444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada surveillance IP camera market represents a rapidly evolving sector within the country’s security technology landscape, driven by increasing security concerns, technological advancements, and growing adoption across residential, commercial, and industrial applications. IP surveillance cameras have become essential components of modern security infrastructure, offering superior image quality, remote monitoring capabilities, and advanced analytics features compared to traditional analog systems.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over the forecast period. This expansion is fueled by rising security awareness, smart city initiatives, and the integration of artificial intelligence and machine learning technologies into surveillance systems. Canadian businesses and homeowners are increasingly recognizing the value of IP-based surveillance solutions for comprehensive security coverage.

Technological innovation continues to reshape the market landscape, with manufacturers introducing advanced features such as 4K resolution, thermal imaging, facial recognition, and cloud-based storage solutions. The market encompasses various camera types including dome cameras, bullet cameras, PTZ cameras, and specialized models designed for specific applications. Regional adoption patterns show particularly strong growth in urban centers like Toronto, Vancouver, and Montreal, where security infrastructure investments are prioritized.

The Canada surveillance IP camera market refers to the comprehensive ecosystem of internet protocol-based security cameras, associated hardware, software, and services designed to provide video surveillance capabilities across various sectors within the Canadian territory. IP surveillance cameras utilize digital technology to capture, process, and transmit video data over network connections, enabling real-time monitoring, recording, and analysis of security footage.

These systems differ fundamentally from traditional analog cameras by offering digital signal processing, network connectivity, and advanced features such as motion detection, night vision, and remote access capabilities. The market encompasses manufacturing, distribution, installation, and maintenance services for IP camera systems, serving residential, commercial, industrial, and government sectors throughout Canada.

Key components of this market include the cameras themselves, network video recorders (NVRs), video management software, storage solutions, and professional services. The technology enables users to monitor properties remotely through smartphones, tablets, or computers, providing enhanced security coverage and operational efficiency for various applications.

The Canadian surveillance IP camera market demonstrates exceptional growth momentum, positioning itself as a critical component of the nation’s security infrastructure. Market expansion is driven by increasing security threats, technological advancements, and growing awareness of surveillance benefits across multiple sectors. Digital transformation initiatives and smart city projects further accelerate market adoption, with government and private sector investments supporting infrastructure development.

Key market drivers include rising crime rates in urban areas, increasing adoption of IoT technologies, and growing demand for remote monitoring solutions. The market benefits from 65% of Canadian businesses planning to upgrade their security systems within the next three years, indicating substantial growth potential. Residential adoption has increased significantly, with homeowners seeking comprehensive security solutions for property protection.

Competitive landscape features both international technology giants and specialized Canadian security companies, creating a dynamic market environment. Innovation focus areas include artificial intelligence integration, cloud-based solutions, and energy-efficient designs. Market challenges include privacy concerns, cybersecurity risks, and the need for skilled installation and maintenance personnel.

Strategic market analysis reveals several critical insights shaping the Canadian surveillance IP camera landscape. The market demonstrates strong resilience and adaptability, with technology evolution driving continuous innovation and application expansion.

Security concerns represent the primary catalyst driving Canadian surveillance IP camera market growth, with increasing crime rates and security threats motivating investments in advanced monitoring systems. Urban areas particularly experience heightened security challenges, prompting businesses and residents to seek comprehensive surveillance solutions for property protection and personal safety.

Technological advancement serves as another significant driver, with continuous innovation in camera resolution, analytics capabilities, and connectivity options. The integration of artificial intelligence and machine learning technologies enables advanced features such as facial recognition, behavior analysis, and automated threat detection. Smart city initiatives across major Canadian municipalities create substantial demand for integrated surveillance infrastructure.

Cost reduction in IP camera technology makes these systems increasingly accessible to small and medium-sized businesses, expanding the potential customer base. Remote monitoring capabilities have become particularly valuable, especially following increased remote work adoption and the need for property monitoring during extended absences. Insurance incentives and regulatory requirements in certain sectors further drive adoption, with many insurance providers offering premium reductions for properties equipped with professional surveillance systems.

Privacy concerns constitute a significant restraint in the Canadian surveillance IP camera market, with stringent privacy laws and public sensitivity regarding surveillance activities. The Personal Information Protection and Electronic Documents Act (PIPEDA) and provincial privacy legislation create compliance requirements that may complicate system deployment and operation, particularly in public spaces and multi-tenant buildings.

Cybersecurity risks present ongoing challenges, as IP-connected cameras can become vulnerable to hacking and unauthorized access. Network security requirements necessitate additional investment in cybersecurity measures, potentially increasing total system costs and complexity. Many organizations remain concerned about data breaches and unauthorized surveillance, creating hesitation in adoption decisions.

