444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam rigid plastic packaging market represents a dynamic and rapidly expanding sector within Southeast Asia’s packaging industry. Vietnam’s robust economic growth, increasing consumer spending, and expanding manufacturing base have positioned the country as a significant player in the regional packaging landscape. The market encompasses various rigid plastic packaging solutions including bottles, containers, jars, trays, and specialized industrial packaging formats.

Manufacturing expansion across multiple industries has driven substantial demand for rigid plastic packaging solutions. The food and beverage sector, pharmaceutical industry, personal care products, and industrial applications collectively represent the primary demand drivers for this market. Vietnam’s strategic location within the ASEAN region, combined with favorable trade policies and competitive manufacturing costs, has attracted significant foreign investment in packaging production facilities.

Technological advancement in packaging manufacturing has enabled Vietnamese producers to offer increasingly sophisticated rigid plastic packaging solutions. The market demonstrates strong growth momentum, with industry analysts projecting a compound annual growth rate of 8.2% through the forecast period. Sustainability initiatives and environmental regulations are increasingly influencing market dynamics, driving innovation in recyclable and bio-based rigid plastic packaging materials.

Consumer behavior shifts toward convenience packaging, coupled with urbanization trends and changing lifestyle patterns, continue to fuel market expansion. The rise of e-commerce and modern retail formats has created new opportunities for specialized rigid plastic packaging solutions designed for product protection during transportation and storage.

The Vietnam rigid plastic packaging market refers to the comprehensive ecosystem of manufacturing, distribution, and consumption of non-flexible plastic packaging materials within Vietnam’s borders. Rigid plastic packaging encompasses containers, bottles, jars, trays, and other packaging formats that maintain their structural integrity and shape under normal handling conditions, distinguishing them from flexible packaging alternatives.

Market scope includes various plastic resin types such as polyethylene terephthalate (PET), high-density polyethylene (HDPE), polypropylene (PP), polystyrene (PS), and polyvinyl chloride (PVC). These materials serve diverse applications across food and beverage packaging, pharmaceutical containers, cosmetic and personal care packaging, household product containers, and industrial packaging solutions.

Value chain participants include raw material suppliers, packaging manufacturers, converters, brand owners, retailers, and end consumers. The market encompasses both domestic production for local consumption and export-oriented manufacturing serving regional and global markets. Regulatory frameworks governing food safety, environmental protection, and product quality standards significantly influence market operations and development strategies.

Innovation drivers within this market include lightweighting technologies, barrier property enhancements, recyclability improvements, and smart packaging integration. The market’s evolution reflects broader trends in consumer preferences, sustainability requirements, and technological capabilities within Vietnam’s manufacturing sector.

Vietnam’s rigid plastic packaging market demonstrates exceptional growth potential driven by robust economic expansion, increasing industrial activity, and evolving consumer preferences. The market benefits from strategic geographic positioning, competitive manufacturing costs, and growing integration into global supply chains. Foreign direct investment continues to flow into the sector, enhancing production capabilities and technological sophistication.

Key growth drivers include expanding food and beverage industry, pharmaceutical sector development, personal care market growth, and increasing adoption of modern retail formats. The market shows particular strength in PET bottle production, HDPE container manufacturing, and specialized packaging for export markets. Sustainability trends are reshaping product development priorities, with manufacturers investing in recyclable materials and circular economy initiatives.

Competitive landscape features a mix of international corporations, regional players, and domestic manufacturers. Market consolidation trends are evident as larger players acquire smaller operations to achieve economies of scale and expand market reach. Technology adoption rates are accelerating, with manufacturers implementing advanced production equipment and quality control systems.

Regional integration through ASEAN trade agreements has opened new export opportunities while intensifying competitive pressures. The market demonstrates resilience to economic fluctuations, supported by diverse end-use applications and growing domestic consumption. Future prospects remain positive, with industry experts anticipating continued expansion driven by urbanization, income growth, and industrial development initiatives.

Market segmentation analysis reveals distinct growth patterns across different application categories and material types. The following insights provide comprehensive understanding of market dynamics:

Emerging trends include increased focus on lightweight packaging solutions, enhanced barrier properties for extended shelf life, and integration of smart packaging technologies. Consumer preferences are shifting toward sustainable packaging options, driving innovation in bio-based materials and improved recyclability features.

Economic growth momentum serves as the primary catalyst for Vietnam’s rigid plastic packaging market expansion. The country’s sustained GDP growth, industrial development initiatives, and increasing foreign investment create favorable conditions for packaging industry development. Manufacturing sector expansion across multiple industries generates consistent demand for diverse packaging solutions.

