444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Egypt rigid plastic packaging market represents a dynamic and rapidly evolving sector within the country’s manufacturing landscape. Rigid plastic packaging solutions have become increasingly essential across multiple industries, including food and beverage, pharmaceuticals, personal care, and industrial applications. The market demonstrates robust growth potential driven by urbanization, changing consumer preferences, and expanding retail infrastructure throughout Egypt.

Market dynamics indicate that Egypt’s rigid plastic packaging sector is experiencing significant transformation, with manufacturers increasingly adopting advanced technologies and sustainable practices. The market encompasses various product categories including bottles, containers, jars, caps, closures, and specialized packaging solutions. Growth projections suggest the market is expanding at a compound annual growth rate (CAGR) of 6.2%, reflecting strong demand across diverse end-user industries.

Regional positioning places Egypt as a strategic hub for rigid plastic packaging manufacturing in the Middle East and North Africa region. The country’s advantageous geographic location, coupled with government initiatives supporting industrial development, has attracted significant investment in packaging infrastructure. Manufacturing capabilities continue to expand, with local producers increasingly focusing on innovation and quality enhancement to meet international standards.

The Egypt rigid plastic packaging market refers to the comprehensive ecosystem of manufacturing, distribution, and consumption of inflexible plastic containers and packaging solutions within Egypt’s borders. Rigid plastic packaging encompasses non-flexible plastic containers that maintain their shape and structural integrity, including bottles, jars, containers, and closures made from various polymer materials such as polyethylene terephthalate (PET), high-density polyethylene (HDPE), and polypropylene (PP).

Market scope includes the entire value chain from raw material procurement and processing to final product delivery across multiple industry verticals. The sector encompasses both domestic production for local consumption and export-oriented manufacturing serving regional and international markets. Product categories span from small-volume containers for cosmetics and pharmaceuticals to large-capacity industrial packaging solutions.

Industry significance extends beyond mere packaging functionality, as these solutions play crucial roles in product preservation, brand differentiation, and consumer convenience. The market represents a critical component of Egypt’s broader manufacturing sector, contributing to employment generation, technological advancement, and economic diversification initiatives.

Market performance in Egypt’s rigid plastic packaging sector demonstrates consistent upward trajectory, supported by favorable demographic trends and expanding industrial base. The market benefits from strong domestic demand driven by population growth, urbanization, and rising disposable incomes. Key growth drivers include the expanding food and beverage industry, pharmaceutical sector development, and increasing adoption of modern retail formats.

Technological advancement remains a central theme, with manufacturers investing in state-of-the-art production equipment and sustainable packaging solutions. The market shows increasing adoption rates of approximately 15% annually for eco-friendly packaging alternatives, reflecting growing environmental consciousness among consumers and regulatory compliance requirements.

Competitive landscape features a mix of established multinational corporations and emerging local players, creating a dynamic environment that fosters innovation and competitive pricing. Market consolidation trends indicate strategic partnerships and acquisitions as companies seek to expand their market presence and technological capabilities.

Future prospects remain highly positive, with industry experts projecting sustained growth driven by infrastructure development, export expansion, and continued industrial diversification. The market is positioned to capitalize on regional trade opportunities and emerging applications in sectors such as e-commerce packaging and specialized industrial solutions.

Strategic insights reveal several critical factors shaping the Egypt rigid plastic packaging market landscape:

Primary growth drivers propelling the Egypt rigid plastic packaging market include several interconnected factors that create sustained demand across multiple sectors. Population growth and urbanization trends represent fundamental drivers, with Egypt’s expanding urban population requiring increased packaging solutions for consumer goods and industrial applications.

Economic development initiatives supported by government policies have stimulated industrial growth, creating increased demand for packaging solutions across manufacturing sectors. The food and beverage industry expansion particularly drives demand for rigid plastic containers, bottles, and specialized packaging solutions that ensure product safety and extend shelf life.

