444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Hungary telecom market represents a dynamic and rapidly evolving telecommunications landscape that has undergone significant transformation over the past decade. Hungary’s telecommunications sector has emerged as a cornerstone of the country’s digital infrastructure, supporting both residential and enterprise communications needs across the nation. The market demonstrates robust growth patterns with a compound annual growth rate (CAGR) of 4.2%, driven by increasing demand for high-speed internet services, mobile connectivity, and advanced digital solutions.

Digital transformation initiatives have positioned Hungary as a leading telecommunications hub in Central Europe, with extensive fiber-optic networks and comprehensive 5G deployment strategies. The market encompasses various service segments including mobile telecommunications, fixed-line services, broadband internet, and emerging technologies such as Internet of Things (IoT) and cloud-based communications. Market penetration rates have reached impressive levels, with mobile penetration exceeding 118% of the population and broadband adoption continuing to expand across urban and rural areas.

Regulatory frameworks established by Hungarian telecommunications authorities have created a competitive environment that encourages innovation while ensuring consumer protection and service quality standards. The market benefits from strategic investments in network infrastructure modernization, with operators focusing on enhancing network capacity and expanding coverage to meet growing data consumption demands.

The Hungary telecom market refers to the comprehensive telecommunications ecosystem encompassing all communication services, infrastructure, and technologies operating within Hungary’s national boundaries. This market includes traditional voice services, data transmission, internet connectivity, mobile communications, and emerging digital services that facilitate communication between individuals, businesses, and organizations throughout the country.

Telecommunications infrastructure forms the backbone of Hungary’s digital economy, supporting various communication channels including fixed-line networks, mobile cellular systems, fiber-optic cables, and wireless broadband technologies. The market encompasses service providers ranging from major international operators to local telecommunications companies, each contributing to the overall connectivity landscape that serves Hungary’s population of approximately 9.7 million residents.

Service categories within the Hungary telecom market include voice communications, data services, internet access, mobile applications, enterprise solutions, and value-added services such as cloud computing and digital entertainment platforms. The market operates under regulatory oversight that ensures fair competition, consumer protection, and adherence to European Union telecommunications standards and directives.

Hungary’s telecommunications market demonstrates remarkable resilience and growth potential, characterized by increasing digitalization trends and substantial infrastructure investments. The market has experienced consistent expansion driven by rising consumer demand for high-speed internet services, mobile data consumption, and enterprise digital transformation initiatives. Key performance indicators reveal strong market fundamentals with broadband penetration reaching 87% of households and mobile data usage growing at an annual rate of 15.3%.

Market dynamics are influenced by technological advancement, regulatory changes, and evolving consumer preferences toward integrated communication solutions. Major telecommunications operators have invested significantly in network modernization projects, including extensive fiber-optic deployment and 5G network rollouts across major urban centers. Competitive landscape features both established international players and emerging local service providers, creating a diverse ecosystem that benefits consumers through improved service quality and competitive pricing.

Strategic developments include partnerships between telecommunications companies and technology providers to deliver innovative services such as smart city solutions, IoT connectivity, and enterprise cloud services. The market outlook remains positive with projected growth supported by government digitalization initiatives and increasing adoption of advanced telecommunications technologies across various industry sectors.

Market intelligence reveals several critical insights that define Hungary’s telecommunications landscape and future growth trajectory:

Primary growth drivers propelling Hungary’s telecommunications market include increasing digitalization across all sectors of the economy and society. Government initiatives supporting digital infrastructure development have created favorable conditions for telecommunications expansion, with significant public and private sector investments in network modernization projects. The growing demand for high-speed internet connectivity, particularly in remote and underserved areas, continues to drive infrastructure development and service expansion.

Consumer behavior changes have accelerated market growth, with individuals and businesses increasingly relying on digital communication platforms for work, education, and entertainment purposes. The rise of remote work arrangements and digital learning environments has intensified demand for reliable, high-capacity internet services. Mobile data consumption has surged as consumers embrace streaming services, social media platforms, and mobile applications that require substantial bandwidth.

Enterprise digital transformation initiatives represent another significant market driver, as businesses seek advanced telecommunications solutions to support operational efficiency and competitive advantage. Companies are investing in cloud-based communication systems, unified communications platforms, and IoT connectivity solutions that require robust telecommunications infrastructure. Technological innovation in areas such as artificial intelligence, edge computing, and smart city applications continues to create new opportunities for telecommunications service providers.

