444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Jordan ICT market represents a dynamic and rapidly evolving sector that serves as a cornerstone of the kingdom’s digital transformation initiatives. Jordan’s information and communication technology landscape has experienced remarkable growth, driven by government digitization programs, increasing internet penetration, and a thriving startup ecosystem. The market encompasses telecommunications, software development, hardware solutions, and emerging technologies such as artificial intelligence and blockchain.

Digital infrastructure development has positioned Jordan as a regional technology hub, with the country achieving 78% internet penetration and demonstrating strong adoption of mobile technologies. The kingdom’s strategic location, educated workforce, and supportive regulatory framework have attracted significant investments from international technology companies and fostered a vibrant local tech ecosystem.

Government initiatives including the Digital Jordan 2025 strategy have accelerated market growth, focusing on e-government services, smart city implementations, and digital skills development. The market continues to expand at a robust CAGR of 8.2%, reflecting strong demand across enterprise, government, and consumer segments.

The Jordan ICT market refers to the comprehensive ecosystem of information and communication technology products, services, and solutions operating within the Hashemite Kingdom of Jordan. This market encompasses telecommunications infrastructure, software development, hardware distribution, cloud computing services, cybersecurity solutions, and digital transformation services that support both public and private sector operations.

Market scope includes traditional ICT services such as telecommunications and IT support, alongside emerging technologies including Internet of Things (IoT), artificial intelligence, and fintech solutions. The sector plays a crucial role in Jordan’s economic diversification strategy, contributing significantly to GDP growth and employment generation while positioning the country as a regional technology leader.

Jordan’s ICT market demonstrates exceptional resilience and growth potential, supported by comprehensive government digitization initiatives and a skilled technology workforce. The market benefits from strategic geographic positioning, enabling Jordan to serve as a technology gateway between Europe, Asia, and Africa.

Key growth drivers include accelerated digital transformation across industries, increasing demand for cloud services, and expanding e-commerce adoption. The telecommunications segment maintains market leadership, while software development and cybersecurity solutions experience rapid expansion. Mobile technology adoption reaches 95% penetration, creating substantial opportunities for mobile-first solutions and applications.

Investment climate remains favorable, with international technology companies establishing regional headquarters and development centers in Jordan. The market attracts significant foreign direct investment, particularly in telecommunications infrastructure and software development capabilities.

Strategic market positioning reveals several critical insights that define Jordan’s ICT landscape:

Government digitization initiatives serve as the primary catalyst for ICT market expansion in Jordan. The comprehensive Digital Jordan 2025 strategy emphasizes e-government services, smart city development, and digital infrastructure modernization, creating substantial demand for technology solutions across public sector organizations.

Economic diversification efforts drive increased ICT adoption as Jordan seeks to reduce dependence on traditional industries. The government actively promotes technology sector development through favorable policies, tax incentives, and infrastructure investments that support both local and international technology companies.

Regional market access positions Jordan as an attractive base for technology companies serving Middle Eastern and North African markets. The country’s strategic location, political stability, and educated workforce create competitive advantages for ICT service providers and software developers.

Youth demographic trends fuel demand for digital services and mobile applications. Jordan’s young, tech-savvy population drives consumer adoption of digital banking, e-commerce, and social media platforms, creating opportunities for innovative technology solutions.

Limited domestic market size constrains growth potential for local ICT companies, requiring expansion into regional markets to achieve significant scale. The relatively small population and economic base limit opportunities for purely domestic technology solutions.

Infrastructure limitations in certain regions affect ICT service delivery and adoption rates. While urban areas enjoy excellent connectivity, rural regions face challenges with broadband access and digital infrastructure development.

Skills gap challenges impact market growth as demand for specialized technology professionals exceeds local supply. Competition for qualified developers, cybersecurity experts, and data scientists creates recruitment difficulties and wage inflation pressures.

Regulatory complexity occasionally slows technology adoption, particularly in heavily regulated sectors such as banking and telecommunications. Compliance requirements and approval processes can delay implementation of innovative solutions.

Smart city initiatives present substantial opportunities for ICT companies to develop integrated urban technology solutions. Jordan’s commitment to sustainable urban development creates demand for IoT sensors, data analytics platforms, and intelligent transportation systems.

