444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia fire truck market represents a critical component of the nation’s emergency response infrastructure, encompassing specialized vehicles designed for firefighting, rescue operations, and emergency medical services. Australia’s unique geography and climate conditions, including vast rural areas prone to bushfires and densely populated urban centers, create distinct requirements for fire truck capabilities and specifications. The market demonstrates steady growth driven by increasing urbanization, climate change impacts, and evolving safety regulations across different states and territories.

Market dynamics indicate that Australia’s fire truck sector is experiencing significant transformation through technological advancement and modernization initiatives. The integration of advanced firefighting technologies, including foam systems, aerial platforms, and specialized rescue equipment, has become increasingly important for fire departments nationwide. Government investment in emergency services infrastructure continues to support market expansion, with federal and state authorities prioritizing fleet upgrades and capacity enhancement programs.

Regional variations across Australia create diverse market segments, with metropolitan fire services requiring different vehicle specifications compared to rural and volunteer fire brigades. The market encompasses various vehicle types, from compact urban fire trucks to large-capacity tankers designed for bushfire suppression. Technological innovation remains a key driver, with manufacturers incorporating smart systems, improved safety features, and enhanced operational efficiency capabilities to meet evolving emergency response requirements.

The Australia fire truck market refers to the comprehensive ecosystem of specialized emergency vehicles designed, manufactured, distributed, and maintained for firefighting and rescue operations across Australian territories. This market encompasses traditional fire engines, aerial ladder trucks, rescue vehicles, hazardous materials response units, and specialized bushfire fighting apparatus tailored to Australia’s unique environmental challenges and operational requirements.

Fire truck specifications in Australia must comply with stringent national standards and local regulations, incorporating features such as water pumping systems, foam delivery mechanisms, equipment storage compartments, and crew safety systems. The market includes both domestic manufacturing and international imports, with local companies adapting global designs to meet Australian conditions and requirements. Service and maintenance components represent significant market segments, ensuring operational readiness and extending vehicle lifecycles for fire departments nationwide.

Australia’s fire truck market demonstrates robust fundamentals supported by consistent government investment, technological advancement, and evolving emergency response requirements. The market benefits from strong regulatory frameworks that mandate regular fleet updates and safety compliance, creating predictable demand patterns for manufacturers and suppliers. Climate change impacts, including increased bushfire frequency and intensity, drive demand for specialized firefighting vehicles with enhanced capabilities and improved operational efficiency.

Key market segments include urban fire departments, rural fire services, volunteer brigades, industrial facilities, and airport fire rescue services, each requiring distinct vehicle specifications and capabilities. The market shows increasing adoption of advanced technologies, including GPS navigation systems, thermal imaging equipment, and integrated communication platforms. Sustainability initiatives are gaining prominence, with fire departments exploring electric and hybrid vehicle options to reduce environmental impact while maintaining operational effectiveness.

Competitive dynamics feature both international manufacturers and local specialists, creating a diverse supplier landscape that supports innovation and competitive pricing. The market demonstrates strong aftermarket potential through maintenance services, equipment upgrades, and vehicle refurbishment programs that extend asset lifecycles and optimize operational budgets for fire departments across Australia.

Strategic market analysis reveals several critical insights shaping Australia’s fire truck market development and future trajectory:

Government investment in emergency services infrastructure represents the primary driver for Australia’s fire truck market, with federal and state authorities consistently allocating substantial budgets for fleet modernization and capacity expansion. Regulatory compliance requirements mandate regular vehicle updates and safety standard adherence, creating predictable replacement cycles that support market stability and growth projections.

Climate change impacts significantly influence market demand, as increasing bushfire frequency and intensity require enhanced firefighting capabilities and specialized vehicle configurations. Urban development patterns create additional demand for fire trucks equipped with aerial platforms and rescue equipment suitable for high-rise buildings and complex infrastructure environments. The growing emphasis on emergency response time optimization drives demand for faster, more maneuverable vehicles with improved acceleration and handling characteristics.

Technological advancement continues driving market evolution, with fire departments seeking vehicles equipped with modern communication systems, GPS navigation, thermal imaging capabilities, and integrated operational management platforms. Population growth in major Australian cities necessitates expanded fire service coverage and increased vehicle deployment, supporting sustained market demand across metropolitan areas.

Budget constraints represent significant challenges for fire departments, particularly smaller rural and volunteer organizations with limited financial resources for vehicle acquisition and maintenance. High vehicle costs associated with specialized firefighting equipment and customization requirements create barriers for fleet expansion and modernization initiatives, especially for departments operating under tight fiscal constraints.