Market challenges facing Hungary’s telecommunications sector include significant capital requirements for infrastructure development and network modernization projects. Investment costs associated with fiber-optic deployment and 5G network implementation create financial pressures for telecommunications operators, particularly smaller regional providers with limited resources. Regulatory compliance requirements and spectrum licensing costs add additional operational expenses that can constrain market expansion efforts.

Competition intensity has led to pricing pressures that impact operator profitability and limit resources available for infrastructure investments. The market faces challenges from over-the-top (OTT) service providers that offer communication services without maintaining physical network infrastructure, creating competitive disadvantages for traditional telecommunications companies. Consumer price sensitivity in certain market segments limits operators’ ability to implement premium pricing strategies for advanced services.

Technical challenges include the complexity of integrating legacy systems with modern telecommunications technologies and ensuring seamless service delivery across diverse network platforms. Rural area coverage remains challenging due to lower population density and higher infrastructure deployment costs per subscriber. Cybersecurity threats require continuous investment in security measures and monitoring systems, adding operational complexity and costs for telecommunications providers.

Emerging opportunities in Hungary’s telecommunications market include the expansion of 5G services and applications that leverage ultra-low latency and high-speed connectivity capabilities. Smart city initiatives present significant growth potential as municipalities seek integrated telecommunications solutions for traffic management, public safety, and environmental monitoring systems. The development of Industry 4.0 applications creates demand for specialized telecommunications services supporting manufacturing automation and industrial IoT implementations.

Digital healthcare services represent a growing opportunity segment, with telemedicine and remote patient monitoring applications requiring reliable telecommunications infrastructure. The expansion of e-commerce and digital payment systems creates additional demand for secure, high-capacity data transmission services. Entertainment and media streaming services continue to drive bandwidth demand, creating opportunities for premium internet service offerings and content delivery network partnerships.

International connectivity opportunities exist through Hungary’s strategic geographic position as a gateway between Western and Eastern Europe. Cross-border telecommunications services and international data transit capabilities offer revenue diversification opportunities for Hungarian operators. Green technology initiatives present opportunities for energy-efficient network solutions and sustainable telecommunications infrastructure development that align with environmental regulations and corporate sustainability goals.

Market dynamics within Hungary’s telecommunications sector reflect the interplay between technological advancement, regulatory evolution, and changing consumer expectations. Competitive forces drive continuous innovation and service improvement as operators strive to differentiate their offerings and maintain market share. The dynamic nature of telecommunications technology requires constant adaptation and investment in emerging platforms and services.

Regulatory influences shape market structure and competitive behavior through licensing requirements, spectrum allocation policies, and consumer protection measures. European Union telecommunications directives provide framework guidelines that Hungarian operators must incorporate into their business strategies and operational procedures. Market consolidation trends have resulted in strategic partnerships and mergers that create larger, more competitive telecommunications entities capable of supporting extensive infrastructure investments.

Technology convergence continues to blur traditional boundaries between telecommunications, media, and technology sectors, creating new competitive dynamics and partnership opportunities. The integration of artificial intelligence and machine learning technologies into network management and customer service operations enhances operational efficiency and service quality. Customer experience optimization has become a critical differentiator as operators compete for subscriber loyalty in an increasingly saturated market environment.

Comprehensive research methodology employed in analyzing Hungary’s telecommunications market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. Primary research activities include structured interviews with telecommunications industry executives, regulatory officials, and key stakeholders across the Hungarian telecommunications ecosystem. Survey methodologies capture consumer behavior patterns, service preferences, and satisfaction levels among residential and business telecommunications users.

Secondary research components involve extensive analysis of industry reports, regulatory filings, financial statements, and market data from telecommunications operators and industry associations. MarkWide Research utilizes proprietary analytical frameworks to evaluate market trends, competitive positioning, and growth opportunities within the Hungarian telecommunications landscape. Data validation processes ensure consistency and accuracy across multiple information sources.

Analytical techniques include statistical modeling, trend analysis, and comparative benchmarking against regional telecommunications markets to provide context and perspective on Hungary’s market performance. Market segmentation analysis examines various service categories, customer demographics, and geographic regions to identify specific growth opportunities and market dynamics. Forecasting methodologies incorporate historical performance data, current market indicators, and projected technology adoption rates to develop realistic growth projections and market outlook scenarios.

