444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada commercial HVAC market represents a dynamic and rapidly evolving sector within the nation’s construction and building services industry. Commercial heating, ventilation, and air conditioning systems serve as the backbone of modern commercial infrastructure across Canada, from office buildings and retail spaces to healthcare facilities and educational institutions. The market demonstrates robust growth potential driven by increasing construction activities, stringent energy efficiency regulations, and growing awareness of indoor air quality standards.

Market dynamics indicate significant expansion opportunities as Canadian businesses prioritize sustainable building solutions and smart HVAC technologies. The sector benefits from government incentives promoting energy-efficient systems and the ongoing modernization of aging commercial infrastructure. With a projected CAGR of 6.2% over the forecast period, the market reflects strong demand across multiple commercial segments including offices, retail, healthcare, hospitality, and industrial facilities.

Regional distribution shows concentrated activity in major metropolitan areas such as Toronto, Vancouver, Calgary, and Montreal, where commercial development remains active. The market encompasses various system types including central air conditioning, heat pumps, chillers, boilers, and advanced building automation systems that integrate seamlessly with modern commercial operations.

The Canada commercial HVAC market refers to the comprehensive ecosystem of heating, ventilation, and air conditioning systems specifically designed for commercial and institutional buildings throughout Canada. This market encompasses the manufacturing, distribution, installation, and maintenance of HVAC equipment and services tailored to meet the unique climate challenges and regulatory requirements of Canadian commercial properties.

Commercial HVAC systems differ significantly from residential units in their scale, complexity, and performance requirements. These systems must handle larger spaces, accommodate varying occupancy levels, and maintain precise environmental controls while operating efficiently in Canada’s diverse climate conditions ranging from humid summers to harsh winters. The market includes both new installations and replacement systems for existing commercial infrastructure.

Key components of this market include centralized heating and cooling equipment, ductwork and ventilation systems, building automation controls, energy management systems, and specialized equipment for specific commercial applications. The market also encompasses related services such as system design, installation, commissioning, maintenance, and energy optimization consulting.

Canada’s commercial HVAC market demonstrates exceptional resilience and growth potential, driven by increasing commercial construction activities and mandatory energy efficiency standards. The market benefits from strong regulatory support through federal and provincial energy codes that mandate high-performance HVAC systems in new commercial buildings. Energy efficiency requirements account for approximately 35% of purchasing decisions in the commercial sector, highlighting the importance of sustainable solutions.

Technology adoption accelerates across the market as businesses seek integrated building management systems that optimize energy consumption while maintaining occupant comfort. Smart HVAC technologies, including IoT-enabled controls and predictive maintenance capabilities, represent the fastest-growing segment with adoption rates increasing by 28% annually among large commercial facilities.

Market segmentation reveals diverse opportunities across office buildings, retail spaces, healthcare facilities, educational institutions, and hospitality venues. The healthcare segment shows particularly strong growth due to stringent air quality requirements and ongoing facility expansions. Replacement market activities constitute approximately 42% of total market demand, driven by aging infrastructure and energy efficiency upgrades.

Competitive landscape features both international manufacturers and specialized Canadian service providers, creating a dynamic ecosystem that supports innovation and customer service excellence. The market’s future trajectory appears positive, supported by continued urbanization, commercial development, and increasing focus on sustainable building operations.

Strategic market insights reveal several critical factors shaping Canada’s commercial HVAC landscape. The market demonstrates strong correlation with commercial construction cycles, with new construction projects driving approximately 58% of equipment demand in major metropolitan areas.

Primary market drivers propel sustained growth in Canada’s commercial HVAC sector through multiple interconnected factors. Government regulations serve as the most significant driver, with federal and provincial energy codes mandating increasingly stringent efficiency standards for commercial buildings. These regulations create consistent demand for high-performance HVAC systems that exceed baseline requirements.

