444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America inland waterway transport market represents a critical component of the region’s transportation infrastructure, encompassing river systems, canals, and navigable waterways that facilitate the movement of goods and passengers across vast continental distances. This market has experienced substantial growth driven by increasing trade volumes, agricultural exports, and the need for cost-effective transportation alternatives to traditional road and rail networks.

Regional waterway systems including the Amazon River basin, Paraguay-Paraná Waterway, and Magdalena River serve as vital arteries for economic development across multiple countries. The market demonstrates significant potential for expansion as governments invest in infrastructure modernization and private sector participation increases. Current growth trajectories indicate the market is expanding at a robust CAGR of 6.2%, reflecting strong demand for efficient cargo transportation solutions.

Key market characteristics include diverse vessel types ranging from bulk carriers and container barges to passenger ferries and specialized cargo vessels. The integration of modern navigation technologies, improved port facilities, and enhanced logistics coordination has transformed traditional waterway operations into sophisticated transportation networks. Environmental considerations and sustainability initiatives further drive market evolution as stakeholders seek eco-friendly alternatives to carbon-intensive transport modes.

The Latin America inland waterway transport market refers to the comprehensive ecosystem of commercial navigation services, infrastructure, and logistics operations conducted on rivers, canals, and other navigable inland water bodies throughout Central and South America. This market encompasses vessel operations, port services, cargo handling, passenger transportation, and supporting infrastructure development across interconnected waterway networks.

Market scope includes both freight and passenger transportation services utilizing various vessel types designed for inland navigation conditions. The definition extends beyond simple transportation to encompass integrated logistics solutions, intermodal connectivity, and value-added services that support regional trade and economic development. Stakeholder participation involves government agencies, private operators, shipping companies, port authorities, and logistics service providers working collaboratively to optimize waterway utilization.

Market dynamics in Latin America’s inland waterway transport sector reflect a complex interplay of economic growth, infrastructure investment, and evolving trade patterns. The region’s extensive river systems provide natural transportation corridors that offer cost advantages over alternative transport modes, particularly for bulk commodities and agricultural products destined for export markets.

Strategic importance of inland waterways continues to grow as countries seek to reduce logistics costs and improve supply chain efficiency. Recent infrastructure investments have enhanced navigation capabilities, with channel deepening projects and port modernization initiatives improving vessel accessibility and cargo handling capacity. The market benefits from increasing agricultural production, with waterway transport capturing approximately 35% of bulk cargo movements in key corridors.

Technology integration has modernized operations through GPS navigation systems, automated cargo handling equipment, and digital logistics platforms. These advancements have improved safety standards, reduced transit times, and enhanced operational efficiency across the transportation network. Environmental sustainability initiatives are driving adoption of cleaner vessel technologies and more efficient operational practices.

Primary market drivers include expanding agricultural exports, growing industrial production, and increasing recognition of waterway transport’s economic and environmental benefits. The following insights characterize current market conditions:

Economic growth across Latin America has generated increased demand for efficient transportation solutions, particularly for agricultural and industrial products destined for domestic and international markets. The region’s position as a major global commodity supplier drives consistent cargo volumes through inland waterway networks, supporting sustained market expansion.

Infrastructure development initiatives by governments and international development organizations have improved navigation conditions, expanded port facilities, and enhanced intermodal connectivity. These investments reduce operational constraints and enable larger vessels to access previously restricted waterway segments. Public-private partnerships facilitate continued infrastructure improvements while sharing investment risks and operational responsibilities.

Environmental regulations and sustainability commitments encourage modal shift from road and rail transport to more eco-friendly waterway alternatives. Carbon reduction targets and environmental impact assessments favor waterway transport due to its lower emissions profile and reduced infrastructure footprint. Corporate sustainability initiatives by major shippers increasingly prioritize environmentally responsible transportation options.

Technological advancement in vessel design, navigation systems, and cargo handling equipment improves operational efficiency and safety standards. Modern vessels feature enhanced fuel efficiency, automated systems, and improved cargo capacity utilization. Digital transformation through logistics platforms and real-time tracking systems optimizes route planning and cargo management processes.

Seasonal water level variations present significant operational challenges, limiting navigation capacity during dry periods and requiring costly dredging operations to maintain channel depths. These fluctuations create uncertainty in transportation schedules and may force cargo diversion to alternative transport modes during critical periods.

