444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam business jets and helicopters market represents a rapidly expanding segment within Southeast Asia’s aviation industry, driven by increasing economic prosperity, growing business activities, and enhanced infrastructure development. Vietnam’s strategic location as a gateway to the Asia-Pacific region has positioned it as an attractive destination for private aviation investments, with both domestic and international operators recognizing the significant potential for growth.

Market dynamics indicate robust expansion across multiple sectors, with the business aviation segment experiencing particularly strong momentum. The market encompasses various aircraft categories, from light jets suitable for regional travel to heavy helicopters designed for offshore operations and emergency services. Economic liberalization and foreign investment policies have created favorable conditions for aviation sector development, contributing to increased demand for private aircraft services.

Infrastructure improvements across Vietnam’s major cities and industrial zones have enhanced the operational environment for business aviation. The development of new airports, heliports, and maintenance facilities has strengthened the foundation for market growth. Government initiatives supporting aviation sector development, combined with rising disposable income among high-net-worth individuals, have created a conducive environment for business jets and helicopters market expansion at a compound annual growth rate of 8.2% over the forecast period.

The Vietnam business jets and helicopters market refers to the comprehensive ecosystem encompassing the sale, lease, operation, and maintenance of private aircraft within Vietnam’s territorial boundaries. This market includes various aircraft types ranging from light business jets and turboprops to single and twin-engine helicopters used for corporate transportation, emergency medical services, tourism, and offshore operations.

Business aviation in Vietnam represents a specialized segment that serves corporate executives, government officials, high-net-worth individuals, and specialized service providers requiring flexible, time-efficient transportation solutions. The market encompasses both fixed-wing aircraft and rotorcraft, each serving distinct operational requirements and market segments within Vietnam’s diverse economic landscape.

Market participants include aircraft manufacturers, operators, maintenance providers, charter services, and supporting infrastructure developers. The ecosystem extends beyond aircraft transactions to include comprehensive services such as pilot training, aircraft management, insurance, and regulatory compliance support, creating a multifaceted industry that contributes significantly to Vietnam’s aviation sector development.

Vietnam’s business jets and helicopters market demonstrates exceptional growth potential, supported by strong economic fundamentals and increasing demand for premium aviation services. The market benefits from Vietnam’s strategic position in Southeast Asia, robust economic growth, and expanding business activities across multiple industries including manufacturing, tourism, and energy exploration.

Key market drivers include rising corporate travel requirements, increasing offshore oil and gas activities, growing medical emergency services demand, and expanding tourism sector needs. The market shows particular strength in helicopter operations, with offshore support services accounting for approximately 35% of total helicopter utilization. Business jet operations are gaining momentum, driven by increasing international business activities and time-sensitive travel requirements.

Market segmentation reveals diverse applications across corporate transportation, emergency medical services, law enforcement, tourism, and industrial support operations. The competitive landscape features both international aircraft manufacturers and local service providers, creating a dynamic environment that supports innovation and service quality improvements. Infrastructure development continues to enhance market accessibility, with new facilities and regulatory improvements supporting sustained growth momentum.

Strategic market analysis reveals several critical insights that define Vietnam’s business jets and helicopters market trajectory. The market demonstrates strong resilience and adaptability, with operators successfully navigating regulatory changes and economic fluctuations while maintaining growth momentum.

Economic prosperity serves as the primary catalyst driving Vietnam’s business jets and helicopters market expansion. The country’s sustained economic growth, increasing foreign direct investment, and expanding industrial base create substantial demand for efficient, flexible transportation solutions that traditional commercial aviation cannot adequately address.

Corporate expansion across Vietnam’s major economic centers generates significant demand for business aviation services. Multinational corporations establishing operations in Vietnam require reliable, time-efficient transportation for executives and key personnel. The need for direct connectivity between business centers, manufacturing facilities, and international destinations drives business jet utilization, with corporate travel accounting for approximately 42% of total business aviation activity.

Offshore energy sector development creates substantial helicopter market opportunities. Vietnam’s expanding oil and gas exploration activities, particularly in the South China Sea region, require specialized helicopter support services for personnel transportation, equipment delivery, and emergency response operations. Industrial helicopter operations benefit from increasing infrastructure development projects, including power line construction, pipeline installation, and construction support activities.

Tourism sector growth contributes significantly to market expansion, with luxury tourism operators utilizing helicopters for scenic flights, resort transfers, and exclusive experiences. The development of premium tourism destinations across Vietnam creates opportunities for specialized aviation services, supporting both domestic and international tourism growth initiatives.

