444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Malaysia domestic CEP market represents a rapidly evolving sector within the country’s logistics and delivery ecosystem. Courier, Express, and Parcel services have become integral to Malaysia’s economic infrastructure, driven by the exponential growth of e-commerce, changing consumer behaviors, and increasing demand for last-mile delivery solutions. The market encompasses a comprehensive range of services including same-day delivery, next-day delivery, express courier services, and specialized parcel handling across Peninsular Malaysia, Sabah, and Sarawak.

Market dynamics indicate robust expansion with the sector experiencing a compound annual growth rate of 12.5% over the past five years. This growth trajectory reflects the fundamental shift in Malaysian consumer preferences toward online shopping and the increasing expectations for faster, more reliable delivery services. The market serves diverse customer segments ranging from individual consumers to small and medium enterprises, large corporations, and government institutions.

Digital transformation has emerged as a key catalyst, with traditional postal services evolving to compete alongside innovative logistics startups and international express delivery companies. The integration of advanced tracking systems, mobile applications, and automated sorting facilities has enhanced service quality while reducing operational costs. Urban areas particularly Kuala Lumpur, Selangor, Penang, and Johor Bahru, account for approximately 70% of total market activity, though rural penetration is steadily increasing through strategic infrastructure investments.

The Malaysia domestic CEP market refers to the comprehensive ecosystem of courier, express, and parcel delivery services operating within Malaysian borders, facilitating the movement of packages, documents, and goods between businesses and consumers across the nation. This market encompasses traditional postal services, private courier companies, express delivery providers, and emerging last-mile delivery specialists that collectively serve the growing demand for efficient logistics solutions.

CEP services distinguish themselves from standard freight and logistics through their focus on time-sensitive deliveries, enhanced tracking capabilities, and premium service levels. The domestic market specifically addresses intra-country deliveries, connecting major urban centers with suburban and rural areas through sophisticated distribution networks. These services range from standard parcel delivery taking 2-3 business days to premium same-day and next-day express options.

Service categories within the market include business-to-business deliveries, business-to-consumer shipments, consumer-to-consumer transfers, and specialized services such as cash-on-delivery, fragile item handling, and temperature-controlled transportation. The market’s evolution reflects Malaysia’s transition toward a digital economy, where efficient logistics infrastructure supports e-commerce growth and facilitates seamless trade across the country’s diverse geographical landscape.

Malaysia’s domestic CEP market stands at a pivotal juncture, characterized by unprecedented growth driven by digital commerce expansion and evolving consumer expectations. The sector has demonstrated remarkable resilience and adaptability, particularly during the COVID-19 pandemic, when delivery services became essential infrastructure supporting economic continuity and social connectivity.

Key market drivers include the surge in e-commerce adoption, with online retail penetration reaching 87% among urban consumers, government initiatives promoting digital economy development, and increasing smartphone penetration facilitating mobile commerce. The market benefits from Malaysia’s strategic geographical position, well-developed transportation infrastructure, and supportive regulatory environment that encourages innovation while maintaining service quality standards.

Competitive landscape features a diverse mix of established players and emerging disruptors. Traditional operators like Pos Malaysia compete alongside international express companies such as DHL, FedEx, and regional specialists including J&T Express, Ninja Van, and City-Link Express. This competition has driven service innovation, pricing optimization, and network expansion, ultimately benefiting consumers through improved service quality and expanded delivery options.

Future prospects remain highly positive, with industry analysts projecting sustained growth driven by continued e-commerce expansion, increasing cross-border trade, and the development of smart city initiatives across major Malaysian urban centers. The market’s evolution toward sustainability, automation, and enhanced customer experience positions it as a critical enabler of Malaysia’s digital transformation agenda.

Strategic analysis reveals several critical insights shaping the Malaysia domestic CEP market landscape. The sector’s transformation reflects broader economic trends while demonstrating unique characteristics specific to Malaysian consumer behavior and infrastructure capabilities.

