444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico digital transformation market represents one of the most dynamic and rapidly evolving sectors in Latin America’s technology landscape. Digital transformation initiatives across Mexico are fundamentally reshaping how businesses operate, deliver services, and engage with customers in the modern economy. The market encompasses a comprehensive range of technologies including cloud computing, artificial intelligence, Internet of Things (IoT), big data analytics, and automation solutions that are driving unprecedented change across industries.

Mexican enterprises are increasingly recognizing the critical importance of digital transformation as a strategic imperative rather than merely a technological upgrade. The market is experiencing robust growth driven by 12.8% annual expansion in digital adoption rates across key sectors including manufacturing, retail, healthcare, and financial services. This transformation is particularly evident in Mexico’s manufacturing sector, where Industry 4.0 technologies are revolutionizing production processes and supply chain management.

Government initiatives play a crucial role in accelerating digital transformation across Mexico, with significant investments in digital infrastructure and smart city projects. The Mexican government’s commitment to digitalization is reflected in comprehensive policy frameworks that support both public and private sector digital initiatives. Small and medium enterprises (SMEs) represent a particularly important segment, with 68% of Mexican SMEs actively pursuing digital transformation strategies to enhance competitiveness and operational efficiency.

The Mexico digital transformation market refers to the comprehensive ecosystem of technologies, services, and solutions that enable organizations across Mexico to fundamentally change their business models, processes, and customer experiences through digital technologies. This market encompasses the adoption and implementation of advanced technologies such as cloud computing, artificial intelligence, machine learning, IoT devices, blockchain, and data analytics platforms that collectively drive organizational modernization and competitive advantage.

Digital transformation in the Mexican context involves the strategic integration of digital technologies into all areas of business operations, fundamentally changing how companies deliver value to customers and stakeholders. The market includes software solutions, hardware infrastructure, professional services, and consulting expertise required to successfully navigate the complex journey from traditional business models to digitally-enabled enterprises.

Mexico’s digital transformation market stands at a pivotal moment of unprecedented growth and opportunity, driven by increasing digitalization demands across all sectors of the economy. The market demonstrates remarkable resilience and adaptability, with organizations rapidly adopting digital technologies to enhance operational efficiency, improve customer experiences, and maintain competitive positioning in an increasingly digital-first business environment.

Key market drivers include accelerating cloud adoption, growing demand for data-driven decision making, and the imperative for businesses to enhance digital customer touchpoints. The market is characterized by strong participation from both international technology providers and emerging local solution developers who understand the unique requirements of the Mexican business landscape. Manufacturing and retail sectors lead digital transformation investments, accounting for approximately 45% of total market activity.

Emerging technologies such as artificial intelligence, machine learning, and advanced analytics are gaining significant traction, with 58% of Mexican enterprises planning substantial investments in AI-powered solutions over the next three years. The market outlook remains highly positive, supported by favorable government policies, increasing digital literacy, and growing recognition of digital transformation as essential for long-term business sustainability.

Strategic market insights reveal several critical trends shaping Mexico’s digital transformation landscape:

Primary market drivers propelling Mexico’s digital transformation market include the urgent need for operational efficiency improvements and competitive differentiation in increasingly digital markets. Cost optimization pressures are compelling organizations to adopt digital solutions that streamline processes, reduce manual interventions, and enhance productivity across all business functions.

Customer expectations represent another powerful driver, as Mexican consumers increasingly demand seamless, personalized, and digitally-enabled experiences across all touchpoints. The rise of e-commerce and digital commerce platforms has fundamentally altered customer behavior patterns, forcing traditional businesses to accelerate their digital transformation initiatives to remain relevant and competitive.

Regulatory compliance requirements are also driving digital transformation adoption, particularly in highly regulated sectors such as financial services and healthcare. Digital solutions provide enhanced capabilities for compliance monitoring, reporting, and audit trail management that are essential for meeting evolving regulatory standards.

Data monetization opportunities are increasingly recognized as significant value drivers, with organizations seeking to leverage their data assets for new revenue streams and enhanced decision-making capabilities. The growing availability of advanced analytics tools and platforms makes data-driven insights more accessible to organizations of all sizes.

