444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan access control market represents a dynamic and rapidly evolving security technology sector that encompasses sophisticated systems designed to regulate and monitor entry to physical and digital spaces. Japan’s commitment to technological innovation and security excellence has positioned the nation as a leading adopter of advanced access control solutions across multiple industries. The market demonstrates robust growth potential driven by increasing security concerns, digital transformation initiatives, and the integration of artificial intelligence and biometric technologies.

Market dynamics in Japan reflect a unique blend of traditional security practices and cutting-edge technological adoption. The country’s emphasis on precision, reliability, and innovation has created a fertile environment for access control system deployment across commercial, residential, and government sectors. Growth projections indicate the market is expanding at a compound annual growth rate of 8.2%, reflecting strong demand for integrated security solutions that combine physical and logical access control capabilities.

Technological advancement serves as a primary catalyst for market expansion, with Japanese organizations increasingly adopting cloud-based access control systems, mobile credentials, and AI-powered analytics. The integration of Internet of Things (IoT) technologies and smart building concepts has further accelerated market growth, creating opportunities for comprehensive security ecosystems that extend beyond traditional access control functionalities.

The Japan access control market refers to the comprehensive ecosystem of security technologies, systems, and services designed to authenticate, authorize, and audit access to physical facilities and digital resources within the Japanese business and residential landscape. Access control systems encompass a wide range of technologies including card readers, biometric scanners, mobile credentials, and software platforms that manage user permissions and monitor entry activities.

Modern access control in Japan extends beyond simple door locks to include sophisticated multi-factor authentication systems, time-based access restrictions, and integration with broader security management platforms. These systems utilize various authentication methods including proximity cards, biometric identifiers such as fingerprints and facial recognition, PIN codes, and increasingly popular mobile-based credentials that leverage smartphone technology.

System architecture typically includes hardware components such as electronic locks, card readers, and control panels, combined with software platforms that manage user databases, access policies, and audit trails. The Japanese market particularly emphasizes reliability and precision, leading to the adoption of redundant systems and fail-safe mechanisms that ensure continuous operation even during power outages or network disruptions.

Japan’s access control market demonstrates exceptional growth momentum driven by technological innovation, increasing security awareness, and the country’s leadership in adopting advanced authentication technologies. The market benefits from Japan’s strong manufacturing base, technological expertise, and commitment to creating secure environments across various sectors including corporate offices, manufacturing facilities, healthcare institutions, and residential complexes.

Key market drivers include the rising adoption of biometric technologies, with facial recognition systems experiencing particularly strong growth at 12.5% annually. The integration of artificial intelligence and machine learning capabilities has enhanced system effectiveness while reducing false positives and improving user experience. Mobile credential adoption has accelerated significantly, with smartphone-based access solutions representing 35% of new installations in commercial environments.

Competitive landscape features both international technology leaders and domestic Japanese companies that leverage local market knowledge and manufacturing capabilities. The market structure supports innovation through partnerships between hardware manufacturers, software developers, and system integrators who provide comprehensive solutions tailored to Japanese business practices and regulatory requirements.

Strategic insights reveal several critical trends shaping the Japan access control market landscape. The convergence of physical and logical security has created opportunities for unified platforms that manage both facility access and network security from centralized management systems.

Security consciousness represents the primary driver propelling Japan’s access control market forward. Increasing concerns about unauthorized access, data breaches, and physical security threats have motivated organizations to invest in comprehensive access control solutions that provide multiple layers of protection. Corporate security policies increasingly mandate advanced authentication methods that go beyond traditional key-based systems.

Technological advancement continues to drive market expansion as organizations seek to leverage cutting-edge solutions that improve security effectiveness while enhancing user convenience. The adoption of contactless technologies has accelerated, particularly following health and safety considerations that emphasize touchless interaction methods. Biometric systems offering 99.9% accuracy rates have become increasingly attractive to organizations requiring high-security environments.