E-commerce proliferation serves as the primary catalyst driving Malaysia’s domestic CEP market expansion. The rapid adoption of online shopping platforms, accelerated by pandemic-induced behavioral changes, has created unprecedented demand for reliable delivery services. Digital marketplaces including Shopee, Lazada, and local platforms have fundamentally altered consumer purchasing patterns, with online retail transactions increasing by 45% annually over the past three years.

Smartphone penetration and improved internet connectivity have democratized access to e-commerce services across diverse demographic segments. Mobile commerce applications enable seamless ordering and real-time delivery tracking, enhancing customer experience while driving volume growth. The integration of digital payment systems and cash-on-delivery options has further expanded market accessibility, particularly among consumers previously hesitant to embrace online shopping.

Government initiatives supporting digital economy development provide substantial momentum for CEP market growth. The Malaysia Digital Economy Blueprint and related policy frameworks encourage logistics innovation while investing in digital infrastructure. Smart city projects across major urban centers create opportunities for advanced delivery solutions including autonomous vehicles, drone delivery trials, and integrated logistics hubs.

Changing consumer expectations regarding delivery speed and convenience continue driving service innovation and market expansion. Modern consumers increasingly demand same-day or next-day delivery options, flexible delivery windows, and enhanced package security. These evolving expectations push CEP providers to invest in network optimization, technology upgrades, and customer service enhancements, creating a positive feedback loop that stimulates further market growth.

Infrastructure limitations present significant challenges for CEP market expansion, particularly in rural and remote areas of Malaysia. While urban centers benefit from well-developed transportation networks, reaching consumers in Sabah, Sarawak, and rural Peninsular Malaysia requires substantial investment in distribution facilities, transportation assets, and local partnerships. Geographic constraints including mountainous terrain, river systems, and island communities complicate delivery logistics and increase operational costs.

Regulatory complexities surrounding postal services, customs procedures, and cross-state transportation create operational challenges for CEP providers. Compliance requirements vary across different service categories and geographical regions, necessitating sophisticated operational management systems and regulatory expertise. Licensing requirements and service quality standards, while ensuring consumer protection, can create barriers to entry for smaller operators and limit market competition.

Labor shortages in the logistics sector, particularly for delivery personnel and warehouse operations, constrain market growth potential. The physically demanding nature of delivery work, combined with competitive employment opportunities in other sectors, creates recruitment and retention challenges. Training requirements for handling specialized packages, operating delivery technology, and maintaining customer service standards further complicate human resource management.

Economic volatility and fluctuating fuel costs impact operational expenses and pricing strategies across the CEP market. Currency fluctuations affect international partnerships and technology investments, while economic uncertainty can reduce consumer spending on non-essential items requiring delivery services. Competitive pricing pressure from both established operators and new market entrants limits profit margins and constrains investment in infrastructure improvements.

Rural market penetration represents a substantial untapped opportunity for CEP providers willing to invest in infrastructure development and innovative delivery solutions. Government rural development initiatives create supportive environments for expanding logistics networks into underserved areas, while growing rural internet connectivity increases e-commerce adoption. Strategic partnerships with local businesses, community centers, and government agencies can facilitate cost-effective rural delivery networks.

Sustainability initiatives offer competitive differentiation opportunities as environmental consciousness grows among Malaysian consumers and businesses. Green delivery options including electric vehicles, bicycle couriers, and carbon-neutral shipping programs appeal to environmentally aware customers while potentially reducing long-term operational costs. Government incentives for sustainable transportation and corporate sustainability mandates create additional market drivers.

Technology integration presents opportunities for operational optimization and service enhancement across the CEP value chain. Artificial intelligence applications in route optimization, demand forecasting, and customer service can significantly improve efficiency while reducing costs. Internet of Things sensors, blockchain tracking systems, and automated sorting facilities offer potential for substantial competitive advantages.

