444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Wi-Fi network equipment market represents a dynamic and rapidly evolving sector within the global telecommunications infrastructure landscape. This comprehensive market encompasses a diverse range of wireless networking hardware components, including access points, routers, switches, controllers, and related infrastructure equipment that enable seamless wireless connectivity across residential, commercial, and industrial environments. Market dynamics indicate substantial growth driven by increasing demand for high-speed internet connectivity, the proliferation of connected devices, and the ongoing digital transformation initiatives across various industries.

Current market trends demonstrate significant expansion opportunities, with the sector experiencing robust growth at a compound annual growth rate (CAGR) of 8.2% through the forecast period. The market landscape is characterized by continuous technological advancement, including the widespread adoption of Wi-Fi 6 and emerging Wi-Fi 6E standards, which offer enhanced performance, reduced latency, and improved capacity for handling multiple device connections simultaneously. Regional distribution shows North America maintaining approximately 35% market share, followed by Asia-Pacific with 32% market penetration, reflecting the global nature of wireless connectivity demand.

Industry transformation is being driven by several key factors, including the exponential growth of Internet of Things (IoT) devices, increasing remote work adoption, smart city initiatives, and the need for reliable wireless infrastructure to support emerging technologies such as augmented reality, virtual reality, and edge computing applications. The market encompasses various deployment scenarios, from small office and home office (SOHO) environments to large-scale enterprise and service provider networks.

The Wi-Fi network equipment market refers to the comprehensive ecosystem of wireless networking hardware, software, and related infrastructure components that enable wireless local area network (WLAN) connectivity and internet access across diverse environments and applications. This market encompasses the design, manufacturing, distribution, and deployment of various wireless networking devices that facilitate seamless data transmission and communication through radio frequency technology operating primarily in the 2.4 GHz, 5 GHz, and emerging 6 GHz frequency bands.

Core components within this market include wireless access points that serve as connection hubs for client devices, wireless routers that combine routing and access point functionality, network switches that manage data flow between devices, wireless controllers that centrally manage multiple access points, and various supporting infrastructure elements such as antennas, cables, and power management systems. The market also encompasses software solutions for network management, security protocols, and analytics platforms that optimize wireless network performance.

Market scope extends beyond traditional networking equipment to include specialized solutions for specific industries and applications, such as outdoor wireless systems for smart cities, industrial-grade equipment for manufacturing environments, healthcare-specific wireless solutions, and high-density deployment systems for stadiums, airports, and large venues. The definition encompasses both hardware and software components that work together to create comprehensive wireless networking solutions.

Market performance in the Wi-Fi network equipment sector demonstrates exceptional resilience and growth potential, driven by fundamental shifts in connectivity requirements and technological advancement. The industry has experienced accelerated adoption across multiple sectors, with enterprise deployments showing particularly strong momentum as organizations prioritize digital infrastructure investments. Technology evolution continues to reshape market dynamics, with Wi-Fi 6 adoption reaching 42% penetration rate among new deployments, while next-generation Wi-Fi 6E and Wi-Fi 7 technologies are beginning to gain traction.

Strategic market positioning reveals significant opportunities for growth across various application segments, including smart building implementations, industrial automation, healthcare digitization, and educational technology integration. The market benefits from increasing recognition of wireless connectivity as critical infrastructure, comparable to traditional utilities, driving sustained investment in network modernization and expansion initiatives. Competitive landscape features both established networking giants and innovative technology companies competing on performance, reliability, and advanced feature sets.

Future growth trajectory appears robust, supported by emerging technologies such as artificial intelligence-driven network optimization, machine learning-based security protocols, and integration with 5G networks for seamless connectivity experiences. The market is positioned to benefit from continued digital transformation initiatives, increasing data consumption patterns, and the growing importance of reliable wireless connectivity for business continuity and operational efficiency across industries.

Fundamental market drivers reveal several critical insights that shape the Wi-Fi network equipment landscape and influence strategic decision-making across the industry:

Digital transformation acceleration serves as the primary catalyst driving Wi-Fi network equipment demand across industries. Organizations worldwide are recognizing wireless connectivity as fundamental infrastructure, essential for supporting modern business operations, employee productivity, and customer experiences. The shift toward digital-first strategies has created unprecedented demand for reliable, high-performance wireless networks capable of supporting diverse applications and user requirements.