Regional expansion potential enables Jordanian ICT companies to leverage their expertise in serving broader Middle Eastern markets. The country’s reputation for quality technology services and skilled workforce attracts international partnerships and joint ventures.

Emerging technology adoption offers growth opportunities in artificial intelligence, blockchain, and cybersecurity solutions. Organizations across sectors seek innovative technologies to improve efficiency, security, and customer experience.

Digital health transformation creates opportunities for health technology solutions, telemedicine platforms, and medical data management systems. The healthcare sector’s digitization efforts drive demand for specialized ICT solutions.

Competitive landscape dynamics reflect a balanced mix of international technology giants and innovative local companies. Global players establish regional operations to serve Middle Eastern markets, while local firms focus on specialized solutions and customer proximity advantages.

Technology evolution patterns show rapid adoption of cloud computing, mobile-first solutions, and cybersecurity technologies. Organizations prioritize digital transformation initiatives that improve operational efficiency and customer engagement capabilities.

Investment flow dynamics demonstrate strong interest from international investors and development organizations. Technology startups attract venture capital funding, while established companies benefit from expansion financing and strategic partnerships.

Regulatory environment evolution supports market growth through progressive policies that encourage innovation while maintaining security standards. Government initiatives promote technology adoption and create favorable conditions for ICT sector development.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Jordan’s ICT market dynamics. Primary research includes extensive interviews with industry executives, government officials, and technology professionals across various market segments.

Data collection approaches combine quantitative surveys with qualitative assessments to capture both statistical trends and strategic insights. Research methodology incorporates analysis of government statistics, industry reports, and company financial disclosures to validate market findings.

Market segmentation analysis utilizes detailed categorization frameworks to examine specific technology sectors, customer segments, and geographic regions. This approach enables precise identification of growth opportunities and competitive dynamics within distinct market niches.

Validation processes ensure data accuracy through cross-referencing multiple sources and expert review panels. MarkWide Research methodology emphasizes rigorous fact-checking and statistical verification to maintain research quality standards.

Amman metropolitan area dominates Jordan’s ICT market, accounting for 72% of technology sector activity and hosting the majority of international technology companies’ regional offices. The capital region benefits from superior infrastructure, skilled workforce concentration, and proximity to government decision-makers.

Northern governorates including Irbid and Jerash experience growing ICT adoption, particularly in telecommunications and e-government services. These regions benefit from university presence and educated populations that drive technology service demand.

Southern regions including Aqaba and Ma’an show increasing ICT investment, supported by special economic zone initiatives and tourism sector digitization. The Red Sea port city of Aqaba attracts technology companies serving regional logistics and trade sectors.

Rural area development focuses on bridging digital divides through improved connectivity and digital literacy programs. Government initiatives target underserved communities with mobile broadband expansion and e-service accessibility improvements.

Market leadership structure features a diverse ecosystem of international corporations, regional players, and innovative local companies competing across various ICT segments:

Competitive strategies emphasize innovation, customer service excellence, and regional market expansion. Companies invest heavily in research and development, strategic partnerships, and talent acquisition to maintain competitive advantages.

Technology segment analysis reveals distinct market categories with varying growth trajectories and competitive dynamics:

By Technology Type:

By End-User Sector:

Telecommunications category maintains market leadership through continuous infrastructure investment and service innovation. Mobile operators focus on 5G network deployment, IoT connectivity, and value-added services that differentiate their offerings in competitive markets.

Software development segment experiences robust growth driven by digital transformation demands across industries. Local companies specialize in Arabic language solutions, regional market requirements, and industry-specific applications that serve niche market needs.

Cybersecurity solutions gain increasing importance as organizations face growing digital threats. The segment benefits from 25% annual growth in enterprise security spending and government initiatives to strengthen national cybersecurity capabilities.

Cloud computing adoption accelerates across all sectors, with organizations migrating legacy systems to cloud platforms for improved scalability and cost efficiency. Hybrid cloud solutions prove particularly popular among enterprises seeking to balance security and flexibility requirements.

Technology companies benefit from Jordan’s strategic location, skilled workforce, and supportive business environment that facilitates regional market expansion. The country offers competitive operational costs, political stability, and excellent connectivity to global markets.

Government organizations achieve improved service delivery, operational efficiency, and citizen satisfaction through ICT adoption. Digital transformation initiatives reduce administrative costs while enhancing transparency and accessibility of public services.