Infrastructure limitations in certain waterway segments restrict vessel sizes and cargo capacity, reducing operational efficiency and increasing per-unit transportation costs. Aging lock systems, inadequate port facilities, and insufficient maintenance of navigation channels create bottlenecks that limit market growth potential.

Regulatory complexity across multiple jurisdictions complicates cross-border operations and increases administrative costs. Varying safety standards, environmental regulations, and customs procedures create operational inefficiencies and compliance challenges for international waterway transport services.

Limited intermodal connectivity at certain locations restricts cargo transfer efficiency and increases total logistics costs. Inadequate road and rail connections to waterway terminals limit market accessibility and reduce the competitive advantage of inland waterway transport for certain cargo types and destinations.

Infrastructure modernization programs present significant opportunities for market expansion through improved navigation conditions, enhanced port facilities, and better intermodal connectivity. Government commitments to waterway development create favorable conditions for private sector investment and operational expansion.

Technology integration offers opportunities to improve operational efficiency, reduce costs, and enhance service quality through advanced navigation systems, automated cargo handling, and digital logistics platforms. Smart waterway initiatives incorporating IoT sensors, real-time monitoring, and predictive analytics can optimize vessel operations and maintenance schedules.

Regional trade growth and expanding agricultural production create increasing demand for cost-effective transportation solutions. Growing exports of soybeans, corn, iron ore, and other bulk commodities provide sustained cargo volumes for waterway operators. Market diversification into container transport and specialized cargo handling expands revenue opportunities.

Environmental initiatives and carbon reduction commitments by governments and corporations favor waterway transport adoption. The sector’s environmental advantages position it favorably for future growth as sustainability considerations become increasingly important in transportation decision-making.

Supply and demand dynamics in the Latin America inland waterway transport market reflect the complex interaction between cargo generation, infrastructure capacity, and operational efficiency. Seasonal agricultural harvests create demand peaks that test system capacity, while industrial cargo provides more consistent year-round volumes.

Competitive forces include competition from road and rail transport modes, particularly for time-sensitive cargo and shorter distances. However, waterway transport maintains competitive advantages for bulk commodities over longer distances, where cost efficiency outweighs speed considerations. Modal competition drives continuous improvement in service quality and operational efficiency.

Pricing mechanisms reflect fuel costs, infrastructure charges, vessel availability, and seasonal demand variations. Freight rates typically demonstrate inverse correlation with cargo volumes, with peak harvest seasons generating higher rates due to capacity constraints. Long-term contracts with major shippers provide revenue stability while spot market rates reflect short-term supply-demand imbalances.

Innovation drivers include pressure to reduce costs, improve environmental performance, and enhance service reliability. Technological advancement in vessel design, navigation systems, and cargo handling equipment responds to market demands for greater efficiency and sustainability. Digital transformation initiatives optimize logistics coordination and improve customer service capabilities.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes interviews with industry stakeholders, government officials, port authorities, and logistics service providers across key Latin American markets. Secondary research incorporates government statistics, industry reports, and academic studies to validate findings and provide historical context.

Data collection processes utilize both quantitative and qualitative research approaches. Quantitative analysis examines cargo volumes, vessel movements, infrastructure investments, and operational performance metrics. Qualitative assessment explores market trends, regulatory developments, competitive dynamics, and strategic initiatives through expert interviews and industry surveys.

Market segmentation analysis categorizes the market by cargo type, vessel category, geographic region, and end-user industry to provide detailed insights into specific market segments. Cross-referencing multiple data sources ensures accuracy and identifies potential discrepancies requiring further investigation.

Validation procedures include triangulation of findings across multiple sources, expert review of preliminary results, and sensitivity analysis to test key assumptions. Regular updates incorporate new data and emerging trends to maintain research relevance and accuracy.

Brazil dominates the Latin America inland waterway transport market, accounting for approximately 45% of regional cargo volumes through its extensive Amazon River system and Tietê-Paraná Waterway. The country’s vast agricultural production and mineral resources generate substantial cargo flows, while ongoing infrastructure investments enhance navigation capabilities and port facilities.

