444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Bangladesh cybersecurity market represents one of the most rapidly evolving technology sectors in South Asia, driven by accelerating digital transformation initiatives and increasing cyber threat sophistication. Digital Bangladesh initiatives have fundamentally transformed the country’s technological landscape, creating unprecedented demand for comprehensive cybersecurity solutions across government, financial services, telecommunications, and emerging technology sectors.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 12.5% as organizations prioritize cybersecurity investments. The increasing adoption of cloud computing, mobile banking, e-commerce platforms, and digital government services has created a complex threat landscape requiring sophisticated security frameworks and advanced protection mechanisms.

Government initiatives play a crucial role in market expansion, with the Bangladesh Computer Emergency Response Team (BD-CERT) and various regulatory bodies implementing comprehensive cybersecurity frameworks. The financial sector leads adoption rates, accounting for approximately 35% of total cybersecurity investments as banks and financial institutions strengthen their digital infrastructure against evolving cyber threats.

Enterprise adoption continues accelerating across manufacturing, healthcare, education, and telecommunications sectors, with organizations recognizing cybersecurity as a critical business enabler rather than merely a compliance requirement. The market encompasses endpoint protection, network security, cloud security, identity and access management, and emerging technologies like artificial intelligence-powered threat detection systems.

The Bangladesh cybersecurity market refers to the comprehensive ecosystem of security technologies, services, and solutions designed to protect digital assets, infrastructure, and data within Bangladesh’s rapidly digitalizing economy. This market encompasses hardware, software, and services that safeguard organizations against cyber threats, data breaches, and digital vulnerabilities.

Cybersecurity solutions in Bangladesh include network security appliances, endpoint protection platforms, security information and event management (SIEM) systems, identity and access management tools, cloud security services, and managed security services. The market also encompasses consulting services, security assessments, incident response capabilities, and cybersecurity training programs tailored to local market requirements.

Market participants include international cybersecurity vendors, local system integrators, managed security service providers, government agencies, and specialized cybersecurity consulting firms. The ecosystem supports various deployment models including on-premises solutions, cloud-based security services, and hybrid security architectures that address diverse organizational requirements and regulatory compliance needs.

Bangladesh’s cybersecurity market demonstrates exceptional growth momentum, driven by digital transformation acceleration, regulatory compliance requirements, and increasing cyber threat sophistication. The market benefits from strong government support through Digital Bangladesh initiatives and comprehensive cybersecurity policy frameworks that encourage private sector investment in security technologies.

Key growth drivers include the rapid expansion of mobile financial services, e-commerce platforms, digital government services, and cloud adoption across enterprises. The banking and financial services sector represents the largest market segment, contributing approximately 40% of total cybersecurity spending as institutions strengthen their digital infrastructure against evolving threats.

Market challenges include limited cybersecurity talent availability, budget constraints among small and medium enterprises, and the need for increased awareness regarding advanced persistent threats. However, growing international partnerships, technology transfer initiatives, and local capacity building programs are addressing these challenges through comprehensive skill development and knowledge transfer programs.

Future prospects remain highly positive, with emerging technologies like artificial intelligence, machine learning, and blockchain creating new opportunities for advanced cybersecurity solutions. The market is expected to benefit from increased foreign direct investment, technology partnerships, and the development of local cybersecurity capabilities through public-private collaboration initiatives.

Strategic market insights reveal several critical trends shaping Bangladesh’s cybersecurity landscape:

Market maturation indicators include the establishment of local cybersecurity service providers, increasing venture capital investment in security startups, and the development of specialized cybersecurity training programs at universities and professional institutions throughout Bangladesh.

Digital transformation acceleration serves as the primary market driver, with organizations across all sectors implementing digital technologies that require comprehensive cybersecurity protection. The rapid adoption of mobile banking, e-commerce, digital government services, and cloud computing creates expanding attack surfaces that demand sophisticated security solutions and continuous monitoring capabilities.

Regulatory compliance requirements significantly influence market growth, with the Bangladesh Bank, telecommunications regulators, and other government agencies implementing stringent cybersecurity standards. These regulations mandate specific security controls, incident reporting procedures, and risk management frameworks that drive systematic cybersecurity investments across regulated industries.

