444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Austria OOH and DOOH market represents a dynamic and evolving landscape within the European advertising ecosystem, characterized by significant technological transformation and growing digital adoption. Out-of-home advertising has maintained its position as a crucial component of Austria’s media mix, while digital out-of-home solutions continue to gain substantial momentum across urban centers and transportation networks.

Market dynamics in Austria reflect broader European trends toward digitalization, with traditional billboard and poster advertising increasingly complemented by sophisticated digital displays and interactive technologies. The Austrian market demonstrates robust growth potential driven by urbanization, technological advancement, and evolving consumer engagement patterns. Vienna, as the primary metropolitan area, leads digital adoption with approximately 45% of total DOOH installations concentrated in the capital region.

Industry transformation is evident through the integration of programmatic advertising capabilities, real-time content management, and data-driven targeting solutions. Austrian advertisers increasingly recognize the value proposition of combining traditional OOH reach with digital flexibility and measurement capabilities. Transportation advertising remains particularly strong, with digital screens in metro stations, airports, and major transit hubs experiencing accelerated adoption rates of 35% annually.

The market landscape encompasses diverse formats including digital billboards, transit displays, street furniture, and emerging technologies such as interactive kiosks and augmented reality installations. Retail integration represents a growing segment, with shopping centers and commercial districts investing heavily in digital signage solutions to enhance customer experiences and advertising effectiveness.

The Austria OOH and DOOH market refers to the comprehensive ecosystem of outdoor advertising solutions operating within Austrian territory, encompassing both traditional static displays and advanced digital advertising platforms. Out-of-home advertising includes conventional billboards, posters, transit advertising, and street furniture, while digital out-of-home represents the technological evolution incorporating LED displays, interactive screens, and programmatically enabled advertising networks.

Market definition extends beyond simple advertising placement to include content management systems, audience measurement technologies, and integrated marketing platforms that enable real-time campaign optimization. The Austrian market specifically reflects Central European characteristics, including high urbanization rates, sophisticated transportation infrastructure, and strong regulatory frameworks governing outdoor advertising practices.

Digital transformation within this context means the convergence of traditional outdoor advertising with advanced technologies including IoT connectivity, artificial intelligence, and data analytics capabilities. Austrian DOOH solutions increasingly incorporate weather-responsive content, demographic targeting, and cross-channel integration with mobile and online advertising platforms.

Stakeholder ecosystem includes media owners, technology providers, advertising agencies, content creators, and regulatory bodies working collaboratively to advance market sophistication while maintaining compliance with Austrian advertising standards and urban planning requirements.

Strategic positioning of Austria’s OOH and DOOH market reflects strong fundamentals driven by urbanization trends, technological innovation, and evolving advertiser preferences for measurable, flexible outdoor advertising solutions. The market demonstrates consistent growth momentum with digital formats experiencing particularly robust expansion across key metropolitan areas and transportation networks.

Key market drivers include increasing digital infrastructure investment, growing advertiser demand for programmatic capabilities, and enhanced measurement technologies enabling improved campaign effectiveness. Austrian businesses increasingly recognize DOOH as essential for omnichannel marketing strategies, driving adoption rates exceeding 28% annually among major advertisers.

Competitive landscape features established international players alongside regional specialists, creating a dynamic environment fostering innovation and service enhancement. Market consolidation trends are balanced by emerging technology providers introducing specialized solutions for niche applications and vertical markets.

Future outlook indicates continued digital transformation with emerging technologies such as 5G connectivity, edge computing, and advanced analytics driving next-generation DOOH capabilities. Sustainability considerations and smart city initiatives are increasingly influencing market development, creating opportunities for environmentally conscious advertising solutions.

Investment patterns show strong commitment to infrastructure modernization and technology advancement, positioning Austria as a leading market for innovative outdoor advertising solutions within the Central European region.

Market intelligence reveals several critical insights shaping Austria’s OOH and DOOH landscape:

Market maturation is evident through sophisticated content management capabilities, real-time optimization features, and integration with broader marketing technology ecosystems. Austrian advertisers demonstrate increasing sophistication in leveraging DOOH capabilities for targeted, measurable outdoor advertising campaigns.

Urbanization trends represent the primary driver of Austria’s OOH and DOOH market expansion, with increasing population concentration in major metropolitan areas creating larger, more engaged audiences for outdoor advertising. Vienna’s continued growth as a regional business hub attracts international companies seeking effective local advertising solutions, driving demand for premium digital advertising locations.