Urbanization trends significantly influence packaging requirements as urban consumers demonstrate increased preference for packaged goods, convenience products, and modern retail shopping experiences. Rising disposable incomes enable greater consumption of packaged food and beverage products, personal care items, and household goods requiring rigid plastic packaging.

Export-oriented manufacturing drives demand for high-quality packaging solutions meeting international standards. Vietnam’s integration into global supply chains requires packaging that ensures product integrity during long-distance transportation and storage. Trade agreement benefits through ASEAN and bilateral trade deals enhance market access opportunities for Vietnamese packaging manufacturers.

Technological advancement in packaging manufacturing enables production of increasingly sophisticated packaging solutions with enhanced functionality, improved aesthetics, and better environmental performance. Investment in modern equipment allows manufacturers to achieve higher production efficiency, consistent quality, and competitive cost structures.

Regulatory support through government policies promoting industrial development, foreign investment incentives, and infrastructure improvements creates an enabling environment for market growth. Food safety regulations drive demand for compliant packaging materials that ensure product safety and quality throughout the supply chain.

Environmental concerns regarding plastic waste management and ocean pollution create regulatory pressures and consumer resistance that may limit market growth. Sustainability requirements impose additional costs on manufacturers for developing eco-friendly alternatives and implementing recycling programs.

Raw material price volatility affects production costs and profit margins, particularly for petroleum-based plastic resins. Supply chain disruptions can impact material availability and increase procurement costs, affecting overall market stability and growth prospects.

Regulatory compliance costs associated with food safety standards, environmental regulations, and quality certifications require significant investments that may burden smaller manufacturers. International competition from established packaging producers in neighboring countries creates pricing pressures and market share challenges.

Technical skill shortages in advanced manufacturing processes and quality control systems may limit production efficiency and innovation capabilities. Infrastructure limitations in certain regions can constrain manufacturing expansion and distribution efficiency.

Economic uncertainties and potential trade policy changes may affect investment decisions and long-term planning for market participants. Consumer awareness regarding environmental impacts of plastic packaging may influence purchasing decisions and demand patterns.

Sustainable packaging innovation presents significant opportunities for manufacturers developing bio-based materials, enhanced recyclability features, and circular economy solutions. Government initiatives supporting green technology adoption and environmental protection create favorable conditions for sustainable packaging development.

E-commerce growth generates new demand for protective packaging solutions designed for online retail applications. Smart packaging integration offers opportunities for value-added products incorporating digital technologies, traceability features, and consumer engagement capabilities.

Regional export expansion through ASEAN market integration and bilateral trade agreements opens new revenue streams for Vietnamese manufacturers. Premium packaging segments in cosmetics, pharmaceuticals, and specialty foods offer higher margin opportunities for quality-focused producers.

Technology partnerships with international equipment suppliers and material developers can enhance production capabilities and product innovation. Vertical integration opportunities allow manufacturers to control supply chains and capture additional value through raw material production or downstream processing.

Niche market development in specialized applications such as medical packaging, industrial containers, and agricultural packaging provides growth avenues beyond traditional consumer goods applications. Investment incentives from government programs support capacity expansion and technology upgrades.

Supply and demand equilibrium in Vietnam’s rigid plastic packaging market reflects the interplay between growing consumption requirements and expanding production capabilities. Demand-side factors include population growth, urbanization, income increases, and changing consumer preferences toward packaged goods.

Supply-side dynamics encompass production capacity expansion, technology adoption, raw material availability, and manufacturing efficiency improvements. Market competition intensifies as new entrants seek market share while established players defend their positions through innovation and cost optimization.

Price dynamics reflect raw material costs, manufacturing efficiency, competitive pressures, and value-added features. Quality requirements continue to rise as brand owners seek packaging solutions that enhance product appeal, ensure safety, and meet sustainability criteria.

Innovation cycles drive market evolution through new material developments, manufacturing process improvements, and functional enhancements. Regulatory influences shape market dynamics through environmental standards, food safety requirements, and trade policies.

Investment flows into the sector support capacity expansion, technology upgrades, and market development initiatives. Market consolidation trends reflect economies of scale benefits and strategic positioning requirements in an increasingly competitive landscape.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes structured interviews with industry executives, manufacturers, suppliers, and end-users to gather firsthand market intelligence and validate secondary research findings.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial statements. Market sizing methodologies utilize bottom-up and top-down approaches to ensure consistency and accuracy in market quantification.