Argentina represents the second-largest market segment, with the Paraguay-Paraná Waterway serving as a crucial export corridor for agricultural commodities. The country’s strategic location provides access to both Atlantic and Pacific markets through interconnected waterway systems. Port development initiatives in Buenos Aires and Rosario enhance cargo handling capacity and operational efficiency.

Paraguay and Uruguay benefit significantly from waterway transport due to their landlocked or limited coastal access. These countries rely heavily on river systems for international trade, with waterway transport capturing over 70% of bulk export volumes. Regional cooperation agreements facilitate seamless cargo movement across borders.

Colombia’s Magdalena River system serves domestic transportation needs and provides access to Caribbean ports for international trade. Recent infrastructure investments aim to restore navigation capacity and improve cargo handling facilities. Peru and Ecuador utilize Amazon tributaries for regional transportation, though market development remains limited compared to Atlantic basin countries.

Venezuela’s Orinoco River system historically supported significant cargo movements, though current economic conditions have reduced market activity. Central American countries have limited inland waterway transport due to geographic constraints, with most activity concentrated on short-distance regional routes.

Market structure includes a diverse mix of large integrated logistics companies, specialized waterway operators, and regional service providers. Competition varies by geographic region and cargo type, with some segments dominated by a few major players while others remain highly fragmented.

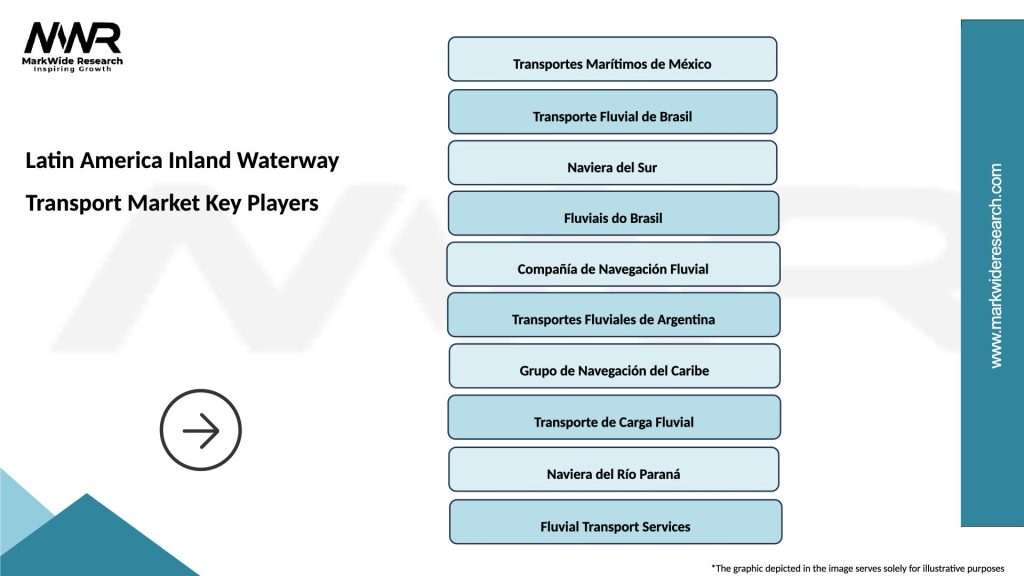

Leading market participants include:

Competitive strategies focus on operational efficiency, service reliability, and cost competitiveness. Companies invest in modern vessel fleets, advanced navigation technologies, and integrated logistics capabilities to differentiate their service offerings. Strategic partnerships with port operators, agricultural producers, and industrial customers provide stable cargo volumes and long-term revenue streams.

By Cargo Type:

By Vessel Type:

By Waterway System:

Agricultural cargo dominates market volumes, driven by Latin America’s position as a major global supplier of soybeans, corn, and other commodities. This segment benefits from seasonal harvest patterns that generate consistent cargo flows, though capacity constraints during peak periods can create operational challenges. Infrastructure investments focus on improving grain handling facilities and expanding storage capacity at key terminals.

Industrial materials provide year-round cargo stability with less seasonal variation than agricultural products. Iron ore transport from Brazilian mining regions represents a significant component, while petroleum products and manufactured goods contribute to cargo diversity. Specialized handling equipment and dedicated terminals serve specific industrial cargo requirements.

