444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan medical tourism market represents a rapidly evolving sector that combines the country’s advanced healthcare infrastructure with its growing appeal as a destination for international patients seeking high-quality medical treatments. Japan’s medical tourism industry has experienced remarkable transformation, driven by the government’s strategic initiatives to position the nation as a premier healthcare destination in Asia. The market encompasses various medical specialties, including advanced cancer treatments, regenerative medicine, cosmetic procedures, and comprehensive health screenings.

Market dynamics indicate substantial growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 12.5% over recent years. This expansion reflects Japan’s commitment to leveraging its technological superiority, medical expertise, and cultural hospitality to attract international patients. The integration of cutting-edge medical technologies, including robotic surgery systems and precision medicine approaches, has positioned Japan as a leader in innovative healthcare delivery.

Regional positioning within the Asia-Pacific medical tourism landscape shows Japan capturing approximately 18% market share among international patients seeking specialized treatments. The country’s reputation for excellence in cancer care, cardiovascular procedures, and preventive medicine continues to drive patient inflows from neighboring countries and beyond. Government support through visa facilitation programs and healthcare infrastructure investments has further accelerated market development.

The Japan medical tourism market refers to the comprehensive ecosystem of healthcare services, facilities, and supporting infrastructure designed to attract international patients seeking medical treatments, procedures, and wellness services in Japan. This market encompasses hospitals, clinics, specialized medical centers, and ancillary services that cater specifically to foreign patients requiring various levels of medical intervention.

Medical tourism in Japan involves the strategic combination of advanced medical treatments with the country’s unique cultural experiences, creating value propositions that extend beyond traditional healthcare delivery. The market includes preventive health screenings, specialized treatments for complex conditions, cosmetic and aesthetic procedures, and comprehensive wellness programs that leverage Japan’s holistic approach to health and longevity.

Key components of this market include medical facilities with international accreditation, multilingual healthcare professionals, patient coordination services, accommodation arrangements, and cultural integration programs. The sector represents Japan’s efforts to diversify its economy while capitalizing on its world-renowned healthcare system and technological innovations in medical science.

Japan’s medical tourism sector has emerged as a significant contributor to the country’s healthcare economy, driven by increasing international recognition of Japanese medical excellence and government initiatives to promote healthcare exports. The market demonstrates strong growth momentum, supported by strategic investments in medical infrastructure and international patient services.

Key growth drivers include Japan’s leadership in cancer treatment technologies, with 85% patient satisfaction rates among international visitors seeking oncology services. The country’s advanced diagnostic capabilities, particularly in early disease detection and preventive medicine, have attracted health-conscious individuals from across the globe. Technological integration in healthcare delivery, including AI-assisted diagnostics and robotic surgical systems, continues to differentiate Japan’s medical tourism offerings.

Market segmentation reveals diverse patient demographics, with approximately 45% of medical tourists originating from other Asian countries, while Western patients increasingly seek Japan’s specialized treatments and wellness programs. The sector’s expansion is supported by collaborative efforts between government agencies, healthcare providers, and tourism organizations to create seamless patient experiences.

Future prospects indicate continued market expansion, driven by aging populations in developed countries seeking advanced medical interventions and Japan’s ongoing innovations in regenerative medicine and precision healthcare approaches.

Strategic market positioning reveals several critical insights that define Japan’s competitive advantages in the global medical tourism landscape:

Market intelligence indicates that Japan’s medical tourism sector benefits from strong word-of-mouth referrals, with 78% of patients reporting high satisfaction levels and recommending Japanese healthcare services to others.

Primary market drivers propelling Japan’s medical tourism growth encompass technological, demographic, and policy-related factors that create favorable conditions for sector expansion.

Technological advancement serves as a fundamental driver, with Japan’s healthcare system incorporating cutting-edge medical equipment and treatment methodologies. The country’s leadership in robotic surgery, precision medicine, and regenerative therapies attracts international patients seeking access to innovative treatments unavailable in their home countries. Digital health integration and telemedicine capabilities further enhance service delivery and patient monitoring.

Demographic trends in aging populations across developed countries create increasing demand for specialized medical interventions and preventive healthcare services. Japan’s expertise in geriatric medicine and age-related condition management positions the country advantageously to serve this growing market segment. Healthcare accessibility challenges in patients’ home countries drive demand for alternative treatment options.