Data validation processes include cross-referencing multiple sources, expert consultations, and statistical analysis to ensure information reliability. Industry expert interviews provide qualitative insights into market trends, competitive dynamics, and future outlook perspectives.

Market segmentation analysis employs detailed categorization by material type, application, end-use industry, and geographic region. Competitive landscape assessment includes company profiling, market share analysis, and strategic positioning evaluation.

Trend analysis incorporates historical data review, current market assessment, and future projection modeling. Quality assurance protocols ensure data accuracy, consistency, and relevance throughout the research process.

Geographic distribution of Vietnam’s rigid plastic packaging market reveals distinct regional characteristics and growth patterns. Southern Vietnam, centered around Ho Chi Minh City, represents the largest manufacturing hub with approximately 45% of total production capacity. This region benefits from established industrial infrastructure, port access, and proximity to major consumer markets.

Northern Vietnam, including Hanoi and surrounding provinces, accounts for 35% of market activity and serves as a key manufacturing center for export-oriented production. The region’s strategic location near the Chinese border facilitates raw material imports and finished product exports.

Central Vietnam demonstrates emerging importance with 20% market share, driven by industrial development initiatives and infrastructure improvements. The region offers competitive manufacturing costs and growing integration into national supply chains.

Industrial zones throughout Vietnam provide specialized infrastructure for packaging manufacturers, including utilities, logistics support, and regulatory facilitation. Port cities such as Ho Chi Minh City, Haiphong, and Da Nang serve as critical export gateways for Vietnamese packaging products.

Regional specialization patterns emerge with certain areas focusing on specific packaging types or end-use applications. Investment distribution reflects regional advantages in terms of infrastructure, labor availability, and market access considerations.

Market structure in Vietnam’s rigid plastic packaging sector features a diverse mix of international corporations, regional players, and domestic manufacturers competing across various segments and applications.

Competitive strategies include capacity expansion, technology upgrades, product innovation, and market diversification. Strategic partnerships between international and domestic companies facilitate technology transfer and market access. Acquisition activities reflect industry consolidation trends and scale economy pursuits.

Market positioning varies from cost leadership strategies to premium quality differentiation approaches. Innovation focus areas include sustainable materials, lightweight designs, and enhanced functionality features.

Material-based segmentation reveals distinct market dynamics across different plastic resin types:

Application-based segmentation demonstrates diverse end-use requirements:

End-use industry segmentation reflects Vietnam’s economic structure and manufacturing capabilities across various sectors requiring rigid plastic packaging solutions.

Beverage packaging category represents the largest segment within Vietnam’s rigid plastic packaging market, driven by growing consumption of bottled water, soft drinks, and alcoholic beverages. PET bottles dominate this category due to their lightweight properties, clarity, and recyclability features. Innovation trends include lightweighting initiatives, enhanced barrier properties, and sustainable material integration.

Food packaging category demonstrates strong growth across multiple subcategories including dairy products, sauces, condiments, and ready-to-eat meals. Container designs focus on convenience features, extended shelf life, and microwave compatibility. Regulatory compliance requirements drive material selection and manufacturing process standards.

Personal care packaging category emphasizes aesthetic appeal, functionality, and brand differentiation. Premium positioning strategies require high-quality materials, sophisticated designs, and innovative dispensing systems. Sustainability initiatives increasingly influence product development and material selection decisions.

Pharmaceutical packaging category requires specialized materials and manufacturing processes to ensure product safety, stability, and regulatory compliance. Child-resistant closures, tamper-evident features, and barrier properties represent critical requirements. Quality standards exceed those of other categories due to health and safety implications.

Industrial packaging category serves diverse applications including chemicals, automotive fluids, and agricultural products. Durability requirements and chemical compatibility considerations drive material selection and design specifications.

Manufacturers benefit from Vietnam’s competitive cost structure, skilled workforce availability, and favorable investment climate. Production efficiency gains through modern equipment and technology adoption enable competitive pricing and quality improvements. Export opportunities through regional trade agreements provide access to broader markets and revenue diversification.

Brand owners gain access to high-quality packaging solutions that enhance product appeal, ensure safety, and support marketing objectives. Supply chain reliability and proximity to manufacturing facilities reduce logistics costs and lead times. Customization capabilities allow for tailored packaging solutions meeting specific brand requirements.

Consumers benefit from improved product protection, convenience features, and enhanced safety standards. Packaging innovations provide better functionality, extended shelf life, and user-friendly designs. Sustainability improvements address environmental concerns while maintaining product quality and safety.