Significant market restraints include the substantial capital investment requirements associated with comprehensive digital transformation initiatives. Many Mexican organizations, particularly smaller enterprises, face challenges in securing adequate funding for large-scale technology implementations and the associated infrastructure upgrades required for successful digital transformation.

Skills shortages represent a critical constraint, with limited availability of qualified digital transformation professionals and technical specialists in key areas such as cloud architecture, data science, and cybersecurity. This talent gap creates implementation delays and increases project costs as organizations compete for scarce expertise.

Legacy system integration challenges pose significant technical and financial obstacles, as many organizations must maintain existing systems while implementing new digital solutions. The complexity of integrating modern digital platforms with established legacy infrastructure often requires extensive customization and specialized expertise.

Cybersecurity concerns and data privacy regulations create additional complexity and cost considerations for digital transformation projects. Organizations must invest in robust security frameworks and compliance capabilities, which can significantly impact project timelines and budgets.

Substantial market opportunities exist in the rapidly expanding e-commerce and digital commerce sectors, where traditional retailers are investing heavily in omnichannel platforms and digital customer engagement solutions. The growth of online shopping and digital payment systems creates significant demand for integrated digital transformation solutions.

Smart city initiatives across major Mexican metropolitan areas present significant opportunities for digital transformation solution providers. Government investments in urban technology infrastructure, traffic management systems, and citizen service platforms create substantial market potential for innovative digital solutions.

Industry 4.0 adoption in Mexico’s manufacturing sector offers extensive opportunities for digital transformation providers specializing in industrial IoT, predictive maintenance, and automated production systems. The country’s strong manufacturing base provides a substantial addressable market for advanced digital solutions.

Financial technology innovation represents another high-growth opportunity area, with increasing demand for digital banking solutions, mobile payment platforms, and blockchain-based financial services. The growing fintech ecosystem in Mexico creates opportunities for specialized digital transformation providers.

Market dynamics in Mexico’s digital transformation sector are characterized by rapid technological evolution and increasing competitive intensity among solution providers. Technology convergence is creating new opportunities for integrated solutions that combine multiple digital capabilities into comprehensive transformation platforms.

Vendor ecosystem evolution shows increasing collaboration between international technology giants and local Mexican solution providers, creating hybrid delivery models that combine global expertise with local market knowledge. This trend is particularly evident in cloud services and enterprise software implementations.

Customer buying behavior is shifting toward outcome-based procurement models, with organizations increasingly seeking digital transformation partners who can demonstrate measurable business results rather than simply providing technology implementations. This evolution is driving greater emphasis on consulting services and change management capabilities.

Competitive differentiation is increasingly based on industry-specific expertise and vertical solution capabilities rather than generic technology offerings. Solution providers are developing specialized competencies in key sectors such as manufacturing, retail, and financial services to capture market share.

Comprehensive research methodology employed for analyzing Mexico’s digital transformation market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. Primary research activities include extensive interviews with key market participants, including technology vendors, system integrators, end-user organizations, and industry experts across various sectors.

Secondary research components involve detailed analysis of industry reports, government publications, company financial statements, and technology adoption surveys conducted by various market research organizations. MarkWide Research analysts utilize proprietary databases and analytical frameworks to validate market data and identify emerging trends.

Data validation processes include cross-referencing multiple information sources, conducting follow-up interviews with key stakeholders, and applying statistical analysis techniques to ensure data consistency and reliability. Market sizing and forecasting models incorporate both bottom-up and top-down analytical approaches to provide comprehensive market perspectives.

Analytical frameworks employed include Porter’s Five Forces analysis, SWOT assessment, and competitive positioning analysis to provide strategic insights into market dynamics and competitive landscapes. Trend analysis and scenario planning techniques are utilized to develop forward-looking market projections and identify potential market disruptions.

