444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe government and security biometrics market represents a rapidly evolving landscape characterized by increasing adoption of advanced identification technologies across public sector institutions and security agencies. Government agencies throughout Europe are implementing sophisticated biometric solutions to enhance border security, law enforcement capabilities, and citizen identification systems. The market encompasses various biometric modalities including fingerprint recognition, facial recognition, iris scanning, voice recognition, and multi-modal biometric systems specifically designed for government and security applications.

Market dynamics indicate robust growth driven by heightened security concerns, regulatory compliance requirements, and digital transformation initiatives across European nations. The integration of artificial intelligence and machine learning technologies has significantly enhanced the accuracy and efficiency of biometric systems, making them increasingly attractive to government entities. Border control agencies, national security departments, and law enforcement organizations are investing heavily in next-generation biometric infrastructure to address evolving security challenges.

Regional adoption patterns show varying levels of implementation across different European countries, with Western European nations leading in terms of technological sophistication and deployment scale. The market is experiencing a compound annual growth rate of 12.4%, reflecting the urgent need for enhanced security measures and streamlined identity verification processes. Public safety initiatives and counter-terrorism efforts continue to drive substantial investments in biometric technologies across the region.

The Europe government and security biometrics market refers to the comprehensive ecosystem of biometric identification and verification technologies specifically deployed by government agencies, security organizations, and public sector institutions across European countries. This market encompasses the development, implementation, and maintenance of biometric systems designed to enhance national security, facilitate border control, support law enforcement activities, and streamline citizen services through advanced identity verification capabilities.

Biometric technologies in this context include physiological and behavioral characteristics such as fingerprints, facial features, iris patterns, voice prints, and palm geometry that are captured, processed, and stored for identification and authentication purposes. Government applications span across multiple domains including passport and visa processing, criminal identification systems, voter registration, social benefit distribution, and access control for sensitive facilities and information systems.

Market expansion in the Europe government and security biometrics sector is driven by escalating security threats, regulatory mandates, and the need for efficient public service delivery. Government agencies are increasingly recognizing the value of biometric technologies in creating secure, reliable, and user-friendly identification systems that can operate across multiple platforms and applications.

Key growth drivers include the implementation of the European Union’s Entry/Exit System (EES), increased focus on counter-terrorism measures, and the digitization of government services. The market is witnessing significant adoption of multi-modal biometric systems that combine multiple biometric modalities to enhance accuracy and security. Cloud-based biometric solutions are gaining traction as they offer scalability, cost-effectiveness, and improved interoperability across different government departments.

Technological advancements in artificial intelligence, machine learning, and edge computing are revolutionizing the capabilities of biometric systems, enabling real-time processing, improved accuracy rates of 99.7% for facial recognition systems, and enhanced user experience. The integration of biometric technologies with existing government IT infrastructure presents both opportunities and challenges for market participants.

Strategic insights reveal several critical trends shaping the Europe government and security biometrics market landscape:

Security imperatives represent the primary driving force behind the expansion of government and security biometrics adoption across Europe. Terrorist threats, cross-border criminal activities, and cyber security concerns have elevated the importance of robust identity verification systems. Government agencies are implementing comprehensive biometric solutions to create secure environments and protect critical infrastructure from unauthorized access.

Digital transformation initiatives within the public sector are accelerating the adoption of biometric technologies as governments seek to modernize service delivery and improve citizen experience. The shift towards e-government services requires reliable identity verification mechanisms that can operate across digital channels while maintaining security standards. Efficiency improvements of 40% in processing times have been achieved through automated biometric systems compared to traditional manual verification methods.

Regulatory mandates and international agreements are compelling European governments to implement standardized biometric systems for border control and security applications. The European Union’s emphasis on harmonized security measures across member states is driving coordinated investments in interoperable biometric infrastructure. Budget allocations for security and defense technologies have increased significantly, with biometrics representing a substantial portion of these investments.

Technological maturity and cost reduction in biometric technologies have made these solutions more accessible to government agencies with varying budget constraints. The availability of scalable deployment options and flexible pricing models has enabled broader adoption across different levels of government organizations.

Privacy concerns and data protection regulations present significant challenges for the implementation of government biometric systems across Europe. GDPR compliance requirements necessitate careful consideration of data collection, storage, and processing practices, potentially slowing deployment timelines and increasing implementation costs. Public acceptance of biometric technologies varies across different European countries, with some populations expressing concerns about surveillance and privacy implications.

