444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia and New Zealand digital transformation market represents one of the most dynamic and rapidly evolving technological landscapes in the Asia-Pacific region. This comprehensive market encompasses the systematic integration of digital technologies across all business areas, fundamentally changing how organizations operate and deliver value to customers. Digital transformation initiatives in these markets are experiencing unprecedented growth, driven by increasing demand for operational efficiency, enhanced customer experiences, and competitive advantage in an increasingly digital economy.

Market dynamics indicate that both Australia and New Zealand are witnessing accelerated adoption of cloud computing, artificial intelligence, Internet of Things (IoT), and advanced analytics solutions. The region’s digital transformation journey is characterized by strong government support, robust technological infrastructure, and a highly skilled workforce. Enterprise adoption rates have reached approximately 78% across major industries, with small and medium enterprises showing remarkable growth in digital technology implementation.

Regional characteristics demonstrate that Australia leads in terms of market maturity and investment scale, while New Zealand showcases innovative approaches to digital governance and sustainable technology practices. The market is experiencing significant momentum across sectors including healthcare, financial services, manufacturing, retail, and government services, with organizations increasingly recognizing digital transformation as essential for long-term sustainability and growth.

The Australia and New Zealand digital transformation market refers to the comprehensive ecosystem of technologies, services, and solutions that enable organizations to digitally evolve their business models, processes, and customer experiences. This market encompasses cloud migration services, data analytics platforms, artificial intelligence implementations, cybersecurity solutions, and digital infrastructure modernization initiatives that collectively drive organizational change and innovation.

Digital transformation in this context represents more than mere technology adoption; it signifies a fundamental shift in organizational culture, operational methodologies, and strategic approaches to business challenges. The market includes software solutions, professional services, system integration, and ongoing support services that facilitate the transition from traditional business models to digitally-enabled enterprises. Key components include enterprise resource planning systems, customer relationship management platforms, business intelligence tools, and emerging technologies such as machine learning and blockchain.

Market scope extends beyond technology implementation to encompass change management, workforce development, and strategic consulting services that ensure successful digital adoption. Organizations participating in this market range from large multinational corporations to small businesses, government agencies, and non-profit organizations, all seeking to leverage digital technologies for improved efficiency, innovation, and competitive positioning in the modern economy.

Strategic analysis reveals that the Australia and New Zealand digital transformation market is experiencing robust expansion driven by accelerating business digitization needs and technological advancement. The market demonstrates strong fundamentals with increasing investment in cloud infrastructure, data analytics capabilities, and artificial intelligence solutions across diverse industry sectors. Growth trajectories indicate sustained momentum with projected compound annual growth rates exceeding 12.5% through 2028.

Key market drivers include government digital initiatives, increasing cybersecurity requirements, remote work adoption, and growing demand for data-driven decision making. Australia’s digital economy strategy and New Zealand’s digital inclusion programs are creating favorable conditions for market expansion. Technology adoption patterns show that approximately 85% of large enterprises have initiated comprehensive digital transformation programs, while mid-market organizations are rapidly following suit.

Competitive landscape features a mix of global technology leaders, regional specialists, and emerging innovative companies providing comprehensive digital transformation solutions. The market is characterized by strategic partnerships, merger and acquisition activity, and increasing focus on industry-specific solutions. Investment flows continue to strengthen market infrastructure and capability development, positioning the region as a significant player in the global digital transformation ecosystem.

Market intelligence reveals several critical insights shaping the Australia and New Zealand digital transformation landscape:

Emerging trends indicate increasing focus on artificial intelligence integration, edge computing deployment, and sustainable technology practices that align with regional environmental commitments and regulatory requirements.

Primary growth drivers propelling the Australia and New Zealand digital transformation market include accelerating business digitization requirements and evolving customer expectations. Organizations across both countries are recognizing that digital transformation is no longer optional but essential for maintaining competitive relevance and operational efficiency. Customer experience enhancement has become a critical driver, with businesses investing heavily in digital touchpoints and omnichannel capabilities.

Government initiatives represent significant market catalysts, with Australia’s Digital Economy Strategy and New Zealand’s Digital Technologies Industry Transformation Plan creating favorable policy environments. These programs include substantial investment in digital infrastructure, skills development, and innovation support that directly benefits market participants. Regulatory compliance requirements are also driving adoption, particularly in financial services, healthcare, and government sectors.

