444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Denmark data center cooling market represents a critical component of the nation’s rapidly expanding digital infrastructure ecosystem. As Denmark positions itself as a leading hub for sustainable technology and digital innovation, the demand for efficient data center cooling solutions has experienced unprecedented growth. The market encompasses various cooling technologies including air-based cooling systems, liquid cooling solutions, and innovative hybrid approaches designed to optimize energy efficiency while maintaining optimal operating temperatures for critical IT equipment.

Market dynamics in Denmark are particularly influenced by the country’s commitment to carbon neutrality and renewable energy adoption. With data centers consuming approximately 3% of Denmark’s total electricity, cooling systems account for nearly 40% of total data center energy consumption. This has driven significant investment in advanced cooling technologies that align with Denmark’s ambitious sustainability goals and stringent environmental regulations.

The Danish market benefits from favorable climatic conditions, with average annual temperatures supporting natural cooling methods for extended periods. Free cooling technologies can operate effectively for approximately 85% of the year in Denmark, providing substantial energy savings compared to traditional mechanical cooling systems. This natural advantage has attracted international hyperscale operators and cloud service providers to establish significant data center operations within Danish borders.

Technological innovation drives market evolution, with emerging solutions including immersion cooling, direct-to-chip liquid cooling, and AI-powered cooling optimization systems gaining traction. The integration of renewable energy sources, particularly wind power which accounts for over 50% of Denmark’s electricity generation, creates unique opportunities for sustainable data center cooling operations.

The Denmark data center cooling market refers to the comprehensive ecosystem of technologies, services, and solutions designed to maintain optimal operating temperatures within data center facilities across Denmark. This market encompasses the procurement, installation, maintenance, and optimization of cooling systems that ensure reliable operation of servers, storage systems, networking equipment, and other critical IT infrastructure components.

Data center cooling involves the removal of heat generated by electronic equipment and the maintenance of environmental conditions within specified temperature and humidity ranges. In the Danish context, this market includes traditional computer room air conditioning (CRAC) units, precision air conditioning systems, chilled water systems, evaporative cooling solutions, and advanced liquid cooling technologies.

The market extends beyond hardware components to include cooling services such as system design, installation, commissioning, maintenance, monitoring, and optimization. It also encompasses energy management solutions, thermal modeling, and consulting services that help data center operators achieve optimal cooling efficiency while minimizing environmental impact and operational costs.

Denmark’s data center cooling market demonstrates robust growth driven by increasing digitalization, cloud adoption, and the country’s emergence as a preferred location for sustainable data center operations. The market benefits from Denmark’s favorable regulatory environment, abundant renewable energy resources, and strategic geographic position serving Northern European markets.

Key market drivers include the rapid expansion of cloud services, growing demand for edge computing solutions, and increasing focus on energy efficiency and sustainability. Approximately 75% of new data center projects in Denmark incorporate advanced cooling technologies designed to minimize power usage effectiveness (PUE) and reduce carbon footprint.

The competitive landscape features a mix of international cooling technology providers, local system integrators, and specialized service companies. Market consolidation trends are evident as larger players acquire specialized cooling technology companies to expand their solution portfolios and geographic reach.

Regulatory compliance requirements related to energy efficiency and environmental impact continue to shape market dynamics. The Danish government’s commitment to achieving carbon neutrality by 2030 has accelerated adoption of innovative cooling solutions and created new opportunities for technology providers focused on sustainable data center operations.

Strategic market insights reveal several critical trends shaping the Denmark data center cooling landscape:

Digital transformation initiatives across Danish enterprises and government organizations create substantial demand for data center capacity, directly driving cooling system requirements. The accelerated adoption of cloud computing, artificial intelligence, and Internet of Things (IoT) applications generates increased heat loads that require sophisticated cooling solutions.

Sustainability mandates represent a primary market driver, with Denmark’s ambitious climate goals requiring data center operators to minimize energy consumption and carbon emissions. Government incentives for renewable energy adoption and energy efficiency improvements encourage investment in advanced cooling technologies that support environmental objectives.