Technical limitations in biometric accuracy and performance under certain conditions continue to pose challenges for widespread adoption. Environmental factors such as lighting conditions, weather, and user demographics can impact system performance, requiring additional investment in robust hardware and software solutions. Interoperability issues between different biometric systems and legacy infrastructure create integration complexities that require specialized expertise and resources.

High implementation costs associated with large-scale biometric deployments can strain government budgets, particularly for smaller agencies or municipalities. The need for specialized training and ongoing maintenance adds to the total cost of ownership, making it challenging for some organizations to justify the investment. Vendor lock-in concerns and the risk of technology obsolescence create additional hesitation among government decision-makers.

Cybersecurity risks associated with biometric data storage and transmission require robust security measures that add complexity and cost to system implementations. The potential for biometric data breaches creates significant liability concerns for government agencies responsible for protecting citizen information.

Emerging applications in smart city initiatives present substantial growth opportunities for biometric technology providers. Urban security systems, traffic management, and public transportation access control are creating new demand for integrated biometric solutions. The convergence of Internet of Things (IoT) technologies with biometrics is opening innovative use cases for government and security applications.

Cross-border collaboration initiatives within the European Union are driving demand for standardized biometric systems that can operate seamlessly across different countries. The implementation of shared biometric databases for law enforcement and security purposes creates opportunities for large-scale system deployments and ongoing service contracts.

Artificial intelligence integration is creating opportunities for enhanced biometric capabilities including predictive analytics, behavioral analysis, and automated threat detection. Machine learning algorithms can improve system accuracy and reduce false positive rates, making biometric solutions more attractive to government agencies. The potential for real-time analytics and intelligence gathering adds significant value to traditional identification systems.

Mobile and remote verification capabilities are becoming increasingly important as governments expand digital service offerings. The ability to perform secure identity verification through smartphones and other mobile devices creates opportunities for new service models and expanded market reach. Contactless biometric technologies have gained particular relevance following health and safety considerations, creating demand for touchless identification solutions.

Competitive dynamics in the Europe government and security biometrics market are characterized by intense competition among established technology providers and emerging innovators. Market consolidation trends are evident as larger companies acquire specialized biometric technology firms to expand their capabilities and market reach. The competitive landscape is influenced by factors such as technological innovation, government relationships, and the ability to deliver large-scale implementations.

Supply chain considerations have become increasingly important as governments seek to ensure the security and reliability of biometric systems. Domestic sourcing preferences and security clearance requirements are influencing vendor selection processes, creating opportunities for European-based technology providers. The need for long-term support and maintenance services is driving the development of comprehensive service offerings beyond initial system deployment.

Technology evolution is rapidly changing market dynamics as new biometric modalities and processing techniques emerge. The integration of edge computing capabilities is enabling more distributed and responsive biometric systems, while advances in quantum-resistant encryption are addressing future security concerns. Standardization efforts across the industry are helping to improve interoperability and reduce implementation risks.

Funding mechanisms and procurement processes within government organizations are evolving to accommodate the unique requirements of biometric technology deployments. Public-private partnerships are becoming more common as a means to share risks and leverage private sector expertise in complex implementations.

Comprehensive market analysis for the Europe government and security biometrics market was conducted using a multi-faceted research approach combining primary and secondary research methodologies. Primary research involved extensive interviews with government officials, security professionals, technology vendors, and system integrators across major European markets to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompassed analysis of government procurement records, regulatory documents, industry reports, and technology specifications to validate market trends and quantify adoption patterns. Data triangulation techniques were employed to ensure accuracy and reliability of market insights by cross-referencing information from multiple sources and stakeholders.

Market segmentation analysis was performed based on technology type, application area, deployment model, and geographic region to provide granular insights into market dynamics. Competitive intelligence gathering included analysis of vendor capabilities, market positioning, and strategic initiatives to understand the competitive landscape comprehensively.

Trend analysis incorporated examination of emerging technologies, regulatory developments, and changing security requirements to identify future market opportunities and challenges. Statistical modeling techniques were applied to project market growth trajectories and validate research findings through quantitative analysis.

Western Europe dominates the government and security biometrics market, accounting for approximately 62% of regional adoption, led by countries such as Germany, France, and the United Kingdom. These nations have implemented comprehensive biometric systems for border control, law enforcement, and citizen services, driving substantial market demand. Germany’s federal structure has created opportunities for multiple system deployments across different states and agencies, while France’s centralized approach has enabled large-scale national implementations.