Technological advancement continues to create new opportunities and capabilities that drive market expansion. The proliferation of cloud services, artificial intelligence tools, and IoT solutions is making digital transformation more accessible and cost-effective for organizations of all sizes. Remote work adoption, accelerated by recent global events, has created sustained demand for digital collaboration tools, cloud infrastructure, and cybersecurity solutions that support distributed workforce models.

Economic factors including the need for operational efficiency, cost optimization, and revenue growth are compelling organizations to embrace digital transformation as a strategic imperative. The ability to leverage data for improved decision-making and the potential for new digital business models are additional drivers supporting market growth across diverse industry sectors.

Implementation challenges represent significant barriers to digital transformation adoption in the Australia and New Zealand markets. Many organizations struggle with the complexity of integrating new digital technologies with existing legacy systems, creating technical and operational hurdles that can delay or derail transformation initiatives. Change management difficulties often emerge as organizations attempt to shift established business processes and organizational cultures to accommodate digital ways of working.

Skills shortages constitute a persistent constraint across both markets, with demand for digital expertise consistently outpacing supply. The scarcity of qualified professionals in areas such as data science, cybersecurity, cloud architecture, and digital strategy creates competitive pressure for talent and can limit the pace of transformation initiatives. Training and development costs associated with upskilling existing workforce capabilities represent additional financial burdens for organizations.

Cybersecurity concerns continue to create hesitation among organizations considering digital transformation, particularly regarding cloud migration and data management practices. The increasing sophistication of cyber threats and regulatory requirements for data protection create additional complexity and cost considerations that can slow adoption decisions. Compliance requirements in regulated industries add layers of complexity that require specialized expertise and careful planning.

Financial constraints affect many organizations, particularly small and medium enterprises, as digital transformation often requires significant upfront investment with returns realized over extended periods. Budget allocation challenges and competing investment priorities can limit the scope and pace of digital transformation initiatives across various market segments.

Emerging technology adoption presents substantial opportunities for market expansion, particularly in areas such as artificial intelligence, machine learning, and advanced analytics. Organizations are increasingly recognizing the potential for these technologies to drive innovation, improve operational efficiency, and create new revenue streams. Industry 4.0 initiatives in manufacturing and industrial sectors offer significant growth potential for digital transformation solution providers.

Small and medium enterprise market represents a largely untapped opportunity, with many smaller organizations yet to fully embrace comprehensive digital transformation strategies. The development of more accessible, cost-effective solutions tailored to SME requirements could unlock substantial market growth. Government digitization programs continue to create opportunities for solution providers to participate in large-scale public sector transformation initiatives.

Sustainability-focused solutions are gaining traction as organizations seek to align digital transformation initiatives with environmental responsibility goals. The integration of green technology practices with digital transformation strategies presents opportunities for innovative solution development and market differentiation. Cross-border collaboration between Australia and New Zealand creates opportunities for shared digital infrastructure and solution development.

Vertical market specialization offers opportunities for solution providers to develop deep expertise in specific industries such as healthcare, education, agriculture, and tourism. The unique requirements of these sectors create demand for specialized digital transformation approaches that can command premium pricing and establish competitive advantages in niche markets.

Competitive dynamics in the Australia and New Zealand digital transformation market are characterized by intense competition among global technology leaders, regional specialists, and emerging innovative companies. The market structure includes established multinational corporations with comprehensive solution portfolios alongside agile local providers offering specialized expertise and personalized service approaches. Partnership strategies are becoming increasingly important as organizations seek to combine complementary capabilities and market reach.

Technology evolution continues to reshape market dynamics, with rapid advancement in areas such as artificial intelligence, edge computing, and quantum technologies creating new competitive landscapes. Organizations must continuously adapt their solution offerings to incorporate emerging technologies while maintaining compatibility with existing systems and processes. Innovation cycles are accelerating, requiring market participants to invest heavily in research and development to maintain competitive positioning.

Customer expectations are evolving rapidly, with organizations demanding more integrated, user-friendly, and outcome-focused digital transformation solutions. The shift toward subscription-based and outcome-based pricing models is changing traditional vendor-customer relationships and requiring new approaches to solution delivery and support. Service delivery models are adapting to include more remote and automated support capabilities.

