444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States DC motor market represents a dynamic and rapidly evolving sector within the broader electrical machinery industry. DC motors continue to play a crucial role in various applications across automotive, industrial automation, consumer electronics, and renewable energy sectors. The market demonstrates robust growth potential driven by increasing demand for electric vehicles, industrial automation, and energy-efficient solutions.

Market dynamics indicate significant expansion opportunities as manufacturers increasingly adopt advanced DC motor technologies. The automotive sector’s transition toward electrification has created substantial demand for high-performance DC motors, particularly in electric and hybrid vehicles. Industrial applications continue to drive steady demand, with manufacturing facilities seeking reliable and efficient motor solutions for automation processes.

Regional distribution across the United States shows concentrated activity in manufacturing hubs, with 65% of market demand originating from the Midwest and Southeast regions. The market benefits from strong domestic manufacturing capabilities and established supply chain networks that support both production and distribution activities.

Technology advancement remains a key differentiator, with brushless DC motors gaining significant traction due to their superior efficiency and reduced maintenance requirements. The market is experiencing a notable shift toward smart motor solutions that integrate IoT capabilities and advanced control systems, reflecting broader industry trends toward digitalization and connectivity.

The United States DC motor market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and application of direct current electric motors within the American industrial landscape. DC motors are electrical machines that convert direct current electrical energy into mechanical rotational energy through electromagnetic principles.

Market scope includes various DC motor types such as brushed DC motors, brushless DC motors, servo motors, and stepper motors. These motors find applications across diverse industries including automotive manufacturing, industrial automation, aerospace, consumer appliances, and renewable energy systems. The market encompasses both original equipment manufacturer sales and aftermarket replacement components.

Value chain participants include motor manufacturers, component suppliers, distributors, system integrators, and end-users across multiple industrial sectors. The market structure reflects both domestic production capabilities and strategic imports of specialized components, creating a complex but resilient supply network.

Technological evolution within this market focuses on improving motor efficiency, reducing size and weight, enhancing control precision, and integrating smart connectivity features. Modern DC motors increasingly incorporate advanced materials, sophisticated control electronics, and digital communication capabilities to meet evolving application requirements.

Market performance in the United States DC motor sector demonstrates sustained growth momentum driven by multiple converging factors. The automotive industry’s electrification initiatives have emerged as a primary growth catalyst, with electric vehicle production creating unprecedented demand for high-performance DC motor solutions.

Industrial automation continues to represent the largest application segment, accounting for approximately 45% of total market demand. Manufacturing facilities across various industries are increasingly adopting automated systems that rely heavily on precision DC motor technologies for conveyor systems, robotic applications, and process control equipment.

Technology trends show accelerating adoption of brushless DC motors, which offer superior efficiency and reliability compared to traditional brushed alternatives. Energy efficiency has become a critical selection criterion, with end-users prioritizing motors that deliver optimal performance while minimizing power consumption and operational costs.

Competitive landscape features a mix of established multinational corporations and specialized domestic manufacturers. Market leaders are investing significantly in research and development to advance motor technologies and maintain competitive advantages in key application segments.

Future prospects remain highly favorable, with emerging applications in renewable energy systems, electric mobility solutions, and advanced manufacturing processes expected to drive continued market expansion throughout the forecast period.

Primary market drivers include the accelerating adoption of electric vehicles, increasing industrial automation, and growing emphasis on energy efficiency across all sectors. These factors collectively create a favorable environment for DC motor market growth and technological advancement.

Market segmentation reveals diverse application requirements driving specialized product development. Each segment presents unique technical challenges and opportunities for motor manufacturers to develop tailored solutions that address specific performance criteria and operational environments.

Electric vehicle adoption stands as the most significant driver propelling the United States DC motor market forward. The automotive industry’s commitment to electrification has created substantial demand for advanced motor technologies capable of delivering high torque, efficiency, and reliability in demanding automotive applications.

Industrial automation expansion continues to drive steady market growth as manufacturers seek to improve productivity, reduce labor costs, and enhance product quality through automated systems. Robotics integration in manufacturing processes requires sophisticated DC motor solutions that provide precise control and consistent performance in continuous operation environments.

Energy efficiency regulations and corporate sustainability initiatives are compelling organizations to replace older, less efficient motor systems with modern alternatives. Government incentives and utility rebate programs further encourage the adoption of high-efficiency motor technologies across industrial and commercial applications.

