444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States commercial vinyl floor covering market represents a dynamic and rapidly evolving segment of the broader flooring industry, characterized by substantial growth momentum and technological innovation. This market encompasses a diverse range of vinyl flooring solutions specifically designed for commercial applications, including luxury vinyl tiles (LVT), vinyl composite tiles (VCT), sheet vinyl, and rigid core vinyl planks. Commercial establishments across various sectors are increasingly adopting vinyl floor coverings due to their exceptional durability, cost-effectiveness, and aesthetic versatility.

Market dynamics indicate that the commercial vinyl flooring sector is experiencing robust expansion, driven by growing demand from healthcare facilities, educational institutions, retail spaces, hospitality venues, and corporate offices. The market is projected to grow at a compound annual growth rate (CAGR) of 6.2% through the forecast period, reflecting strong adoption rates across multiple commercial segments. Technological advancements in manufacturing processes have significantly enhanced product quality, with modern vinyl flooring solutions offering superior wear resistance, antimicrobial properties, and design flexibility.

Regional distribution shows concentrated market activity in major metropolitan areas, with the Northeast and West Coast regions accounting for approximately 45% of total market demand. The commercial construction boom, coupled with renovation activities in existing commercial spaces, continues to fuel market growth. Sustainability initiatives are increasingly influencing purchasing decisions, with eco-friendly vinyl flooring options gaining significant traction among environmentally conscious commercial buyers.

The United States commercial vinyl floor covering market refers to the comprehensive ecosystem of vinyl-based flooring products specifically manufactured, distributed, and installed for commercial applications across various industry sectors. This market encompasses the entire value chain from raw material procurement and manufacturing to distribution, installation, and maintenance services for commercial-grade vinyl flooring solutions.

Commercial vinyl floor covering includes multiple product categories designed to meet the demanding requirements of high-traffic commercial environments. These products are engineered with enhanced durability features, slip resistance, stain resistance, and acoustic properties that distinguish them from residential vinyl flooring options. The market includes both replacement and new installation segments, serving diverse commercial applications from healthcare and education to retail and hospitality sectors.

Market participants include manufacturers, distributors, contractors, architects, facility managers, and end-users who collectively drive demand and innovation within this specialized flooring segment. The commercial focus necessitates compliance with stringent building codes, safety regulations, and performance standards that shape product development and market dynamics.

Strategic analysis reveals that the United States commercial vinyl floor covering market is positioned for sustained growth, driven by favorable market conditions and evolving customer preferences. The market benefits from strong fundamentals including increasing commercial construction activity, growing awareness of vinyl flooring benefits, and continuous product innovation by leading manufacturers.

Key growth drivers include the healthcare sector’s expansion, which accounts for approximately 28% of commercial vinyl flooring demand, and the education sector’s modernization initiatives. The retail and hospitality segments are also contributing significantly to market growth, with many establishments choosing vinyl flooring for its combination of aesthetic appeal and practical performance characteristics.

Market segmentation shows luxury vinyl tiles (LVT) emerging as the fastest-growing category, capturing increased market share due to superior design options and enhanced durability. The competitive landscape features both established flooring manufacturers and innovative newcomers, creating a dynamic environment that benefits end-users through improved product offerings and competitive pricing.

Future prospects remain highly favorable, with market expansion expected to accelerate as commercial property owners increasingly recognize the long-term value proposition of high-quality vinyl flooring solutions. Sustainability trends and technological advancements are expected to further drive market evolution and growth opportunities.

Market intelligence reveals several critical insights that define the current state and future trajectory of the United States commercial vinyl floor covering market:

Primary growth drivers propelling the United States commercial vinyl floor covering market include several interconnected factors that create sustained demand across multiple commercial sectors. The healthcare industry’s continued expansion represents the most significant driver, as medical facilities require flooring solutions that meet strict hygiene standards while providing durability and comfort for staff and patients.

Commercial construction activity serves as another major catalyst, with new office buildings, retail centers, and educational facilities incorporating vinyl flooring due to its cost-effectiveness and design flexibility. The renovation and retrofit market also contributes substantially, as property owners seek to modernize aging commercial spaces with contemporary flooring solutions that offer improved performance and aesthetic appeal.