Regulatory environment continues to influence market dynamics, with data privacy regulations, cybersecurity requirements, and industry-specific compliance standards shaping solution development and implementation approaches. The increasing focus on digital sovereignty and data localization requirements is creating opportunities for regional solution providers while challenging global vendors to adapt their offerings to local requirements.

Comprehensive research approach employed for analyzing the Australia and New Zealand digital transformation market combines primary and secondary research methodologies to ensure accurate and reliable market insights. The methodology incorporates quantitative analysis of market trends, competitive positioning, and growth projections alongside qualitative assessment of industry dynamics, customer requirements, and technological developments.

Primary research activities include extensive interviews with industry executives, technology leaders, and end-user organizations across both Australia and New Zealand. Survey data collection from diverse market participants provides insights into adoption patterns, investment priorities, and future planning considerations. Expert consultations with technology analysts, academic researchers, and government officials contribute specialized knowledge and perspective on market developments.

Secondary research sources encompass government publications, industry reports, company financial statements, and technology vendor documentation to establish comprehensive market understanding. Analysis of patent filings, research publications, and conference proceedings provides insights into emerging technology trends and innovation directions. Data validation processes ensure accuracy and reliability of market information through cross-referencing multiple sources and expert verification.

Analytical frameworks applied include market sizing methodologies, competitive analysis models, and trend projection techniques that account for regional market characteristics and global technology developments. The research approach considers both quantitative metrics and qualitative factors that influence market dynamics and future growth potential in the Australia and New Zealand context.

Australia market characteristics demonstrate strong digital transformation momentum driven by large enterprise adoption and government investment in digital infrastructure. The Australian market benefits from a mature technology ecosystem, substantial venture capital availability, and strong educational institutions producing skilled digital professionals. Major metropolitan areas including Sydney, Melbourne, and Brisbane serve as technology hubs with concentrated digital transformation activity and innovation centers.

New Zealand market dynamics showcase innovative approaches to digital transformation with particular strength in government digitization and sustainable technology practices. Despite its smaller scale, New Zealand demonstrates high per-capita technology adoption rates and progressive regulatory frameworks that support digital innovation. Wellington and Auckland emerge as primary centers for digital transformation activity, with strong government and private sector collaboration.

Sectoral distribution across both markets shows financial services leading in digital transformation investment, followed by healthcare, manufacturing, and retail sectors. Government digitization initiatives represent significant market segments in both countries, with public sector adoption rates reaching approximately 68% for major digital initiatives. Rural and regional areas present both challenges and opportunities, with connectivity improvements enabling broader digital transformation adoption.

Cross-border collaboration between Australia and New Zealand is increasing, with shared digital infrastructure projects and coordinated regulatory approaches creating integrated market opportunities. The Trans-Tasman digital economy relationship facilitates technology transfer, skills mobility, and joint innovation initiatives that benefit both markets and create synergies for solution providers operating across both countries.

Market leadership in the Australia and New Zealand digital transformation space is distributed among several categories of providers, each bringing distinct capabilities and market approaches:

Competitive strategies focus on developing comprehensive solution portfolios, establishing strategic partnerships, and building industry-specific expertise. Many providers are investing heavily in local talent development and regional data center infrastructure to address data sovereignty requirements and provide improved service delivery capabilities.

Market positioning varies significantly among competitors, with global providers leveraging scale and comprehensive capabilities while regional specialists emphasize local expertise, personalized service, and deep understanding of regulatory requirements. Innovation focus areas include artificial intelligence integration, sustainability solutions, and industry-specific digital transformation approaches that address unique regional market requirements.

Technology segmentation of the Australia and New Zealand digital transformation market reveals distinct categories based on solution types and implementation approaches:

By Technology:

By Organization Size:

By Industry Vertical:

Cloud computing solutions represent the largest and fastest-growing segment of the digital transformation market, with organizations prioritizing cloud migration as the foundation for broader transformation initiatives. Hybrid cloud adoption is particularly strong, allowing organizations to balance performance, security, and cost considerations while maintaining flexibility for future technology evolution. Multi-cloud strategies are becoming increasingly common as organizations seek to avoid vendor lock-in and optimize capabilities across different platforms.