Hyperscale expansion by major cloud service providers and content delivery networks drives demand for large-scale, efficient cooling solutions. International operators choose Denmark for its stable political environment, reliable power grid, and favorable cooling climate, creating opportunities for cooling technology providers.

Edge computing proliferation creates new market segments requiring distributed cooling solutions. The deployment of 5G networks and IoT infrastructure necessitates smaller data centers with specialized cooling requirements positioned closer to end users.

Regulatory compliance requirements related to energy efficiency standards and environmental reporting drive adoption of advanced cooling technologies. The European Union’s Energy Efficiency Directive and Denmark’s national climate policies create mandatory requirements for cooling system optimization.

Cost optimization pressures encourage operators to invest in efficient cooling solutions that reduce operational expenses. Rising energy costs and increasing focus on total cost of ownership drive demand for technologies that minimize long-term operational expenditure.

High capital investment requirements for advanced cooling technologies create barriers to adoption, particularly for smaller data center operators with limited financial resources. The initial cost of liquid cooling systems and sophisticated air conditioning equipment can be substantially higher than traditional cooling solutions.

Technical complexity associated with advanced cooling systems requires specialized expertise for design, installation, and maintenance. The shortage of qualified technicians and engineers with experience in modern cooling technologies constrains market growth and increases implementation risks.

Integration challenges with existing data center infrastructure can complicate cooling system upgrades and retrofits. Legacy facilities may require significant modifications to accommodate new cooling technologies, increasing project costs and complexity.

Regulatory uncertainty regarding future environmental standards and energy efficiency requirements creates hesitation among operators considering long-term cooling system investments. Potential changes in government policies or EU regulations may impact technology selection decisions.

Supply chain constraints for specialized cooling components and equipment can delay project implementations and increase costs. Global semiconductor shortages and manufacturing disruptions affect availability of critical cooling system components.

Performance reliability concerns related to newer cooling technologies may cause conservative operators to prefer proven traditional solutions. The perceived risk of system failures and their potential impact on critical IT operations influences technology adoption decisions.

Waste heat recovery presents significant opportunities for cooling system providers to develop integrated solutions that capture and utilize excess heat from data centers. Denmark’s extensive district heating network creates unique possibilities for beneficial heat reuse, potentially generating additional revenue streams for data center operators.

AI and machine learning integration offers opportunities to develop intelligent cooling systems that optimize performance based on real-time conditions and predictive analytics. Smart cooling solutions can automatically adjust parameters to minimize energy consumption while maintaining optimal operating conditions.

Renewable energy integration creates opportunities for cooling systems designed to operate efficiently with variable renewable power sources. Solutions that can adapt to fluctuating wind and solar power availability align with Denmark’s renewable energy abundance.

Modular data center growth opens new market segments for prefabricated cooling solutions that can be rapidly deployed and easily scaled. Containerized and modular data center designs require specialized cooling approaches that can be manufactured and tested off-site.

Retrofit and modernization projects provide opportunities to upgrade existing data center cooling infrastructure with more efficient technologies. As older facilities seek to improve energy efficiency and reduce operating costs, cooling system upgrades become priority investments.

International expansion opportunities exist for Danish cooling technology companies to leverage their expertise in cold climate optimization for global markets. The experience gained in Denmark’s unique operating environment can be valuable for similar climates worldwide.

Competitive dynamics in the Denmark data center cooling market reflect a balance between established international providers and emerging technology innovators. Market leaders focus on comprehensive solution portfolios while specialized companies target niche applications and advanced technologies.

Technology evolution drives continuous market transformation, with liquid cooling solutions gaining market share from traditional air-based systems. The transition toward higher-density computing and AI workloads accelerates adoption of direct liquid cooling and immersion cooling technologies.

Customer behavior patterns show increasing sophistication in cooling system evaluation, with operators conducting detailed total cost of ownership analyses and sustainability assessments. Decision-making processes increasingly involve multiple stakeholders including facilities management, IT operations, and sustainability teams.

Pricing dynamics reflect the premium associated with energy-efficient and sustainable cooling solutions. While initial costs may be higher, operators increasingly recognize the long-term value proposition of advanced cooling technologies through reduced operational expenses and improved reliability.