Skilled technician shortages impact market growth through limited maintenance and repair capabilities, potentially extending vehicle downtime and increasing operational costs for fire departments. Complex regulatory requirements across different Australian states and territories create compliance challenges for manufacturers and increase development costs for specialized vehicle configurations.

Long procurement cycles typical of government purchasing processes can delay vehicle delivery and impact market responsiveness to changing operational requirements. Infrastructure limitations in some rural areas may restrict the deployment of larger, more capable fire trucks, limiting market potential for certain vehicle categories and configurations.

Electric vehicle adoption presents substantial opportunities for fire truck manufacturers to develop environmentally sustainable solutions that meet Australia’s carbon reduction goals while maintaining operational effectiveness. Smart city initiatives across major Australian metropolitan areas create demand for connected fire trucks with advanced communication and data sharing capabilities that integrate with urban management systems.

Export potential exists for Australian fire truck manufacturers to leverage local expertise in bushfire fighting and extreme weather operations for international markets facing similar challenges. Retrofit and upgrade services offer significant opportunities to enhance existing vehicle capabilities without complete fleet replacement, providing cost-effective solutions for budget-conscious fire departments.

Public-private partnerships create opportunities for innovative financing and service delivery models that can accelerate fleet modernization while optimizing operational costs. Training and simulation technologies integrated with fire truck systems present opportunities for enhanced firefighter preparation and improved emergency response effectiveness. Autonomous vehicle technologies may eventually create opportunities for unmanned firefighting capabilities in high-risk situations.

Supply chain dynamics in Australia’s fire truck market involve complex interactions between international manufacturers, local assembly operations, component suppliers, and service providers. Demand patterns demonstrate cyclical characteristics influenced by government budget cycles, emergency incident frequency, and fleet replacement schedules across different fire departments and jurisdictions.

Competitive pressures drive continuous innovation in vehicle design, operational efficiency, and cost optimization, with manufacturers competing on technology integration, customization capabilities, and after-sales service quality. Regulatory changes periodically reshape market requirements, creating opportunities for compliant manufacturers while potentially disadvantaging those unable to adapt quickly to new standards.

Economic factors including currency fluctuations, material costs, and labor availability impact market pricing and profitability for both manufacturers and purchasers. Technological convergence between automotive, telecommunications, and emergency response sectors creates new possibilities for integrated solutions that enhance firefighting effectiveness and operational efficiency. According to MarkWide Research analysis, market dynamics indicate increasing integration of digital technologies with traditional firefighting equipment.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Australia’s fire truck market dynamics and trends. Primary research includes structured interviews with fire department officials, vehicle manufacturers, equipment suppliers, and industry experts to gather firsthand insights into market requirements, challenges, and opportunities.

Secondary research encompasses analysis of government procurement records, industry publications, regulatory documents, and financial reports from key market participants. Data triangulation methods validate findings across multiple sources to ensure accuracy and reliability of market insights and projections.

Quantitative analysis incorporates statistical modeling of historical trends, procurement patterns, and fleet replacement cycles to project future market development. Qualitative assessment examines technological trends, regulatory changes, and competitive dynamics that influence market evolution and strategic decision-making processes.

New South Wales represents the largest regional market segment, driven by Sydney’s metropolitan fire service requirements and extensive rural fire service operations. The state demonstrates approximately 35% market share due to population density, urban development patterns, and significant bushfire risk areas requiring specialized firefighting capabilities.

Victoria maintains strong market presence with roughly 25% market share, supported by Melbourne’s urban fire service needs and the state’s comprehensive Country Fire Authority network. Queensland accounts for approximately 20% market share, with demand driven by both urban centers and vast rural areas requiring specialized bushfire fighting equipment and rescue capabilities.

Western Australia demonstrates about 12% market share, with Perth’s metropolitan requirements and mining industry fire service needs supporting consistent demand. South Australia, Tasmania, Northern Territory, and ACT collectively represent the remaining 8% market share, with specialized requirements based on local geography, climate conditions, and operational challenges unique to each jurisdiction.

Market leadership involves both international manufacturers and specialized Australian companies that understand local requirements and operational conditions:

Competitive differentiation focuses on technological innovation, customization capabilities, local support services, and understanding of Australian operational requirements. Market consolidation trends show larger manufacturers acquiring specialized local companies to enhance market presence and technical capabilities.

By Vehicle Type:

By End User:

Pumper trucks represent the largest market category, accounting for approximately 45% of total demand due to their versatility and essential role in most firefighting operations. These vehicles demonstrate consistent demand across all fire service types, with modern units incorporating advanced pump systems, foam capabilities, and comprehensive equipment storage solutions.

