variations in beverage consumption, holiday packaging requirements, and economic conditions affecting consumer spending patterns. Market participants adapt production schedules and inventory management strategies to accommodate these cyclical variations effectively.

Technological evolution drives continuous improvements in manufacturing processes, quality control systems, and product innovation. Investment in research and development enables market participants to maintain competitive advantages and respond to evolving customer requirements.

Regulatory landscape influences market dynamics through environmental standards, safety requirements, and trade policies affecting both domestic production and international competition. Compliance with evolving regulations requires ongoing investment in process improvements and quality assurance systems.

Market consolidation trends reflect economies of scale advantages and strategic positioning requirements. Mergers, acquisitions, and partnerships reshape competitive dynamics while creating opportunities for operational efficiency improvements and market expansion.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the UK container glass market. Primary research involves direct engagement with industry stakeholders, including manufacturers, suppliers, distributors, and end-users, through structured interviews and surveys designed to capture current market conditions and future expectations.

Secondary research encompasses extensive analysis of industry reports, government publications, trade association data, and academic studies relevant to the container glass sector. This approach provides historical context, market trends, and comparative analysis with international markets to establish comprehensive market understanding.

Data validation processes ensure information accuracy through cross-referencing multiple sources, expert consultations, and statistical analysis techniques. Market sizing methodologies combine top-down and bottom-up approaches to establish reliable market parameters and growth projections.

Industry expert insights contribute valuable perspectives on market dynamics, technological developments, and future trends through consultations with experienced professionals across the container glass value chain. These insights enhance analytical depth and provide practical market intelligence.

England dominates the UK container glass market, accounting for approximately 78% of total production capacity and consumption. Major manufacturing facilities concentrated in the Midlands and Northern England benefit from established industrial infrastructure, skilled workforce availability, and proximity to key customer markets.

Scotland contributes significantly to the market, particularly in whisky bottle production and specialized glass containers for the country’s renowned spirits industry. Scottish manufacturers leverage regional expertise and heritage associations to serve both domestic and international markets effectively.

Wales maintains important manufacturing capabilities with facilities focused on food packaging applications and industrial glass containers. The region benefits from competitive production costs and strategic location for serving both UK and European markets.

Northern Ireland represents a smaller but growing market segment with increasing demand for glass packaging solutions across various industries. The region’s strategic location provides access to both UK and European Union markets, creating unique positioning advantages.

Regional specialization patterns emerge based on local industry concentrations, with areas near major beverage producers, food manufacturers, and pharmaceutical companies developing specialized capabilities to serve these sectors effectively.

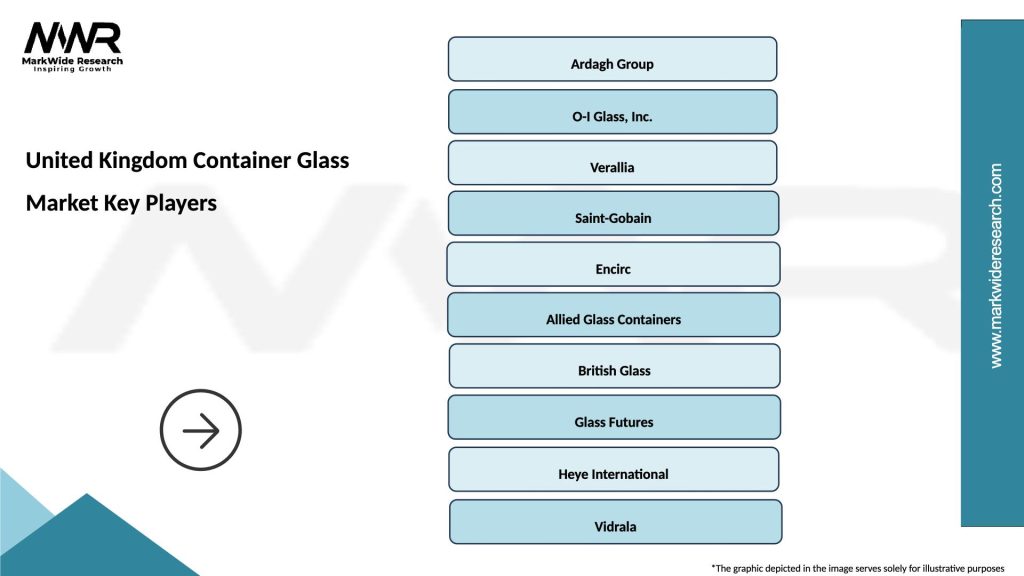

Market leadership in the UK container glass sector is characterized by a mix of international corporations and specialized domestic manufacturers, each contributing unique strengths and capabilities to the overall market ecosystem.