Container transport represents a growing market segment as trade patterns evolve and shippers seek intermodal solutions. However, infrastructure limitations and handling capacity constraints restrict growth potential in many waterway corridors. Investment priorities include container handling equipment and improved road-rail connectivity at waterway terminals.

Passenger services serve both transportation and tourism functions, particularly in Amazon region where waterways provide essential connectivity to remote communities. This segment faces competition from improved road networks and air services, but maintains importance for regional accessibility and eco-tourism development.

Cost advantages represent the primary benefit for shippers utilizing inland waterway transport, with freight rates typically 40-50% lower than equivalent road transport for bulk commodities. These savings translate directly to improved profit margins and enhanced competitiveness in international markets, particularly important for agricultural exporters facing global price pressures.

Environmental benefits align with corporate sustainability initiatives and regulatory requirements. Waterway transport produces significantly lower carbon emissions per ton-kilometer compared to road and rail alternatives, supporting environmental goals while potentially qualifying for carbon credit programs and sustainability certifications.

Capacity advantages enable efficient movement of large cargo volumes with minimal infrastructure requirements compared to equivalent road or rail capacity. Single barge convoys can transport cargo equivalent to hundreds of trucks, reducing traffic congestion and infrastructure wear while improving overall logistics efficiency.

Reliability benefits include reduced weather-related disruptions and traffic delays compared to road transport. Waterway operations typically maintain more consistent schedules and face fewer external disruptions, improving supply chain predictability and reducing inventory requirements for shippers.

Regional development benefits extend to local communities through employment opportunities, infrastructure investment, and improved connectivity. Waterway operations support economic development in rural areas while providing essential transportation services to remote communities with limited alternative access.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation initiatives are revolutionizing waterway operations through integrated logistics platforms, real-time cargo tracking, and automated vessel systems. These technologies improve operational efficiency, enhance customer service, and provide better visibility throughout the transportation process. According to MarkWide Research, digital adoption in waterway operations has increased by over 40% in recent years.

Environmental sustainability has become a central focus as operators invest in cleaner vessel technologies, fuel-efficient engines, and emission reduction systems. Regulatory pressure and corporate sustainability commitments drive adoption of environmentally friendly operational practices and equipment upgrades.

Infrastructure modernization continues across the region with government and private sector investments in channel improvements, port facility upgrades, and intermodal connectivity enhancements. These projects aim to increase navigation capacity, improve operational efficiency, and expand market accessibility.

Regional integration efforts focus on harmonizing regulations, improving cross-border procedures, and developing coordinated infrastructure investments. Multi-national agreements facilitate seamless cargo movement and reduce administrative barriers to international waterway transport.

Vessel technology advancement includes development of larger, more efficient vessels designed specifically for inland waterway conditions. Modern designs incorporate improved fuel efficiency, enhanced cargo handling capabilities, and advanced navigation systems to optimize operational performance.

Major infrastructure projects across the region include channel deepening initiatives, lock system modernization, and port facility expansions. Brazil’s Tietê-Paraná Waterway improvements and Argentina’s Paraguay-Paraná navigation enhancements represent significant investments in regional transportation capacity.

Technology partnerships between waterway operators and technology companies are developing advanced navigation systems, automated cargo handling solutions, and integrated logistics platforms. These collaborations aim to improve operational efficiency and service quality while reducing costs.

Regulatory developments include updated safety standards, environmental regulations, and cross-border cooperation agreements. Recent initiatives focus on harmonizing technical standards and improving coordination between national waterway authorities.

Private sector investments in vessel fleets, terminal facilities, and logistics capabilities demonstrate continued confidence in market growth potential. Major operators are expanding their service offerings and geographic coverage to capture emerging opportunities.

International cooperation programs involve development banks, government agencies, and private sector partners working to improve waterway infrastructure and operational capabilities. These initiatives provide financing and technical expertise for strategic improvement projects.

Infrastructure investment should prioritize critical bottlenecks and capacity constraints that limit system efficiency. Strategic improvements in channel depth, lock capacity, and port facilities can generate significant returns through increased cargo volumes and operational efficiency gains.

Technology adoption offers substantial opportunities for operational improvement and cost reduction. Operators should evaluate advanced navigation systems, automated cargo handling equipment, and integrated logistics platforms to enhance competitiveness and service quality.

