444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States container glass market represents a cornerstone of American packaging industry, serving diverse sectors from food and beverage to pharmaceuticals and cosmetics. This mature yet evolving market demonstrates remarkable resilience and adaptability, driven by increasing consumer preference for sustainable packaging solutions and premium product presentation. Container glass manufacturing in the United States encompasses bottles, jars, vials, and specialty containers that meet stringent quality standards across multiple industries.

Market dynamics indicate robust growth potential, with the sector experiencing a 4.2% CAGR over recent years. The industry benefits from strong domestic demand, technological innovations in glass manufacturing, and growing environmental consciousness among consumers. Glass containers offer unique advantages including complete recyclability, chemical inertness, and superior product protection, positioning them favorably against alternative packaging materials.

Regional distribution shows concentrated manufacturing capabilities in the Midwest and Southeast, with major production facilities strategically located near raw material sources and key consumer markets. The market serves both domestic consumption and export opportunities, with 65% of production dedicated to food and beverage applications, while pharmaceutical and specialty applications account for the remaining segments.

The United States container glass market refers to the comprehensive ecosystem of glass container manufacturing, distribution, and consumption within American borders, encompassing all forms of hollow glass packaging designed for product containment and preservation. This market includes traditional bottles and jars used across food, beverage, pharmaceutical, and cosmetic industries, as well as specialized containers for industrial and laboratory applications.

Container glass specifically denotes hollow glass products manufactured through automated processes, including blow-and-blow and press-and-blow techniques, resulting in containers with consistent wall thickness, dimensional accuracy, and structural integrity. These products serve as primary packaging solutions, providing barrier protection against moisture, oxygen, and contaminants while maintaining product quality and extending shelf life.

The market encompasses the entire value chain from raw material procurement and glass melting to container formation, quality control, and distribution to end-users. Glass manufacturing involves precise temperature control, chemical composition management, and automated production systems that ensure consistent quality and high-volume output to meet diverse industry requirements.

Strategic positioning of the United States container glass market reflects a mature industry experiencing technological renaissance and sustainability-driven growth. The sector demonstrates strong fundamentals with established manufacturing infrastructure, skilled workforce, and comprehensive distribution networks serving domestic and international markets. Innovation initiatives focus on lightweighting technologies, enhanced barrier properties, and sustainable manufacturing processes that reduce environmental impact.

Market leadership remains concentrated among established players who leverage economies of scale, technological expertise, and long-term customer relationships. These companies invest significantly in modernization programs, automation upgrades, and energy-efficient furnace technologies that improve productivity while reducing operational costs. Competitive advantages include proximity to major consumer markets, reliable supply chains, and ability to customize products for specific applications.

Growth drivers encompass increasing demand for premium packaging, craft beverage expansion, pharmaceutical sector growth, and consumer preference for sustainable packaging solutions. The market benefits from 78% consumer preference for glass packaging in premium product categories, reflecting perceived quality and environmental benefits. Future prospects indicate continued expansion supported by technological innovations and evolving consumer preferences toward eco-friendly packaging alternatives.

Fundamental market characteristics reveal a sophisticated industry structure with distinct competitive dynamics across different application segments. The following insights provide comprehensive understanding of market positioning and strategic opportunities:

Primary growth catalysts propelling the United States container glass market encompass diverse factors ranging from consumer behavior shifts to technological advancements. Sustainability consciousness among consumers drives increasing preference for glass packaging, perceived as environmentally responsible and premium quality option compared to plastic alternatives.

Craft beverage expansion represents a significant growth driver, with craft breweries, artisanal spirits, and specialty wine producers preferring glass containers for product differentiation and quality preservation. This segment demonstrates 12% annual growth in glass container demand, reflecting the premiumization trend across alcoholic beverage categories.

Pharmaceutical sector growth creates substantial opportunities for specialized glass containers, including vials, ampoules, and injection bottles. Increasing healthcare spending, aging population demographics, and biopharmaceutical innovation drive demand for high-quality glass packaging that ensures product integrity and patient safety.