Technological advancement in motor design and control systems enables new applications and improved performance characteristics. Smart manufacturing initiatives drive demand for motors with integrated sensors, communication capabilities, and predictive maintenance features that support Industry 4.0 objectives.

Renewable energy growth creates additional market opportunities as solar tracking systems, wind turbines, and energy storage systems require specialized motor solutions. The expanding renewable energy infrastructure represents a significant long-term growth driver for the DC motor market.

High initial costs associated with advanced DC motor systems can limit adoption, particularly among smaller manufacturers and cost-sensitive applications. Capital investment requirements for upgrading existing systems often create barriers to market penetration in price-competitive segments.

Technical complexity of modern DC motor systems requires specialized knowledge for proper installation, configuration, and maintenance. Skills shortage in the technical workforce can impede adoption rates as organizations struggle to find qualified personnel capable of managing sophisticated motor control systems.

Supply chain disruptions have periodically affected component availability and pricing, creating challenges for motor manufacturers and end-users. Raw material costs for rare earth magnets and specialized alloys can significantly impact production costs and market pricing dynamics.

Competition from alternative technologies such as AC motors and linear actuators in certain applications can limit DC motor market expansion. Technology substitution risks require continuous innovation and value proposition enhancement to maintain market position.

Regulatory compliance requirements for electromagnetic compatibility, safety standards, and environmental regulations can increase development costs and time-to-market for new motor products. Certification processes often require substantial investment in testing and documentation.

Electric mobility expansion presents unprecedented opportunities for DC motor manufacturers as the transportation sector undergoes fundamental transformation. Commercial vehicle electrification represents a particularly promising segment with substantial growth potential in delivery trucks, buses, and specialty vehicles.

Smart manufacturing initiatives create opportunities for motor manufacturers to develop integrated solutions that combine motors with advanced sensors, communication interfaces, and predictive analytics capabilities. Industry 4.0 adoption drives demand for intelligent motor systems that support automated decision-making and optimization.

Renewable energy infrastructure development offers significant growth opportunities in solar tracking systems, wind turbine pitch control, and energy storage applications. Grid modernization initiatives further expand potential applications for specialized DC motor solutions.

Medical device innovation creates niche opportunities for precision motor applications in surgical robots, diagnostic equipment, and patient care devices. Healthcare automation trends drive demand for reliable, quiet, and precise motor solutions.

Aerospace and defense applications continue to evolve, requiring advanced motor technologies for unmanned systems, satellite positioning, and aircraft control systems. Space exploration initiatives create additional opportunities for specialized motor applications in extreme environments.

Supply and demand dynamics in the United States DC motor market reflect the complex interplay between technological advancement, application requirements, and economic factors. Demand patterns show increasing preference for high-efficiency, intelligent motor solutions that deliver superior performance while minimizing operational costs.

Manufacturing capacity has expanded significantly to meet growing demand, with both domestic and international suppliers establishing production facilities and distribution networks. Production efficiency improvements have enabled manufacturers to offer competitive pricing while maintaining quality standards.

Innovation cycles are accelerating as manufacturers invest heavily in research and development to maintain competitive advantages. Product lifecycles are shortening due to rapid technological advancement, requiring continuous innovation and market responsiveness.

Customer relationships are evolving toward long-term partnerships that encompass not only product supply but also technical support, system integration, and lifecycle services. Value-added services are becoming increasingly important differentiators in competitive market segments.

Market consolidation trends show larger companies acquiring specialized manufacturers to expand product portfolios and market reach. Strategic alliances between motor manufacturers and system integrators are creating new opportunities for market development and customer engagement.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry executives, technical experts, and end-users across various application segments to gather firsthand market intelligence.

Secondary research encompasses analysis of industry publications, technical journals, patent databases, and regulatory documents to understand market trends and technological developments. Data triangulation methods validate findings across multiple sources to ensure accuracy and reliability.

Market modeling techniques incorporate quantitative analysis of historical trends, current market conditions, and future projections based on identified drivers and constraints. Statistical analysis methods ensure robust data interpretation and meaningful trend identification.

Industry expert consultation provides valuable insights into market dynamics, competitive landscapes, and emerging opportunities. Technical validation ensures that market analysis accurately reflects technological capabilities and application requirements.

Continuous monitoring of market developments, regulatory changes, and technological advancement ensures that research findings remain current and relevant. Update mechanisms incorporate new information and market developments to maintain analytical accuracy.

Geographic distribution of the United States DC motor market shows distinct regional patterns driven by industrial concentration, automotive manufacturing, and technology development centers. Regional analysis reveals significant variations in demand patterns, application preferences, and growth trajectories across different areas.