Government initiatives play a crucial role in market development, including visa facilitation programs, healthcare infrastructure investments, and international marketing campaigns. The establishment of medical tourism promotion organizations and partnerships with international healthcare networks expand market reach and patient access.

Quality reputation and safety standards in Japanese healthcare create trust among international patients, while cultural factors such as hospitality and attention to detail enhance the overall patient experience and encourage repeat visits and referrals.

Market limitations present challenges that may impede the full potential of Japan’s medical tourism sector, requiring strategic attention and mitigation efforts.

Cost considerations represent a significant restraint, as Japan’s high-quality healthcare services often command premium pricing that may limit accessibility for price-sensitive international patients. Currency fluctuations and economic conditions in source countries can further impact patient decision-making regarding treatment destinations.

Language barriers continue to pose challenges despite improvements in multilingual services. Complex medical terminology and cultural nuances in healthcare communication may create difficulties for some international patients, potentially affecting treatment outcomes and patient satisfaction.

Regulatory complexities surrounding medical licensing, insurance coverage, and treatment protocols may create administrative burdens for both patients and healthcare providers. Differences in medical practice standards between countries can complicate treatment planning and follow-up care coordination.

Geographic limitations and travel requirements may restrict access for patients with mobility issues or those requiring immediate medical attention. The distance from major source markets can increase overall treatment costs and complicate family involvement in care decisions.

Cultural differences in healthcare expectations and communication styles may create misunderstandings or dissatisfaction among some international patients, despite Japan’s emphasis on hospitality and patient care.

Emerging opportunities within Japan’s medical tourism market present significant potential for growth and diversification across multiple healthcare segments and patient demographics.

Wellness tourism integration offers substantial expansion possibilities, combining medical treatments with Japan’s traditional wellness practices, hot springs therapy, and holistic health approaches. This integration appeals to health-conscious travelers seeking comprehensive wellness experiences beyond conventional medical interventions.

Telemedicine expansion creates opportunities for pre-treatment consultations, post-care monitoring, and ongoing patient relationships that extend beyond physical visits. Digital health platforms can facilitate continuous care coordination and expand Japan’s healthcare reach to international patients.

Specialized treatment centers focusing on niche medical areas such as fertility treatments, mental health services, and addiction recovery programs can capture underserved market segments. Japan’s expertise in these areas, combined with cultural sensitivity, creates competitive advantages.

Corporate health programs represent growing opportunities as multinational companies seek comprehensive health screening and preventive care services for their executives and employees. Japan’s advanced diagnostic capabilities and executive health programs align well with corporate healthcare needs.

Medical education tourism combining treatment with educational experiences for healthcare professionals creates additional revenue streams while promoting Japan’s medical expertise and building long-term professional relationships.

Regional partnerships with neighboring countries can facilitate patient referral networks and shared healthcare resources, expanding market reach while maintaining quality standards.

Complex market dynamics shape the evolution of Japan’s medical tourism sector, involving interactions between healthcare providers, government policies, international patients, and global healthcare trends.

Supply-side dynamics reflect Japan’s healthcare system’s capacity to accommodate international patients while maintaining service quality for domestic populations. Hospital capacity utilization rates of approximately 72% indicate potential for international patient accommodation without compromising local healthcare access. Healthcare workforce development and international training programs enhance service delivery capabilities.

Demand-side factors include changing patient preferences for personalized medicine, preventive healthcare, and culturally sensitive treatment approaches. International patients increasingly seek comprehensive care experiences that combine medical excellence with cultural immersion and wellness components.

Competitive dynamics involve positioning against other medical tourism destinations in Asia, with Japan differentiating through technology leadership, safety standards, and unique cultural experiences. Market positioning strategies focus on premium service delivery rather than cost competition.

Regulatory dynamics encompass evolving healthcare policies, international agreements, and quality assurance frameworks that facilitate cross-border healthcare delivery. Government initiatives to streamline visa processes and establish international healthcare standards support market development.

Technology dynamics drive continuous innovation in treatment methodologies, patient communication systems, and healthcare delivery platforms that enhance the medical tourism experience and outcomes.

Comprehensive research methodology employed in analyzing Japan’s medical tourism market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy and reliability of market insights.

Primary research involves direct engagement with healthcare providers, medical tourism facilitators, government agencies, and international patients to gather firsthand insights into market conditions, challenges, and opportunities. Structured interviews and surveys provide qualitative and quantitative data on market dynamics and stakeholder perspectives.

