444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China DC motor market represents one of the most dynamic and rapidly evolving segments within the global electric motor industry. China’s manufacturing prowess combined with increasing automation demands across various industrial sectors has positioned the nation as a dominant force in DC motor production and consumption. The market encompasses a comprehensive range of applications from automotive systems and industrial machinery to consumer electronics and renewable energy solutions.

Market dynamics indicate robust growth driven by the country’s industrial modernization initiatives and the transition toward electric vehicles. The market demonstrates exceptional diversity with brushed and brushless DC motors serving distinct application requirements. Manufacturing capabilities in China have evolved significantly, with domestic companies increasingly competing with international players through technological innovation and cost-effective production methods.

Regional distribution shows concentrated activity in major industrial hubs including Guangdong, Jiangsu, and Zhejiang provinces, where established manufacturing ecosystems support both domestic consumption and export activities. The market benefits from government support for electric vehicle adoption and industrial automation, creating sustained demand across multiple sectors. Growth projections indicate the market will expand at a compound annual growth rate of 8.2% through the forecast period, reflecting strong underlying demand fundamentals.

The China DC motor market refers to the comprehensive ecosystem encompassing the design, manufacture, distribution, and application of direct current electric motors within Chinese territory. DC motors are electrical machines that convert direct current electrical energy into mechanical rotational energy through electromagnetic induction principles. These motors operate by creating magnetic fields that interact with current-carrying conductors to produce rotational motion.

Market scope includes various DC motor types such as brushed DC motors, brushless DC motors, servo motors, and stepper motors, each serving specific application requirements. The market encompasses both domestic production for local consumption and manufacturing for global export markets. Industrial applications span automotive systems, manufacturing equipment, HVAC systems, consumer appliances, and emerging sectors like electric vehicles and renewable energy systems.

Technological evolution within the market reflects advancing capabilities in motor control systems, efficiency improvements, and integration with digital control technologies. The market represents a critical component of China’s broader industrial infrastructure, supporting the nation’s position as a global manufacturing hub while serving domestic modernization objectives.

China’s DC motor market demonstrates exceptional growth momentum driven by industrial automation trends and electric vehicle adoption. The market benefits from established manufacturing infrastructure, technological advancement capabilities, and supportive government policies promoting industrial modernization. Key growth drivers include increasing automation in manufacturing processes, expanding electric vehicle production, and growing demand for energy-efficient motor solutions.

Market segmentation reveals diverse application areas with automotive applications representing the largest segment, followed by industrial machinery and consumer electronics. Brushless DC motors show particularly strong growth potential due to their superior efficiency characteristics and longer operational life. Competitive dynamics feature both established international players and emerging domestic manufacturers competing through innovation and cost optimization.

Regional concentration in eastern coastal provinces reflects established industrial clusters and proximity to key end-user markets. The market demonstrates export strength with approximately 35% of production destined for international markets, highlighting China’s global competitiveness in DC motor manufacturing. Future prospects remain positive with continued industrial modernization and electric vehicle market expansion supporting sustained demand growth.

Market intelligence reveals several critical insights shaping the China DC motor landscape. Technological advancement continues as a primary differentiator with manufacturers investing heavily in research and development to improve motor efficiency and control capabilities. The integration of smart technologies and IoT connectivity represents an emerging trend with significant growth potential.

Key insights include:

Primary market drivers propelling China’s DC motor market growth encompass both domestic demand factors and global market opportunities. Industrial automation represents the most significant driver as Chinese manufacturers increasingly adopt automated production systems to improve efficiency and reduce labor costs. This trend accelerates across multiple industries including automotive, electronics, textiles, and food processing.

Electric vehicle adoption serves as another crucial driver with China leading global EV market development. Government policies supporting electric vehicle adoption, including subsidies and infrastructure development, create substantial demand for DC motors in automotive applications. Manufacturing modernization initiatives under China’s industrial policy framework promote advanced manufacturing technologies requiring sophisticated motor control systems.