Food industry trends toward premium packaging and artisanal products support glass container adoption across categories including sauces, preserves, and specialty foods. Consumer research indicates 85% preference for glass packaging in premium food categories, driving brand owners to specify glass containers for product differentiation and quality perception.

Operational challenges facing the United States container glass market include high energy costs associated with glass melting processes, which require continuous furnace operation at temperatures exceeding 1,500 degrees Celsius. Energy expenses typically represent 15-20% of total production costs, making manufacturers vulnerable to natural gas price fluctuations and energy supply disruptions.

Competition from alternatives poses ongoing challenges, particularly from lightweight plastic containers and flexible packaging solutions that offer cost advantages and transportation efficiencies. Plastic packaging continues to gain market share in certain applications where glass advantages are less pronounced, requiring glass manufacturers to demonstrate superior value propositions.

Transportation costs represent significant constraints due to glass weight and fragility characteristics. Logistics expenses for glass containers typically exceed those of alternative packaging materials by 25-30%, impacting total cost of ownership for customers and limiting market expansion in certain geographic regions.

Capital intensity requirements for glass manufacturing create barriers to capacity expansion and technology upgrades. Furnace rebuilds and major equipment investments require substantial capital commitments with long payback periods, constraining industry flexibility and responsiveness to market changes.

Emerging opportunities within the United States container glass market reflect evolving consumer preferences, technological innovations, and regulatory developments that favor glass packaging solutions. Sustainable packaging mandates from major corporations and government initiatives create substantial growth potential for recyclable glass containers across multiple application segments.

Premium market expansion offers significant opportunities as consumers increasingly associate glass packaging with quality, authenticity, and environmental responsibility. Craft industries including artisanal foods, specialty beverages, and premium cosmetics demonstrate strong preference for glass containers, supporting price premiums and margin improvement opportunities.

Technological innovations in glass manufacturing enable development of enhanced products with improved performance characteristics. Smart packaging solutions incorporating sensors, RFID technology, and interactive features create new market segments and value-added applications beyond traditional container functions.

Export market development presents growth opportunities as United States manufacturers leverage quality reputation and technological capabilities to serve international markets. Trade agreements and proximity to Canadian and Mexican markets support expansion strategies for established manufacturers seeking geographic diversification.

Competitive dynamics within the United States container glass market reflect industry maturity with established players maintaining market leadership through operational excellence, customer relationships, and technological capabilities. Market consolidation trends continue as companies seek economies of scale and operational efficiencies through strategic acquisitions and facility optimization.

Supply chain relationships play crucial roles in market dynamics, with glass manufacturers developing long-term partnerships with raw material suppliers, equipment manufacturers, and key customers. These relationships ensure supply security, quality consistency, and collaborative innovation initiatives that drive industry advancement.

Technology adoption rates vary across market segments, with pharmaceutical and specialty applications driving demand for advanced glass formulations and precision manufacturing capabilities. Automation investments improve production efficiency and quality consistency while reducing labor dependency and operational costs.

Environmental regulations increasingly influence market dynamics, with emissions standards, recycling requirements, and sustainability reporting driving operational changes and investment priorities. Regulatory compliance costs represent growing operational considerations while creating competitive advantages for companies with advanced environmental management systems.

Comprehensive analysis of the United States container glass market employs multiple research methodologies to ensure accuracy, completeness, and reliability of market insights. Primary research includes extensive interviews with industry executives, manufacturing specialists, and key stakeholders across the value chain to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry publications, government statistics, trade association reports, and company financial statements to establish market baselines and validate primary research findings. Data triangulation techniques ensure consistency and accuracy across multiple information sources and analytical approaches.

Market modeling utilizes statistical analysis and forecasting methodologies to project future market trends and quantify growth opportunities across different segments and applications. Scenario analysis considers various economic, technological, and regulatory factors that could influence market development trajectories.

