444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Argentina lubricants market represents a dynamic and evolving sector within South America’s industrial landscape, driven by diverse applications across automotive, industrial, and marine sectors. Market dynamics indicate substantial growth potential as the country’s manufacturing base expands and automotive sector modernizes. The lubricants industry in Argentina encompasses conventional mineral oils, synthetic lubricants, and bio-based alternatives, serving critical functions in machinery protection, friction reduction, and operational efficiency enhancement.

Regional positioning places Argentina as a significant player in the South American lubricants market, with domestic production capabilities and strategic import partnerships supporting market demand. The sector demonstrates resilience through economic fluctuations while adapting to evolving environmental regulations and technological advancements. Growth trajectories suggest expanding opportunities across multiple application segments, with automotive lubricants maintaining the largest market share at approximately 45% of total consumption.

Industrial transformation continues to shape market dynamics, with increasing emphasis on high-performance lubricants that extend equipment life and improve operational efficiency. The market benefits from Argentina’s robust agricultural machinery sector, mining operations, and expanding manufacturing base, creating diverse demand patterns across different lubricant categories.

The Argentina lubricants market refers to the comprehensive ecosystem of lubricating oils, greases, and specialty fluids used across automotive, industrial, marine, and agricultural applications within Argentina’s economic framework. This market encompasses the production, distribution, and consumption of various lubricant types designed to reduce friction, prevent wear, and enhance the performance of mechanical systems and equipment.

Market scope includes conventional mineral-based lubricants derived from petroleum refining, synthetic lubricants engineered for superior performance characteristics, and emerging bio-based alternatives developed from renewable sources. The sector serves critical functions in supporting Argentina’s transportation infrastructure, manufacturing operations, mining activities, and agricultural machinery maintenance requirements.

Value chain integration spans from raw material procurement and refining processes to specialized formulation, packaging, distribution networks, and end-user applications. The market operates through established supply chains connecting international oil companies, domestic refiners, specialty lubricant manufacturers, and extensive distribution networks serving diverse customer segments across Argentina’s geographic regions.

Strategic analysis reveals the Argentina lubricants market as a mature yet evolving sector characterized by steady demand growth, technological advancement, and increasing environmental consciousness. Market fundamentals demonstrate strong correlation with economic activity levels, automotive sales trends, and industrial production capacity utilization across key sectors.

Competitive dynamics feature established international players alongside domestic manufacturers, creating a balanced market structure that supports innovation while maintaining competitive pricing. The sector benefits from Argentina’s strategic location for regional distribution and established refining infrastructure supporting both domestic consumption and export opportunities.

Growth drivers include expanding automotive fleet modernization, industrial equipment upgrades, and increasing adoption of high-performance lubricants that deliver superior protection and extended service intervals. Market penetration of synthetic lubricants continues expanding at approximately 8.5% annually, driven by performance advantages and total cost of ownership benefits.

Future prospects indicate sustained market expansion supported by infrastructure development projects, mining sector growth, and agricultural mechanization trends. Environmental regulations increasingly influence product development toward lower-emission formulations and biodegradable alternatives, creating new market segments and competitive advantages for innovative manufacturers.

Market intelligence reveals several critical insights shaping the Argentina lubricants landscape. Consumption patterns demonstrate strong seasonal variations aligned with agricultural cycles and industrial production schedules, requiring sophisticated inventory management and distribution strategies.

Technology trends indicate growing demand for specialized formulations addressing specific application requirements, including extreme temperature performance, extended drain intervals, and compatibility with modern engine technologies and emission control systems.

Primary growth drivers propelling the Argentina lubricants market encompass multiple interconnected factors spanning economic development, technological advancement, and regulatory evolution. Automotive sector expansion remains the fundamental driver, with increasing vehicle ownership rates and fleet modernization creating sustained demand for engine oils, transmission fluids, and specialty automotive lubricants.

Industrial development across manufacturing, mining, and energy sectors generates substantial demand for industrial lubricants, hydraulic fluids, and specialty greases. Argentina’s mining sector expansion, particularly in lithium extraction and traditional mineral mining, requires high-performance lubricants capable of operating under extreme conditions while meeting environmental standards.