Technological advancements in vinyl manufacturing have created products with enhanced performance characteristics, including improved wear resistance, better acoustic properties, and superior stain resistance. These innovations make vinyl flooring increasingly attractive to commercial buyers who prioritize long-term performance and reduced maintenance requirements.

Economic factors play a crucial role, as vinyl flooring typically offers lower total cost of ownership compared to alternative commercial flooring materials. The combination of competitive initial costs, reduced installation time, and minimal maintenance requirements creates compelling value propositions for cost-conscious commercial buyers.

Market challenges facing the United States commercial vinyl floor covering industry include several factors that may limit growth potential or create operational difficulties for market participants. Environmental concerns regarding vinyl production and disposal represent ongoing challenges, despite industry efforts to develop more sustainable manufacturing processes and recycling programs.

Competitive pressure from alternative flooring materials, particularly ceramic tiles, polished concrete, and engineered hardwood, creates market share challenges in certain commercial applications. These alternatives may offer specific advantages in particular environments, limiting vinyl flooring adoption in some market segments.

Raw material costs and supply chain disruptions can impact manufacturing costs and product availability, particularly for petroleum-based components used in vinyl production. Fluctuating oil prices and global supply chain challenges may affect pricing stability and profit margins throughout the value chain.

Installation complexity in certain commercial applications may require specialized skills and equipment, potentially limiting market penetration in projects where simpler installation methods are preferred. Additionally, some commercial buyers may perceive vinyl flooring as less prestigious than premium alternatives, affecting adoption in high-end commercial applications.

Emerging opportunities within the United States commercial vinyl floor covering market present significant potential for growth and market expansion. The healthcare sector’s ongoing modernization efforts create substantial opportunities, particularly as medical facilities seek flooring solutions that combine infection control properties with patient comfort and staff safety features.

Sustainability initiatives represent a major opportunity area, as manufacturers develop eco-friendly vinyl products using recycled materials and sustainable production methods. Commercial buyers increasingly prioritize environmental responsibility, creating market demand for green building-certified vinyl flooring solutions that contribute to LEED and other sustainability certifications.

Technology integration offers opportunities for product differentiation and market expansion. Smart flooring solutions incorporating sensors, antimicrobial treatments, and advanced surface technologies can command premium pricing while addressing specific commercial needs such as safety monitoring and hygiene maintenance.

Geographic expansion into underserved markets and emerging commercial sectors presents growth opportunities. The e-commerce fulfillment center boom, co-working space proliferation, and senior living facility expansion create new market segments with specific flooring requirements that vinyl products can effectively address.

Market dynamics within the United States commercial vinyl floor covering sector reflect complex interactions between supply-side factors, demand drivers, and competitive forces that shape industry evolution. The relationship between manufacturers, distributors, contractors, and end-users creates a multi-layered market structure where each participant influences overall market behavior and growth patterns.

Supply chain dynamics have evolved significantly, with manufacturers investing in domestic production capacity to reduce dependence on international suppliers and improve delivery times. This trend toward supply chain localization has enhanced market responsiveness while creating opportunities for regional manufacturers to compete more effectively with established industry leaders.

Demand patterns show increasing sophistication among commercial buyers, who now evaluate flooring decisions based on total cost of ownership rather than initial purchase price alone. This shift has elevated the importance of product durability, maintenance requirements, and lifecycle performance in purchasing decisions, benefiting high-quality vinyl flooring solutions.

Competitive dynamics feature ongoing innovation in product development, with manufacturers differentiating through enhanced performance characteristics, expanded design options, and specialized solutions for specific commercial applications. The market rewards companies that can demonstrate clear value propositions and maintain consistent product quality across diverse commercial environments.

Comprehensive research methodology employed in analyzing the United States commercial vinyl floor covering market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. Primary research activities include extensive interviews with industry stakeholders, including manufacturers, distributors, contractors, and commercial end-users across various sectors.

Secondary research encompasses analysis of industry publications, trade association reports, government statistics, and company financial disclosures to establish market baselines and identify trends. This approach provides comprehensive coverage of market dynamics while ensuring data triangulation for enhanced accuracy and reliability.

