444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa trace detection market represents a rapidly expanding sector driven by increasing security concerns, stringent regulatory requirements, and growing awareness of safety protocols across various industries. This specialized market encompasses advanced technologies designed to identify minute quantities of hazardous substances, explosives, narcotics, and chemical agents in diverse environments ranging from airports and border crossings to industrial facilities and public venues.

Regional dynamics in the Middle East and Africa present unique opportunities for trace detection technology deployment, with governments investing heavily in security infrastructure and industrial safety measures. The market is experiencing robust growth driven by geopolitical tensions, increased international trade, and the expansion of critical infrastructure projects across the region. Security agencies and private sector organizations are increasingly adopting sophisticated trace detection systems to enhance their operational capabilities and ensure compliance with international safety standards.

Technological advancement continues to shape the market landscape, with manufacturers developing more sensitive, portable, and user-friendly detection systems. The integration of artificial intelligence, machine learning algorithms, and advanced sensor technologies is revolutionizing trace detection capabilities, enabling faster and more accurate identification of target substances. Market penetration is accelerating across multiple sectors, including aviation security, customs enforcement, military applications, and industrial safety monitoring.

The Middle East and Africa trace detection market refers to the comprehensive ecosystem of technologies, equipment, and services designed to identify and analyze microscopic quantities of specific substances within the MEA region. These sophisticated systems utilize various detection methodologies including ion mobility spectrometry, mass spectrometry, X-ray fluorescence, and electrochemical sensors to identify trace amounts of explosives, drugs, chemical warfare agents, and other hazardous materials.

Trace detection technology operates on the principle of detecting molecular signatures or chemical fingerprints of target substances, even when present in extremely small concentrations measured in parts per billion or trillion. The systems are engineered to provide rapid, accurate, and reliable results while maintaining high sensitivity levels and minimizing false positive rates. Applications span across security screening, environmental monitoring, quality control, and forensic investigations.

Market scope encompasses portable handheld devices, desktop analyzers, walk-through portals, and integrated screening systems that can be deployed in various operational environments. The technology serves critical functions in maintaining public safety, supporting law enforcement activities, ensuring regulatory compliance, and protecting critical infrastructure assets throughout the Middle East and Africa region.

Strategic analysis of the Middle East and Africa trace detection market reveals significant growth potential driven by escalating security threats, regulatory mandates, and technological innovations. The market is characterized by increasing adoption of advanced detection systems across government agencies, commercial enterprises, and industrial facilities seeking to enhance their security posture and operational safety.

Key market drivers include rising terrorism concerns, drug trafficking activities, and the need for enhanced border security measures. Government initiatives to strengthen national security infrastructure and comply with international aviation security standards are creating substantial demand for trace detection solutions. Investment patterns indicate strong government spending on security technologies, with approximately 68% of procurement originating from public sector agencies.

Technology trends are shifting toward more sophisticated, AI-enabled systems that offer improved detection accuracy and reduced operational complexity. The integration of cloud-based analytics, real-time data sharing capabilities, and mobile connectivity is transforming traditional trace detection workflows. Market dynamics suggest continued expansion driven by infrastructure development projects, increased international trade volumes, and growing awareness of chemical and biological threats.

Regional variations in market development reflect different security priorities, economic conditions, and regulatory frameworks across Middle Eastern and African countries. The Gulf Cooperation Council nations lead in technology adoption, while African markets show increasing interest in cost-effective detection solutions for border security and customs applications.

Market intelligence reveals several critical insights that define the current landscape and future trajectory of trace detection technology adoption in the Middle East and Africa region:

Security threat escalation serves as the primary catalyst driving trace detection market growth throughout the Middle East and Africa region. Increasing incidents of terrorism, smuggling activities, and cross-border criminal operations have heightened awareness of the need for advanced detection capabilities. Government agencies are investing substantially in comprehensive security infrastructure that includes sophisticated trace detection systems as core components.

Regulatory mandates from international aviation authorities and customs organizations are compelling organizations to implement compliant trace detection solutions. The International Civil Aviation Organization standards and various bilateral security agreements require specific detection capabilities at airports and border crossings. Compliance requirements are driving systematic upgrades of existing security infrastructure across the region.