Digital transformation initiatives across Japanese enterprises have created demand for integrated security platforms that support modern workplace concepts including hot-desking, flexible work arrangements, and visitor management. The need for real-time monitoring and analytics capabilities has driven adoption of intelligent access control systems that provide actionable insights for security optimization and operational efficiency improvements.

Regulatory compliance requirements continue to influence market growth as organizations must meet stringent security standards across various industries. Government initiatives promoting cybersecurity and physical security best practices have encouraged investment in professional-grade access control solutions that support comprehensive audit trails and reporting capabilities.

Implementation costs represent a significant barrier for many organizations considering advanced access control system deployment. The initial investment required for comprehensive solutions including hardware, software, installation, and training can be substantial, particularly for small and medium-sized enterprises with limited security budgets. Total cost of ownership considerations often extend beyond initial purchase prices to include ongoing maintenance, software updates, and system administration expenses.

Technical complexity associated with modern access control systems can create implementation challenges for organizations lacking specialized IT expertise. Integration with existing security infrastructure, network configuration, and user management require technical knowledge that may necessitate external consulting services or additional staff training. System compatibility issues between different vendors’ products can complicate deployment and increase project timelines.

Privacy concerns related to biometric data collection and storage have created hesitation among some organizations and end users. Japanese privacy regulations require careful handling of personal information, and organizations must implement appropriate data protection measures that may add complexity and cost to system deployment. User acceptance of biometric technologies varies, with some individuals expressing concerns about personal data security and potential misuse.

Maintenance requirements for sophisticated access control systems can strain organizational resources, particularly for systems incorporating multiple technologies and integration points. Regular software updates, hardware maintenance, and user database management require ongoing attention that may challenge organizations with limited technical support capabilities.

Smart city initiatives across Japan present substantial opportunities for access control system integration within broader urban infrastructure projects. Government investments in intelligent transportation, public safety, and digital governance create demand for scalable access control solutions that can support large-scale deployments while maintaining high security standards. Public-private partnerships offer pathways for technology providers to participate in major infrastructure development projects.

Healthcare sector expansion represents a significant growth opportunity as medical facilities increasingly require sophisticated access control systems to protect patient information, secure pharmaceutical storage areas, and manage visitor access. The aging population in Japan drives healthcare facility expansion, creating demand for HIPAA-compliant access control solutions that support medical workflow requirements while maintaining strict security protocols.

Residential market growth offers opportunities for access control system providers to develop solutions tailored to apartment complexes, condominiums, and single-family homes. The trend toward smart home integration creates demand for access control systems that connect with home automation platforms and provide remote monitoring capabilities. Property management companies seek solutions that reduce operational costs while improving resident security and convenience.

Industrial automation trends in Japanese manufacturing create opportunities for access control integration within Industry 4.0 initiatives. Smart factories require sophisticated access control systems that support role-based access to different production areas while integrating with manufacturing execution systems and quality management platforms. Operational efficiency improvements through automated access management can provide significant value propositions for manufacturing organizations.

Competitive dynamics within Japan’s access control market reflect a balance between established international technology leaders and innovative domestic companies that leverage local market knowledge and manufacturing capabilities. Market consolidation trends have created opportunities for strategic partnerships and acquisitions that combine complementary technologies and market access capabilities.

Technology evolution continues to reshape market dynamics as artificial intelligence, machine learning, and cloud computing capabilities become standard features rather than premium options. Organizations increasingly expect predictive analytics capabilities that can identify potential security threats and optimize access policies based on usage patterns and risk assessments. The integration of behavioral analytics provides enhanced security through anomaly detection and automated response capabilities.

Customer expectations have evolved to demand seamless user experiences that balance security requirements with operational convenience. Modern access control systems must support multiple authentication methods, provide intuitive management interfaces, and offer mobile applications that enable remote system administration. User adoption rates improve significantly when systems provide clear benefits in terms of convenience and efficiency rather than simply adding security layers.

