444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam flexible plastic packaging market represents one of the most dynamic and rapidly expanding segments within Southeast Asia’s packaging industry. Market dynamics indicate substantial growth driven by increasing consumer demand, urbanization, and the expansion of retail sectors across the country. The market encompasses a diverse range of products including pouches, bags, films, wraps, and specialized packaging solutions for various industries.

Growth projections suggest the market is experiencing robust expansion at a CAGR of 8.2%, significantly outpacing regional averages. This acceleration stems from Vietnam’s strategic position as a manufacturing hub and its growing middle-class population with evolving consumption patterns. The market benefits from foreign direct investment in manufacturing facilities and the country’s integration into global supply chains.

Key applications span across food and beverage packaging, pharmaceutical packaging, personal care products, and industrial applications. The food packaging segment dominates with approximately 65% market share, reflecting Vietnam’s strong agricultural sector and growing processed food industry. E-commerce growth has further accelerated demand for flexible packaging solutions, particularly in urban centers like Ho Chi Minh City and Hanoi.

The Vietnam flexible plastic packaging market refers to the comprehensive ecosystem of lightweight, adaptable packaging materials manufactured from various plastic polymers including polyethylene, polypropylene, polyester, and specialized barrier films. These materials are designed to provide protection, preservation, and convenience while maintaining cost-effectiveness and sustainability considerations.

Flexible packaging encompasses products that can be readily shaped, formed, or molded to accommodate different product requirements. This includes stand-up pouches, flexible films, shrink wraps, stretch films, and multi-layer barrier packaging solutions. The technology enables manufacturers to create customized packaging that optimizes product shelf life while minimizing material usage and transportation costs.

Market participants include domestic manufacturers, international corporations, and specialized converters who transform raw materials into finished packaging products. The sector serves diverse industries from traditional agriculture and food processing to modern consumer goods and pharmaceutical applications, making it integral to Vietnam’s economic development strategy.

Vietnam’s flexible plastic packaging market demonstrates exceptional growth potential driven by rapid industrialization, urbanization, and changing consumer preferences. The market benefits from government initiatives promoting manufacturing and export-oriented industries, creating favorable conditions for packaging sector expansion.

Key growth drivers include the expanding food processing industry, increasing retail modernization, and growing e-commerce penetration reaching 42% of urban consumers. The market shows strong diversification across applications, with emerging segments in pharmaceutical and personal care packaging gaining significant traction alongside traditional food packaging applications.

Technological advancement plays a crucial role in market evolution, with manufacturers adopting advanced printing technologies, barrier coating systems, and sustainable material innovations. The integration of digital printing capabilities has enabled shorter production runs and customized packaging solutions, particularly benefiting small and medium enterprises.

Regional distribution shows concentration in industrial zones around major cities, with Ho Chi Minh City accounting for 35% of production capacity and Hanoi region representing 25% of market activity. The market structure includes both large-scale integrated manufacturers and specialized converters serving niche applications.