Competitive strategies emphasize technological innovation, sustainability initiatives, customer service excellence, and strategic partnerships to maintain market position and drive growth in an increasingly competitive environment.

By Application:

By Container Type:

By Glass Type:

Beverage packaging represents the largest market category, driven by the UK’s substantial alcoholic beverage industry and growing craft beer segment. Premium spirits and wine packaging demand high-quality glass containers that enhance product presentation and maintain beverage integrity. The category benefits from consistent demand patterns and established supply relationships.

Food packaging demonstrates steady growth supported by increasing consumer preference for preserved and artisanal food products. Glass containers provide excellent barrier properties and premium positioning for specialty foods, sauces, and gourmet products. The segment shows 15% growth in premium applications as consumers seek quality packaging solutions.

Pharmaceutical applications represent a high-value market segment with stringent quality requirements and specialized container specifications. Growing pharmaceutical manufacturing in the UK creates opportunities for specialized glass container suppliers capable of meeting regulatory standards and quality specifications.

Cosmetics packaging focuses on premium positioning and aesthetic appeal, with glass containers communicating luxury and quality to consumers. This segment demonstrates strong growth potential as beauty and personal care markets expand and brands seek differentiation through packaging excellence.

Manufacturers benefit from stable demand patterns, established customer relationships, and opportunities for technological innovation that enhance operational efficiency and product quality. Investment in advanced manufacturing equipment and process optimization creates competitive advantages and improved profitability.

Suppliers gain from long-term partnerships with glass manufacturers, providing raw materials, equipment, and services essential for production operations. The market’s stability enables predictable business relationships and opportunities for collaborative innovation and process improvements.

End-users receive high-quality packaging solutions that enhance product presentation, ensure product integrity, and support sustainability objectives. Glass containers provide excellent barrier properties, recyclability, and premium positioning that benefit brand image and consumer acceptance.

Consumers enjoy products packaged in environmentally friendly, recyclable containers that maintain product quality and safety. Glass packaging supports sustainability goals while providing transparency and aesthetic appeal that enhances the overall product experience.

Environmental stakeholders benefit from glass packaging’s contribution to circular economy objectives through infinite recyclability and reduced environmental impact compared to alternative packaging materials. The industry’s commitment to sustainability supports broader environmental goals and regulatory compliance.

Strengths:

Weaknesses:

Opportunities:

Threats:

Lightweight innovation represents a transformative trend reshaping the UK container glass market. Manufacturers invest in advanced technologies that reduce container weight while maintaining structural integrity and barrier properties. This development addresses transportation cost concerns and environmental impact reduction while preserving glass packaging’s inherent benefits.

Customization demand increases as brands seek unique packaging solutions that differentiate products in competitive markets. Advanced decoration techniques, custom shapes, and specialized finishes enable glass container manufacturers to provide tailored solutions that enhance brand identity and consumer appeal.

Digital integration emerges as manufacturers adopt smart manufacturing technologies, quality control systems, and supply chain optimization tools. These innovations improve operational efficiency, reduce waste, and enhance product quality while enabling better customer service and responsiveness.

Circular economy focus drives initiatives to maximize glass recycling rates and develop closed-loop systems that minimize environmental impact. Industry collaboration with recycling organizations and government agencies creates comprehensive sustainability programs that benefit all stakeholders.

Premium positioning trends continue across multiple market segments as consumers associate glass packaging with quality, sustainability, and premium product characteristics. This trend supports pricing strategies and market expansion opportunities for manufacturers serving quality-conscious market segments.

Manufacturing investments in advanced furnace technologies and production line automation enhance operational efficiency and product quality while reducing environmental impact. Recent facility upgrades demonstrate industry commitment to technological advancement and competitive positioning.

Sustainability initiatives include partnerships with recycling organizations, development of closed-loop systems, and investment in renewable energy sources for manufacturing operations. These developments align with government environmental objectives and consumer expectations for responsible business practices.

Product innovation focuses on lightweight container development, enhanced barrier properties, and specialized applications for pharmaceutical and cosmetic industries. Research and development investments create new market opportunities and competitive advantages for innovative manufacturers.

Strategic partnerships between manufacturers and major customers create collaborative relationships that optimize supply chain efficiency, product development, and market expansion opportunities. These alliances strengthen market position and enable better customer service delivery.

Market expansion initiatives target international markets, specialized applications, and emerging industry segments that offer growth potential beyond traditional domestic markets. Export development and new application exploration diversify revenue sources and reduce market concentration risks.