Cross-border expansion opportunities emerge as Malaysia’s CEP infrastructure matures and regional trade increases. ASEAN economic integration creates demand for efficient cross-border logistics services, while Malaysia’s strategic location positions domestic CEP providers for regional expansion. Partnerships with international logistics companies and investment in customs clearance capabilities can unlock significant growth potential.

Competitive intensity within Malaysia’s domestic CEP market has intensified significantly as traditional postal services, international express companies, and innovative startups compete for market share. This competition drives continuous innovation in service offerings, pricing strategies, and customer experience enhancements. Market consolidation trends are emerging as smaller operators seek partnerships or acquisition opportunities to compete effectively against larger, well-resourced competitors.

Technology disruption continues reshaping market dynamics through automation, artificial intelligence, and digital platform integration. MarkWide Research analysis indicates that companies investing in advanced technology solutions achieve 25% higher operational efficiency compared to traditional operators. The adoption of predictive analytics, route optimization algorithms, and automated customer service systems creates competitive advantages while improving service quality.

Customer behavior evolution drives market adaptation as consumers become increasingly sophisticated in their delivery preferences and expectations. The demand for flexible delivery options, real-time tracking, and seamless returns processing requires CEP providers to continuously enhance their service capabilities. Social commerce integration and influencer-driven purchasing patterns create new delivery volume sources while requiring specialized handling capabilities.

Regulatory evolution influences market dynamics through changing postal regulations, data protection requirements, and environmental standards. Government digitalization initiatives create opportunities for CEP providers to participate in public sector logistics while requiring compliance with enhanced security and service level requirements. The balance between market liberalization and consumer protection continues shaping competitive dynamics across the sector.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into Malaysia’s domestic CEP market dynamics. The research approach combined quantitative data collection with qualitative analysis to provide a holistic understanding of market trends, competitive landscape, and growth opportunities.

Primary research involved extensive interviews with industry executives, logistics managers, e-commerce platform operators, and regulatory officials across Malaysia’s major economic centers. Survey methodology captured consumer preferences, delivery experiences, and satisfaction levels among diverse demographic segments. Focus group discussions provided deeper insights into changing consumer behaviors and expectations regarding CEP services.

Secondary research analyzed government statistics, industry reports, company financial statements, and regulatory filings to establish market baselines and identify trends. Data triangulation techniques validated findings across multiple sources while ensuring research accuracy and reliability. Economic indicators, trade statistics, and demographic data provided contextual framework for market analysis.

Market modeling utilized statistical analysis and forecasting techniques to project future market trends and growth scenarios. Competitive analysis examined market share distribution, service differentiation strategies, and pricing dynamics across major CEP providers. Technology adoption patterns and infrastructure development trends were analyzed to assess market evolution trajectories and identify emerging opportunities.

Peninsular Malaysia dominates the domestic CEP market, accounting for approximately 85% of total delivery volumes due to higher population density, concentrated economic activity, and well-developed transportation infrastructure. Klang Valley including Kuala Lumpur and Selangor represents the largest market segment, driven by e-commerce concentration, corporate headquarters, and affluent consumer demographics demanding premium delivery services.

Northern region comprising Penang, Kedah, and Perak demonstrates strong growth potential supported by manufacturing activity, tourism, and increasing e-commerce adoption. Penang’s technology sector and Georgetown’s UNESCO World Heritage status create unique delivery requirements including specialized handling for electronics and tourism-related services. The region benefits from proximity to Thailand border trade and established logistics infrastructure.

Southern region anchored by Johor Bahru shows robust market development driven by proximity to Singapore, manufacturing activity, and cross-border trade. Iskandar Malaysia development corridor creates opportunities for advanced logistics services while Singapore’s influence drives higher service expectations. The region’s strategic location supports both domestic and international CEP operations.

East Malaysia including Sabah and Sarawak presents unique challenges and opportunities for CEP market development. Geographic constraints including mountainous terrain, river systems, and dispersed island communities require innovative delivery solutions and substantial infrastructure investment. However, growing oil and gas industry activity, tourism development, and government rural connectivity initiatives create expanding market opportunities. Regional market share currently represents 15% of national volumes but demonstrates 18% annual growth rates as infrastructure improvements and economic development accelerate.