Market segmentation analysis utilizes both quantitative and qualitative research methods to understand demand patterns across different commercial applications, geographic regions, and product categories. Survey research among commercial facility managers and purchasing decision-makers provides insights into selection criteria, satisfaction levels, and future purchasing intentions.

Competitive analysis combines public information research with industry expert interviews to assess market positioning, competitive strategies, and market share dynamics among leading participants. This methodology ensures comprehensive understanding of competitive landscapes and strategic implications for market participants.

Regional market analysis reveals significant variations in demand patterns, competitive dynamics, and growth opportunities across different geographic areas within the United States commercial vinyl floor covering market. The Northeast region maintains the largest market share at approximately 32%, driven by high commercial construction activity in major metropolitan areas and extensive renovation projects in aging commercial buildings.

West Coast markets demonstrate strong growth momentum, particularly in California, Washington, and Oregon, where environmental regulations and sustainability initiatives favor eco-friendly vinyl flooring solutions. This region accounts for roughly 28% of national demand, with technology companies and healthcare facilities representing major end-user segments.

Southeast regional markets show rapid expansion, fueled by population growth, business relocations, and new commercial development. States like Florida, Texas, and North Carolina are experiencing increased demand for commercial vinyl flooring, particularly in healthcare, education, and hospitality applications. The region represents approximately 25% of total market demand.

Midwest markets maintain steady demand levels, with manufacturing facilities, educational institutions, and healthcare systems driving consistent vinyl flooring adoption. The region’s focus on cost-effective solutions and practical performance characteristics aligns well with vinyl flooring value propositions, accounting for about 15% of national market share.

Competitive landscape analysis reveals a dynamic market structure featuring established industry leaders alongside innovative emerging companies that collectively drive market evolution and customer value creation. The competitive environment is characterized by ongoing product innovation, strategic partnerships, and market expansion initiatives.

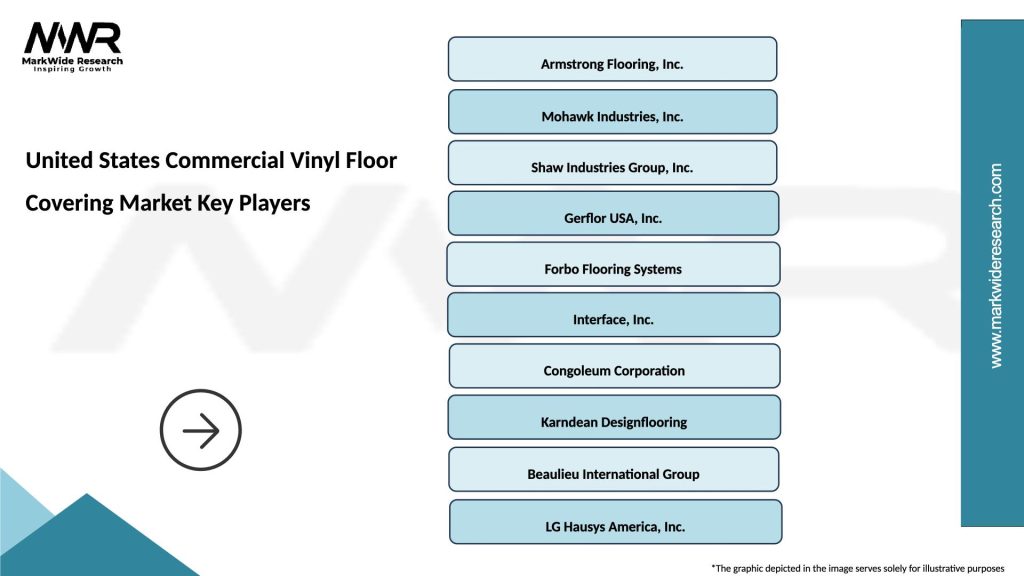

Leading market participants include:

Competitive strategies focus on product differentiation through enhanced performance characteristics, expanded design options, and specialized solutions for specific commercial applications. Companies are investing in research and development to create innovative products that address evolving customer needs while maintaining competitive pricing structures.