Tanker trucks show strong growth at 8.2% annually driven by increasing bushfire risks and rural development patterns. Aerial ladder trucks maintain steady demand in metropolitan areas, with about 15% market share supported by urban development and high-rise construction trends.

Rescue vehicles demonstrate growing importance at 12% market share as fire departments expand their emergency response capabilities beyond traditional firefighting. Specialized vehicles including hazmat units and airport fire rescue equipment represent niche but critical market segments with specific technical requirements and regulatory compliance needs.

Fire departments benefit from advanced vehicle technologies that improve operational efficiency, enhance firefighter safety, and expand emergency response capabilities. Modern fire trucks provide superior performance, reliability, and versatility compared to older vehicles, enabling more effective emergency response and improved community protection.

Manufacturers gain access to a stable market with predictable replacement cycles and opportunities for technological innovation and differentiation. Local suppliers benefit from proximity to customers, understanding of specific requirements, and ability to provide rapid support and customization services.

Communities receive enhanced emergency protection through improved fire service capabilities, faster response times, and more effective firefighting and rescue operations. Government stakeholders achieve better value for public investment through improved vehicle performance, extended service life, and enhanced operational efficiency that optimizes emergency service budgets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification trends are gaining momentum as fire departments explore electric and hybrid fire trucks to reduce environmental impact while maintaining operational effectiveness. Smart technology integration includes GPS navigation, real-time communication systems, and operational data collection capabilities that enhance emergency response coordination and effectiveness.

Customization demand continues increasing as fire departments seek vehicles tailored to specific operational requirements, local conditions, and unique emergency response scenarios. Sustainability initiatives drive interest in fuel-efficient vehicles, alternative power sources, and environmentally friendly firefighting agents and systems.

Training technology integration incorporates simulation systems and virtual reality platforms that help firefighters master complex vehicle operations and emergency response procedures. Predictive maintenance technologies utilize sensors and data analytics to optimize vehicle reliability, reduce downtime, and extend operational lifecycles. MWR data indicates that approximately 60% of fire departments are actively evaluating advanced technology options for future vehicle acquisitions.

Recent industry developments demonstrate significant progress in fire truck technology and market evolution. Rosenbauer Australia launched advanced electric fire truck prototypes designed for urban operations with reduced noise and emissions. Varley Group expanded manufacturing capabilities to meet growing demand for specialized bushfire fighting vehicles with enhanced water capacity and off-road performance.

Government initiatives include updated procurement guidelines emphasizing sustainability, technology integration, and operational efficiency in fire truck acquisitions. Industry partnerships between manufacturers and fire departments have accelerated development of customized solutions addressing specific Australian operational requirements and environmental challenges.

Technology partnerships with telecommunications and software companies are creating integrated emergency response platforms that connect fire trucks with dispatch centers, other emergency vehicles, and incident command systems. Training program developments focus on preparing firefighters for advanced vehicle technologies and complex operational scenarios requiring specialized skills and knowledge.

Strategic recommendations for fire departments include developing comprehensive fleet management strategies that balance operational requirements, budget constraints, and technological advancement opportunities. Procurement planning should incorporate long-term operational costs, maintenance requirements, and technology upgrade potential when evaluating vehicle options and supplier capabilities.

Manufacturers should focus on developing modular vehicle designs that allow for customization and future upgrades without complete vehicle replacement. Investment in local support infrastructure, including service centers and parts distribution networks, will enhance competitive positioning and customer satisfaction levels.

Government stakeholders should consider standardization initiatives that promote interoperability between different fire departments while maintaining flexibility for specialized requirements. Funding mechanisms that support fleet modernization and technology adoption will enhance emergency response capabilities and optimize long-term operational costs across Australian fire services.

Market projections indicate continued growth driven by government investment, technological advancement, and evolving emergency response requirements. Electric vehicle adoption is expected to accelerate significantly over the next decade, with MarkWide Research projecting that approximately 25% of new fire truck acquisitions may incorporate electric or hybrid powertrains by 2030.

Technology integration will continue expanding, with artificial intelligence, predictive analytics, and autonomous systems potentially transforming fire truck capabilities and operational effectiveness. Climate change adaptation will drive demand for specialized vehicles capable of operating in extreme weather conditions and addressing evolving emergency scenarios.

Market consolidation may occur as larger manufacturers acquire specialized local companies to enhance capabilities and market presence. International expansion opportunities exist for Australian companies with expertise in bushfire fighting and extreme weather operations, particularly in markets facing similar environmental challenges and operational requirements.