Supply chain considerations have gained importance as organizations seek reliable technology partners who can provide ongoing support, regular updates, and responsive customer service. The preference for local support capabilities has created opportunities for domestic system integrators and service providers who can offer personalized attention and rapid response times for technical issues and system modifications.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into Japan’s access control market dynamics. Primary research activities included structured interviews with industry executives, technology providers, system integrators, and end-user organizations across various sectors including commercial real estate, manufacturing, healthcare, and government facilities.

Secondary research encompassed analysis of industry reports, government publications, technology specifications, and competitive intelligence gathered from public sources and industry databases. MarkWide Research analysts conducted extensive review of market trends, regulatory developments, and technological innovations that influence access control system adoption and deployment patterns across different market segments.

Data validation processes included cross-referencing information from multiple sources, conducting follow-up interviews to clarify findings, and utilizing statistical analysis to identify trends and correlations within the collected data. Market sizing and growth projections were developed using bottom-up analysis of segment-specific demand drivers and top-down validation through industry expert consultations.

Quantitative analysis incorporated survey data from technology users, purchasing decision makers, and industry professionals to understand adoption patterns, budget allocations, and technology preferences. Qualitative insights were gathered through focus groups and in-depth interviews that explored user experiences, implementation challenges, and future requirements for access control system functionality and performance.

Tokyo metropolitan area dominates Japan’s access control market, representing approximately 42% of total market activity due to the concentration of corporate headquarters, government facilities, and high-rise commercial buildings requiring sophisticated security systems. The region’s emphasis on technological innovation and early adoption of advanced security solutions creates a favorable environment for cutting-edge access control system deployment.

Osaka region contributes significantly to market growth through its strong manufacturing base and commercial activity, accounting for approximately 18% of market share. Industrial facilities in the region drive demand for robust access control systems that integrate with manufacturing operations while supporting worker safety and security protocols. The presence of major technology companies has accelerated adoption of AI-powered access control solutions.

Nagoya area represents a growing market segment focused on automotive and aerospace industries that require high-security access control systems for protecting intellectual property and ensuring operational security. The region’s manufacturing concentration creates demand for systems that support shift-based access management and integration with production scheduling systems.

Regional cities including Fukuoka, Sendai, and Hiroshima demonstrate increasing adoption of access control technologies as local businesses and government facilities modernize their security infrastructure. These markets often prioritize cost-effective solutions that provide essential security functionality while supporting future expansion capabilities. Rural areas show growing interest in residential access control systems as smart home technologies become more accessible and affordable.

Market leadership in Japan’s access control sector is characterized by a diverse ecosystem of international technology providers, domestic manufacturers, and specialized system integrators who collaborate to deliver comprehensive security solutions. The competitive environment emphasizes innovation, reliability, and customer service excellence as key differentiators.

Strategic partnerships between hardware manufacturers, software developers, and system integrators create comprehensive solution offerings that address complex customer requirements. Many companies focus on developing ecosystem approaches that integrate access control with broader security and building management platforms to provide enhanced value propositions.

Technology segmentation reveals distinct market categories based on authentication methods and system architectures. Card-based systems continue to represent the largest segment, though biometric technologies are experiencing rapid growth as costs decrease and accuracy improves. Multi-factor authentication systems combining multiple technologies are increasingly popular in high-security applications.

By Technology:

By Application:

Biometric technology categories demonstrate varying adoption patterns based on accuracy requirements, user acceptance, and implementation costs. Fingerprint recognition maintains strong market position due to established technology maturity and user familiarity, while facial recognition systems experience rapid growth driven by contactless operation benefits and improved accuracy rates reaching 99.7% in controlled environments.

Card-based systems continue to evolve with enhanced security features including encryption, anti-cloning protection, and integration with mobile applications. Smart card technologies offer advantages in multi-application environments where single credentials can support access control, time attendance, and cashless payment systems. The migration from legacy proximity cards to more secure technologies represents a significant replacement market opportunity.

