444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Ireland ICT market represents one of Europe’s most dynamic and rapidly evolving technology ecosystems, characterized by robust digital transformation initiatives and substantial foreign direct investment. Ireland’s strategic position as a European technology hub has attracted numerous multinational corporations, establishing the country as a critical gateway for digital services across the continent. The market demonstrates exceptional growth momentum, with cloud computing adoption rates reaching 78% among Irish enterprises, significantly above the European average.

Digital infrastructure development continues to accelerate across Ireland, driven by government initiatives such as the National Broadband Plan and substantial private sector investments in next-generation technologies. The market encompasses diverse segments including software development, telecommunications, cybersecurity, artificial intelligence, and emerging technologies like blockchain and Internet of Things solutions. Enterprise digital transformation remains a primary growth driver, with organizations increasingly adopting integrated ICT solutions to enhance operational efficiency and competitive positioning.

Foreign technology companies maintain significant presence in Ireland, with major players establishing European headquarters and research facilities throughout Dublin, Cork, and other key urban centers. The market benefits from Ireland’s favorable business environment, skilled workforce, and English-speaking advantage, positioning it as an attractive destination for technology investments and innovation initiatives.

The Ireland ICT market refers to the comprehensive ecosystem of information and communication technology products, services, and solutions operating within the Irish economy, encompassing hardware, software, telecommunications, and digital services sectors. This market includes domestic technology companies, multinational corporations with Irish operations, government technology initiatives, and the extensive network of supporting infrastructure and services that enable digital commerce and communication throughout the country.

ICT market scope extends beyond traditional technology boundaries to include emerging digital solutions such as cloud computing platforms, cybersecurity services, artificial intelligence applications, data analytics tools, and mobile technology solutions. The market serves diverse customer segments including large enterprises, small and medium businesses, government agencies, educational institutions, and individual consumers, creating a multifaceted technology landscape that supports Ireland’s broader economic development objectives.

Ireland’s ICT market demonstrates exceptional resilience and growth potential, driven by strategic government policies, substantial foreign investment, and a highly educated workforce specializing in technology disciplines. The market benefits from Ireland’s position as a European Union member state with strong regulatory frameworks and business-friendly policies that attract international technology companies seeking European market access.

Key market characteristics include high adoption rates of cloud technologies, robust cybersecurity investments, and increasing focus on artificial intelligence and machine learning applications. The telecommunications sector continues modernizing infrastructure with 5G network deployment reaching 45% coverage across major urban areas, supporting advanced mobile applications and Internet of Things implementations.

Market dynamics reflect strong collaboration between public and private sectors, with government initiatives supporting digital skills development, research and development activities, and startup ecosystem growth. The presence of major technology companies has created a skilled talent pool and established Ireland as a center for software development, data center operations, and digital services delivery across European markets.

Strategic market positioning reveals Ireland’s competitive advantages in attracting technology investments and fostering innovation-driven economic growth. The following insights highlight critical market dynamics:

Digital transformation initiatives across Irish enterprises continue driving substantial ICT market growth, with organizations investing in comprehensive technology modernization programs to enhance operational efficiency and customer engagement capabilities. Cloud migration strategies represent a primary growth driver, as businesses seek scalable, cost-effective technology solutions that support remote work arrangements and digital collaboration requirements.

Government policy support plays a crucial role in market expansion through strategic initiatives such as the Digital Ireland Framework, National Broadband Plan, and various technology funding programs. These policies create favorable conditions for technology adoption, infrastructure development, and skills enhancement across public and private sectors. Regulatory compliance requirements also drive ICT investments, particularly in cybersecurity, data protection, and financial technology sectors.

Foreign direct investment continues flowing into Ireland’s technology sector, with multinational corporations establishing European operations and expanding existing facilities. This investment creates demand for advanced ICT infrastructure, specialized services, and skilled technology professionals. Brexit implications have further enhanced Ireland’s attractiveness as an English-speaking EU member state, attracting companies seeking European market access while maintaining operational continuity.

Emerging technology adoption drives market growth through artificial intelligence, machine learning, Internet of Things, and blockchain implementations across various industry sectors. Irish organizations increasingly recognize the competitive advantages these technologies provide, leading to substantial investments in advanced ICT solutions and supporting infrastructure.

