444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States over-the-counter drugs market represents a dynamic and rapidly evolving healthcare segment that continues to experience substantial growth driven by increasing consumer preference for self-medication and accessible healthcare solutions. Over-the-counter medications have become an integral component of American healthcare, offering consumers convenient access to treatments for common ailments without requiring prescription authorization from healthcare providers.

Market dynamics indicate robust expansion across multiple therapeutic categories, with the sector demonstrating remarkable resilience and adaptability to changing consumer needs. The market encompasses a comprehensive range of pharmaceutical products including pain relievers, cough and cold medications, digestive health products, vitamins and supplements, and topical treatments. Consumer behavior patterns show increasing sophistication in self-care decisions, with Americans spending significant amounts annually on non-prescription medications.

Growth trajectories suggest the market is expanding at a compound annual growth rate of approximately 6.2%, reflecting strong consumer confidence in OTC solutions and the ongoing trend toward preventive healthcare. Demographic shifts including an aging population and increased health consciousness among younger consumers are contributing to sustained market momentum across diverse product categories.

The United States over-the-counter drugs market refers to the comprehensive ecosystem of non-prescription pharmaceutical products that consumers can purchase directly from retail outlets without requiring medical prescriptions or healthcare provider authorization for treatment of minor health conditions and wellness maintenance.

Over-the-counter medications encompass a broad spectrum of therapeutic products regulated by the Food and Drug Administration (FDA) that have been deemed safe and effective for consumer use when following labeled directions. These products include analgesics, antihistamines, antacids, cough suppressants, topical antiseptics, vitamins, minerals, and various health supplements designed to address common health concerns.

Market participants include major pharmaceutical manufacturers, generic drug producers, private label brands, and specialty health product companies that develop, manufacture, and distribute OTC medications through various retail channels including pharmacies, grocery stores, mass merchandisers, and online platforms.

Strategic analysis reveals the United States over-the-counter drugs market is experiencing unprecedented growth driven by evolving consumer healthcare preferences, demographic transitions, and increased accessibility through diverse retail channels. Market penetration continues expanding across all major therapeutic categories, with pain management products maintaining the largest market share at approximately 23% of total OTC sales.

Consumer trends indicate growing preference for natural and organic formulations, with herbal and dietary supplement segments showing particularly strong growth momentum. Digital transformation is reshaping market dynamics through e-commerce platforms, telemedicine integration, and mobile health applications that facilitate informed consumer decision-making regarding OTC product selection.

Competitive landscape features established pharmaceutical giants alongside emerging specialty brands, creating a diverse ecosystem that serves varied consumer preferences and price points. Innovation drivers include advanced drug delivery systems, combination therapies, and personalized health solutions that enhance therapeutic efficacy and consumer convenience.

Regulatory environment remains supportive of market expansion while maintaining stringent safety standards, with recent FDA initiatives streamlining approval processes for certain OTC categories and enabling prescription-to-OTC switches for qualified medications.

Market intelligence reveals several critical insights shaping the United States over-the-counter drugs landscape:

Market segmentation analysis indicates pain relief products maintain dominant position, followed by cough and cold medications, digestive health products, and vitamins and supplements. Regional variations show stronger growth in urban markets with higher disposable incomes and health consciousness levels.

Primary growth drivers propelling the United States over-the-counter drugs market include several interconnected factors that create sustained demand across multiple therapeutic categories. Healthcare cost containment pressures motivate consumers to seek affordable self-treatment options for minor ailments, reducing reliance on expensive physician visits and prescription medications.

Demographic transitions significantly impact market dynamics, with an aging population requiring increased management of chronic conditions and age-related health concerns. Baby boomers represent a substantial consumer segment driving demand for arthritis pain relievers, digestive aids, and cardiovascular health supplements. Simultaneously, millennial consumers demonstrate strong preference for preventive healthcare solutions and natural wellness products.

Digital health revolution enhances consumer access to medical information and self-diagnosis tools, empowering individuals to make informed decisions about OTC medication selection. Telemedicine platforms and health applications provide guidance on appropriate OTC treatments, expanding market reach and consumer confidence in self-care approaches.

Regulatory facilitation through FDA prescription-to-OTC switches creates new market opportunities by making previously prescription-only medications available for consumer purchase. Recent switches in categories such as allergy medications and acid reducers have significantly expanded addressable market segments.