Infrastructure development projects including new airports, seaports, and industrial facilities are incorporating trace detection systems as integral security components from the design phase. Major construction projects in the Gulf region and emerging African markets are creating substantial demand for advanced detection technologies. Smart city initiatives are also integrating trace detection capabilities into comprehensive urban security frameworks.

Technological advancement is making trace detection systems more accessible, reliable, and cost-effective for a broader range of applications. Improvements in sensor technology, data processing capabilities, and user interfaces are expanding the potential market for these solutions. Innovation cycles are accelerating, with manufacturers introducing enhanced features that address specific regional requirements and operational challenges.

High implementation costs represent a significant barrier to widespread adoption of advanced trace detection systems, particularly for smaller organizations and developing markets within the region. The substantial capital investment required for procurement, installation, and integration of sophisticated detection equipment can strain budget allocations. Financial constraints often limit the scope of security upgrades and delay technology adoption timelines.

Technical complexity associated with modern trace detection systems requires specialized knowledge and training for effective operation and maintenance. The shortage of qualified technical personnel in many regional markets creates operational challenges and increases dependency on external support services. Skills gaps can lead to suboptimal system utilization and higher long-term operational costs.

Environmental challenges including extreme temperatures, humidity, dust, and corrosive conditions prevalent in many Middle Eastern and African locations can affect system performance and reliability. Equipment designed for temperate climates may require significant modifications or enhanced protection systems to function effectively. Maintenance requirements often increase in harsh environmental conditions, adding to operational expenses.

Regulatory variations across different countries and jurisdictions create complexity in system specification and deployment. Inconsistent standards and approval processes can delay project implementation and increase compliance costs. Bureaucratic procedures and lengthy procurement cycles in government organizations can further impede market growth and technology adoption rates.

Emerging market segments present substantial growth opportunities as awareness of trace detection benefits expands beyond traditional security applications. Industrial facilities, educational institutions, and commercial venues are increasingly recognizing the value of trace detection capabilities for safety and security enhancement. Market diversification is creating new revenue streams and expanding the addressable market significantly.

Technology partnerships between international manufacturers and local distributors are facilitating market penetration and creating opportunities for customized solutions. Collaborative approaches that combine global expertise with regional market knowledge are proving effective in addressing specific customer requirements. Strategic alliances are enabling more comprehensive service offerings and improved customer support capabilities.

Government modernization initiatives across the region are creating opportunities for large-scale trace detection system deployments. National security strategies and infrastructure development programs include provisions for advanced detection technologies. Public sector procurement represents approximately 72% of total market demand, indicating substantial opportunities for qualified suppliers.

Cross-border trade expansion and increased international connectivity are driving demand for enhanced customs and border security capabilities. Growing trade volumes require more efficient and effective screening processes that can maintain security while facilitating legitimate commerce. Trade facilitation initiatives are creating opportunities for advanced detection systems that balance security and operational efficiency.

Competitive dynamics in the Middle East and Africa trace detection market are characterized by the presence of established international manufacturers competing alongside emerging regional players. Market consolidation trends are evident as larger companies acquire specialized technology providers to expand their product portfolios and regional presence. Competition is intensifying around technological innovation, customer service capabilities, and total cost of ownership propositions.

Supply chain considerations play a crucial role in market dynamics, with successful companies establishing robust distribution networks and local support capabilities. The complexity of trace detection systems requires comprehensive after-sales support, including training, maintenance, and technical assistance. Service quality has become a key differentiator in vendor selection processes.

Innovation cycles are accelerating as manufacturers invest in research and development to address evolving threat landscapes and customer requirements. The integration of artificial intelligence, machine learning, and advanced analytics is transforming detection capabilities and operational efficiency. Technology roadmaps indicate continued advancement in sensitivity, speed, and user-friendliness of detection systems.

Market maturation varies significantly across different countries and application segments within the region. While some markets demonstrate sophisticated procurement processes and advanced technology adoption, others are in early development stages with basic detection requirements. Growth patterns reflect economic development levels, security priorities, and regulatory frameworks in different regional markets.