MarkWide Research analysis suggests that UK container glass manufacturers should prioritize investment in lightweight technology development to address transportation cost concerns while maintaining product quality and performance characteristics. This strategic focus can enhance competitive positioning against alternative packaging materials.

Sustainability leadership represents a critical success factor, with companies advised to develop comprehensive environmental programs that exceed regulatory requirements and meet evolving consumer expectations. Investment in renewable energy, recycling partnerships, and circular economy initiatives creates long-term competitive advantages.

Market diversification strategies should target high-value applications in pharmaceutical and cosmetic industries where quality requirements and profit margins support premium pricing strategies. Specialized capabilities in these sectors can offset challenges in traditional commodity markets.

Innovation investment in advanced manufacturing technologies, quality control systems, and product development capabilities enables differentiation and competitive advantage. Companies should balance operational efficiency improvements with new product development to maintain market leadership.

Strategic partnerships with key customers, suppliers, and technology providers can optimize supply chain efficiency, reduce costs, and accelerate innovation development. Collaborative approaches create mutual benefits and strengthen market position for all participants.

Market prospects for the UK container glass industry remain positive, supported by growing environmental consciousness, premium product trends, and technological innovations that address traditional limitations. The industry’s alignment with sustainability objectives positions glass packaging favorably in evolving market conditions.

Growth projections indicate continued expansion driven by pharmaceutical sector development, premium beverage market growth, and increasing consumer preference for sustainable packaging solutions. Market participants expect sustained growth rates of 3.8% annually over the next five years, reflecting underlying demand strength.

Technology advancement will continue reshaping manufacturing processes, product capabilities, and market applications. Investment in research and development, automation technologies, and sustainable manufacturing practices creates opportunities for operational improvement and market expansion.

Regulatory evolution toward stricter environmental standards and circular economy requirements supports glass packaging adoption while creating compliance requirements that favor established manufacturers with advanced capabilities and quality systems.

MWR projections suggest that successful market participants will be those who effectively balance operational efficiency, sustainability leadership, and innovation investment to meet evolving customer requirements and market conditions. Strategic positioning in high-value applications and export markets will drive long-term success in this dynamic industry.

The United Kingdom container glass market demonstrates remarkable resilience and adaptability in an evolving packaging landscape characterized by increasing environmental consciousness and premium product trends. Market participants benefit from established infrastructure, quality reputation, and strategic positioning in sustainable packaging solutions that align with consumer preferences and regulatory requirements.

Strategic opportunities exist for companies that invest in technological innovation, sustainability leadership, and market diversification strategies targeting high-value applications. The industry’s commitment to circular economy principles and environmental responsibility creates competitive advantages that support long-term market success.

Future success will depend on manufacturers’ ability to balance operational efficiency with innovation investment, sustainability initiatives with profitability objectives, and domestic market leadership with international expansion opportunities. The UK container glass market’s fundamental strengths and strategic positioning support optimistic long-term prospects for industry participants committed to excellence and continuous improvement.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

What are the key players in the United Kingdom Container Glass Market?

Key players in the United Kingdom Container Glass Market include companies like Ardagh Group, O-I Glass, and Beatson Clark, which are known for their extensive range of glass packaging solutions. These companies focus on innovation and sustainability in their production processes, among others.

What are the growth factors driving the United Kingdom Container Glass Market?

The growth of the United Kingdom Container Glass Market is driven by increasing consumer demand for sustainable packaging solutions, the rise in the beverage industry, and the growing trend of eco-friendly products. Additionally, the shift towards glass over plastic for health and environmental reasons is significant.

What challenges does the United Kingdom Container Glass Market face?

The United Kingdom Container Glass Market faces challenges such as high production costs, competition from alternative packaging materials, and the need for significant energy consumption during manufacturing. These factors can impact profitability and market growth.

What opportunities exist in the United Kingdom Container Glass Market?

Opportunities in the United Kingdom Container Glass Market include the increasing demand for premium glass packaging in the food and beverage sector, innovations in lightweight glass technology, and the expansion of recycling initiatives. These trends can enhance market growth and sustainability efforts.

What trends are shaping the United Kingdom Container Glass Market?

Trends shaping the United Kingdom Container Glass Market include a growing emphasis on sustainability, the introduction of smart packaging solutions, and the rise of personalized glass products. These trends reflect changing consumer preferences and regulatory pressures towards eco-friendly practices.

United Kingdom Container Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Jugs, Vials |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Household |

| Packaging Type | Recyclable, Non-Recyclable, Bulk, Custom |

| Grade | Standard, Premium, Specialty, Eco-Friendly |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Container Glass Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at