Regional market distribution across Mexico shows significant concentration in major metropolitan areas, with Mexico City, Guadalajara, and Monterrey accounting for approximately 72% of digital transformation activity. These urban centers benefit from superior digital infrastructure, higher concentrations of technology talent, and greater access to international solution providers.

Mexico City region dominates the market with the highest concentration of large enterprises and government organizations driving substantial digital transformation investments. The capital region benefits from proximity to decision-making centers and access to international technology vendors establishing regional operations.

Northern Mexico regions, particularly around Monterrey and Tijuana, show strong growth in manufacturing-focused digital transformation initiatives. The proximity to the United States border and concentration of manufacturing operations create significant demand for Industry 4.0 solutions and supply chain digitalization.

Emerging regional markets in central and southern Mexico are experiencing accelerating digital transformation adoption, driven by government initiatives to promote technology adoption in underserved areas. These regions present significant growth opportunities for solution providers willing to invest in local market development.

Competitive landscape in Mexico’s digital transformation market features a diverse mix of international technology giants, regional solution providers, and specialized consulting firms competing across various market segments and industry verticals.

Market competition is intensifying as traditional IT service providers expand their digital transformation capabilities while new entrants bring specialized expertise in emerging technologies such as artificial intelligence and blockchain.

Market segmentation analysis reveals distinct categories based on technology type, deployment model, organization size, and industry vertical, each presenting unique growth characteristics and competitive dynamics.

By Technology Type:

By Deployment Model:

By Organization Size:

Cloud computing solutions represent the largest and fastest-growing segment of Mexico’s digital transformation market, with organizations increasingly adopting cloud-first strategies for new application development and legacy system modernization. Hybrid cloud architectures are particularly popular, allowing organizations to maintain sensitive data on-premises while leveraging public cloud scalability for other workloads.

Artificial intelligence and machine learning solutions are experiencing rapid adoption growth, with 35% of Mexican enterprises implementing AI-powered applications for customer service, fraud detection, and predictive analytics. The segment benefits from increasing availability of pre-built AI models and platforms that reduce implementation complexity and costs.

Internet of Things implementations are gaining significant traction in manufacturing and logistics sectors, where connected sensors and devices provide real-time visibility into operations and enable predictive maintenance capabilities. Smart building solutions are also driving IoT adoption in commercial real estate and facility management applications.

Cybersecurity solutions have become essential components of digital transformation initiatives, with organizations investing in comprehensive security frameworks that protect digital assets while enabling business agility. Zero-trust security models are increasingly adopted as organizations expand their digital footprints and remote work capabilities.

Technology vendors benefit from expanding market opportunities as Mexican organizations accelerate digital transformation investments across all sectors. The growing market provides opportunities for both established technology companies and innovative startups to capture market share through specialized solutions and industry expertise.

System integrators and consultants experience increased demand for their services as organizations require expert guidance to navigate complex digital transformation journeys. The market expansion creates opportunities for service providers to develop specialized capabilities and build long-term client relationships.

End-user organizations gain significant competitive advantages through digital transformation initiatives, including improved operational efficiency, enhanced customer experiences, and new revenue opportunities. Digital capabilities enable organizations to respond more effectively to market changes and customer demands.

Government entities benefit from digital transformation through improved citizen services, enhanced operational efficiency, and better data-driven policy making capabilities. Smart city initiatives create opportunities to address urban challenges while improving quality of life for residents.

Economic stakeholders benefit from the overall economic growth and productivity improvements generated by widespread digital transformation adoption. The technology sector’s growth contributes to job creation, skills development, and increased competitiveness of Mexican businesses in global markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is becoming increasingly sophisticated, with organizations moving beyond basic automation to implement advanced AI capabilities for predictive analytics, customer personalization, and intelligent decision-making. Machine learning models are being embedded into core business processes to drive continuous improvement and competitive advantage.

Edge computing adoption is accelerating as organizations seek to process data closer to its source for improved performance and reduced latency. This trend is particularly evident in manufacturing and logistics applications where real-time processing capabilities are critical for operational efficiency.

