444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa two-wheeler market represents a dynamic and rapidly evolving segment within the country’s automotive industry, characterized by increasing urbanization, changing consumer preferences, and growing demand for affordable transportation solutions. Two-wheelers in South Africa encompass motorcycles, scooters, and electric bikes that serve diverse consumer needs ranging from daily commuting to recreational activities. The market has experienced significant transformation over recent years, driven by economic factors, infrastructure development, and shifting mobility patterns across urban and rural areas.

Market dynamics indicate robust growth potential, with the sector benefiting from rising fuel costs, traffic congestion in major cities, and increasing awareness of environmental sustainability. The South African two-wheeler market demonstrates strong resilience despite economic challenges, with manufacturers and dealers adapting to local preferences and requirements. Growth rates have shown consistent upward trends, particularly in the entry-level and mid-segment categories, reflecting the market’s accessibility to a broader consumer base.

Regional distribution across South Africa shows concentrated demand in major metropolitan areas including Johannesburg, Cape Town, Durban, and Pretoria, while rural markets present emerging opportunities for affordable mobility solutions. The market landscape encompasses both imported and locally assembled vehicles, with competitive pricing strategies playing a crucial role in market penetration and consumer adoption rates.

The South Africa two-wheeler market refers to the comprehensive ecosystem of motorcycles, scooters, electric bikes, and related vehicles with two wheels that are manufactured, imported, distributed, and sold within South African borders. This market encompasses various vehicle categories ranging from small-displacement commuter bikes to high-performance motorcycles, serving diverse consumer segments including urban commuters, delivery services, recreational riders, and rural transportation needs.

Two-wheeler vehicles in this context include traditional internal combustion engine motorcycles, automatic scooters, manual transmission bikes, and increasingly popular electric two-wheelers. The market definition extends beyond vehicle sales to include aftermarket services, spare parts, accessories, financing solutions, and maintenance services that support the complete ownership experience for South African consumers.

Market participants include international manufacturers, local assemblers, authorized dealers, independent retailers, and service providers who collectively contribute to the market’s growth and development. The scope encompasses both new vehicle sales and the thriving used vehicle segment, which plays a significant role in making two-wheeler transportation accessible to price-sensitive consumers across different economic segments.

South Africa’s two-wheeler market demonstrates remarkable resilience and growth potential, driven by urbanization trends, economic considerations, and evolving transportation preferences. The market has shown consistent expansion with annual growth rates reflecting strong consumer demand across multiple segments. Key market drivers include rising fuel costs, traffic congestion in major cities, and increasing adoption of two-wheelers as primary transportation modes for daily commuting and commercial applications.

Competitive landscape features a mix of established international brands and emerging local players, with market share distribution showing healthy competition across different price segments. The entry-level segment continues to dominate sales volumes, while premium and electric segments show promising growth trajectories. Consumer preferences increasingly favor fuel-efficient, reliable, and affordable models that offer practical solutions for South African road conditions and economic realities.

Market challenges include economic volatility, regulatory changes, and infrastructure limitations, while opportunities emerge from growing urbanization, expanding middle class, and increasing environmental consciousness. The market’s future outlook remains positive, supported by demographic trends, technological advancements, and evolving mobility patterns that favor two-wheeler adoption across diverse consumer segments.

Strategic insights reveal several critical factors shaping the South African two-wheeler market landscape:

Primary market drivers propelling the South African two-wheeler market include multiple interconnected factors that create favorable conditions for sustained growth and expansion.

Economic factors play a fundamental role, with two-wheelers offering significantly lower total cost of ownership compared to cars. The affordability advantage extends beyond initial purchase price to include reduced fuel consumption, lower insurance premiums, minimal maintenance costs, and affordable spare parts availability. These economic benefits make two-wheelers particularly attractive to cost-conscious consumers and first-time vehicle buyers.

Urbanization trends across South Africa create increasing demand for efficient transportation solutions. As more people migrate to cities for employment opportunities, the need for affordable and practical mobility options grows substantially. Traffic congestion in major metropolitan areas makes two-wheelers highly practical for navigating crowded streets and reducing commute times significantly.