Regional market distribution across Hungary reveals significant variations in telecommunications infrastructure development and service adoption patterns. Budapest metropolitan area commands approximately 35% of the national telecommunications market, benefiting from concentrated population density, advanced infrastructure, and high consumer spending power. The capital region demonstrates the highest penetration rates for premium services including fiber-optic broadband and 5G mobile connectivity.

Western Hungary regions including Győr-Moson-Sopron and Vas counties account for 22% of market activity, supported by industrial development and proximity to Austrian markets. These areas benefit from cross-border telecommunications services and international connectivity requirements driven by multinational corporations and manufacturing facilities. Eastern regions represent 28% of the market with growing infrastructure investments aimed at reducing digital divide gaps and improving rural connectivity.

Southern Hungary encompasses 15% of telecommunications market activity, with ongoing development projects focused on expanding broadband access and mobile network coverage in less densely populated areas. Regional development initiatives supported by European Union funding programs have accelerated telecommunications infrastructure improvements across rural communities. Network coverage expansion continues to prioritize underserved regions to ensure equitable access to modern telecommunications services throughout the country.

Competitive environment in Hungary’s telecommunications market features several major operators competing across multiple service segments:

Market competition drives continuous service innovation and infrastructure investment as operators seek to maintain competitive advantages and expand market share. Strategic partnerships between telecommunications companies and technology providers create opportunities for enhanced service offerings and operational efficiency improvements. Competitive differentiation focuses on network quality, customer service excellence, and innovative digital services that address evolving consumer and business requirements.

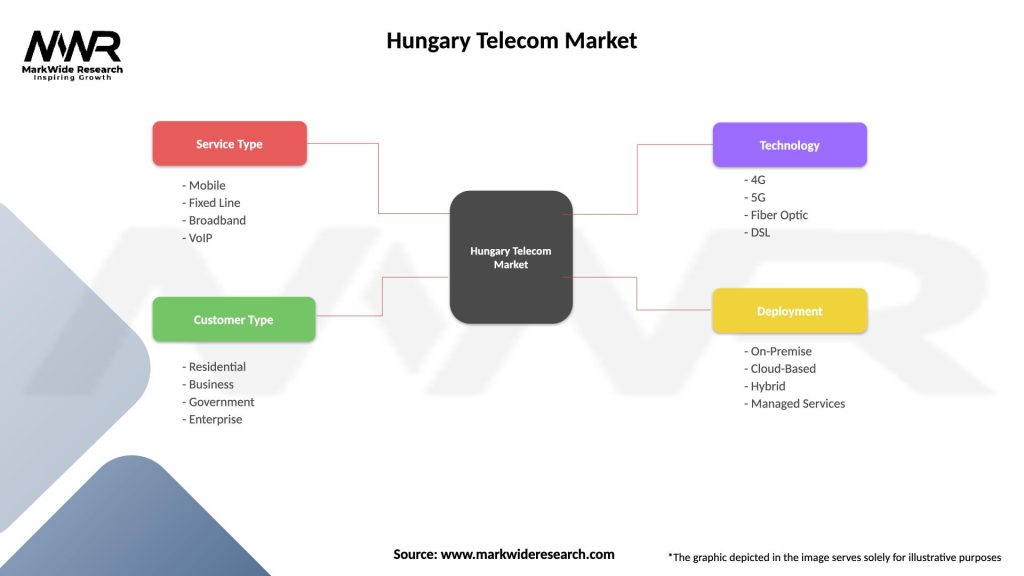

Market segmentation within Hungary’s telecommunications sector encompasses multiple dimensions including service type, customer category, and technology platform:

By Service Type:

By Customer Segment:

By Technology Platform:

Mobile telecommunications represents the largest and most dynamic segment within Hungary’s telecommunications market, driven by high smartphone adoption rates and increasing mobile data consumption. Mobile penetration rates exceed national population levels, indicating multiple device ownership and strong market saturation. The segment benefits from ongoing 5G network deployment and enhanced mobile service offerings that support advanced applications and high-bandwidth requirements.