Secondary research encompasses analysis of government publications, healthcare industry reports, academic studies, and international medical tourism databases. This approach ensures comprehensive coverage of market trends, regulatory developments, and competitive landscape analysis.

Data triangulation methods validate findings across multiple sources and analytical approaches, ensuring consistency and reliability of market assessments. Cross-referencing of information from various stakeholders helps identify common themes and divergent perspectives.

Quantitative analysis employs statistical methods to analyze market trends, growth patterns, and performance metrics. Time-series analysis and comparative studies provide insights into market evolution and future projections.

Qualitative assessment focuses on understanding market dynamics, stakeholder motivations, and cultural factors that influence medical tourism decisions. This approach provides context for quantitative findings and identifies emerging trends and opportunities.

Regional market analysis reveals distinct patterns in Japan’s medical tourism sector, with geographic concentrations of healthcare facilities and varying international patient flows across different regions.

Tokyo metropolitan area dominates the medical tourism landscape, accounting for approximately 42% of international patient visits. The capital region’s concentration of world-class medical facilities, international airports, and supporting infrastructure creates optimal conditions for medical tourism development. Leading hospitals in Tokyo offer comprehensive services ranging from advanced cancer treatments to cosmetic procedures.

Osaka region represents the second-largest medical tourism hub, capturing 28% market share among international patients. The area’s strength in cardiovascular medicine, organ transplantation, and regenerative medicine attracts patients seeking specialized treatments. Kansai International Airport provides convenient access for international patients from across Asia.

Kyoto and surrounding areas appeal to medical tourists seeking combination experiences of healthcare and cultural immersion. The region’s traditional medicine integration and wellness tourism offerings create unique value propositions for health-conscious international visitors.

Hokkaido region has emerged as a specialized destination for wellness tourism and preventive medicine, leveraging natural hot springs and clean environment to attract health-focused international patients. The region shows 15% annual growth in medical tourism activities.

Kyushu region benefits from proximity to South Korea and China, facilitating medical tourism flows from these countries. Regional specializations in fertility treatments and traditional medicine integration appeal to specific patient demographics.

Competitive environment in Japan’s medical tourism market involves diverse healthcare providers, medical tourism facilitators, and supporting service organizations that collectively shape the sector’s development and patient experiences.

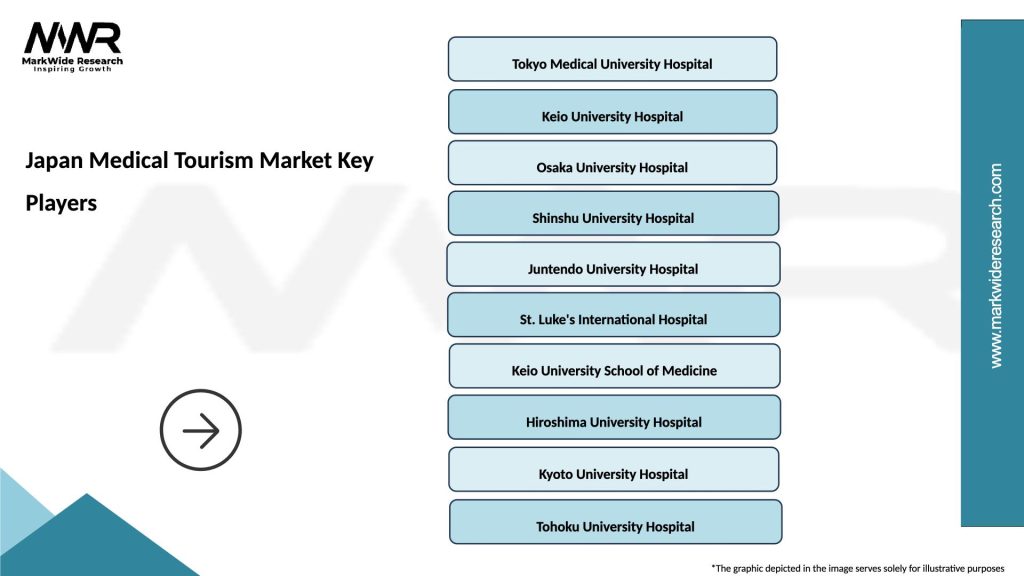

Leading healthcare institutions driving medical tourism growth include:

Medical tourism facilitators play crucial roles in patient coordination, including travel arrangements, accommodation booking, and cultural orientation services. These organizations bridge communication gaps between international patients and Japanese healthcare providers.