Regulatory complexity presents significant challenges for market participants, with evolving aviation regulations, airspace restrictions, and bureaucratic processes creating operational uncertainties. The regulatory environment requires substantial compliance investments and can limit operational flexibility, particularly for new market entrants seeking to establish operations in Vietnam’s aviation sector.

Infrastructure limitations constrain market growth in certain regions, with inadequate airport facilities, limited maintenance capabilities, and insufficient fuel supply networks restricting operational scope. While major cities benefit from improved infrastructure, remote areas and secondary markets often lack the necessary facilities to support regular business aviation operations.

High operational costs associated with aircraft acquisition, maintenance, insurance, and regulatory compliance create barriers to market entry and expansion. Import duties, taxes, and currency fluctuations can significantly impact operational economics, particularly for operators relying on foreign-manufactured aircraft and components. Fuel costs and availability represent ongoing operational challenges, especially for helicopter operations in remote locations.

Skilled personnel shortage limits market expansion, with qualified pilots, maintenance technicians, and aviation professionals in high demand across the region. Training requirements, certification processes, and competitive compensation expectations create human resource challenges that can constrain operational capacity and service quality.

Government infrastructure initiatives create substantial opportunities for market expansion, with planned airport developments, heliport construction, and aviation sector investments enhancing operational capabilities. The government’s commitment to improving transportation infrastructure supports long-term market growth and creates opportunities for both domestic and international aviation service providers.

Emerging market segments offer significant growth potential, including air medical services, law enforcement support, disaster response operations, and specialized industrial applications. The development of these niche markets creates opportunities for operators to diversify service offerings and establish sustainable competitive advantages in specialized operational areas.

Regional connectivity expansion presents opportunities for business aviation operators to serve growing demand for direct transportation links between Vietnam and neighboring countries. Cross-border business activities, regional tourism growth, and international trade expansion create demand for flexible aviation solutions that can efficiently connect Vietnam with regional markets.

Technology advancement integration offers opportunities for operational efficiency improvements, cost reduction, and service quality enhancement. Advanced avionics, predictive maintenance systems, and digital operational platforms can help operators optimize performance while meeting evolving customer expectations and regulatory requirements.

Supply and demand dynamics in Vietnam’s business jets and helicopters market reflect the complex interplay between economic growth, regulatory environment, and infrastructure development. The market demonstrates strong demand fundamentals supported by diverse end-user segments, while supply constraints related to aircraft availability, qualified personnel, and operational infrastructure create market tensions that influence pricing and service delivery.

Competitive dynamics feature both international and domestic players competing across various market segments. International aircraft manufacturers and operators bring advanced technology and global expertise, while local companies offer market knowledge and cost advantages. This competitive environment drives innovation, service quality improvements, and market expansion initiatives that benefit end users.

Pricing dynamics reflect the premium nature of business aviation services, with operators balancing operational costs, competitive pressures, and customer value expectations. Market maturity varies across different segments, with established offshore helicopter operations demonstrating different pricing characteristics compared to emerging business jet services. Utilization rates averaging 65% across the helicopter segment indicate healthy market demand.

Seasonal dynamics influence market performance, with tourism-related operations experiencing peak demand during favorable weather periods and holiday seasons. Business aviation services show more consistent demand patterns, though economic cycles and corporate budget constraints can impact utilization levels and pricing strategies across different market segments.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry stakeholders, including aircraft operators, manufacturers, service providers, and regulatory officials. These interviews provide firsthand insights into market trends, challenges, and opportunities that shape the Vietnam business jets and helicopters market.

Secondary research encompasses analysis of government publications, industry reports, regulatory documents, and economic data sources. This research foundation provides quantitative data on market size, growth trends, and regulatory developments that influence market dynamics. MarkWide Research utilizes proprietary databases and analytical frameworks to synthesize diverse data sources into coherent market intelligence.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical analysis techniques. Market forecasts incorporate economic modeling, trend analysis, and scenario planning to provide reliable projections for strategic decision-making. The research methodology emphasizes both quantitative metrics and qualitative insights to deliver comprehensive market understanding.

Industry expertise integration involves collaboration with aviation industry professionals, regulatory specialists, and market analysts who provide specialized knowledge and validation of research findings. This expert input ensures that research conclusions reflect real-world market conditions and provide actionable insights for market participants and stakeholders.

Ho Chi Minh City region dominates Vietnam’s business jets and helicopters market, accounting for approximately 45% of total market activity. As the country’s economic center, this region hosts the highest concentration of multinational corporations, financial institutions, and business aviation operators. The presence of Tan Son Nhat International Airport and developing business aviation facilities supports robust market activity across both business jets and helicopters segments.