Increasing cyber threat sophistication compels organizations to invest in advanced security technologies and services. The evolution from simple malware to advanced persistent threats, ransomware attacks, and state-sponsored cyber espionage requires comprehensive security architectures that combine multiple defense layers and advanced threat detection capabilities.

Government initiatives through Digital Bangladesh programs provide substantial market momentum, with public sector digitalization creating demand for enterprise-grade cybersecurity solutions. Smart city projects, digital identity systems, and e-governance platforms require robust security frameworks that protect citizen data and maintain public trust in digital services.

Financial sector expansion drives significant cybersecurity investment, with mobile financial services, digital banking platforms, and fintech innovations requiring comprehensive security infrastructure. The sector’s rapid growth and regulatory scrutiny create sustained demand for advanced security technologies and specialized cybersecurity services.

Limited cybersecurity talent represents a significant market constraint, with organizations struggling to recruit and retain qualified security professionals. The shortage of experienced cybersecurity experts, ethical hackers, and security analysts limits the effective implementation and management of advanced security solutions across enterprises and government agencies.

Budget limitations among small and medium enterprises restrict market penetration, as comprehensive cybersecurity solutions often require substantial initial investments and ongoing operational expenses. Many organizations prioritize immediate business needs over cybersecurity investments, creating vulnerability gaps that affect overall market growth potential.

Awareness gaps regarding advanced cyber threats and security best practices limit market adoption, particularly among traditional industries and smaller organizations. Insufficient understanding of cybersecurity risks, compliance requirements, and available solutions prevents many potential customers from making informed security investment decisions.

Infrastructure limitations in certain regions affect the deployment and effectiveness of advanced cybersecurity solutions. Inconsistent internet connectivity, power supply issues, and limited technical support infrastructure can impede the successful implementation of comprehensive security architectures, particularly in rural and developing areas.

Regulatory complexity and evolving compliance requirements create implementation challenges for organizations attempting to navigate multiple regulatory frameworks. The complexity of meeting various government standards, industry regulations, and international compliance requirements can delay security project implementations and increase overall costs.

Artificial intelligence integration presents substantial opportunities for advanced cybersecurity solutions that leverage machine learning algorithms for threat detection, behavioral analysis, and automated incident response. The growing availability of AI technologies creates possibilities for developing sophisticated security platforms tailored to Bangladesh’s unique threat landscape and regulatory requirements.

Cloud security services offer significant growth potential as organizations accelerate cloud adoption and require specialized security solutions for hybrid and multi-cloud environments. The increasing migration to cloud platforms creates demand for cloud-native security tools, security orchestration platforms, and managed cloud security services.

Cybersecurity education and training services represent emerging opportunities, with organizations requiring comprehensive security awareness programs, professional certification training, and specialized skill development initiatives. The growing recognition of human factors in cybersecurity creates demand for innovative training solutions and security culture development programs.

Industry-specific solutions provide opportunities for developing specialized cybersecurity platforms tailored to healthcare, manufacturing, telecommunications, and other vertical markets. Each industry has unique security requirements, compliance needs, and operational constraints that create demand for customized security solutions and specialized expertise.

Public-private partnerships create opportunities for collaborative cybersecurity initiatives, threat intelligence sharing platforms, and joint security infrastructure development projects. Government initiatives to strengthen national cybersecurity capabilities through private sector collaboration offer substantial business opportunities for security vendors and service providers.

Competitive dynamics in Bangladesh’s cybersecurity market reflect a mix of international vendors, regional players, and emerging local providers competing across various market segments. Global cybersecurity leaders establish local partnerships and distribution channels to serve large enterprise and government customers, while local system integrators focus on small and medium enterprise markets with customized solutions and localized support services.

Technology evolution drives continuous market transformation, with emerging technologies like zero-trust architecture, extended detection and response (XDR), and security orchestration creating new competitive landscapes. Organizations increasingly seek integrated security platforms that provide comprehensive visibility, automated threat response, and simplified management capabilities across complex IT environments.

Customer behavior patterns indicate a shift from reactive security approaches to proactive risk management strategies, with organizations investing in threat intelligence, security analytics, and continuous monitoring capabilities. The adoption rate of managed security services has increased by approximately 25% as organizations seek to augment internal capabilities with specialized expertise and 24/7 monitoring services.