Agricultural mechanization continues driving demand for agricultural lubricants, with modern farming equipment requiring specialized formulations that protect against wear while operating in dusty, high-load conditions. Equipment modernization trends favor synthetic and semi-synthetic lubricants offering superior protection and extended service intervals, contributing to market value growth despite potentially lower volume consumption.

Infrastructure development projects including transportation networks, energy facilities, and industrial complexes create substantial lubricant demand during construction and ongoing maintenance phases. Regulatory compliance requirements increasingly mandate higher-quality lubricants meeting specific environmental and performance standards, driving market premiumization trends.

Economic volatility represents a significant restraint affecting the Argentina lubricants market, with currency fluctuations, inflation pressures, and periodic economic downturns impacting both consumer purchasing power and industrial activity levels. Price sensitivity among cost-conscious consumers often leads to preference for lower-cost conventional lubricants over premium synthetic alternatives.

Import dependencies for specialized additives and high-performance base stocks create vulnerability to supply chain disruptions and foreign exchange rate fluctuations. Regulatory complexity surrounding environmental standards and product specifications requires significant compliance investments that may burden smaller market participants.

Market maturity in certain segments limits volume growth opportunities, particularly in traditional automotive applications where extended drain intervals and improved fuel efficiency reduce per-vehicle lubricant consumption. Competitive pressure from established international brands creates challenges for domestic manufacturers seeking to expand market share in premium segments.

Infrastructure limitations in remote regions may constrain distribution efficiency and market penetration, particularly for specialized products requiring specific handling or storage conditions. Environmental concerns regarding used oil disposal and recycling create additional operational costs and regulatory compliance requirements for market participants.

Emerging opportunities within the Argentina lubricants market present substantial growth potential across multiple dimensions. Synthetic lubricant adoption offers significant expansion possibilities as awareness of total cost of ownership benefits increases among commercial and industrial users. Market penetration rates for synthetic products remain below 25% in most segments, indicating substantial room for growth.

Bio-based lubricants represent an emerging opportunity aligned with sustainability trends and environmental regulations. Agricultural applications particularly favor biodegradable formulations that minimize environmental impact while delivering required performance characteristics. Innovation opportunities exist in developing specialized formulations for Argentina’s unique operating conditions and application requirements.

Export potential to neighboring South American markets leverages Argentina’s strategic location and established refining infrastructure. Regional integration initiatives may facilitate expanded market access and economies of scale in production and distribution operations.

Digital transformation opportunities include advanced distribution management systems, predictive maintenance applications, and customer engagement platforms that enhance service delivery and market penetration. Partnership opportunities with equipment manufacturers enable development of co-branded lubricants optimized for specific machinery and applications.

Market dynamics in the Argentina lubricants sector reflect complex interactions between supply-side factors, demand patterns, and external economic influences. Supply chain integration varies significantly across product categories, with base oils showing increasing domestic production while specialized additives maintain import dependency.

Competitive intensity differs across market segments, with commodity lubricants experiencing price-based competition while specialty products compete on performance characteristics and technical support. Customer loyalty patterns demonstrate strong brand preferences in automotive applications while industrial customers increasingly focus on total cost of ownership considerations.

Seasonal fluctuations create predictable demand patterns, with agricultural lubricants peaking during planting and harvest seasons while automotive demand shows more consistent year-round patterns. Economic sensitivity varies by application, with industrial lubricants showing higher correlation to economic activity levels compared to essential automotive maintenance applications.

Technology adoption rates accelerate in commercial and industrial applications where performance benefits justify premium pricing, while consumer automotive applications show more gradual adoption of advanced formulations. Distribution evolution includes expanding online channels and direct-to-customer programs that bypass traditional wholesale networks.

Comprehensive research methodology employed in analyzing the Argentina lubricants market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry participants across the value chain, from raw material suppliers and manufacturers to distributors and end-users.

Secondary research encompasses analysis of industry publications, government statistics, trade association data, and regulatory filings to establish market baselines and identify trends. Quantitative analysis utilizes statistical modeling techniques to project market trends and validate findings across different data sources.

Market segmentation analysis employs detailed categorization by product type, application, end-user industry, and geographic region to identify specific growth opportunities and competitive dynamics. Supply chain mapping traces product flows from production through distribution to end-use applications, identifying key bottlenecks and efficiency opportunities.