Mobile credential categories are experiencing rapid innovation with solutions ranging from basic Bluetooth proximity detection to sophisticated encrypted digital keys that support offline operation and temporary access provisioning. Smartphone integration provides opportunities for enhanced user experiences through push notifications, remote access management, and integration with other mobile applications.

Cloud-based solutions are gaining traction across all technology categories as organizations seek to reduce infrastructure costs and improve system scalability. Software-as-a-Service models provide attractive alternatives to traditional on-premises deployments, particularly for multi-site organizations requiring centralized management capabilities and consistent security policies across all locations.

Technology providers benefit from Japan’s strong market demand for innovative security solutions and the country’s willingness to adopt advanced technologies that improve operational efficiency and security effectiveness. The market provides opportunities for premium pricing for solutions that demonstrate clear value propositions and superior performance characteristics compared to basic alternatives.

System integrators gain advantages through the complexity of modern access control deployments that require specialized expertise in system design, installation, and ongoing support. The trend toward integrated security platforms creates opportunities for comprehensive service offerings that extend beyond basic installation to include consulting, training, and managed services.

End-user organizations realize significant benefits through improved security posture, operational efficiency gains, and enhanced user experiences that support modern workplace requirements. Return on investment typically includes reduced security staffing costs, improved audit compliance, and decreased losses from unauthorized access incidents.

Property managers benefit from access control systems that reduce operational costs while improving tenant satisfaction and building security. Modern systems provide remote management capabilities that enable efficient administration of multiple properties from centralized locations, reducing the need for on-site security personnel and improving response times for access-related issues.

Government agencies gain advantages through access control systems that support regulatory compliance requirements while providing detailed audit trails and reporting capabilities. Public safety improvements result from better control over facility access and enhanced ability to respond to security incidents through real-time monitoring and automated alert systems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Contactless technology adoption has accelerated significantly, driven by health and safety considerations that emphasize touchless interaction methods. Facial recognition systems and mobile credentials have experienced increased demand as organizations seek to minimize physical contact points while maintaining security effectiveness. This trend has created opportunities for technology providers offering advanced biometric solutions and mobile-based access management platforms.

Artificial intelligence integration represents a transformative trend that enhances access control system capabilities through predictive analytics, behavioral analysis, and automated threat detection. Machine learning algorithms improve system accuracy over time while reducing false positives and providing actionable insights for security optimization. Organizations increasingly expect intelligent features that go beyond basic access control to provide comprehensive security intelligence.

Cloud-based deployment models are gaining traction as organizations seek scalable solutions that reduce infrastructure costs and improve system management capabilities. Software-as-a-Service offerings provide attractive alternatives to traditional on-premises systems, particularly for multi-site organizations requiring centralized management and consistent security policies across all locations.

Mobile integration continues to evolve with sophisticated smartphone applications that support remote system administration, temporary access provisioning, and real-time monitoring capabilities. Digital credentials stored on mobile devices provide enhanced security through encryption and biometric authentication while improving user convenience through familiar interfaces and interaction methods.

Sustainability focus influences technology selection as organizations prioritize energy-efficient solutions that support environmental responsibility goals. Green building certifications increasingly require access control systems that minimize power consumption while providing comprehensive security functionality, creating opportunities for innovative low-power technologies and renewable energy integration.

Strategic partnerships between technology providers and system integrators have created comprehensive solution offerings that address complex customer requirements across multiple market segments. Recent collaborations focus on developing integrated platforms that combine access control with video surveillance, alarm systems, and building automation technologies to provide unified security management capabilities.

Product innovation continues to drive market evolution with new technologies including advanced biometric sensors, encrypted mobile credentials, and AI-powered analytics platforms. MarkWide Research analysis indicates that companies investing in research and development are gaining competitive advantages through differentiated product offerings that address specific market needs and customer pain points.

Regulatory developments have influenced system design and deployment practices, particularly regarding biometric data protection and privacy compliance. New guidelines for personal information handling require enhanced security measures and user consent protocols that impact system architecture and operational procedures across all market segments.

