444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Morocco poultry market represents a cornerstone of the nation’s agricultural economy, demonstrating remarkable resilience and consistent growth patterns over the past decade. Morocco’s poultry industry encompasses broiler production, layer farming, turkey production, and duck farming, with broiler meat and egg production dominating the sector. The market has experienced substantial expansion driven by increasing domestic consumption, population growth, and evolving dietary preferences toward protein-rich foods.

Market dynamics indicate that Morocco’s poultry sector has achieved impressive growth rates, with broiler production expanding at approximately 6.2% annually over recent years. The industry benefits from favorable climatic conditions, government support initiatives, and strategic investments in modern farming technologies. Domestic consumption patterns show a strong preference for chicken meat, which accounts for nearly 78% of total meat consumption in the country, reflecting the cultural and economic accessibility of poultry products.

Regional distribution of poultry farms spans across key agricultural zones, with significant concentrations in the Rabat-Salé-Kénitra region, Casablanca-Settat, and Fès-Meknès areas. The sector employs thousands of workers directly and indirectly, contributing substantially to rural employment and economic development. Export potential remains promising, with Morocco positioning itself as a potential supplier to European and African markets, leveraging its strategic geographic location and improving production standards.

The Morocco poultry market refers to the comprehensive ecosystem encompassing the production, processing, distribution, and consumption of poultry products including chicken meat, eggs, turkey, and other fowl within Morocco’s borders. This market includes commercial poultry farming operations, small-scale family farms, processing facilities, feed manufacturing, veterinary services, and retail distribution networks that collectively serve the domestic demand for poultry products.

Market scope extends beyond primary production to include value-added processing, cold storage facilities, transportation networks, and export-oriented operations. The definition encompasses both traditional farming methods and modern industrial poultry operations, reflecting the diverse nature of Morocco’s agricultural landscape. Stakeholder participation includes farmers, cooperatives, agribusiness companies, feed suppliers, veterinary service providers, processors, distributors, and retailers who contribute to the complete poultry value chain.

Morocco’s poultry market stands as a dynamic and rapidly evolving sector within the country’s agricultural framework, characterized by robust domestic demand and increasing modernization efforts. The market demonstrates strong fundamentals with consistent growth in both production capacity and consumption patterns, supported by favorable demographic trends and rising disposable incomes among urban populations.

Key performance indicators reveal that the sector has maintained steady expansion, with egg production increasing by approximately 4.8% annually and broiler production showing even stronger growth trajectories. The market benefits from government initiatives promoting agricultural modernization, including subsidies for modern equipment, training programs for farmers, and infrastructure development projects that enhance distribution capabilities.

Strategic positioning of Morocco’s poultry industry reflects both domestic market strength and export potential, with the country leveraging its proximity to European markets and growing relationships with African trading partners. The sector faces opportunities in value-added processing, organic production, and halal certification for international markets, while addressing challenges related to feed costs, disease management, and market consolidation trends.

Market insights reveal several critical factors driving Morocco’s poultry sector development and future growth prospects:

Population growth serves as a fundamental driver for Morocco’s poultry market expansion, with the country’s population increasing steadily and urbanization rates accelerating. Demographic trends indicate a growing middle class with higher disposable incomes and changing dietary preferences toward protein-rich foods, particularly chicken meat and eggs which are perceived as affordable and nutritious options.

Government support initiatives play a crucial role in market development through the Green Morocco Plan (Plan Maroc Vert) and its successor strategies, which provide financial incentives, technical assistance, and infrastructure development support to poultry farmers. These programs include subsidies for modern equipment, training programs, and facilitation of access to credit for farm modernization projects.

Economic factors contributing to market growth include Morocco’s stable macroeconomic environment, improving infrastructure, and strategic trade relationships that facilitate both domestic market development and export opportunities. The country’s geographic position provides advantages for accessing both European and African markets, while domestic economic growth supports increased consumer spending on protein products.

Technological advancement adoption in poultry farming operations drives productivity improvements and cost reductions. Modern breeding techniques, automated feeding systems, climate control technologies, and improved veterinary care contribute to higher production efficiency and better product quality, making Moroccan poultry products more competitive in domestic and international markets.