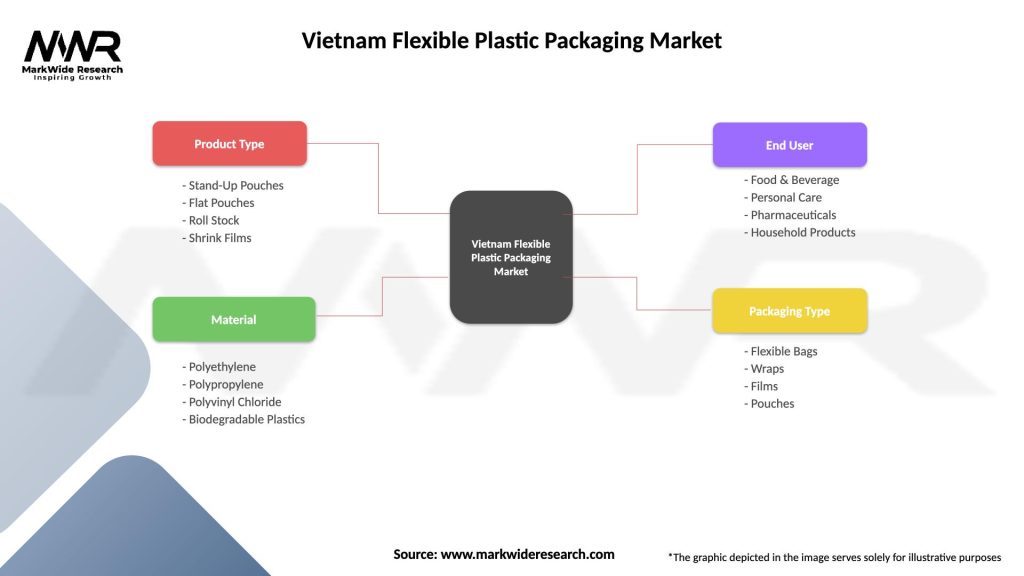

Market segmentation reveals diverse opportunities across multiple dimensions including material type, application, end-use industry, and geographic distribution. Understanding these segments provides crucial insights for strategic planning and investment decisions.

Economic growth serves as the primary catalyst for Vietnam’s flexible plastic packaging market expansion. The country’s GDP growth trajectory, coupled with increasing disposable income levels, creates sustained demand for packaged goods across multiple consumer categories. Urbanization trends contribute significantly, with urban population growth driving demand for convenient, portable packaging solutions.

Food industry expansion represents a major growth driver, particularly in processed foods, snacks, and ready-to-eat meals. Vietnam’s agricultural abundance combined with modern processing technologies creates substantial packaging requirements. The growing export of agricultural products also necessitates high-quality packaging solutions that meet international standards and extend shelf life during transportation.

Retail modernization accelerates market growth through the expansion of supermarkets, convenience stores, and modern trade channels. These retail formats require sophisticated packaging that enhances product presentation, provides consumer information, and ensures product integrity. The shift from traditional wet markets to organized retail creates new packaging requirements and quality standards.

E-commerce proliferation generates substantial demand for protective and efficient packaging solutions. Online retail growth necessitates packaging that can withstand shipping stresses while minimizing costs and environmental impact. The rise of food delivery services further expands packaging requirements for takeaway and delivery applications.

Environmental concerns pose significant challenges to the flexible plastic packaging market, with increasing scrutiny on plastic waste and its environmental impact. Government regulations targeting single-use plastics and growing consumer awareness about sustainability issues create pressure for alternative solutions and recycling initiatives.

Raw material price volatility affects market stability, particularly fluctuations in petroleum-based polymer prices. These variations impact production costs and profit margins, requiring manufacturers to implement sophisticated pricing strategies and supply chain management approaches. Currency fluctuations also affect import costs for specialized materials and equipment.

Technical complexity in advanced packaging applications requires significant investment in technology and skilled workforce development. Many manufacturers face challenges in upgrading equipment and training personnel to meet evolving quality standards and customer requirements. The need for continuous innovation demands substantial research and development investments.

Competition from alternatives includes rigid packaging solutions, paper-based materials, and emerging biodegradable options. These alternatives may offer specific advantages in certain applications, requiring flexible packaging manufacturers to continuously demonstrate value propositions and develop competitive solutions.

Sustainable packaging solutions present substantial opportunities for market expansion and differentiation. Development of recyclable, biodegradable, and compostable flexible packaging materials addresses environmental concerns while meeting performance requirements. Companies investing in sustainable technologies can capture growing market segments focused on environmental responsibility.

Export market expansion offers significant growth potential, leveraging Vietnam’s competitive manufacturing costs and strategic location. The country’s participation in trade agreements like CPTPP and EVFTA creates preferential access to major markets, enabling packaging manufacturers to serve regional and global customers effectively.

Technology integration creates opportunities for smart packaging solutions incorporating sensors, indicators, and digital connectivity. These innovations enhance product traceability, safety monitoring, and consumer engagement while commanding premium pricing. Investment in Industry 4.0 technologies can improve operational efficiency and product quality.

Pharmaceutical packaging growth represents an emerging opportunity driven by healthcare sector expansion and aging population demographics. Specialized packaging requirements for medications, medical devices, and healthcare products offer higher margins and stable demand patterns compared to traditional applications.

Supply chain integration shapes market dynamics through vertical and horizontal consolidation trends. Manufacturers are establishing closer relationships with raw material suppliers and end-user industries to ensure supply security and cost optimization. This integration enables better demand forecasting and inventory management while reducing transaction costs.

Technological advancement drives continuous market evolution through improved production processes, material innovations, and quality enhancement systems. Manufacturers investing in modern equipment achieve 25% efficiency improvements while reducing waste and energy consumption. Digital technologies enable real-time monitoring and predictive maintenance capabilities.