Data analytics and artificial intelligence solutions are experiencing rapid growth as organizations recognize the strategic value of data-driven decision making. Machine learning platforms, predictive analytics tools, and business intelligence solutions are being deployed across diverse use cases from customer experience optimization to operational efficiency improvement. AI adoption rates have reached approximately 45% among large enterprises with continued expansion expected across market segments.

Cybersecurity solutions are increasingly integrated into digital transformation planning rather than treated as separate initiatives. Zero-trust security models, identity and access management systems, and advanced threat detection capabilities are becoming standard components of transformation projects. The growing sophistication of cyber threats and regulatory requirements are driving sustained investment in security technologies and services.

Industry-specific solutions are gaining market share as organizations seek digital transformation approaches tailored to their unique operational requirements and regulatory environments. Healthcare digitization, financial services innovation, and manufacturing automation represent particularly active segments with specialized solution development and implementation approaches that address sector-specific challenges and opportunities.

Technology vendors participating in the Australia and New Zealand digital transformation market benefit from sustained demand growth, premium pricing opportunities for innovative solutions, and the ability to establish long-term customer relationships through comprehensive transformation partnerships. The market’s maturity and sophistication create opportunities for vendors to showcase advanced capabilities and develop reference implementations that support global expansion strategies.

System integrators and consultants gain access to high-value engagements that combine technology implementation with strategic consulting and change management services. The complexity of digital transformation initiatives creates demand for specialized expertise and end-to-end service delivery capabilities that command premium pricing and establish competitive differentiation in the professional services market.

End-user organizations realize significant benefits including improved operational efficiency, enhanced customer experiences, and new revenue opportunities through digital business model innovation. Productivity improvements from digital transformation initiatives typically range from 20% to 40% depending on implementation scope and organizational readiness. Access to advanced analytics and artificial intelligence capabilities enables better decision-making and competitive advantage in rapidly evolving markets.

Government agencies benefit from improved service delivery capabilities, enhanced citizen engagement, and more efficient administrative processes through digital transformation initiatives. The ability to leverage data for policy development and service optimization creates significant public value while reducing operational costs and improving transparency and accountability in government operations.

Economic stakeholders including investors, financial institutions, and economic development organizations benefit from the job creation, innovation stimulus, and productivity improvements generated by digital transformation market growth. The development of digital capabilities strengthens regional competitiveness and attracts international investment in technology and innovation sectors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is becoming a dominant trend across the Australia and New Zealand digital transformation market, with organizations increasingly incorporating AI capabilities into their transformation strategies. Machine learning algorithms, natural language processing, and computer vision technologies are being deployed across diverse applications from customer service automation to predictive maintenance and fraud detection. AI implementation rates are growing at approximately 35% annually among medium and large enterprises.

Sustainability-focused digital transformation is gaining significant momentum as organizations seek to align technology initiatives with environmental responsibility goals. Green computing practices, energy-efficient data centers, and digital solutions that reduce carbon footprints are becoming standard considerations in transformation planning. The integration of environmental metrics into digital transformation ROI calculations reflects growing corporate commitment to sustainability objectives.

Edge computing deployment is accelerating as organizations seek to reduce latency, improve performance, and enhance data security for distributed applications. The proliferation of IoT devices and real-time analytics requirements is driving demand for computing capabilities closer to data sources and end users. Edge infrastructure investment is expanding rapidly across industries including manufacturing, healthcare, and retail sectors.

Low-code and no-code platforms are democratizing application development and enabling business users to participate more directly in digital transformation initiatives. These platforms are reducing development time and costs while enabling more agile responses to changing business requirements. The trend toward citizen development is reshaping traditional IT roles and accelerating digital transformation timelines across organizations of all sizes.

Strategic partnerships between global technology providers and regional specialists are reshaping the competitive landscape, with major vendors establishing local capabilities and regional players gaining access to advanced technologies and global markets. These collaborations are creating more comprehensive solution offerings and improved service delivery capabilities for end-user organizations across both Australia and New Zealand.

Government digital initiatives continue to drive market development, with significant investments in digital infrastructure, cybersecurity capabilities, and citizen service platforms. Australia’s Digital Economy Strategy and New Zealand’s Digital Technologies Industry Transformation Plan are creating substantial opportunities for technology providers while establishing frameworks for broader digital transformation adoption across public and private sectors.