Market constraints present challenges that could potentially limit growth in the United States over-the-counter drugs sector. Regulatory complexity surrounding FDA approval processes for new OTC products creates barriers to entry for smaller manufacturers and can delay product launches, limiting innovation and market expansion opportunities.

Safety concerns regarding self-medication practices pose ongoing challenges, particularly with consumers potentially misusing OTC products or experiencing adverse interactions with prescription medications. Healthcare provider skepticism about patient self-treatment capabilities sometimes discourages OTC adoption, especially for complex health conditions requiring professional medical supervision.

Economic pressures during periods of financial uncertainty can reduce consumer spending on non-essential health products, particularly premium-priced vitamins and supplements. Insurance coverage limitations for OTC products, unlike prescription medications, place full cost burden on consumers, potentially limiting accessibility for price-sensitive market segments.

Competition from prescription alternatives and generic medications can erode OTC market share, especially when prescription options become more affordable through insurance coverage or generic availability. Counterfeit products and unregulated online sales channels create consumer safety risks and undermine confidence in legitimate OTC brands.

Emerging opportunities in the United States over-the-counter drugs market present significant potential for growth and innovation across multiple dimensions. Digital health integration offers unprecedented possibilities for personalized OTC recommendations through artificial intelligence, wearable device data, and consumer health profiles that optimize treatment selection and dosing protocols.

Natural and organic segments represent rapidly expanding opportunities as consumers increasingly seek plant-based, sustainable, and environmentally conscious healthcare solutions. Herbal supplements and traditional medicine formulations adapted for modern consumers show particularly strong growth potential, especially among health-conscious demographics.

Prescription-to-OTC switches continue creating new market categories, with several promising candidates in development including certain cholesterol medications, diabetes management products, and specialized dermatological treatments. MarkWide Research analysis suggests these switches could expand addressable market segments by approximately 15-20% over the next five years.

E-commerce expansion enables direct-to-consumer marketing strategies, subscription-based delivery models, and personalized product recommendations that enhance customer loyalty and lifetime value. International expansion opportunities through cross-border e-commerce platforms allow domestic manufacturers to access global markets with established OTC product portfolios.

Market dynamics in the United States over-the-counter drugs sector reflect complex interactions between consumer behavior, regulatory environment, technological advancement, and competitive pressures. Supply chain evolution demonstrates increasing sophistication with direct-to-consumer fulfillment, automated inventory management, and predictive analytics optimizing product availability across diverse retail channels.

Consumer purchasing patterns show significant seasonal variations, with cough and cold products experiencing peak demand during winter months while sun protection and allergy medications surge during spring and summer periods. Brand loyalty dynamics vary considerably across therapeutic categories, with pain relievers showing strong brand preference while generic alternatives capture substantial market share in basic therapeutic areas.

Innovation cycles accelerate through advanced research and development investments, with pharmaceutical companies dedicating increasing resources to OTC product development and line extensions. Formulation improvements including extended-release technologies, combination therapies, and enhanced bioavailability create competitive advantages and premium pricing opportunities.

Retail channel dynamics continue evolving with traditional pharmacies facing competition from mass merchandisers, grocery chains, and online platforms. Private label growth represents approximately 18% of total OTC sales, offering retailers higher margins while providing consumers with cost-effective alternatives to national brands.

Comprehensive research methodology employed for analyzing the United States over-the-counter drugs market incorporates multiple data collection and analysis techniques to ensure accuracy, reliability, and actionable insights. Primary research includes extensive surveys of consumers, healthcare professionals, retail pharmacists, and industry executives to capture firsthand perspectives on market trends, preferences, and challenges.

Secondary research encompasses analysis of FDA databases, industry publications, company financial reports, patent filings, and regulatory documents to establish comprehensive market understanding. Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting methodologies to project market growth trajectories and identify emerging opportunities.

Qualitative research incorporates focus groups, in-depth interviews, and expert consultations to understand consumer motivations, decision-making processes, and unmet needs in the OTC medication space. Market segmentation analysis employs demographic, psychographic, and behavioral variables to identify distinct consumer groups and their specific requirements.

Competitive intelligence gathering includes monitoring competitor activities, product launches, pricing strategies, and marketing campaigns to assess market positioning and strategic initiatives. Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification of findings and conclusions.