Retail sector modernization contributes significantly to market growth, as traditional retail formats evolve toward modern supermarkets and hypermarkets requiring standardized packaging solutions. E-commerce growth has created new demand categories for protective packaging and shipping containers, expanding market opportunities beyond traditional applications.

Export market development provides additional growth momentum, with Egyptian manufacturers increasingly targeting regional and international markets. The country’s competitive manufacturing costs and strategic location enable export competitiveness in rigid plastic packaging solutions. Infrastructure investments in transportation and logistics further support export-oriented growth strategies.

Technological advancement in manufacturing processes enables improved product quality, cost efficiency, and design flexibility, attracting new customers and applications. Sustainability initiatives drive demand for innovative packaging solutions that meet environmental standards while maintaining functional performance.

Market challenges facing the Egypt rigid plastic packaging sector include several factors that may limit growth potential or create operational difficulties. Raw material price volatility represents a significant constraint, as petroleum-based polymer prices fluctuate based on global oil markets and supply chain disruptions.

Environmental concerns and increasing regulatory pressure regarding plastic waste management create compliance challenges and additional operational costs. Sustainability requirements necessitate investments in recycling infrastructure and alternative materials, potentially impacting profit margins and requiring significant capital expenditure.

Competition from alternative packaging materials such as glass, metal, and biodegradable materials poses ongoing challenges, particularly in premium market segments where consumers prioritize environmental considerations. Import competition from low-cost international suppliers may pressure domestic manufacturers on pricing and market share.

Technical expertise limitations in specialized applications may restrict market expansion into high-value segments requiring advanced engineering and design capabilities. Infrastructure constraints in certain regions may limit distribution efficiency and market penetration in rural areas.

Economic uncertainties and currency fluctuations can impact investment decisions and long-term planning, particularly for export-oriented operations. Regulatory compliance costs associated with quality standards and environmental regulations may disproportionately affect smaller manufacturers, potentially leading to market consolidation.

Emerging opportunities in the Egypt rigid plastic packaging market present significant potential for growth and innovation across multiple dimensions. Sustainable packaging solutions represent a major opportunity, with increasing demand for recyclable, biodegradable, and reduced-material packaging alternatives driving innovation and premium pricing opportunities.

Export market expansion offers substantial growth potential, particularly targeting African markets where Egyptian manufacturers can leverage competitive advantages in cost, quality, and geographic proximity. Regional trade agreements and improved logistics infrastructure support export-oriented strategies and market diversification.

Pharmaceutical packaging growth presents high-value opportunities as Egypt’s healthcare sector expands and pharmaceutical manufacturing increases. Specialized packaging requirements for medications, medical devices, and healthcare products command premium pricing and require advanced technical capabilities.

E-commerce packaging solutions represent a rapidly growing opportunity as online retail expands throughout Egypt. Protective packaging and shipping containers designed for e-commerce applications offer new revenue streams and market segments.

Industrial packaging applications in sectors such as chemicals, automotive, and construction materials provide opportunities for specialized, high-performance packaging solutions. Custom packaging design and value-added services enable differentiation and premium positioning in competitive markets.

Technology integration opportunities include smart packaging solutions incorporating tracking, authentication, and consumer engagement features. Digital printing and customization capabilities enable small-batch production and personalized packaging solutions for niche markets.

Market dynamics in Egypt’s rigid plastic packaging sector reflect complex interactions between supply-side factors, demand drivers, and external influences. Supply chain integration has become increasingly important, with manufacturers seeking vertical integration opportunities to control costs and ensure quality consistency.

Demand patterns show seasonal variations across different application segments, with food and beverage packaging experiencing peak demand during religious holidays and summer months. Industrial applications demonstrate more consistent demand patterns but are sensitive to broader economic cycles and industrial production levels.

Price dynamics are influenced by raw material costs, energy prices, and competitive pressures from both domestic and international suppliers. Value-based pricing strategies are increasingly adopted for specialized applications and premium market segments, while commodity packaging remains price-sensitive.

Innovation cycles in the market are accelerating, with manufacturers investing approximately 8% of revenues in research and development activities. Product lifecycle management has become more sophisticated, with companies focusing on continuous improvement and rapid response to changing customer requirements.