Comprehensive market analysis was conducted using a multi-faceted research approach combining primary and secondary data collection methodologies. Primary research involved structured interviews with key industry stakeholders including manufacturers, distributors, end-users, and regulatory officials across major markets in the Middle East and Africa region. Survey instruments were designed to capture quantitative data on market size, growth trends, and technology adoption patterns.

Secondary research encompassed extensive analysis of industry reports, government publications, trade association data, and company financial statements. Data triangulation techniques were employed to validate findings and ensure accuracy of market assessments. Multiple information sources were cross-referenced to establish reliable baseline data and growth projections.

Market segmentation analysis utilized both top-down and bottom-up approaches to determine market size and growth potential across different technology categories, application segments, and geographic regions. Statistical modeling techniques were applied to forecast future market trends and identify key growth drivers and constraints.

Expert validation processes involved consultation with industry specialists and technology experts to verify research findings and market projections. MarkWide Research analysts conducted detailed reviews of data quality and methodology consistency to ensure research reliability and accuracy. Quality assurance procedures included peer review and external validation of key findings and conclusions.

Gulf Cooperation Council countries represent the most mature and technologically advanced segment of the Middle East and Africa trace detection market. The UAE, Saudi Arabia, and Qatar lead in technology adoption, driven by substantial government investments in security infrastructure and international connectivity requirements. Market penetration in GCC countries reaches approximately 78% for aviation security applications, with growing adoption in other sectors.

North African markets including Egypt, Morocco, and Tunisia are experiencing steady growth in trace detection technology adoption, primarily driven by tourism security requirements and border control modernization initiatives. These markets demonstrate increasing sophistication in procurement processes and technology evaluation criteria. Growth rates in North Africa are projected to accelerate as economic conditions improve and security investments increase.

Sub-Saharan African markets present significant long-term growth potential despite current limitations in infrastructure and budget availability. South Africa leads the region in technology adoption, while Nigeria, Kenya, and Ghana show increasing interest in trace detection solutions. Market development is closely linked to economic growth and international trade expansion in these emerging markets.

Levant region markets including Jordan, Lebanon, and Iraq face unique security challenges that create specific requirements for trace detection technologies. Political instability and security concerns drive demand for advanced detection capabilities, though budget constraints often limit procurement scope. Regional dynamics indicate potential for substantial growth as stability improves and reconstruction efforts accelerate.

Market leadership in the Middle East and Africa trace detection sector is characterized by a mix of established international manufacturers and emerging regional specialists. The competitive environment reflects diverse customer requirements, varying technology preferences, and different service expectations across regional markets.

Competitive strategies emphasize technological innovation, comprehensive service offerings, and regional market expertise. Companies are investing in local partnerships, training programs, and support infrastructure to enhance their competitive positioning. Market share distribution indicates that the top five companies control approximately 65% of total market revenue, with remaining share distributed among smaller specialized providers.

Technology-based segmentation reveals distinct market categories based on detection methodologies and technical approaches:

Application-based segmentation demonstrates diverse market opportunities across multiple sectors:

End-user segmentation reflects different procurement patterns and requirements:

Explosives detection represents the largest and most mature category within the trace detection market, driven by aviation security requirements and counter-terrorism initiatives. This segment benefits from established regulatory frameworks and proven technology solutions. Market penetration approaches 85% in major airports across the region, with continued growth in secondary facilities and non-aviation applications.

Narcotics detection is experiencing rapid growth as governments intensify efforts to combat drug trafficking and substance abuse. Border security applications and law enforcement operations are driving demand for portable and field-deployable detection systems. Technology advancement in this category focuses on expanding detection libraries and improving sensitivity for emerging synthetic drugs.

Chemical warfare agent detection represents a specialized but critical market category driven by security concerns and military applications. Government agencies and critical infrastructure operators are investing in detection capabilities for chemical threats. Market development is influenced by geopolitical tensions and international security cooperation agreements.