Competitive intelligence gathering includes analysis of company financial reports, product portfolios, distribution strategies, and market positioning approaches. Regulatory analysis examines current and proposed environmental standards, safety requirements, and trade policies affecting market development. MarkWide Research methodology ensures comprehensive coverage of market dynamics while maintaining analytical objectivity and accuracy.

Geographic distribution of the Argentina lubricants market reveals significant regional variations in consumption patterns, distribution infrastructure, and competitive dynamics. Buenos Aires metropolitan region dominates market consumption with approximately 40% of total demand, reflecting population concentration, industrial activity, and transportation hub functions.

Córdoba province represents the second-largest regional market, driven by automotive manufacturing, agricultural machinery production, and extensive farming operations. Industrial concentration in this region creates substantial demand for both automotive and industrial lubricants, supported by well-developed distribution networks.

Santa Fe province demonstrates strong agricultural lubricant demand aligned with intensive farming operations and grain processing facilities. Regional distribution challenges in remote areas require specialized logistics solutions and local inventory management strategies.

Northern regions including Salta and Tucumán show growing demand driven by mining operations, sugar production, and agricultural activities. Patagonian regions present unique opportunities in oil and gas extraction activities, requiring specialized lubricants for extreme operating conditions.

Coastal regions demonstrate significant marine lubricant demand from fishing fleets, port operations, and shipping activities. Regional preferences vary based on local economic activities, with mining regions favoring heavy-duty industrial lubricants while agricultural areas emphasize seasonal demand patterns.

Competitive structure in the Argentina lubricants market features a balanced mix of international oil companies, regional players, and specialized manufacturers. Market leadership positions are established through brand recognition, distribution network strength, and product portfolio breadth across multiple application segments.

Competitive strategies emphasize product differentiation, technical support services, and distribution network optimization. Innovation focus includes development of specialized formulations for local operating conditions and application requirements.

Market segmentation analysis reveals distinct characteristics across product types, applications, and end-user categories. Product-based segmentation encompasses engine oils, industrial lubricants, hydraulic fluids, gear oils, and specialty greases, each serving specific performance requirements and market dynamics.

By Product Type:

By Application:

Automotive lubricants represent the dominant category with consistent demand driven by vehicle population growth and maintenance requirements. Premium segment growth shows synthetic motor oils gaining market share at approximately 12% annually, driven by extended drain intervals and superior engine protection benefits.

Industrial lubricants demonstrate strong correlation with manufacturing activity levels and capital equipment investments. Hydraulic fluids show particular strength in construction and mining applications, while metalworking fluids benefit from expanding manufacturing operations.

Agricultural lubricants exhibit seasonal demand patterns with peak consumption during planting and harvest periods. Specialty formulations for modern agricultural equipment require enhanced protection against contamination and extended service capabilities under demanding operating conditions.

Marine lubricants serve Argentina’s significant fishing industry and commercial shipping activities. Environmental regulations increasingly influence product specifications, driving demand for biodegradable formulations and low-emission alternatives.

Specialty products including food-grade lubricants, pharmaceutical applications, and extreme-temperature formulations represent niche but growing market segments with higher profit margins and specialized distribution requirements.

Market participants in the Argentina lubricants sector realize multiple strategic benefits through effective positioning and operational excellence. Manufacturers benefit from diverse application segments that provide revenue stability and growth opportunities across economic cycles.

Distribution partners leverage established networks and customer relationships to capture value through service differentiation and technical support capabilities. Brand recognition advantages enable premium pricing for established players while creating barriers to entry for new competitors.

End-users benefit from competitive market dynamics that drive innovation, improve product quality, and maintain reasonable pricing across different performance categories. Technical advancement in lubricant formulations delivers operational benefits including extended equipment life, reduced maintenance costs, and improved efficiency.

Economic stakeholders including suppliers, logistics providers, and service companies benefit from market growth and increasing sophistication in product offerings and distribution methods. Environmental benefits from advanced lubricant technologies include reduced emissions, improved fuel economy, and enhanced recyclability.

Regional development benefits include job creation in manufacturing, distribution, and service sectors while supporting industrial competitiveness through reliable lubricant supply chains and technical support services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability trends increasingly influence the Argentina lubricants market, with growing emphasis on bio-based formulations, recycling programs, and reduced environmental impact throughout product lifecycles. Circular economy principles drive development of re-refined base oils and closed-loop lubricant management systems.