Merger and acquisition activity is increasing as organizations seek to consolidate capabilities, expand market reach, and acquire specialized expertise in emerging technology areas. Recent transactions have focused on artificial intelligence, cybersecurity, and industry-specific solution providers that offer unique capabilities and established customer relationships in key market segments.

Innovation investments in research and development are expanding, with both government and private sector funding supporting development of advanced digital transformation capabilities. Focus areas include quantum computing, advanced analytics, and sustainable technology solutions that address unique regional requirements and global market opportunities. R&D investment growth is averaging approximately 18% annually across technology sectors.

MarkWide Research recommends that organizations prioritize comprehensive digital transformation strategies that integrate technology implementation with organizational change management and workforce development initiatives. Successful transformation requires balanced attention to technical capabilities, process optimization, and cultural adaptation to maximize return on investment and ensure sustainable outcomes.

Technology selection strategies should emphasize flexibility, scalability, and interoperability to accommodate future technology evolution and changing business requirements. Organizations should avoid vendor lock-in situations and maintain the ability to adapt their technology portfolios as new capabilities emerge and business needs evolve. Cloud-first approaches provide optimal flexibility while enabling access to latest innovations and capabilities.

Skills development investment is critical for digital transformation success, with organizations needing to balance hiring external expertise with upskilling existing workforce capabilities. Comprehensive training programs, strategic partnerships with educational institutions, and knowledge transfer initiatives can help address skills shortages while building internal capabilities for ongoing digital innovation and adaptation.

Cybersecurity integration should be embedded throughout digital transformation planning and implementation rather than treated as a separate consideration. Zero-trust security models, comprehensive risk assessment, and ongoing security monitoring are essential components of successful transformation initiatives that protect organizational assets while enabling digital innovation and growth.

Market growth projections indicate continued expansion of the Australia and New Zealand digital transformation market, with sustained investment in cloud computing, artificial intelligence, and data analytics solutions driving long-term growth momentum. MWR analysis suggests that market growth rates will remain robust, supported by increasing recognition of digital transformation as essential for competitive success and operational efficiency.

Technology evolution will continue to create new opportunities and challenges, with emerging capabilities in quantum computing, advanced artificial intelligence, and sustainable technology solutions reshaping market dynamics. Organizations that maintain flexibility and adaptability in their digital transformation approaches will be best positioned to leverage these emerging opportunities while managing associated risks and complexities.

Industry consolidation is expected to continue as market participants seek to achieve scale, expand capabilities, and improve competitive positioning. Strategic partnerships, mergers, and acquisitions will likely reshape the competitive landscape while creating more comprehensive solution offerings and improved service delivery capabilities for end-user organizations.

Regulatory development will influence market evolution, with increasing focus on data privacy, cybersecurity, and digital sovereignty requirements shaping solution development and implementation approaches. Organizations and solution providers that proactively address regulatory requirements and demonstrate compliance capabilities will maintain competitive advantages in increasingly regulated digital environments.

Regional integration between Australia and New Zealand will likely deepen, creating opportunities for shared digital infrastructure, coordinated regulatory approaches, and joint innovation initiatives. This integration will benefit both markets by creating larger addressable markets for solution providers while enabling more efficient resource utilization and knowledge sharing across the Trans-Tasman region.

The Australia and New Zealand digital transformation market represents a dynamic and rapidly evolving landscape characterized by strong growth momentum, technological innovation, and increasing organizational commitment to digital business models. Market fundamentals remain robust, supported by government investment, advanced infrastructure, and skilled workforce capabilities that create favorable conditions for continued expansion and development.

Strategic opportunities abound for technology providers, system integrators, and end-user organizations willing to embrace comprehensive digital transformation approaches that balance technological capability with organizational change management and workforce development. The market’s maturity and sophistication create demand for advanced solutions while providing platforms for innovation and competitive differentiation.

Future success in this market will depend on organizations’ ability to navigate evolving technology landscapes, address cybersecurity challenges, and develop sustainable digital transformation strategies that deliver measurable business value. The integration of artificial intelligence, sustainability considerations, and industry-specific solutions will continue to drive market evolution and create new opportunities for growth and innovation across both Australia and New Zealand.