Government stakeholders benefit from increased industrial activity, employment generation, and export revenue contributions. Technology transfer through foreign investment enhances domestic capabilities and competitiveness. Tax revenue and economic multiplier effects support broader economic development objectives.

Environmental benefits emerge through improved recycling infrastructure, sustainable material development, and circular economy initiatives. Innovation investments drive development of eco-friendly packaging solutions addressing environmental challenges.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping Vietnam’s rigid plastic packaging market. Circular economy principles drive development of recyclable materials, reduced packaging weight, and closed-loop recycling systems. Bio-based materials gain traction as manufacturers seek alternatives to traditional petroleum-based plastics.

Smart packaging integration introduces digital technologies including QR codes, NFC chips, and IoT sensors for enhanced consumer engagement and supply chain visibility. Traceability features become increasingly important for food safety, authenticity verification, and brand protection.

Lightweighting initiatives focus on material reduction while maintaining packaging performance and protection capabilities. Advanced design techniques and material innovations enable significant weight reductions without compromising functionality.

Customization demand increases as brands seek differentiated packaging solutions that enhance market positioning and consumer appeal. Short-run production capabilities become competitive advantages for manufacturers serving diverse customer requirements.

E-commerce packaging requirements drive innovation in protective packaging solutions designed for online retail applications. Shipping optimization and damage prevention become critical design considerations.

Capacity expansion projects across Vietnam demonstrate strong investor confidence in market growth prospects. Major international companies continue investing in new production facilities and technology upgrades to serve growing demand.

Technology partnerships between Vietnamese manufacturers and international equipment suppliers facilitate knowledge transfer and capability enhancement. Research and development initiatives focus on sustainable materials, improved manufacturing processes, and innovative packaging designs.

Regulatory developments include updated food safety standards, environmental protection requirements, and quality certification processes. Government initiatives supporting industrial development and export promotion create favorable operating conditions.

Merger and acquisition activities reflect industry consolidation trends as companies seek scale economies and market expansion opportunities. Strategic alliances enable resource sharing, technology access, and market development.

Sustainability certifications become increasingly important for market access and brand positioning. Recycling infrastructure development supports circular economy objectives and environmental compliance requirements.

MarkWide Research recommends that market participants focus on sustainable packaging innovation as a key differentiator and growth driver. Investment in recycling capabilities and bio-based material development will provide competitive advantages in an increasingly environmentally conscious market.

Technology adoption should prioritize automation, quality control systems, and digital integration to enhance manufacturing efficiency and product consistency. Workforce development programs will ensure availability of skilled personnel for advanced manufacturing operations.

Market diversification strategies should explore high-value applications in pharmaceuticals, cosmetics, and specialty foods to reduce dependence on commodity packaging segments. Export market development through ASEAN and bilateral trade agreements offers significant growth potential.

Supply chain optimization including raw material sourcing, inventory management, and logistics efficiency will improve cost competitiveness and customer service levels. Quality certification investments will enhance market credibility and access to premium applications.

Sustainability reporting and environmental compliance will become essential for maintaining market position and accessing international customers. Innovation partnerships with research institutions and technology providers will accelerate product development capabilities.

Long-term growth prospects for Vietnam’s rigid plastic packaging market remain highly positive, supported by continued economic expansion, industrial development, and consumer market evolution. Market maturation will likely bring increased focus on value-added products, sustainability features, and technological sophistication.

Sustainability requirements will increasingly influence market dynamics, driving innovation in recyclable materials, circular economy solutions, and environmental compliance. MWR analysis suggests that companies investing early in sustainable packaging technologies will gain significant competitive advantages.

Technology integration will accelerate across manufacturing processes, product design, and customer engagement platforms. Digital transformation initiatives will enhance operational efficiency, quality control, and market responsiveness.

Regional integration through ASEAN economic cooperation will create larger market opportunities while intensifying competitive pressures. Export growth potential remains substantial as Vietnamese manufacturers establish quality reputations and cost competitiveness.

Innovation cycles will likely accelerate as market demands become more sophisticated and differentiated. Investment requirements for technology, sustainability, and market development will favor larger, well-capitalized market participants.

Vietnam’s rigid plastic packaging market represents a compelling growth opportunity within the broader Southeast Asian packaging industry landscape. Strong fundamentals including economic growth, industrial expansion, and favorable demographics support sustained market development. The combination of competitive manufacturing capabilities, strategic location, and government support creates an attractive environment for both domestic and international market participants.

