444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico online gambling market represents one of Latin America’s most dynamic and rapidly evolving digital entertainment sectors. Digital transformation has fundamentally reshaped how Mexican consumers engage with gambling activities, creating unprecedented opportunities for operators and technology providers. The market encompasses various segments including online casinos, sports betting platforms, poker rooms, and lottery services, each contributing to the sector’s robust expansion trajectory.

Regulatory developments have played a crucial role in shaping market dynamics, with Mexican authorities implementing comprehensive frameworks to govern online gambling operations. The sector demonstrates remarkable resilience and adaptability, particularly following increased digitization trends that accelerated during recent years. Mobile gaming adoption has reached approximately 78% penetration among active users, while sports betting accounts for nearly 45% market share of total online gambling activities.

Consumer behavior patterns indicate strong preference for localized content, Spanish-language interfaces, and payment methods aligned with Mexican banking preferences. The market attracts both domestic and international operators seeking to capitalize on Mexico’s substantial population base and growing digital literacy rates. Technological infrastructure improvements continue supporting market expansion, with enhanced internet connectivity and smartphone adoption driving user engagement across diverse demographic segments.

The Mexico online gambling market refers to the comprehensive ecosystem of internet-based gambling services, platforms, and activities legally operated within Mexican jurisdiction. This market encompasses all forms of digital wagering, including casino games, sports betting, poker tournaments, lottery draws, and fantasy sports accessible through web browsers and mobile applications.

Market participants include licensed operators, software providers, payment processors, regulatory bodies, and millions of registered users engaging in various gambling activities. The sector operates under specific regulatory frameworks established by Mexican gaming authorities, ensuring consumer protection, fair play standards, and responsible gambling practices. Revenue generation occurs through multiple streams including player deposits, advertising partnerships, affiliate commissions, and licensing fees.

Technological integration forms the foundation of market operations, incorporating advanced security protocols, random number generators, live dealer technologies, and sophisticated user analytics platforms. The market serves diverse consumer segments ranging from casual recreational players to professional gamblers, each requiring tailored experiences and specialized service offerings.

Strategic positioning within the Mexico online gambling market reveals significant growth potential driven by favorable demographic trends, regulatory clarity, and technological advancement. The sector demonstrates exceptional resilience with user acquisition rates increasing by approximately 23% annually, while mobile platform usage represents 82% of total engagement across all gambling categories.

Market consolidation trends indicate increasing competition among established operators while creating opportunities for innovative newcomers offering differentiated services. Sports betting dominance continues with football-related wagering generating substantial user interest, particularly during major tournament seasons. Casino gaming segments show steady growth with slot games and live dealer experiences attracting diverse player demographics.

Regulatory compliance remains paramount for sustainable market participation, with authorities emphasizing responsible gambling measures, anti-money laundering protocols, and consumer protection standards. Payment innovation drives user convenience through integration of local banking systems, digital wallets, and cryptocurrency options. The market’s trajectory suggests continued expansion supported by improving internet infrastructure and evolving consumer preferences toward digital entertainment platforms.

Consumer demographics reveal that the Mexico online gambling market attracts primarily urban, tech-savvy individuals aged 25-45 with disposable income and regular internet access. Gender distribution shows increasing female participation, now representing approximately 38% of active users, indicating broader market appeal beyond traditional male-dominated gambling segments.

Digital infrastructure development serves as the primary catalyst for Mexico online gambling market expansion, with improved internet connectivity reaching rural areas and enhanced mobile network coverage supporting seamless gaming experiences. Smartphone penetration continues accelerating, enabling broader population access to online gambling platforms and creating opportunities for operators to expand their user base significantly.

Regulatory clarity provides essential market stability, encouraging both domestic and international operators to invest in Mexican operations with confidence. Government initiatives promoting digital economy growth indirectly support online gambling sector development through improved payment infrastructure and cybersecurity frameworks. Tax revenue generation motivates authorities to maintain supportive regulatory environments while ensuring consumer protection standards.

Cultural acceptance of gambling activities has evolved considerably, with younger generations embracing digital entertainment options including online betting and casino gaming. Sports popularity, particularly football, creates natural demand for betting opportunities during major tournaments and league seasons. Economic factors including rising disposable income levels and urbanization trends contribute to increased participation in recreational gambling activities across diverse demographic segments.

Regulatory complexity presents ongoing challenges for market participants, with evolving compliance requirements demanding continuous adaptation and significant operational investments. Banking restrictions in certain regions limit payment processing capabilities, potentially excluding segments of the population from participating in online gambling activities. Competition intensity creates pressure on profit margins while requiring substantial marketing expenditures to maintain market position.