Market consolidation trends indicate ongoing merger and acquisition activity as companies seek scale advantages and technological capabilities. Strategic partnerships between manufacturers and end-users are becoming more common, enabling collaborative product development and long-term supply agreements.

Comprehensive research methodology employed in analyzing the Egypt rigid plastic packaging market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, manufacturing specialists, and key stakeholders across the value chain.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and trend identification. Market sizing methodologies utilize both top-down and bottom-up approaches to validate findings and ensure consistency across different market segments.

Data collection processes include structured surveys of market participants, focus groups with end-users, and expert panel discussions to gather qualitative insights and validate quantitative findings. Statistical analysis employs advanced econometric models to identify correlations and forecast future market trends.

Quality assurance measures include cross-validation of data sources, peer review of analytical methodologies, and sensitivity analysis to test the robustness of conclusions. Market intelligence is continuously updated through ongoing monitoring of industry developments, regulatory changes, and competitive activities.

Analytical frameworks incorporate Porter’s Five Forces analysis, SWOT assessment, and value chain analysis to provide comprehensive market understanding. Forecasting models utilize multiple scenario analysis to account for various market development possibilities and risk factors.

Regional market distribution across Egypt reveals significant geographic variations in rigid plastic packaging demand and manufacturing concentration. Greater Cairo region dominates the market with approximately 45% market share, driven by high population density, industrial concentration, and proximity to major consumer markets.

Alexandria and Delta region represents the second-largest market segment, accounting for approximately 25% of total demand. This region benefits from port access, established industrial infrastructure, and strong agricultural processing activities that drive packaging demand. Manufacturing facilities in this region often focus on export-oriented production.

Upper Egypt regions show growing market potential, with increasing industrial development and infrastructure investments creating new demand centers. Regional development initiatives supported by government policies are attracting packaging manufacturers to establish operations in these areas, benefiting from lower operational costs and strategic incentives.

Suez Canal region presents unique opportunities due to its strategic location and expanding industrial zones. Logistics advantages and proximity to international shipping routes make this region attractive for export-oriented packaging manufacturers. Free trade zone facilities provide additional incentives for international companies seeking regional manufacturing bases.

Market penetration rates vary significantly across regions, with urban areas showing higher adoption of premium packaging solutions while rural regions focus primarily on functional, cost-effective packaging options. Distribution network development continues to expand market reach into previously underserved areas.

Competitive environment in Egypt’s rigid plastic packaging market features a diverse mix of international corporations, regional players, and local manufacturers competing across different market segments and price points. Market leadership is distributed among several key players, each with distinct competitive advantages and market positioning strategies.