Hanoi region represents the second-largest market segment, driven by government activities, diplomatic missions, and northern Vietnam’s industrial development. The capital region accounts for approximately 28% of market share, with strong demand for both corporate transportation and government aviation services. Infrastructure improvements and regulatory center proximity enhance the region’s attractiveness for business aviation operations.

Coastal regions demonstrate significant helicopter market activity, particularly supporting offshore oil and gas operations. The southeastern coastal area, including Ba Ria-Vung Tau province, serves as a hub for offshore helicopter operations, while central coastal regions support tourism and industrial activities. These areas collectively represent approximately 18% of total market activity.

Northern mountainous regions and Mekong Delta areas show emerging market potential, driven by tourism development, infrastructure projects, and specialized industrial applications. While currently representing smaller market shares, these regions demonstrate growth potential as infrastructure development and economic activities expand into previously underserved areas.

Market leadership in Vietnam’s business jets and helicopters sector features a diverse mix of international manufacturers, local operators, and specialized service providers. The competitive environment reflects the market’s developmental stage, with established players focusing on market expansion while new entrants seek to capture emerging opportunities.

Competitive strategies focus on service quality, operational reliability, and comprehensive support capabilities. Market leaders invest in local infrastructure, personnel training, and regulatory compliance to establish sustainable competitive advantages in Vietnam’s developing business aviation market.

By Aircraft Type: The market segments into distinct categories based on aircraft specifications and operational capabilities. Business jets include light jets, mid-size jets, and heavy jets, each serving different range and passenger capacity requirements. Helicopter segments encompass single-engine, twin-engine, and heavy-lift helicopters designed for various operational applications.

By Application: Market segmentation reflects diverse operational requirements across multiple industries. Corporate transportation represents the largest business jet segment, while offshore operations dominate helicopter utilization. Emergency medical services, law enforcement, tourism, and industrial support create additional market segments with specific operational requirements and growth characteristics.

By Ownership Model: The market includes various ownership and operational models, from direct ownership and fractional ownership to charter services and aircraft management programs. Each model serves different customer segments with varying utilization patterns, financial requirements, and operational preferences.

By Service Type: Segmentation includes aircraft sales, leasing, charter operations, maintenance services, pilot training, and aircraft management. This comprehensive service ecosystem supports market development and provides multiple revenue streams for industry participants across the value chain.

Light Business Jets: This category demonstrates strong growth potential in Vietnam’s market, driven by increasing regional business travel requirements and cost-conscious operators. Light jets offer optimal balance between operational efficiency and acquisition costs, making them attractive for emerging market segments. Operational flexibility and lower infrastructure requirements support market penetration in secondary cities and developing business centers.

Mid-size Business Jets: Growing demand from established corporations and high-net-worth individuals drives this segment’s expansion. Mid-size jets provide enhanced range and comfort capabilities suitable for regional and international travel requirements. The segment benefits from increasing business activities between Vietnam and neighboring countries, with international flights accounting for 38% of mid-size jet operations.

Single-Engine Helicopters: This category serves diverse applications including pilot training, tourism, and light utility operations. Cost-effective operations and simplified maintenance requirements make single-engine helicopters attractive for emerging operators and specialized applications. The segment demonstrates particular strength in tourism and training applications.

Twin-Engine Helicopters: Offshore operations, emergency medical services, and corporate transportation drive demand in this category. Enhanced safety capabilities and operational reliability make twin-engine helicopters essential for critical operations and challenging environments. The segment benefits from expanding offshore energy activities and growing medical emergency services requirements.

Aircraft Manufacturers benefit from Vietnam’s expanding market through increased sales opportunities, growing aftermarket services demand, and potential for local assembly or manufacturing partnerships. The developing market provides opportunities for market share establishment and long-term customer relationship development in a high-growth region.

Operators and Service Providers gain access to diverse revenue streams through multiple market segments and applications. The market’s developmental stage allows early entrants to establish competitive advantages and build market presence before full market maturity. Operational diversification across different segments provides risk mitigation and revenue stability.

End Users benefit from improved transportation efficiency, time savings, and enhanced business capabilities. Business aviation services enable access to remote locations, flexible scheduling, and direct connectivity that supports business growth and operational efficiency. Productivity improvements and competitive advantages justify premium service investments for many corporate users.