Social concerns regarding gambling addiction and responsible gaming practices generate public scrutiny and potential regulatory restrictions that could impact market growth trajectories. Economic volatility affects consumer spending patterns, with discretionary entertainment budgets fluctuating based on broader economic conditions. Cybersecurity threats require continuous investment in advanced security measures to protect user data and maintain platform integrity.

Technical infrastructure limitations in certain regions restrict market penetration, particularly in rural areas with limited internet connectivity or outdated mobile networks. Cultural resistance from traditional segments of society may limit broader market acceptance and create challenges for mainstream adoption. International competition from established global operators presents challenges for domestic companies seeking to maintain competitive positioning in their home market.

Emerging technologies present substantial opportunities for market differentiation and enhanced user experiences, including virtual reality casino environments, augmented reality sports betting interfaces, and blockchain-based gaming platforms. Artificial intelligence integration enables personalized gaming recommendations, fraud detection capabilities, and automated customer service solutions that improve operational efficiency while enhancing user satisfaction.

Market expansion into underserved demographic segments offers significant growth potential, particularly among female users, senior citizens, and rural populations gaining improved internet access. Partnership opportunities with traditional sports organizations, entertainment venues, and media companies create new revenue streams and user acquisition channels. Cross-border collaboration with other Latin American markets enables shared technology platforms and expanded tournament offerings.

Payment innovation through cryptocurrency integration, central bank digital currencies, and alternative payment methods addresses current banking limitations while attracting tech-savvy user segments. Responsible gaming technology development creates competitive advantages while addressing regulatory requirements and social concerns. Data analytics advancement enables sophisticated user behavior analysis, predictive modeling, and targeted marketing campaigns that improve customer lifetime value and retention rates.

Competitive landscape evolution demonstrates increasing sophistication as operators invest in advanced technology platforms, comprehensive game portfolios, and enhanced user experience features. Market consolidation trends indicate potential merger and acquisition activity as companies seek to achieve economies of scale and expand market reach. Innovation cycles accelerate with regular introduction of new gaming formats, betting options, and interactive features designed to maintain user engagement.

Regulatory dynamics continue shaping market structure through evolving licensing requirements, taxation policies, and consumer protection measures. MarkWide Research analysis indicates that regulatory stability correlates directly with market investment levels and operator confidence in long-term growth prospects. Consumer behavior shifts toward mobile-first experiences drive platform development priorities and marketing strategy adjustments across the sector.

Technology adoption patterns reveal rapid integration of emerging solutions including live streaming, social gaming features, and gamification elements that enhance traditional gambling experiences. Economic sensitivity affects market performance with correlation between disposable income levels and gambling participation rates. Seasonal fluctuations create predictable demand patterns aligned with major sporting events, holidays, and cultural celebrations throughout the Mexican calendar year.

Comprehensive data collection methodologies encompass primary research through industry surveys, operator interviews, and consumer focus groups combined with secondary research from regulatory filings, industry reports, and market databases. Quantitative analysis utilizes statistical modeling, trend analysis, and comparative benchmarking to identify market patterns and growth trajectories across different segments and geographic regions.

Primary research initiatives include structured interviews with key industry stakeholders, including licensed operators, technology providers, regulatory officials, and consumer advocacy groups. Survey methodologies capture consumer preferences, usage patterns, and satisfaction levels through representative sampling across major Mexican metropolitan areas. Focus group sessions provide qualitative insights into user motivations, platform preferences, and emerging trend identification.

Secondary research sources encompass government publications, industry association reports, academic studies, and financial analyst coverage of publicly traded gambling companies operating in Mexico. Data validation processes ensure accuracy through cross-referencing multiple sources, expert review panels, and statistical verification methods. Analytical frameworks incorporate market sizing models, competitive positioning analysis, and scenario planning techniques to provide comprehensive market understanding and future projections.

Mexico City metropolitan area dominates market activity with approximately 28% of total user base, driven by high internet penetration, disposable income levels, and concentrated urban population. Guadalajara region represents the second-largest market segment with strong technology sector presence supporting digital gambling adoption. Monterrey demonstrates robust growth potential with industrial economy supporting higher income levels and recreational spending patterns.

Northern border states show unique characteristics influenced by proximity to United States markets and cross-border cultural exchange. Tijuana and Ciudad Juárez exhibit higher sports betting participation rates, particularly for American sports leagues. Central Mexico regions including Puebla and León demonstrate steady growth with expanding middle-class populations and improving digital infrastructure.