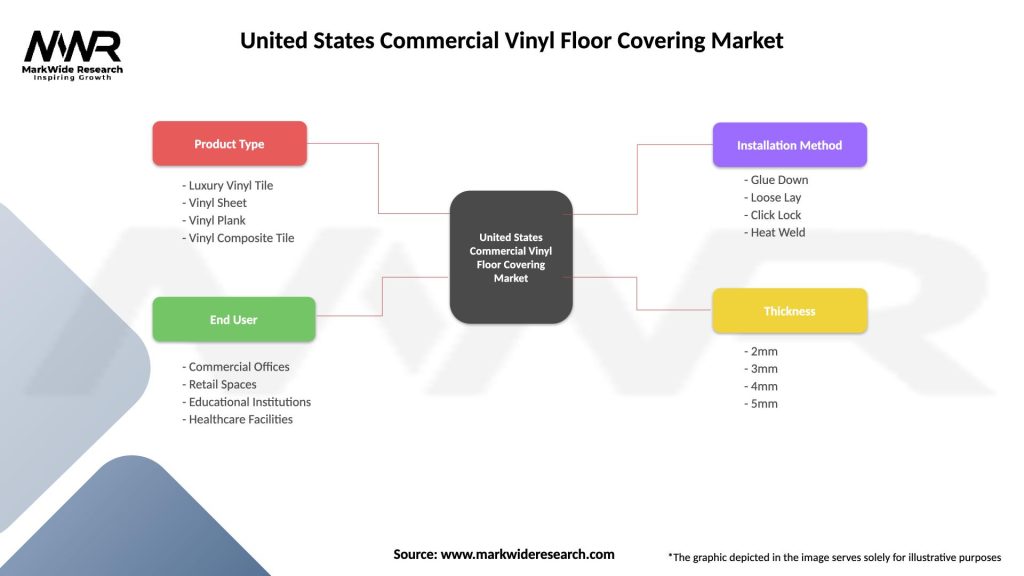

Market segmentation within the United States commercial vinyl floor covering market encompasses multiple classification criteria that help identify distinct customer groups, product categories, and application areas. This comprehensive segmentation approach enables better understanding of market dynamics and growth opportunities across different market segments.

By Product Type:

By End-User Application:

Healthcare segment analysis reveals this category as the dominant force in the commercial vinyl floor covering market, driven by stringent hygiene requirements and the need for antimicrobial flooring solutions. Healthcare facilities prioritize products that can withstand frequent cleaning with harsh disinfectants while maintaining appearance and performance over extended periods. Sheet vinyl products are particularly popular in this segment due to their seamless installation capabilities and superior cleanability.

Educational institution demand focuses on durability and safety characteristics, with schools and universities seeking flooring solutions that can withstand heavy foot traffic while providing slip resistance and acoustic benefits. Luxury vinyl tiles are gaining popularity in this segment as they offer design flexibility while meeting performance requirements for classroom and common area applications.

Retail space applications emphasize aesthetic appeal and durability, with store owners seeking flooring that enhances the shopping experience while withstanding constant foot traffic and merchandise movement. The ability to replicate premium materials like hardwood and stone makes vinyl flooring increasingly attractive to retail operators seeking cost-effective design solutions.

Office building requirements focus on professional appearance, acoustic properties, and comfort for employees who spend extended periods on their feet. Modern vinyl flooring products offer improved comfort characteristics while maintaining the professional appearance required in corporate environments.

Manufacturers benefit from the growing commercial vinyl floor covering market through expanded revenue opportunities and the ability to leverage economies of scale in production. The market’s growth trajectory enables manufacturers to invest in research and development for innovative products while maintaining healthy profit margins through efficient manufacturing processes and strategic pricing.

Distributors and retailers gain from increased demand across multiple commercial segments, creating opportunities for expanded inventory turnover and enhanced customer relationships. The diverse application areas for commercial vinyl flooring enable distributors to serve multiple market segments while building expertise in specialized applications that command premium pricing.