Fixed broadband services continue to experience steady growth as consumers and businesses demand higher internet speeds and more reliable connectivity. Fiber-optic network expansion has significantly improved service quality and customer satisfaction levels across urban and suburban areas. The segment faces competition from mobile broadband alternatives but maintains advantages in terms of capacity, stability, and cost-effectiveness for high-usage applications.

Enterprise telecommunications solutions represent a high-value market segment with growing demand for integrated communication platforms and cloud-based services. Digital transformation initiatives across various industries drive adoption of advanced telecommunications technologies including unified communications, IoT connectivity, and managed network services. The segment offers higher profit margins and longer-term customer relationships compared to consumer-focused services.

Telecommunications operators benefit from Hungary’s growing digital economy and increasing demand for advanced communication services. Revenue diversification opportunities exist through expansion into enterprise solutions, IoT services, and digital platform offerings that leverage existing network infrastructure. Operators can capitalize on government digitalization initiatives and European Union funding programs that support telecommunications infrastructure development.

Technology vendors and equipment suppliers gain access to a modernizing telecommunications market with substantial infrastructure investment requirements. Partnership opportunities with Hungarian operators create channels for introducing innovative technologies and solutions that enhance network capabilities and service offerings. The market provides a platform for testing and deploying new telecommunications technologies before broader European market expansion.

Consumers and businesses benefit from improved telecommunications services, competitive pricing, and enhanced connectivity options that support digital lifestyle and business operations. Service quality improvements resulting from network modernization and competitive pressures create value for end-users through faster internet speeds, better mobile coverage, and more reliable communication services. Innovation adoption enables access to cutting-edge telecommunications technologies and applications that enhance productivity and quality of life.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital convergence represents a fundamental trend reshaping Hungary’s telecommunications landscape, with operators expanding beyond traditional communication services into digital entertainment, cloud computing, and smart home solutions. Service bundling strategies combine multiple telecommunications offerings to create comprehensive digital lifestyle packages that increase customer value and reduce churn rates. This trend reflects consumer preferences for integrated solutions and simplified billing arrangements.

Network virtualization and software-defined networking technologies are transforming telecommunications infrastructure management and service delivery capabilities. Cloud-native network functions enable more flexible and cost-effective network operations while supporting rapid service deployment and customization. These technological advances allow operators to respond more quickly to market demands and optimize network resource utilization.

Sustainability initiatives are becoming increasingly important as telecommunications operators focus on reducing energy consumption and environmental impact. Green network technologies and renewable energy adoption demonstrate corporate responsibility while potentially reducing operational costs. MarkWide Research indicates that environmental considerations are influencing infrastructure investment decisions and technology selection processes across the Hungarian telecommunications sector.

Recent industry developments include significant investments in 5G network infrastructure by major Hungarian telecommunications operators, with initial deployments focusing on urban centers and high-traffic areas. Spectrum auction results have allocated additional radio frequencies to support enhanced mobile services and network capacity expansion. These developments position Hungary among the leading European countries in 5G technology adoption and implementation.

Strategic partnerships between telecommunications operators and technology companies have accelerated innovation in areas such as edge computing, artificial intelligence, and IoT connectivity solutions. International collaboration agreements facilitate knowledge transfer and technology sharing that benefit Hungarian market development. These partnerships enable local operators to access advanced technologies and expertise while expanding their service capabilities.

Regulatory developments include updated consumer protection measures and enhanced cybersecurity requirements that strengthen market stability and user confidence. European Union telecommunications directives continue to influence Hungarian market regulations and operational standards. Government digitalization programs provide funding and policy support for telecommunications infrastructure development in underserved regions.

Strategic recommendations for telecommunications operators include prioritizing 5G network deployment in high-value market segments while maintaining service quality across existing 4G infrastructure. Investment focus should emphasize fiber-optic network expansion to support both consumer broadband demand and mobile network backhaul requirements. Operators should develop comprehensive IoT service portfolios that leverage network capabilities to serve emerging industrial and smart city applications.

Market positioning strategies should emphasize service differentiation through superior customer experience, innovative digital services, and competitive pricing models that reflect value delivery. Partnership development with technology providers, content companies, and enterprise solution vendors can create additional revenue streams and enhance service offerings. Operators should invest in network security capabilities and compliance systems to address growing cybersecurity requirements and regulatory expectations.