Market leadership within Malaysia’s domestic CEP sector reflects a diverse competitive environment where traditional postal services compete alongside international express companies and innovative regional specialists. The competitive dynamics continue evolving as market participants adapt to changing consumer expectations and technological advancement opportunities.

Competitive strategies increasingly focus on technology integration, customer experience enhancement, and network optimization to achieve sustainable competitive advantages. Strategic partnerships with e-commerce platforms, retail chains, and technology providers enable market participants to expand service capabilities while controlling infrastructure investment costs.

Service type segmentation reveals distinct market categories each serving specific customer needs and delivery requirements across Malaysia’s domestic CEP market. Understanding these segments enables providers to optimize service offerings and pricing strategies while identifying growth opportunities.

By Service Speed:

By Customer Type:

By Package Type:

E-commerce fulfillment emerges as the dominant category driving Malaysia’s domestic CEP market growth, with online retail deliveries accounting for approximately 60% of total parcel volumes. This category benefits from strategic partnerships between CEP providers and major e-commerce platforms, enabling seamless integration of ordering, payment, and delivery processes. Peak season dynamics during shopping festivals and promotional events create capacity challenges while generating substantial revenue opportunities.

Business document delivery maintains steady demand despite digital transformation trends, as legal requirements, original signatures, and physical document exchange continue supporting traditional courier services. Corporate customers value reliability, security, and comprehensive tracking capabilities, often willing to pay premium pricing for guaranteed service levels. The segment benefits from long-term contracts and predictable volume patterns.

Food delivery services represent a rapidly expanding category driven by changing lifestyle patterns, urbanization, and mobile application adoption. Restaurant partnerships and cloud kitchen concepts create new delivery volume sources while requiring specialized handling capabilities including temperature control and time-sensitive delivery windows. The category demonstrates strong growth potential as food delivery becomes integrated into daily consumer routines.

Healthcare logistics including pharmaceutical delivery and medical supply distribution presents specialized opportunities requiring regulatory compliance, temperature control, and enhanced security measures. Telemedicine growth and aging population demographics drive demand for reliable medication delivery services. The category offers higher margins while requiring substantial investment in specialized infrastructure and training.

CEP service providers benefit from Malaysia’s expanding domestic market through multiple revenue streams and growth opportunities. Diversified customer base including individual consumers, small businesses, and large corporations provides stability while reducing dependence on any single market segment. The growing e-commerce ecosystem creates partnership opportunities with online platforms, enabling CEP providers to access new customer segments while sharing marketing and customer acquisition costs.

E-commerce businesses leverage reliable CEP services to enhance customer satisfaction, expand market reach, and optimize fulfillment operations. Integrated logistics solutions enable online retailers to focus on core business activities while outsourcing complex delivery operations to specialized providers. Access to nationwide delivery networks allows small businesses to compete effectively with larger competitors by offering comparable delivery options.

Consumers enjoy enhanced convenience, expanded shopping options, and improved delivery experiences through competitive CEP market dynamics. Service innovation driven by market competition results in faster delivery times, flexible delivery options, and enhanced package tracking capabilities. Competitive pricing benefits consumers while increasing access to goods and services previously unavailable in local markets.

Government stakeholders benefit from CEP market development through economic growth, employment creation, and enhanced connectivity between urban and rural areas. Digital economy initiatives supported by efficient logistics infrastructure accelerate Malaysia’s transformation toward a knowledge-based economy. Tax revenue generation and foreign investment attraction result from a thriving logistics sector supporting broader economic development objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration continues reshaping Malaysia’s domestic CEP market as providers invest heavily in technology infrastructure, mobile applications, and automated systems. Artificial intelligence integration enables predictive analytics for demand forecasting, route optimization, and customer service enhancement. Real-time tracking systems and mobile notifications have become standard features, with consumers expecting comprehensive visibility throughout the delivery process.

