444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The viral vector contract development and manufacturing organization (CDMO) market represents a rapidly expanding segment within the biotechnology and pharmaceutical industries, driven by the increasing demand for gene and cell therapies. This specialized market encompasses organizations that provide comprehensive services for the development, production, and manufacturing of viral vectors used in therapeutic applications. Viral vector CDMOs play a crucial role in supporting biotechnology companies, pharmaceutical giants, and research institutions in bringing innovative gene therapies to market.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of approximately 18.5% over the forecast period. This substantial growth trajectory reflects the increasing adoption of gene therapy approaches, expanding clinical trial activities, and growing investment in advanced therapeutic modalities. The market encompasses various viral vector platforms, including adeno-associated virus (AAV), lentivirus, adenovirus, and retrovirus systems, each serving specific therapeutic applications.

Geographic distribution shows North America maintaining the largest market share at approximately 45% of global activity, followed by Europe at 32% and Asia-Pacific at 18%. The remaining 5% is distributed across other regions, with emerging markets showing increasing interest in viral vector manufacturing capabilities. This distribution reflects the concentration of biotechnology innovation hubs, regulatory expertise, and established pharmaceutical infrastructure in developed markets.

The viral vector CDMO market refers to the specialized sector comprising contract development and manufacturing organizations that provide comprehensive services for the design, development, production, and manufacturing of viral vectors used in gene therapy applications. These organizations serve as critical partners for biotechnology companies, pharmaceutical firms, and academic institutions that require expertise in viral vector production but may lack the specialized facilities, equipment, or technical knowledge necessary for in-house manufacturing.

Viral vectors are engineered viruses that have been modified to safely deliver therapeutic genes into target cells, making them essential tools in gene therapy, vaccine development, and regenerative medicine. CDMOs specializing in viral vectors offer end-to-end services including process development, analytical testing, regulatory support, clinical manufacturing, and commercial-scale production. These organizations maintain specialized facilities with appropriate biosafety levels, advanced purification systems, and quality control capabilities required for viral vector production.

The comprehensive service model typically includes upstream and downstream processing, formulation development, fill-finish operations, and regulatory compliance support. Many viral vector CDMOs also provide additional services such as vector design optimization, characterization studies, stability testing, and supply chain management to support their clients’ therapeutic development programs.

Market expansion in the viral vector CDMO sector is being driven by several converging factors that create a compelling growth environment. The increasing number of gene therapy clinical trials, with over 75% growth in trial initiations over the past three years, has created unprecedented demand for specialized manufacturing services. Biotechnology companies are increasingly recognizing the strategic advantages of partnering with specialized CDMOs rather than investing in costly in-house manufacturing capabilities.

Technology advancement continues to reshape the competitive landscape, with CDMOs investing heavily in next-generation manufacturing platforms, improved purification technologies, and enhanced analytical capabilities. The adoption of single-use technologies has increased manufacturing flexibility by approximately 40% while reducing contamination risks and operational costs. Automation integration is becoming increasingly prevalent, with leading CDMOs reporting efficiency improvements of up to 35% through automated production systems.

Regulatory environment evolution has created both opportunities and challenges for viral vector CDMOs. Enhanced regulatory guidance from agencies like the FDA and EMA has provided clearer pathways for gene therapy development, while simultaneously raising quality and compliance standards. Strategic partnerships between CDMOs and pharmaceutical companies are becoming more sophisticated, often involving long-term agreements, technology sharing arrangements, and co-investment in manufacturing capabilities.

Market consolidation trends are evident as larger pharmaceutical companies acquire specialized CDMO capabilities and established CDMOs expand their service offerings through strategic acquisitions. This consolidation is creating more comprehensive service providers capable of supporting clients from early-stage development through commercial manufacturing.

Industry transformation is occurring across multiple dimensions within the viral vector CDMO market, creating new opportunities and challenges for market participants. The following key insights highlight the most significant trends shaping market evolution:

Gene therapy advancement represents the primary driver propelling viral vector CDMO market growth, with increasing numbers of therapeutic programs entering clinical development phases. The success of approved gene therapies has validated the therapeutic approach and encouraged greater investment in vector-based treatments. Pharmaceutical companies are recognizing the potential of gene therapy to address previously untreatable conditions, driving demand for specialized manufacturing services.