Government and Regulatory Bodies benefit from aviation sector development through economic growth, job creation, and enhanced emergency response capabilities. The industry contributes to infrastructure development, technology transfer, and international connectivity that supports broader economic development objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization and Technology Integration represents a transformative trend reshaping Vietnam’s business jets and helicopters market. Advanced avionics systems, predictive maintenance technologies, and digital operational platforms enhance safety, efficiency, and customer experience. Smart aircraft systems provide real-time operational data, enabling proactive maintenance and optimized flight operations.

Sustainable Aviation Initiatives gain momentum as environmental consciousness increases among operators and customers. Fuel-efficient aircraft, sustainable aviation fuels, and carbon offset programs become important differentiators in the market. Environmental compliance requirements drive investment in cleaner technologies and operational practices.

Service Integration and Customization trends reflect evolving customer expectations for comprehensive, tailored aviation solutions. Operators develop integrated service packages combining aircraft operations, ground handling, concierge services, and travel coordination. Customer experience enhancement becomes a key competitive differentiator in the premium aviation market.

Regional Connectivity Expansion drives market development as Vietnam strengthens economic ties with neighboring countries. Cross-border business activities, tourism growth, and trade expansion create demand for flexible aviation solutions connecting Vietnam with regional markets. International operations growth represents approximately 25% annual increase in cross-border flight activities.

Infrastructure expansion projects significantly impact market development, with new airport facilities, heliport construction, and maintenance capability development enhancing operational environment. Recent developments include upgraded business aviation terminals, expanded fuel supply networks, and improved ground handling facilities that support market growth.

Regulatory framework evolution continues to shape market dynamics, with updated aviation regulations, simplified certification processes, and enhanced safety standards. MWR analysis indicates that regulatory improvements have contributed to increased operator confidence and market entry activities, supporting overall sector development.

Strategic partnerships and joint ventures between international manufacturers and local companies create opportunities for technology transfer, market development, and service capability enhancement. These collaborations support market localization while maintaining international quality standards and operational expertise.

Fleet expansion announcements from major operators indicate strong market confidence and growth expectations. Recent fleet additions include modern business jets and helicopters equipped with advanced technology systems, reflecting operator commitment to service quality and market expansion initiatives.

Market entry strategies should focus on understanding local regulatory requirements, establishing strategic partnerships, and developing comprehensive service capabilities. New market entrants benefit from collaboration with established local partners who provide market knowledge, regulatory expertise, and operational support during initial market development phases.

Investment priorities should emphasize infrastructure development, personnel training, and technology integration to establish sustainable competitive advantages. Operators investing in modern aircraft, advanced maintenance capabilities, and skilled personnel position themselves for long-term success in Vietnam’s developing market.

Risk management approaches must address regulatory compliance, operational safety, and economic volatility concerns. Diversified service portfolios, flexible operational models, and strong financial management help operators navigate market uncertainties while maintaining growth momentum.

Growth strategies should leverage Vietnam’s strategic location, economic development, and infrastructure improvements to capture emerging opportunities. Focus on niche market segments, specialized applications, and regional connectivity can provide competitive advantages in the evolving market landscape.

Long-term market prospects remain highly positive, supported by Vietnam’s continued economic growth, infrastructure development, and increasing integration with regional and global markets. The business jets and helicopters market is positioned to benefit from sustained demand growth across multiple segments and applications.

Technology advancement integration will continue reshaping market dynamics, with electric and hybrid aircraft, autonomous systems, and advanced connectivity solutions creating new operational possibilities. These technological developments will enhance efficiency, reduce environmental impact, and expand market accessibility over the forecast period.

Market maturation is expected to bring increased competition, service standardization, and operational efficiency improvements. As the market develops, operators will focus on specialization, service quality differentiation, and comprehensive customer solutions to maintain competitive positioning.

Regional market integration will create expanded opportunities for cross-border operations, shared resources, and collaborative service development. Vietnam’s position in ASEAN and broader Asia-Pacific aviation networks supports long-term growth potential and market expansion opportunities, with regional operations projected to grow at 12.5% annually through the forecast period.

Vietnam’s business jets and helicopters market represents a compelling growth opportunity within Southeast Asia’s expanding aviation sector. The market benefits from strong economic fundamentals, government support, strategic location advantages, and diverse application opportunities that create sustainable demand across multiple segments.

Market development continues to accelerate, driven by infrastructure improvements, regulatory framework evolution, and increasing business aviation awareness among potential customers. While challenges related to regulatory complexity, infrastructure limitations, and operational costs persist, the overall market trajectory remains positive with significant growth potential.

Strategic opportunities exist for both international and domestic market participants willing to invest in comprehensive service capabilities, regulatory compliance, and customer relationship development. The market’s developmental stage provides advantages for early entrants who can establish market presence and competitive positioning before full market maturity.