Infrastructure development supports market growth through improved road networks, better connectivity between urban and rural areas, and enhanced safety measures. Government initiatives promoting transportation accessibility and economic development indirectly benefit the two-wheeler market by creating favorable conditions for adoption and usage.

Demographic shifts including a growing young population, expanding middle class, and increasing female participation in the workforce contribute to market expansion. These demographic trends create new consumer segments with distinct preferences and requirements for personal mobility solutions.

Market restraints present challenges that may limit the full potential of South Africa’s two-wheeler market growth and development.

Safety concerns represent a significant restraint, with two-wheelers generally perceived as less safe than four-wheelers. Accident rates and injury severity associated with motorcycle accidents create consumer hesitation, particularly among safety-conscious buyers and families. Limited protective features compared to cars contribute to these safety perceptions and may restrict market penetration in certain consumer segments.

Weather dependency poses practical challenges for two-wheeler usage in South Africa’s diverse climate conditions. Seasonal variations, rainfall patterns, and extreme weather events can limit the practicality of two-wheelers as primary transportation modes, particularly for daily commuting and long-distance travel.

Infrastructure limitations including inadequate parking facilities, limited dedicated lanes, and insufficient charging infrastructure for electric vehicles constrain market growth. Poor road conditions in certain areas and lack of proper maintenance facilities in rural regions further limit market expansion opportunities.

Regulatory challenges including licensing requirements, safety regulations, and import duties affect market dynamics. Complex registration processes, mandatory safety equipment requirements, and varying provincial regulations create barriers for both consumers and manufacturers operating in the market.

Economic volatility and currency fluctuations impact import costs, pricing strategies, and consumer purchasing power, creating uncertainty for market participants and affecting long-term planning and investment decisions.

Significant opportunities exist within the South African two-wheeler market, driven by evolving consumer needs, technological advancements, and changing market dynamics.

Electric vehicle transition presents substantial growth opportunities as environmental consciousness increases and government policies support sustainable transportation. The electric two-wheeler segment offers potential for rapid expansion, particularly in urban areas where environmental concerns and fuel cost savings drive adoption. Technological improvements in battery life, charging infrastructure, and vehicle performance create favorable conditions for electric vehicle market development.

Commercial segment expansion offers significant opportunities through growing e-commerce, food delivery services, and last-mile logistics requirements. Business applications for two-wheelers continue expanding as companies seek cost-effective solutions for urban delivery and service operations. The gig economy growth creates additional demand for affordable commercial vehicles.

Rural market penetration represents untapped potential, with improved road infrastructure and rising rural incomes creating opportunities for market expansion beyond traditional urban centers. Agricultural applications and rural transportation needs present specific market segments with distinct requirements and growth potential.

Technology integration opportunities include connected vehicles, smart features, and advanced safety systems that enhance the value proposition for modern consumers. Digital services integration, mobile applications, and IoT connectivity create additional revenue streams and customer engagement opportunities.

Financing innovation through flexible payment schemes, lease options, and digital lending platforms can expand market accessibility and accelerate adoption rates across diverse consumer segments.

Market dynamics in the South African two-wheeler sector reflect complex interactions between supply-side factors, demand patterns, competitive forces, and external influences that shape overall market behavior and performance.

Supply chain dynamics involve intricate relationships between international manufacturers, local assemblers, component suppliers, and distribution networks. Import dependencies for key components and finished vehicles create sensitivity to currency fluctuations, trade policies, and global supply chain disruptions. Local assembly operations provide some insulation from these factors while creating employment opportunities and supporting economic development.

Demand patterns show seasonal variations influenced by weather conditions, economic cycles, and consumer spending patterns. Peak demand periods typically align with favorable weather conditions, bonus payments, and holiday seasons, while economic uncertainty can create temporary demand contractions across different market segments.

Competitive dynamics feature intense competition across price segments, with manufacturers employing various strategies including competitive pricing, feature differentiation, brand building, and dealer network expansion. Market share battles drive innovation, improve value propositions, and ultimately benefit consumers through better products and services.

Regulatory dynamics continue evolving with government policies affecting import duties, safety standards, environmental regulations, and electric vehicle incentives. These regulatory changes create both challenges and opportunities for market participants, requiring adaptive strategies and compliance investments.