Expert validation processes involve review and verification of research findings by industry specialists and technical experts to ensure analytical accuracy and practical relevance. Peer review mechanisms provide additional quality assurance and enhance the credibility of research conclusions and recommendations.

Geographic distribution of the United States container glass market reveals distinct regional characteristics influenced by manufacturing infrastructure, raw material availability, and customer proximity. Midwest region maintains the largest market share at approximately 35%, benefiting from abundant silica sand deposits, established manufacturing facilities, and central location for distribution to national markets.

Southeast region represents the second-largest market segment with 28% market share, driven by growing beverage industry presence, favorable business climate, and proximity to major consumer markets. Manufacturing investments in states like Georgia, North Carolina, and Florida support regional market expansion and job creation.

West Coast markets account for 22% of national demand, characterized by premium product focus, craft beverage concentration, and strong environmental consciousness among consumers. California leadership in wine production and craft brewing creates substantial demand for specialized glass containers with custom designs and premium quality requirements.

Northeast region maintains 15% market share despite higher operational costs, supported by pharmaceutical industry concentration, specialty food producers, and premium beverage markets. Logistics advantages and proximity to major population centers offset higher manufacturing costs and support continued market presence.

Market leadership within the United States container glass industry reflects established companies with comprehensive manufacturing capabilities, extensive distribution networks, and long-term customer relationships. The competitive environment demonstrates clear market segmentation between large-scale commodity producers and specialized manufacturers serving niche applications.

Competitive strategies focus on operational efficiency, customer service excellence, and technological innovation to maintain market position and profitability. Differentiation approaches include specialized product development, custom design capabilities, and comprehensive service offerings that extend beyond basic container supply.

Market segmentation analysis reveals distinct categories based on application, product type, and end-user requirements. By Application segmentation demonstrates food and beverage dominance while highlighting growth opportunities in pharmaceutical and specialty segments.

By Product Type:

By End-User Industry:

Food and Beverage Category maintains market dominance through diverse applications ranging from mass-market products to premium artisanal offerings. Alcoholic beverage packaging represents the largest sub-segment, with beer bottles accounting for significant volume while wine and spirits containers command higher margins through premium positioning and custom designs.

Pharmaceutical Category demonstrates highest growth potential driven by biopharmaceutical expansion, aging population demographics, and increasing healthcare spending. Regulatory requirements create barriers to entry while ensuring stable demand patterns and premium pricing for qualified suppliers meeting stringent quality standards.

Specialty Applications offer attractive opportunities for differentiation and margin improvement through custom solutions, technical expertise, and value-added services. Cosmetic packaging emphasizes aesthetic appeal and brand differentiation, supporting premium pricing and design innovation initiatives.

Industrial Applications provide stable demand patterns and long-term customer relationships, though typically at lower margins compared to consumer-facing applications. Laboratory glassware and chemical containers require specialized glass formulations and precise manufacturing tolerances.

Manufacturing Benefits for glass container producers include operational stability through long-term customer contracts, economies of scale in large-volume production, and opportunities for value creation through technological innovation and process optimization. Vertical integration strategies enable cost control and quality assurance throughout the production process.

Customer Advantages encompass superior product protection, premium brand positioning, and environmental sustainability credentials that support marketing initiatives and consumer preference development. Glass packaging offers complete recyclability, chemical inertness, and barrier properties that maintain product quality and extend shelf life.

Supply Chain Benefits include established distribution networks, reliable supply relationships, and collaborative innovation partnerships that drive industry advancement. Logistics optimization through regional manufacturing and strategic inventory management reduces transportation costs and delivery times.