Multi-threat detection systems are gaining popularity as organizations seek comprehensive security solutions that can identify multiple substance categories simultaneously. These integrated systems offer operational efficiency and cost-effectiveness compared to single-purpose devices. Adoption rates for multi-threat systems are increasing at approximately 12% annually across the region.

Enhanced security capabilities represent the primary benefit for organizations implementing trace detection systems, providing advanced threat identification and risk mitigation capabilities. Security enhancement enables organizations to protect personnel, assets, and operations while maintaining compliance with regulatory requirements. Detection systems provide early warning capabilities that enable proactive security responses.

Operational efficiency improvements result from automated detection processes that reduce manual inspection requirements and accelerate screening procedures. Modern trace detection systems can process samples rapidly while maintaining high accuracy levels. Throughput optimization enables organizations to handle increased volumes without compromising security effectiveness.

Regulatory compliance assurance helps organizations meet mandatory security standards and avoid penalties or operational restrictions. Trace detection systems provide documented evidence of security screening activities and maintain audit trails for regulatory review. Compliance management becomes more systematic and reliable with automated detection and reporting capabilities.

Risk management benefits include reduced liability exposure and improved incident prevention capabilities. Organizations can demonstrate due diligence in security measures and reduce potential losses from security breaches. Insurance considerations may also favor organizations with comprehensive trace detection capabilities, potentially reducing premium costs.

Competitive advantages emerge for organizations that implement advanced trace detection systems, particularly in sectors where security is a key differentiator. Market positioning can be enhanced through demonstrated security capabilities and regulatory compliance. Customer confidence increases when organizations can provide verified security assurances.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming trace detection capabilities by enabling more sophisticated threat analysis and reducing false positive rates. AI-powered systems can learn from operational data and continuously improve detection accuracy while adapting to evolving threat patterns. Machine learning algorithms are being incorporated to enhance substance identification and automate decision-making processes.

Miniaturization trends are making trace detection technology more portable and accessible for field deployment applications. Advances in sensor technology and electronics are enabling the development of handheld devices with capabilities previously available only in larger laboratory instruments. Portable solutions are expanding market opportunities in law enforcement and mobile security applications.

Connectivity and data integration represent key trends as organizations seek to incorporate trace detection systems into broader security and operational frameworks. Network-enabled systems provide real-time data sharing, centralized monitoring, and integrated reporting capabilities. Cloud-based analytics and remote monitoring are becoming standard features in modern detection systems.

Multi-modal detection approaches are gaining popularity as organizations seek comprehensive threat identification capabilities. Systems that combine multiple detection technologies can provide enhanced accuracy and broader threat coverage. Integrated platforms offer operational efficiency and cost-effectiveness compared to separate single-purpose systems.

User experience optimization is driving development of more intuitive interfaces and simplified operation procedures. Manufacturers are focusing on reducing training requirements and improving system usability for non-technical operators. Operational simplicity is becoming a key differentiator in procurement decisions, particularly for organizations with limited technical resources.

Technology partnerships between international manufacturers and regional distributors are accelerating market development and improving customer support capabilities. Recent collaborations have focused on developing region-specific solutions and establishing local service networks. Strategic alliances are enabling more comprehensive market coverage and enhanced customer relationships.

Government procurement initiatives across the region are driving large-scale deployments of trace detection systems in airports, border crossings, and critical infrastructure facilities. Major contracts have been awarded for comprehensive security upgrades incorporating advanced detection technologies. Public sector investment continues to represent the primary growth driver for the market.

Regulatory developments including updated aviation security standards and customs modernization programs are creating new requirements for trace detection capabilities. MarkWide Research analysis indicates that regulatory changes are driving approximately 45% of new system deployments across the region. Compliance requirements are becoming more stringent and comprehensive.

Innovation investments by leading manufacturers are resulting in next-generation detection systems with enhanced capabilities and improved operational characteristics. Recent product launches have focused on AI integration, improved sensitivity, and enhanced user interfaces. R&D spending in the trace detection sector has increased significantly as companies compete for technological leadership.

Market consolidation activities including acquisitions and mergers are reshaping the competitive landscape and creating larger, more comprehensive solution providers. Industry consolidation is enabling companies to offer broader product portfolios and enhanced service capabilities. Strategic transactions are expected to continue as companies seek to strengthen their market positions.