Market consolidation trends emerge as larger cybersecurity vendors acquire specialized local providers to enhance their market presence and technical capabilities. These acquisitions enable international vendors to better serve local market requirements while providing local companies with access to advanced technologies and global resources.

Innovation cycles accelerate as cybersecurity vendors invest heavily in research and development to address evolving threat landscapes and customer requirements. The integration of artificial intelligence, machine learning, and automation technologies into security platforms creates opportunities for differentiation and competitive advantage in the rapidly evolving market.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Bangladesh’s cybersecurity market dynamics. Primary research includes structured interviews with cybersecurity vendors, system integrators, end-user organizations, government officials, and industry experts to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of government publications, industry reports, regulatory documents, company financial statements, and technology vendor announcements to validate primary research findings and identify broader market patterns. This approach ensures comprehensive coverage of market dynamics from multiple perspectives and information sources.

Market sizing methodologies utilize bottom-up and top-down approaches to estimate market segments, growth rates, and competitive positioning. The analysis considers factors such as organizational IT spending patterns, cybersecurity budget allocations, technology adoption rates, and regulatory compliance requirements to develop accurate market projections and trend analysis.

Data validation processes include cross-referencing information from multiple sources, conducting follow-up interviews with key stakeholders, and analyzing market data consistency across different research methodologies. This rigorous validation approach ensures the reliability and accuracy of market insights and strategic recommendations.

Expert consultation with cybersecurity professionals, technology analysts, and industry consultants provides additional validation and context for research findings. These consultations help identify emerging trends, validate market assumptions, and ensure that research conclusions accurately reflect current market realities and future prospects.

Dhaka metropolitan area dominates the cybersecurity market, accounting for approximately 60% of total market activity due to the concentration of government agencies, financial institutions, telecommunications companies, and multinational corporations. The capital region benefits from superior IT infrastructure, skilled workforce availability, and proximity to key decision-makers and technology vendors.

Chittagong region represents the second-largest market segment, driven by port operations, manufacturing industries, and growing commercial activities that require comprehensive cybersecurity protection. The region’s industrial base and export-oriented businesses create demand for specialized security solutions that protect critical infrastructure and supply chain operations.

Sylhet division demonstrates emerging market potential, with growing IT services, telecommunications infrastructure, and educational institutions driving cybersecurity adoption. The region benefits from remittance-driven economic growth and increasing technology investments that create opportunities for security vendors and service providers.

Regional distribution patterns indicate that urban centers lead cybersecurity adoption, while rural areas present significant growth opportunities as digital infrastructure expands and internet connectivity improves. Government initiatives to extend digital services to rural communities create demand for scalable security solutions that can operate effectively in diverse infrastructure environments.

Cross-regional collaboration initiatives, including shared threat intelligence platforms and coordinated incident response capabilities, enhance overall cybersecurity resilience while creating opportunities for vendors that can provide integrated security solutions across multiple regions and organizational boundaries.

Market leadership reflects a diverse ecosystem of international vendors, regional players, and emerging local providers competing across various cybersecurity segments:

Local market players include system integrators, managed security service providers, and specialized consulting firms that provide customized solutions and localized support services. These companies often partner with international vendors to deliver comprehensive security solutions while maintaining close customer relationships and deep understanding of local market requirements.

Competitive strategies focus on technology innovation, local partnership development, talent acquisition, and customer relationship management. Successful vendors invest heavily in local presence, technical support capabilities, and specialized expertise that addresses unique market requirements and regulatory compliance needs.

By Solution Type:

By Deployment Model:

By Organization Size:

By Industry Vertical:

Network Security Solutions dominate the market with approximately 30% market share, driven by the fundamental need to protect organizational perimeters and internal network infrastructure. Next-generation firewalls and unified threat management platforms gain popularity as organizations seek integrated security architectures that provide comprehensive protection while simplifying management and reducing operational complexity.

Endpoint Security represents a rapidly growing segment, with advanced endpoint detection and response (EDR) solutions gaining traction among enterprises seeking to protect against sophisticated threats that bypass traditional antivirus solutions. The increasing adoption of mobile devices and remote work arrangements drives demand for comprehensive endpoint protection that covers diverse device types and usage scenarios.