Economic Impact extends beyond direct manufacturing employment to include supporting industries, raw material suppliers, and service providers. Regional development benefits from manufacturing facility investments, job creation, and tax revenue generation in local communities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Lightweighting Innovation represents a dominant trend as manufacturers develop technologies to reduce glass weight while maintaining structural integrity and performance characteristics. Advanced engineering techniques enable weight reductions of 15-20% compared to traditional designs, improving transportation efficiency and reducing environmental impact.

Sustainable Manufacturing initiatives focus on energy efficiency improvements, renewable energy adoption, and circular economy principles. Furnace technology advances and process optimization reduce energy consumption while maintaining production quality and capacity utilization rates.

Customization Capabilities expand as manufacturers invest in flexible production systems and design technologies that enable rapid product development and small-batch production for specialty applications. Digital printing and surface treatment technologies provide enhanced decoration options and brand differentiation opportunities.

Smart Packaging Integration emerges as manufacturers explore opportunities to incorporate sensors, RFID technology, and interactive features into glass containers. Connected packaging solutions provide supply chain visibility, consumer engagement, and product authentication capabilities.

Technology Investments across the industry focus on automation upgrades, energy efficiency improvements, and quality enhancement systems. MarkWide Research analysis indicates significant capital allocation toward furnace modernization and production line optimization initiatives that improve operational efficiency and product consistency.

Sustainability Initiatives include major commitments to carbon footprint reduction, renewable energy adoption, and circular economy implementation. Industry leaders announce ambitious environmental targets and invest in technologies that support sustainable manufacturing practices and waste reduction.

Market Consolidation activities continue as companies seek operational synergies and market position strengthening through strategic acquisitions and facility optimization. Capacity rationalization efforts focus on improving asset utilization and eliminating redundant operations.

Product Innovation developments include enhanced barrier properties, improved strength characteristics, and specialized glass formulations for demanding applications. Research partnerships with universities and technology companies accelerate innovation timelines and expand technical capabilities.

Strategic Recommendations for industry participants emphasize operational excellence, customer relationship management, and selective market expansion opportunities. Investment priorities should focus on energy efficiency improvements, automation upgrades, and sustainability initiatives that reduce operational costs while enhancing competitive positioning.

Market Development strategies should target high-growth segments including craft beverages, pharmaceutical applications, and premium food packaging where glass advantages are most pronounced. Customer collaboration initiatives can drive innovation and create value-added solutions that strengthen competitive moats.

Technology Adoption recommendations include investments in digital manufacturing systems, predictive maintenance capabilities, and quality control automation that improve operational efficiency and product consistency. Data analytics applications can optimize production planning and inventory management.

Sustainability Leadership positions companies favorably for future regulatory requirements and customer preferences while potentially reducing operational costs through energy efficiency and waste reduction initiatives. Circular economy participation creates competitive advantages and supports long-term market positioning.

Long-term prospects for the United States container glass market indicate continued growth driven by sustainability trends, premium market expansion, and technological innovation. Market evolution toward higher-value applications and specialized products supports margin improvement and competitive differentiation opportunities.

Growth projections suggest sustained expansion at 3.8% CAGR over the next five years, supported by favorable demographic trends, increasing environmental consciousness, and continued premiumization across consumer product categories. MWR forecasts indicate particular strength in pharmaceutical and specialty applications.

Technology Integration will accelerate as manufacturers adopt advanced automation, artificial intelligence, and Internet of Things capabilities that improve operational efficiency and enable new product development. Smart manufacturing initiatives will enhance quality control and reduce production costs.

Market Structure evolution may include further consolidation among commodity producers while specialty manufacturers maintain independence through differentiation strategies and niche market focus. Competitive dynamics will increasingly emphasize innovation, sustainability, and customer service excellence as key differentiators.

Strategic positioning of the United States container glass market reflects a mature industry experiencing renaissance through sustainability trends, technological innovation, and premium market expansion. Market fundamentals remain strong with established manufacturing infrastructure, skilled workforce, and comprehensive customer relationships supporting continued growth and profitability.