Comprehensive research methodology employed for analyzing the South African two-wheeler market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of market insights.

Primary research involves direct engagement with key market participants including manufacturers, dealers, consumers, and industry experts through structured interviews, surveys, and focus group discussions. This approach provides firsthand insights into market trends, consumer preferences, competitive strategies, and future outlook from stakeholders directly involved in market operations.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, company financial statements, and regulatory documents. Data triangulation from multiple secondary sources ensures comprehensive coverage of market aspects and validates findings from primary research activities.

Market analysis techniques include quantitative modeling, trend analysis, competitive benchmarking, and scenario planning to develop robust market assessments and projections. Statistical analysis of historical data identifies patterns, growth rates, and market relationships that inform future market behavior predictions.

Validation processes involve cross-referencing findings with industry experts, conducting peer reviews, and applying sensitivity analysis to test the robustness of conclusions and recommendations. This multi-layered approach ensures research quality and reliability for strategic decision-making purposes.

Regional analysis reveals distinct market characteristics and opportunities across South Africa’s diverse geographical and economic landscape, with each region presenting unique dynamics and growth potential.

Gauteng Province dominates the market with approximately 35% market share, driven by high population density, economic activity concentration, and urban transportation needs. Johannesburg and Pretoria serve as primary demand centers, with strong dealer networks, service infrastructure, and consumer purchasing power supporting robust market performance. The province’s industrial and commercial activities create significant demand for commercial two-wheelers and delivery applications.

Western Cape represents the second-largest market with roughly 22% market share, centered around Cape Town’s metropolitan area. The region shows strong preference for premium and recreational vehicles, supported by higher disposable incomes and tourism activities. Coastal conditions and scenic routes contribute to recreational motorcycle demand, while urban congestion drives commuter segment growth.

KwaZulu-Natal accounts for approximately 18% market share, with Durban serving as the primary market center. The province’s diverse economic base, including manufacturing, agriculture, and tourism, creates varied demand patterns across different two-wheeler segments. Port activities and industrial operations support commercial vehicle demand.

Eastern Cape, Free State, and other provinces collectively represent the remaining 25% market share, with growth potential driven by infrastructure development, mining activities, and rural transportation needs. These regions present opportunities for market expansion as economic development and road infrastructure improvements continue.

Competitive landscape in the South African two-wheeler market features diverse participants ranging from global manufacturers to local assemblers, creating a dynamic environment with multiple strategic approaches and market positioning strategies.

Market competition intensifies across all segments, with manufacturers employing strategies including product localization, competitive pricing, dealer network expansion, and customer service enhancement to gain market share and build brand loyalty.

Market segmentation analysis reveals distinct categories based on various parameters including vehicle type, engine capacity, application, and price range, each serving specific consumer needs and preferences.

By Vehicle Type:

By Engine Capacity:

By Application:

Category-wise analysis provides detailed insights into specific market segments, revealing distinct characteristics, growth patterns, and opportunities within the South African two-wheeler market.

Entry-level Category (Up to 150cc): This segment maintains dominance with approximately 60% market share, driven by affordability, fuel efficiency, and accessibility to first-time buyers. Consumer preferences focus on reliability, low maintenance costs, and practical features suitable for daily commuting. Popular models in this category offer excellent fuel economy, often exceeding 45 kilometers per liter, making them attractive for cost-conscious consumers.

Mid-segment Category (151-300cc): Representing roughly 25% market share, this category appeals to consumers seeking enhanced performance without premium pricing. Growth drivers include improving economic conditions, rising consumer aspirations, and desire for better highway performance. These vehicles offer superior power-to-weight ratios and advanced features while maintaining reasonable operating costs.

Premium Category (Above 300cc): Although smaller in volume with 15% market share, this segment shows strong value growth and profitability for manufacturers. Consumer demographics include affluent professionals, motorcycle enthusiasts, and recreational riders willing to pay premium prices for advanced features, superior performance, and brand prestige.

Electric Vehicle Category: Currently representing a small but rapidly growing segment with adoption rates increasing by over 40% annually. Urban consumers drive initial adoption, attracted by environmental benefits, lower operating costs, and government incentives supporting sustainable transportation solutions.

