444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Peru cybersecurity market represents a rapidly evolving landscape driven by increasing digital transformation initiatives, growing cyber threats, and heightened awareness of data protection requirements across various industries. Peru’s cybersecurity sector has experienced significant momentum as organizations recognize the critical importance of protecting their digital assets and maintaining operational continuity in an increasingly connected business environment.

Digital transformation acceleration across Peru’s public and private sectors has created substantial demand for comprehensive cybersecurity solutions. The market encompasses various security technologies including network security, endpoint protection, cloud security, identity and access management, and security analytics. Government initiatives promoting digitalization and regulatory compliance have further strengthened the market foundation, creating opportunities for both international and domestic cybersecurity providers.

Market growth is projected at approximately 12.5% CAGR over the forecast period, reflecting the urgent need for robust security infrastructure. The increasing frequency of cyber attacks targeting Peruvian organizations, combined with growing regulatory requirements and digital adoption rates, continues to drive investment in advanced cybersecurity technologies and services.

The Peru cybersecurity market refers to the comprehensive ecosystem of security technologies, services, and solutions designed to protect digital infrastructure, data, and systems from cyber threats within Peru’s business and government sectors. This market encompasses various security domains including network protection, data security, application security, cloud security, and managed security services tailored to address the unique challenges and requirements of Peruvian organizations.

Cybersecurity solutions in Peru include both preventive and reactive measures, ranging from firewalls and antivirus software to advanced threat detection systems and incident response services. The market serves diverse sectors including banking and financial services, government agencies, healthcare organizations, manufacturing companies, and telecommunications providers, each with specific security requirements and compliance obligations.

Peru’s cybersecurity market demonstrates robust growth potential driven by accelerating digital transformation, increasing cyber threat sophistication, and strengthening regulatory frameworks. The market benefits from growing awareness among organizations regarding the critical importance of cybersecurity investments and the potential consequences of security breaches on business operations and reputation.

Key market drivers include the rapid adoption of cloud computing services, increasing mobile device usage, expanding e-commerce activities, and government initiatives promoting digital governance. Approximately 68% of Peruvian organizations have increased their cybersecurity budgets in response to evolving threat landscapes and regulatory requirements.

Market segmentation reveals strong demand across multiple solution categories, with network security and endpoint protection representing the largest segments. The services segment, including managed security services and consulting, shows particularly strong growth as organizations seek expert guidance in implementing comprehensive security strategies.

Strategic market insights reveal several critical trends shaping Peru’s cybersecurity landscape:

Digital transformation acceleration serves as the primary driver for Peru’s cybersecurity market growth. Organizations across various sectors are implementing digital technologies to improve operational efficiency, enhance customer experiences, and maintain competitive advantages. This digital shift creates expanded attack surfaces and new security vulnerabilities that require comprehensive protection strategies.

Regulatory compliance requirements continue to strengthen market demand as Peru implements more stringent data protection and cybersecurity regulations. The Personal Data Protection Law and sector-specific regulations in banking, healthcare, and telecommunications create mandatory security requirements that drive consistent investment in cybersecurity solutions.

Increasing cyber threat sophistication represents another critical market driver. Peruvian organizations face growing numbers of advanced persistent threats, ransomware attacks, and social engineering attempts. Cyber attack frequency has increased by approximately 35% annually, creating urgent demand for advanced threat detection and response capabilities.

Cloud adoption growth drives specific demand for cloud security solutions as organizations migrate critical applications and data to cloud platforms. The need for secure cloud configurations, data encryption, and cloud access security brokers continues to expand as cloud adoption accelerates across Peru’s business landscape.

Budget constraints represent a significant challenge for many Peruvian organizations, particularly small and medium enterprises with limited financial resources for comprehensive cybersecurity investments. The perception of cybersecurity as a cost center rather than a business enabler continues to limit investment levels in some sectors.

Skills shortage in cybersecurity professionals creates implementation and management challenges for organizations seeking to build internal security capabilities. The limited availability of qualified cybersecurity experts in Peru’s job market increases costs and extends implementation timelines for security projects.

Technology complexity poses adoption barriers for organizations lacking technical expertise to implement and manage advanced cybersecurity solutions. The complexity of integrating multiple security tools and maintaining effective security operations centers can overwhelm organizations with limited IT resources.

Awareness gaps persist among some organizations regarding the true scope and potential impact of cyber threats. Insufficient understanding of cybersecurity risks and the business value of security investments continues to limit market growth in certain sectors and organization sizes.