Technological advancement enables new advertising formats and capabilities previously unavailable in traditional outdoor media. High-resolution LED displays, interactive touchscreens, and IoT-enabled content management systems provide advertisers with unprecedented flexibility and engagement opportunities. 5G network deployment across Austria facilitates real-time content updates and enhanced interactive capabilities.

Consumer behavior evolution toward mobile-first lifestyles creates opportunities for integrated campaigns linking outdoor advertising with digital experiences. Austrian consumers demonstrate high smartphone penetration rates, enabling QR code interactions, location-based targeting, and social media integration with DOOH campaigns.

Advertiser demand for measurable, accountable advertising solutions drives investment in digital outdoor formats offering detailed analytics, audience measurement, and campaign optimization capabilities. Programmatic advertising adoption enables automated buying processes and real-time campaign adjustments based on performance data.

Infrastructure investment by both public and private sectors supports market expansion through improved transportation networks, smart city initiatives, and commercial development projects incorporating advanced digital signage solutions.

Regulatory complexity presents ongoing challenges for market participants, with varying municipal regulations governing outdoor advertising placement, content restrictions, and digital display specifications. Permit processes can be lengthy and complex, particularly for new digital installations requiring technical approvals and urban planning compliance.

High capital requirements for digital infrastructure deployment create barriers for smaller market participants and limit rapid expansion in secondary markets. Premium digital displays, content management systems, and ongoing maintenance costs require significant upfront investment and operational expertise.

Weather dependency affects outdoor advertising effectiveness, with Austrian climate conditions potentially impacting visibility and audience engagement during winter months. Seasonal advertising patterns create revenue fluctuations that challenge consistent market growth and investment planning.

Technology obsolescence risks require continuous investment in equipment upgrades and system modernization to maintain competitive positioning. Rapid advancement in display technologies and content management capabilities necessitates ongoing capital allocation for infrastructure updates.

Competition from digital media channels, particularly mobile and social media advertising, creates pressure on outdoor advertising budgets and requires demonstration of unique value propositions and complementary benefits within integrated marketing strategies.

Smart city initiatives across Austrian municipalities create substantial opportunities for integrated DOOH solutions supporting public information systems, emergency communications, and community engagement platforms. Vienna’s smart city strategy specifically includes provisions for advanced digital signage networks supporting both commercial and public service applications.

Retail digitalization presents significant growth potential as shopping centers, retail chains, and commercial districts invest in digital signage solutions for customer engagement, wayfinding, and promotional activities. Omnichannel retail strategies increasingly incorporate DOOH as essential touchpoints in customer journey mapping.

Event marketing expansion offers opportunities for temporary and mobile DOOH installations supporting festivals, conferences, and sporting events throughout Austria. The country’s strong tourism and cultural event calendar creates consistent demand for flexible, high-impact advertising solutions.

Transportation modernization projects, including airport expansions, railway upgrades, and public transit improvements, incorporate advanced digital advertising infrastructure as revenue-generating components. ÖBB infrastructure investments specifically include provisions for enhanced digital advertising capabilities across the national railway network.

Emerging technologies such as augmented reality, artificial intelligence, and advanced analytics create opportunities for innovative advertising formats and enhanced audience engagement capabilities. 5G network deployment enables real-time interactive experiences and sophisticated content personalization.

Competitive intensity within Austria’s OOH and DOOH market continues to increase as established players expand digital capabilities while new entrants introduce innovative technologies and service models. Market consolidation trends are balanced by emerging specialists focusing on niche applications and vertical-specific solutions.

Technology evolution drives continuous market transformation, with artificial intelligence, machine learning, and advanced analytics becoming standard components of sophisticated DOOH platforms. Programmatic advertising capabilities are experiencing adoption rates of approximately 38% among major Austrian advertisers, indicating strong momentum toward automated buying processes.

Customer expectations for measurable, accountable advertising solutions drive demand for comprehensive analytics, real-time optimization, and integrated campaign management capabilities. Austrian advertisers increasingly require detailed audience measurement, engagement metrics, and ROI demonstration from outdoor advertising investments.

Supply chain dynamics reflect global technology trends while accommodating local market requirements and regulatory compliance needs. European manufacturing preferences for digital display components support regional suppliers while ensuring quality standards and service reliability.

Investment patterns show strong commitment to infrastructure modernization and technology advancement, with both media owners and advertisers allocating significant resources toward digital transformation initiatives and capability enhancement.