Future success in Vietnam’s business jets and helicopters market will depend on operational excellence, regulatory compliance, customer service quality, and strategic adaptation to evolving market conditions. Companies that effectively navigate these requirements while capitalizing on growth opportunities will be well-positioned to benefit from Vietnam’s expanding business aviation sector and contribute to its continued development.

What is Vietnam Business Jets And Helicopters?

Vietnam Business Jets And Helicopters refers to the segment of the aviation industry that focuses on the operation, sale, and maintenance of business jets and helicopters within Vietnam. This includes services for corporate travel, air taxi services, and medical evacuations, among others.

What are the key players in the Vietnam Business Jets And Helicopters Market?

Key players in the Vietnam Business Jets And Helicopters Market include Vietstar Airlines, Hai Au Aviation, and Jetstar Pacific, among others. These companies provide various services such as charter flights, aircraft management, and maintenance services.

What are the growth factors driving the Vietnam Business Jets And Helicopters Market?

The growth of the Vietnam Business Jets And Helicopters Market is driven by increasing demand for corporate travel, the expansion of tourism, and the need for efficient transportation in remote areas. Additionally, rising disposable incomes and a growing business environment contribute to this growth.

What challenges does the Vietnam Business Jets And Helicopters Market face?

The Vietnam Business Jets And Helicopters Market faces challenges such as regulatory hurdles, high operational costs, and limited infrastructure at some airports. These factors can hinder the growth and accessibility of business aviation services in the region.

What opportunities exist in the Vietnam Business Jets And Helicopters Market?

Opportunities in the Vietnam Business Jets And Helicopters Market include the potential for expanding air taxi services, increasing investment in tourism, and the development of new routes to underserved areas. Additionally, advancements in technology may enhance operational efficiency.

What trends are shaping the Vietnam Business Jets And Helicopters Market?

Trends in the Vietnam Business Jets And Helicopters Market include a growing preference for on-demand charter services, increased focus on sustainability, and the adoption of advanced aviation technologies. These trends reflect changing consumer preferences and the industry’s response to environmental concerns.

Vietnam Business Jets And Helicopters Market

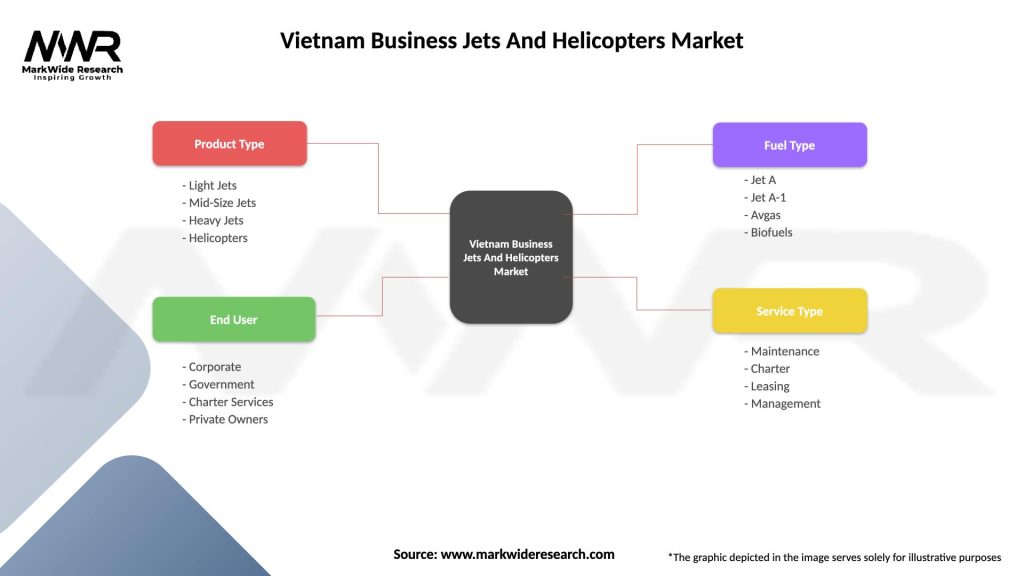

| Segmentation Details | Description |

|---|---|

| Product Type | Light Jets, Mid-Size Jets, Heavy Jets, Helicopters |

| End User | Corporate, Government, Charter Services, Private Owners |

| Fuel Type | Jet A, Jet A-1, Avgas, Biofuels |

| Service Type | Maintenance, Charter, Leasing, Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Business Jets And Helicopters Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at