Regulatory support from global health authorities has created a more favorable environment for gene therapy development. The establishment of specialized regulatory pathways, expedited review processes, and clearer guidance documents has reduced development timelines and increased investor confidence. FDA initiatives such as the Regenerative Medicine Advanced Therapy (RMAT) designation have accelerated the path to market for promising gene therapies.

Investment influx into the biotechnology sector has provided companies with the capital necessary to advance gene therapy programs through clinical development. Venture capital funding, public offerings, and strategic partnerships have created a robust financial environment supporting viral vector CDMO demand. Big pharma involvement through acquisitions, licensing agreements, and direct investment has further validated the market opportunity.

Manufacturing complexity associated with viral vector production has made outsourcing an attractive option for many companies. The specialized facilities, equipment, and expertise required for viral vector manufacturing represent significant capital investments that many biotechnology companies prefer to avoid. CDMOs offer established infrastructure, experienced personnel, and proven manufacturing processes that reduce risk and accelerate time to market.

Technology innovation continues to improve viral vector manufacturing efficiency, yield, and quality. Advances in upstream processing, purification technologies, and analytical methods have made viral vector production more scalable and cost-effective. Platform technologies that can be adapted for multiple vector types provide CDMOs with operational flexibility and clients with streamlined development pathways.

Manufacturing complexity presents significant challenges for viral vector CDMOs, requiring specialized expertise, sophisticated equipment, and stringent quality control measures. The technical difficulties associated with viral vector production can lead to batch failures, extended development timelines, and increased costs. Process optimization often requires extensive experimentation and validation, creating bottlenecks in manufacturing capacity and client project timelines.

Regulatory uncertainty continues to impact market growth, particularly as regulatory agencies develop new guidance documents and evolve their expectations for viral vector manufacturing. Changes in regulatory requirements can necessitate costly facility modifications, process changes, and additional validation studies. International regulatory harmonization remains incomplete, creating additional complexity for CDMOs serving global markets.

Capacity limitations across the industry have created supply chain constraints that limit market growth potential. The specialized nature of viral vector manufacturing facilities means that capacity expansion requires significant time and investment. Skilled workforce shortages in viral vector manufacturing further exacerbate capacity constraints, as experienced personnel are essential for successful operations.

High capital requirements for establishing and maintaining viral vector manufacturing capabilities create barriers to entry and limit the number of qualified service providers. The need for specialized facilities, advanced equipment, and comprehensive quality systems requires substantial upfront investment. Ongoing operational costs associated with maintaining biosafety standards, regulatory compliance, and technical expertise are significant.

Technology risks associated with emerging viral vector platforms and manufacturing processes create uncertainty for both CDMOs and their clients. The rapid pace of technological advancement can make existing capabilities obsolete, requiring continuous investment in new technologies and process improvements. Intellectual property considerations around viral vector technologies can also create constraints on CDMO operations and service offerings.

Emerging markets present significant expansion opportunities for viral vector CDMOs, particularly in Asia-Pacific regions where biotechnology sectors are rapidly developing. Countries like China, South Korea, and Singapore are investing heavily in biotechnology infrastructure and creating favorable regulatory environments for gene therapy development. Local partnerships and facility establishment in these markets can provide CDMOs with access to growing demand and cost-effective operations.

Technology platform expansion offers opportunities for CDMOs to differentiate their services and capture additional market share. Development of capabilities in emerging viral vector systems, such as engineered AAV variants, hybrid vectors, and tissue-specific targeting systems, can create competitive advantages. Platform integration that combines multiple vector types under unified manufacturing processes can improve operational efficiency and client convenience.

Service diversification beyond traditional manufacturing services presents opportunities for revenue growth and client relationship deepening. Regulatory consulting, analytical development, supply chain management, and commercial manufacturing services can create comprehensive partnerships with biotechnology companies. Digital services including process monitoring, data analytics, and project management platforms can enhance service delivery and operational efficiency.