Regulatory environment influences market development through food safety standards, environmental regulations, and trade policies. Compliance requirements drive investment in quality management systems and testing capabilities while creating barriers for smaller manufacturers. Evolving regulations require continuous adaptation and investment in compliance infrastructure.

Consumer behavior changes impact packaging requirements through preferences for convenience, sustainability, and product information. Demographic shifts, lifestyle changes, and cultural evolution create new packaging needs and design requirements. Understanding these trends enables manufacturers to develop targeted solutions and capture emerging market segments.

Primary research forms the foundation of market analysis through comprehensive surveys, interviews, and direct engagement with industry stakeholders. This approach includes structured questionnaires administered to manufacturers, suppliers, distributors, and end-users across different market segments and geographic regions within Vietnam.

Secondary research encompasses extensive analysis of industry reports, government publications, trade association data, and academic studies. This methodology ensures comprehensive coverage of market trends, regulatory developments, and technological innovations affecting the flexible plastic packaging sector.

Data validation employs triangulation techniques comparing information from multiple sources to ensure accuracy and reliability. Cross-verification of quantitative data with qualitative insights provides robust analytical foundations for market projections and strategic recommendations.

Market modeling utilizes statistical analysis and forecasting techniques to project future market trends and growth patterns. This approach considers multiple variables including economic indicators, demographic trends, industry developments, and regulatory changes to generate comprehensive market outlook scenarios.

Southern Vietnam dominates the flexible plastic packaging market, centered around Ho Chi Minh City and surrounding industrial zones. This region accounts for approximately 40% of national production capacity and benefits from established manufacturing infrastructure, skilled workforce, and proximity to major ports facilitating raw material imports and finished product exports.

Northern Vietnam represents the second-largest market concentration, with Hanoi and surrounding provinces hosting significant manufacturing facilities. The region benefits from government administrative presence, established industrial parks, and growing consumer markets. Northern region market share reaches approximately 30% of national capacity.

Central Vietnam shows emerging growth potential driven by industrial development initiatives and improving transportation infrastructure. Cities like Da Nang and surrounding areas are attracting investment in manufacturing facilities, particularly those serving export markets. The region’s strategic location enables efficient distribution to both northern and southern markets.

Mekong Delta region presents unique opportunities related to agricultural packaging applications. The area’s abundant agricultural production creates substantial demand for packaging solutions for fresh produce, processed foods, and agricultural exports. Specialized packaging requirements for tropical products drive innovation in barrier technologies and preservation systems.

Market structure includes a diverse mix of international corporations, domestic manufacturers, and specialized converters serving different market segments. The competitive environment encourages innovation, quality improvement, and cost optimization while maintaining service excellence.

By Material Type: The market segments into various polymer categories each serving specific application requirements and performance characteristics. Polyethylene dominates with versatile applications, while specialized materials address specific barrier and performance needs.

By Application: Market applications span diverse industries with varying requirements for protection, preservation, and presentation. Each application segment demands specific material properties and manufacturing processes.

Food packaging category demonstrates the strongest growth momentum, driven by expanding food processing industry and changing consumer preferences. This segment benefits from increasing demand for convenient, portable food products and the growth of modern retail channels. Innovation focus centers on extending shelf life, improving food safety, and enhancing consumer convenience.

Pharmaceutical packaging represents the highest-value segment with stringent quality requirements and regulatory compliance needs. Growth drivers include healthcare sector expansion, aging population demographics, and increasing healthcare awareness. This category demands specialized materials, controlled manufacturing environments, and comprehensive quality management systems.

Personal care packaging shows strong growth potential driven by rising disposable incomes and beauty consciousness among Vietnamese consumers. The segment benefits from premiumization trends and the expansion of international beauty brands in the Vietnamese market. Design innovation and aesthetic appeal play crucial roles in this category.

Industrial packaging applications provide stable demand patterns serving manufacturing and export industries. This category includes packaging for chemicals, agricultural products, and industrial materials requiring specific barrier properties and durability characteristics. Bulk packaging solutions and specialized applications offer differentiation opportunities.

Manufacturers benefit from Vietnam’s competitive cost structure, skilled workforce availability, and favorable government policies supporting industrial development. The country’s strategic location provides access to regional markets while domestic demand growth ensures stable business foundations.