Comprehensive market analysis employs multiple research methodologies to ensure accurate, reliable insights into Austria’s OOH and DOOH market dynamics. Primary research includes extensive interviews with industry stakeholders, including media owners, technology providers, advertising agencies, and major advertisers operating within the Austrian market.

Secondary research incorporates analysis of industry reports, regulatory filings, company financial statements, and government statistics related to advertising expenditure, urbanization trends, and infrastructure development. Market intelligence gathering includes monitoring of competitive activities, technology developments, and regulatory changes affecting market dynamics.

Data validation processes ensure accuracy through cross-referencing multiple sources, expert verification, and statistical analysis of market trends and patterns. Quantitative analysis incorporates advertising expenditure data, installation counts, and performance metrics from various market participants.

Qualitative insights are gathered through structured interviews with industry experts, focus groups with advertisers, and analysis of case studies demonstrating successful DOOH implementations across different market segments and applications.

Market modeling techniques incorporate historical data analysis, trend extrapolation, and scenario planning to develop accurate projections and identify key growth drivers and potential challenges affecting future market development.

Vienna metropolitan area dominates Austria’s OOH and DOOH market, accounting for approximately 52% of total advertising inventory and representing the most advanced digital infrastructure deployment. The capital region benefits from high population density, extensive public transportation networks, and concentration of major businesses driving advertising demand.

Graz region represents the second-largest market segment, with growing digital adoption in commercial districts and transportation hubs. The city’s university presence and technology sector create demand for innovative advertising formats and digital engagement solutions. Regional growth rates exceed national averages, indicating strong expansion potential.

Linz and surrounding areas demonstrate increasing DOOH investment, particularly in industrial and commercial zones serving major manufacturing companies. The region’s strategic location and economic development initiatives support continued market expansion and infrastructure modernization.

Salzburg market benefits from strong tourism flows and cultural events driving demand for flexible, high-impact advertising solutions. Seasonal variations create opportunities for specialized campaigns targeting both business and leisure audiences throughout the year.

Innsbruck and western regions show growing interest in digital outdoor advertising, supported by winter sports tourism and cross-border business activities. Mountain resort areas present unique opportunities for specialized DOOH installations serving affluent tourist demographics.

Rural and secondary markets represent emerging opportunities as digital infrastructure expands and local businesses recognize the value of professional outdoor advertising solutions. Regional development programs support technology adoption and infrastructure improvement initiatives.

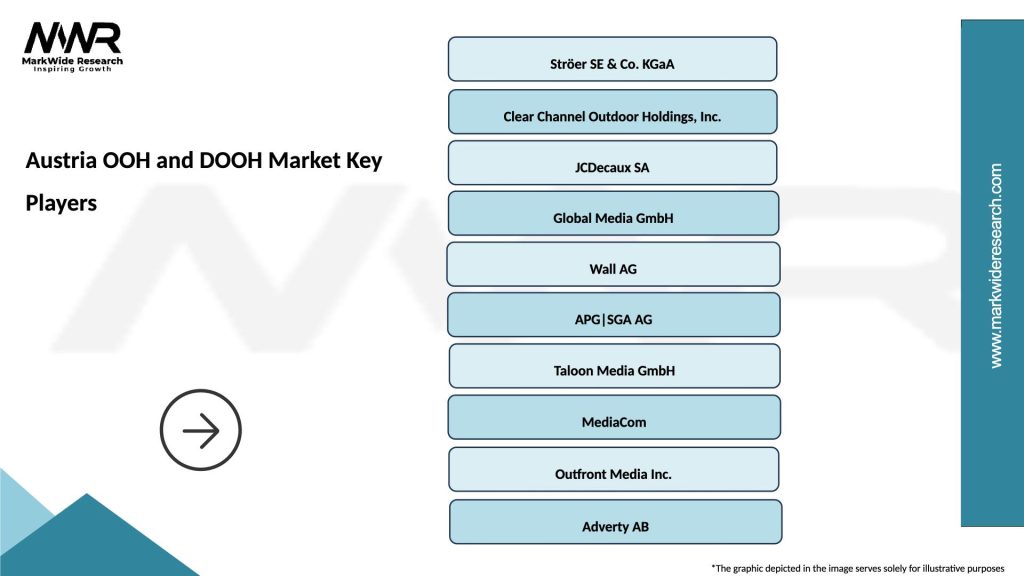

Market leadership is distributed among several key players offering comprehensive OOH and DOOH solutions across Austria:

Competitive differentiation increasingly focuses on technology capabilities, data analytics, programmatic advertising integration, and comprehensive service offerings. Market participants invest heavily in digital infrastructure, content management systems, and audience measurement technologies to maintain competitive positioning.