Low-code and no-code platforms are gaining significant traction, enabling organizations to accelerate application development and reduce dependence on scarce technical resources. These platforms democratize digital transformation by allowing business users to create and modify applications without extensive programming expertise.

Sustainability-focused digital solutions are becoming increasingly important as organizations seek to reduce environmental impact while improving operational efficiency. Green technology initiatives are driving demand for energy-efficient digital solutions and carbon footprint monitoring capabilities.

API-first architectures are becoming standard practice for digital transformation initiatives, enabling greater flexibility and integration capabilities across diverse technology ecosystems. This approach facilitates modular solution development and easier third-party integrations.

Major cloud providers are establishing additional data centers and infrastructure in Mexico to support growing demand for local cloud services and comply with data residency requirements. These investments significantly improve service performance and reduce latency for Mexican organizations.

Government digitalization initiatives are expanding rapidly, with new programs focused on digital identity, electronic government services, and smart city development. These initiatives create substantial opportunities for digital transformation solution providers while improving citizen services.

Industry partnerships between international technology companies and Mexican organizations are increasing, creating opportunities for knowledge transfer and local capability development. These collaborations often result in customized solutions that address specific Mexican market requirements.

Venture capital investment in Mexican technology startups is growing significantly, providing funding for innovative digital transformation solutions and fostering local innovation ecosystems. This trend supports the development of Mexico-specific solutions and capabilities.

Educational institutions are expanding digital technology programs and partnerships with industry to address skills shortages and develop the next generation of digital transformation professionals. These initiatives are crucial for long-term market sustainability and growth.

MarkWide Research analysts recommend that organizations prioritize comprehensive digital transformation strategies that align technology investments with specific business objectives and measurable outcomes. Phased implementation approaches are often more successful than attempting large-scale transformations simultaneously across all business areas.

Investment in change management and employee training is critical for successful digital transformation initiatives. Organizations should allocate adequate resources for workforce development and cultural transformation to ensure technology implementations deliver expected benefits.

Cybersecurity considerations should be integrated into digital transformation planning from the initial stages rather than being addressed as an afterthought. Security-by-design approaches are essential for protecting digital assets and maintaining stakeholder confidence.

Partnership strategies with experienced solution providers and system integrators can significantly improve implementation success rates and reduce project risks. Organizations should carefully evaluate potential partners based on industry expertise and proven track records.

Data governance frameworks should be established early in digital transformation journeys to ensure effective data management and compliance with evolving regulatory requirements. Data quality initiatives are fundamental for realizing the full value of digital transformation investments.

Future market prospects for Mexico’s digital transformation market remain highly positive, with continued strong growth expected across all major segments and industry verticals. The market is projected to maintain robust expansion driven by increasing digital adoption rates and growing recognition of digital transformation as essential for business competitiveness.

Emerging technologies such as quantum computing, advanced robotics, and augmented reality are expected to create new market opportunities and drive the next wave of digital transformation initiatives. Organizations that invest early in these technologies may gain significant competitive advantages.

Government support for digital transformation is expected to continue expanding, with new initiatives focused on digital infrastructure development, skills training, and regulatory frameworks that support innovation while protecting consumer interests.

International collaboration and technology transfer are likely to increase as Mexico strengthens its position as a regional technology hub. The country’s strategic location and growing technical capabilities make it an attractive destination for global technology investments.

Market consolidation may occur as successful solution providers expand their capabilities and market reach through acquisitions and strategic partnerships. This trend could lead to the emergence of comprehensive digital transformation platforms that address multiple technology requirements through integrated solutions.

Mexico’s digital transformation market represents a compelling growth opportunity characterized by strong fundamentals, supportive government policies, and increasing enterprise recognition of digital transformation as a strategic imperative. The market benefits from Mexico’s robust manufacturing base, strategic geographic location, and growing pool of technical talent that collectively create favorable conditions for sustained growth.

Market dynamics indicate continued expansion across all major segments, with cloud computing, artificial intelligence, and IoT solutions leading growth initiatives. The increasing sophistication of digital transformation projects and growing emphasis on outcome-based implementations suggest a maturing market that offers substantial opportunities for both technology providers and end-user organizations.