Industry participants and stakeholders in the South African two-wheeler market enjoy multiple benefits from market participation, creating value across the entire ecosystem.

Manufacturers benefit from growing market demand, diverse consumer segments, and opportunities for product differentiation. The market’s size and growth potential justify investments in local assembly, dealer network development, and brand building activities. Economies of scale from increasing volumes improve profitability and competitive positioning in the market.

Dealers and retailers enjoy expanding business opportunities through growing consumer demand, diverse product portfolios, and multiple revenue streams including sales, service, and spare parts. Franchise opportunities with established brands provide business stability and growth potential for entrepreneurial investors.

Consumers benefit from increased choice, competitive pricing, improved product quality, and enhanced after-sales service. Market competition drives innovation, better value propositions, and customer-focused improvements across all market segments.

Government stakeholders benefit from economic development, employment creation, tax revenues, and improved transportation accessibility. The industry contributes to economic growth through manufacturing activities, job creation, and support for related industries including components, accessories, and services.

Financial institutions find opportunities in vehicle financing, insurance products, and related financial services. Growing market volumes and improving credit profiles create expanding business opportunities in the automotive finance sector.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the South African two-wheeler market reflect evolving consumer preferences, technological advancements, and changing mobility patterns that influence future market development.

Electric Vehicle Adoption represents the most significant trend, with MarkWide Research indicating accelerating consumer interest in sustainable transportation solutions. Battery technology improvements, expanding charging infrastructure, and government incentives support this transition, particularly in urban areas where environmental concerns and fuel cost savings drive adoption decisions.

Connectivity and Smart Features increasingly influence consumer purchasing decisions, with modern two-wheelers incorporating digital instrumentation, smartphone connectivity, GPS navigation, and security features. Technology integration enhances the ownership experience and appeals to tech-savvy consumers, particularly younger demographics.

Customization and Personalization trends show growing consumer interest in personalizing their vehicles through accessories, modifications, and custom features. This trend creates additional revenue opportunities for manufacturers and dealers while enhancing customer engagement and brand loyalty.

Subscription and Sharing Models emerge as alternative ownership models, particularly in urban areas where consumers seek flexible mobility solutions without long-term ownership commitments. These models appeal to younger consumers and urban professionals seeking convenient transportation options.

Safety Technology Integration includes advanced braking systems, traction control, and rider assistance features that address safety concerns and expand market appeal to safety-conscious consumers and families.

Recent industry developments demonstrate the dynamic nature of the South African two-wheeler market, with significant changes affecting competitive dynamics, consumer options, and market growth prospects.

Manufacturing Investments by several international brands include local assembly facility expansions, component localization initiatives, and dealer network strengthening programs. These investments demonstrate long-term confidence in market potential and commitment to serving South African consumers effectively.

Electric Vehicle Launches accelerate as manufacturers introduce electric models specifically designed for South African conditions and consumer preferences. Product development focuses on range optimization, charging convenience, and cost competitiveness to drive mainstream adoption.

Digital Transformation initiatives include online sales platforms, digital marketing campaigns, virtual showrooms, and mobile applications that enhance customer experience and engagement. These developments reflect changing consumer behavior and preferences for digital interactions.

Partnership Agreements between manufacturers, financial institutions, and technology companies create integrated solutions for consumers including financing, insurance, connectivity services, and maintenance packages that simplify the ownership experience.

Regulatory Updates include revised safety standards, environmental regulations, and electric vehicle incentive programs that shape market dynamics and influence manufacturer strategies and consumer choices.

Strategic recommendations for market participants focus on leveraging opportunities while addressing challenges to maximize success in the evolving South African two-wheeler market environment.

Product Portfolio Optimization should prioritize fuel-efficient, reliable, and affordable models that address core consumer needs while gradually introducing electric and premium options to capture emerging segments. Localization strategies can reduce costs and improve competitiveness while supporting local economic development objectives.

Market Expansion Strategies should focus on underserved rural markets, commercial applications, and emerging consumer segments including women riders and young professionals. Dealer network expansion in secondary cities and rural areas can capture growth opportunities while strengthening market presence.

Technology Integration investments should focus on features that provide tangible value to consumers including connectivity, safety systems, and convenience features that justify premium pricing and enhance brand differentiation.