Skills shortage challenges represent a significant constraint on Ireland’s ICT market growth, with high demand for specialized technology professionals exceeding available talent supply. This shortage particularly affects cybersecurity, artificial intelligence, and advanced software development roles, potentially limiting market expansion and innovation capabilities. Competition for talent among technology companies has resulted in increased salary expectations and recruitment difficulties.

Infrastructure limitations in certain rural and remote areas constrain market development, despite ongoing National Broadband Plan implementation. Digital divide concerns persist between urban centers with advanced connectivity and rural regions with limited high-speed internet access, affecting technology adoption rates and business development opportunities in less connected areas.

Regulatory complexity associated with data protection, cybersecurity, and international technology standards creates compliance challenges for businesses, particularly smaller organizations with limited resources for regulatory management. Cost considerations related to advanced technology implementations may restrict adoption among small and medium enterprises, despite potential long-term benefits.

Market saturation in certain technology segments may limit growth opportunities for new entrants, while established players face increasing competition and margin pressure. Economic uncertainty and global technology market volatility can impact investment decisions and technology spending patterns across Irish organizations.

Artificial intelligence and machine learning present substantial growth opportunities across Ireland’s ICT market, with increasing demand for intelligent automation, predictive analytics, and advanced data processing capabilities. Irish companies are well-positioned to develop and deploy AI solutions across various industry sectors, supported by strong research capabilities and government innovation funding programs.

Cybersecurity services represent a rapidly expanding opportunity area, driven by increasing cyber threats, regulatory requirements, and digital transformation initiatives. MarkWide Research analysis indicates growing demand for comprehensive security solutions, creating opportunities for specialized service providers and technology companies focusing on cybersecurity innovations.

Green technology initiatives offer significant market potential as organizations seek sustainable ICT solutions aligned with environmental objectives and regulatory requirements. Opportunities include energy-efficient data centers, sustainable software development practices, and technology solutions supporting circular economy principles. Carbon neutrality commitments from major technology companies create demand for innovative environmental solutions.

Financial technology expansion continues creating opportunities in digital payments, blockchain applications, regulatory technology, and innovative financial services. Ireland’s strong financial services sector provides a foundation for fintech innovation and technology adoption. Digital health solutions represent another growing opportunity area, particularly following increased healthcare digitization during recent global health challenges.

Competitive landscape dynamics in Ireland’s ICT market reflect intense competition among domestic and international technology providers, driving continuous innovation and service enhancement. Market consolidation trends are evident as larger companies acquire specialized firms to expand capabilities and market reach, while startup companies continue emerging with innovative solutions addressing specific market needs.

Technology convergence creates dynamic market conditions as traditional boundaries between telecommunications, software, and hardware sectors continue blurring. This convergence enables integrated solution offerings but also increases competitive pressure across previously distinct market segments. Customer expectations for seamless, integrated technology experiences drive market evolution toward comprehensive service platforms.

Investment patterns show increasing focus on research and development activities, with companies allocating substantial resources to innovation initiatives and emerging technology development. Partnership strategies between technology companies, academic institutions, and government agencies create collaborative ecosystems supporting market growth and knowledge transfer.

Market maturity levels vary significantly across different ICT segments, with established areas like enterprise software showing steady growth while emerging technologies like quantum computing represent early-stage opportunities with substantial future potential.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Ireland’s ICT market dynamics. Primary research activities include structured interviews with industry executives, technology professionals, government officials, and key stakeholders across various market segments to gather firsthand insights and validate market trends.

Secondary research components encompass analysis of government publications, industry reports, company financial statements, technology adoption surveys, and academic research papers focusing on Irish technology markets. Data triangulation methods ensure consistency and accuracy across multiple information sources, providing robust foundations for market analysis and projections.

Quantitative analysis techniques include statistical modeling, trend analysis, and comparative assessments of market performance indicators across different time periods and geographic regions. Qualitative research methods involve expert interviews, focus group discussions, and case study development to understand market dynamics and strategic implications.

Market validation processes include peer review by industry experts, cross-referencing with established market databases, and verification of key findings through multiple independent sources to ensure research reliability and credibility.

Dublin metropolitan area dominates Ireland’s ICT market, hosting approximately 60% of technology companies and serving as the primary hub for multinational corporations, startup companies, and technology services providers. The region benefits from concentrated infrastructure, skilled workforce availability, and proximity to major universities and research institutions. Dublin’s technology cluster includes major software development centers, data centers, and European headquarters for global technology companies.