Southern regions present emerging opportunities as internet connectivity improvements reach previously underserved areas. Yucatan Peninsula shows growing market potential driven by tourism industry development and increasing urbanization. Coastal areas along both Pacific and Gulf coasts demonstrate seasonal variations correlated with tourism patterns and local economic cycles. Rural market penetration remains limited but shows improvement as mobile network coverage expands and smartphone adoption increases across diverse geographic areas.

Market leadership remains distributed among several key operators, each focusing on different strategic approaches and target demographics. International operators leverage global experience and technology platforms while adapting to local market preferences and regulatory requirements.

Competitive differentiation occurs through specialized game offerings, superior mobile experiences, localized customer service, and innovative payment solutions. Market share distribution remains relatively fragmented, creating opportunities for both established operators and new entrants to gain significant market position through strategic positioning and targeted marketing efforts.

By Gaming Type: The Mexico online gambling market segments into distinct categories based on gaming preferences and user behavior patterns. Sports betting maintains dominant position with 47% market share, driven by football popularity and major tournament events. Online casinos represent 31% of market activity with slot games, table games, and live dealer experiences attracting diverse user demographics.

By Device Type: Mobile platforms account for 84% of user engagement, reflecting consumer preference for convenient, accessible gaming experiences. Desktop usage remains relevant for complex betting strategies and extended gaming sessions. Tablet adoption shows steady growth among users seeking larger screen experiences while maintaining portability.

By Demographics: Age segmentation reveals 25-34 age group representing 38% of active users, followed by 35-44 demographic at 29% participation. Gender distribution shows increasing female participation reaching 36% of total user base. Income levels correlate with participation rates, with middle and upper-middle-class segments driving primary market activity.

By Geographic Region: Urban areas dominate with 76% of total market activity, while rural participation grows steadily with infrastructure improvements. Regional preferences vary with northern states favoring sports betting and central regions showing balanced gaming preferences across multiple categories.

Sports Betting Category: Football wagering dominates with Liga MX, international tournaments, and World Cup events generating peak activity periods. Live betting features show 43% user preference over traditional pre-match wagering options. Basketball and baseball represent secondary sports with growing participation rates, particularly among younger demographics.

Online Casino Category: Slot games maintain popularity with 58% of casino users engaging regularly in video slot experiences. Live dealer games demonstrate rapid growth with 31% year-over-year increase in user participation. Table games including blackjack, roulette, and baccarat attract experienced players seeking strategic gaming experiences.

Poker Category: Texas Hold’em tournaments generate significant user engagement with both recreational and professional players participating in regular events. Cash game popularity varies by stakes levels with micro and low-stakes games attracting majority participation. Mobile poker adoption reaches 79% of total poker activity, enabling convenient multi-table gaming experiences.

Lottery and Instant Games: Digital lottery platforms replicate traditional lottery experiences while adding interactive features and instant-win games. Scratch card simulations attract casual players seeking quick entertainment options. Progressive jackpot games create excitement through accumulating prize pools and community participation elements.

For Operators: Market expansion opportunities provide access to Mexico’s substantial population base with growing digital adoption rates and increasing disposable income levels. Technology infrastructure enables cost-effective platform deployment and scalable operations across multiple gaming verticals. Regulatory framework offers operational certainty and consumer protection standards that build trust and long-term sustainability.

For Technology Providers: Innovation demand creates opportunities for advanced gaming solutions, mobile optimization, and emerging technology integration. Localization requirements generate demand for specialized services including Spanish-language interfaces, local payment integration, and cultural adaptation. Compliance solutions address regulatory requirements while enabling efficient operations and risk management.

For Consumers: Entertainment variety provides diverse gaming options accessible from any location with internet connectivity. Convenience factors eliminate travel requirements to physical gambling venues while offering 24/7 accessibility. Promotional benefits include welcome bonuses, loyalty programs, and special event promotions that enhance gaming value.

For Government: Tax revenue generation contributes to public finances through licensing fees, gaming taxes, and economic activity. Consumer protection frameworks ensure responsible gambling practices and prevent problem gambling behaviors. Economic development attracts international investment and creates employment opportunities in technology and customer service sectors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Mobile Gaming Dominance: Smartphone-first strategies continue reshaping platform development with operators prioritizing mobile user experience over desktop alternatives. App store optimization becomes crucial for user acquisition while native applications provide superior performance compared to mobile web browsers. Cross-platform synchronization enables seamless gaming experiences across multiple devices.

Live Gaming Integration: Real-time dealer experiences bridge the gap between online and land-based gambling through high-definition streaming and interactive features. Social gaming elements incorporate chat functions, multiplayer tournaments, and community features that enhance user engagement. Augmented reality applications begin emerging in premium gaming experiences.