Northern European countries including Sweden, Norway, and Denmark represent approximately 18% of market activity, characterized by high technology adoption rates and strong privacy protection frameworks. These nations are pioneering privacy-preserving biometric technologies that comply with strict data protection regulations while maintaining security effectiveness. Digital government initiatives in these countries are driving innovative applications of biometric technologies in citizen services.

Southern Europe accounts for roughly 15% of market share, with Italy and Spain leading adoption efforts focused primarily on border security and immigration control. The region’s emphasis on tourism security and management of migration flows has created specific demand for biometric solutions at ports of entry and processing centers. EU funding programs are supporting technology modernization efforts across the region.

Eastern Europe represents the fastest-growing segment with 5% current market share but experiencing rapid expansion as countries modernize their security infrastructure. Nations such as Poland and Czech Republic are implementing comprehensive biometric systems to align with EU standards and enhance security capabilities. MarkWide Research analysis indicates this region will experience the highest growth rates over the forecast period.

Market leadership in the Europe government and security biometrics sector is characterized by a mix of global technology giants and specialized biometric solution providers. The competitive environment is shaped by factors including technological innovation, government relationships, implementation experience, and the ability to deliver comprehensive solutions.

Strategic partnerships and acquisitions are common as companies seek to expand their technological capabilities and market reach. The competitive landscape is also influenced by government procurement preferences for domestic or allied nation suppliers, particularly for sensitive security applications.

Technology segmentation reveals distinct market dynamics across different biometric modalities:

By Technology Type:

By Application Area:

By Deployment Model:

Fingerprint biometrics continue to dominate government applications due to their proven reliability, cost-effectiveness, and user familiarity. Law enforcement agencies rely heavily on fingerprint systems for criminal identification and background checks, while border control applications utilize fingerprint capture for visa and immigration processing. The maturity of fingerprint technology has resulted in standardized implementations and interoperable systems across different agencies.

Facial recognition technology is experiencing rapid growth driven by advances in artificial intelligence and the need for contactless identification solutions. Airport security systems are increasingly deploying facial recognition for passenger processing and threat detection, while urban surveillance applications are expanding across European cities. The technology’s ability to operate at a distance and in various lighting conditions makes it particularly suitable for security applications.

Iris recognition systems are primarily deployed in high-security government facilities and sensitive border crossing points where maximum accuracy is required. The technology’s resistance to spoofing and high accuracy rates make it ideal for critical infrastructure protection and diplomatic facility security. However, higher costs and specialized hardware requirements limit broader adoption.

Multi-modal biometric systems are gaining traction as government agencies seek to balance security, accuracy, and user convenience. These systems combine multiple biometric modalities to achieve enhanced security levels while providing backup options in case of individual biometric failure. Border control applications increasingly utilize multi-modal systems to process travelers efficiently while maintaining security standards.

Government agencies benefit from enhanced security capabilities, improved operational efficiency, and better citizen service delivery through biometric technology implementation. Automated identity verification reduces processing times and human error while providing auditable records of all transactions. The ability to integrate biometric systems with existing databases and applications creates comprehensive identity management capabilities.

Technology vendors gain access to stable, long-term revenue streams through government contracts and ongoing support services. The recurring nature of government business provides predictable cash flows and opportunities for system upgrades and expansions. Reference customers in the government sector enhance credibility and facilitate expansion into commercial markets.

System integrators benefit from complex, high-value projects that require specialized expertise and long-term relationships. Government biometric projects often involve multiple phases and ongoing support requirements, creating sustained business opportunities. The need for security clearances and specialized knowledge creates barriers to entry that protect established players.

Citizens and end users experience improved service delivery, reduced wait times, and enhanced security protection through modern biometric systems. Streamlined processes for passport applications, border crossings, and government services improve overall user experience while maintaining security standards.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the government biometrics landscape. Machine learning algorithms are enhancing biometric matching accuracy, reducing false positive rates, and enabling real-time threat detection capabilities. Deep learning models are particularly effective in facial recognition applications, achieving accuracy improvements of 25% over traditional algorithms.

Contactless biometric technologies have gained prominence following health and safety considerations, driving adoption of facial recognition, iris scanning, and voice recognition systems. Touchless fingerprint scanning and palm recognition technologies are emerging as alternatives to traditional contact-based systems, particularly in high-throughput environments such as airports and border crossings.