Technology adoption priorities include artificial intelligence integration for network optimization and customer service enhancement, edge computing capabilities to support low-latency applications, and cloud-native network functions that improve operational efficiency. MWR analysis suggests that operators should balance infrastructure investment with service innovation to maintain competitive advantages while managing capital expenditure requirements effectively.

Market projections indicate continued growth in Hungary’s telecommunications sector, driven by increasing digitalization across all economic sectors and ongoing infrastructure modernization initiatives. 5G technology adoption is expected to accelerate over the next five years, with network coverage expanding beyond urban areas to serve rural communities and specialized industrial applications. The market outlook reflects growing demand for high-capacity, low-latency connectivity solutions that support emerging technologies and digital services.

Revenue growth opportunities will likely emerge from enterprise digital transformation projects, IoT connectivity services, and premium consumer offerings that leverage advanced network capabilities. Market consolidation trends may continue as operators seek economies of scale and enhanced competitive positioning through strategic partnerships and acquisitions. The integration of telecommunications services with digital platforms and content delivery creates additional value creation opportunities.

Long-term market evolution will be influenced by technological advancement, regulatory development, and changing consumer behavior patterns. Sustainability considerations will become increasingly important in infrastructure investment decisions and operational practices. The market is expected to maintain its growth trajectory with projected annual expansion rates of 4.5% to 5.2% over the next decade, supported by continued digital economy development and technological innovation adoption.

Hungary’s telecommunications market demonstrates remarkable resilience and growth potential, characterized by robust infrastructure development, competitive service offerings, and strong regulatory framework support. The market has successfully navigated technological transitions while maintaining service quality and expanding coverage across diverse geographic and demographic segments. Strategic investments in 5G networks, fiber-optic infrastructure, and digital service platforms position Hungarian operators for continued success in an evolving telecommunications landscape.

Market fundamentals remain strong with growing demand for advanced telecommunications services, supportive government policies, and favorable economic conditions that encourage continued investment and innovation. The competitive environment drives continuous improvement in service quality, pricing, and customer experience while creating opportunities for market differentiation and growth. Future prospects indicate sustained market expansion supported by digitalization trends, technological advancement, and increasing connectivity requirements across all sectors of Hungarian society and economy.

Success factors for market participants include strategic focus on emerging technologies, customer-centric service development, and operational excellence that delivers superior value propositions. The Hungary telecom market represents a dynamic and opportunity-rich environment that rewards innovation, strategic thinking, and commitment to meeting evolving customer needs in an increasingly connected digital world.

What is Hungary Telecom?

Hungary Telecom refers to the telecommunications sector in Hungary, encompassing services such as mobile and fixed-line telephony, internet access, and broadcasting. This sector plays a crucial role in connecting individuals and businesses across the country.

What are the key players in the Hungary Telecom Market?

The Hungary Telecom Market features several prominent companies, including Magyar Telekom, Vodafone Hungary, and Telenor Hungary, which provide a range of telecommunications services. These companies compete in areas such as mobile services, broadband internet, and digital television, among others.

What are the growth factors driving the Hungary Telecom Market?

The Hungary Telecom Market is driven by factors such as increasing smartphone penetration, the demand for high-speed internet, and the expansion of digital services. Additionally, the rise of IoT applications and smart home technologies is further fueling growth in this sector.

What challenges does the Hungary Telecom Market face?

The Hungary Telecom Market faces challenges including regulatory pressures, intense competition among service providers, and the need for continuous investment in infrastructure. These factors can impact profitability and service quality in the sector.

What opportunities exist in the Hungary Telecom Market?

Opportunities in the Hungary Telecom Market include the expansion of 5G networks, the growth of cloud-based services, and the increasing demand for digital content. These trends present avenues for innovation and investment in new technologies.

What trends are shaping the Hungary Telecom Market?

Trends in the Hungary Telecom Market include the shift towards mobile-first services, the integration of artificial intelligence in customer service, and the rise of subscription-based models for content delivery. These trends are transforming how consumers interact with telecom services.

Hungary Telecom Market

| Segmentation Details | Description |

|---|---|

| Service Type | Mobile, Fixed Line, Broadband, VoIP |

| Customer Type | Residential, Business, Government, Enterprise |

| Technology | 4G, 5G, Fiber Optic, DSL |

| Deployment | On-Premise, Cloud-Based, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Hungary Telecom Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at