Sustainability initiatives gain momentum as environmental consciousness grows among consumers and regulatory pressure increases. Electric vehicle adoption for last-mile delivery reduces carbon emissions while potentially lowering long-term operational costs. Green packaging solutions, carbon-neutral shipping options, and sustainable logistics practices become competitive differentiators appealing to environmentally aware customers.

Last-mile innovation drives investment in alternative delivery solutions addressing urban congestion and changing consumer preferences. Smart locker networks provide convenient pickup options while reducing failed delivery attempts and operational costs. Flexible delivery windows, contactless delivery options, and neighborhood pickup points enhance customer convenience while optimizing delivery efficiency.

Cross-platform integration enables seamless connectivity between e-commerce platforms, payment systems, and delivery services. API development facilitates real-time integration allowing customers to track packages across multiple platforms while enabling businesses to automate order fulfillment processes. Social commerce integration and influencer marketing create new delivery volume sources requiring specialized handling capabilities.

Infrastructure investments across Malaysia’s CEP sector demonstrate commitment to long-term market development and service enhancement. Automated sorting facilities in major urban centers improve processing efficiency while reducing labor dependency and operational costs. Strategic warehouse locations and distribution hubs optimize delivery networks while supporting expansion into previously underserved areas.

Strategic partnerships between CEP providers and technology companies accelerate innovation adoption and service capability enhancement. MWR analysis indicates that companies with strong technology partnerships achieve 30% faster service delivery times compared to traditional operators. Collaborations with fintech companies enable enhanced payment options while partnerships with automotive companies support electric vehicle adoption.

Regulatory developments including updated postal regulations and licensing requirements create both challenges and opportunities for market participants. Government digitalization initiatives provide opportunities for CEP providers to participate in public sector logistics while requiring compliance with enhanced security and service standards. Consumer protection regulations ensure service quality while creating operational requirements for tracking, insurance, and complaint resolution.

Market consolidation activities including mergers, acquisitions, and strategic alliances reshape competitive dynamics while enabling smaller operators to access resources and capabilities necessary for market competition. International expansion by regional players creates opportunities for knowledge transfer and best practice adoption while intensifying competitive pressure on domestic operators.

Technology investment prioritization should focus on customer-facing applications and operational efficiency improvements that provide measurable competitive advantages. Mobile application development enabling seamless ordering, tracking, and customer service creates direct customer relationships while reducing operational overhead. Investment in route optimization algorithms and predictive analytics generates immediate operational benefits while supporting long-term scalability.

Rural market penetration strategies require innovative approaches balancing service coverage expansion with operational cost management. Partnership models with local businesses, community centers, and government agencies can provide cost-effective rural delivery solutions while building community relationships. Hub-and-spoke distribution models optimize transportation efficiency while maintaining service quality across diverse geographical areas.

Sustainability integration should be approached strategically, focusing on initiatives that provide both environmental benefits and operational advantages. Electric vehicle adoption in urban areas reduces emissions while potentially lowering fuel costs and maintenance requirements. Green packaging solutions and carbon-neutral shipping options appeal to environmentally conscious consumers while supporting corporate sustainability objectives.

Customer experience enhancement requires comprehensive approaches addressing all touchpoints throughout the delivery journey. Proactive communication including delivery notifications, delay alerts, and resolution updates builds customer trust while reducing service inquiries. Flexible delivery options and seamless returns processing create competitive advantages while improving customer satisfaction and retention rates.

Market expansion prospects for Malaysia’s domestic CEP sector remain highly positive, driven by continued e-commerce growth, digital economy development, and evolving consumer expectations. MarkWide Research projects sustained growth momentum with the market expected to maintain double-digit growth rates over the next five years. This growth trajectory reflects fundamental shifts in consumer behavior, business operations, and economic structure supporting long-term demand for CEP services.