Government digitalization initiatives create substantial opportunities for cybersecurity providers as public sector agencies implement digital governance platforms and citizen services. The government’s commitment to digital transformation includes significant cybersecurity requirements that will drive consistent demand for security solutions and services.

Financial sector expansion presents significant growth opportunities as Peru’s banking and financial services sector continues to innovate with digital payment systems, mobile banking applications, and fintech solutions. Regulatory requirements and customer trust considerations make cybersecurity investments essential for financial institutions.

SME market penetration offers substantial growth potential as affordable, cloud-based security solutions become more accessible to smaller organizations. Approximately 78% of Peruvian SMEs have not implemented comprehensive cybersecurity measures, representing a significant market opportunity for solution providers.

Managed security services demand continues to grow as organizations seek to address skills shortages and reduce operational complexity. The opportunity to provide comprehensive security monitoring, incident response, and compliance management services appeals to organizations across various sectors and sizes.

Market dynamics in Peru’s cybersecurity sector reflect the complex interplay between technological advancement, threat evolution, regulatory development, and organizational maturity. The market demonstrates strong growth momentum driven by increasing recognition of cybersecurity as a business imperative rather than merely a technical requirement.

Competitive dynamics show a mix of international cybersecurity vendors and emerging local providers competing across different market segments. International vendors typically focus on enterprise customers with comprehensive security requirements, while local providers often target SME markets with cost-effective, localized solutions.

Technology evolution continues to reshape market dynamics as artificial intelligence, machine learning, and automation become integral components of cybersecurity solutions. Organizations increasingly seek integrated security platforms that provide comprehensive protection while reducing operational complexity and management overhead.

Customer behavior patterns indicate growing sophistication in cybersecurity procurement decisions, with organizations conducting more thorough risk assessments and seeking solutions that align with specific business requirements and compliance obligations. Security investment priorities have shifted toward proactive threat detection and response capabilities rather than purely preventive measures.

Research methodology for analyzing Peru’s cybersecurity market employs a comprehensive approach combining primary and secondary research techniques to ensure accurate and reliable market insights. The methodology incorporates quantitative analysis of market trends, competitive landscape assessment, and qualitative evaluation of industry dynamics and growth drivers.

Primary research activities include structured interviews with cybersecurity vendors, end-user organizations, government officials, and industry experts to gather firsthand insights into market conditions, challenges, and opportunities. Survey research among IT decision-makers and security professionals provides quantitative data on adoption patterns, investment priorities, and technology preferences.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, and company financial statements to establish market context and validate primary research findings. MarkWide Research analysts utilize proprietary databases and analytical frameworks to ensure comprehensive market coverage and accurate trend identification.

Data validation processes include cross-referencing multiple sources, conducting expert reviews, and applying statistical analysis techniques to ensure research accuracy and reliability. The methodology emphasizes current market conditions while incorporating forward-looking analysis based on identified trends and market drivers.

Lima metropolitan area dominates Peru’s cybersecurity market, accounting for approximately 65% of total market activity due to the concentration of large enterprises, government agencies, and financial institutions. The capital region benefits from better technology infrastructure, higher cybersecurity awareness levels, and greater availability of skilled professionals.

Northern regions including Trujillo and Chiclayo show growing cybersecurity adoption driven by expanding manufacturing and agricultural export industries. These regions demonstrate increasing recognition of cybersecurity importance as businesses implement digital technologies to improve operational efficiency and market competitiveness.

Southern regions centered around Arequipa and Cusco present emerging opportunities as mining companies, tourism operators, and regional businesses invest in digital transformation initiatives. The growing importance of these regions in Peru’s economy drives corresponding increases in cybersecurity investment requirements.

Coastal regions benefit from better internet connectivity and higher technology adoption rates, creating favorable conditions for cybersecurity market growth. Port cities and industrial centers along Peru’s coast demonstrate particular demand for network security and industrial control system protection solutions.

Competitive landscape in Peru’s cybersecurity market features a diverse mix of international technology vendors, regional solution providers, and emerging local companies competing across various market segments and customer categories.

Local and regional providers focus on delivering cost-effective solutions with localized support and Spanish-language services, particularly targeting SME markets and specific industry verticals with specialized requirements.

By Solution Type:

By Service Type:

By Deployment Model:

Network Security maintains the largest market share due to fundamental requirements for perimeter protection and network monitoring. Organizations prioritize firewall implementations and intrusion detection systems as foundational security measures, with approximately 85% of enterprises implementing some form of network security solution.