Cloud Security Services experience accelerated growth as organizations migrate applications and data to cloud platforms. Cloud access security brokers (CASB) and cloud workload protection platforms become essential components of enterprise security architectures, providing visibility and control over cloud-based resources and applications.

Identity and Access Management gains strategic importance as organizations implement zero-trust security models and strengthen authentication mechanisms. Multi-factor authentication and privileged access management solutions become standard requirements for organizations seeking to prevent unauthorized access and protect sensitive resources.

Security Analytics and SIEM platforms evolve toward artificial intelligence-powered solutions that provide automated threat detection, behavioral analysis, and incident response capabilities. Organizations increasingly seek security platforms that can process large volumes of security data and provide actionable intelligence for proactive threat management.

Organizations benefit from comprehensive cybersecurity solutions that protect digital assets, ensure business continuity, and maintain customer trust in an increasingly connected business environment. Risk reduction through proactive security measures helps organizations avoid costly data breaches, regulatory penalties, and reputation damage that can significantly impact business operations and financial performance.

Government agencies gain enhanced capabilities to protect critical infrastructure, citizen data, and national security interests through advanced cybersecurity technologies and services. Digital government initiatives benefit from robust security frameworks that enable safe and secure delivery of public services while maintaining public trust and confidence.

Financial institutions achieve regulatory compliance, customer data protection, and fraud prevention through comprehensive security solutions tailored to banking and financial services requirements. Digital banking platforms and mobile financial services benefit from advanced security technologies that enable innovation while maintaining the highest levels of security and customer protection.

Technology vendors access growing market opportunities in a rapidly expanding economy with increasing technology adoption and cybersecurity awareness. Local partnerships and market presence enable international vendors to serve diverse customer requirements while contributing to local economic development and technology transfer initiatives.

Cybersecurity professionals benefit from expanding career opportunities, professional development programs, and the chance to contribute to national cybersecurity capabilities. The growing market creates demand for diverse cybersecurity skills, from technical implementation to strategic risk management and compliance expertise.

Strengths:

Weaknesses:

Opportunities:

Threats:

Zero-Trust Architecture adoption accelerates as organizations recognize the limitations of traditional perimeter-based security models. Identity-centric security approaches gain prominence, with organizations implementing comprehensive authentication, authorization, and continuous verification mechanisms that assume no implicit trust within network environments.

Artificial Intelligence Integration transforms cybersecurity capabilities, with machine learning algorithms enabling advanced threat detection, behavioral analysis, and automated incident response. Organizations increasingly seek AI-powered security solutions that can process vast amounts of security data and identify sophisticated threats that traditional signature-based systems might miss.

Cloud-First Security strategies emerge as organizations prioritize cloud-native security solutions that provide scalability, flexibility, and reduced infrastructure requirements. Security-as-a-Service models gain popularity, particularly among small and medium enterprises seeking enterprise-grade security capabilities without substantial capital investments.

Managed Security Services experience rapid growth as organizations seek to augment internal capabilities with specialized expertise and 24/7 monitoring services. Security operations centers (SOCs) and managed detection and response services become essential components of comprehensive security strategies for organizations of all sizes.

Regulatory Compliance Automation becomes increasingly important as organizations face complex and evolving compliance requirements. Compliance management platforms that automate reporting, monitoring, and audit processes gain traction among organizations seeking to streamline compliance activities while maintaining security effectiveness.

Government Initiatives include the establishment of the National Computer Security Incident Response Team (NCSIRT) and comprehensive cybersecurity policy frameworks that strengthen national cybersecurity capabilities. Digital Bangladesh 2021 initiatives continue driving systematic cybersecurity adoption across public and private sectors through targeted investment programs and regulatory requirements.

Financial Sector Regulations implemented by Bangladesh Bank mandate comprehensive cybersecurity frameworks for banks and financial institutions, including incident reporting requirements, security assessment protocols, and risk management standards. These regulations drive substantial cybersecurity investments and create opportunities for specialized financial services security solutions.

Educational Partnerships between universities, government agencies, and international organizations establish cybersecurity degree programs, professional certification courses, and research initiatives that address talent shortage challenges. MarkWide Research analysis indicates that these educational initiatives contribute to a 15% annual increase in qualified cybersecurity professionals entering the market.