Strategic partnerships with pharmaceutical companies, biotechnology firms, and academic institutions can create stable revenue streams and shared investment opportunities. Risk-sharing arrangements, technology licensing deals, and co-development agreements can provide CDMOs with access to innovative technologies while reducing client costs and risks.

Automation advancement presents opportunities to improve manufacturing efficiency, reduce costs, and enhance quality consistency. Implementation of advanced process control systems, robotic automation, and artificial intelligence applications can create competitive advantages and operational improvements. Digital transformation initiatives can streamline operations, improve client communication, and enhance regulatory compliance.

Supply and demand imbalances continue to characterize the viral vector CDMO market, with demand consistently exceeding available manufacturing capacity. This dynamic has created favorable pricing conditions for CDMOs while simultaneously driving investment in capacity expansion. Market participants are responding through facility expansions, technology upgrades, and strategic acquisitions to address capacity constraints.

Competitive intensity is increasing as more organizations enter the viral vector CDMO space and existing players expand their capabilities. Differentiation strategies are becoming increasingly important, with CDMOs focusing on specialized technologies, superior quality systems, and comprehensive service offerings. Client relationships are evolving toward longer-term partnerships that provide stability for both CDMOs and their biotechnology clients.

Technology evolution continues to reshape market dynamics, with new manufacturing platforms, improved purification methods, and enhanced analytical capabilities creating competitive advantages. Innovation cycles are accelerating, requiring CDMOs to continuously invest in technology upgrades and process improvements. Intellectual property considerations are becoming increasingly complex as the number of patented technologies and processes expands.

Regulatory dynamics influence market conditions through evolving guidance documents, inspection practices, and approval processes. Harmonization efforts between regulatory agencies are gradually reducing complexity, while new requirements for manufacturing standards and quality systems continue to raise operational standards. Regulatory expertise has become a critical differentiator for CDMOs serving global markets.

Financial dynamics within the biotechnology sector directly impact viral vector CDMO demand, with funding availability influencing the number and scope of gene therapy development programs. Investment trends toward gene therapy and cell therapy applications continue to support market growth, while economic uncertainties can create volatility in project timelines and budgets.

Comprehensive market analysis for the viral vector CDMO market employed a multi-faceted research approach combining primary and secondary research methodologies. Primary research included extensive interviews with industry executives, technical experts, regulatory specialists, and key opinion leaders across the viral vector manufacturing ecosystem. These interviews provided insights into market trends, competitive dynamics, technological developments, and future growth prospects.

Secondary research encompassed analysis of industry reports, regulatory filings, patent databases, clinical trial registries, and company financial statements. Market intelligence was gathered from peer-reviewed scientific literature, industry conferences, trade publications, and regulatory agency guidance documents. This comprehensive approach ensured broad coverage of market factors and validation of key findings.

Data validation processes included cross-referencing information from multiple sources, conducting follow-up interviews to clarify findings, and employing statistical analysis techniques to identify trends and patterns. Market modeling incorporated various scenarios and assumptions to project future market conditions and growth trajectories. Expert panels provided additional validation of research findings and market projections.

Quantitative analysis focused on market sizing, growth rate calculations, and competitive positioning assessments. Qualitative research explored market drivers, challenges, opportunities, and strategic considerations affecting industry participants. Regional analysis examined geographic variations in market conditions, regulatory environments, and competitive landscapes.

Continuous monitoring of market developments, regulatory changes, and competitive activities ensured that research findings remained current and relevant. Industry databases and monitoring systems provided real-time updates on clinical trial activities, regulatory approvals, and company announcements affecting the viral vector CDMO market.

North America maintains its position as the dominant regional market for viral vector CDMO services, accounting for approximately 45% of global market activity. The region benefits from a well-established biotechnology ecosystem, supportive regulatory environment, and significant investment in gene therapy development. United States leads regional growth with major CDMO facilities concentrated in biotechnology hubs including Boston, San Francisco, and Research Triangle Park.