Commercial construction activity remains robust across major Canadian cities, driven by population growth, urbanization trends, and business expansion. New office developments, retail centers, healthcare facilities, and educational institutions require sophisticated HVAC systems capable of maintaining optimal indoor environments while minimizing energy consumption. Construction spending in the commercial sector maintains steady growth, supporting sustained HVAC market expansion.

Energy cost concerns motivate commercial property owners to invest in efficient HVAC systems that reduce operational expenses. With energy costs representing a significant portion of commercial building operating budgets, businesses increasingly view high-efficiency HVAC systems as strategic investments rather than necessary expenses. Payback periods for energy-efficient systems continue to decrease, making upgrades financially attractive.

Technological advancement drives market growth through innovative solutions that offer enhanced performance, reliability, and user control. Smart building technologies, predictive maintenance capabilities, and integrated building management systems create compelling value propositions for commercial property owners seeking competitive advantages through operational efficiency.

Market restraints present challenges that commercial HVAC stakeholders must navigate to maintain growth momentum. High initial capital costs represent the primary barrier for many commercial property owners, particularly smaller businesses and older facilities with limited budgets. Advanced HVAC systems require substantial upfront investments that may strain financial resources despite long-term operational savings.

Skilled labor shortages impact the market significantly, as installation, commissioning, and maintenance of sophisticated commercial HVAC systems require specialized expertise. The industry faces ongoing challenges recruiting and retaining qualified technicians capable of working with advanced building automation systems and energy management technologies. Training requirements for new technologies add complexity and cost to workforce development initiatives.

Economic uncertainty affects commercial real estate investment decisions, potentially delaying HVAC upgrade projects or new construction activities. Market volatility can cause businesses to postpone capital expenditures, impacting demand for commercial HVAC systems and services. Interest rate fluctuations influence financing costs for large-scale HVAC projects, affecting project feasibility and timing.

Regulatory complexity creates challenges for market participants navigating varying provincial codes, municipal requirements, and federal standards. Compliance costs and administrative burdens associated with meeting diverse regulatory requirements can slow project implementation and increase overall system costs. Code variations between provinces complicate standardization efforts and increase complexity for national HVAC providers.

Significant market opportunities emerge from evolving commercial building requirements and technological innovations. Retrofit and modernization projects represent substantial growth potential as aging commercial buildings require HVAC system upgrades to meet current energy efficiency standards and occupant expectations. Many Canadian commercial buildings constructed before modern energy codes offer excellent opportunities for comprehensive HVAC improvements.

Smart building integration creates opportunities for HVAC providers to offer comprehensive building automation solutions that optimize energy consumption, improve occupant comfort, and provide valuable operational data. The convergence of HVAC systems with IoT technologies, artificial intelligence, and predictive analytics opens new revenue streams and service models for market participants.

Healthcare sector expansion drives demand for specialized HVAC systems capable of maintaining precise environmental controls, air quality standards, and infection control protocols. Canada’s aging population and healthcare infrastructure investments create sustained opportunities for HVAC providers with expertise in medical facility requirements and regulatory compliance.

Sustainability initiatives across commercial sectors create opportunities for providers offering carbon-neutral HVAC solutions, renewable energy integration, and comprehensive energy management services. Corporate sustainability goals increasingly influence HVAC purchasing decisions, favoring providers who can demonstrate measurable environmental benefits and support ESG reporting requirements.

Market dynamics in Canada’s commercial HVAC sector reflect complex interactions between regulatory requirements, technological advancement, and economic factors. Supply chain considerations significantly impact market operations, with global component sourcing creating both opportunities and challenges for Canadian HVAC providers. Recent supply chain disruptions have emphasized the importance of local partnerships and inventory management strategies.

Competitive pressures drive continuous innovation and service improvement as market participants seek differentiation through technology leadership, service excellence, and customer relationships. The market rewards providers who can demonstrate superior energy efficiency, reliability, and total cost of ownership advantages. Performance-based contracting models gain traction as customers seek guaranteed outcomes rather than equipment purchases.