Remote work proliferation has fundamentally altered connectivity requirements, with organizations investing heavily in wireless infrastructure to support distributed workforces and hybrid office environments. This trend has driven demand for enterprise-grade wireless equipment that can handle increased traffic loads, provide secure connectivity for remote access, and support collaboration technologies. Bandwidth requirements have increased by approximately 65% annually in many organizations, necessitating infrastructure upgrades and capacity expansion.

IoT device explosion continues to drive market growth as connected devices become ubiquitous across residential, commercial, and industrial environments. Smart buildings, industrial automation systems, healthcare monitoring devices, and consumer electronics are creating complex connectivity ecosystems that require sophisticated wireless infrastructure. The need to support thousands of simultaneous device connections while maintaining performance and security standards is driving adoption of advanced Wi-Fi technologies and network management solutions.

Cloud computing adoption and the migration of applications and services to cloud platforms have increased reliance on robust wireless connectivity. Organizations require wireless networks that can provide consistent, high-speed access to cloud resources while maintaining security and performance standards. This trend is driving demand for enterprise-grade wireless equipment with advanced quality of service capabilities and integrated security features.

Implementation complexity represents a significant challenge for organizations considering wireless network upgrades or deployments. The technical expertise required for proper network design, installation, and configuration can be substantial, particularly for complex enterprise environments or specialized applications. Many organizations struggle with the complexity of integrating new wireless equipment with existing network infrastructure, legacy systems, and security protocols, leading to delayed implementations and increased costs.

Security vulnerabilities continue to concern organizations, as wireless networks inherently present additional attack vectors compared to wired infrastructure. The need to balance accessibility with security creates ongoing challenges, particularly in environments handling sensitive data or critical operations. Organizations must invest in comprehensive security solutions, regular updates, and ongoing monitoring, which can increase total cost of ownership and complexity.

Interference and spectrum limitations pose technical challenges, particularly in dense deployment environments where multiple wireless networks operate in proximity. The limited availability of clean spectrum, especially in urban areas and large facilities, can impact network performance and reliability. Organizations must carefully plan frequency allocation and implement interference mitigation strategies, which can complicate deployments and increase costs.

Budget constraints affect many organizations, particularly smaller businesses and educational institutions that require modern wireless infrastructure but face financial limitations. The total cost of ownership for enterprise-grade wireless equipment, including hardware, software licensing, installation, and ongoing maintenance, can be substantial. Economic uncertainties and competing technology priorities can delay wireless infrastructure investments despite recognized benefits.

Wi-Fi 6E and Wi-Fi 7 adoption presents substantial growth opportunities as organizations seek to leverage expanded spectrum availability and enhanced performance capabilities. The introduction of 6 GHz spectrum through Wi-Fi 6E provides significant capacity increases and reduced interference, creating opportunities for equipment manufacturers to develop advanced solutions targeting high-density environments and demanding applications. Early adopters are demonstrating performance improvements of up to 40% in throughput and latency reduction.

Smart city initiatives are creating new market segments for outdoor wireless equipment and specialized connectivity solutions. Municipal governments worldwide are investing in wireless infrastructure to support public safety, traffic management, environmental monitoring, and citizen services. These deployments require ruggedized equipment capable of operating in challenging environmental conditions while providing reliable connectivity across large geographic areas.

Industrial automation expansion offers significant opportunities for specialized wireless equipment designed for manufacturing, logistics, and industrial environments. Industry 4.0 initiatives are driving demand for wireless solutions that can support real-time communication, machine-to-machine connectivity, and industrial IoT applications while meeting stringent reliability and security requirements. Manufacturing sector adoption is growing at approximately 12% annually, creating substantial market potential.

Healthcare digitization continues to drive demand for specialized wireless solutions that can support medical devices, patient monitoring systems, and healthcare applications while meeting regulatory requirements and security standards. The integration of wireless connectivity in medical equipment, telemedicine platforms, and hospital information systems creates opportunities for healthcare-specific wireless solutions with enhanced security and reliability features.