Energy efficiency regulations drive demand for high-efficiency motor solutions as industries seek to reduce operational costs and meet environmental compliance requirements. Export opportunities expand as global manufacturers source DC motors from Chinese suppliers, benefiting from competitive pricing and improving quality standards. Technological advancement in motor control electronics and materials science enables new applications and performance improvements, stimulating market growth across diverse sectors.

Market constraints affecting China’s DC motor industry include several structural and competitive challenges. Raw material costs represent a significant concern as copper, rare earth elements, and steel prices experience volatility, impacting manufacturing margins. Supply chain dependencies on imported materials create vulnerability to global commodity price fluctuations and trade policy changes.

Competitive pressure from established international brands challenges domestic manufacturers in premium market segments where brand reputation and proven reliability command price premiums. Technology gaps persist in certain specialized applications requiring advanced motor control algorithms and precision manufacturing capabilities. Quality perception issues affect market positioning as some customers prefer established international brands despite competitive pricing from domestic suppliers.

Regulatory complexity creates challenges as manufacturers navigate evolving safety, efficiency, and environmental standards across different application sectors. Intellectual property concerns limit technology transfer opportunities and may restrict access to advanced motor technologies. Market saturation in certain traditional applications reduces growth opportunities, requiring manufacturers to identify new application areas and geographic markets for sustained expansion.

Significant opportunities exist within China’s DC motor market across emerging applications and technological advancement areas. Electric vehicle expansion presents the most substantial opportunity as China continues leading global EV adoption with ambitious electrification targets. The transition from internal combustion engines creates massive demand for various DC motor applications including traction motors, cooling system motors, and auxiliary system motors.

Industrial robotics represents another high-growth opportunity as Chinese manufacturers increasingly adopt robotic automation systems. Servo motors and stepper motors experience particularly strong demand in precision manufacturing applications. Renewable energy systems create new opportunities as solar tracking systems, wind turbine pitch control, and energy storage applications require specialized DC motor solutions.

Smart manufacturing initiatives under Industry 4.0 concepts drive demand for intelligent motor systems with integrated sensors and connectivity capabilities. Export market expansion offers growth potential as Chinese manufacturers improve quality standards and develop relationships with international customers. Technology partnerships with international companies provide opportunities to access advanced technologies while leveraging China’s manufacturing cost advantages.

Market dynamics within China’s DC motor sector reflect complex interactions between supply-side capabilities and demand-side requirements. Supply chain integration represents a key dynamic as manufacturers seek to optimize component sourcing and reduce dependency on imported materials. Vertical integration strategies enable better cost control and quality assurance while reducing supply chain risks.

Technological evolution drives market dynamics as brushless DC motors gain market share due to superior efficiency and reliability characteristics. MarkWide Research analysis indicates that brushless DC motors demonstrate efficiency improvements of 15-20% compared to brushed alternatives, supporting adoption across energy-conscious applications. Price competition intensifies as domestic manufacturers compete with international players through cost optimization and value engineering.

Customer requirements evolve toward integrated solutions combining motors with control electronics and software capabilities. Market consolidation trends emerge as larger manufacturers acquire smaller players to gain technological capabilities and market access. Innovation cycles accelerate with shorter product development timelines and rapid technology adoption across applications. Regulatory dynamics influence market development as efficiency standards and safety requirements shape product specifications and market access requirements.

Research methodology employed for analyzing China’s DC motor market incorporates comprehensive primary and secondary research approaches. Primary research includes extensive interviews with industry participants including manufacturers, distributors, end-users, and technology providers. Survey methodologies capture quantitative data regarding market size, growth rates, and competitive positioning across different market segments.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial information. Market modeling techniques utilize historical data to project future market trends and growth patterns. Supply chain analysis examines raw material flows, manufacturing processes, and distribution channels to understand market structure and competitive dynamics.

Data validation processes ensure accuracy through triangulation of multiple information sources and expert review procedures. Regional analysis methodology incorporates provincial-level data collection and analysis to understand geographic market variations. Technology assessment includes evaluation of patent filings, R&D investments, and product innovation trends. Competitive intelligence gathering utilizes public information sources and industry expert insights to develop comprehensive competitor profiles and market positioning analysis.