Seasonal demand patterns influence market dynamics, with peak installation activities typically occurring during spring and fall months when weather conditions optimize construction and commissioning activities. Service demand shows counter-seasonal patterns, with maintenance and repair activities increasing during extreme weather periods when HVAC systems experience maximum stress.

Technology convergence reshapes market dynamics as HVAC systems integrate with broader building management platforms, cybersecurity systems, and data analytics tools. This convergence creates opportunities for comprehensive service providers while challenging traditional equipment-focused business models. Digital transformation accelerates across the market, with remote monitoring and predictive maintenance becoming standard offerings.

Comprehensive research methodology ensures accurate analysis of Canada’s commercial HVAC market through multiple data collection and validation approaches. Primary research activities include structured interviews with industry executives, commercial property managers, HVAC contractors, and regulatory officials across major Canadian markets. These interviews provide insights into market trends, customer preferences, and operational challenges that quantitative data alone cannot capture.

Secondary research encompasses analysis of industry reports, government statistics, building permit data, energy consumption studies, and regulatory documentation from federal and provincial sources. Market intelligence gathering includes monitoring of construction industry publications, trade association reports, and manufacturer announcements to identify emerging trends and competitive developments.

Data validation processes ensure research accuracy through triangulation of multiple sources, expert review panels, and statistical analysis of market indicators. MarkWide Research employs rigorous quality control measures to verify data consistency and eliminate potential biases in market analysis. Cross-referencing of government statistics with industry data provides confidence in market sizing and growth projections.

Analytical frameworks incorporate both quantitative modeling and qualitative assessment to provide comprehensive market understanding. Statistical analysis includes correlation studies between economic indicators and HVAC market performance, seasonal adjustment calculations, and trend analysis across multiple time periods to identify sustainable growth patterns versus cyclical fluctuations.

Regional market analysis reveals significant variations in commercial HVAC demand patterns across Canada’s provinces and territories. Ontario dominates the market with approximately 38% market share, driven by the Greater Toronto Area’s extensive commercial development and the province’s stringent energy efficiency standards. The region benefits from concentrated commercial construction activity and a mature service infrastructure supporting complex HVAC installations.

British Columbia represents the second-largest regional market, accounting for approximately 22% of national demand. Vancouver’s commercial real estate boom and the province’s aggressive carbon reduction targets drive strong demand for high-efficiency HVAC systems and renewable energy integration. The region shows particular strength in green building technologies and sustainable HVAC solutions.

Alberta’s market demonstrates resilience despite economic challenges in the energy sector, with commercial HVAC demand supported by ongoing infrastructure investments and industrial facility requirements. The province’s extreme climate conditions create unique opportunities for specialized HVAC systems designed for harsh winter operations and variable load conditions.

Quebec maintains steady market growth driven by Montreal’s commercial development and the province’s focus on energy independence. French-language service requirements and provincial building codes create specific market dynamics that favor local and bilingual service providers. Atlantic provinces show modest but consistent growth, with healthcare and educational facility investments driving HVAC demand in smaller urban centers.

Competitive landscape in Canada’s commercial HVAC market features diverse participants ranging from global manufacturers to specialized local service providers. Market leadership requires combination of product innovation, service excellence, and regional market knowledge to address Canada’s unique climate and regulatory requirements.

Competitive strategies focus on technology differentiation, energy efficiency leadership, and comprehensive service capabilities. Market leaders invest heavily in research and development to meet evolving regulatory requirements and customer expectations for smart building integration.

Market segmentation analysis reveals diverse opportunities across multiple commercial HVAC categories and applications. By system type, the market divides into several key segments with distinct growth characteristics and customer requirements.

By Technology:

By Application:

Category-wise analysis provides detailed understanding of performance characteristics and growth potential across commercial HVAC segments. Central air conditioning systems maintain market leadership through their ability to serve large commercial buildings efficiently while integrating with building automation systems. These systems benefit from economies of scale and centralized maintenance advantages that appeal to facility managers.