Technological evolution continues to reshape market dynamics as new wireless standards emerge and existing technologies mature. The transition from Wi-Fi 5 to Wi-Fi 6 and the introduction of Wi-Fi 6E are driving equipment refresh cycles while creating opportunities for performance improvements and new applications. Technology adoption rates indicate that organizations are increasingly prioritizing future-proof solutions that can support emerging requirements and provide long-term value.

Competitive intensity remains high as established networking vendors compete with innovative technology companies and specialized solution providers. Market dynamics favor companies that can demonstrate clear performance advantages, provide comprehensive solutions, and offer strong support and services. The ability to integrate artificial intelligence, machine learning, and advanced analytics into wireless solutions is becoming increasingly important for competitive differentiation.

Supply chain considerations have gained prominence as organizations seek reliable equipment sources and predictable delivery schedules. Global supply chain disruptions have highlighted the importance of vendor diversification and local manufacturing capabilities. Companies that can provide consistent product availability and responsive support are gaining competitive advantages in the market.

Regulatory environment influences market dynamics through spectrum allocation decisions, security requirements, and industry-specific regulations. Changes in regulatory frameworks can create new opportunities or challenges for equipment manufacturers and users. The ongoing evolution of wireless regulations, particularly regarding 6 GHz spectrum usage and security standards, continues to shape market development and product innovation strategies.

Comprehensive market analysis for the Wi-Fi network equipment sector employs a multi-faceted research approach that combines quantitative data collection with qualitative insights from industry experts, technology vendors, and end-user organizations. The methodology encompasses primary research through structured interviews with key market participants, including equipment manufacturers, system integrators, and enterprise customers across various industries and geographic regions.

Data collection strategies include extensive secondary research utilizing industry reports, technology specifications, regulatory filings, and market intelligence databases to establish baseline market understanding and validate primary research findings. The research framework incorporates analysis of patent filings, technology roadmaps, and standards development activities to identify emerging trends and future market directions.

Market segmentation analysis employs detailed categorization by product type, technology standard, deployment environment, industry vertical, and geographic region to provide comprehensive market understanding. The methodology includes competitive landscape analysis through company financial reports, product announcements, partnership agreements, and market positioning strategies to assess competitive dynamics and market share distribution.

Validation processes ensure research accuracy through triangulation of data sources, expert review panels, and statistical analysis of market trends and projections. The methodology incorporates regular updates to reflect rapidly evolving technology landscapes and changing market conditions, ensuring research findings remain current and actionable for strategic decision-making.

North American market leadership continues with the region maintaining approximately 35% global market share, driven by early technology adoption, substantial enterprise investments, and robust digital infrastructure development. The United States leads regional growth through significant corporate spending on wireless infrastructure modernization, government initiatives supporting broadband expansion, and strong demand from technology-intensive industries. Canada’s market contribution shows steady growth, particularly in smart city implementations and industrial automation projects.

Asia-Pacific emergence as a major growth region reflects rapid economic development, urbanization trends, and increasing technology adoption across diverse markets. China represents approximately 45% of regional demand, driven by massive infrastructure investments, manufacturing sector modernization, and smart city initiatives. Japan and South Korea demonstrate strong adoption of advanced Wi-Fi technologies, while India and Southeast Asian markets show rapid growth potential driven by digital transformation initiatives and increasing internet penetration.

European market dynamics are characterized by strong regulatory frameworks, emphasis on data privacy and security, and significant investments in digital infrastructure modernization. Germany, United Kingdom, and France lead regional adoption, with particular strength in industrial applications and smart building implementations. The region shows growing adoption rates of 28% annually for Wi-Fi 6 technologies, driven by corporate digital transformation initiatives and government digitization programs.

Emerging markets in Latin America, Middle East, and Africa present significant growth opportunities as infrastructure development accelerates and technology costs decrease. These regions are experiencing rapid mobile internet adoption, increasing demand for wireless connectivity solutions, and growing investments in digital infrastructure to support economic development and social connectivity initiatives.

Market leadership is distributed among several key players who have established strong positions through technology innovation, comprehensive product portfolios, and extensive partner networks:

Competitive strategies emphasize technology differentiation, comprehensive solution portfolios, and strong customer support capabilities. Leading companies are investing heavily in research and development to maintain technology leadership, particularly in areas such as AI-driven network optimization, advanced security features, and integration with emerging technologies.