Enterprise customers gain competitive advantages through technology adoption that improves productivity, reduces costs, and enables new business models. ICT solutions help organizations adapt to changing market conditions and customer expectations.

Educational institutions enhance learning outcomes and operational efficiency through technology integration. Digital platforms expand access to educational resources and enable innovative teaching methodologies that prepare students for technology-driven careers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration represents the most significant trend shaping Jordan’s ICT market, with organizations across sectors prioritizing technology adoption to improve efficiency and competitiveness. This trend drives demand for cloud computing, data analytics, and automation solutions.

Mobile-first strategy adoption reflects changing consumer behavior and business requirements. Organizations develop mobile applications and responsive platforms to serve customers who increasingly access services through smartphones and tablets.

Cybersecurity investment surge responds to growing digital threats and regulatory requirements. Organizations allocate increasing budgets to security solutions, creating opportunities for specialized cybersecurity companies and service providers.

Artificial intelligence integration gains momentum across industries, with companies exploring AI applications for customer service, data analysis, and process automation. Early adopters achieve competitive advantages through intelligent technology implementation.

Fintech innovation expansion transforms financial services delivery, with digital payment systems, mobile banking, and blockchain solutions gaining widespread adoption. Traditional banks partner with fintech companies to enhance service offerings.

5G network deployment initiatives by major telecommunications operators create new opportunities for IoT applications, smart city solutions, and enhanced mobile services. The advanced connectivity enables innovative applications across industries.

Government digitization projects accelerate with comprehensive e-government platform implementations, digital identity systems, and online service delivery improvements. These initiatives drive significant ICT procurement and development activities.

International partnership expansion sees global technology companies establishing regional operations and development centers in Jordan. These partnerships bring advanced technologies, investment capital, and market access opportunities.

Startup ecosystem growth supported by incubators, accelerators, and venture capital funds creates a vibrant entrepreneurial environment. Young companies develop innovative solutions addressing local and regional market needs.

Skills development programs launched by government and private sector organizations address workforce requirements for emerging technologies. These initiatives ensure adequate talent supply for continued market growth.

Strategic focus recommendations for market participants emphasize leveraging Jordan’s unique advantages while addressing key challenges. MarkWide Research analysis suggests that companies should prioritize regional expansion strategies that capitalize on Jordan’s strategic location and skilled workforce.

Investment priorities should focus on emerging technologies including artificial intelligence, cybersecurity, and fintech solutions that address growing market demands. Organizations benefit from early adoption of these technologies to establish competitive advantages.

Partnership strategies prove essential for accessing regional markets and complementary capabilities. Local companies should seek international partnerships, while global firms benefit from local partner relationships that provide market knowledge and customer access.

Talent development initiatives require immediate attention to address skills gaps and ensure sustainable growth. Companies should invest in training programs, university partnerships, and knowledge transfer initiatives that build local capabilities.

Government collaboration opportunities exist through participation in national digitization initiatives and smart city projects. Private sector engagement in public sector transformation creates mutual benefits and market expansion opportunities.

Long-term growth prospects for Jordan’s ICT market remain highly positive, supported by continued government digitization efforts, regional expansion opportunities, and emerging technology adoption. The market is projected to maintain strong growth momentum over the next five years.

Technology evolution trends indicate increasing adoption of cloud computing, artificial intelligence, and cybersecurity solutions across all sectors. Organizations will continue investing in digital transformation initiatives that improve operational efficiency and customer experience.

Regional market integration opportunities will expand as Jordan strengthens its position as a technology hub serving Middle Eastern and North African markets. The country’s strategic advantages position it well for continued growth in regional technology services.

Investment climate outlook remains favorable, with continued international interest in Jordan’s technology sector. Government support, political stability, and skilled workforce advantages will continue attracting foreign direct investment and strategic partnerships.

Innovation ecosystem development will accelerate through startup incubators, research initiatives, and technology transfer programs. These developments will create new market opportunities and strengthen Jordan’s competitive position in emerging technology sectors.

Jordan’s ICT market demonstrates exceptional potential for continued growth and regional leadership, supported by comprehensive government digitization strategies, skilled workforce capabilities, and strategic geographic advantages. The market benefits from strong fundamentals including political stability, advanced infrastructure, and supportive regulatory frameworks that attract international investment and foster innovation.