Regulatory advantages in North America include the FDA’s progressive approach to gene therapy regulation, expedited approval pathways, and clear guidance documents. The region’s investment climate supports biotechnology innovation through venture capital funding, government grants, and pharmaceutical company partnerships. Infrastructure development continues with multiple facility expansions and new CDMO establishments planned across the region.

Europe represents the second-largest regional market with approximately 32% market share, driven by strong biotechnology sectors in the United Kingdom, Germany, Switzerland, and the Netherlands. European Medicines Agency (EMA) regulatory frameworks support gene therapy development while maintaining rigorous quality standards. Regional collaboration through EU funding programs and cross-border partnerships enhances the competitive position of European CDMOs.

Asia-Pacific emerges as the fastest-growing regional market with 18% current market share and expectations for accelerated expansion. China leads regional growth through government investment in biotechnology infrastructure, favorable regulatory reforms, and increasing domestic demand for gene therapy manufacturing. Singapore, South Korea, and Australia also contribute to regional growth through specialized CDMO capabilities and supportive business environments.

Emerging markets in Latin America, Middle East, and Africa represent 5% of current market activity but show potential for future growth as biotechnology sectors develop and regulatory frameworks mature. Strategic opportunities exist for established CDMOs to expand into these markets through partnerships, joint ventures, and facility development initiatives.

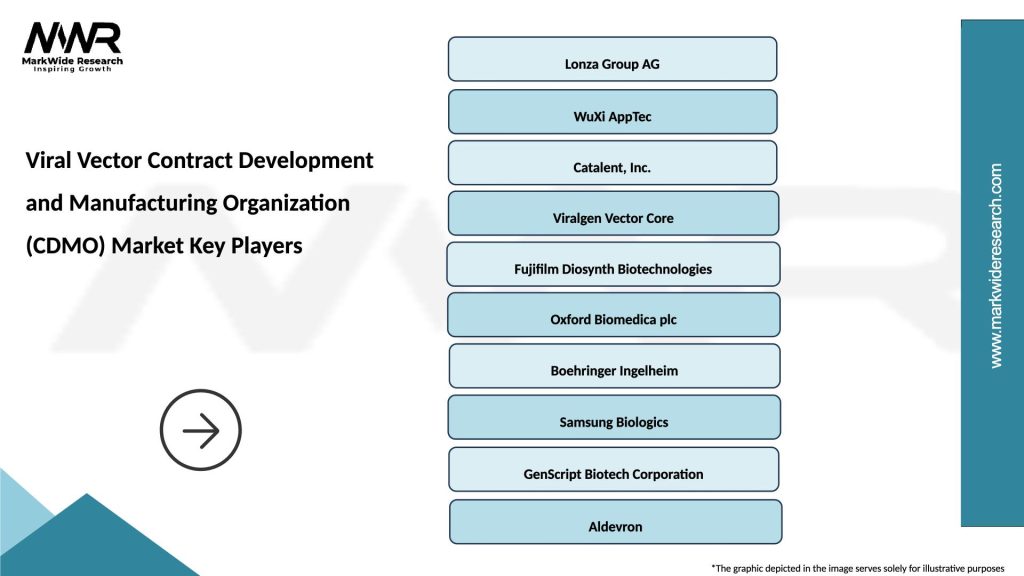

Market leadership in the viral vector CDMO sector is characterized by a mix of specialized biotechnology service companies, pharmaceutical company subsidiaries, and contract manufacturing organizations that have expanded into viral vector production. The competitive landscape continues to evolve through acquisitions, partnerships, and organic growth initiatives.

Leading market participants include:

Competitive differentiation strategies focus on technology platforms, manufacturing capacity, quality systems, regulatory expertise, and service integration. Strategic partnerships with biotechnology companies and pharmaceutical firms provide competitive advantages through long-term revenue commitments and shared technology development.