Personalization Technology: Artificial intelligence algorithms analyze user behavior patterns to deliver customized game recommendations, promotional offers, and betting suggestions. Machine learning applications improve fraud detection, responsible gambling monitoring, and customer service automation. Predictive analytics enable operators to anticipate user preferences and optimize platform features accordingly.

Payment Innovation: Cryptocurrency integration addresses banking limitations while attracting tech-savvy user segments interested in alternative payment methods. Digital wallet adoption simplifies transaction processes and reduces payment friction. Instant payment solutions enable real-time deposits and withdrawals that improve user satisfaction and platform competitiveness.

Regulatory Evolution: Mexican gaming authorities continue refining online gambling regulations with emphasis on consumer protection, responsible gaming practices, and anti-money laundering compliance. Licensing framework updates streamline application processes while maintaining strict operational standards. Cross-border cooperation with international regulatory bodies enhances oversight capabilities and information sharing.

Technology Advancement: Blockchain implementation begins appearing in lottery systems and provably fair gaming applications that enhance transparency and user trust. 5G network deployment enables enhanced mobile gaming experiences with reduced latency and improved streaming quality. Cloud computing adoption provides scalable infrastructure solutions for growing operator requirements.

Market Consolidation: Merger and acquisition activity increases as operators seek economies of scale and expanded market coverage. Strategic partnerships between technology providers and operators create integrated solutions for improved efficiency. International expansion strategies focus on Latin American regional markets with shared cultural and linguistic characteristics.

Responsible Gaming Innovation: Advanced monitoring systems utilize artificial intelligence to identify potential problem gambling behaviors and implement protective measures. Self-exclusion tools become more sophisticated with cross-platform integration and extended cooling-off periods. Educational initiatives promote awareness of responsible gambling practices through operator and government collaboration.

Strategic Positioning: Market participants should prioritize mobile platform optimization and localized user experiences to capture growing smartphone adoption trends. MWR analysis suggests that operators focusing on Spanish-language content and Mexican cultural preferences achieve higher user retention rates. Differentiation strategies should emphasize unique gaming content, superior customer service, and innovative payment solutions.

Technology Investment: Artificial intelligence integration represents critical competitive advantage for personalization, fraud detection, and operational efficiency improvements. Live gaming capabilities should receive priority investment as consumer preferences shift toward interactive, social gaming experiences. Mobile application development requires continuous optimization for performance, security, and user interface enhancement.

Regulatory Compliance: Proactive compliance strategies ensure sustainable operations while building trust with regulators and consumers. Responsible gaming implementation should exceed minimum requirements to demonstrate industry leadership and social responsibility. Data protection measures must align with evolving privacy regulations and consumer expectations for security.

Market Expansion: Geographic diversification within Mexico should target emerging urban areas with improving digital infrastructure. Demographic expansion opportunities exist among female users, senior citizens, and younger adults entering gambling age. Partnership development with sports organizations, entertainment venues, and media companies creates new user acquisition channels and revenue opportunities.

Growth Trajectory: The Mexico online gambling market demonstrates strong momentum with projected growth rates maintaining double-digit expansion over the next five years. Mobile gaming adoption will likely reach 90% penetration among active users as smartphone technology continues advancing and internet connectivity improves nationwide. Sports betting dominance should persist while casino gaming segments gain market share through innovation and enhanced user experiences.

Technology Evolution: Emerging technologies including virtual reality, augmented reality, and blockchain applications will gradually integrate into mainstream gambling platforms. Artificial intelligence sophistication will enable increasingly personalized gaming experiences and more effective responsible gambling measures. 5G network expansion will support enhanced mobile gaming with real-time features and high-quality streaming capabilities.

Regulatory Development: MarkWide Research projects continued regulatory refinement with emphasis on consumer protection, taxation optimization, and international cooperation frameworks. Licensing processes may become more streamlined while maintaining strict operational standards and compliance requirements. Cross-border regulations could facilitate regional market integration and shared regulatory standards across Latin America.

Market Maturation: Industry consolidation will likely accelerate with larger operators acquiring smaller competitors to achieve scale advantages and market coverage. Innovation cycles will continue driving platform differentiation and user experience improvements. Mainstream acceptance of online gambling will expand as social attitudes evolve and younger demographics become primary market participants, supporting sustained long-term growth prospects.

The Mexico online gambling market represents a compelling growth opportunity characterized by favorable demographics, improving regulatory frameworks, and accelerating digital adoption trends. Market dynamics indicate strong potential for sustained expansion driven by mobile gaming preferences, sports betting popularity, and technological innovation across multiple gaming segments.