Sustainability transformation will define the market’s evolution as environmental concerns, regulatory requirements, and consumer preferences drive innovation in eco-friendly packaging solutions. Technology adoption and quality improvements will remain critical success factors for manufacturers seeking to compete in increasingly sophisticated market segments.

Future success will depend on companies’ ability to balance cost competitiveness with sustainability requirements, quality standards, and innovation capabilities. Market leaders will likely emerge from organizations that effectively combine operational excellence with strategic vision for long-term market development. The Vietnam rigid plastic packaging market’s trajectory points toward continued expansion, technological advancement, and increasing integration into regional and global value chains.

What is Rigid Plastic Packaging?

Rigid plastic packaging refers to containers made from plastic that maintain their shape and do not deform under normal handling. This type of packaging is commonly used for products such as food, beverages, and consumer goods due to its durability and versatility.

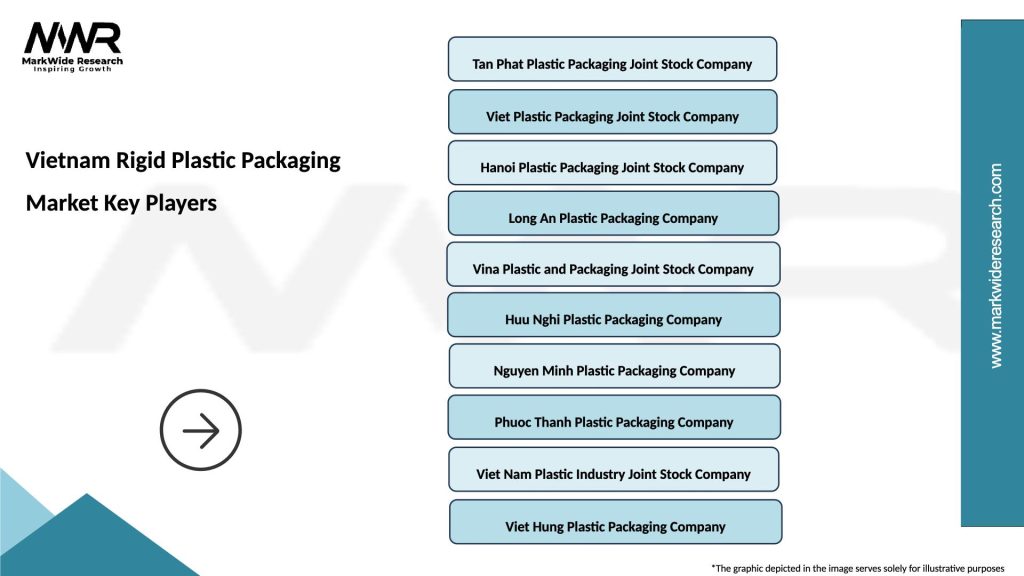

What are the key players in the Vietnam Rigid Plastic Packaging Market?

Key players in the Vietnam Rigid Plastic Packaging Market include companies like Tetra Pak, Amcor, and Sealed Air, which are known for their innovative packaging solutions and extensive product offerings in various sectors, including food and beverage, personal care, and pharmaceuticals, among others.

What are the growth factors driving the Vietnam Rigid Plastic Packaging Market?

The growth of the Vietnam Rigid Plastic Packaging Market is driven by increasing consumer demand for convenience, the rise of e-commerce, and the need for sustainable packaging solutions. Additionally, the expansion of the food and beverage industry significantly contributes to market growth.

What challenges does the Vietnam Rigid Plastic Packaging Market face?

The Vietnam Rigid Plastic Packaging Market faces challenges such as environmental concerns regarding plastic waste and stringent regulations on plastic usage. Additionally, competition from alternative packaging materials can impact market dynamics.

What opportunities exist in the Vietnam Rigid Plastic Packaging Market?

Opportunities in the Vietnam Rigid Plastic Packaging Market include the development of biodegradable plastics and smart packaging technologies. As consumer preferences shift towards sustainable options, companies can innovate to meet these demands.

What trends are shaping the Vietnam Rigid Plastic Packaging Market?

Trends in the Vietnam Rigid Plastic Packaging Market include the increasing adoption of lightweight materials and the integration of digital printing technologies. These trends enhance branding opportunities and reduce material usage, aligning with sustainability goals.

Vietnam Rigid Plastic Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Containers, Jars, Trays |

| Material | Polyethylene, Polypropylene, Polystyrene, PET |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Household |

| Packaging Type | Flexible, Rigid, Semi-Rigid, Blister |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Rigid Plastic Packaging Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at