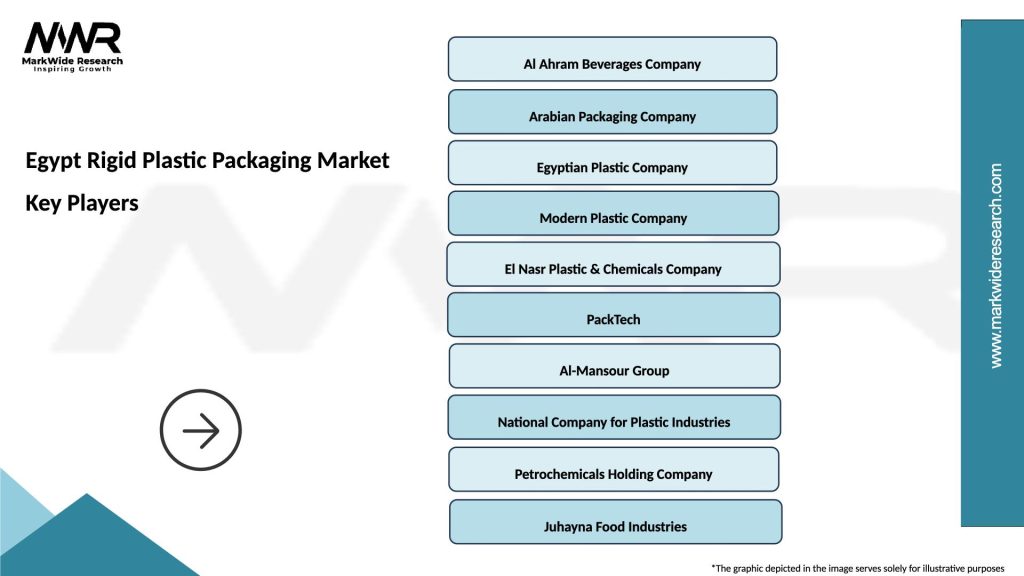

Major market participants include:

Competitive strategies vary significantly among market participants, with international players focusing on technology leadership and premium market segments, while local manufacturers compete primarily on cost efficiency and market responsiveness. Strategic partnerships and joint ventures are increasingly common as companies seek to combine technological expertise with local market knowledge.

Market segmentation analysis reveals distinct categories based on multiple criteria including product type, material composition, end-user application, and manufacturing technology. Product-based segmentation represents the primary classification framework for market analysis and strategic planning.

By Product Type:

By Material Type:

By End-User Industry:

Food and beverage packaging represents the largest category within Egypt’s rigid plastic packaging market, driven by expanding food processing industries and changing consumer lifestyles. Beverage bottles dominate this segment, with PET bottles showing particularly strong growth due to their lightweight properties and recyclability advantages.

Pharmaceutical packaging demonstrates the highest growth potential, with increasing healthcare investments and expanding pharmaceutical manufacturing creating demand for specialized packaging solutions. Regulatory compliance requirements drive premium pricing and create barriers to entry for new market participants. Child-resistant packaging and tamper-evident solutions represent high-value subcategories within this segment.

Personal care and cosmetics packaging shows strong growth driven by rising disposable incomes and increasing beauty consciousness among Egyptian consumers. Premium packaging solutions with enhanced aesthetic appeal and functional features command higher margins and demonstrate resilience to economic fluctuations.

Industrial packaging applications provide stable demand patterns with opportunities for long-term supply contracts and customized solutions. Chemical packaging requires specialized materials and designs, creating opportunities for manufacturers with advanced technical capabilities. Automotive packaging represents an emerging opportunity as Egypt’s automotive sector expands.

E-commerce packaging emerges as a rapidly growing category, with protective packaging solutions and shipping containers experiencing significant demand increases. This category requires innovative designs balancing protection, cost efficiency, and sustainability considerations.

Manufacturing companies benefit from Egypt’s rigid plastic packaging market through multiple value creation opportunities. Cost advantages from local raw material availability and competitive labor costs enable attractive profit margins and export competitiveness. Market diversification across multiple end-user industries reduces dependency risks and provides stable revenue streams.

Technology providers find significant opportunities in equipment supply, process optimization, and technical services. Advanced manufacturing technologies command premium pricing and create ongoing service revenue opportunities. Sustainability solutions represent a growing market segment with high-value potential.

Raw material suppliers benefit from growing demand and opportunities for vertical integration. Petrochemical companies can leverage Egypt’s energy resources to develop competitive polymer production capabilities. Recycling companies find expanding opportunities as circular economy principles gain adoption.

End-user industries benefit from improved packaging solutions that enhance product protection, extend shelf life, and support brand differentiation. Cost optimization through local sourcing reduces logistics expenses and supply chain risks. Customization capabilities enable tailored solutions meeting specific application requirements.

Investors find attractive opportunities in a growing market with strong fundamentals and government support. Export potential provides additional growth avenues and currency diversification benefits. Infrastructure development creates opportunities in logistics, recycling, and supporting services.

Government stakeholders benefit from industrial development, employment generation, and export revenue creation. Technology transfer and skills development contribute to broader economic modernization objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend shaping Egypt’s rigid plastic packaging market, with manufacturers increasingly adopting circular economy principles and developing recyclable packaging solutions. Bio-based materials and reduced-material designs are gaining traction as environmental consciousness grows among consumers and regulators.