Competitive advantages for industry participants include superior product protection characteristics, complete recyclability, and premium brand positioning that align with evolving consumer preferences and corporate sustainability initiatives. Innovation opportunities in lightweighting, smart packaging, and specialized applications provide pathways for differentiation and margin improvement.

Future success will depend on operational excellence, customer collaboration, and strategic investments in technology and sustainability initiatives. Market leaders who effectively balance cost competitiveness with innovation capabilities and environmental responsibility will capture disproportionate value creation opportunities in this evolving marketplace.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

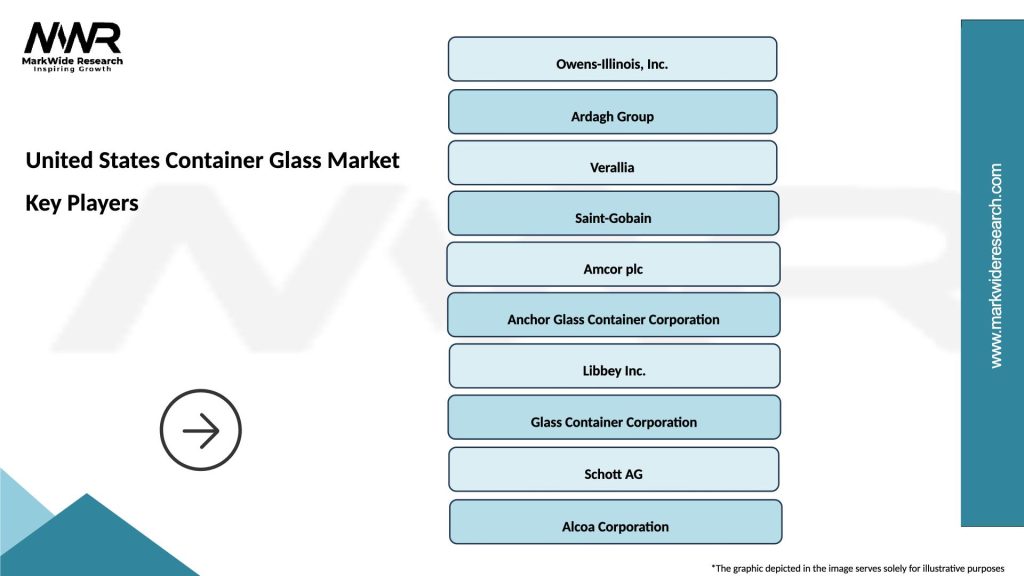

What are the key players in the United States Container Glass Market?

Key players in the United States Container Glass Market include Owens-Illinois, Inc., Ardagh Group, and Verallia, among others. These companies are involved in the production and supply of a wide range of glass containers for various industries.

What are the growth factors driving the United States Container Glass Market?

The growth of the United States Container Glass Market is driven by increasing consumer demand for sustainable packaging solutions, the rise in the beverage industry, and the growing trend of eco-friendly products. Additionally, the shift towards glass packaging due to its recyclability is contributing to market expansion.

What challenges does the United States Container Glass Market face?

The United States Container Glass Market faces challenges such as high production costs, competition from alternative packaging materials like plastics, and fluctuations in raw material prices. These factors can impact profitability and market growth.

What opportunities exist in the United States Container Glass Market?

Opportunities in the United States Container Glass Market include the increasing demand for premium glass packaging in the food and beverage sector, innovations in glass manufacturing technologies, and the expansion of e-commerce, which requires robust packaging solutions.

What trends are shaping the United States Container Glass Market?

Trends shaping the United States Container Glass Market include a growing emphasis on sustainability, the introduction of lightweight glass containers, and the development of smart packaging solutions. These trends reflect consumer preferences for environmentally friendly and technologically advanced packaging options.

United States Container Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Jugs, Vials |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Household Products |

| Grade | Recycled, Virgin, Specialty, High-Performance |

| Packaging Type | Rigid, Flexible, Bulk, Custom |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Container Glass Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at