By Product Type:

By Technology Standard:

By Deployment Environment:

Enterprise wireless solutions represent the largest and most dynamic market segment, driven by corporate digital transformation initiatives and the need for reliable, high-performance wireless connectivity. This category encompasses sophisticated access points, centralized management systems, and advanced security features designed to support large-scale deployments with thousands of concurrent users. Enterprise adoption rates show strong preference for Wi-Fi 6 technology, with 58% of new deployments utilizing the latest standard.

Small and medium business (SMB) solutions focus on cost-effective, easy-to-deploy wireless equipment that provides enterprise-like features at accessible price points. This segment emphasizes simplified management, cloud-based configuration, and scalable solutions that can grow with business requirements. The SMB market shows increasing sophistication in requirements, with growing demand for advanced security features and performance optimization capabilities.

Consumer and residential markets continue to drive volume growth through increasing demand for high-performance home networking solutions. The proliferation of connected devices, streaming services, and remote work requirements has elevated consumer expectations for wireless performance and reliability. Consumer upgrade cycles are accelerating, with average replacement intervals decreasing to approximately 3-4 years as performance requirements increase.

Specialized vertical solutions are emerging as significant growth drivers, with healthcare, education, retail, and manufacturing sectors requiring customized wireless solutions that address specific industry requirements. These solutions often incorporate specialized features such as medical device compatibility, educational content filtering, retail analytics integration, or industrial-grade environmental protection.

Technology vendors benefit from sustained market growth driven by continuous technology evolution and increasing connectivity requirements across all sectors. The market provides opportunities for differentiation through innovation, specialized solutions, and comprehensive service offerings. Vendors can leverage emerging technologies such as artificial intelligence and machine learning to create advanced solutions that provide competitive advantages and higher value propositions.

System integrators and channel partners gain from increasing complexity in wireless deployments, which drives demand for professional services, installation expertise, and ongoing support. The market evolution toward more sophisticated solutions creates opportunities for value-added services, consulting, and managed services that generate recurring revenue streams and stronger customer relationships.

End-user organizations benefit from improved productivity, operational efficiency, and competitive advantages through modern wireless infrastructure. Advanced wireless solutions enable new business models, support digital transformation initiatives, and provide the foundation for emerging technologies such as IoT, artificial intelligence, and edge computing applications.

Service providers can leverage Wi-Fi equipment to extend network coverage, offload cellular traffic, and provide enhanced customer experiences. The integration of Wi-Fi with cellular networks creates opportunities for seamless connectivity experiences and new service offerings that can differentiate providers in competitive markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Cloud-managed networking is transforming how organizations deploy and manage wireless infrastructure, with cloud-based management platforms providing centralized control, advanced analytics, and simplified operations. This trend is reducing the technical expertise required for wireless network management while enabling more sophisticated optimization and troubleshooting capabilities. Cloud adoption rates in wireless management are growing at approximately 25% annually, driven by operational efficiency benefits and reduced infrastructure requirements.

Artificial intelligence integration is becoming increasingly prevalent in wireless networking solutions, enabling predictive maintenance, automated optimization, and intelligent troubleshooting capabilities. AI-driven solutions can analyze network performance patterns, predict potential issues, and automatically adjust configurations to optimize performance and user experience. This trend is particularly valuable in complex enterprise environments where manual optimization would be impractical.

Security-first design is becoming standard practice as organizations prioritize cybersecurity in wireless infrastructure planning. Modern wireless solutions incorporate advanced encryption, network segmentation, and threat detection capabilities as fundamental features rather than optional add-ons. The integration of zero-trust security principles into wireless networking is driving demand for solutions that can provide granular access control and continuous security monitoring.

Sustainability focus is influencing product development and deployment strategies, with organizations seeking energy-efficient wireless solutions that reduce environmental impact and operational costs. Manufacturers are developing more efficient hardware designs, implementing power management features, and providing tools for optimizing energy consumption in wireless networks.

Standards evolution continues with the development of Wi-Fi 7 (802.11be) technology, which promises significant performance improvements including higher throughput, lower latency, and enhanced reliability. Early Wi-Fi 7 products are beginning to appear in the market, with full commercial availability expected to drive the next major upgrade cycle. The standard introduces features such as multi-link operation and improved spectrum efficiency that will enable new applications and use cases.