Regional distribution within China’s DC motor market demonstrates significant concentration in eastern coastal provinces where established industrial infrastructure and proximity to end markets create competitive advantages. Guangdong Province leads market activity with approximately 28% of national production capacity, benefiting from established electronics manufacturing clusters and proximity to Hong Kong’s trading infrastructure.

Jiangsu Province represents another major market hub with strong automotive and machinery manufacturing sectors driving DC motor demand. The region hosts several international motor manufacturers and maintains 22% market share in national production. Zhejiang Province demonstrates particular strength in small motor manufacturing serving consumer electronics and appliance applications, accounting for 18% of market activity.

Northern regions including Beijing, Tianjin, and surrounding areas focus on automotive applications and heavy industrial machinery, representing 15% of market demand. Western provinces show emerging growth potential as industrial development initiatives and infrastructure investments create new opportunities. Central China benefits from transportation advantages and lower labor costs, attracting manufacturing investments and representing 12% of market share. Regional specialization patterns emerge with different areas focusing on specific motor types and applications based on local industrial strengths and supply chain advantages.

Competitive dynamics within China’s DC motor market feature a diverse mix of international corporations, established domestic manufacturers, and emerging technology companies. Market leadership positions vary across different application segments with international players maintaining advantages in premium applications while domestic companies compete effectively in cost-sensitive markets.

Key market participants include:

Competitive strategies emphasize technology development, cost optimization, and market expansion through both organic growth and strategic acquisitions. Innovation focus areas include motor efficiency improvements, smart connectivity features, and application-specific customization capabilities.

Market segmentation within China’s DC motor industry reflects diverse application requirements and technological specifications. By motor type, the market divides into brushed DC motors, brushless DC motors, servo motors, and stepper motors, each serving distinct performance and cost requirements. Brushless DC motors demonstrate the strongest growth trajectory due to superior efficiency and reliability characteristics.

Application-based segmentation reveals:

Power rating segmentation spans from micro motors under 1 watt to high-power motors exceeding 10 kilowatts, with different segments serving specific application requirements. Voltage classifications include low voltage (under 48V), medium voltage (48V-400V), and high voltage (above 400V) categories.

Brushed DC motors maintain significant market presence despite technological limitations due to cost advantages and simplicity in control systems. These motors serve price-sensitive applications where efficiency requirements are less stringent. Market share for brushed motors remains stable at approximately 40% of unit volume though declining in value terms due to lower average selling prices.

Brushless DC motors represent the fastest-growing category with superior efficiency, longer operational life, and reduced maintenance requirements. Adoption rates increase rapidly in automotive applications where efficiency directly impacts vehicle range and performance. Technology advancement in motor control electronics reduces implementation complexity and cost barriers.

Servo motors experience strong growth in industrial automation applications requiring precise position and speed control. Market expansion reflects increasing adoption of robotic systems and CNC machinery in Chinese manufacturing. Stepper motors serve specialized applications requiring precise positioning without feedback systems, particularly in 3D printing and textile machinery. Performance improvements across all categories focus on efficiency enhancement, noise reduction, and integration with digital control systems.

Industry participants in China’s DC motor market benefit from multiple value creation opportunities across the supply chain. Manufacturers leverage China’s cost-competitive manufacturing environment, established supply chains, and skilled workforce to achieve global competitiveness. Scale advantages enable efficient production and competitive pricing while supporting continuous investment in technology development and capacity expansion.

End-user benefits include:

Stakeholder advantages extend to suppliers, distributors, and service providers who benefit from market growth and expanding opportunities. Technology partners gain access to large-scale manufacturing capabilities and cost-effective production platforms. Investment opportunities attract both domestic and international capital seeking exposure to China’s industrial growth and technology advancement.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological trends shaping China’s DC motor market emphasize efficiency improvement, smart connectivity, and application-specific optimization. Brushless motor adoption accelerates across applications as cost barriers decrease and efficiency benefits become more apparent. Integration trends combine motors with control electronics, sensors, and communication capabilities to create intelligent motor systems.