Regional market analysis reveals significant variations in over-the-counter drug consumption patterns, preferences, and growth rates across different United States geographic regions. Northeast markets demonstrate higher per-capita OTC spending, driven by urban populations with greater health consciousness and disposable income levels, accounting for approximately 28% of national OTC sales.

Southern regions show strong growth in diabetes management and cardiovascular health products, reflecting demographic health patterns and lifestyle factors prevalent in these areas. Western markets lead in natural and organic OTC product adoption, with California and Pacific Northwest states showing particularly strong preference for herbal supplements and alternative health solutions.

Midwest markets maintain steady demand across traditional OTC categories, with strong performance in pain relief and cold/flu medications. Rural versus urban consumption patterns reveal distinct preferences, with rural consumers showing greater brand loyalty while urban markets demonstrate higher willingness to try new products and premium formulations.

State-level variations reflect local regulations, healthcare infrastructure, and demographic characteristics that influence OTC market dynamics. Climate factors significantly impact seasonal product demand, with southern states showing extended allergy seasons while northern regions experience concentrated cold and flu medication sales during winter months.

Competitive landscape in the United States over-the-counter drugs market features a diverse ecosystem of established pharmaceutical giants, specialty health companies, and emerging innovative brands competing across multiple therapeutic categories and price points.

Market consolidation continues through strategic acquisitions and partnerships, with major pharmaceutical companies expanding OTC portfolios through targeted acquisitions of specialty brands and emerging product categories. Innovation competition intensifies as companies invest in advanced formulations, delivery systems, and combination therapies to differentiate products and command premium pricing.

Market segmentation analysis reveals the United States over-the-counter drugs market comprises multiple distinct categories serving diverse consumer needs and therapeutic applications. By Product Type, the market segments into several major categories with varying growth trajectories and market dynamics.

By Therapeutic Category:

By Distribution Channel:

Category-specific analysis provides detailed insights into performance drivers and growth opportunities across major over-the-counter drug segments. Pain relief products maintain market leadership through consistent consumer demand and brand loyalty, with ibuprofen-based products showing particularly strong growth among active adult demographics.

Cough and cold medications experience significant seasonal volatility but demonstrate resilient long-term growth driven by recurring annual demand cycles. Innovation trends in this category focus on multi-symptom relief formulations and natural ingredient integration to appeal to health-conscious consumers seeking effective yet gentle treatment options.

Digestive health products benefit from increasing consumer awareness of gut health importance and growing prevalence of digestive issues related to dietary and lifestyle factors. Probiotic supplements represent the fastest-growing subcategory, with sales increasing at approximately 12% annually as consumers seek preventive digestive health solutions.

Vitamins and supplements continue expanding through demographic trends favoring preventive healthcare and wellness optimization. Specialty formulations targeting specific age groups, gender-specific needs, and lifestyle requirements drive premium pricing and market differentiation opportunities across this diverse category.

Industry participants in the United States over-the-counter drugs market enjoy numerous strategic advantages and growth opportunities that create value for manufacturers, retailers, and service providers. Pharmaceutical manufacturers benefit from reduced regulatory complexity compared to prescription drugs, shorter development timelines, and direct consumer marketing capabilities that enable brand building and customer loyalty development.

Retail stakeholders gain from higher profit margins on OTC products compared to prescription medications, increased customer traffic, and opportunities for private label development that enhance competitive positioning. Healthcare providers benefit from reduced patient consultation demands for minor ailments, allowing focus on more complex medical conditions requiring professional expertise.

Consumer benefits include convenient access to effective treatments, cost savings compared to prescription alternatives, and empowerment to manage minor health conditions independently. Insurance companies experience reduced claims costs when consumers choose OTC alternatives for appropriate conditions, contributing to overall healthcare cost containment efforts.

Technology companies find opportunities in digital health integration, e-commerce platform development, and data analytics services that support personalized OTC recommendations and inventory optimization for retail partners.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the United States over-the-counter drugs market reflect evolving consumer preferences, technological advancement, and healthcare industry transformation. Natural and organic formulations gain increasing market share as consumers seek plant-based alternatives to synthetic medications, with herbal supplement sales growing at approximately 8.5% annually.

Personalization trends drive development of targeted formulations for specific demographic groups, including age-specific vitamins, gender-tailored supplements, and condition-specific combination therapies. Digital health integration enables smart packaging, dosage tracking applications, and AI-powered product recommendations that enhance consumer experience and treatment outcomes.