Edge computing deployment is enabling more distributed and responsive biometric systems that can operate independently of centralized servers. This trend is particularly important for remote border crossings and mobile law enforcement applications where connectivity may be limited. Real-time processing capabilities at the edge improve system responsiveness and reduce bandwidth requirements.

Privacy-preserving technologies including homomorphic encryption, secure multi-party computation, and differential privacy are being integrated into biometric systems to address regulatory requirements and public concerns. Template protection techniques ensure that biometric data cannot be reverse-engineered or misused while maintaining system functionality.

Blockchain integration is emerging as a method to create tamper-proof audit trails and enable secure sharing of biometric credentials across different government agencies and jurisdictions. Distributed ledger technologies provide transparency and accountability in biometric system operations while maintaining data security.

Regulatory developments continue to shape the market landscape with the implementation of new EU regulations for biometric data processing and cross-border information sharing. The Entry/Exit System (EES) implementation has created substantial demand for biometric infrastructure at European border crossings, driving significant investments in automated processing systems.

Technology partnerships between major biometric vendors and cloud service providers are enabling new deployment models and enhanced capabilities. Strategic alliances between European technology companies and government agencies are fostering innovation in privacy-preserving biometric technologies and standardization efforts.

Standardization initiatives led by organizations such as ISO and NIST are promoting interoperability and quality standards for government biometric systems. Common criteria evaluations and security certifications are becoming standard requirements for government procurement processes, influencing product development priorities.

Investment in research and development is accelerating as companies seek to differentiate their offerings through advanced capabilities and improved performance. MWR analysis indicates that R&D spending in the sector has increased by 30% annually over the past three years, reflecting the competitive intensity and rapid technological evolution.

Pilot programs and proof-of-concept deployments are expanding as government agencies test new biometric technologies and applications. These initiatives are providing valuable insights into system performance, user acceptance, and operational requirements that inform larger-scale deployments.

Strategic recommendations for market participants include focusing on privacy-compliant solutions that address European regulatory requirements while maintaining security effectiveness. Technology vendors should prioritize development of AI-enhanced biometric systems that can operate in challenging conditions and provide superior accuracy compared to traditional solutions.

Government agencies are advised to adopt phased implementation approaches that allow for technology evaluation and user acceptance testing before full-scale deployment. Interoperability planning should be a key consideration in system selection to ensure compatibility with existing infrastructure and future expansion requirements.

Investment priorities should focus on multi-modal biometric systems that provide flexibility and enhanced security capabilities. Cloud-based deployment models offer advantages in terms of scalability and cost-effectiveness, particularly for smaller government agencies with limited IT resources.

Partnership strategies between technology vendors and system integrators are essential for successful government biometric implementations. Local presence and government relationships are critical success factors in the European market, requiring strategic investments in regional capabilities and expertise.

Cybersecurity considerations must be integrated into all aspects of biometric system design and deployment. Zero-trust architectures and comprehensive security frameworks are becoming standard requirements for government biometric applications.

Market evolution over the next five years will be characterized by continued growth driven by expanding government digitization initiatives and evolving security requirements. MarkWide Research projects sustained demand for biometric technologies as European governments modernize their identity management and security infrastructure.

Technology advancement will focus on improving accuracy, reducing costs, and enhancing user experience through AI integration and advanced processing capabilities. Quantum-resistant encryption and post-quantum cryptography will become increasingly important as governments prepare for future security challenges.

Application expansion beyond traditional security uses will create new market opportunities in areas such as healthcare, social services, and digital identity management. Cross-sector integration will enable comprehensive identity ecosystems that serve multiple government functions through unified biometric platforms.

Regional growth patterns indicate that Eastern European countries will experience the highest growth rates as they modernize their security infrastructure and align with EU standards. Investment levels in biometric technologies are expected to increase by 15% annually across the region as governments prioritize security and efficiency improvements.

Competitive dynamics will continue to evolve through consolidation, partnerships, and new market entrants bringing innovative technologies and business models. The market will likely see increased specialization as vendors focus on specific applications or technology niches to differentiate their offerings.

The Europe government and security biometrics market represents a dynamic and rapidly evolving sector characterized by strong growth drivers, technological innovation, and expanding applications across the public sector. Government agencies throughout Europe are increasingly recognizing the value of biometric technologies in enhancing security, improving operational efficiency, and delivering better citizen services.

Market opportunities remain substantial as digital transformation initiatives accelerate and security requirements continue to evolve. The integration of artificial intelligence, cloud computing, and edge processing technologies is creating new possibilities for biometric applications while addressing traditional limitations in accuracy and performance. Privacy-preserving technologies and regulatory compliance solutions are becoming essential differentiators in the competitive landscape.