Endpoint Security shows strong growth driven by increasing mobile device usage and remote work adoption. The shift toward distributed work environments creates expanded endpoint attack surfaces requiring comprehensive device protection and monitoring capabilities.

Cloud Security represents the fastest-growing category as organizations accelerate cloud adoption for cost efficiency and scalability benefits. The need for cloud-native security solutions and secure cloud configurations drives consistent investment in this category.

Managed Security Services demonstrate significant growth potential as organizations seek to address cybersecurity skills shortages while maintaining effective security operations. The complexity of modern threat landscapes makes outsourced security monitoring and incident response increasingly attractive to organizations of various sizes.

For Organizations:

For Solution Providers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Zero Trust Architecture adoption represents a fundamental shift in cybersecurity strategy as organizations move away from perimeter-based security models toward comprehensive identity verification and least-privilege access principles. This trend reflects growing recognition that traditional security approaches are insufficient for modern distributed computing environments.

Artificial Intelligence Integration continues to transform cybersecurity solutions through automated threat detection, behavioral analysis, and incident response capabilities. AI-powered security tools demonstrate improved accuracy in identifying sophisticated threats while reducing false positive rates and operational overhead.

Cloud-Native Security solutions gain prominence as organizations seek security tools designed specifically for cloud environments rather than adapted from traditional on-premises solutions. This trend emphasizes the importance of cloud-specific security capabilities and seamless integration with cloud platforms.

Security Orchestration and Automation become increasingly important as organizations seek to improve incident response times and reduce manual security operations. Automated security workflows and orchestrated response procedures help address skills shortages while improving overall security effectiveness.

Regulatory Framework Strengthening includes updates to Peru’s Personal Data Protection Law and implementation of sector-specific cybersecurity requirements in banking, telecommunications, and critical infrastructure sectors. These developments create mandatory compliance requirements that drive consistent cybersecurity investment.

Public-Private Partnerships in cybersecurity have expanded through government initiatives promoting information sharing, threat intelligence collaboration, and joint cybersecurity awareness campaigns. MWR analysis indicates these partnerships significantly improve overall cybersecurity posture across participating organizations.

International Cooperation agreements with other Latin American countries and global cybersecurity organizations enhance Peru’s cybersecurity capabilities through knowledge sharing, best practice exchange, and coordinated threat response initiatives.

Skills Development Programs launched by universities, government agencies, and private organizations aim to address cybersecurity talent shortages through specialized training programs, certification courses, and professional development initiatives.

Market Entry Strategy recommendations for cybersecurity vendors include focusing on specific industry verticals or organization sizes where they can demonstrate clear value propositions and competitive advantages. Successful market entry requires understanding local business practices, regulatory requirements, and customer preferences.

Partnership Development with local system integrators, consulting firms, and technology distributors provides essential market access and customer relationship advantages. These partnerships enable international vendors to leverage local market knowledge and established customer relationships.

Solution Localization including Spanish-language interfaces, local support capabilities, and compliance with Peruvian regulations enhances market acceptance and customer satisfaction. Organizations prefer solutions that demonstrate understanding of local business requirements and cultural considerations.

Education and Awareness initiatives help build market demand by demonstrating cybersecurity value propositions and addressing common misconceptions about security investments. Thought leadership activities and educational content establish vendor credibility and market presence.

Market growth trajectory indicates continued expansion driven by accelerating digital transformation, evolving threat landscapes, and strengthening regulatory requirements. The cybersecurity market is expected to maintain robust growth rates as organizations recognize security as a fundamental business requirement rather than optional investment.

Technology evolution will continue reshaping the cybersecurity landscape through artificial intelligence, machine learning, and automation integration. Future solutions will emphasize proactive threat hunting, predictive analytics, and automated response capabilities to address increasingly sophisticated cyber threats.

Market maturation will likely result in greater solution integration, platform consolidation, and emphasis on comprehensive security ecosystems rather than point solutions. Organizations will increasingly seek unified security platforms that provide comprehensive protection while reducing operational complexity.

Skills development initiatives and educational programs are expected to gradually address current talent shortages, though demand for cybersecurity professionals will likely continue exceeding supply for the foreseeable future. This dynamic will sustain strong demand for managed security services and automated security solutions.