Cork region represents the second-largest ICT market concentration, with significant pharmaceutical technology, manufacturing automation, and software development activities. The area benefits from strong university partnerships and government support for technology innovation initiatives. Cork’s technology sector shows particular strength in biotechnology, medical devices, and advanced manufacturing technologies.

Galway and western regions demonstrate growing ICT market presence, supported by university research activities, government regional development programs, and increasing technology company investments. These areas show particular strength in telecommunications, software development, and emerging technology applications. Regional development initiatives continue attracting technology investments outside traditional Dublin concentration.

Other regional centers including Limerick, Waterford, and smaller urban areas contribute to Ireland’s distributed ICT ecosystem, with specialized technology clusters and niche market focus areas. Rural connectivity improvements through the National Broadband Plan are expected to support broader geographic distribution of technology activities and opportunities.

Major international players dominate Ireland’s ICT market through substantial local operations and strategic investments. The competitive environment includes both global technology leaders and specialized regional providers:

Domestic technology companies also play significant roles in Ireland’s ICT market, including specialized software developers, telecommunications providers, and innovative startup companies addressing specific market needs and opportunities.

By Technology Category:

By End-User Sector:

Software development sector represents Ireland’s strongest ICT market category, with numerous multinational companies establishing development centers and Irish companies creating innovative software solutions for global markets. Enterprise software applications show particular strength, supported by Ireland’s business-friendly environment and skilled developer workforce. The sector benefits from strong university partnerships and government support for software innovation initiatives.

Cloud computing services demonstrate exceptional growth momentum, with Irish organizations increasingly adopting cloud-first strategies for technology infrastructure and application deployment. Data center investments from major cloud providers have established Ireland as a European cloud services hub, supporting both domestic and international market requirements. Hybrid cloud adoption shows particular strength among Irish enterprises seeking flexible, scalable technology solutions.

Cybersecurity market segment experiences rapid expansion driven by increasing cyber threats, regulatory requirements, and digital transformation initiatives. Irish organizations show growing awareness of cybersecurity risks and invest substantially in protective technologies and services. Managed security services represent a particularly strong growth area as organizations seek specialized expertise for threat detection and response capabilities.

Telecommunications infrastructure continues modernizing with 5G network deployments, fiber optic expansions, and advanced mobile services. The sector supports Ireland’s broader ICT market development through reliable, high-speed connectivity enabling advanced technology applications and digital business models.

Technology companies benefit from Ireland’s strategic location providing European Union market access, English-speaking workforce, and favorable business environment. Operational advantages include competitive corporate tax rates, skilled talent availability, and strong intellectual property protection frameworks supporting innovation and business development activities.

Enterprise customers gain access to advanced technology solutions, specialized expertise, and competitive pricing through Ireland’s diverse ICT market. Digital transformation support from experienced technology providers enables organizations to modernize operations, improve efficiency, and enhance competitive positioning in global markets.

Government stakeholders benefit from increased economic activity, job creation, and tax revenues generated by Ireland’s thriving ICT sector. Innovation spillovers from technology companies contribute to broader economic development and support Ireland’s transition toward a knowledge-based economy.

Educational institutions benefit from industry partnerships, research collaboration opportunities, and enhanced graduate employment prospects in technology fields. Knowledge transfer activities between academia and industry support innovation development and maintain Ireland’s competitive advantages in technology markets.

Individual professionals benefit from diverse career opportunities, competitive compensation packages, and continuous learning opportunities in Ireland’s dynamic ICT market environment.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a dominant trend across Ireland’s ICT market, with organizations implementing AI-powered solutions for process automation, customer service enhancement, and data analytics applications. Machine learning adoption shows particular strength in financial services, healthcare, and manufacturing sectors, supported by government AI strategy initiatives and university research programs.

Sustainability focus drives increasing demand for green technology solutions, energy-efficient data centers, and environmentally responsible ICT practices. Carbon neutrality commitments from major technology companies influence market development toward sustainable technology solutions and circular economy principles. MWR analysis indicates growing importance of environmental considerations in technology procurement decisions.

Remote work technologies continue expanding following widespread adoption during recent global changes, with organizations investing in collaboration platforms, cloud-based productivity tools, and cybersecurity solutions supporting distributed workforce models. Hybrid work arrangements drive demand for flexible, scalable technology infrastructure and applications.