Technology evolution will continue driving market transformation through automation, artificial intelligence, and innovative delivery solutions. Autonomous delivery vehicles and drone technology trials may begin commercial deployment in controlled environments, while smart city initiatives create opportunities for integrated logistics solutions. The Internet of Things integration and blockchain technology adoption will enhance package tracking and security while improving operational transparency.

Regional integration opportunities emerge as ASEAN economic cooperation deepens and cross-border trade increases. Malaysia’s strategic position within Southeast Asia positions domestic CEP providers for regional expansion while attracting international operators seeking regional hub locations. Cross-border e-commerce growth creates demand for integrated logistics solutions spanning multiple countries.

Sustainability requirements will increasingly influence market development as environmental regulations tighten and consumer awareness grows. Carbon-neutral delivery options may become standard offerings while electric vehicle adoption accelerates across urban delivery networks. Circular economy principles including packaging reduction and reuse programs will create new service categories while supporting environmental objectives.

Malaysia’s domestic CEP market represents a dynamic and rapidly evolving sector positioned for sustained growth driven by digital economy expansion, changing consumer behaviors, and technological innovation. The market’s transformation from traditional postal services to sophisticated logistics networks reflects broader economic modernization while creating substantial opportunities for industry participants and stakeholders.

Competitive dynamics continue intensifying as established operators, international companies, and innovative startups compete for market share through service differentiation, technology adoption, and customer experience enhancement. This competition ultimately benefits consumers through improved service quality, expanded delivery options, and competitive pricing while driving continuous innovation across the sector.

Future success in Malaysia’s domestic CEP market will require strategic focus on technology integration, sustainability initiatives, and customer experience optimization. Companies that successfully balance operational efficiency with service quality while adapting to evolving consumer expectations will capture the greatest opportunities in this expanding market. The sector’s continued development supports Malaysia’s broader digital transformation objectives while contributing to economic growth and social connectivity across the nation.

What is Domestic CEP?

Domestic CEP refers to the domestic courier and express parcel services that facilitate the transportation of goods within Malaysia. This sector plays a crucial role in e-commerce, retail, and logistics by ensuring timely delivery of packages to consumers and businesses.

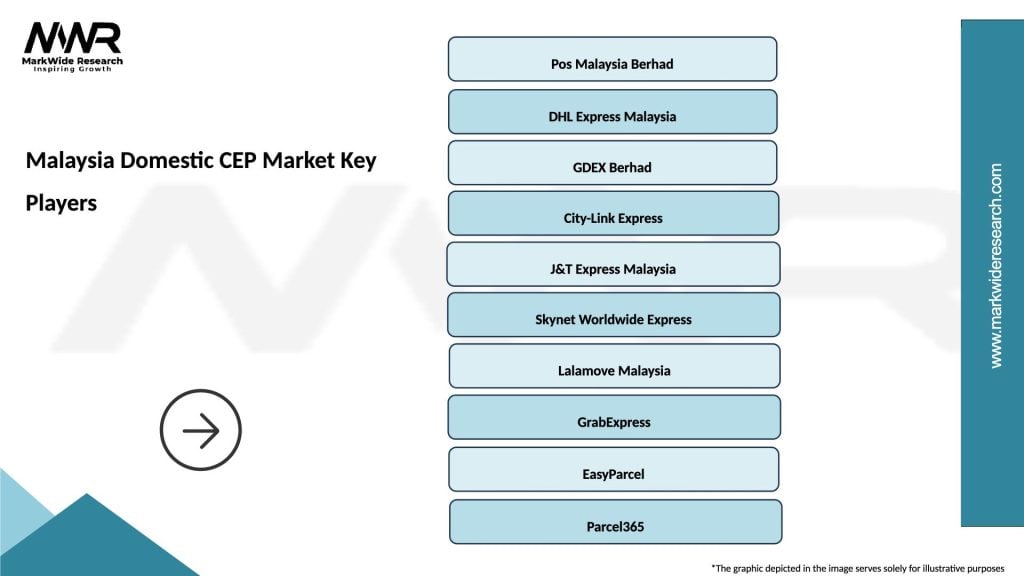

What are the key players in the Malaysia Domestic CEP Market?