Strategic partnerships between media owners, technology providers, and advertising agencies create comprehensive solutions addressing complex advertiser requirements. Innovation initiatives include development of interactive displays, augmented reality capabilities, and advanced targeting solutions.

Market consolidation trends are balanced by emerging specialists introducing niche solutions and vertical-specific capabilities. Technology integration becomes increasingly important for maintaining competitive advantage and meeting evolving advertiser expectations.

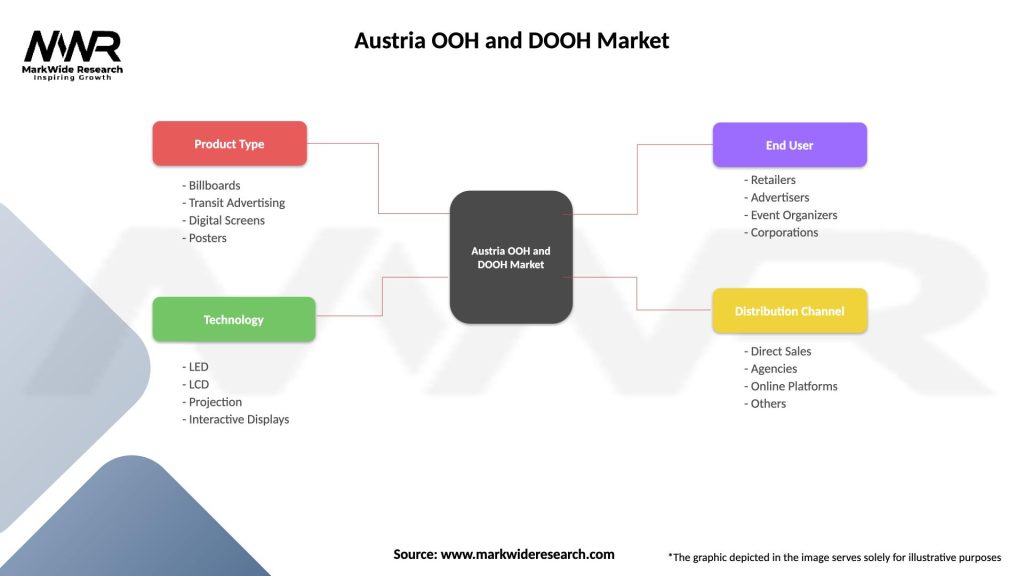

By Format:

By Technology:

By Application:

Digital Billboard Category represents the premium segment of Austria’s DOOH market, with installations concentrated in high-traffic urban locations and major transportation corridors. Technology advancement enables 4K resolution displays, weather-adaptive brightness control, and real-time content management capabilities. Advertiser preference for digital billboards reflects their ability to deliver impactful, flexible messaging with detailed performance measurement.

Transit Advertising Segment demonstrates the strongest growth momentum, driven by extensive public transportation usage in Austrian cities and ongoing infrastructure modernization projects. Vienna’s U-Bahn system represents the largest concentration of transit DOOH installations, with digital penetration rates reaching 67% across major stations and platforms.

Street Furniture Category benefits from urban development initiatives and smart city projects incorporating digital information and advertising capabilities. Integration opportunities with public WiFi, charging stations, and information services create additional value propositions for both municipalities and advertisers.

Retail Digital Signage experiences rapid adoption as shopping centers and commercial districts invest in customer experience enhancement and revenue diversification. Omnichannel integration capabilities enable seamless connection between outdoor advertising and mobile marketing campaigns.

Interactive Display Segment represents emerging opportunities for enhanced customer engagement and data collection capabilities. Touchscreen installations in shopping centers, transportation hubs, and tourist areas provide unique advertising formats and measurable interaction metrics.

Media Owners benefit from digital transformation through enhanced revenue opportunities, operational efficiency improvements, and competitive differentiation capabilities. Programmatic advertising integration enables automated inventory management and optimized pricing strategies, while advanced analytics provide detailed performance insights supporting premium pricing justification.

Advertisers gain access to flexible, measurable outdoor advertising solutions offering real-time optimization capabilities and detailed audience insights. Campaign effectiveness improves through dynamic content capabilities, weather-responsive messaging, and integration with broader digital marketing strategies.