Heat pump technology demonstrates exceptional growth potential as Canadian businesses seek year-round climate solutions that minimize energy consumption. Advanced heat pump systems capable of operating efficiently in extreme cold conditions address Canada’s unique climate challenges while meeting stringent energy codes. Cold climate heat pumps show particular promise in regions with harsh winter conditions.

Variable refrigerant flow systems gain market share rapidly among modern commercial buildings seeking precise zone control and energy optimization. These systems offer superior flexibility for buildings with varying occupancy patterns and diverse space requirements. VRF adoption rates increase by approximately 31% annually in new commercial construction projects.

Smart HVAC controls represent the fastest-growing category as building owners prioritize operational efficiency and occupant comfort optimization. Integration with building management systems, IoT sensors, and predictive analytics creates compelling value propositions for commercial property owners seeking competitive advantages through technology leadership.

Industry participants benefit from multiple value creation opportunities within Canada’s commercial HVAC market. Equipment manufacturers gain access to a stable, regulated market with consistent demand driven by construction activity and replacement cycles. The market rewards innovation and energy efficiency leadership, creating sustainable competitive advantages for technology leaders.

Service providers benefit from recurring revenue opportunities through maintenance contracts, energy optimization services, and system upgrades. The complexity of modern commercial HVAC systems creates barriers to entry that protect established service relationships and support premium pricing for specialized expertise. Service revenue typically represents 45-55% of total market value for established providers.

Commercial property owners realize significant benefits through reduced energy costs, improved tenant satisfaction, and enhanced property values. Modern HVAC systems contribute to building certification programs such as LEED and ENERGY STAR, supporting premium lease rates and improved occupancy levels. Energy savings from high-efficiency HVAC systems typically range from 20-40% compared to older equipment.

Building occupants benefit from improved indoor air quality, consistent comfort levels, and healthier work environments. Advanced HVAC systems provide better humidity control, air filtration, and temperature stability that enhance productivity and well-being. Occupant satisfaction scores show measurable improvement in buildings with modern HVAC systems and smart controls.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shape the evolution of Canada’s commercial HVAC sector through technological innovation and changing customer expectations. Electrification trends gain momentum as provinces implement carbon reduction policies and businesses seek to eliminate fossil fuel dependencies. Heat pump adoption accelerates across commercial applications, supported by improved cold-climate performance and utility incentive programs.

Digital transformation revolutionizes HVAC system operation and maintenance through IoT integration, cloud-based monitoring, and artificial intelligence applications. Predictive maintenance becomes standard practice for large commercial facilities, reducing downtime and optimizing system performance. Remote monitoring capabilities enable proactive service delivery and energy optimization.

Indoor air quality focus intensifies following pandemic-related health concerns, driving demand for advanced filtration systems, UV sterilization, and enhanced ventilation capabilities. Commercial buildings prioritize air quality monitoring and reporting to demonstrate safe, healthy environments for occupants. Air quality standards increasingly influence HVAC system selection and operation protocols.

Energy storage integration emerges as commercial buildings seek to optimize energy costs through demand management and grid interaction capabilities. HVAC systems increasingly coordinate with battery storage systems and renewable energy sources to minimize peak demand charges and support grid stability. MWR analysis indicates growing interest in thermal energy storage solutions for large commercial applications.

Recent industry developments demonstrate accelerating innovation and market evolution within Canada’s commercial HVAC sector. Regulatory updates include strengthened federal energy codes and provincial carbon pricing mechanisms that influence HVAC technology selection and system design approaches. New efficiency standards drive market demand for advanced equipment that exceeds minimum requirements.

Technology partnerships between HVAC manufacturers and software companies create integrated solutions that combine equipment performance with advanced analytics and building optimization capabilities. These collaborations enable comprehensive building management platforms that optimize energy consumption while maintaining occupant comfort and indoor air quality standards.