Peru’s cybersecurity market presents significant growth opportunities driven by digital transformation acceleration, increasing cyber threat sophistication, and strengthening regulatory frameworks. The market demonstrates strong fundamentals with growing awareness of cybersecurity importance across all sectors and organization sizes.

Key success factors for market participants include understanding local business requirements, developing appropriate partnership strategies, and delivering solutions that address specific Peruvian market needs. The combination of international expertise and local market knowledge creates optimal conditions for sustainable growth and market leadership.

Future market development will be shaped by continued technology evolution, regulatory enhancement, and growing cybersecurity maturity among Peruvian organizations. The market’s trajectory indicates sustained growth potential with opportunities for both established vendors and emerging solution providers who can effectively address evolving customer requirements and market dynamics.

What is Cybersecurity?

Cybersecurity refers to the practices and technologies designed to protect networks, devices, and data from unauthorized access, attacks, or damage. It encompasses various measures, including firewalls, encryption, and intrusion detection systems, to safeguard information in digital environments.

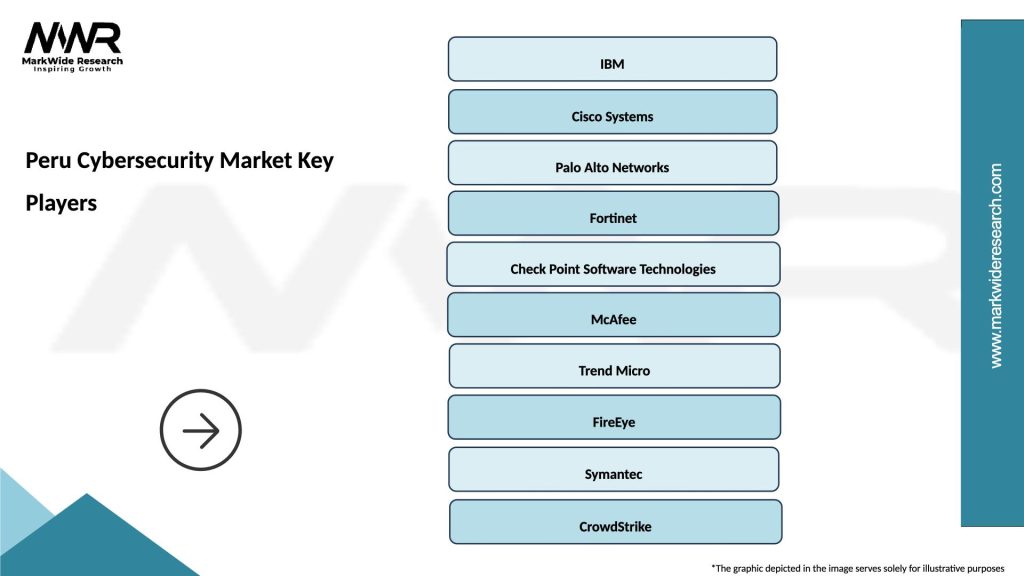

What are the key players in the Peru Cybersecurity Market?

Key players in the Peru Cybersecurity Market include companies like IBM, Cisco, and Fortinet, which provide a range of cybersecurity solutions such as threat intelligence, network security, and endpoint protection, among others.

What are the main drivers of growth in the Peru Cybersecurity Market?

The main drivers of growth in the Peru Cybersecurity Market include the increasing frequency of cyberattacks, the rising adoption of cloud services, and the growing awareness of data privacy regulations. These factors compel organizations to invest in robust cybersecurity measures.

What challenges does the Peru Cybersecurity Market face?

The Peru Cybersecurity Market faces challenges such as a shortage of skilled cybersecurity professionals, the evolving nature of cyber threats, and budget constraints for many organizations. These issues can hinder the effective implementation of security measures.

What opportunities exist in the Peru Cybersecurity Market?

Opportunities in the Peru Cybersecurity Market include the expansion of digital transformation initiatives, increased government focus on cybersecurity regulations, and the growing demand for managed security services. These trends create avenues for innovation and investment.

What trends are shaping the Peru Cybersecurity Market?

Trends shaping the Peru Cybersecurity Market include the rise of artificial intelligence in threat detection, the shift towards zero-trust security models, and the increasing importance of compliance with international cybersecurity standards. These trends are influencing how organizations approach their security strategies.

Peru Cybersecurity Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| End User | Government, BFSI, Healthcare, Retail |

| Solution | Network Security, Endpoint Protection, Application Security, Data Loss Prevention |

| Service Type | Consulting, Implementation, Support, Training |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Peru Cybersecurity Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at