Technology Providers find expanding opportunities for specialized solutions including content management systems, audience measurement technologies, and interactive display capabilities. Innovation demand drives continuous development of advanced features and integration capabilities.

Advertising Agencies benefit from enhanced creative possibilities, detailed campaign measurement, and integrated planning capabilities across traditional and digital outdoor formats. Client service enhancement results from comprehensive analytics and optimization capabilities.

Municipal Authorities gain revenue opportunities through digital advertising partnerships while providing enhanced public information and emergency communication capabilities. Smart city initiatives benefit from integrated digital infrastructure supporting both commercial and public service applications.

Consumers experience improved urban environments through dynamic information services, entertainment content, and interactive capabilities integrated with digital outdoor advertising installations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Programmatic Advertising Adoption represents the most significant trend transforming Austria’s DOOH market, with automated buying platforms enabling real-time campaign optimization and improved targeting capabilities. MarkWide Research indicates that programmatic DOOH adoption is accelerating rapidly among Austrian advertisers seeking efficiency and accountability in outdoor advertising investments.

Interactive Technology Integration creates new engagement opportunities through touchscreen displays, gesture recognition, and augmented reality capabilities. Consumer interaction rates with interactive DOOH installations demonstrate engagement levels 340% higher than traditional static displays, driving advertiser interest in advanced technology solutions.

Sustainability Focus influences market development through energy-efficient LED technologies, solar-powered installations, and environmentally conscious content strategies. Green advertising initiatives become increasingly important for brand positioning and regulatory compliance.

Data-Driven Optimization enables sophisticated audience measurement, content personalization, and campaign effectiveness analysis. Advanced analytics capabilities provide detailed insights into audience demographics, engagement patterns, and conversion metrics.

Cross-Channel Integration connects DOOH campaigns with mobile advertising, social media, and online marketing initiatives, creating comprehensive omnichannel experiences. QR code integration and location-based targeting enable seamless transitions between outdoor and digital touchpoints.

Content Personalization through artificial intelligence and machine learning enables dynamic messaging based on time, weather, audience demographics, and real-time events. Contextual advertising capabilities improve campaign relevance and effectiveness.

Infrastructure Modernization Projects across major Austrian cities include comprehensive digital signage upgrades and smart city technology integration. Vienna’s digital transformation initiative specifically incorporates advanced DOOH capabilities as essential components of urban communication and advertising infrastructure.

Technology Partnership Announcements between media owners and international technology providers bring advanced capabilities including artificial intelligence, programmatic advertising, and interactive display solutions to the Austrian market. These partnerships enable rapid deployment of cutting-edge DOOH technologies.

Regulatory Framework Updates address digital outdoor advertising standards, content guidelines, and technical specifications for new installations. Municipal cooperation initiatives streamline permit processes and establish consistent standards across different Austrian cities and regions.

Major Installation Projects include airport expansions, shopping center developments, and transportation infrastructure upgrades incorporating state-of-the-art digital advertising capabilities. Vienna International Airport expansion includes comprehensive DOOH network serving both domestic and international advertising requirements.

Sustainability Initiatives drive adoption of energy-efficient technologies, renewable power sources, and environmentally conscious installation practices. Industry standards increasingly emphasize environmental responsibility and sustainable operation practices.

Market Consolidation Activities include strategic acquisitions, partnership agreements, and technology licensing arrangements strengthening competitive positioning and expanding service capabilities across the Austrian market.

Strategic Investment Focus should prioritize digital infrastructure development, particularly in secondary markets where growth potential remains substantial. Market participants are advised to invest in programmatic advertising capabilities, advanced analytics, and interactive technologies to maintain competitive positioning in the evolving marketplace.

Technology Integration recommendations emphasize the importance of comprehensive content management systems, real-time optimization capabilities, and cross-channel integration features. Artificial intelligence and machine learning capabilities should be prioritized for content personalization and campaign optimization.

Partnership Development strategies should focus on collaboration with technology providers, advertising agencies, and municipal authorities to create comprehensive solutions addressing complex market requirements. Strategic alliances enable rapid capability expansion and market penetration.

Regulatory Compliance requires ongoing attention to evolving municipal regulations, environmental standards, and technical specifications. Proactive engagement with regulatory authorities helps ensure smooth project implementation and long-term operational success.

Market Expansion opportunities exist in secondary cities and specialized applications including retail environments, event venues, and transportation facilities. Geographic diversification reduces market concentration risks while capturing emerging growth opportunities.