Midwest region dominates market demand with approximately 35% market share, driven by concentrated automotive manufacturing and heavy industrial activities. Manufacturing hubs in Michigan, Ohio, and Illinois create substantial demand for industrial automation and automotive applications.

Southeast region accounts for 30% of market demand, supported by expanding manufacturing facilities, aerospace industries, and growing automotive production. Economic development initiatives in states like North Carolina, South Carolina, and Georgia attract motor-intensive industries.

West Coast represents 20% of market activity, with strong demand from technology companies, renewable energy projects, and advanced manufacturing facilities. Innovation centers in California drive demand for specialized and high-performance motor applications.

Northeast region contributes 15% of market demand, primarily from established manufacturing industries, medical device companies, and research institutions. Technology development activities in this region focus on advanced motor control systems and specialized applications.

Regional growth patterns indicate accelerating expansion in the Southeast and Southwest regions, driven by industrial relocation, renewable energy development, and favorable business environments. Infrastructure development in these regions supports continued market growth and manufacturing expansion.

Market competition in the United States DC motor sector features a diverse mix of multinational corporations, specialized manufacturers, and emerging technology companies. Competitive dynamics are shaped by technological innovation, product quality, customer service, and pricing strategies.

Competitive strategies emphasize technological differentiation, customer relationship management, and value-added services. Market leaders invest significantly in research and development to maintain technological advantages and expand application opportunities.

Innovation focus areas include motor efficiency improvement, smart connectivity features, and specialized solutions for emerging applications. Partnership strategies with system integrators and OEMs enable market expansion and customer relationship development.

Market segmentation analysis reveals distinct categories based on motor type, application, power rating, and end-user industry. Segmentation insights provide valuable understanding of market dynamics and growth opportunities across different product categories and applications.

By Motor Type:

By Power Rating:

By Application:

Brushless DC motors demonstrate the strongest growth trajectory, driven by superior efficiency characteristics and reduced maintenance requirements. Market adoption of brushless technology accelerates across automotive, industrial, and consumer applications as cost differentials narrow and performance advantages become more apparent.

Industrial automation applications continue to represent the largest market segment, with steady demand growth driven by manufacturing modernization and productivity improvement initiatives. Precision requirements in automated systems favor advanced motor technologies with integrated control capabilities.

Automotive applications show explosive growth potential as electric vehicle production scales up significantly. Performance requirements for automotive motors emphasize high torque density, efficiency, and reliability under demanding operating conditions.

Power rating categories reveal distinct market dynamics, with fractional horsepower motors benefiting from consumer electronics growth and high-power motors driven by industrial and automotive applications. Technology trends show increasing power density and efficiency across all rating categories.

Emerging applications in renewable energy, medical devices, and aerospace create new market opportunities for specialized motor solutions. Application diversity drives continued innovation and product development across multiple technology platforms.

Motor manufacturers benefit from expanding market opportunities across multiple high-growth sectors, enabling revenue diversification and reduced dependence on traditional industrial applications. Technology leadership positions provide competitive advantages and premium pricing opportunities in specialized market segments.

End-users gain access to increasingly sophisticated motor solutions that deliver improved performance, energy efficiency, and operational reliability. Total cost of ownership improvements through reduced maintenance requirements and energy consumption provide compelling value propositions.

System integrators benefit from growing demand for complete automation solutions that incorporate advanced motor technologies. Partnership opportunities with motor manufacturers enable comprehensive solution offerings and enhanced customer value delivery.

Component suppliers experience increased demand for specialized materials, electronic components, and manufacturing equipment required for advanced motor production. Supply chain relationships with motor manufacturers provide stable revenue streams and growth opportunities.

Technology investors find attractive opportunities in motor technology companies developing innovative solutions for emerging applications. Market growth potential and technological advancement create favorable investment environments for venture capital and strategic investors.

Research institutions benefit from increased industry collaboration and funding for motor technology development. Innovation partnerships with manufacturers accelerate technology transfer and commercialization of advanced motor concepts.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization trends are transforming the DC motor market as manufacturers integrate IoT capabilities, predictive maintenance features, and advanced control algorithms into motor systems. Smart connectivity enables real-time monitoring, performance optimization, and predictive maintenance capabilities that reduce operational costs and improve reliability.

Efficiency optimization continues as a dominant trend driven by energy cost concerns and environmental regulations. Advanced materials and design techniques enable motor manufacturers to achieve higher efficiency ratings while reducing size and weight characteristics.