Customer Experience Enhancement through improved after-sales service, financing options, digital engagement platforms, and comprehensive ownership solutions can build brand loyalty and support premium positioning strategies.

Sustainability Initiatives including electric vehicle development, environmental responsibility programs, and sustainable business practices can position companies favorably for future market developments and regulatory requirements.

Future market outlook for the South African two-wheeler market remains positive, supported by favorable demographic trends, economic development, and evolving transportation needs that create sustained growth opportunities.

Growth projections indicate continued market expansion with compound annual growth rates expected to remain robust across most segments. MWR analysis suggests that urbanization trends, rising fuel costs, and infrastructure improvements will continue driving market demand throughout the forecast period.

Electric vehicle transition will accelerate significantly, with adoption rates potentially reaching 15-20% of total market volumes within the next decade. Government support, improving technology, and environmental consciousness will drive this transformation, particularly in urban markets where infrastructure development supports electric vehicle adoption.

Market consolidation may occur as competition intensifies, with stronger brands and efficient operations gaining market share while weaker participants face challenges. This consolidation could improve overall market efficiency and customer service standards.

Technology integration will become standard across all segments, with connectivity, safety features, and smart systems becoming expected rather than premium features. This evolution will enhance the value proposition and appeal of two-wheelers to modern consumers.

Commercial segment growth will accelerate driven by e-commerce expansion, delivery service growth, and last-mile logistics requirements that favor two-wheeler solutions for urban and suburban applications.

The South Africa two-wheeler market presents a compelling growth story characterized by strong fundamentals, evolving consumer preferences, and significant opportunities for market participants. The market’s resilience during economic challenges, combined with favorable demographic trends and urbanization patterns, creates a solid foundation for sustained expansion across multiple segments and applications.

Key success factors for market participants include understanding local consumer preferences, building strong dealer networks, offering competitive pricing strategies, and investing in technology and sustainability initiatives that align with future market trends. The market’s diversity across price segments, applications, and regional markets provides multiple pathways for growth and success.

Strategic positioning should focus on addressing core consumer needs including affordability, reliability, fuel efficiency, and safety while gradually introducing advanced features and sustainable solutions that appeal to evolving consumer preferences. The electric vehicle transition represents both a challenge and opportunity that requires careful planning and investment to capture emerging demand.

Long-term prospects remain favorable, with the South Africa two-wheeler market expected to continue its growth trajectory supported by economic development, infrastructure improvements, and changing mobility patterns that favor two-wheeler adoption. Market participants who adapt to changing conditions, invest in customer experience, and embrace technological advancement will be best positioned to capitalize on the significant opportunities ahead in this dynamic and evolving market landscape.

What is Two-Wheeler?

Two-wheelers refer to vehicles that have two wheels, primarily including motorcycles and scooters. They are popular for personal transportation due to their fuel efficiency and maneuverability in urban areas.