Key success factors include the country’s ability to serve as a regional technology hub, government commitment to digital transformation, and the presence of both established international companies and innovative local firms. The market’s diversity across telecommunications, software development, and emerging technologies provides resilience and multiple growth opportunities.

Future prospects remain highly positive as Jordan continues implementing its Digital Jordan 2025 strategy while expanding its role as a regional technology center. The combination of domestic market development and regional expansion opportunities positions the Jordan ICT market for sustained growth and continued success in serving evolving technology needs across multiple sectors and geographic markets.

What is ICT?

ICT stands for Information and Communication Technology, encompassing technologies that provide access to information through telecommunications, the internet, and other communication mediums. It includes hardware, software, and services used in various sectors such as education, healthcare, and business.

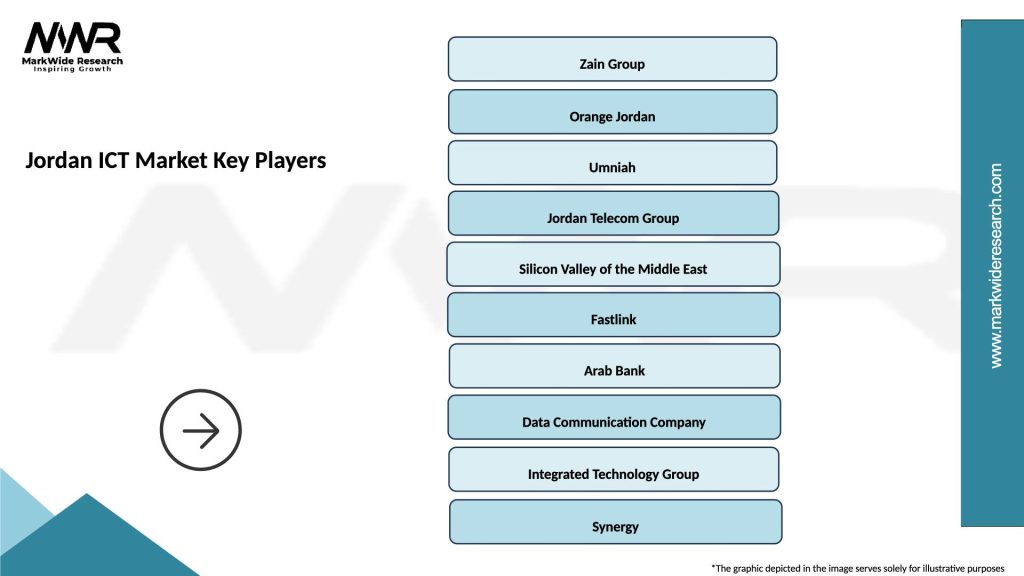

What are the key players in the Jordan ICT Market?

The Jordan ICT Market features several prominent companies, including Zain Jordan, Orange Jordan, and Umniah, which provide telecommunications and internet services. Additionally, firms like Jordan Data Systems and MenaITech contribute to software development and IT solutions, among others.

What are the growth factors driving the Jordan ICT Market?

The Jordan ICT Market is driven by increasing internet penetration, a growing demand for mobile services, and the expansion of e-commerce. Additionally, government initiatives to promote digital transformation and innovation play a significant role in fostering market growth.

What challenges does the Jordan ICT Market face?

The Jordan ICT Market faces challenges such as regulatory hurdles, limited infrastructure in rural areas, and competition from international players. These factors can hinder the growth and development of local ICT companies.

What opportunities exist in the Jordan ICT Market?

The Jordan ICT Market presents opportunities in areas such as cloud computing, cybersecurity, and digital education solutions. As businesses increasingly adopt digital technologies, there is potential for growth in IT services and innovative tech startups.

What trends are shaping the Jordan ICT Market?

Key trends in the Jordan ICT Market include the rise of artificial intelligence, the expansion of mobile applications, and the increasing focus on data analytics. These trends are transforming how businesses operate and engage with consumers.

Jordan ICT Market

| Segmentation Details | Description |

|---|---|

| Product Type | Software, Hardware, Networking Equipment, Cloud Services |

| End User | Government, Education, Healthcare, Enterprises |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| Technology | AI, IoT, Big Data, Cybersecurity |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Jordan ICT Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at