Success factors for market participants include technological innovation, strong government relationships, comprehensive solution offerings, and the ability to navigate complex regulatory environments. The market rewards vendors who can demonstrate proven implementation experience, security expertise, and long-term support capabilities. Strategic partnerships and local presence remain critical for accessing government opportunities and building sustainable competitive advantages.

Future growth prospects appear positive as European governments continue to invest in modernizing their security infrastructure and expanding digital service offerings. The Europe government and security biometrics market is well-positioned to benefit from ongoing trends in digitization, security enhancement, and citizen service improvement across the region.

What is Government And Security Biometrics?

Government and security biometrics refer to the use of biometric technologies, such as fingerprint recognition, facial recognition, and iris scanning, for identification and verification purposes in governmental and security applications.

What are the key players in the Europe Government And Security Biometrics Market?

Key players in the Europe Government And Security Biometrics Market include NEC Corporation, Thales Group, and Gemalto, among others.

What are the main drivers of the Europe Government And Security Biometrics Market?

The main drivers of the Europe Government And Security Biometrics Market include the increasing need for enhanced security measures, the rise in identity theft cases, and the growing adoption of biometric systems in border control and law enforcement.

What challenges does the Europe Government And Security Biometrics Market face?

Challenges in the Europe Government And Security Biometrics Market include concerns over privacy and data security, high implementation costs, and the need for interoperability among different biometric systems.

What opportunities exist in the Europe Government And Security Biometrics Market?

Opportunities in the Europe Government And Security Biometrics Market include advancements in biometric technology, increasing government investments in security infrastructure, and the potential for integration with artificial intelligence for improved accuracy.

What trends are shaping the Europe Government And Security Biometrics Market?

Trends shaping the Europe Government And Security Biometrics Market include the growing use of mobile biometrics, the integration of biometric systems with cloud computing, and the rising demand for multi-modal biometric solutions.

Europe Government And Security Biometrics Market

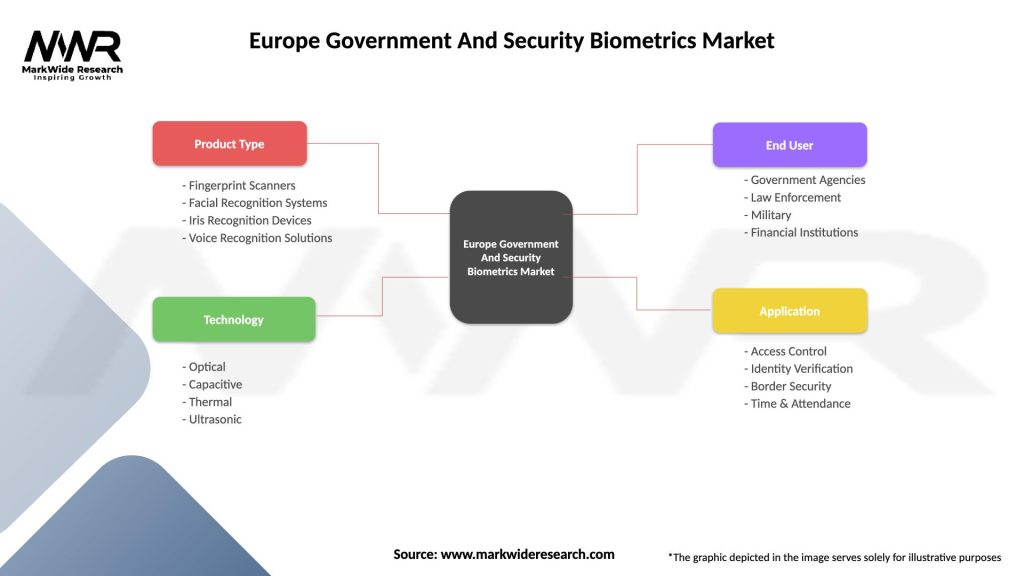

| Segmentation Details | Description |

|---|---|

| Product Type | Fingerprint Scanners, Facial Recognition Systems, Iris Recognition Devices, Voice Recognition Solutions |

| Technology | Optical, Capacitive, Thermal, Ultrasonic |

| End User | Government Agencies, Law Enforcement, Military, Financial Institutions |

| Application | Access Control, Identity Verification, Border Security, Time & Attendance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Government And Security Biometrics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at