Market consolidation trends continue as larger organizations acquire specialized capabilities and smaller CDMOs seek strategic partners for growth capital and market access. Technology licensing and platform sharing arrangements are becoming increasingly common as companies seek to expand their service offerings without extensive internal development.

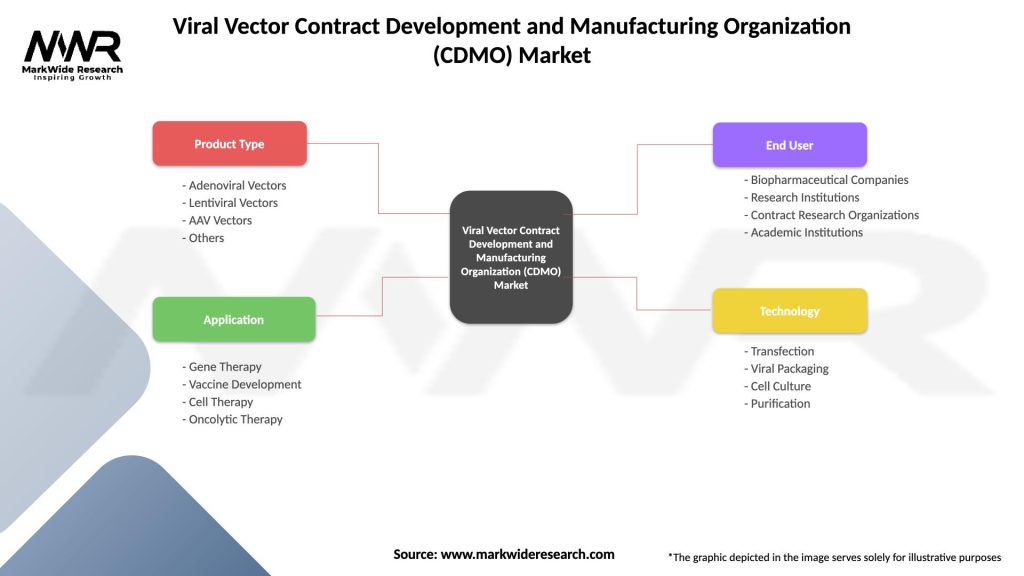

Vector type segmentation represents the primary market classification, with distinct characteristics and growth patterns across different viral vector platforms:

By Vector Type:

By Application:

By Service Type:

By End User:

AAV vector manufacturing dominates the viral vector CDMO market due to its favorable safety profile, broad tissue tropism, and established regulatory pathway. Manufacturing challenges include low production yields, complex purification requirements, and the need for specialized analytical methods. Technology advancement in AAV production focuses on improved cell lines, enhanced purification processes, and scalable manufacturing platforms.

Lentiviral vector services represent a growing market segment driven by CAR-T cell therapy applications and ex vivo gene modification approaches. Manufacturing complexity requires specialized containment facilities, sophisticated quality control measures, and expertise in pseudotyping technologies. Market opportunities exist in developing more efficient production systems and expanding applications beyond current therapeutic areas.

Process development services have become increasingly important as biotechnology companies seek to optimize manufacturing processes before clinical production. Service integration combining process development with analytical characterization and regulatory support provides comprehensive solutions for clients. Technology platforms that enable rapid process optimization and scale-up are becoming competitive differentiators.

Clinical manufacturing represents the largest revenue segment for most viral vector CDMOs, with demand driven by increasing numbers of gene therapy clinical trials. Capacity utilization rates remain high, creating opportunities for premium pricing and long-term client commitments. Quality systems and regulatory compliance capabilities are critical success factors in this segment.

Commercial manufacturing is emerging as an important growth driver as gene therapies receive regulatory approvals and enter commercial production. Scale-up challenges from clinical to commercial volumes require specialized expertise and flexible manufacturing platforms. Supply chain management becomes increasingly important for commercial-stage products with global distribution requirements.

Biotechnology companies benefit significantly from viral vector CDMO partnerships through access to specialized expertise, established manufacturing infrastructure, and reduced capital requirements. Risk mitigation is achieved through partnering with experienced CDMOs that have proven track records in viral vector production and regulatory compliance. Time-to-market acceleration results from leveraging established processes and avoiding the lengthy facility construction and validation timelines.