Market consolidation activities including mergers and acquisitions have reshaped the competitive landscape as companies seek to expand technology portfolios and market reach. These developments create opportunities for enhanced solution integration and improved customer support capabilities while potentially reducing the number of independent technology providers in specific market segments.

International expansion efforts by Japanese companies have strengthened domestic market positions while providing global experience that enhances local solution development. Companies leveraging international best practices and technology innovations are better positioned to serve sophisticated customers requiring world-class security solutions and support services.

Technology investment recommendations emphasize the importance of selecting scalable solutions that can accommodate future growth and evolving security requirements. Organizations should prioritize open architecture systems that support integration with existing infrastructure while providing flexibility for future technology additions and upgrades. The focus should be on platforms that offer both immediate security benefits and long-term value through expandability and adaptability.

Implementation strategy should include comprehensive planning that addresses user training, change management, and ongoing support requirements. Phased deployment approaches often provide better results than large-scale implementations by allowing organizations to optimize system configuration and address issues before full-scale rollout. Pilot programs can help identify potential challenges and refine operational procedures.

Vendor selection criteria should emphasize long-term partnership potential rather than simply focusing on initial system costs. Organizations benefit from working with technology providers who offer comprehensive support services, regular software updates, and responsive customer service. Local support capabilities are particularly important for ensuring rapid response to technical issues and system modifications.

Security policy integration requires careful consideration of how access control systems support broader organizational security objectives and compliance requirements. Policy alignment ensures that technology investments provide maximum value while supporting regulatory compliance and risk management goals. Regular policy reviews help maintain system effectiveness as organizational needs evolve.

Future-proofing strategies should consider emerging technologies and evolving security threats that may impact system effectiveness over time. Organizations should evaluate solutions based on their ability to incorporate new technologies and adapt to changing security requirements without requiring complete system replacement.

Market evolution projections indicate continued strong growth driven by technological advancement and increasing security awareness across all market segments. The integration of artificial intelligence and machine learning capabilities will become standard features rather than premium options, creating opportunities for enhanced security effectiveness and operational efficiency improvements.

Technology convergence trends suggest that access control systems will become increasingly integrated with broader security and building management platforms. Unified security ecosystems that combine physical access control, video surveillance, intrusion detection, and cybersecurity capabilities will provide comprehensive protection while simplifying system management and reducing operational costs.

Mobile technology advancement will continue to drive innovation in credential management and user interaction methods. Smartphone integration will become more sophisticated with enhanced security features, offline operation capabilities, and seamless integration with other mobile applications and services. The adoption rate of mobile credentials is expected to reach 60% of new installations within the next five years.

Cloud adoption will accelerate as organizations recognize the benefits of scalable, centrally managed solutions that reduce infrastructure costs and improve system reliability. Hybrid deployment models combining on-premises and cloud-based components will provide flexibility for organizations with specific security or regulatory requirements while enabling access to advanced cloud-based analytics and management capabilities.

Sustainability considerations will increasingly influence technology selection as organizations prioritize energy-efficient solutions that support environmental responsibility goals. Green technology integration including solar power, energy harvesting, and low-power wireless communications will become more prevalent in access control system design and deployment.

Japan’s access control market represents a dynamic and rapidly evolving sector that combines technological innovation with practical security requirements across diverse industry segments. The market demonstrates strong growth potential driven by increasing security awareness, digital transformation initiatives, and the adoption of advanced technologies including artificial intelligence, biometrics, and mobile credentials.

Market opportunities extend across multiple segments including smart city development, healthcare facility expansion, residential applications, and industrial automation. The convergence of physical and logical security creates demand for integrated platforms that provide comprehensive protection while improving operational efficiency and user experience.

Success factors for market participants include technological innovation, customer service excellence, and the ability to provide scalable solutions that adapt to evolving security requirements. Organizations that invest in research and development while maintaining strong local market presence are best positioned to capitalize on growth opportunities and build sustainable competitive advantages.