Sustainability initiatives include manufacturer commitments to carbon-neutral operations and product lifecycle improvements. Industry leaders invest in refrigerant alternatives with lower global warming potential and manufacturing processes that minimize environmental impact. Circular economy principles influence product design and end-of-life management strategies.

Workforce development programs expand through partnerships between industry associations, educational institutions, and government agencies. These initiatives address skilled labor shortages while preparing technicians for advanced HVAC technologies and smart building systems. Apprenticeship programs adapt curricula to include digital controls, energy management, and building automation competencies.

Strategic recommendations for commercial HVAC market participants focus on positioning for long-term success in an evolving regulatory and technological environment. Technology investment should prioritize smart building integration capabilities and energy management solutions that provide measurable value to commercial property owners. Companies must balance innovation with reliability to meet customer expectations for both performance and dependability.

Service model evolution represents critical success factor as customers increasingly value outcomes over equipment ownership. Performance contracting and energy-as-a-service models create opportunities for providers who can guarantee efficiency improvements and operational cost reductions. Building long-term customer relationships through comprehensive service offerings supports sustainable revenue growth.

Regional market strategies should account for varying provincial regulations, climate conditions, and customer preferences across Canada. Successful providers develop local expertise and partnerships while maintaining national scale advantages. Bilingual capabilities remain essential for Quebec market success, while western provinces may prioritize industrial and resource sector applications.

Talent acquisition and development requires proactive strategies to address skilled labor shortages and prepare for technological advancement. Companies should invest in training programs, apprenticeships, and technology tools that enhance technician productivity and service quality. Digital service tools can help optimize workforce utilization while improving customer service delivery.

Future market outlook for Canada’s commercial HVAC sector appears positive, supported by fundamental drivers including commercial construction activity, energy efficiency mandates, and technological advancement. MarkWide Research projects sustained growth momentum driven by replacement market activities and increasing adoption of smart building technologies across commercial sectors.

Technology convergence will continue reshaping market dynamics as HVAC systems integrate more closely with building automation, energy management, and occupant experience platforms. The market expects growth rates of 6-8% annually for smart HVAC solutions that provide comprehensive building optimization capabilities. Artificial intelligence and machine learning applications will enhance system performance and predictive maintenance capabilities.

Regulatory evolution will drive continued market growth through strengthened energy codes, carbon pricing mechanisms, and indoor air quality standards. Federal and provincial governments remain committed to building sector decarbonization, creating sustained demand for high-efficiency HVAC systems and renewable energy integration solutions.

Market consolidation may accelerate as smaller players seek scale advantages and larger companies pursue comprehensive service capabilities. Strategic partnerships between equipment manufacturers, service providers, and technology companies will create integrated solutions that address evolving customer requirements for performance, efficiency, and operational optimization.

Canada’s commercial HVAC market demonstrates exceptional resilience and growth potential, driven by strong regulatory support, technological innovation, and evolving customer requirements for energy efficiency and indoor environmental quality. The market benefits from diverse demand sources including new construction, replacement activities, and retrofit projects that modernize aging commercial building stock.

Strategic opportunities abound for market participants who can navigate the complex regulatory environment while delivering innovative solutions that address Canada’s unique climate challenges and energy efficiency mandates. Success requires balancing technology leadership with service excellence, regional market knowledge, and customer relationship management capabilities.

Future growth prospects remain positive as commercial buildings increasingly prioritize operational efficiency, occupant health, and environmental sustainability. The convergence of HVAC systems with smart building technologies creates new value propositions and revenue opportunities for providers who can demonstrate measurable benefits through integrated solutions and performance-based service models.

What is Commercial HVAC?

Commercial HVAC refers to heating, ventilation, and air conditioning systems specifically designed for commercial buildings, such as offices, retail spaces, and industrial facilities. These systems are essential for maintaining indoor air quality and comfort in larger spaces compared to residential HVAC systems.