Feed cost volatility represents a significant challenge for Morocco’s poultry industry, as feed ingredients constitute approximately 70% of total production costs. Import dependency for key feed components such as corn and soybean meal exposes producers to international price fluctuations and currency exchange risks, impacting profit margins and production planning capabilities.

Disease management challenges pose ongoing risks to poultry operations, with avian influenza outbreaks and other infectious diseases potentially causing significant production losses. Biosecurity measures require substantial investments in infrastructure and operational protocols, while disease outbreaks can lead to trade restrictions and market access limitations for export-oriented producers.

Infrastructure limitations in rural areas constrain market development, particularly regarding cold storage facilities, transportation networks, and processing capabilities. Supply chain inefficiencies result in higher costs and quality issues, limiting the competitiveness of Moroccan poultry products in both domestic and international markets.

Regulatory compliance requirements, while necessary for food safety and quality assurance, impose additional costs on producers, particularly smaller operations that may lack resources for comprehensive compliance programs. Environmental regulations regarding waste management and water usage add operational complexity and costs to poultry farming operations.

Export market expansion presents substantial opportunities for Morocco’s poultry industry, particularly in African markets where demand for quality poultry products continues growing. Halal certification provides competitive advantages in Muslim-majority countries, while Morocco’s strategic location offers logistical benefits for serving both European and African markets efficiently.

Value-added processing opportunities include development of convenience foods, ready-to-cook products, and specialty items that command premium prices in urban markets. Product diversification into organic poultry, free-range products, and specialty breeds can capture growing consumer segments willing to pay higher prices for perceived quality and health benefits.

Technology integration opportunities encompass precision farming techniques, IoT applications for monitoring and control, and data analytics for optimizing production efficiency. Automation investments can reduce labor costs while improving consistency and quality, making Moroccan poultry operations more competitive globally.

Vertical integration strategies offer opportunities for companies to control more of the value chain, from feed production through processing and distribution. Strategic partnerships with international companies can provide access to advanced technologies, management expertise, and global market networks that accelerate growth and competitiveness.

Supply and demand dynamics in Morocco’s poultry market reflect strong domestic consumption growth coupled with expanding production capacity. Demand patterns show consistent increases in per capita consumption, driven by population growth, urbanization, and dietary preference shifts toward affordable protein sources. The market demonstrates seasonal variations with higher consumption during religious holidays and summer months.

Competitive dynamics feature a mix of large integrated companies and smaller independent producers, with increasing consolidation trends as larger players acquire smaller operations to achieve economies of scale. Market competition focuses on cost efficiency, product quality, and distribution network strength, with leading companies investing heavily in modern production facilities and technology upgrades.

Price dynamics reflect input cost fluctuations, particularly feed prices, while consumer price sensitivity influences demand patterns. Market pricing strategies balance affordability for consumers with profitability requirements for producers, with premium segments emerging for organic and specialty products that command higher margins.

Innovation dynamics drive continuous improvements in production efficiency, product quality, and market responsiveness. Research and development activities focus on breeding programs, nutrition optimization, disease prevention, and processing technologies that enhance competitiveness and market positioning for Moroccan poultry products.

Research approach for analyzing Morocco’s poultry market employs comprehensive primary and secondary research methodologies to ensure accurate and reliable market intelligence. Primary research includes structured interviews with industry stakeholders, including poultry farmers, processors, distributors, government officials, and industry associations to gather firsthand insights into market conditions, challenges, and opportunities.

Secondary research encompasses analysis of government statistics, industry reports, trade publications, and academic studies related to Morocco’s agricultural sector and poultry industry specifically. Data collection methods include review of official production statistics, import/export data, consumer surveys, and industry publications that provide quantitative and qualitative insights into market trends and dynamics.

Analytical framework applies both quantitative and qualitative analysis techniques to interpret market data and identify key trends, drivers, and challenges affecting the poultry sector. Market modeling incorporates statistical analysis, trend extrapolation, and scenario planning to develop insights into future market developments and growth prospects.