Partnership strategies become increasingly important as cooling system providers collaborate with data center developers, renewable energy companies, and technology integrators. Strategic alliances enable comprehensive solution delivery and market expansion opportunities.

Innovation cycles accelerate as market demands drive rapid technology development. The pace of cooling system innovation increases to address evolving requirements for efficiency, sustainability, and performance optimization.

Primary research activities encompass comprehensive interviews with key stakeholders across the Denmark data center cooling ecosystem, including cooling system manufacturers, data center operators, system integrators, and technology consultants. These interviews provide insights into market trends, technology preferences, and future requirements.

Secondary research involves analysis of industry reports, government publications, regulatory documents, and company financial statements to understand market structure and competitive dynamics. Technical literature and patent filings provide insights into emerging cooling technologies and innovation trends.

Market sizing methodologies utilize multiple approaches including top-down analysis based on data center capacity growth and bottom-up calculations based on cooling system deployment patterns. Cross-validation ensures accuracy and reliability of market assessments.

Stakeholder validation processes involve review of research findings with industry experts and market participants to ensure accuracy and completeness. Feedback from validation sessions refines analysis and enhances the quality of market insights.

Data collection protocols maintain strict quality standards and ensure consistency across research activities. Standardized questionnaires and interview guides facilitate systematic data gathering and analysis processes.

Greater Copenhagen region dominates the Danish data center cooling market, accounting for approximately 60% of total market activity. The concentration of major data center facilities in this area, driven by proximity to submarine cable landing points and robust fiber infrastructure, creates substantial demand for cooling solutions.

Jutland peninsula emerges as a growing market segment, particularly in areas with abundant renewable energy resources. The region’s access to wind power and lower land costs attract data center developments that require efficient cooling solutions optimized for sustainable operations.

Zealand region benefits from its strategic location and established industrial infrastructure, supporting both traditional and edge data center deployments. The area’s proximity to major population centers creates opportunities for waste heat recovery and district heating integration.

Bornholm island represents a unique market segment focused on renewable energy integration and grid stability applications. Data center cooling solutions in this region must accommodate variable power availability and support grid balancing requirements.

Regional specialization patterns reflect local advantages and market conditions. Coastal areas leverage natural cooling opportunities while inland regions focus on renewable energy integration and agricultural waste heat utilization.

Market leadership in the Denmark data center cooling sector is characterized by a diverse ecosystem of international technology providers and specialized local companies:

Competitive strategies focus on sustainability credentials, energy efficiency performance, and total cost of ownership optimization. Companies differentiate through technology innovation, service capabilities, and local market expertise.

By Cooling Technology:

By Data Center Type:

By Application:

Air-based cooling systems continue to dominate the market, representing approximately 70% of installed cooling capacity. However, their market share is gradually declining as liquid cooling technologies gain adoption for high-density applications and sustainability-focused deployments.

Liquid cooling solutions experience rapid growth, particularly in hyperscale and high-performance computing applications. Direct-to-chip cooling systems show strong adoption rates among operators seeking maximum energy efficiency and heat density management capabilities.

Free cooling technologies benefit from Denmark’s favorable climate conditions, enabling natural cooling for extended periods throughout the year. These systems achieve significant energy savings and support sustainability objectives while reducing operational costs.

Modular cooling systems gain traction as data center operators seek flexible, scalable solutions that can adapt to changing capacity requirements. Prefabricated cooling modules enable rapid deployment and standardized performance characteristics.

Smart cooling solutions incorporating IoT sensors, AI analytics, and automated control systems represent the fastest-growing market segment. These technologies enable predictive maintenance, optimal performance tuning, and energy consumption optimization.

Data center operators benefit from reduced energy consumption, lower operational costs, and improved sustainability credentials through advanced cooling technologies. Enhanced reliability and performance optimization contribute to better service quality and customer satisfaction.

Cooling system providers gain access to a growing market with strong emphasis on innovation and sustainability. The Danish market serves as a testing ground for advanced technologies that can be deployed globally, providing competitive advantages and technology validation.

Technology integrators benefit from increasing demand for complex cooling system installations and ongoing maintenance services. The market’s focus on energy efficiency and sustainability creates opportunities for specialized expertise and value-added services.