High initial investment costs for comprehensive surveillance systems can deter small businesses and residential customers, despite long-term benefits. Installation complexity and the need for professional setup services add to overall system costs. Maintenance requirements and the need for ongoing technical support create additional operational expenses that some potential customers find prohibitive.

Smart city development presents substantial opportunities for surveillance IP camera market expansion, with Canadian municipalities investing in integrated technology infrastructure. Government initiatives supporting public safety and urban modernization create demand for advanced surveillance systems in transportation hubs, public spaces, and critical infrastructure facilities.

Artificial intelligence integration opens new application possibilities beyond traditional security monitoring, including traffic management, crowd analysis, and operational optimization. Edge computing capabilities enable real-time processing and decision-making, reducing bandwidth requirements and improving system responsiveness. Retail analytics applications offer businesses valuable insights into customer behavior and operational efficiency.

Residential market expansion represents significant growth potential, with increasing homeowner interest in DIY security solutions and professional monitoring services. Integration opportunities with home automation systems and IoT devices create comprehensive smart home ecosystems. Subscription-based services for cloud storage, monitoring, and maintenance provide recurring revenue opportunities for service providers.

The Canadian surveillance IP camera market operates within a complex ecosystem of technological, regulatory, and economic factors that influence growth patterns and adoption trends. Market dynamics are characterized by rapid technological evolution, changing customer expectations, and evolving regulatory frameworks that shape industry development.

Supply chain considerations play a crucial role in market dynamics, with global component sourcing and manufacturing affecting product availability and pricing. Canadian distributors and system integrators serve as critical intermediaries, providing local expertise and support services. Seasonal variations in installation activity, particularly in harsh winter conditions, influence market timing and project planning.

Competitive pressures drive continuous innovation and price optimization, with manufacturers competing on features, reliability, and total cost of ownership. Customer education remains essential, as many potential users require guidance on system capabilities, installation requirements, and ongoing maintenance needs. Partnership strategies between manufacturers, distributors, and service providers create integrated value propositions that enhance market penetration.

Comprehensive market research for the Canadian surveillance IP camera market employs multiple methodological approaches to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry stakeholders, including manufacturers, distributors, system integrators, and end-users across various sectors and geographic regions within Canada.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and trend identification. Data triangulation methods validate findings across multiple sources, ensuring research accuracy and minimizing potential biases in market assessment.

Quantitative analysis includes market sizing calculations, growth projections, and statistical modeling to forecast future market developments. Qualitative insights from expert interviews and focus groups provide context for numerical data and identify emerging trends. Regional analysis considers provincial variations in regulations, economic conditions, and adoption patterns to provide comprehensive market understanding.

Ontario dominates the Canadian surveillance IP camera market, accounting for approximately 42% of national demand, driven by the concentration of major urban centers, industrial facilities, and commercial establishments. Toronto metropolitan area represents the largest single market, with extensive adoption across financial districts, retail centers, and residential developments. Manufacturing sectors in southern Ontario drive significant industrial surveillance demand.

British Columbia holds the second-largest market share at approximately 23%, with Vancouver leading adoption in both commercial and residential sectors. Port facilities and transportation infrastructure create substantial demand for specialized surveillance solutions. Technology sector companies in the region often serve as early adopters of advanced IP camera systems.

Quebec represents approximately 18% of the market, with Montreal driving significant commercial and institutional demand. Provincial language requirements influence system selection and service provider choices. Alberta accounts for roughly 12% of market share, with energy sector installations and urban development projects supporting growth. Atlantic provinces and territories collectively represent the remaining 5% of market demand, with growth potential in resource extraction and government facility applications.

The competitive landscape of the Canadian surveillance IP camera market features a diverse mix of international technology leaders, specialized security companies, and local system integrators. Market competition focuses on technological innovation, product reliability, customer service, and total cost of ownership.

Competitive strategies include product differentiation through advanced analytics, cloud integration, and specialized applications. Local partnerships with Canadian distributors and system integrators enhance market reach and customer support capabilities.

Market segmentation analysis reveals distinct categories based on technology, application, end-user, and geographic factors. Technology segmentation includes various camera types, resolution capabilities, and feature sets that address specific customer requirements and budget considerations.

By Technology:

By Resolution:

Commercial applications represent the largest market category, driven by retail establishments, office buildings, and industrial facilities seeking comprehensive security coverage. Retail surveillance systems focus on loss prevention, customer analytics, and operational monitoring, with advanced features such as people counting and behavior analysis becoming increasingly popular.

Residential category shows rapid growth, with homeowners investing in DIY security systems and professional monitoring services. Smart home integration capabilities drive adoption, allowing seamless connectivity with existing home automation systems. Apartment buildings and condominiums represent significant opportunities for bulk installations and property management applications.