Validation processes ensure data accuracy through cross-referencing multiple sources, expert consultations, and triangulation of findings from different research approaches. Quality assurance measures include peer review, data verification, and continuous updating of information to maintain relevance and accuracy of market intelligence.

Northern Morocco dominates poultry production, with the Rabat-Salé-Kénitra region accounting for approximately 32% of national production. This region benefits from favorable climate conditions, proximity to major consumer markets, and well-developed infrastructure including ports for feed imports and product distribution. Casablanca-Settat region contributes significantly to both production and consumption, hosting major processing facilities and serving as a distribution hub for urban markets.

Central regions including Fès-Meknès and Béni Mellal-Khénifra show strong growth potential with expanding production facilities and improving infrastructure. These areas benefit from lower land costs and government incentives for agricultural development, attracting investments in modern poultry operations. Production efficiency in these regions continues improving through technology adoption and better management practices.

Southern regions present emerging opportunities despite infrastructure challenges, with growing local demand and potential for export-oriented production targeting African markets. Regional development initiatives focus on improving transportation networks, cold storage facilities, and processing capabilities to support poultry industry expansion in these areas.

Coastal areas benefit from port access for feed imports and export opportunities, while inland regions focus primarily on serving domestic markets. Regional specialization trends show coastal areas developing export capabilities while interior regions concentrate on efficient domestic market supply, creating complementary development patterns across Morocco’s poultry sector.

Market leadership in Morocco’s poultry sector features several key players who have established strong positions through strategic investments, operational efficiency, and market development initiatives:

Competitive strategies emphasize vertical integration, technology adoption, and market expansion initiatives. Leading companies invest heavily in modern production facilities, automated systems, and quality assurance programs to maintain competitive advantages. Market positioning strategies focus on cost efficiency, product quality, and distribution network strength to capture market share and defend against competitive pressures.

Strategic partnerships between domestic companies and international players provide access to advanced technologies, management expertise, and global market opportunities. Consolidation trends continue as larger companies acquire smaller operations to achieve economies of scale and expand market presence across different regions and market segments.

By Product Type:

By Production System:

By Distribution Channel:

Broiler production represents the largest and most dynamic segment of Morocco’s poultry market, characterized by rapid growth and continuous modernization efforts. Production efficiency improvements through better genetics, nutrition, and management practices have resulted in shorter growing cycles and improved feed conversion ratios. The segment benefits from strong domestic demand and growing export opportunities, particularly in processed products.

Layer farming for egg production shows steady growth with increasing demand from both household consumption and food processing industries. Modern layer operations adopt cage-free and enriched housing systems to meet evolving consumer preferences and regulatory requirements. The segment faces challenges from feed cost volatility but benefits from consistent demand patterns and relatively stable pricing.

Turkey production remains a smaller but profitable segment with seasonal demand peaks during holidays and special occasions. Market positioning focuses on premium quality and traditional preparation methods, with opportunities for value-added processing and export development. Production systems range from small-scale traditional farms to modern commercial operations.

Specialty poultry including duck, guinea fowl, and other species serve niche markets with higher profit margins but limited scale potential. Market development focuses on quality differentiation, traditional cuisine applications, and premium positioning to justify higher prices and maintain profitability despite smaller market size.

Farmers and producers benefit from Morocco’s growing poultry market through increased income opportunities, access to modern technologies, and government support programs that facilitate farm modernization and expansion. Economic benefits include stable demand for poultry products, improving profit margins through efficiency gains, and opportunities for value-added activities such as processing and direct marketing.

Consumers enjoy benefits including affordable protein sources, improving product quality and safety standards, and increasing product variety and convenience options. Nutritional benefits from increased poultry consumption contribute to improved dietary quality, while competitive pricing makes protein accessible to broader population segments.

Government and policymakers realize benefits through rural development, employment creation, food security enhancement, and export revenue generation. Economic development benefits include agricultural sector modernization, reduced import dependency for protein products, and strengthened rural economies through poultry industry growth.