Technology Transfer Programs facilitate knowledge sharing and capability development through partnerships with international cybersecurity vendors and research institutions. These programs enable local organizations to access advanced technologies while developing indigenous cybersecurity capabilities and expertise.

Public-Private Partnerships create collaborative platforms for threat intelligence sharing, joint security initiatives, and coordinated incident response capabilities. These partnerships enhance overall cybersecurity resilience while creating business opportunities for security vendors and service providers.

Strategic Investment in cybersecurity education and training programs represents a critical priority for market development. Organizations should invest in comprehensive security awareness programs, professional development initiatives, and partnerships with educational institutions to address talent shortage challenges and build sustainable cybersecurity capabilities.

Technology Partnerships with international cybersecurity vendors enable local organizations to access advanced technologies while developing local expertise and market presence. MWR recommends that organizations pursue strategic partnerships that combine global technology capabilities with local market knowledge and customer relationships.

Regulatory Compliance should be viewed as a business enabler rather than merely a compliance requirement, with organizations leveraging regulatory frameworks to justify cybersecurity investments and implement comprehensive security architectures. Proactive compliance strategies can provide competitive advantages and enhance customer trust.

Market Segmentation strategies should focus on vertical-specific solutions that address unique industry requirements and compliance needs. Organizations that develop specialized expertise in healthcare, manufacturing, telecommunications, or other vertical markets can achieve competitive differentiation and premium pricing opportunities.

Innovation Investment in artificial intelligence, machine learning, and automation technologies will become essential for maintaining competitive positioning in the evolving cybersecurity market. Organizations should prioritize research and development initiatives that leverage emerging technologies to enhance security effectiveness and operational efficiency.

Market expansion prospects remain highly positive, with continued digital transformation initiatives, government support, and increasing cybersecurity awareness driving sustained growth across all market segments. The market is expected to maintain robust growth momentum, with projected CAGR of 14.2% over the next five years as organizations prioritize cybersecurity investments and regulatory requirements strengthen.

Technology evolution will continue transforming the cybersecurity landscape, with artificial intelligence, quantum computing, and blockchain technologies creating new opportunities for advanced security solutions. Quantum-resistant cryptography and AI-powered threat detection systems will become increasingly important as organizations prepare for next-generation cyber threats and technological disruptions.

Market maturation indicators include the development of local cybersecurity capabilities, increasing venture capital investment in security startups, and the establishment of specialized cybersecurity research and development centers. These developments suggest a transition from technology adoption to technology innovation and indigenous capability development.

Regional expansion opportunities will emerge as digital infrastructure extends to rural areas and smaller cities, creating demand for scalable security solutions that can operate effectively in diverse environments. The expansion of mobile connectivity and digital services will drive cybersecurity adoption beyond traditional urban markets.

International collaboration will strengthen through technology partnerships, knowledge sharing initiatives, and joint cybersecurity research programs. These collaborations will enhance Bangladesh’s position as a regional cybersecurity hub while creating opportunities for local organizations to participate in global cybersecurity markets and supply chains.

Bangladesh’s cybersecurity market represents one of the most dynamic and promising technology sectors in South Asia, driven by comprehensive digital transformation initiatives, strong government support, and increasing recognition of cybersecurity as a critical business enabler. The market benefits from robust regulatory frameworks, substantial financial sector investment, and growing awareness of cyber threats across all organizational levels.

Growth prospects remain exceptionally strong, with multiple market drivers including cloud adoption, mobile financial services expansion, digital government initiatives, and evolving regulatory requirements creating sustained demand for comprehensive cybersecurity solutions. The market’s evolution from basic security tools to sophisticated, AI-powered security platforms reflects the maturation of both threat landscapes and organizational security requirements.

Strategic opportunities abound for organizations that can effectively address talent development challenges, provide cost-effective solutions for small and medium enterprises, and develop specialized expertise in vertical markets. The combination of international technology partnerships and local market knowledge creates optimal conditions for sustainable competitive advantage and market leadership.

Future success in Bangladesh’s cybersecurity market will depend on continuous innovation, strategic partnerships, talent development, and the ability to adapt to rapidly evolving threat landscapes and regulatory requirements. Organizations that invest in comprehensive capabilities, maintain customer focus, and contribute to national cybersecurity objectives will be best positioned to capitalize on the market’s substantial growth potential and long-term opportunities.