Government and regulatory bodies achieve environmental and energy efficiency objectives through market-driven adoption of sustainable cooling technologies. The data center sector’s contribution to carbon reduction goals supports national climate commitments.

End users and enterprises benefit from improved service reliability, reduced environmental impact, and potentially lower costs as data center operators optimize their cooling infrastructure. Enhanced performance and availability support digital transformation initiatives.

Local communities benefit from waste heat recovery programs, job creation in the technology sector, and reduced environmental impact from data center operations. District heating integration provides additional community benefits.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as the dominant trend, with cooling system selection increasingly driven by environmental impact considerations. Operators prioritize solutions that minimize carbon footprint and support renewable energy integration, fundamentally changing technology evaluation criteria.

Liquid cooling adoption accelerates across various data center types, driven by increasing compute density and heat generation from AI and high-performance computing workloads. Direct-to-chip cooling and immersion cooling technologies transition from niche applications to mainstream deployment.

AI-powered optimization transforms cooling system management through predictive analytics, automated control, and machine learning algorithms. These technologies enable dynamic optimization based on real-time conditions, weather forecasts, and workload patterns.

Waste heat utilization becomes increasingly important as operators seek to maximize energy efficiency and create additional value streams. Integration with district heating networks and other heat recovery applications supports both sustainability goals and economic optimization.

Modular and prefabricated solutions gain popularity as operators seek faster deployment, standardized performance, and scalable capacity expansion. Factory-built cooling modules reduce on-site construction time and ensure consistent quality standards.

Edge computing proliferation creates demand for compact, efficient cooling solutions suitable for smaller facilities and distributed deployments. These applications require different cooling approaches optimized for space constraints and remote operation.

Major infrastructure investments by international hyperscale operators continue to drive market expansion, with several large-scale data center projects incorporating advanced cooling technologies. These developments demonstrate confidence in Denmark’s market potential and regulatory environment.

Technology partnerships between cooling system providers and renewable energy companies create integrated solutions that optimize both cooling efficiency and sustainable power utilization. These collaborations develop innovative approaches to variable renewable energy integration.

Research and development initiatives at Danish universities and technology institutes focus on next-generation cooling technologies and energy optimization strategies. MarkWide Research indicates that public-private partnerships in cooling technology development have increased by 45% over the past two years.

Regulatory developments including updated energy efficiency standards and environmental reporting requirements continue to shape market dynamics. New regulations emphasize lifecycle environmental impact assessment and circular economy principles in cooling system design.

Market consolidation activities involve acquisitions and strategic partnerships as companies seek to expand their technology portfolios and geographic reach. These developments create more comprehensive solution providers capable of addressing diverse customer requirements.

Pilot projects for innovative cooling technologies including quantum cooling, magnetic refrigeration, and advanced heat pump systems demonstrate the market’s commitment to technological advancement and sustainability improvement.

Investment prioritization should focus on cooling technologies that demonstrate clear sustainability benefits and energy efficiency improvements. Operators should conduct comprehensive lifecycle assessments to evaluate total environmental impact and long-term cost implications.

Technology diversification strategies should incorporate multiple cooling approaches to optimize performance across varying conditions and applications. Hybrid systems that combine air and liquid cooling provide flexibility and risk mitigation benefits.

Skill development initiatives are essential to address the shortage of qualified technicians and engineers with advanced cooling system expertise. Training programs and certification courses should be established to support market growth and technology adoption.

Partnership development with renewable energy providers, district heating operators, and technology integrators creates opportunities for innovative solutions and market expansion. Collaborative approaches enable comprehensive value propositions and competitive differentiation.

Regulatory compliance preparation should anticipate future environmental standards and energy efficiency requirements. Proactive compliance strategies reduce implementation risks and ensure long-term operational viability.

Market expansion strategies should leverage Danish cooling expertise for international opportunities in similar climate regions. Export potential exists for technologies and services developed in the Danish market context.

Market evolution over the next decade will be characterized by continued growth driven by digital transformation, sustainability requirements, and technological innovation. The Denmark data center cooling market is projected to experience robust expansion with compound annual growth rates exceeding 8% through 2030.