Digitalization trends encompass predictive maintenance applications, IoT-enabled condition monitoring, and data-driven lubricant selection and management systems. Smart lubrication technologies enable optimized change intervals and proactive maintenance scheduling, improving operational efficiency.

Performance enhancement trends focus on extended drain intervals, improved fuel economy contributions, and enhanced equipment protection under extreme operating conditions. Additive technology advancement enables superior performance characteristics while meeting increasingly stringent environmental requirements.

Customization trends include development of application-specific formulations tailored to unique operating conditions and equipment requirements. OEM partnerships facilitate co-development of lubricants optimized for specific machinery and performance specifications.

Distribution evolution includes expanding e-commerce channels, direct-to-customer programs, and integrated supply chain management systems that improve service delivery and cost efficiency. Service integration trends combine lubricant supply with technical support, training, and maintenance services.

Recent developments in the Argentina lubricants market reflect ongoing industry evolution and adaptation to changing market conditions. Capacity expansions by major players indicate confidence in long-term market growth prospects and commitment to serving domestic demand.

Product launches emphasize advanced synthetic formulations, bio-based alternatives, and specialized applications addressing specific market needs. Technology partnerships between lubricant manufacturers and additive suppliers accelerate innovation and product development cycles.

Regulatory compliance initiatives include reformulation programs to meet evolving environmental standards and safety requirements. Sustainability programs encompass used oil collection and recycling initiatives, carbon footprint reduction efforts, and renewable feedstock utilization.

Distribution network enhancements include digital platform implementations, logistics optimization projects, and customer service capability improvements. Market consolidation activities through acquisitions and partnerships reshape competitive dynamics and market structure.

Investment activities focus on production facility upgrades, research and development capabilities, and market expansion initiatives. Export development programs target regional market opportunities and leverage Argentina’s strategic geographic position.

Strategic recommendations for Argentina lubricants market participants emphasize diversification, innovation, and operational excellence as key success factors. MWR analysis suggests focusing on high-growth segments including synthetic lubricants, specialty applications, and environmentally friendly formulations.

Market positioning strategies should emphasize total cost of ownership benefits rather than initial price considerations, particularly in commercial and industrial applications. Brand differentiation through technical support, application expertise, and service quality creates sustainable competitive advantages.

Distribution optimization recommendations include expanding digital channels, improving logistics efficiency, and developing regional service capabilities. Partnership strategies with equipment manufacturers and service providers enable market penetration and customer loyalty development.

Innovation priorities should address sustainability requirements, performance enhancement, and application-specific needs. Investment recommendations favor research and development capabilities, production flexibility, and market expansion initiatives.

Risk management strategies should address economic volatility, regulatory changes, and supply chain vulnerabilities through diversification and contingency planning. Long-term success requires balancing growth investments with operational efficiency and market responsiveness.

Future prospects for the Argentina lubricants market indicate sustained growth driven by economic development, industrial expansion, and technological advancement. Market evolution toward higher-performance products and environmentally friendly alternatives creates opportunities for innovation and differentiation.

Growth projections suggest continued expansion across multiple application segments, with synthetic lubricants expected to achieve 30% market penetration within the next five years. Industrial applications show particular promise aligned with manufacturing sector development and infrastructure investments.

Technology trends will continue driving product development toward enhanced performance, extended service life, and environmental compatibility. Digital integration will transform distribution and customer engagement models, creating new value propositions and competitive advantages.

Regulatory evolution toward stricter environmental standards will accelerate adoption of advanced formulations and sustainable practices. Market maturation in traditional segments will drive focus toward specialty applications and value-added services.

Regional integration opportunities may expand market access and enable economies of scale in production and distribution operations. MarkWide Research projections indicate robust market fundamentals supporting continued investment and development activities across the Argentina lubricants sector.

The Argentina lubricants market demonstrates strong fundamentals and promising growth prospects across diverse application segments and product categories. Market dynamics reflect a mature yet evolving sector adapting to technological advancement, environmental requirements, and changing customer expectations.

Competitive positioning favors companies that successfully balance innovation, operational excellence, and customer service while maintaining cost competitiveness. Growth opportunities exist particularly in synthetic lubricants, specialty applications, and environmentally friendly formulations that address evolving market needs.