Market entry strategies should focus on establishing strong local partnerships and developing region-specific solutions that address unique operational requirements and environmental conditions. Companies entering the Middle East and Africa trace detection market should prioritize relationship building with key stakeholders and invest in comprehensive customer support capabilities. Local presence is essential for successful market penetration and long-term growth.

Technology development priorities should emphasize environmental resilience, operational simplicity, and cost-effectiveness to address regional market requirements. Solutions designed for harsh operating conditions and simplified maintenance requirements will have competitive advantages. Innovation focus should balance advanced capabilities with practical deployment considerations.

Service strategy development represents a critical success factor, with comprehensive training, maintenance, and technical support capabilities becoming key differentiators. Organizations should invest in local service infrastructure and personnel development to ensure customer satisfaction and retention. Service quality often determines long-term customer relationships and repeat business opportunities.

Pricing strategies should consider total cost of ownership rather than initial purchase price, as customers increasingly evaluate long-term operational costs and value propositions. Flexible financing options and service packages can improve market accessibility and customer adoption rates. Value-based pricing approaches that demonstrate clear return on investment will be most effective.

Regulatory engagement is essential for understanding evolving requirements and influencing standards development. Companies should actively participate in industry associations and regulatory discussions to stay informed about changing requirements and contribute to standards development. Compliance expertise can become a significant competitive advantage in regulated markets.

Market growth trajectory indicates continued expansion driven by increasing security awareness, regulatory requirements, and technological advancement. The Middle East and Africa trace detection market is projected to experience sustained growth over the next decade, with particularly strong performance in aviation security and border control applications. MWR projections suggest that market penetration will accelerate as economic conditions improve and security investments increase.

Technology evolution will continue toward more intelligent, connected, and user-friendly systems that provide enhanced detection capabilities while reducing operational complexity. Artificial intelligence integration and advanced analytics will become standard features in next-generation detection systems. Innovation cycles are expected to accelerate as competition intensifies and customer requirements become more sophisticated.

Geographic expansion opportunities will emerge as developing markets in Africa invest in security infrastructure and border modernization programs. Economic growth and increased international connectivity will drive demand for trace detection capabilities in previously underserved markets. Market development will follow infrastructure investment patterns and economic development trajectories.

Application diversification will create new market segments as awareness of trace detection benefits expands beyond traditional security applications. Industrial safety, environmental monitoring, and quality control applications represent emerging opportunities for growth. Market expansion into new sectors will require adapted solutions and specialized marketing approaches.

Competitive landscape evolution will likely involve continued consolidation and the emergence of specialized solution providers focusing on specific market segments or geographic regions. Companies that successfully combine technological innovation with comprehensive service capabilities will achieve sustainable competitive advantages. Market leadership will depend on the ability to adapt to changing customer requirements and regulatory environments.

The Middle East and Africa trace detection market represents a dynamic and rapidly evolving sector with substantial growth potential driven by increasing security concerns, regulatory requirements, and technological advancement. The market demonstrates strong fundamentals with sustained demand from government agencies, commercial organizations, and critical infrastructure operators seeking enhanced security capabilities.

Regional diversity creates both opportunities and challenges, with varying levels of market maturity, economic development, and security priorities across different countries and sub-regions. Successful market participants must develop flexible strategies that address diverse customer requirements while maintaining technological excellence and comprehensive service capabilities.

Technology trends toward artificial intelligence integration, enhanced portability, and improved user experience are reshaping the competitive landscape and creating new market opportunities. Companies that successfully balance innovation with practical deployment considerations will achieve sustainable competitive advantages in this evolving market environment.

Future success in the Middle East and Africa trace detection market will depend on the ability to establish strong local partnerships, develop region-specific solutions, and provide comprehensive customer support. Organizations that invest in understanding regional requirements and building lasting customer relationships will be best positioned to capitalize on the significant growth opportunities ahead in this critical security technology sector.

What is Trace Detection?