Sustainability initiatives influence packaging design, manufacturing processes, and ingredient sourcing as environmentally conscious consumers prefer brands demonstrating ecological responsibility. Convenience innovations include single-dose packaging, dissolvable formulations, and extended-release technologies that improve medication adherence and user experience.

Preventive healthcare focus shifts consumer attention toward wellness maintenance rather than reactive treatment, driving growth in immune support products, stress management supplements, and lifestyle-specific health solutions. MarkWide Research indicates that preventive health products represent the fastest-growing OTC segment, with market penetration increasing by 22% over the past three years.

Recent industry developments demonstrate the dynamic nature of the United States over-the-counter drugs market, with significant advances in product innovation, regulatory approvals, and strategic business initiatives reshaping competitive landscape. FDA prescription-to-OTC switches continue creating new market opportunities, with several high-profile approvals expanding consumer access to previously prescription-only medications.

Merger and acquisition activity intensifies as major pharmaceutical companies seek to strengthen OTC portfolios through strategic acquisitions of specialty brands and emerging product categories. Technology partnerships between traditional pharmaceutical companies and digital health startups enable innovative product development and enhanced consumer engagement strategies.

Regulatory modernization initiatives streamline approval processes for certain OTC categories while maintaining safety standards, reducing time-to-market for new products and encouraging innovation investment. Supply chain optimization efforts focus on improving product availability, reducing costs, and enhancing distribution efficiency across diverse retail channels.

International expansion strategies enable domestic manufacturers to access global markets, while foreign companies establish stronger presence in the United States market through local partnerships and direct investment initiatives.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing competitive challenges in the evolving United States over-the-counter drugs landscape. Innovation investment should prioritize natural formulations, advanced delivery systems, and personalized health solutions that align with consumer preferences for effective, convenient, and sustainable healthcare options.

Digital transformation initiatives require comprehensive e-commerce strategies, data analytics capabilities, and consumer engagement platforms that enhance brand loyalty and market share. Partnership strategies with healthcare providers, technology companies, and retail partners can create synergistic value propositions and expanded market access opportunities.

Brand differentiation efforts should emphasize unique value propositions, clinical efficacy, and consumer education to justify premium pricing and build sustainable competitive advantages. Market expansion opportunities exist in underserved demographic segments, emerging therapeutic categories, and geographic regions with growing healthcare awareness.

Regulatory compliance and safety monitoring remain critical success factors, requiring robust quality systems and proactive risk management approaches that protect brand reputation and consumer trust. Supply chain resilience investments ensure product availability and cost competitiveness in an increasingly complex global marketplace.

Future prospects for the United States over-the-counter drugs market appear highly favorable, with multiple growth drivers supporting sustained expansion across diverse therapeutic categories and consumer segments. Demographic trends including population aging and increased health consciousness create long-term demand stability while emerging consumer preferences drive innovation and market evolution.

Technology integration will continue transforming market dynamics through artificial intelligence, personalized medicine, and digital health platforms that enhance consumer experience and treatment outcomes. Market projections suggest continued growth at approximately 6-7% annually over the next five years, driven by new product launches, prescription-to-OTC switches, and expanding consumer acceptance of self-care approaches.

Innovation acceleration in natural products, combination therapies, and advanced formulations will create new market segments and premium pricing opportunities for companies investing in research and development. Regulatory evolution toward more streamlined approval processes and expanded OTC categories will facilitate market growth while maintaining consumer safety standards.

Global market integration through e-commerce platforms and international partnerships will expand opportunities for domestic manufacturers while introducing new competitive pressures from international brands. MWR analysis indicates that companies successfully adapting to digital transformation and consumer preference evolution will capture disproportionate market share growth in the coming decade.

Comprehensive analysis of the United States over-the-counter drugs market reveals a robust, dynamic sector positioned for sustained growth driven by favorable demographic trends, evolving consumer preferences, and continuous innovation in product development and delivery mechanisms. Market fundamentals remain strong across all major therapeutic categories, with particular strength in pain management, digestive health, and preventive wellness segments.

Strategic opportunities abound for companies capable of adapting to changing consumer needs, embracing digital transformation, and investing in natural and personalized health solutions. Competitive advantages will increasingly depend on brand differentiation, innovation capabilities, and effective omnichannel distribution strategies that serve diverse consumer preferences and shopping behaviors.