Sustainability Integration should be incorporated into all strategic planning and investment decisions, reflecting growing environmental consciousness and regulatory requirements. Green technology adoption provides competitive advantages and supports long-term market positioning.

Market evolution toward sophisticated, data-driven DOOH solutions will continue accelerating, with artificial intelligence, machine learning, and advanced analytics becoming standard capabilities across premium installations. 5G network deployment will enable real-time interactive experiences and enhanced content personalization capabilities throughout Austria.

Growth projections indicate continued expansion in digital format adoption, with traditional static displays increasingly replaced by dynamic, programmable alternatives. MWR analysis suggests that digital penetration rates will reach 75% of premium outdoor advertising locations within the next five years, driven by advertiser demand for measurable, flexible solutions.

Technology advancement will introduce new capabilities including augmented reality integration, advanced gesture recognition, and sophisticated audience analytics. Interactive advertising formats will become increasingly sophisticated, enabling immersive brand experiences and detailed engagement measurement.

Market consolidation trends will continue as established players acquire specialized capabilities and emerging technologies, while new entrants focus on niche applications and innovative solutions. Competitive dynamics will increasingly emphasize technology differentiation and comprehensive service offerings.

Sustainability requirements will drive continued adoption of energy-efficient technologies, renewable power sources, and environmentally conscious installation practices. Smart city integration will create opportunities for DOOH solutions supporting both commercial advertising and public service applications.

Investment outlook remains positive, with continued infrastructure modernization and technology advancement supporting market expansion and capability enhancement across all major Austrian metropolitan areas and transportation networks.

Austria’s OOH and DOOH market demonstrates strong fundamentals and promising growth prospects driven by urbanization trends, technological advancement, and evolving advertiser preferences for measurable, flexible outdoor advertising solutions. The market’s transformation toward digital formats reflects broader industry trends while maintaining unique characteristics specific to Austrian market conditions and consumer behaviors.

Digital adoption acceleration continues reshaping the competitive landscape, with programmatic advertising capabilities, interactive technologies, and advanced analytics becoming essential components of successful market positioning. Infrastructure investment by both public and private sectors supports continued expansion and capability enhancement across major metropolitan areas and transportation networks.

Strategic opportunities exist for market participants willing to invest in advanced technologies, comprehensive service offerings, and innovative solutions addressing evolving advertiser requirements. Smart city initiatives and sustainability considerations create additional growth drivers while supporting long-term market development and competitive differentiation.

Future success in Austria’s OOH and DOOH market will depend on technology integration, regulatory compliance, strategic partnerships, and continuous innovation in response to changing market dynamics and customer expectations. The market’s evolution toward sophisticated, data-driven solutions positions Austria as a leading example of DOOH advancement within the Central European region.

What is OOH and DOOH?

OOH stands for Out-Of-Home advertising, which includes any advertising that reaches the consumer while they are outside their home. DOOH, or Digital Out-Of-Home, refers specifically to digital displays used in public spaces for advertising purposes.

What are the key players in the Austria OOH and DOOH Market?

Key players in the Austria OOH and DOOH Market include companies like Ströer, JCDecaux, and Clear Channel, which provide various advertising solutions across different formats and locations, among others.

What are the growth factors driving the Austria OOH and DOOH Market?

The growth of the Austria OOH and DOOH Market is driven by increasing urbanization, advancements in digital technology, and the rising demand for targeted advertising. Additionally, the integration of data analytics enhances campaign effectiveness.

What challenges does the Austria OOH and DOOH Market face?

The Austria OOH and DOOH Market faces challenges such as regulatory restrictions on outdoor advertising, competition from digital media, and the need for continuous innovation to capture consumer attention.

What opportunities exist in the Austria OOH and DOOH Market?

Opportunities in the Austria OOH and DOOH Market include the expansion of smart city initiatives, increased investment in interactive advertising technologies, and the potential for enhanced audience engagement through mobile integration.

What trends are shaping the Austria OOH and DOOH Market?

Trends shaping the Austria OOH and DOOH Market include the rise of programmatic advertising, the use of augmented reality in campaigns, and a growing focus on sustainability in advertising practices.

Austria OOH and DOOH Market

| Segmentation Details | Description |

|---|---|

| Product Type | Billboards, Transit Advertising, Digital Screens, Posters |

| Technology | LED, LCD, Projection, Interactive Displays |

| End User | Retailers, Advertisers, Event Organizers, Corporations |

| Distribution Channel | Direct Sales, Agencies, Online Platforms, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Austria OOH and DOOH Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at