Installation contractors benefit from steady demand for professional installation services, particularly as product complexity increases and commercial buyers seek warranty protection through certified installation. The growth in renovation and retrofit projects creates additional opportunities for contractors with specialized commercial flooring expertise.

Commercial end-users realize significant benefits through reduced total cost of ownership, improved facility aesthetics, and enhanced operational efficiency. The durability and low maintenance requirements of modern vinyl flooring solutions enable facility managers to allocate resources more effectively while maintaining high-quality commercial environments.

Building owners and developers benefit from vinyl flooring’s contribution to faster project completion times, reduced construction costs, and improved tenant satisfaction. The wide range of design options enables developers to create distinctive commercial spaces while maintaining budget discipline and construction schedules.

Strengths:

Weaknesses:

Opportunities:

Threats:

Design innovation trends are reshaping the United States commercial vinyl floor covering market, with manufacturers investing heavily in photographic imaging technology and surface texturing techniques to create increasingly realistic replications of natural materials. Wood-look vinyl planks and stone-pattern tiles are gaining significant market traction as commercial buyers seek the aesthetic appeal of premium materials without associated costs and maintenance requirements.

Sustainability trends are driving product development toward eco-friendly solutions, with manufacturers incorporating recycled content, developing recyclable products, and implementing sustainable manufacturing processes. Green building certifications are becoming increasingly important in commercial purchasing decisions, creating market demand for environmentally responsible vinyl flooring options.

Technology integration trends include the development of antimicrobial surface treatments, enhanced wear layers, and smart flooring solutions that can monitor foot traffic patterns and maintenance needs. These technological advances enable vinyl flooring to address specific commercial requirements while providing additional value to facility managers and building operators.

Installation innovation trends focus on simplified installation methods, including click-lock systems and adhesive-free installation options that reduce labor costs and installation time. These innovations make vinyl flooring more attractive to commercial buyers seeking to minimize construction disruption and project timelines.

Recent industry developments demonstrate the dynamic nature of the United States commercial vinyl floor covering market, with significant investments in manufacturing capacity, product innovation, and market expansion initiatives by leading industry participants. Manufacturing expansion projects have increased domestic production capacity, reducing dependence on international suppliers while improving delivery times and customer service capabilities.

Product launch activities have accelerated, with manufacturers introducing specialized solutions for specific commercial applications, including healthcare-focused antimicrobial products, education-oriented safety flooring, and hospitality-designed luxury vinyl options. These targeted product developments reflect increasing market sophistication and customer demand for application-specific solutions.

Strategic partnerships between manufacturers and distributors have strengthened market coverage and customer service capabilities, enabling better support for commercial contractors and end-users. These partnerships often include training programs, technical support services, and warranty enhancements that add value for commercial buyers.

Sustainability initiatives have gained momentum, with several manufacturers announcing commitments to carbon neutrality, increased recycled content usage, and product recyclability programs. These developments respond to growing environmental awareness among commercial buyers and regulatory pressures for sustainable building materials.

Strategic recommendations for market participants in the United States commercial vinyl floor covering industry emphasize the importance of continued innovation, market diversification, and customer-focused value creation. MarkWide Research analysis suggests that companies should prioritize development of specialized solutions for high-growth commercial segments, particularly healthcare and education applications where specific performance requirements create opportunities for premium pricing.

Investment priorities should focus on manufacturing technology upgrades that enable production of higher-performance products while reducing environmental impact. Companies that can demonstrate clear sustainability advantages while maintaining competitive pricing will be well-positioned for long-term market success and customer loyalty.

Market expansion strategies should consider geographic diversification into high-growth regions and vertical market penetration into emerging commercial segments such as e-commerce fulfillment centers, co-working spaces, and senior living facilities. These markets offer growth potential with less established competitive dynamics.

Partnership development with architects, designers, and facility management companies can create competitive advantages through early involvement in commercial project planning and specification processes. Building strong relationships with these influencers can generate sustained demand and market share growth over time.

Future market prospects for the United States commercial vinyl floor covering industry remain highly favorable, with multiple growth drivers supporting sustained expansion through the forecast period. MWR projections indicate continued market growth driven by commercial construction activity, renovation projects, and increasing adoption of vinyl flooring across diverse commercial applications.