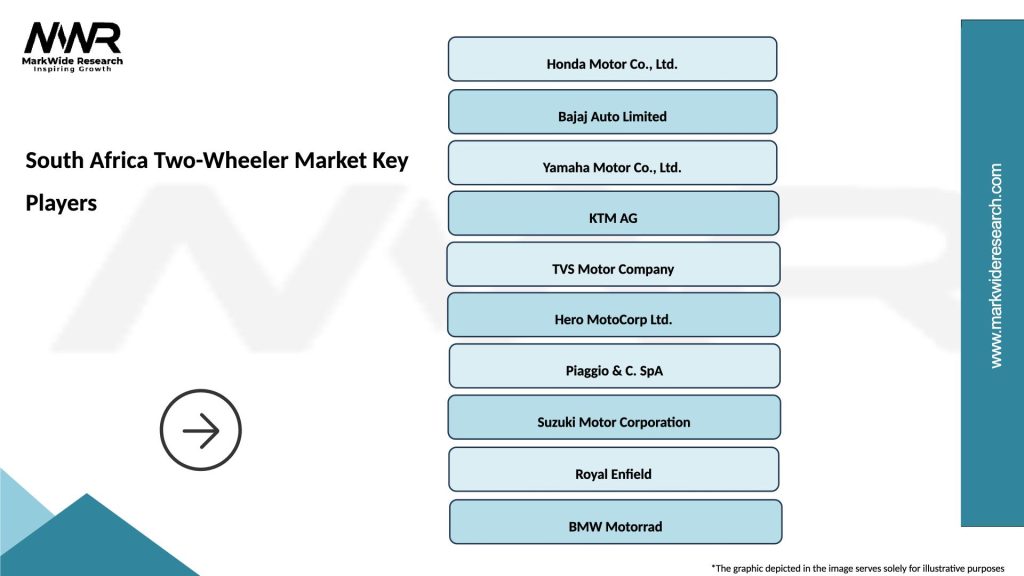

What are the key players in the South Africa Two-Wheeler Market?

Key players in the South Africa Two-Wheeler Market include Honda, Yamaha, and Bajaj Auto, which offer a range of motorcycles and scooters tailored to local consumer preferences, among others.

What are the growth factors driving the South Africa Two-Wheeler Market?

The South Africa Two-Wheeler Market is driven by factors such as increasing urbanization, rising fuel prices, and a growing demand for affordable transportation options. Additionally, the convenience of two-wheelers in congested traffic contributes to their popularity.

What challenges does the South Africa Two-Wheeler Market face?

The South Africa Two-Wheeler Market faces challenges such as regulatory hurdles, safety concerns, and competition from public transportation. These factors can impact consumer purchasing decisions and market growth.

What opportunities exist in the South Africa Two-Wheeler Market?

Opportunities in the South Africa Two-Wheeler Market include the potential for electric two-wheelers, which align with global sustainability trends, and the expansion of ride-sharing services that utilize two-wheelers for last-mile connectivity.

What trends are shaping the South Africa Two-Wheeler Market?

Trends in the South Africa Two-Wheeler Market include the increasing adoption of smart technology in vehicles, a shift towards electric models, and a growing interest in adventure and off-road motorcycles among consumers.

South Africa Two-Wheeler Market

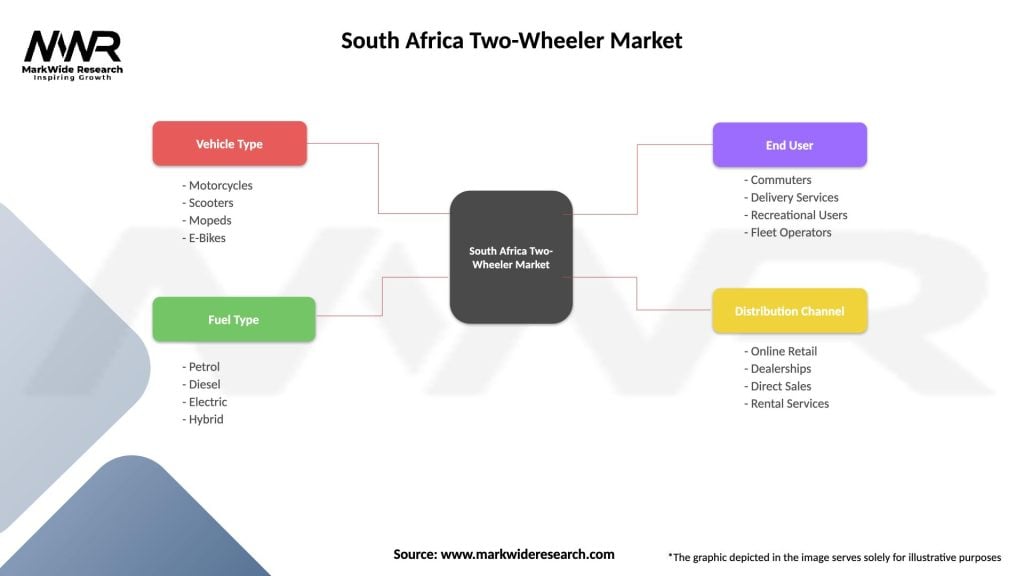

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Motorcycles, Scooters, Mopeds, E-Bikes |

| Fuel Type | Petrol, Diesel, Electric, Hybrid |

| End User | Commuters, Delivery Services, Recreational Users, Fleet Operators |

| Distribution Channel | Online Retail, Dealerships, Direct Sales, Rental Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Two-Wheeler Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at