Pharmaceutical companies gain access to specialized capabilities that complement their existing manufacturing infrastructure while maintaining focus on core competencies. Flexibility advantages include the ability to scale production based on clinical trial results and market demand without fixed capacity commitments. Cost optimization is achieved through variable cost structures and shared infrastructure investments.

CDMOs themselves benefit from growing market demand, premium pricing opportunities, and long-term client relationships that provide revenue stability. Technology advancement through client partnerships and internal R&D investments creates competitive advantages and intellectual property assets. Market expansion opportunities exist through geographic expansion, service diversification, and strategic acquisitions.

Investors benefit from exposure to the high-growth gene therapy market through CDMO investments that provide diversified revenue streams across multiple therapeutic programs. Risk distribution across multiple clients and therapeutic areas reduces dependence on individual program success. Market positioning in a supply-constrained industry provides pricing power and growth opportunities.

Patients and healthcare systems ultimately benefit from accelerated gene therapy development, improved manufacturing quality, and reduced therapy costs through efficient production systems. Treatment access is enhanced through reliable manufacturing capabilities that support consistent product supply. Innovation acceleration results from specialized CDMO capabilities that enable more biotechnology companies to advance therapeutic programs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation integration is transforming viral vector manufacturing operations, with CDMOs investing heavily in robotic systems, automated purification platforms, and digital process control technologies. Manufacturing efficiency improvements of up to 35% are being achieved through automation implementation, while quality consistency and regulatory compliance are enhanced through reduced human intervention. Scalability benefits from automated systems enable more flexible capacity utilization and faster response to client demands.

Platform standardization is emerging as a key trend, with CDMOs developing standardized manufacturing processes that can be adapted for multiple viral vector types and client programs. Process efficiency gains result from leveraging common equipment, procedures, and quality systems across different projects. Client benefits include reduced development timelines, lower costs, and improved regulatory predictability through proven platform approaches.

Geographic diversification continues as established CDMOs expand their global footprint to serve regional markets and provide supply chain redundancy. Asia-Pacific expansion is particularly prominent, with 60% of major CDMOs planning facility investments in the region. Regulatory harmonization efforts are facilitating international expansion by reducing compliance complexity across different jurisdictions.

Service portfolio expansion beyond traditional manufacturing services is becoming increasingly common as CDMOs seek to provide comprehensive solutions for their biotechnology clients. Integrated offerings combining manufacturing, analytical testing, regulatory support, and supply chain management create competitive advantages and deeper client relationships. Digital services including project management platforms, real-time monitoring systems, and data analytics capabilities are enhancing service delivery.

Sustainability initiatives are gaining importance as CDMOs implement environmentally responsible manufacturing practices, waste reduction programs, and energy-efficient operations. Single-use technologies adoption reduces water consumption and cleaning requirements while improving operational flexibility. Green manufacturing approaches are becoming client requirements and regulatory expectations in some jurisdictions.

Capacity expansion initiatives across the industry reflect the strong demand environment and growth projections for viral vector manufacturing services. Major CDMOs have announced facility expansions, new site developments, and equipment investments totaling substantial capital commitments over the next several years. Geographic distribution of new capacity includes both established markets and emerging regions, particularly in Asia-Pacific.

Strategic acquisitions continue to reshape the competitive landscape as larger organizations acquire specialized capabilities and smaller CDMOs seek strategic partners for growth capital. Recent transactions have focused on technology platforms, manufacturing capacity, and geographic expansion opportunities. Integration challenges following acquisitions include harmonizing quality systems, combining manufacturing processes, and retaining key personnel.

Technology partnerships between CDMOs and technology providers are accelerating innovation in viral vector manufacturing. Collaboration areas include advanced purification systems, analytical instrumentation, process automation, and digital manufacturing platforms. Intellectual property sharing arrangements and joint development programs are creating new technology solutions for the industry.