Customization demand increases as end-users seek motor solutions tailored to specific application requirements. Modular design approaches enable manufacturers to offer customized solutions while maintaining production efficiency and cost competitiveness.

Sustainability focus drives development of environmentally friendly motor technologies and manufacturing processes. Circular economy principles influence product design decisions, emphasizing recyclability and lifecycle environmental impact reduction.

Integration trends show motors becoming part of larger system solutions rather than standalone components. System-level optimization approaches consider motor performance within broader application contexts to maximize overall efficiency and functionality.

Miniaturization continues across consumer electronics and portable device applications, driving development of compact, lightweight motor solutions. Power density improvements enable smaller motors to deliver equivalent or superior performance compared to larger predecessors.

Technology advancement in magnetic materials has enabled significant improvements in motor performance and efficiency. Rare earth magnet alternatives are being developed to reduce supply chain risks and cost volatility associated with traditional magnetic materials.

Manufacturing innovation includes adoption of advanced production techniques such as additive manufacturing for motor components and automated assembly systems. Production efficiency improvements enable cost reduction while maintaining quality standards.

Strategic partnerships between motor manufacturers and automotive OEMs are accelerating development of specialized electric vehicle motor solutions. Collaborative development programs focus on optimizing motor performance for specific vehicle platforms and applications.

Regulatory developments include updated efficiency standards and environmental regulations that influence motor design and manufacturing processes. Compliance requirements drive continuous improvement in motor efficiency and environmental performance.

Market consolidation activities include acquisitions and mergers that reshape competitive dynamics and market structure. Industry restructuring creates opportunities for market leaders to expand capabilities and geographic reach.

Investment activities in motor technology startups and research initiatives demonstrate strong industry confidence in future growth prospects. Venture capital funding supports development of innovative motor technologies and applications.

Strategic positioning recommendations emphasize the importance of technology leadership and application specialization in maintaining competitive advantages. MarkWide Research analysis suggests that companies should focus on developing differentiated solutions for high-growth market segments rather than competing primarily on price in commodity markets.

Investment priorities should emphasize research and development activities that advance motor efficiency, smart connectivity, and application-specific optimization. Technology roadmaps should align with emerging trends in electric mobility, industrial automation, and renewable energy applications.

Partnership strategies can accelerate market penetration and technology development through collaboration with system integrators, OEMs, and technology companies. Strategic alliances enable access to new markets and application expertise while sharing development risks and costs.

Market expansion opportunities exist in emerging applications and geographic regions where motor technology adoption is accelerating. International markets present significant growth potential for companies with advanced technology capabilities and strong brand recognition.

Operational excellence initiatives should focus on manufacturing efficiency, supply chain optimization, and customer service enhancement. Continuous improvement programs can deliver cost advantages and quality differentiation in competitive market environments.

Talent development investments are crucial for maintaining innovation capabilities and technical expertise required for advanced motor development. Skills training programs should address emerging technology requirements and application knowledge needs.

Long-term prospects for the United States DC motor market remain highly favorable, with multiple growth drivers supporting sustained expansion over the forecast period. Market evolution will be shaped by technological advancement, application diversification, and changing customer requirements across key end-user segments.

Electric vehicle adoption is expected to accelerate significantly, creating substantial growth opportunities for motor manufacturers capable of delivering high-performance automotive solutions. Market penetration of electric vehicles could reach 25-30% of new vehicle sales within the next decade, driving unprecedented demand for automotive motor systems.

Industrial automation trends will continue driving steady demand growth as manufacturers seek to improve productivity and competitiveness through advanced automation technologies. Smart manufacturing adoption rates are projected to increase substantially, creating opportunities for intelligent motor solutions.

Technology convergence between motors, sensors, and control systems will create new product categories and application opportunities. Integrated solutions that combine multiple functions within single packages will become increasingly important in space-constrained applications.

Sustainability requirements will drive continued emphasis on energy efficiency and environmental performance across all motor applications. Regulatory trends suggest increasingly stringent efficiency standards and environmental requirements that will favor advanced motor technologies.

Market maturation in traditional applications will drive innovation toward emerging sectors such as renewable energy, medical devices, and aerospace applications. Application diversity will provide resilience against economic cycles and technology disruptions in individual market segments.

The United States DC motor market stands at a pivotal point in its evolution, with transformative trends in electric mobility, industrial automation, and smart technologies creating unprecedented growth opportunities. Market fundamentals remain strong, supported by diverse application segments and continuous technological advancement.