Success factors for market participants include developing deep industry expertise, investing in local capabilities, and maintaining focus on delivering measurable business value through digital transformation initiatives. Organizations that can effectively combine global technology expertise with local market knowledge are positioned to capture significant market share in this dynamic and rapidly evolving market landscape.

What is Digital Transformation?

Digital Transformation refers to the integration of digital technology into all areas of a business, fundamentally changing how it operates and delivers value to customers. It encompasses various aspects such as process automation, data analytics, and customer engagement strategies.

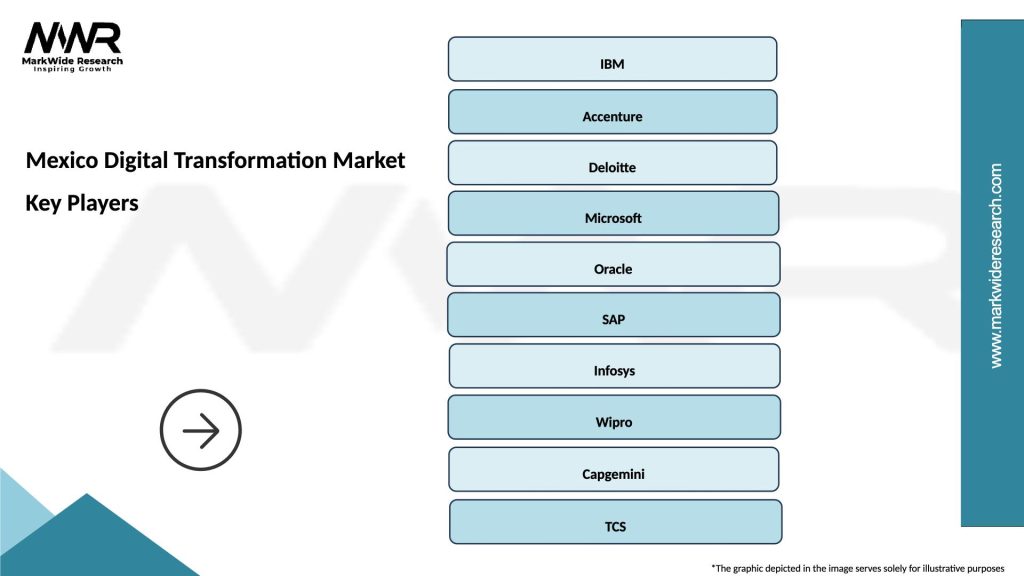

What are the key players in the Mexico Digital Transformation Market?

Key players in the Mexico Digital Transformation Market include companies like Softtek, Kio Networks, and Accenture, which provide a range of services from IT consulting to cloud solutions and digital strategy development, among others.

What are the main drivers of the Mexico Digital Transformation Market?

The main drivers of the Mexico Digital Transformation Market include the increasing demand for improved customer experiences, the need for operational efficiency, and the growing adoption of cloud technologies across various industries.

What challenges does the Mexico Digital Transformation Market face?

Challenges in the Mexico Digital Transformation Market include resistance to change within organizations, a shortage of skilled workforce, and concerns regarding data security and privacy, which can hinder the adoption of new technologies.

What opportunities exist in the Mexico Digital Transformation Market?

Opportunities in the Mexico Digital Transformation Market include the potential for small and medium-sized enterprises to leverage digital tools for growth, the rise of e-commerce, and the increasing investment in smart technologies and IoT solutions.

What trends are shaping the Mexico Digital Transformation Market?

Trends shaping the Mexico Digital Transformation Market include the growing emphasis on artificial intelligence and machine learning, the shift towards remote work solutions, and the increasing importance of data-driven decision-making in business strategies.

Mexico Digital Transformation Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premise, Cloud-Based, Hybrid, Edge Computing |

| Solution | AI Solutions, IoT Platforms, Data Analytics, Cybersecurity Tools |

| End User | Manufacturing, Retail, Healthcare, Education |

| Service Type | Consulting, Integration, Support, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Digital Transformation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at