End-users gain access to diverse packaging solutions meeting specific requirements while benefiting from competitive pricing and improving quality standards. Local manufacturing capabilities ensure reliable supply and responsive customer service.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation emerges as the most significant trend reshaping the flexible plastic packaging market. Manufacturers are investing in recyclable materials, biodegradable alternatives, and circular economy initiatives. Consumer awareness about environmental impact drives demand for sustainable packaging solutions, with 72% of consumers expressing willingness to pay premium prices for environmentally responsible packaging.

Digital printing adoption revolutionizes packaging customization and short-run production capabilities. This technology enables cost-effective production of customized packaging for small and medium enterprises while reducing inventory requirements and waste generation. Digital integration also facilitates smart packaging solutions incorporating QR codes and interactive features.

E-commerce packaging optimization drives innovation in protective and efficient packaging solutions. The growth of online retail creates demand for packaging that balances protection, cost-effectiveness, and sustainability. Packaging design increasingly focuses on unboxing experience and brand differentiation in digital commerce environments.

Barrier technology advancement enables extended shelf life and improved product protection across various applications. Innovations in multi-layer films and coating technologies provide enhanced performance while reducing material usage. These developments particularly benefit food packaging applications requiring extended preservation capabilities.

Investment expansion characterizes recent industry developments with both domestic and international companies establishing new manufacturing facilities. MarkWide Research analysis indicates significant capacity additions planned over the next five years, driven by growing domestic demand and export opportunities.

Technology partnerships between Vietnamese manufacturers and international technology providers accelerate capability development and quality improvement initiatives. These collaborations enable access to advanced manufacturing processes, quality management systems, and sustainable packaging technologies.

Regulatory developments include new food safety standards and environmental regulations affecting packaging requirements. The government’s focus on reducing plastic waste drives investment in recycling infrastructure and sustainable packaging alternatives. These regulatory changes create both challenges and opportunities for market participants.

Merger and acquisition activities reshape the competitive landscape as companies seek to achieve scale advantages and technological capabilities. Consolidation trends enable more efficient operations while expanding market reach and customer service capabilities.

Investment prioritization should focus on sustainable packaging technologies and advanced manufacturing capabilities. Companies investing early in environmentally friendly solutions will capture growing market segments while meeting evolving regulatory requirements. MWR analysis suggests that sustainability-focused investments yield 15% higher returns compared to traditional capacity expansion.

Market diversification strategies should target high-value segments including pharmaceutical packaging, electronics packaging, and specialized industrial applications. These segments offer higher margins and more stable demand patterns compared to commodity packaging applications. Building expertise in regulatory compliance and quality management systems enables access to these premium markets.

Technology adoption recommendations include investment in digital printing capabilities, smart packaging solutions, and Industry 4.0 technologies. These investments improve operational efficiency, enable customization capabilities, and enhance customer service levels. Companies should also consider partnerships with technology providers to accelerate capability development.

Export market development should leverage Vietnam’s competitive advantages and strategic location. Focus on markets with growing packaging demand and favorable trade relationships. Building quality certifications and international standards compliance enables access to premium export markets with higher profitability.

Growth trajectory remains positive with sustained expansion expected across multiple market segments. The combination of domestic demand growth, export opportunities, and technological advancement creates favorable conditions for continued market development. Long-term projections indicate sustained growth rates exceeding regional averages.

Technology evolution will drive market transformation through sustainable materials, smart packaging solutions, and advanced manufacturing processes. Companies adapting to these technological changes will capture competitive advantages while those failing to innovate may face market share erosion. Innovation investment becomes crucial for long-term success.

Sustainability requirements will increasingly influence market dynamics, with environmental considerations becoming primary factors in packaging selection decisions. Manufacturers developing comprehensive sustainability strategies will benefit from regulatory compliance advantages and consumer preference alignment.

Market consolidation trends are expected to continue as companies seek scale advantages and technological capabilities. This consolidation will create more efficient market structure while potentially reducing competition in certain segments. Strategic positioning becomes crucial for maintaining competitive advantages in evolving market conditions.

Vietnam’s flexible plastic packaging market presents exceptional growth opportunities driven by economic development, urbanization, and evolving consumer preferences. The market benefits from favorable government policies, competitive manufacturing costs, and strategic geographic location enabling access to regional and global markets.

Key success factors include investment in sustainable technologies, quality improvement initiatives, and market diversification strategies. Companies focusing on high-value segments while maintaining cost competitiveness will capture the greatest opportunities in this dynamic market environment.