Technology advancement will focus on energy efficiency optimization, renewable energy integration, and intelligent system management. Liquid cooling technologies are expected to achieve 30% market penetration within five years, driven by increasing compute density and sustainability requirements.

Sustainability leadership will position Denmark as a global reference for environmentally responsible data center cooling practices. The integration of cooling systems with renewable energy sources and waste heat recovery will become standard practice rather than exceptional implementation.

Market maturation will bring increased standardization, improved cost-effectiveness, and broader technology adoption across various data center types. Edge computing expansion will create new market segments requiring specialized cooling solutions optimized for distributed deployments.

International recognition of Danish cooling expertise will create export opportunities and technology transfer possibilities. According to MWR analysis, Danish cooling technology companies are positioned to capture significant market share in similar climate regions globally.

Innovation acceleration will continue as market demands drive development of next-generation cooling technologies. Quantum cooling, advanced materials, and AI-powered optimization systems represent emerging opportunities for market differentiation and performance improvement.

The Denmark data center cooling market represents a dynamic and rapidly evolving sector positioned at the intersection of digital transformation, sustainability imperatives, and technological innovation. The market benefits from unique advantages including favorable climate conditions, abundant renewable energy resources, and strong regulatory support for environmental responsibility.

Market growth prospects remain robust, driven by increasing digitalization, cloud adoption, and the country’s emergence as a preferred location for sustainable data center operations. The combination of natural cooling advantages and advanced technology adoption creates a compelling value proposition for both domestic and international operators.

Sustainability focus will continue to be the primary driver of market evolution, with cooling system selection increasingly based on environmental impact and energy efficiency considerations. The integration of renewable energy sources and waste heat recovery will become standard practice, supporting Denmark’s ambitious climate goals.

Technology innovation will accelerate as market demands drive development of more efficient, intelligent, and sustainable cooling solutions. The transition toward liquid cooling, AI-powered optimization, and integrated energy management systems will reshape the competitive landscape and create new opportunities for market participants.

The Denmark data center cooling market is well-positioned for continued growth and innovation, serving as a model for sustainable data center operations and a testing ground for next-generation cooling technologies that will shape the global industry’s future development.

What is Data Center Cooling?

Data Center Cooling refers to the methods and technologies used to maintain optimal temperatures in data centers, ensuring efficient operation of servers and IT equipment. Effective cooling is crucial for preventing overheating and ensuring reliability in data processing environments.

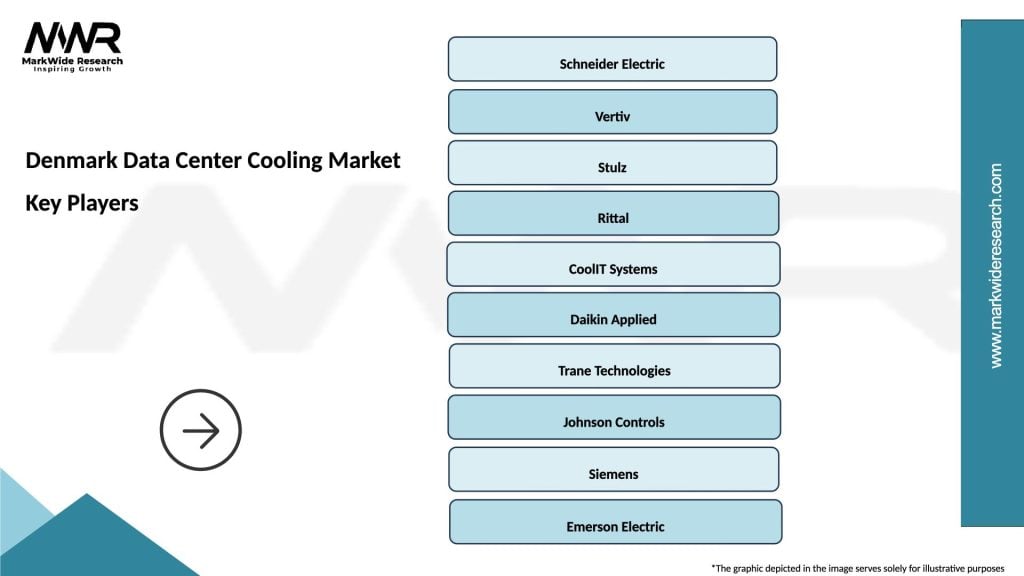

What are the key players in the Denmark Data Center Cooling Market?