Merger and acquisition activity has intensified as companies seek to strengthen their market positions and expand their technology portfolios. Recent consolidation in the networking industry has created larger, more comprehensive solution providers capable of addressing diverse customer requirements and competing more effectively in global markets. These developments are reshaping competitive dynamics and creating new market leaders.

Partnership ecosystem expansion is evident as wireless equipment vendors collaborate with cloud providers, software companies, and system integrators to deliver comprehensive solutions. These partnerships enable integrated offerings that combine wireless hardware with cloud services, security solutions, and vertical-specific applications to address complete customer requirements.

Investment in research and development remains strong as companies prepare for future technology transitions and emerging market requirements. Focus areas include advanced antenna technologies, improved spectrum efficiency, enhanced security capabilities, and integration with emerging technologies such as edge computing and 5G networks.

Strategic positioning recommendations emphasize the importance of developing comprehensive solution portfolios that address complete customer requirements rather than focusing solely on individual products. MarkWide Research analysis indicates that customers increasingly prefer vendors who can provide integrated solutions including hardware, software, services, and ongoing support. Companies should invest in developing ecosystem partnerships and service capabilities to differentiate their offerings in competitive markets.

Technology investment priorities should focus on emerging standards such as Wi-Fi 6E and Wi-Fi 7, while maintaining support for existing deployments and migration paths. Organizations should prioritize solutions that provide future-proofing capabilities and can adapt to evolving requirements without requiring complete infrastructure replacement. The ability to support multiple technology generations simultaneously will be crucial for market success.

Market expansion strategies should target emerging vertical markets and geographic regions where wireless infrastructure development is accelerating. Companies should develop specialized solutions for industries such as healthcare, manufacturing, and smart cities that have unique requirements and are willing to invest in advanced wireless technologies. International expansion opportunities exist in developing markets where infrastructure investment is increasing.

Customer engagement approaches should emphasize education, consultation, and ongoing support to help organizations navigate the complexity of modern wireless networking. The ability to provide expert guidance, professional services, and responsive support will become increasingly important as wireless networks become more critical to business operations and customer experiences.

Long-term growth prospects for the Wi-Fi network equipment market remain exceptionally positive, driven by fundamental trends that show no signs of slowing. The continued expansion of digital technologies, increasing device connectivity, and growing reliance on wireless infrastructure for business operations create a strong foundation for sustained market growth. MWR projections indicate that the market will continue expanding at robust rates through the next decade, supported by technology evolution and expanding application areas.

Technology roadmap evolution points toward increasingly sophisticated wireless solutions that integrate artificial intelligence, advanced security capabilities, and seamless connectivity with other networking technologies. The convergence of Wi-Fi with 5G, edge computing, and IoT platforms will create new market opportunities and drive demand for more advanced equipment capable of supporting complex, integrated networking environments.

Application expansion into new industries and use cases will continue driving market growth, with emerging applications in autonomous vehicles, augmented reality, industrial automation, and smart infrastructure creating demand for specialized wireless solutions. These applications often require higher performance, lower latency, and greater reliability than traditional networking applications, driving innovation and premium pricing opportunities.

Geographic expansion opportunities remain substantial as developing markets continue investing in digital infrastructure and connectivity solutions. The global nature of digital transformation initiatives ensures that demand for wireless networking equipment will continue growing across all regions, with particularly strong growth expected in Asia-Pacific, Latin America, and emerging markets where infrastructure development is accelerating.

The Wi-Fi network equipment market represents a dynamic and essential component of global digital infrastructure, positioned for continued growth driven by technological advancement, expanding connectivity requirements, and digital transformation initiatives across industries. The market demonstrates remarkable resilience and adaptability, continuously evolving to meet changing customer needs and emerging technology requirements while maintaining its fundamental role as the backbone of wireless connectivity.

Market fundamentals remain strong, supported by increasing device connectivity, growing data consumption, and the critical importance of reliable wireless infrastructure for business operations and daily life. The ongoing evolution of Wi-Fi standards, integration of advanced technologies such as artificial intelligence and machine learning, and expansion into new application areas create substantial opportunities for continued growth and innovation.