Australia’s fire truck market demonstrates strong fundamentals supported by consistent government investment, technological innovation, and evolving emergency response requirements. The market benefits from stable regulatory frameworks, predictable replacement cycles, and growing emphasis on operational efficiency and environmental sustainability. Key growth drivers include climate change impacts, urban development patterns, and advancing firefighting technologies that enhance emergency response capabilities.

Strategic opportunities exist in electric vehicle development, smart technology integration, and specialized vehicle configurations addressing unique Australian operational requirements. Market participants who focus on innovation, customization capabilities, and comprehensive support services are well-positioned for sustained success in this critical public safety sector. The outlook remains positive for continued market growth and technological advancement in Australia’s fire truck industry.

What is Fire Truck?

Fire trucks are specialized vehicles designed for firefighting operations, equipped with water tanks, hoses, and firefighting equipment. They play a crucial role in emergency response and fire prevention in various settings, including urban and rural areas.

What are the key players in the Australia Fire Truck Market?

Key players in the Australia Fire Truck Market include companies such as Rosenbauer, Scania, and Iveco, which manufacture a range of fire trucks and emergency response vehicles. These companies focus on innovation and technology to enhance firefighting capabilities, among others.

What are the growth factors driving the Australia Fire Truck Market?

The Australia Fire Truck Market is driven by factors such as increasing urbanization, rising awareness of fire safety, and government investments in emergency services. Additionally, advancements in firefighting technology and equipment are contributing to market growth.

What challenges does the Australia Fire Truck Market face?

Challenges in the Australia Fire Truck Market include high maintenance costs, the need for skilled personnel, and budget constraints faced by fire departments. These factors can hinder the procurement and upgrading of fire truck fleets.

What opportunities exist in the Australia Fire Truck Market?

Opportunities in the Australia Fire Truck Market include the development of electric and hybrid fire trucks, which can reduce operational costs and environmental impact. Additionally, increasing demand for advanced firefighting technologies presents growth potential for manufacturers.

What trends are shaping the Australia Fire Truck Market?

Trends in the Australia Fire Truck Market include the integration of smart technologies, such as GPS and telematics, into fire trucks for improved operational efficiency. Furthermore, there is a growing emphasis on sustainability and eco-friendly firefighting solutions.

Australia Fire Truck Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Fire Engine, Aerial Ladder, Tanker, Wildland |

| Technology | Electric, Hybrid, Diesel, Gasoline |

| End User | Municipal, Industrial, Forestry, Airport |

| Size | Light, Medium, Heavy, Super Heavy |

Please note: The segmentation can be entirely customized to align with our client’s needs.

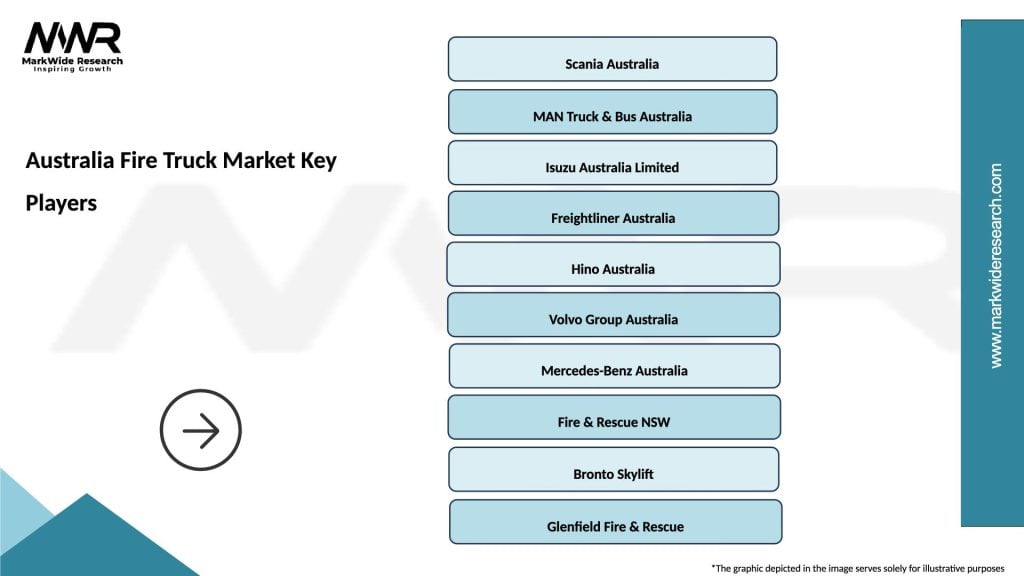

Leading companies in the Australia Fire Truck Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at