Digital integration is revolutionizing packaging design and production processes, with smart packaging technologies incorporating QR codes, NFC chips, and other digital features. Industry 4.0 adoption in manufacturing facilities enables improved efficiency, quality control, and customization capabilities.

Lightweighting initiatives continue to gain momentum as manufacturers seek to reduce material costs and environmental impact while maintaining package integrity. Advanced design software and simulation technologies enable optimization of package structures for maximum efficiency.

Customization and personalization trends drive demand for flexible manufacturing capabilities and shorter production runs. Digital printing technologies enable cost-effective customization for small and medium-sized brands seeking differentiation in competitive markets.

Supply chain integration is becoming increasingly important, with manufacturers developing closer relationships with both suppliers and customers. Collaborative innovation and co-development projects are becoming more common as companies seek competitive advantages through partnership.

Regulatory compliance requirements are driving investments in quality systems and traceability capabilities. Food safety standards and pharmaceutical regulations create opportunities for specialized manufacturers with appropriate certifications and capabilities.

Recent industry developments demonstrate the dynamic nature of Egypt’s rigid plastic packaging market and indicate future growth directions. MarkWide Research analysis reveals several significant developments that are reshaping the competitive landscape and market opportunities.

Manufacturing capacity expansion represents a major development trend, with several international companies establishing or expanding production facilities in Egypt. Technology transfer agreements and joint venture formations are facilitating knowledge sharing and capability development in the local market.

Sustainability initiatives have accelerated, with major manufacturers announcing commitments to carbon neutrality and circular economy principles. Recycling infrastructure investments are expanding throughout the country, supported by both private sector initiatives and government policies.

Export market development has gained momentum, with Egyptian manufacturers securing significant contracts in African and Middle Eastern markets. Trade facilitation agreements and logistics infrastructure improvements are supporting export growth and market diversification strategies.

Digital transformation projects are being implemented across the industry, with manufacturers investing in automated production systems, quality control technologies, and supply chain management platforms. These investments are improving operational efficiency and competitive positioning.

Regulatory framework updates include new standards for packaging safety, environmental compliance, and quality assurance. Industry associations are playing increasingly important roles in standard development and market promotion activities.

Strategic recommendations for market participants in Egypt’s rigid plastic packaging sector focus on leveraging growth opportunities while addressing key challenges. Investment priorities should emphasize technology advancement, sustainability initiatives, and market diversification to ensure long-term competitiveness.

Manufacturing companies should prioritize investments in advanced production technologies and quality management systems to meet international standards and access premium market segments. Sustainability initiatives should be integrated into core business strategies rather than treated as compliance requirements.

Market expansion strategies should focus on export development and regional market penetration to reduce dependency on domestic demand fluctuations. Product diversification into high-value segments such as pharmaceuticals and specialty applications can improve profit margins and market resilience.

Partnership development with international technology providers and end-user companies can accelerate capability building and market access. Vertical integration opportunities should be evaluated to improve cost competitiveness and supply chain control.

Innovation investments in sustainable packaging solutions and smart packaging technologies can create competitive differentiation and access to premium market segments. Research and development partnerships with universities and research institutions can accelerate innovation while managing costs.

Risk management strategies should address raw material price volatility, regulatory changes, and competitive pressures through diversification and hedging mechanisms. Scenario planning and contingency strategies are essential for navigating market uncertainties.

Long-term prospects for Egypt’s rigid plastic packaging market remain highly positive, with multiple growth drivers supporting sustained expansion over the next decade. Market projections indicate continued growth at a compound annual growth rate of 6.8% through 2030, driven by demographic trends, economic development, and industrial diversification.

Technology evolution will continue to reshape the market, with automation, artificial intelligence, and sustainable materials becoming increasingly important competitive factors. Digital transformation will enable new business models and customer engagement strategies, creating opportunities for innovative market participants.