Edge computing development gains momentum as organizations seek reduced latency, improved performance, and enhanced data processing capabilities closer to end users. This trend supports Internet of Things implementations, real-time analytics, and advanced mobile applications across various industry sectors.

Cybersecurity evolution reflects increasing sophistication of threats and regulatory requirements, with organizations adopting zero-trust security models, advanced threat detection systems, and comprehensive security frameworks. Security automation shows growing adoption as organizations seek efficient threat response capabilities.

Major infrastructure investments continue transforming Ireland’s ICT landscape, with significant data center developments, 5G network deployments, and fiber optic expansions supporting advanced technology applications. Government initiatives including the National Broadband Plan and Digital Ireland Framework create foundations for continued market growth and innovation.

Strategic partnerships between technology companies, universities, and government agencies foster innovation ecosystems and support research and development activities. Industry collaboration programs address skills development needs, emerging technology research, and market development opportunities across various ICT segments.

Regulatory developments including GDPR implementation, cybersecurity frameworks, and data protection standards influence market dynamics and create opportunities for compliance-focused technology solutions. Brexit implications continue affecting market positioning and investment decisions as companies adapt to changing European market conditions.

Startup ecosystem growth demonstrates Ireland’s innovation capabilities, with increasing venture capital investment, accelerator programs, and successful technology company exits. Innovation hubs in Dublin, Cork, and other regional centers support entrepreneurship and technology commercialization activities.

Acquisition activities reflect market consolidation trends as larger companies acquire specialized firms to expand capabilities, market reach, and technology portfolios. These developments create opportunities for innovation transfer and market expansion across various ICT segments.

Strategic positioning recommendations for ICT market participants emphasize the importance of leveraging Ireland’s unique advantages while addressing key challenges and market constraints. Companies should focus on developing specialized expertise in emerging technologies, building strong local partnerships, and maintaining competitive differentiation through innovation and service excellence.

Talent development strategies require immediate attention given persistent skills shortages across various technology disciplines. Organizations should invest in comprehensive training programs, university partnerships, and international recruitment initiatives to build sustainable workforce capabilities. Skills development programs should emphasize emerging technologies, cybersecurity, and advanced analytics capabilities.

Market expansion approaches should consider Ireland’s role as a European gateway while developing capabilities for broader international market penetration. Export development strategies can leverage Ireland’s reputation for technology excellence and established business relationships across global markets.

Innovation investment priorities should focus on artificial intelligence, cybersecurity, sustainable technology solutions, and digital health applications where Ireland demonstrates competitive advantages and market opportunities. Research and development collaboration with academic institutions can support innovation development and technology commercialization activities.

Infrastructure development considerations should address regional distribution challenges while supporting continued growth in established technology centers. Sustainability initiatives should align with environmental objectives and regulatory requirements while creating competitive advantages in green technology markets.

Long-term market prospects for Ireland’s ICT sector remain exceptionally positive, supported by continued government policy support, ongoing foreign investment, and strong foundation capabilities in key technology areas. Market growth projections indicate sustained expansion across most ICT segments, with particularly strong performance expected in artificial intelligence, cybersecurity, and cloud computing applications.

Technology evolution trends suggest increasing convergence between traditional ICT boundaries, creating opportunities for integrated solution providers and comprehensive service platforms. Digital transformation acceleration across Irish organizations will continue driving demand for advanced technology solutions and specialized expertise. MarkWide Research projects continued market leadership in software development and cloud services delivery.

Emerging technology adoption including quantum computing, advanced artificial intelligence, and next-generation telecommunications will create new market segments and opportunities for innovation-focused companies. Sustainability requirements will increasingly influence technology procurement decisions and market development priorities.

Competitive landscape evolution will likely feature continued market consolidation, strategic partnerships, and increasing specialization as companies focus on specific technology niches and market segments. International expansion opportunities will support Irish technology companies’ growth beyond domestic market limitations.

Skills development initiatives and educational program enhancements will be crucial for maintaining Ireland’s competitive advantages in global technology markets. Innovation ecosystem maturation will support continued startup development and technology commercialization activities across various industry sectors.

Ireland’s ICT market represents a dynamic and rapidly evolving ecosystem that combines strategic advantages, innovative capabilities, and substantial growth potential across multiple technology segments. The market benefits from Ireland’s unique position as an English-speaking European Union member state with favorable business policies, skilled workforce, and strong infrastructure supporting advanced technology applications.