Regulatory developments continue to influence industry operations through updated guidance documents, inspection practices, and approval processes. Recent initiatives by regulatory agencies include enhanced focus on manufacturing quality systems, supply chain security, and international harmonization. Industry response includes increased investment in compliance capabilities and regulatory expertise.

According to MarkWide Research analysis, the convergence of these industry developments is creating a more mature and sophisticated viral vector CDMO market with enhanced capabilities, improved quality systems, and expanded global reach. Market evolution continues toward greater specialization, technology integration, and client partnership models that support the growing gene therapy industry.

Capacity planning should be a top priority for viral vector CDMOs given the strong demand environment and long lead times for facility construction and validation. Strategic recommendations include developing flexible manufacturing platforms that can accommodate multiple vector types and client programs while maintaining operational efficiency. Investment timing is critical to capture market opportunities while avoiding overcapacity situations as the market matures.

Technology investment strategies should focus on next-generation manufacturing platforms that offer improved yields, enhanced quality, and greater scalability. Automation integration should be prioritized to address skilled labor shortages and improve operational consistency. Digital transformation initiatives can create competitive advantages through improved client communication, process monitoring, and regulatory compliance.

Geographic expansion opportunities should be evaluated based on regional market growth potential, regulatory environments, and competitive landscapes. Asia-Pacific markets offer significant growth opportunities but require careful consideration of local partnership requirements, regulatory compliance, and cultural factors. Market entry strategies should balance speed to market with risk management and operational control.

Service diversification beyond core manufacturing capabilities can create additional revenue streams and strengthen client relationships. Regulatory consulting, analytical services, and supply chain management represent high-value service areas with strong client demand. Partnership opportunities with specialized service providers can accelerate service portfolio expansion without extensive internal development.

Quality system enhancement should be continuous priority given the critical nature of viral vector manufacturing and evolving regulatory expectations. Investment areas include advanced analytical capabilities, process monitoring systems, and quality management platforms. Regulatory compliance capabilities should be strengthened through dedicated expertise and systematic compliance management systems.

Market growth trajectory for the viral vector CDMO sector remains strongly positive, driven by expanding gene therapy pipelines, increasing clinical trial activity, and growing commercial manufacturing demand. Long-term projections indicate sustained growth rates above 15% CAGR through the forecast period, supported by continued innovation in gene therapy approaches and expanding therapeutic applications.

Technology evolution will continue to reshape manufacturing capabilities, with advances in cell line development, purification technologies, and process automation creating new competitive advantages. Next-generation platforms are expected to improve manufacturing yields by 40-50% while reducing production costs and timelines. Artificial intelligence and machine learning applications will enhance process optimization and quality control capabilities.

Market maturation is expected to bring greater standardization, improved regulatory clarity, and more sophisticated client-CDMO partnerships. Consolidation trends will likely continue as the industry evolves toward larger, more capable service providers with comprehensive global capabilities. Competitive differentiation will increasingly focus on technology platforms, service integration, and client relationship management.

Regulatory environment evolution will continue to influence market dynamics through updated guidance documents, harmonized international standards, and enhanced quality expectations. MWR projections suggest that regulatory clarity will improve over the forecast period, reducing development risks and supporting market growth. Global harmonization efforts will facilitate international expansion and supply chain optimization.

Geographic expansion will accelerate as biotechnology sectors develop in emerging markets and established CDMOs seek growth opportunities. Asia-Pacific markets are expected to achieve growth rates exceeding 25% annually as local biotechnology industries mature and regulatory frameworks develop. Supply chain regionalization trends will drive local manufacturing capability development in key markets.

The viral vector CDMO market represents a critical infrastructure supporting the global gene therapy and vaccine development revolution, driven by unprecedented therapeutic innovation, regulatory approvals, and substantial biopharmaceutical industry investment in advanced therapies. Market dynamics demonstrate exceptional growth potential supported by expanding gene therapy pipelines, AAV vector demand acceleration, and increasing outsourcing preferences among biotech companies seeking specialized manufacturing expertise. Capacity expansion initiatives and technology platform investments continue addressing supply constraints and positioning the industry for sustained long-term growth.