Supporting industries including feed manufacturers, equipment suppliers, veterinary services, and transportation companies benefit from expanding business opportunities as the poultry sector grows. Value chain development creates multiplier effects throughout the agricultural economy, supporting employment and economic activity in related sectors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Consolidation trends continue shaping Morocco’s poultry industry as larger companies acquire smaller operations to achieve economies of scale and improve market positioning. Vertical integration strategies become increasingly common, with companies investing in feed mills, processing facilities, and distribution networks to control more of the value chain and improve profitability.

Technology adoption accelerates across the industry, with modern farms implementing automated feeding systems, climate control technologies, and data management systems to optimize production efficiency. Precision farming techniques including IoT sensors and analytics platforms help producers monitor bird health, optimize feed utilization, and improve overall performance metrics.

Sustainability initiatives gain importance as consumers and regulators focus on environmental impact, animal welfare, and resource efficiency. Sustainable practices include waste management improvements, water conservation measures, and renewable energy adoption in poultry operations, responding to growing environmental consciousness.

Product diversification trends include development of value-added products, organic and free-range options, and convenience foods that meet evolving consumer preferences. Market segmentation strategies target different consumer groups with specialized products, premium positioning, and enhanced quality attributes that command higher prices and improve profitability.

Infrastructure investments by both government and private sector focus on improving cold storage facilities, processing capabilities, and transportation networks that support poultry industry growth. Modern processing plants with international quality standards enable export market development and improve product quality for domestic consumers.

Research and development initiatives include breeding programs for improved genetics, nutrition research for better feed efficiency, and disease prevention strategies that enhance production sustainability. MarkWide Research indicates that investment in R&D activities has increased significantly, with companies and research institutions collaborating on innovation projects.

Trade agreements and market access negotiations open new opportunities for Moroccan poultry exports, particularly in African markets where demand continues growing. Export certification programs help producers meet international quality and safety standards required for global market participation.

Training and education programs for farmers and industry workers improve technical skills, management capabilities, and adoption of best practices throughout the poultry value chain. Capacity building initiatives supported by government and international organizations enhance industry competitiveness and sustainability.

Strategic recommendations for Morocco’s poultry industry focus on addressing key challenges while capitalizing on growth opportunities. Feed security improvements through domestic production development, strategic sourcing arrangements, and risk management strategies can reduce cost volatility and supply risks that currently constrain industry growth.

Technology adoption acceleration through financing programs, training initiatives, and demonstration projects can help smaller producers access modern production systems and improve competitiveness. Cooperative development and farmer organization strengthening can facilitate technology sharing, bulk purchasing, and collective marketing that benefit smaller producers.

Market development strategies should emphasize export market expansion, particularly in African countries where Morocco has competitive advantages and growing trade relationships. Quality assurance programs and international certification initiatives can support export development and premium market positioning.

Policy recommendations include continued support for infrastructure development, research and development funding, and regulatory frameworks that balance food safety requirements with industry competitiveness. Investment incentives for modern production facilities, processing capabilities, and technology adoption can accelerate industry modernization and growth.

Growth projections for Morocco’s poultry market indicate continued expansion driven by demographic trends, economic development, and increasing protein consumption patterns. MWR analysis suggests that the sector will maintain robust growth rates over the next decade, with production capacity expanding to meet both domestic demand and export opportunities.

Market evolution trends point toward increased consolidation, technology integration, and value chain development that will reshape the industry structure. Modernization efforts will continue transforming traditional farming operations into efficient commercial enterprises capable of competing in global markets while serving growing domestic demand.

Export development represents a key growth driver, with Morocco positioned to become a significant supplier to African markets and potentially European markets through strategic positioning and quality improvements. Regional integration initiatives and trade agreements will facilitate market access and support export growth objectives.

Innovation focus will emphasize sustainability, efficiency, and quality improvements that address consumer preferences and regulatory requirements. Technology integration including automation, data analytics, and precision farming will become standard practices in modern poultry operations, driving productivity gains and competitive advantages.

Morocco’s poultry market demonstrates strong fundamentals and promising growth prospects, supported by favorable demographic trends, government support, and strategic geographic positioning. The industry has achieved significant progress in production efficiency, quality improvements, and market development, establishing a solid foundation for continued expansion and modernization.