Future market development will be shaped by sustainability requirements, technological advancement, and regulatory evolution. Market participants adapting to these changes while maintaining operational excellence will achieve sustainable competitive advantages and superior financial performance in Vietnam’s expanding flexible plastic packaging market.

What is Flexible Plastic Packaging?

Flexible Plastic Packaging refers to packaging made from flexible materials that can be easily shaped and molded. This type of packaging is widely used in various industries, including food, pharmaceuticals, and consumer goods, due to its lightweight and versatile nature.

What are the key players in the Vietnam Flexible Plastic Packaging Market?

Key players in the Vietnam Flexible Plastic Packaging Market include companies like Tan Phat Plastic Packaging, Binh Minh Plastic, and An Phat Holdings, which are known for their innovative packaging solutions and extensive product ranges, among others.

What are the growth factors driving the Vietnam Flexible Plastic Packaging Market?

The growth of the Vietnam Flexible Plastic Packaging Market is driven by increasing consumer demand for convenient packaging, the rise of e-commerce, and the need for sustainable packaging solutions. Additionally, the food and beverage sector’s expansion significantly contributes to market growth.

What challenges does the Vietnam Flexible Plastic Packaging Market face?

The Vietnam Flexible Plastic Packaging Market faces challenges such as environmental concerns regarding plastic waste and stringent regulations on packaging materials. Additionally, competition from alternative packaging solutions can hinder market growth.

What opportunities exist in the Vietnam Flexible Plastic Packaging Market?

Opportunities in the Vietnam Flexible Plastic Packaging Market include the development of biodegradable packaging materials and the increasing demand for customized packaging solutions. The growing trend towards sustainability also presents avenues for innovation and market expansion.

What trends are shaping the Vietnam Flexible Plastic Packaging Market?

Trends shaping the Vietnam Flexible Plastic Packaging Market include the adoption of smart packaging technologies and the shift towards eco-friendly materials. Additionally, the rise of online shopping is influencing packaging designs to enhance product visibility and consumer engagement.

Vietnam Flexible Plastic Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Stand-Up Pouches, Flat Pouches, Roll Stock, Shrink Films |

| Material | Polyethylene, Polypropylene, Polyvinyl Chloride, Biodegradable Plastics |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Household Products |

| Packaging Type | Flexible Bags, Wraps, Films, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

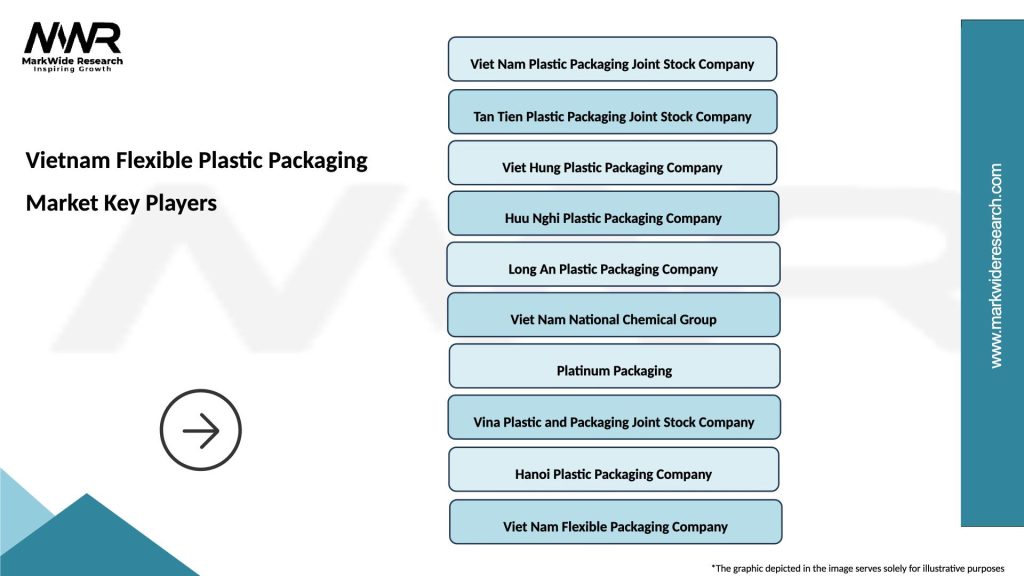

Leading companies in the Vietnam Flexible Plastic Packaging Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at