Key players in the Denmark Data Center Cooling Market include companies like Schneider Electric, Vertiv, and Stulz, which provide innovative cooling solutions tailored for data centers. These companies focus on energy efficiency and advanced cooling technologies, among others.

What are the main drivers of the Denmark Data Center Cooling Market?

The main drivers of the Denmark Data Center Cooling Market include the increasing demand for data storage and processing, the growth of cloud computing, and the need for energy-efficient cooling solutions. Additionally, the rise in digital transformation across various industries fuels the market’s expansion.

What challenges does the Denmark Data Center Cooling Market face?

Challenges in the Denmark Data Center Cooling Market include the high costs associated with advanced cooling technologies and the need for continuous innovation to keep up with rapidly changing IT demands. Furthermore, environmental regulations may impose additional constraints on cooling practices.

What opportunities exist in the Denmark Data Center Cooling Market?

Opportunities in the Denmark Data Center Cooling Market include the development of sustainable cooling solutions and the integration of AI and IoT technologies for smarter cooling management. As data centers strive for greater efficiency, innovative cooling methods will likely gain traction.

What trends are shaping the Denmark Data Center Cooling Market?

Trends shaping the Denmark Data Center Cooling Market include the adoption of liquid cooling systems, the use of renewable energy sources for cooling, and the implementation of modular data center designs. These trends reflect a shift towards more efficient and environmentally friendly cooling solutions.

Denmark Data Center Cooling Market

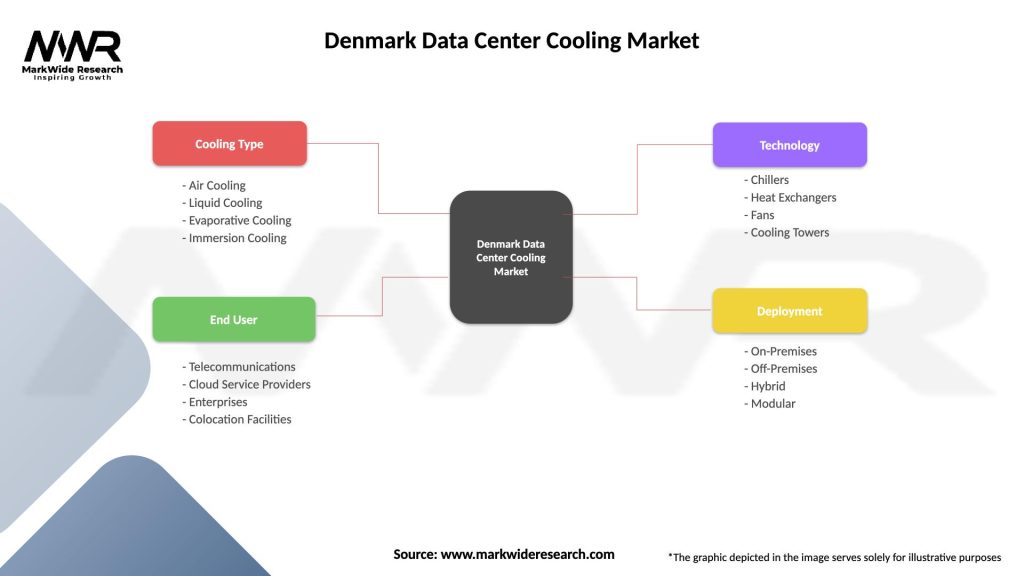

| Segmentation Details | Description |

|---|---|

| Cooling Type | Air Cooling, Liquid Cooling, Evaporative Cooling, Immersion Cooling |

| End User | Telecommunications, Cloud Service Providers, Enterprises, Colocation Facilities |

| Technology | Chillers, Heat Exchangers, Fans, Cooling Towers |

| Deployment | On-Premises, Off-Premises, Hybrid, Modular |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Denmark Data Center Cooling Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at