Key players in the Malaysia Domestic CEP Market include Pos Malaysia, GDEX, and Ninja Van, which provide a range of delivery services tailored to meet the needs of various industries. These companies are known for their extensive networks and innovative solutions, among others.

What are the growth factors driving the Malaysia Domestic CEP Market?

The growth of the Malaysia Domestic CEP Market is driven by the rise of e-commerce, increasing consumer demand for fast delivery services, and advancements in logistics technology. Additionally, the expansion of retail businesses and the need for efficient supply chain solutions contribute to market growth.

What challenges does the Malaysia Domestic CEP Market face?

The Malaysia Domestic CEP Market faces challenges such as high operational costs, competition from alternative delivery methods, and regulatory hurdles. Additionally, issues related to last-mile delivery efficiency and customer service can impact overall performance.

What opportunities exist in the Malaysia Domestic CEP Market?

Opportunities in the Malaysia Domestic CEP Market include the potential for partnerships with e-commerce platforms, the adoption of green logistics practices, and the integration of advanced technologies like AI and automation. These factors can enhance service offerings and operational efficiency.

What trends are shaping the Malaysia Domestic CEP Market?

Trends shaping the Malaysia Domestic CEP Market include the increasing use of mobile apps for tracking shipments, the rise of same-day delivery services, and the growing emphasis on sustainability in logistics. These trends reflect changing consumer preferences and technological advancements.

Malaysia Domestic CEP Market

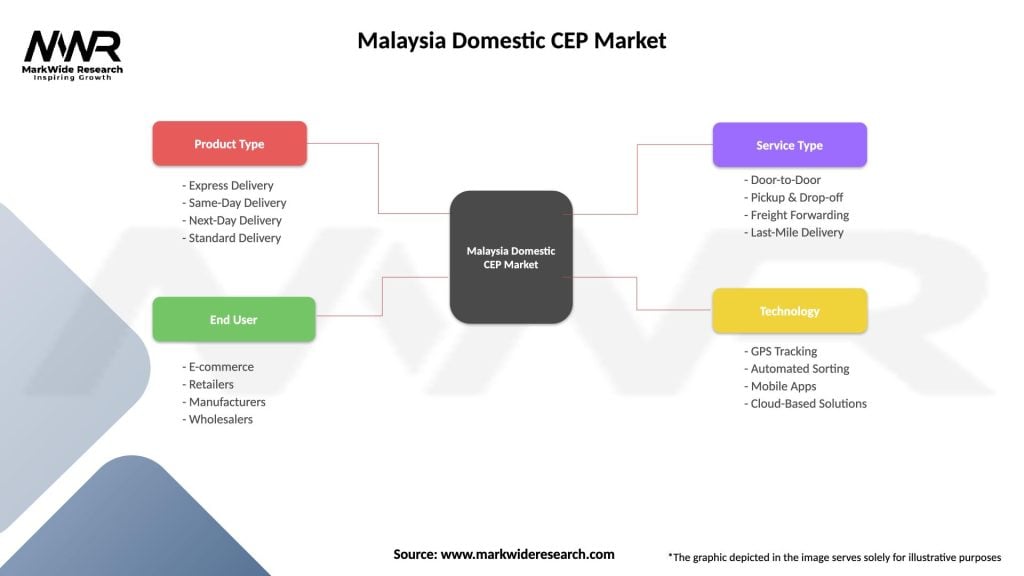

| Segmentation Details | Description |

|---|---|

| Product Type | Express Delivery, Same-Day Delivery, Next-Day Delivery, Standard Delivery |

| End User | E-commerce, Retailers, Manufacturers, Wholesalers |

| Service Type | Door-to-Door, Pickup & Drop-off, Freight Forwarding, Last-Mile Delivery |

| Technology | GPS Tracking, Automated Sorting, Mobile Apps, Cloud-Based Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Malaysia Domestic CEP Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at