Digitalization trends include IoT connectivity enabling remote monitoring, predictive maintenance, and performance optimization. MWR analysis indicates that smart motor solutions demonstrate 25% faster adoption rates in industrial applications compared to traditional motor systems. Miniaturization trends drive development of compact, high-performance motors for portable and space-constrained applications.

Sustainability trends emphasize energy efficiency and environmental compliance with manufacturers developing motors meeting stringent efficiency standards. Customization trends reflect increasing demand for application-specific motor solutions rather than standard products. Service trends evolve toward comprehensive solutions including installation, maintenance, and performance optimization services. Supply chain trends focus on localization and vertical integration to reduce costs and improve supply security.

Recent industry developments demonstrate the dynamic nature of China’s DC motor market with significant investments in technology advancement and capacity expansion. Manufacturing investments by both domestic and international companies reflect confidence in long-term market growth prospects. Technology partnerships between Chinese and international companies facilitate knowledge transfer and capability development.

Product innovations focus on efficiency improvements, noise reduction, and integration capabilities. Automotive sector developments include specialized motor designs for electric vehicle applications with emphasis on power density and thermal management. Industrial automation developments feature advanced servo motor systems with enhanced precision and connectivity capabilities.

Regulatory developments include updated efficiency standards and safety requirements affecting product design and market access. Infrastructure developments support market growth through improved transportation networks and industrial park development. Export market developments include quality certifications and compliance with international standards enabling global market access. Investment developments attract both domestic and foreign capital supporting technology advancement and capacity expansion initiatives.

Strategic recommendations for market participants emphasize technology development, quality improvement, and market diversification. Manufacturers should prioritize R&D investments to develop advanced motor technologies and close technology gaps with international competitors. Quality enhancement initiatives should focus on manufacturing process improvement and quality control systems to build customer confidence and brand reputation.

Market expansion strategies should target emerging applications in electric vehicles, industrial robotics, and renewable energy systems where growth potential remains strong. Export development requires investment in international quality certifications, customer relationship building, and distribution network development. Technology partnerships with international companies can provide access to advanced technologies while leveraging China’s manufacturing advantages.

Operational recommendations include supply chain optimization to reduce raw material costs and improve supply security. Product portfolio diversification should emphasize high-value applications and smart motor solutions with integrated electronics and connectivity. Customer service enhancement through technical support, application engineering, and after-sales service can differentiate offerings in competitive markets. Sustainability initiatives should align with environmental regulations and customer requirements for energy-efficient solutions.

Future prospects for China’s DC motor market remain highly positive with multiple growth drivers supporting sustained expansion. Electric vehicle market growth represents the most significant opportunity with China’s EV adoption targets creating massive demand for various motor applications. MarkWide Research projections indicate the automotive segment will maintain growth rates exceeding 12% annually through the forecast period.

Industrial automation trends will continue driving demand for precision motor solutions as Chinese manufacturers modernize production facilities and adopt robotic systems. Technology advancement will focus on efficiency improvement, smart connectivity, and application-specific optimization. Market consolidation may occur as larger manufacturers acquire smaller players to gain technology capabilities and market access.

Export growth potential remains substantial as Chinese manufacturers improve quality standards and develop international customer relationships. Emerging applications in renewable energy, medical devices, and aerospace sectors will create new growth opportunities. Regulatory evolution toward stricter efficiency standards will favor advanced motor technologies and drive market premiumization. Investment flows into technology development and capacity expansion will support long-term competitiveness and market leadership positions.

China’s DC motor market demonstrates exceptional growth potential driven by industrial modernization, electric vehicle adoption, and technological advancement. The market benefits from established manufacturing infrastructure, competitive cost structures, and supportive government policies promoting industrial automation and electrification. Market dynamics favor continued expansion with diverse application opportunities and emerging technology trends creating sustained demand growth.