Strategic success in this market will depend on the ability to anticipate and respond to rapidly evolving customer requirements, invest in emerging technologies, and develop comprehensive solutions that address complete connectivity needs. Companies that can combine technological innovation with strong customer relationships, comprehensive service capabilities, and global reach will be best positioned to capitalize on the significant opportunities ahead in the Wi-Fi network equipment market.

What is Wi-Fi Network Equipment?

Wi-Fi Network Equipment refers to the hardware devices that enable wireless communication over a Wi-Fi network. This includes routers, access points, and range extenders that facilitate internet connectivity for various devices in homes and businesses.

What are the key players in the Wi-Fi Network Equipment Market?

Key players in the Wi-Fi Network Equipment Market include Cisco Systems, Netgear, TP-Link, and Aruba Networks, among others. These companies are known for their innovative products and solutions that enhance wireless connectivity.

What are the main drivers of the Wi-Fi Network Equipment Market?

The main drivers of the Wi-Fi Network Equipment Market include the increasing demand for high-speed internet, the proliferation of smart devices, and the growth of IoT applications. These factors are pushing consumers and businesses to upgrade their network infrastructure.

What challenges does the Wi-Fi Network Equipment Market face?

The Wi-Fi Network Equipment Market faces challenges such as network security concerns, the complexity of installation and configuration, and competition from alternative technologies like wired connections. These issues can hinder market growth and consumer adoption.

What opportunities exist in the Wi-Fi Network Equipment Market?

Opportunities in the Wi-Fi Network Equipment Market include the expansion of smart home technologies, the rollout of Wi-Fi six, and the increasing need for reliable connectivity in remote work environments. These trends are likely to drive innovation and investment in the sector.

What trends are shaping the Wi-Fi Network Equipment Market?

Trends shaping the Wi-Fi Network Equipment Market include the shift towards mesh networking solutions, the integration of AI for network management, and the growing emphasis on cybersecurity features. These trends are influencing product development and consumer preferences.

Wi-Fi Network Equipment Market

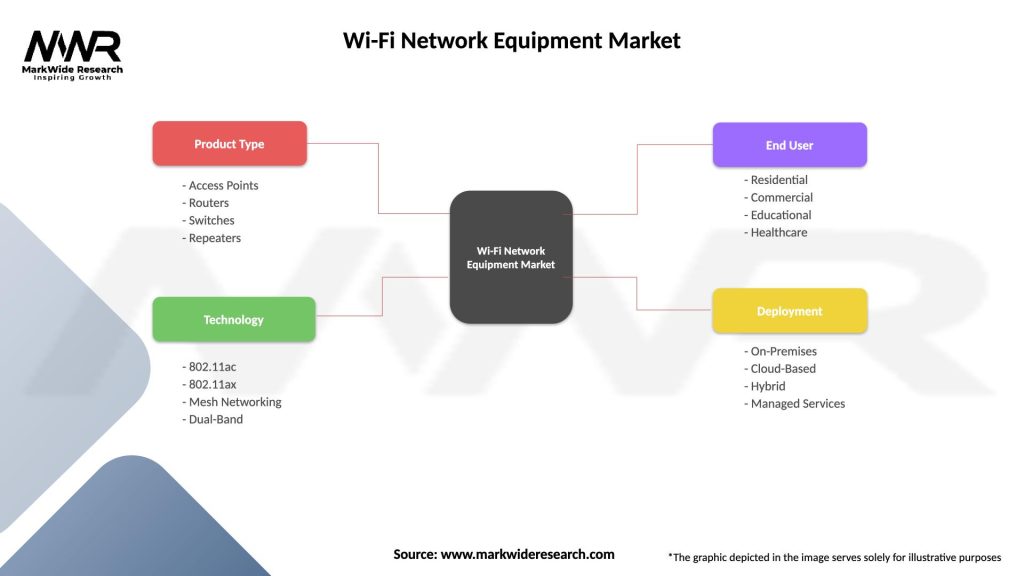

| Segmentation Details | Description |

|---|---|

| Product Type | Access Points, Routers, Switches, Repeaters |

| Technology | 802.11ac, 802.11ax, Mesh Networking, Dual-Band |

| End User | Residential, Commercial, Educational, Healthcare |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Wi-Fi Network Equipment Market

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at