Future prospects remain positive as Japan continues to lead in technology adoption and security innovation. The market will benefit from continued investment in smart infrastructure, increasing awareness of security threats, and the ongoing evolution of access control technologies that provide enhanced security effectiveness while improving user convenience and operational efficiency. Long-term growth projections support continued market expansion driven by both replacement of legacy systems and new installation demand across all market segments.

What is Access Control?

Access control refers to the security technique that regulates who or what can view or use resources in a computing environment. It is essential in various applications, including physical security systems, IT security, and data protection.

What are the key players in the Japan Access Control Market?

Key players in the Japan Access Control Market include NEC Corporation, Hitachi, and Panasonic, which provide a range of access control solutions for various sectors such as corporate, healthcare, and education, among others.

What are the growth factors driving the Japan Access Control Market?

The Japan Access Control Market is driven by increasing security concerns, the rise in smart building technologies, and the growing adoption of IoT devices in security systems. These factors contribute to enhanced safety and operational efficiency.

What challenges does the Japan Access Control Market face?

Challenges in the Japan Access Control Market include the high costs associated with advanced security systems and the complexity of integrating new technologies with existing infrastructure. Additionally, concerns about data privacy and cybersecurity can hinder market growth.

What opportunities exist in the Japan Access Control Market?

The Japan Access Control Market presents opportunities in the development of cloud-based access control solutions and the integration of AI for enhanced security features. The increasing demand for contactless access solutions also opens new avenues for growth.

What trends are shaping the Japan Access Control Market?

Trends in the Japan Access Control Market include the shift towards mobile access control solutions and the use of biometric authentication methods. Additionally, there is a growing emphasis on integrating access control with other security systems for comprehensive protection.

Japan Access Control Market

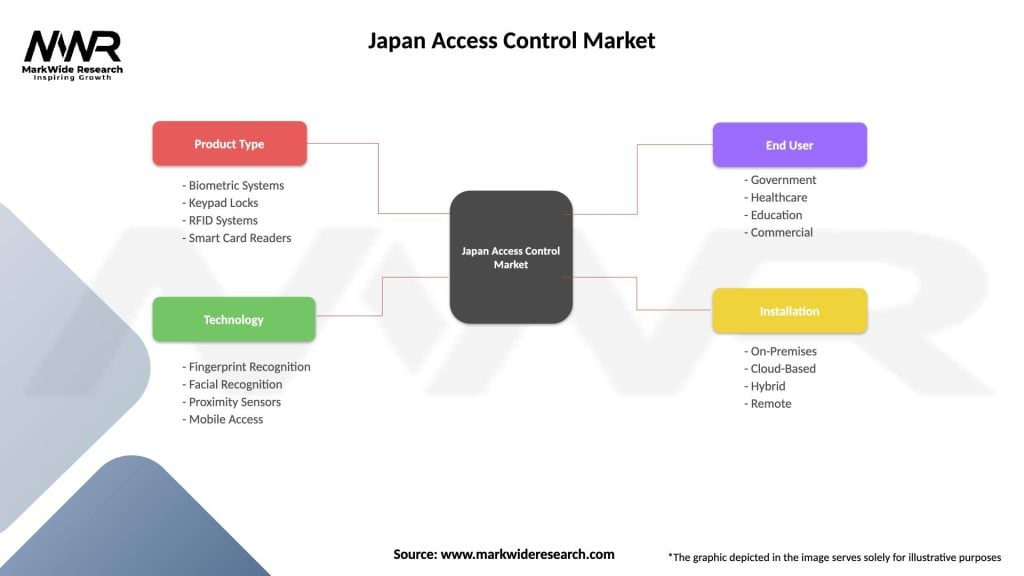

| Segmentation Details | Description |

|---|---|

| Product Type | Biometric Systems, Keypad Locks, RFID Systems, Smart Card Readers |

| Technology | Fingerprint Recognition, Facial Recognition, Proximity Sensors, Mobile Access |

| End User | Government, Healthcare, Education, Commercial |

| Installation | On-Premises, Cloud-Based, Hybrid, Remote |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Access Control Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at