What is Cybersecurity?

Cybersecurity refers to the practice of protecting systems, networks, and programs from digital attacks. It encompasses various technologies, processes, and practices designed to safeguard sensitive information and ensure the integrity of data across different sectors.

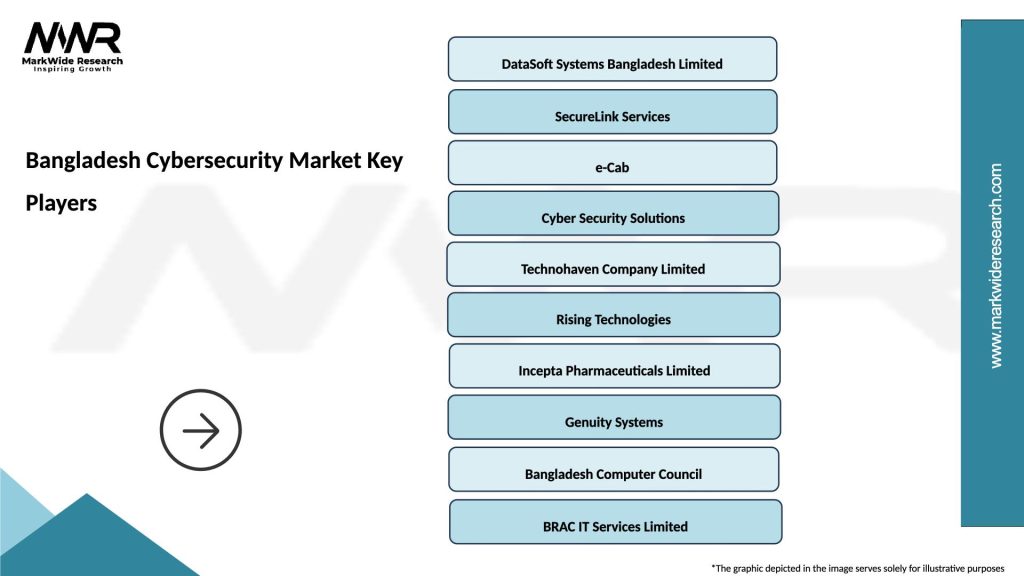

What are the key players in the Bangladesh Cybersecurity Market?

Key players in the Bangladesh Cybersecurity Market include companies like DataSoft Systems Bangladesh Limited, e-Government Computer Incident Response Team (BGD e-GOV), and SecureSoft Technologies, among others. These companies provide a range of cybersecurity solutions tailored to local needs.

What are the main drivers of growth in the Bangladesh Cybersecurity Market?

The growth of the Bangladesh Cybersecurity Market is driven by increasing cyber threats, the rise of digital transformation initiatives, and the growing awareness of data privacy among businesses and consumers. Additionally, government regulations are pushing organizations to adopt stronger cybersecurity measures.

What challenges does the Bangladesh Cybersecurity Market face?

The Bangladesh Cybersecurity Market faces challenges such as a shortage of skilled cybersecurity professionals, limited awareness of cybersecurity best practices among small and medium enterprises, and the evolving nature of cyber threats that require constant adaptation.

What opportunities exist in the Bangladesh Cybersecurity Market?

Opportunities in the Bangladesh Cybersecurity Market include the potential for growth in managed security services, the development of local cybersecurity startups, and increased investment in cybersecurity infrastructure by both public and private sectors. These factors can enhance the overall security landscape.

What trends are shaping the Bangladesh Cybersecurity Market?

Trends shaping the Bangladesh Cybersecurity Market include the adoption of artificial intelligence for threat detection, the increasing use of cloud security solutions, and a focus on compliance with international cybersecurity standards. These trends are helping organizations to better protect their digital assets.

Bangladesh Cybersecurity Market

| Segmentation Details | Description |

|---|---|

| Solution | Endpoint Security, Network Security, Cloud Security, Application Security |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| End User | Government, BFSI, Healthcare, Telecommunications |

| Service Type | Consulting, Implementation, Managed Security Services, Training |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Bangladesh Cybersecurity Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at