Key success factors include continued investment in skills development, infrastructure enhancement, and innovation initiatives that maintain Ireland’s competitive positioning in global technology markets. The presence of major multinational corporations, combined with a thriving domestic technology sector and supportive government policies, creates a robust foundation for sustained market growth and development.

Future opportunities in artificial intelligence, cybersecurity, sustainable technology solutions, and digital health applications position Ireland’s ICT market for continued expansion and innovation leadership. Strategic challenges including skills shortages, regional development balance, and increasing global competition require proactive management and collaborative solutions across industry, government, and educational stakeholders.

Market outlook remains highly positive, with Ireland’s ICT sector expected to continue serving as a critical driver of economic growth, innovation development, and international competitiveness. The combination of established strengths and emerging opportunities creates substantial potential for continued market leadership and technology excellence in the evolving global Ireland ICT market landscape.

What is ICT?

ICT stands for Information and Communications Technology, encompassing a range of technologies used to handle telecommunications, broadcast media, audio-visual processing and transmission systems, intelligent building management systems, and more.

What are the key players in the Ireland ICT Market?

Key players in the Ireland ICT Market include companies like Accenture, IBM, and Microsoft, which provide various ICT solutions and services, among others.

What are the growth factors driving the Ireland ICT Market?

The growth of the Ireland ICT Market is driven by increasing digital transformation initiatives, the rise of cloud computing, and the demand for cybersecurity solutions across various sectors.

What challenges does the Ireland ICT Market face?

Challenges in the Ireland ICT Market include a shortage of skilled professionals, rapid technological changes, and increasing competition from global players.

What opportunities exist in the Ireland ICT Market?

Opportunities in the Ireland ICT Market include the expansion of artificial intelligence applications, the growth of the Internet of Things (IoT), and the increasing need for data analytics services.

What trends are shaping the Ireland ICT Market?

Trends shaping the Ireland ICT Market include the shift towards remote work solutions, the adoption of edge computing, and the growing emphasis on sustainability in technology practices.

Ireland ICT Market

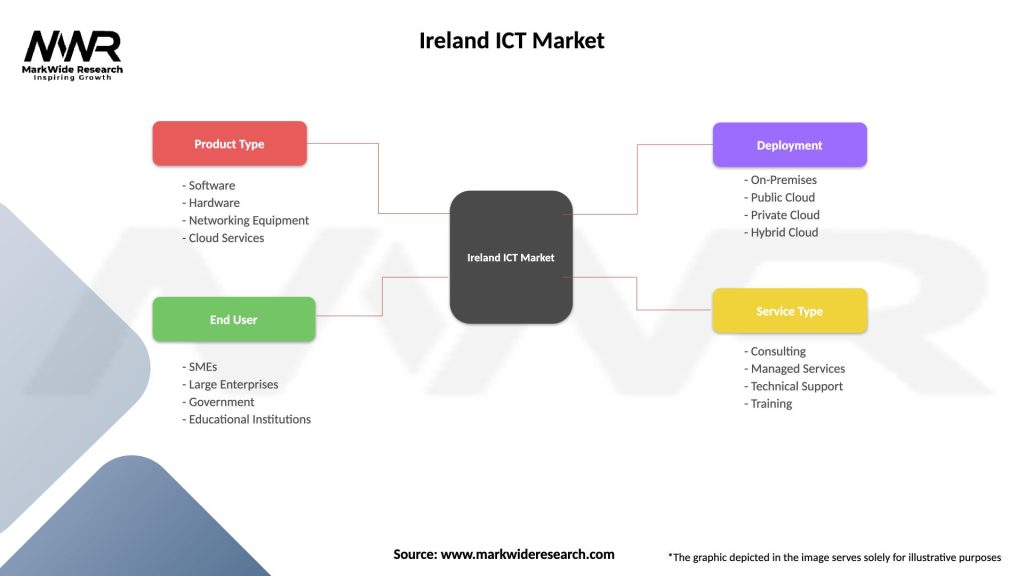

| Segmentation Details | Description |

|---|---|

| Product Type | Software, Hardware, Networking Equipment, Cloud Services |

| End User | SMEs, Large Enterprises, Government, Educational Institutions |

| Deployment | On-Premises, Public Cloud, Private Cloud, Hybrid Cloud |

| Service Type | Consulting, Managed Services, Technical Support, Training |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Ireland ICT Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at