Strategic success in this highly specialized market requires deep technical expertise in viral vector production, regulatory compliance excellence, and flexible manufacturing capabilities serving diverse client needs from early-stage development through commercial production. Companies that prioritize scalable platform technologies, quality management systems, and collaborative partnership approaches will be best positioned to capture opportunities in this rapidly expanding sector. Manufacturing innovation and process optimization capabilities have become essential differentiators as clients demand improved yields, reduced timelines, and cost-effective production solutions.

Industry leadership in suspension cell culture platforms, downstream purification technologies, and analytical characterization methods positions leading CDMOs as strategic partners enabling gene therapy commercialization success. Geographic expansion and regional manufacturing presence address supply chain resilience concerns while meeting local regulatory requirements and client proximity preferences. Therapeutic diversity across ophthalmology, neurology, rare diseases, and oncology applications creates broad market opportunities and portfolio diversification benefits for established service providers.

The competitive landscape will continue intensifying as both specialized viral vector CDMOs and diversified contract manufacturers compete for market leadership in this high-growth biotechnology sector. Sustained growth will require ongoing investment in manufacturing capacity, technology platforms, and regulatory expertise to meet escalating demand from gene therapy developers and vaccine manufacturers worldwide. Client-focused approaches emphasizing technical excellence, supply reliability, and end-to-end service capabilities will become increasingly critical differentiators in this essential and rapidly expanding viral vector contract development and manufacturing organization market.

What is Viral Vector Contract Development and Manufacturing Organization (CDMO)?

A Viral Vector Contract Development and Manufacturing Organization (CDMO) specializes in the development and production of viral vectors used in gene therapy and vaccine development. These organizations provide services that include vector design, production, and quality control to support biopharmaceutical companies.

What are the key players in the Viral Vector Contract Development and Manufacturing Organization (CDMO) Market?

Key players in the Viral Vector Contract Development and Manufacturing Organization (CDMO) Market include companies like Lonza, WuXi AppTec, and Catalent, which offer comprehensive services for viral vector production and development, among others.

What are the growth factors driving the Viral Vector Contract Development and Manufacturing Organization (CDMO) Market?

The growth of the Viral Vector Contract Development and Manufacturing Organization (CDMO) Market is driven by the increasing demand for gene therapies and vaccines, advancements in viral vector technologies, and the rising number of clinical trials in the biopharmaceutical sector.

What challenges does the Viral Vector Contract Development and Manufacturing Organization (CDMO) Market face?

Challenges in the Viral Vector Contract Development and Manufacturing Organization (CDMO) Market include regulatory hurdles, the complexity of viral vector production, and the need for high-quality standards to ensure safety and efficacy in therapeutic applications.

What opportunities exist in the Viral Vector Contract Development and Manufacturing Organization (CDMO) Market?

Opportunities in the Viral Vector Contract Development and Manufacturing Organization (CDMO) Market include the expansion of personalized medicine, increasing investments in biotechnology, and the potential for partnerships between CDMOs and pharmaceutical companies to enhance research and development capabilities.

What trends are shaping the Viral Vector Contract Development and Manufacturing Organization (CDMO) Market?

Trends in the Viral Vector Contract Development and Manufacturing Organization (CDMO) Market include the adoption of advanced manufacturing technologies, such as continuous processing and automation, as well as a growing focus on sustainability and environmentally friendly practices in production.

Viral Vector Contract Development and Manufacturing Organization (CDMO) Market

| Segmentation Details | Description |

|---|---|

| Product Type | Adenoviral Vectors, Lentiviral Vectors, AAV Vectors, Others |

| Application | Gene Therapy, Vaccine Development, Cell Therapy, Oncolytic Therapy |

| End User | Biopharmaceutical Companies, Research Institutions, Contract Research Organizations, Academic Institutions |

| Technology | Transfection, Viral Packaging, Cell Culture, Purification |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Viral Vector Contract Development and Manufacturing Organization (CDMO) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at