Future success in this market requires balancing traditional pharmaceutical expertise with modern consumer marketing approaches, technology integration, and sustainability initiatives that resonate with environmentally conscious consumers. The United States over-the-counter drugs market represents a compelling investment opportunity for companies positioned to capitalize on the ongoing transformation of American healthcare toward more accessible, affordable, and consumer-directed treatment options.

What is Over-The-Counter Drugs?

Over-The-Counter (OTC) drugs are medications that can be purchased without a prescription. They are commonly used for treating minor ailments such as headaches, colds, and allergies, and are available in various forms including tablets, liquids, and creams.

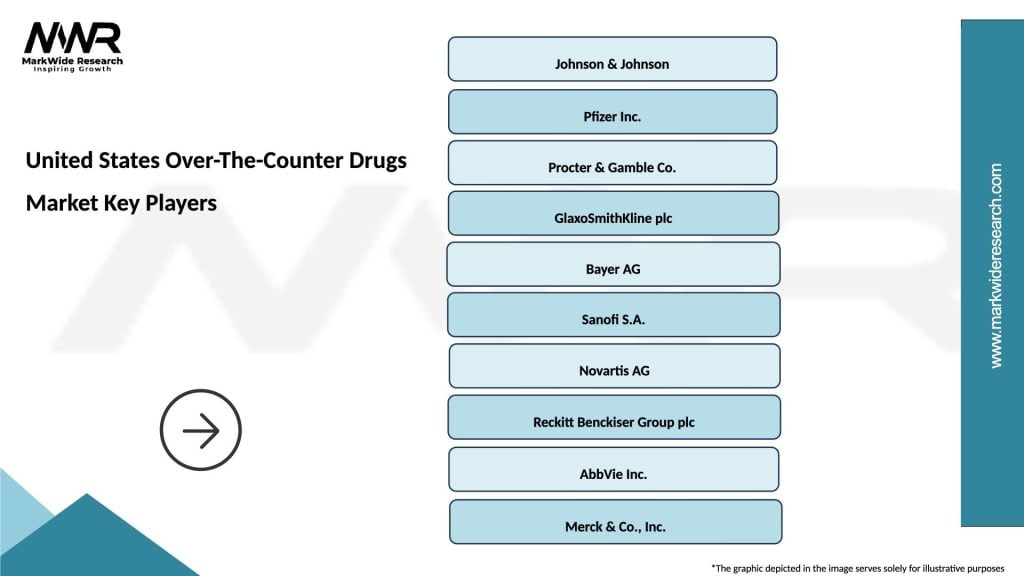

What are the key players in the United States Over-The-Counter Drugs Market?

Key players in the United States Over-The-Counter Drugs Market include Johnson & Johnson, Procter & Gamble, Pfizer, and GlaxoSmithKline, among others. These companies are known for their extensive product lines and strong market presence.

What are the growth factors driving the United States Over-The-Counter Drugs Market?

The growth of the United States Over-The-Counter Drugs Market is driven by factors such as increasing consumer awareness about self-medication, the rising prevalence of chronic diseases, and the convenience of purchasing OTC products without a prescription.

What challenges does the United States Over-The-Counter Drugs Market face?

The United States Over-The-Counter Drugs Market faces challenges such as regulatory hurdles, competition from prescription drugs, and the potential for misuse of certain OTC medications. These factors can impact market growth and consumer trust.

What opportunities exist in the United States Over-The-Counter Drugs Market?

Opportunities in the United States Over-The-Counter Drugs Market include the development of new formulations, expansion into e-commerce platforms, and increasing demand for natural and herbal remedies. These trends can enhance market growth and consumer engagement.

What trends are shaping the United States Over-The-Counter Drugs Market?

Trends shaping the United States Over-The-Counter Drugs Market include the rise of personalized medicine, the growing popularity of health and wellness products, and advancements in digital health technologies. These trends are influencing consumer preferences and product offerings.

United States Over-The-Counter Drugs Market

| Segmentation Details | Description |

|---|---|

| Product Type | Pain Relievers, Cold & Allergy Medications, Digestive Aids, Sleep Aids |

| Dosage Form | Tablets, Capsules, Liquids, Powders |

| Route of Administration | Oral, Topical, Nasal, Rectal |

| Packaging Type | Blister Packs, Bottles, Sachets, Tubes |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Over-The-Counter Drugs Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at