Industrial surveillance focuses on perimeter security, process monitoring, and safety compliance applications. Manufacturing facilities utilize IP cameras for quality control, equipment monitoring, and workplace safety enhancement. Critical infrastructure including utilities, transportation, and government facilities require specialized surveillance solutions with enhanced security features and reliability.

According to MarkWide Research analysis, the residential segment demonstrates the highest growth potential, with adoption rates increasing by 15% annually as homeowners recognize the value of professional-grade surveillance systems for property protection and peace of mind.

Manufacturers benefit from expanding market opportunities driven by technological advancement and increasing security awareness. Product innovation in areas such as artificial intelligence, cloud connectivity, and energy efficiency creates competitive advantages and premium pricing opportunities. Canadian market entry provides access to stable economic conditions and growing demand across multiple sectors.

Distributors and resellers gain from recurring revenue opportunities through maintenance contracts, software subscriptions, and system upgrades. Value-added services including installation, training, and technical support create additional revenue streams and customer loyalty. Partnership opportunities with manufacturers enable access to latest technologies and marketing support.

System integrators benefit from increasing demand for complex installations and custom solutions. Specialization opportunities in vertical markets such as healthcare, education, or retail create competitive differentiation. End-users gain enhanced security coverage, operational insights, and peace of mind through advanced surveillance capabilities. Insurance benefits and potential premium reductions provide additional value for property owners investing in professional surveillance systems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend shaping the Canadian surveillance IP camera market, with advanced analytics capabilities becoming standard features rather than premium options. Machine learning algorithms enable sophisticated threat detection, behavior analysis, and automated response systems that enhance security effectiveness while reducing false alarms.

Cloud-based solutions gain increasing adoption as organizations seek scalable, flexible surveillance systems without significant on-premise infrastructure investments. Hybrid cloud models combine local storage for immediate access with cloud backup for long-term retention and remote accessibility. Mobile integration continues expanding, with smartphone applications providing real-time monitoring and system control capabilities.

Edge computing emerges as a critical trend, enabling real-time processing and decision-making at the camera level rather than requiring centralized processing. Privacy-by-design approaches address regulatory requirements and public concerns through features such as automatic face blurring and selective recording zones. Sustainability focus drives demand for energy-efficient cameras and solar-powered installations, particularly for remote locations.

Recent industry developments highlight the dynamic nature of the Canadian surveillance IP camera market, with continuous innovation and strategic initiatives shaping competitive positioning. Major manufacturers have announced significant investments in Canadian operations, including expanded distribution networks and local technical support capabilities.

Technology partnerships between camera manufacturers and software developers create integrated solutions that address specific vertical market requirements. Cybersecurity enhancements receive increased focus, with manufacturers implementing advanced encryption, secure boot processes, and regular firmware updates to address security concerns.

Government initiatives supporting smart city development and public safety infrastructure create substantial opportunities for surveillance system deployment. MWR data indicates that municipal investments in surveillance technology have increased by 28% over the past two years, reflecting growing recognition of technology’s role in public safety and urban management.

Industry consolidation continues as larger companies acquire specialized technology firms and regional distributors to expand capabilities and market reach. Standards development efforts focus on interoperability, cybersecurity, and privacy protection to support market growth and customer confidence.

Market participants should prioritize cybersecurity capabilities and privacy compliance features to address growing customer concerns and regulatory requirements. Investment in artificial intelligence and analytics capabilities will become essential for competitive differentiation as these features transition from premium options to standard expectations.

Channel partner development remains critical for market success, with manufacturers needing strong relationships with local distributors and system integrators who understand regional requirements and customer preferences. Training programs for installation and maintenance personnel will become increasingly important as systems become more sophisticated.

Vertical market specialization offers opportunities for differentiation and premium pricing, with customized solutions for healthcare, education, retail, and industrial applications. Subscription service models should be developed to provide recurring revenue streams and ongoing customer relationships beyond initial hardware sales.

Sustainability initiatives including energy-efficient designs and environmentally responsible manufacturing processes will become increasingly important for customer selection criteria and regulatory compliance. Integration capabilities with existing security systems and building management platforms should be prioritized to reduce implementation complexity and costs.

The Canadian surveillance IP camera market demonstrates strong growth prospects driven by technological advancement, increasing security awareness, and expanding application opportunities. Market evolution will be characterized by continued innovation in artificial intelligence, cloud integration, and specialized applications that extend beyond traditional security monitoring.

Growth projections indicate sustained expansion across all major market segments, with residential applications showing particularly strong potential as homeowners increasingly recognize the value of professional-grade surveillance systems. Commercial and industrial sectors will continue driving demand through facility expansion, security upgrades, and integration with broader operational management systems.

Technology convergence will create new opportunities as surveillance systems integrate with IoT devices, building automation systems, and business intelligence platforms. 5G connectivity will enable enhanced mobile monitoring capabilities and support for higher-resolution cameras with advanced analytics features. Regulatory evolution will continue shaping market development, with privacy protection and cybersecurity requirements influencing product design and deployment practices.