What is Digital Transformation?

Digital transformation refers to the integration of digital technology into all areas of a business, fundamentally changing how it operates and delivers value to customers. It encompasses various aspects such as process automation, data analytics, and customer engagement strategies.

What are the key players in the Australia And New Zealand Digital Transformation Market?

Key players in the Australia And New Zealand Digital Transformation Market include companies like Telstra, Optus, and IBM, which provide a range of digital solutions and services. These companies focus on enhancing customer experiences and operational efficiencies through innovative technologies, among others.

What are the main drivers of the Australia And New Zealand Digital Transformation Market?

The main drivers of the Australia And New Zealand Digital Transformation Market include the increasing demand for improved customer experiences, the need for operational efficiency, and the rapid adoption of cloud technologies. Additionally, businesses are leveraging data analytics to make informed decisions and enhance competitiveness.

What challenges does the Australia And New Zealand Digital Transformation Market face?

Challenges in the Australia And New Zealand Digital Transformation Market include resistance to change within organizations, cybersecurity concerns, and the need for skilled workforce. Companies often struggle with integrating new technologies into existing systems while ensuring data security and compliance.

What opportunities exist in the Australia And New Zealand Digital Transformation Market?

Opportunities in the Australia And New Zealand Digital Transformation Market include the growth of artificial intelligence and machine learning applications, the expansion of e-commerce platforms, and the increasing focus on sustainability through digital solutions. These trends present avenues for innovation and investment.

What trends are shaping the Australia And New Zealand Digital Transformation Market?

Trends shaping the Australia And New Zealand Digital Transformation Market include the rise of remote work technologies, the integration of Internet of Things (IoT) devices, and the emphasis on data-driven decision-making. Companies are increasingly adopting agile methodologies to enhance their digital capabilities.

Australia And New Zealand Digital Transformation Market

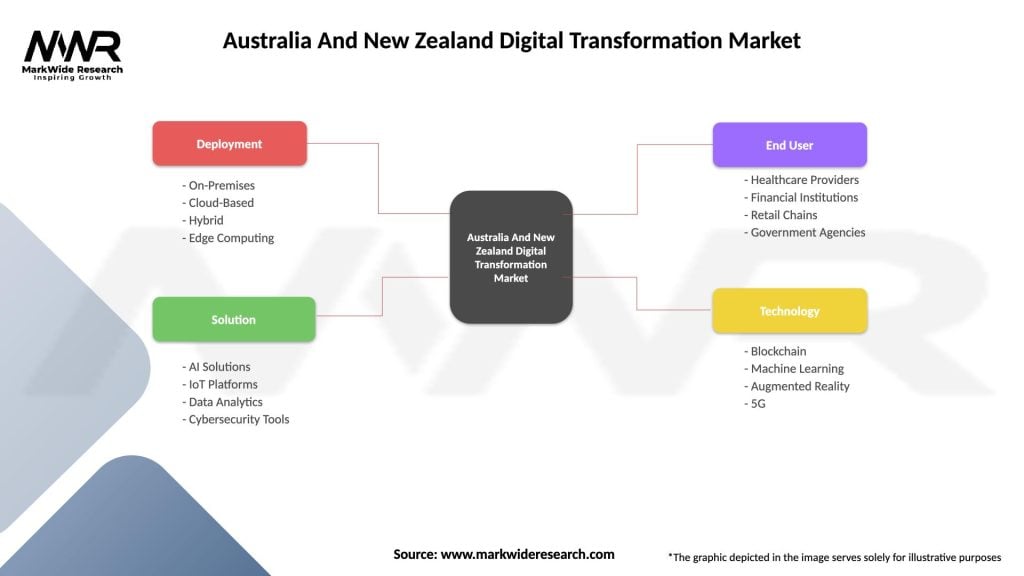

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premises, Cloud-Based, Hybrid, Edge Computing |

| Solution | AI Solutions, IoT Platforms, Data Analytics, Cybersecurity Tools |

| End User | Healthcare Providers, Financial Institutions, Retail Chains, Government Agencies |

| Technology | Blockchain, Machine Learning, Augmented Reality, 5G |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia And New Zealand Digital Transformation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at