Trace detection refers to the methods and technologies used to identify and analyze minute quantities of substances, such as explosives, narcotics, or chemical agents. This process is crucial in various sectors, including security, law enforcement, and environmental monitoring.

What are the key players in the Middle East And Africa Trace Detection Market?

Key players in the Middle East And Africa Trace Detection Market include Smiths Detection, Thermo Fisher Scientific, and FLIR Systems, among others. These companies are known for their innovative technologies and solutions in trace detection applications.

What are the growth factors driving the Middle East And Africa Trace Detection Market?

The growth of the Middle East And Africa Trace Detection Market is driven by increasing security concerns, the rise in terrorism, and the need for advanced detection technologies in airports and public spaces. Additionally, regulatory requirements for safety and security are also contributing to market expansion.

What challenges does the Middle East And Africa Trace Detection Market face?

Challenges in the Middle East And Africa Trace Detection Market include high costs associated with advanced detection technologies and the need for skilled personnel to operate these systems. Furthermore, varying regulations across countries can complicate market entry for new technologies.

What opportunities exist in the Middle East And Africa Trace Detection Market?

Opportunities in the Middle East And Africa Trace Detection Market include the growing demand for portable detection devices and advancements in sensor technologies. Additionally, increasing investments in security infrastructure present significant growth potential for market players.

What trends are shaping the Middle East And Africa Trace Detection Market?

Trends in the Middle East And Africa Trace Detection Market include the integration of artificial intelligence and machine learning in detection systems, enhancing accuracy and speed. Moreover, the development of multi-threat detection systems is gaining traction, allowing for the simultaneous identification of various substances.

Middle East And Africa Trace Detection Market

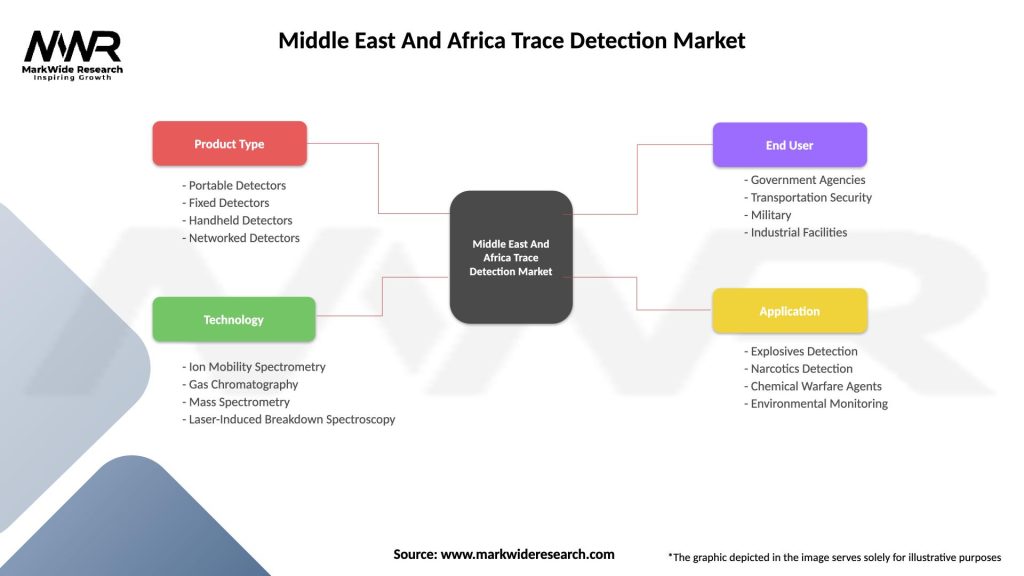

| Segmentation Details | Description |

|---|---|

| Product Type | Portable Detectors, Fixed Detectors, Handheld Detectors, Networked Detectors |

| Technology | Ion Mobility Spectrometry, Gas Chromatography, Mass Spectrometry, Laser-Induced Breakdown Spectroscopy |

| End User | Government Agencies, Transportation Security, Military, Industrial Facilities |

| Application | Explosives Detection, Narcotics Detection, Chemical Warfare Agents, Environmental Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East And Africa Trace Detection Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at