Competitive positioning continues evolving as domestic manufacturers enhance capabilities and compete more effectively with international players through innovation and cost optimization. Technology trends toward brushless motors, smart connectivity, and application-specific solutions will shape future market development. Regional strengths in eastern coastal provinces provide competitive advantages while emerging opportunities in other regions support market expansion.

Future success will depend on continued investment in technology development, quality improvement, and market diversification strategies. The market’s strong fundamentals, supported by China’s industrial growth and electrification trends, position it for sustained expansion and increasing global competitiveness in the years ahead.

What is DC Motor?

DC motors are electric motors that run on direct current electricity. They are widely used in various applications, including automotive, industrial machinery, and consumer electronics due to their simplicity and efficiency.

What are the key players in the China DC Motor Market?

Key players in the China DC Motor Market include companies like Nidec Corporation, Maxon Motor, and Siemens AG, which are known for their innovative motor technologies and extensive product ranges, among others.

What are the growth factors driving the China DC Motor Market?

The growth of the China DC Motor Market is driven by the increasing demand for automation in manufacturing, the rise of electric vehicles, and advancements in robotics technology, which require efficient motor solutions.

What challenges does the China DC Motor Market face?

The China DC Motor Market faces challenges such as intense competition among manufacturers, fluctuating raw material prices, and the need for continuous innovation to meet evolving consumer demands.

What opportunities exist in the China DC Motor Market?

Opportunities in the China DC Motor Market include the growing adoption of renewable energy systems, the expansion of smart home technologies, and the increasing use of DC motors in electric and hybrid vehicles.

What trends are shaping the China DC Motor Market?

Trends in the China DC Motor Market include the development of brushless DC motors for improved efficiency, the integration of IoT technology for smart motor control, and a focus on sustainable manufacturing practices.

China DC Motor Market

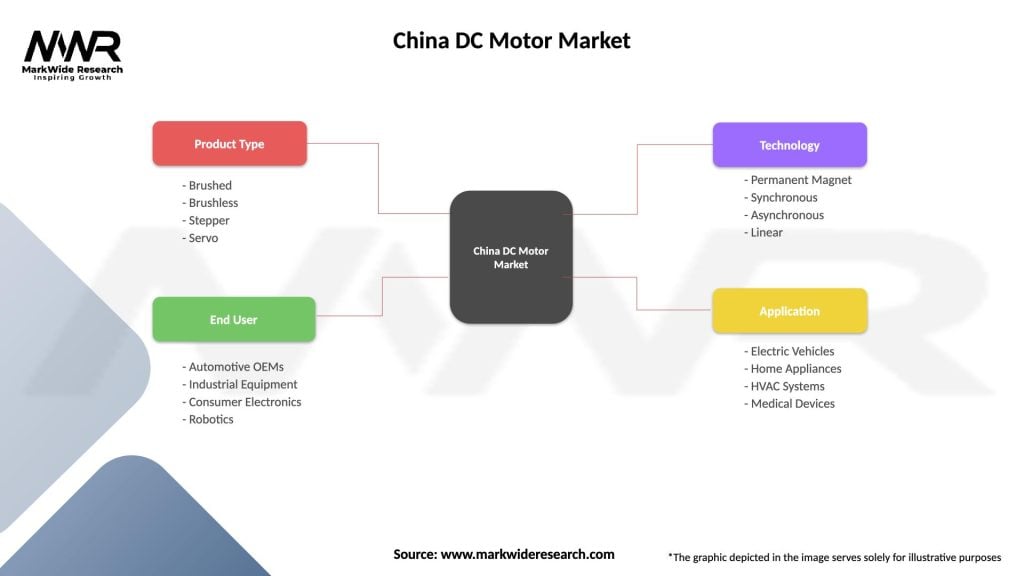

| Segmentation Details | Description |

|---|---|

| Product Type | Brushed, Brushless, Stepper, Servo |

| End User | Automotive OEMs, Industrial Equipment, Consumer Electronics, Robotics |

| Technology | Permanent Magnet, Synchronous, Asynchronous, Linear |

| Application | Electric Vehicles, Home Appliances, HVAC Systems, Medical Devices |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China DC Motor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at