Strategic success factors include mobile-first platform development, localized user experiences, comprehensive regulatory compliance, and innovative payment solutions that address current market limitations. Competitive positioning requires differentiation through superior technology, customer service excellence, and responsible gaming leadership that builds long-term consumer trust and regulatory support.

Future prospects remain highly positive with projected growth rates supporting continued market expansion and operator investment. Technology advancement will enable enhanced gaming experiences while regulatory evolution provides operational stability and consumer protection frameworks. The market’s trajectory suggests Mexico will become a leading online gambling destination in Latin America, offering substantial opportunities for operators, technology providers, and stakeholders committed to sustainable, responsible market development.

What is Online Gambling?

Online gambling refers to the act of placing bets or wagers on games, sports, or other events via the internet. It encompasses various forms such as online casinos, sports betting, and poker, allowing users to participate from anywhere with internet access.

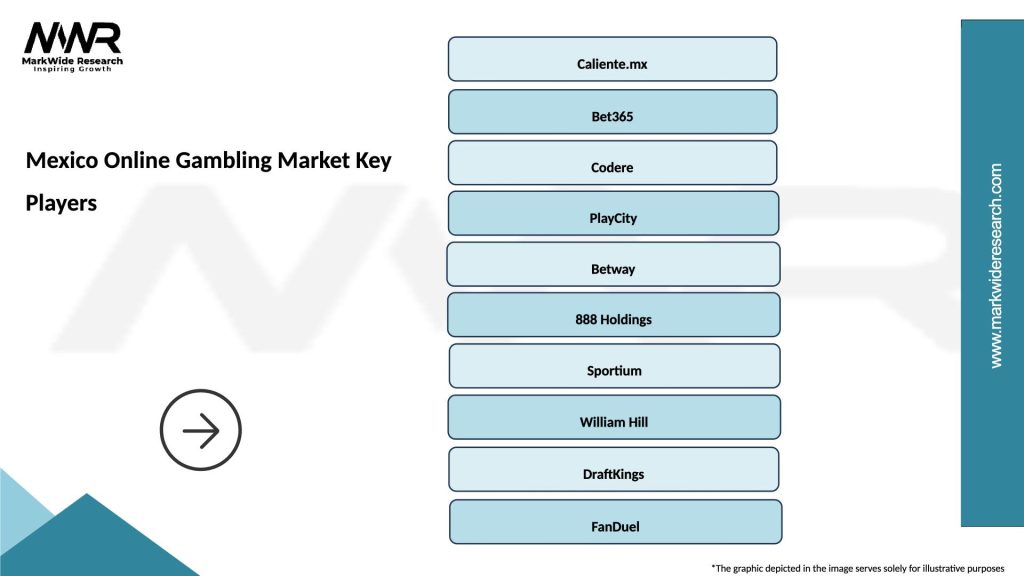

What are the key players in the Mexico Online Gambling Market?

Key players in the Mexico Online Gambling Market include companies like Caliente, Bet365, and Codere, which offer a range of online betting options. These companies are known for their diverse gaming platforms and user-friendly interfaces, catering to a growing audience of online gamblers.

What are the growth factors driving the Mexico Online Gambling Market?

The Mexico Online Gambling Market is driven by factors such as increasing internet penetration, the rise of mobile gaming, and changing consumer attitudes towards gambling. Additionally, the legalization of online gambling in various states has contributed to market expansion.

What challenges does the Mexico Online Gambling Market face?

Challenges in the Mexico Online Gambling Market include regulatory hurdles, concerns over responsible gambling, and competition from illegal operators. These factors can hinder market growth and create a complex environment for legitimate businesses.

What opportunities exist in the Mexico Online Gambling Market?

The Mexico Online Gambling Market presents opportunities such as the expansion of esports betting, the introduction of new gaming technologies, and partnerships with local businesses. These developments can enhance user engagement and attract a broader audience.

What trends are shaping the Mexico Online Gambling Market?

Trends in the Mexico Online Gambling Market include the increasing popularity of live dealer games, the integration of virtual reality in gaming experiences, and the growth of cryptocurrency as a payment method. These innovations are transforming how consumers interact with online gambling platforms.

Mexico Online Gambling Market

| Segmentation Details | Description |

|---|---|

| Product Type | Sports Betting, Casino Games, Poker, Bingo |

| Customer Type | Casual Gamblers, High Rollers, Mobile Users, Online Enthusiasts |

| Payment Method | Credit Cards, E-Wallets, Bank Transfers, Prepaid Cards |

| Device Type | Smartphones, Tablets, Desktops, Laptops |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Online Gambling Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at