Technology advancement will continue to drive product innovation, with next-generation vinyl flooring solutions offering enhanced performance characteristics, improved sustainability profiles, and specialized features for specific commercial applications. The integration of smart technologies and advanced surface treatments will create new market opportunities and enable premium pricing for innovative products.

Market maturation is expected to favor companies with strong brand recognition, comprehensive product portfolios, and established distribution networks. Consolidation activities may increase as smaller manufacturers seek scale advantages and market access through strategic partnerships or acquisitions.

Sustainability requirements will become increasingly important in commercial purchasing decisions, creating competitive advantages for manufacturers that can demonstrate environmental responsibility while maintaining product performance and cost competitiveness. The market is expected to reward companies that successfully balance sustainability goals with commercial viability and customer value creation.

Market analysis of the United States commercial vinyl floor covering industry reveals a robust and dynamic market characterized by strong growth fundamentals, continuous innovation, and expanding application opportunities across diverse commercial sectors. The market benefits from favorable demographic trends, increasing commercial construction activity, and growing recognition of vinyl flooring’s performance advantages and cost-effectiveness.

Key success factors for market participants include product innovation capabilities, manufacturing efficiency, distribution network strength, and customer service excellence. Companies that can effectively address specific commercial market requirements while maintaining competitive pricing and reliable product quality will be well-positioned for sustained growth and market share expansion.

Strategic implications suggest that the market will continue to reward companies that invest in research and development, sustainability initiatives, and customer-focused value creation. The increasing sophistication of commercial buyers creates opportunities for manufacturers that can demonstrate clear value propositions and differentiated product offerings tailored to specific application requirements.

Long-term outlook remains positive, with the United States commercial vinyl floor covering market expected to maintain steady growth supported by favorable industry dynamics, technological advancement, and expanding commercial applications. Market participants that successfully navigate competitive challenges while capitalizing on emerging opportunities will benefit from this market’s continued evolution and expansion.

What is Commercial Vinyl Floor Covering?

Commercial Vinyl Floor Covering refers to resilient flooring materials designed for high-traffic areas in commercial settings, offering durability, ease of maintenance, and aesthetic versatility. These products are commonly used in offices, retail spaces, and healthcare facilities.

What are the key players in the United States Commercial Vinyl Floor Covering Market?

Key players in the United States Commercial Vinyl Floor Covering Market include Armstrong Flooring, Mohawk Industries, and Tarkett, among others. These companies are known for their innovative designs and sustainable flooring solutions.

What are the growth factors driving the United States Commercial Vinyl Floor Covering Market?

The growth of the United States Commercial Vinyl Floor Covering Market is driven by increasing demand for cost-effective and durable flooring solutions in commercial spaces, along with a rising focus on aesthetic appeal and sustainability in design.

What challenges does the United States Commercial Vinyl Floor Covering Market face?

Challenges in the United States Commercial Vinyl Floor Covering Market include competition from alternative flooring materials, fluctuating raw material prices, and the need for continuous innovation to meet changing consumer preferences.

What opportunities exist in the United States Commercial Vinyl Floor Covering Market?

Opportunities in the United States Commercial Vinyl Floor Covering Market include the growing trend of eco-friendly flooring solutions and the expansion of the construction industry, which is increasing the demand for versatile and sustainable flooring options.

What trends are shaping the United States Commercial Vinyl Floor Covering Market?

Trends in the United States Commercial Vinyl Floor Covering Market include the rise of luxury vinyl tiles that mimic natural materials, advancements in manufacturing technology for improved performance, and a growing emphasis on health and wellness in flooring choices.

United States Commercial Vinyl Floor Covering Market

| Segmentation Details | Description |

|---|---|

| Product Type | Luxury Vinyl Tile, Vinyl Sheet, Vinyl Plank, Vinyl Composite Tile |

| End User | Commercial Offices, Retail Spaces, Educational Institutions, Healthcare Facilities |

| Installation Method | Glue Down, Loose Lay, Click Lock, Heat Weld |

| Thickness | 2mm, 3mm, 4mm, 5mm |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Commercial Vinyl Floor Covering Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at