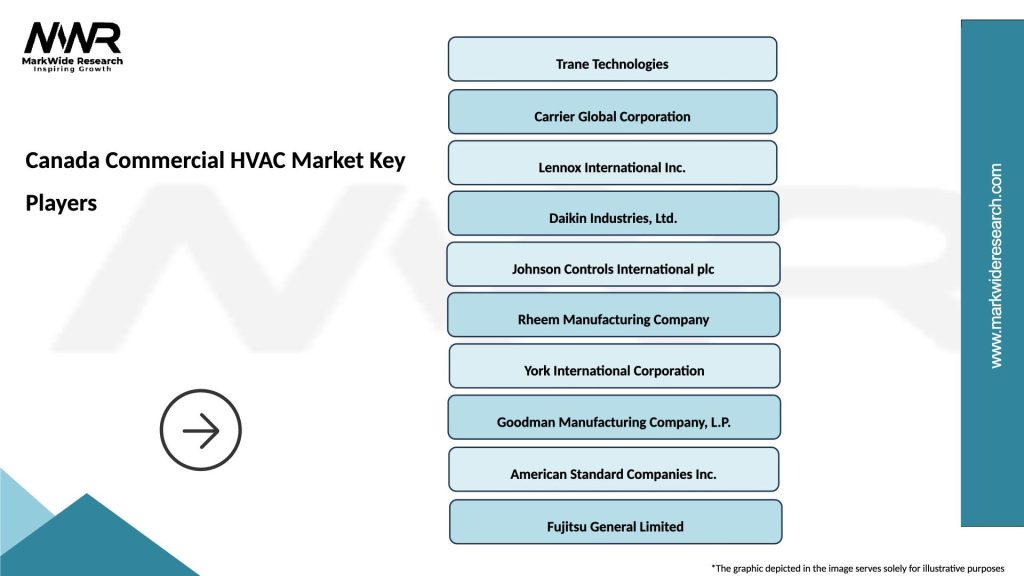

What are the key players in the Canada Commercial HVAC Market?

Key players in the Canada Commercial HVAC Market include companies like Trane Technologies, Carrier Global Corporation, and Lennox International. These companies provide a range of HVAC solutions tailored for commercial applications, among others.

What are the main drivers of the Canada Commercial HVAC Market?

The main drivers of the Canada Commercial HVAC Market include the increasing demand for energy-efficient systems, the growth of the construction industry, and the rising focus on indoor air quality. Additionally, government regulations promoting sustainable building practices are also contributing to market growth.

What challenges does the Canada Commercial HVAC Market face?

The Canada Commercial HVAC Market faces challenges such as high installation and maintenance costs, as well as the complexity of integrating advanced technologies. Additionally, fluctuating energy prices can impact operational costs for businesses relying on HVAC systems.

What opportunities exist in the Canada Commercial HVAC Market?

Opportunities in the Canada Commercial HVAC Market include the adoption of smart HVAC technologies and the increasing demand for retrofitting existing systems to improve energy efficiency. Furthermore, the growing trend towards sustainable building practices presents additional avenues for innovation.

What trends are shaping the Canada Commercial HVAC Market?

Trends shaping the Canada Commercial HVAC Market include the integration of IoT technology for better system monitoring and control, as well as the shift towards environmentally friendly refrigerants. Additionally, there is a growing emphasis on enhancing indoor air quality through advanced filtration systems.

Canada Commercial HVAC Market

| Segmentation Details | Description |

|---|---|

| Product Type | Chillers, Heat Pumps, Rooftop Units, Fan Coils |

| Technology | Variable Refrigerant Flow, Hydronic Systems, Ductless Mini-Splits, Geothermal |

| End User | Office Buildings, Retail Spaces, Educational Institutions, Healthcare Facilities |

| Installation | New Construction, Retrofit, Replacement, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Commercial HVAC Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at