Government agencies including the Japan National Tourism Organization and Ministry of Health, Labour and Welfare actively promote medical tourism through international marketing campaigns and policy support initiatives.

Technology companies provide digital platforms for patient communication, telemedicine services, and healthcare management systems that enhance the medical tourism experience and operational efficiency.

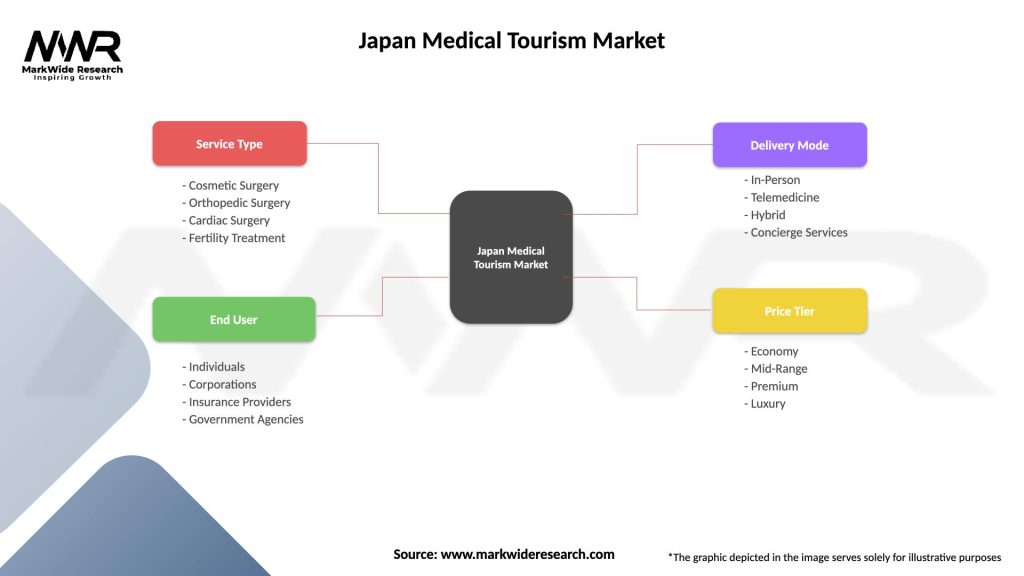

Market segmentation analysis reveals distinct categories within Japan’s medical tourism sector, each characterized by specific patient needs, treatment types, and service requirements.

By Treatment Type:

By Patient Demographics:

By Service Level:

Detailed category analysis provides specific insights into performance and growth potential across different segments of Japan’s medical tourism market.

Cancer Treatment Category represents the largest segment, driven by Japan’s world-renowned oncology expertise and innovative treatment approaches. Patient outcomes in cancer care consistently exceed international benchmarks, with five-year survival rates showing 8-12% improvement compared to global averages. The integration of immunotherapy, precision medicine, and traditional Japanese healing approaches creates unique value propositions.

Preventive Medicine Segment shows rapid growth as international patients increasingly prioritize early disease detection and wellness optimization. Japan’s comprehensive health screening programs, including advanced imaging technologies and genetic testing, attract health-conscious individuals seeking proactive healthcare management.

Cosmetic Surgery Category benefits from Japan’s reputation for precision and aesthetic excellence, particularly in facial procedures and minimally invasive treatments. Cultural understanding of beauty standards and attention to natural-looking results appeal to international patients seeking subtle enhancements.

Cardiovascular Medicine leverages Japan’s leadership in heart disease treatment and surgical innovation. Advanced procedures including minimally invasive cardiac surgery and complex interventional procedures attract patients from countries with limited access to such specialized care.

Regenerative Medicine represents an emerging high-growth category, with Japan’s regulatory framework supporting innovative therapies and clinical trials. International patients seek access to cutting-edge treatments for degenerative conditions and age-related disorders.

Comprehensive benefits accrue to various stakeholders within Japan’s medical tourism ecosystem, creating value across healthcare providers, patients, government entities, and supporting industries.

Healthcare Providers benefit from:

International Patients gain access to:

Government Stakeholders realize:

Comprehensive SWOT analysis evaluates internal strengths and weaknesses alongside external opportunities and threats affecting Japan’s medical tourism market development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shape the evolution of Japan’s medical tourism market, reflecting changing patient preferences, technological advancements, and healthcare delivery innovations.