Sustainability requirements will intensify, driving demand for circular economy solutions and environmentally responsible packaging. Companies that successfully navigate this transition will gain significant competitive advantages and access to premium market segments.

Export market development presents substantial growth opportunities, with MWR analysis indicating potential for 25% annual export growth over the next five years. Regional trade integration and infrastructure improvements will facilitate market expansion and diversification.

Industry consolidation is expected to continue, with strategic mergers and acquisitions creating larger, more capable market participants. Technology partnerships and joint ventures will become increasingly important for accessing advanced capabilities and international markets.

Regulatory environment evolution will create both challenges and opportunities, with companies that proactively address compliance requirements gaining competitive advantages. Quality standards and sustainability regulations will continue to raise industry benchmarks and create barriers for low-quality competitors.

The Egypt rigid plastic packaging market represents a dynamic and rapidly evolving sector with substantial growth potential and attractive investment opportunities. Market fundamentals remain strong, supported by favorable demographics, expanding industrial base, and strategic geographic advantages that position Egypt as a regional hub for packaging manufacturing.

Growth trajectory analysis indicates sustained expansion driven by multiple factors including urbanization, industrial diversification, export development, and technological advancement. The market’s resilience and adaptability have been demonstrated through successful navigation of economic challenges and evolving regulatory requirements.

Competitive landscape evolution toward greater sophistication and international standards creates opportunities for companies that invest in technology, quality, and sustainability initiatives. Market segmentation reveals diverse opportunities across multiple end-user industries, enabling risk diversification and specialized positioning strategies.

Future success in this market will depend on companies’ ability to balance traditional competitive factors such as cost and quality with emerging requirements including sustainability, innovation, and digital integration. Strategic positioning for long-term growth requires comprehensive understanding of market dynamics, customer needs, and regulatory trends.

The Egypt rigid plastic packaging market stands poised for continued expansion, offering significant opportunities for manufacturers, investors, and supporting industries that align their strategies with market evolution trends and customer requirements. Sustainable growth will reward companies that successfully integrate operational excellence with environmental responsibility and technological innovation.

What is Rigid Plastic Packaging?

Rigid plastic packaging refers to containers made from plastic that maintain their shape and do not deform under normal handling. This type of packaging is commonly used for food, beverages, pharmaceuticals, and consumer goods due to its durability and versatility.

What are the key players in the Egypt Rigid Plastic Packaging Market?

Key players in the Egypt Rigid Plastic Packaging Market include companies like Juhayna Food Industries, El-Nasr Plastic, and Al-Ahram Beverages Company, among others. These companies are involved in producing a variety of rigid plastic packaging solutions for different industries.

What are the growth factors driving the Egypt Rigid Plastic Packaging Market?

The growth of the Egypt Rigid Plastic Packaging Market is driven by increasing demand for packaged food and beverages, rising consumer awareness about hygiene, and the convenience of plastic packaging. Additionally, the expansion of the retail sector contributes to this growth.

What challenges does the Egypt Rigid Plastic Packaging Market face?

The Egypt Rigid Plastic Packaging Market faces challenges such as environmental concerns regarding plastic waste and stringent regulations on plastic usage. Additionally, competition from alternative packaging materials can impact market growth.

What opportunities exist in the Egypt Rigid Plastic Packaging Market?

Opportunities in the Egypt Rigid Plastic Packaging Market include the development of sustainable packaging solutions and innovations in biodegradable plastics. The growing e-commerce sector also presents new avenues for rigid plastic packaging applications.

What trends are shaping the Egypt Rigid Plastic Packaging Market?

Trends in the Egypt Rigid Plastic Packaging Market include the increasing adoption of smart packaging technologies and the shift towards lightweight packaging solutions. Additionally, there is a growing focus on recycling and reducing the carbon footprint of packaging materials.

Egypt Rigid Plastic Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Containers, Jars, Trays |

| Material | Polyethylene, Polypropylene, Polystyrene, PET |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Household Products |

| Packaging Type | Flexible Packaging, Rigid Packaging, Blister Packs, Clamshells |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Egypt Rigid Plastic Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at