Technology leadership will be crucial for success in this dynamic market environment, as customers increasingly demand sophisticated solutions that deliver superior performance, efficiency, and connectivity. Innovation capabilities and application expertise will differentiate market leaders from commodity suppliers in competitive segments.

Strategic positioning around high-growth applications such as electric vehicles, renewable energy, and smart manufacturing will be essential for capturing market opportunities. MWR analysis indicates that companies with focused strategies and strong technical capabilities are best positioned for long-term success.

Market outlook remains highly positive, with multiple growth drivers supporting sustained expansion across diverse application segments. Future success will depend on companies’ ability to anticipate market needs, develop innovative solutions, and execute effective go-to-market strategies in this rapidly evolving landscape.

What is DC Motor?

DC motors are electric motors that run on direct current (DC) electricity. They are widely used in various applications, including automotive, robotics, and industrial machinery due to their simplicity and efficiency.

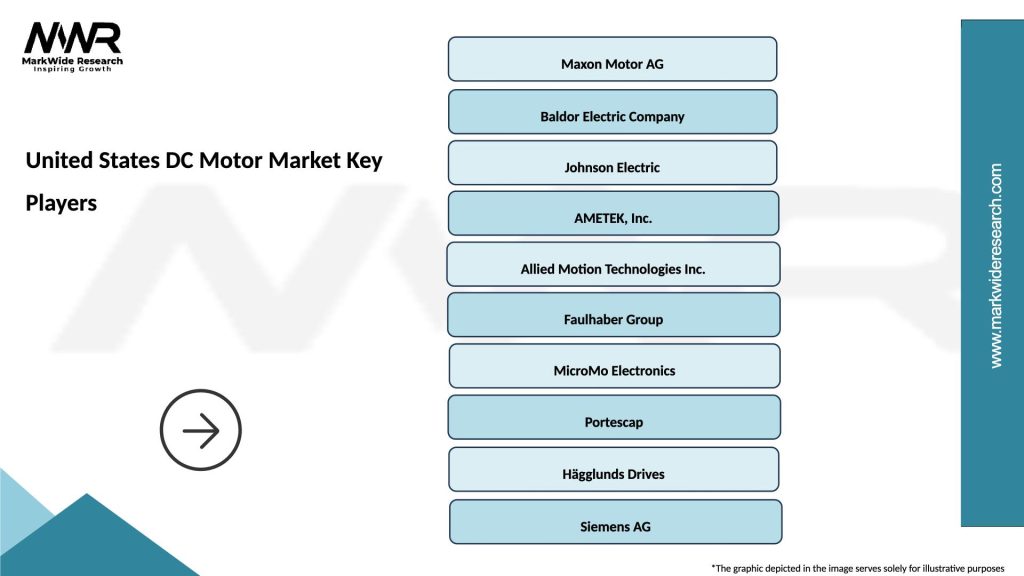

What are the key players in the United States DC Motor Market?

Key players in the United States DC Motor Market include companies like Nidec Corporation, Baldor Electric Company, and Maxon Motor AG, among others. These companies are known for their innovative motor designs and extensive product offerings.

What are the growth factors driving the United States DC Motor Market?

The growth of the United States DC Motor Market is driven by the increasing demand for automation in industries, the rise of electric vehicles, and advancements in motor technology. Additionally, the push for energy-efficient solutions is also contributing to market expansion.

What challenges does the United States DC Motor Market face?

The United States DC Motor Market faces challenges such as competition from alternative motor technologies, fluctuating raw material prices, and the need for continuous innovation. These factors can impact production costs and market dynamics.

What opportunities exist in the United States DC Motor Market?

Opportunities in the United States DC Motor Market include the growing adoption of renewable energy systems, the expansion of electric vehicle infrastructure, and the increasing use of automation in manufacturing processes. These trends are expected to create new avenues for growth.

What are the current trends in the United States DC Motor Market?

Current trends in the United States DC Motor Market include the development of smart motors with integrated sensors, the shift towards miniaturization for compact applications, and the increasing focus on sustainability and energy efficiency in motor design.

United States DC Motor Market

| Segmentation Details | Description |

|---|---|

| Product Type | Brushed, Brushless, Stepper, Servo |

| End User | Automotive OEMs, Industrial Equipment, Consumer Electronics, Robotics |

| Technology | Permanent Magnet, Synchronous, Asynchronous, Linear |

| Application | HVAC Systems, Power Tools, Electric Vehicles, Medical Devices |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States DC Motor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at