Market diversification strategies should explore container transport, specialized cargo handling, and value-added logistics services to reduce dependence on traditional bulk commodity transport. These segments offer higher margins and growth potential despite requiring additional infrastructure investment.

Regional cooperation initiatives should focus on regulatory harmonization, infrastructure coordination, and operational standardization to improve cross-border efficiency and reduce administrative costs. Collaborative approaches can achieve better results than individual national efforts.

Environmental initiatives should be integrated into long-term strategic planning as sustainability considerations become increasingly important for customer selection and regulatory compliance. Proactive environmental improvements can provide competitive advantages and support market positioning.

Market growth prospects remain positive driven by expanding agricultural production, increasing industrial activity, and growing recognition of waterway transport’s economic and environmental advantages. MWR analysis indicates the market will continue expanding at a steady CAGR of 6.2% through the forecast period, supported by infrastructure investments and operational improvements.

Infrastructure development will continue as governments and private sector partners invest in capacity expansion and modernization projects. Priority areas include channel improvements, port facility upgrades, and intermodal connectivity enhancements that support increased cargo volumes and operational efficiency.

Technology integration will accelerate as operators seek competitive advantages through improved efficiency, enhanced service quality, and reduced operational costs. Advanced navigation systems, automated equipment, and digital logistics platforms will become standard components of modern waterway operations.

Environmental considerations will play an increasingly important role in market development as regulatory requirements tighten and corporate sustainability commitments expand. Operators investing in clean technologies and efficient operations will be better positioned for long-term success.

Regional integration efforts will continue improving cross-border operations and expanding market opportunities. Harmonized regulations, coordinated infrastructure investments, and streamlined procedures will enhance the competitiveness of waterway transport for international trade.

The Latin America inland waterway transport market represents a vital component of regional transportation infrastructure with significant growth potential driven by expanding trade volumes, infrastructure investments, and environmental considerations. The market’s natural advantages in cost efficiency and environmental performance position it favorably for continued expansion as stakeholders seek sustainable transportation solutions.

Key success factors include strategic infrastructure investments, technology adoption, operational efficiency improvements, and enhanced regional cooperation. Market participants who effectively leverage these opportunities while addressing operational challenges will be well-positioned to capture growth in this dynamic sector. Continued development of waterway transport capabilities will support regional economic growth while providing environmentally responsible transportation alternatives for Latin America’s expanding trade requirements.

What is Inland Waterway Transport?

Inland Waterway Transport refers to the movement of goods and passengers via navigable rivers, canals, and lakes. This mode of transport is crucial for connecting inland areas to major ports and facilitating trade within regions.

What are the key players in the Latin America Inland Waterway Transport Market?

Key players in the Latin America Inland Waterway Transport Market include companies like Hidrovias do Brasil, Transpetro, and Grupo Arcor, which are involved in logistics and transportation services on inland waterways, among others.

What are the growth factors driving the Latin America Inland Waterway Transport Market?

The growth of the Latin America Inland Waterway Transport Market is driven by increasing demand for cost-effective transportation solutions, the expansion of trade routes, and government initiatives to enhance infrastructure for inland navigation.

What challenges does the Latin America Inland Waterway Transport Market face?

The Latin America Inland Waterway Transport Market faces challenges such as inadequate infrastructure, seasonal variations in water levels, and regulatory hurdles that can impede efficient operations.

What opportunities exist in the Latin America Inland Waterway Transport Market?

Opportunities in the Latin America Inland Waterway Transport Market include the potential for investment in modernizing infrastructure, the development of multimodal transport solutions, and the increasing focus on sustainable transport options.

What trends are shaping the Latin America Inland Waterway Transport Market?

Trends in the Latin America Inland Waterway Transport Market include the adoption of digital technologies for logistics management, a shift towards greener transport solutions, and collaborations between public and private sectors to improve waterway systems.

Latin America Inland Waterway Transport Market

| Segmentation Details | Description |

|---|---|

| Type | Bulk Cargo, Containerized Cargo, Liquid Cargo, General Cargo |

| End User | Agriculture, Manufacturing, Construction, Energy |

| Service Type | Freight Transport, Logistics Management, Warehousing, Charter Services |

| Technology | Navigation Systems, Cargo Handling Equipment, Communication Tools, Monitoring Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Inland Waterway Transport Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at