MarkWide Research projects that the market will maintain robust growth momentum, with adoption rates expected to increase by 12% annually over the next five years as technology costs decrease and awareness of surveillance benefits continues expanding across all customer segments.

The Canada surveillance IP camera market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological innovation, increasing security concerns, and expanding application opportunities. Market fundamentals remain strong, supported by robust demand across residential, commercial, and industrial sectors, along with government initiatives promoting smart city development and public safety infrastructure.

Key success factors for market participants include continuous innovation in artificial intelligence and analytics capabilities, strong cybersecurity features, privacy compliance, and comprehensive channel partner networks. The integration of advanced technologies such as edge computing, cloud services, and mobile connectivity will continue driving market evolution and creating new value propositions for customers.

Future market development will be shaped by regulatory frameworks, technological convergence, and changing customer expectations regarding system capabilities and service delivery. Organizations that successfully navigate these trends while maintaining focus on customer needs and technological excellence will be well-positioned to capitalize on the significant opportunities within Canada’s expanding surveillance IP camera market.

What is Surveillance IP Camera?

Surveillance IP Camera refers to a digital video camera that transmits data over a network, allowing for remote monitoring and recording. These cameras are widely used in security systems for homes, businesses, and public spaces.

What are the key players in the Canada Surveillance IP Camera Market?

Key players in the Canada Surveillance IP Camera Market include Hikvision, Dahua Technology, Axis Communications, and Bosch Security Systems, among others.

What are the main drivers of growth in the Canada Surveillance IP Camera Market?

The main drivers of growth in the Canada Surveillance IP Camera Market include the increasing demand for security solutions, advancements in camera technology, and the rise in smart city initiatives.

What challenges does the Canada Surveillance IP Camera Market face?

Challenges in the Canada Surveillance IP Camera Market include concerns over privacy and data security, high installation costs, and the need for continuous technological upgrades.

What opportunities exist in the Canada Surveillance IP Camera Market?

Opportunities in the Canada Surveillance IP Camera Market include the integration of artificial intelligence for enhanced analytics, the growth of cloud-based storage solutions, and the increasing adoption of IoT devices.

What trends are shaping the Canada Surveillance IP Camera Market?

Trends shaping the Canada Surveillance IP Camera Market include the shift towards wireless camera systems, the use of high-definition video technology, and the growing emphasis on cybersecurity measures.

Canada Surveillance IP Camera Market

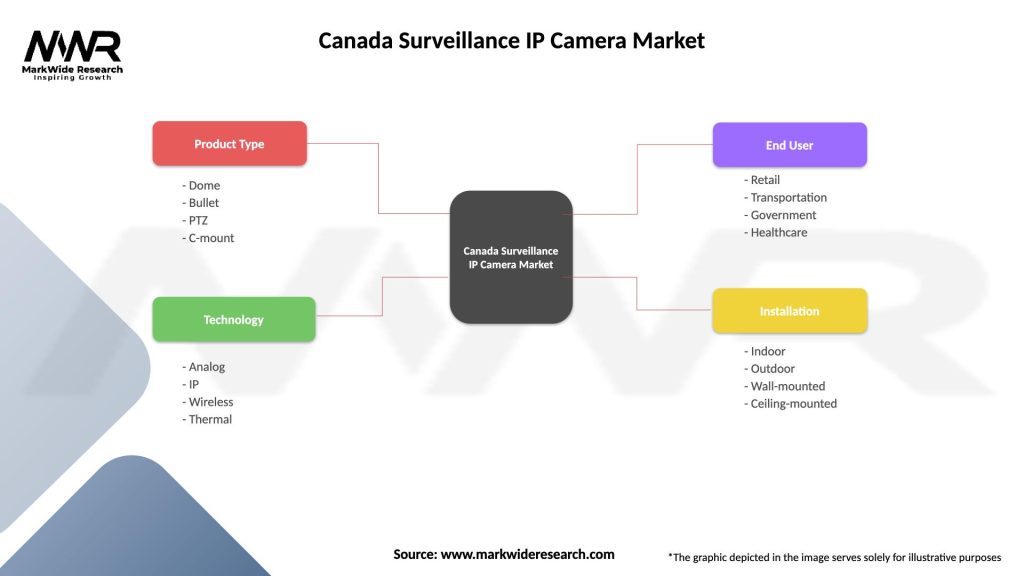

| Segmentation Details | Description |

|---|---|

| Product Type | Dome, Bullet, PTZ, C-mount |

| Technology | Analog, IP, Wireless, Thermal |

| End User | Retail, Transportation, Government, Healthcare |

| Installation | Indoor, Outdoor, Wall-mounted, Ceiling-mounted |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Surveillance IP Camera Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at