Digital Health Integration represents a transformative trend, with telemedicine platforms enabling pre-treatment consultations, post-care monitoring, and ongoing patient relationships. Virtual reality applications for patient education and treatment planning enhance the medical tourism experience while reducing travel requirements for initial consultations.

Personalized Medicine approaches gain prominence as patients increasingly seek treatments tailored to their genetic profiles and individual health characteristics. Japan’s leadership in precision medicine and genomic research attracts international patients seeking customized therapeutic approaches.

Wellness Tourism Integration combines medical treatments with traditional Japanese wellness practices, creating comprehensive health experiences that appeal to holistic health-seeking patients. Hot springs therapy, meditation programs, and nutritional counseling complement medical interventions.

Sustainable Healthcare Tourism emerges as patients and providers increasingly consider environmental impacts of medical travel. Carbon offset programs and eco-friendly healthcare facilities appeal to environmentally conscious medical tourists.

Corporate Health Programs expand as multinational companies invest in comprehensive employee health initiatives. Executive health screenings and preventive medicine programs represent growing market segments with 25% annual growth in corporate bookings.

Medical Education Tourism combines treatment with educational experiences for healthcare professionals, creating additional revenue streams while promoting Japan’s medical expertise globally.

Significant industry developments demonstrate the dynamic nature of Japan’s medical tourism sector and ongoing efforts to enhance competitiveness and service delivery.

Government initiatives include the establishment of specialized medical tourism promotion offices and streamlined visa processes for international patients. MarkWide Research analysis indicates these policy changes have contributed to 20% improvement in patient processing efficiency and overall satisfaction rates.

Healthcare facility expansions focus on international patient wings and specialized treatment centers designed specifically for medical tourists. Major hospitals have invested in multilingual staff training and cultural sensitivity programs to enhance patient experiences.

Technology partnerships with international healthcare networks facilitate patient referrals and treatment coordination across borders. Digital platforms for patient communication and medical record sharing improve care continuity and treatment outcomes.

Quality accreditation initiatives ensure Japanese medical facilities meet international standards for patient safety and service quality. Multiple hospitals have achieved Joint Commission International accreditation, enhancing credibility among international patients.

Research collaborations with international medical institutions expand access to clinical trials and experimental treatments, attracting patients seeking cutting-edge therapies unavailable elsewhere.

Insurance partnerships with international providers facilitate payment processes and reduce financial barriers for medical tourists, making Japanese healthcare more accessible to global patients.

Strategic recommendations for stakeholders in Japan’s medical tourism market focus on sustainable growth, competitive positioning, and enhanced patient value delivery.

Healthcare providers should prioritize international accreditation and multilingual service capabilities to meet growing patient expectations. Investment in digital health platforms and telemedicine infrastructure can extend market reach while improving patient engagement and follow-up care coordination.

Government agencies should continue policy support through visa facilitation, healthcare infrastructure investments, and international marketing initiatives. Regulatory harmonization with international standards can reduce administrative barriers and improve patient access to Japanese healthcare services.

Medical tourism facilitators should develop comprehensive service packages that combine medical treatments with cultural experiences and wellness programs. Enhanced patient coordination services and 24/7 support capabilities can differentiate offerings in competitive markets.

Technology companies should focus on developing patient-centric digital platforms that facilitate communication, appointment scheduling, and medical record management across international borders. AI-powered translation services and cultural adaptation tools can address language and cultural barriers.

Marketing strategies should emphasize Japan’s unique value propositions including technology leadership, safety standards, and cultural hospitality. Targeted campaigns in key source markets can increase awareness and patient conversion rates.

Quality assurance programs should maintain rigorous standards while adapting to diverse international patient needs and expectations. Continuous improvement initiatives based on patient feedback can enhance satisfaction and encourage repeat visits and referrals.

Future projections for Japan’s medical tourism market indicate continued growth and evolution, driven by demographic trends, technological advancement, and strategic market positioning initiatives.

Growth trajectory suggests sustained expansion with projected annual growth rates of 10-14% over the next five years. This growth reflects increasing international recognition of Japanese healthcare excellence and ongoing government support for sector development. Patient volume is expected to increase significantly as travel restrictions ease and international healthcare cooperation expands.