Key success factors include addressing feed security challenges, accelerating technology adoption, and developing export capabilities that leverage Morocco’s competitive advantages. The sector’s ability to balance traditional farming systems with modern commercial operations provides flexibility and resilience in meeting diverse market demands and consumer preferences.

Strategic priorities for industry stakeholders include infrastructure development, technology integration, and market diversification that support sustainable growth and competitiveness. Collaborative efforts between government, private sector, and international partners will be essential for realizing the full potential of Morocco’s poultry industry and its contribution to national economic development and food security objectives.

What is Poultry?

Poultry refers to domesticated birds raised for their meat, eggs, or feathers. Common types include chickens, turkeys, ducks, and geese, which are significant in the food industry for their nutritional value and economic importance.

What are the key players in the Morocco Poultry Market?

Key players in the Morocco Poultry Market include Les Domaines Agricoles, Groupe Abenis, and Copag, which are involved in poultry production, processing, and distribution, among others.

What are the growth factors driving the Morocco Poultry Market?

The Morocco Poultry Market is driven by increasing consumer demand for protein-rich foods, urbanization leading to higher meat consumption, and advancements in poultry farming technologies.

What challenges does the Morocco Poultry Market face?

Challenges in the Morocco Poultry Market include disease outbreaks affecting bird populations, fluctuating feed prices, and regulatory hurdles that impact production and distribution.

What opportunities exist in the Morocco Poultry Market?

Opportunities in the Morocco Poultry Market include the potential for export growth, the rise of organic poultry products, and increasing investments in modern farming practices.

What trends are shaping the Morocco Poultry Market?

Trends in the Morocco Poultry Market include a shift towards sustainable farming practices, the adoption of technology for better production efficiency, and a growing preference for locally sourced poultry products.

Morocco Poultry Market

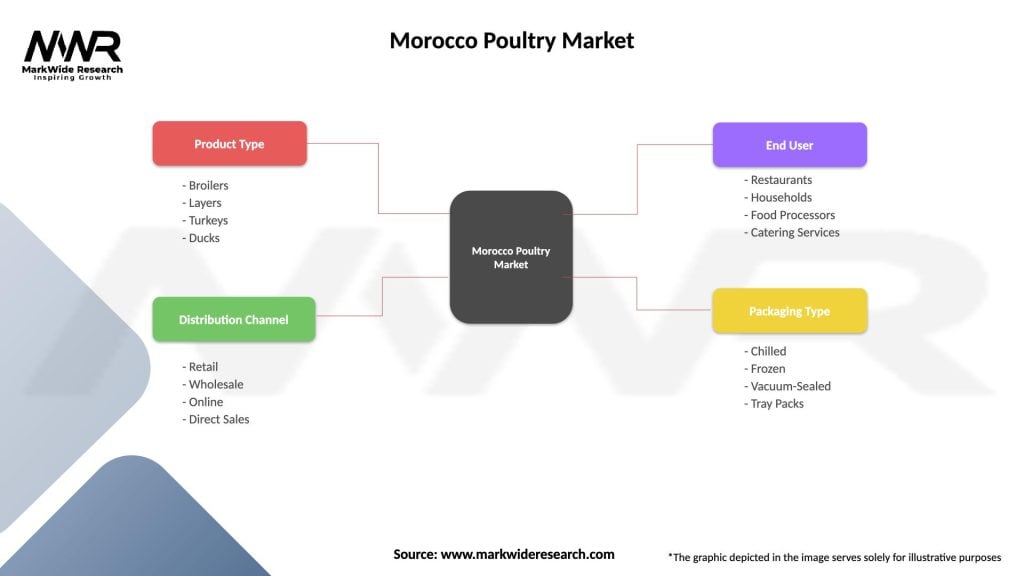

| Segmentation Details | Description |

|---|---|

| Product Type | Broilers, Layers, Turkeys, Ducks |

| Distribution Channel | Retail, Wholesale, Online, Direct Sales |

| End User | Restaurants, Households, Food Processors, Catering Services |

| Packaging Type | Chilled, Frozen, Vacuum-Sealed, Tray Packs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Morocco Poultry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at