Strategic success requires understanding regional market variations, application-specific requirements, and the complex interplay between economic conditions and lubricant demand patterns. Future market leadership will depend on companies’ ability to innovate, adapt to regulatory changes, and deliver superior value propositions to increasingly sophisticated customers across Argentina’s diverse industrial landscape.

What is Lubricants?

Lubricants are substances used to reduce friction between surfaces in mutual contact, which ultimately reduces the heat generated when the surfaces move. They are essential in various applications, including automotive, industrial machinery, and consumer products.

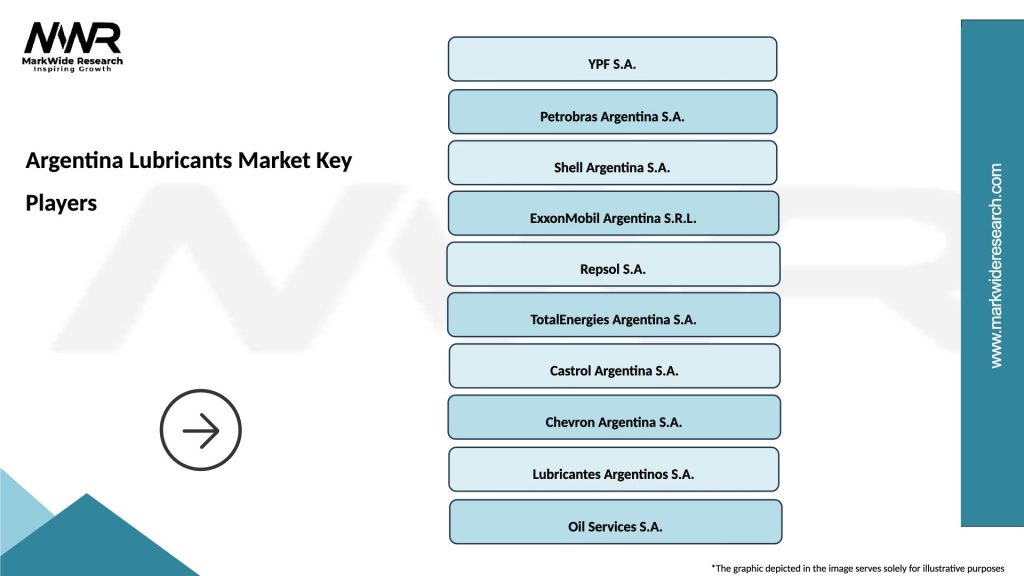

What are the key players in the Argentina Lubricants Market?

Key players in the Argentina Lubricants Market include YPF S.A., Petrobras Argentina, and Shell Argentina, among others. These companies are involved in the production and distribution of various lubricant products for automotive and industrial applications.

What are the growth factors driving the Argentina Lubricants Market?

The Argentina Lubricants Market is driven by the increasing demand for automotive lubricants due to rising vehicle ownership and the growth of the manufacturing sector. Additionally, advancements in lubricant formulations and a focus on sustainability are contributing to market growth.

What challenges does the Argentina Lubricants Market face?

The Argentina Lubricants Market faces challenges such as fluctuating raw material prices and stringent environmental regulations. These factors can impact production costs and the availability of certain lubricant types.

What opportunities exist in the Argentina Lubricants Market?

Opportunities in the Argentina Lubricants Market include the growing trend towards bio-based lubricants and the expansion of electric vehicle usage, which may require specialized lubricants. Additionally, increasing industrial activities present further growth potential.

What trends are shaping the Argentina Lubricants Market?

Trends in the Argentina Lubricants Market include the shift towards synthetic lubricants and the development of high-performance products. There is also a growing emphasis on eco-friendly formulations to meet consumer demand for sustainable options.

Argentina Lubricants Market

| Segmentation Details | Description |

|---|---|

| Product Type | Engine Oil, Transmission Fluid, Hydraulic Oil, Grease |

| End User | Automotive, Industrial, Marine, Agriculture |

| Application | Passenger Vehicles, Commercial Vehicles, Heavy Machinery, Two-Wheelers |

| Packaging Type | Drums, Pails, Bottles, Bulk |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Argentina Lubricants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at