Technology integration will continue transforming service delivery, with artificial intelligence, robotics, and precision medicine becoming standard components of Japanese medical tourism offerings. Digital health platforms will enable seamless patient experiences from initial consultation through post-treatment follow-up care.

Market diversification will expand beyond traditional medical treatments to include wellness tourism, preventive medicine, and medical education programs. Corporate health initiatives represent particularly promising growth areas as companies invest in employee wellness and executive health programs.

Regional expansion will extend Japan’s medical tourism reach to new source markets in Southeast Asia, the Middle East, and Latin America. Strategic partnerships with international healthcare networks will facilitate patient referrals and treatment coordination.

Sustainability initiatives will become increasingly important as patients and providers prioritize environmental responsibility in healthcare tourism decisions. Green healthcare facilities and carbon-neutral treatment programs will differentiate Japanese offerings in global markets.

According to MarkWide Research projections, Japan’s medical tourism sector will achieve significant market penetration in key international segments while maintaining its reputation for quality and innovation in healthcare delivery.

Japan’s medical tourism market represents a dynamic and rapidly evolving sector that successfully combines advanced healthcare capabilities with cultural excellence and government support. The market demonstrates strong growth potential driven by technological leadership, quality standards, and unique patient experiences that differentiate Japan from competing destinations.

Key success factors include the country’s reputation for medical excellence, innovative treatment approaches, and commitment to patient-centered care. Government initiatives supporting visa facilitation, infrastructure development, and international marketing have created favorable conditions for sustained market expansion.

Strategic positioning as a premium medical tourism destination allows Japan to compete effectively despite higher costs compared to other Asian countries. The focus on quality, safety, and cultural hospitality creates value propositions that justify premium pricing and attract discerning international patients.

Future opportunities in wellness tourism integration, digital health platforms, and specialized treatment programs provide pathways for continued growth and market diversification. The sector’s ability to adapt to changing patient needs and leverage technological innovations positions it well for long-term success.

Challenges including cost competitiveness, language barriers, and regional competition require ongoing attention and strategic responses. However, Japan’s fundamental strengths in healthcare quality, technological innovation, and cultural excellence provide solid foundations for addressing these challenges while maintaining market leadership in premium medical tourism segments.

What is Japan Medical Tourism?

Japan Medical Tourism refers to the practice of traveling to Japan for medical care, which includes a range of services such as surgeries, wellness treatments, and advanced healthcare technologies. This sector attracts international patients seeking high-quality medical services and specialized treatments.

What are the key players in the Japan Medical Tourism Market?

Key players in the Japan Medical Tourism Market include major hospitals like Keio University Hospital and St. Luke’s International Hospital, as well as medical tourism facilitators such as Japan Healthcare Info and Medical Excellence Japan. These organizations play a crucial role in promoting Japan as a destination for medical care, among others.

What are the main drivers of growth in the Japan Medical Tourism Market?

The growth of the Japan Medical Tourism Market is driven by factors such as the country’s advanced healthcare technology, high standards of medical care, and a growing reputation for specialized treatments in areas like oncology and orthopedics. Additionally, Japan’s cultural appeal and hospitality enhance its attractiveness to international patients.

What challenges does the Japan Medical Tourism Market face?

The Japan Medical Tourism Market faces challenges such as language barriers for international patients, complex visa processes, and competition from other countries offering medical tourism services. These factors can hinder the ease of access and overall experience for potential medical tourists.

What opportunities exist in the Japan Medical Tourism Market?

Opportunities in the Japan Medical Tourism Market include expanding partnerships with international insurance companies, increasing awareness of Japan’s medical capabilities, and developing tailored packages for specific patient needs. Additionally, leveraging digital marketing can attract more patients from abroad.

What trends are shaping the Japan Medical Tourism Market?

Trends in the Japan Medical Tourism Market include the rise of telemedicine services, which allow for pre- and post-treatment consultations, and the growing interest in wellness tourism that combines medical care with holistic health experiences. Furthermore, advancements in minimally invasive surgical techniques are attracting more patients seeking innovative treatments.

Japan Medical Tourism Market

| Segmentation Details | Description |

|---|---|

| Service Type | Cosmetic Surgery, Orthopedic Surgery, Cardiac Surgery, Fertility Treatment |

| End User | Individuals, Corporations, Insurance Providers, Government Agencies |

| Delivery Mode | In-Person, Telemedicine, Hybrid, Concierge Services |

| Price Tier | Economy, Mid-Range, Premium, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Medical Tourism Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at