444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa internal combustion engines market represents a dynamic and evolving sector driven by diverse industrial applications, automotive demands, and energy infrastructure requirements. This region showcases significant growth potential across multiple engine categories, from automotive powertrains to industrial machinery and power generation systems. Market dynamics indicate robust expansion opportunities, particularly in emerging economies where industrialization and infrastructure development continue to accelerate.

Regional characteristics define the market landscape, with the Middle East demonstrating strong demand for high-performance engines in oil and gas applications, while Africa presents substantial opportunities in agricultural machinery, mining equipment, and transportation sectors. The market encompasses various engine types including gasoline engines, diesel engines, and specialized industrial powertrains, each serving distinct applications across different economic sectors.

Growth trajectories suggest the market is expanding at a compound annual growth rate of 6.2%, driven by increasing industrialization, infrastructure development projects, and rising automotive penetration rates across the region. Key factors influencing market expansion include economic diversification initiatives, urbanization trends, and growing energy sector investments that require reliable internal combustion engine solutions.

Technological advancement plays a crucial role in shaping market evolution, with manufacturers focusing on fuel efficiency improvements, emission reduction technologies, and enhanced durability features suited to the region’s challenging operating conditions. The integration of advanced materials, electronic control systems, and hybrid technologies represents significant development areas within the regional market framework.

The Middle East and Africa internal combustion engines market refers to the comprehensive ecosystem encompassing the production, distribution, and application of internal combustion engines across the Middle Eastern and African regions. This market includes various engine types designed for automotive, industrial, marine, and power generation applications, serving diverse economic sectors from oil and gas to agriculture and transportation.

Internal combustion engines represent mechanical devices that convert chemical energy from fuel combustion into mechanical work through controlled explosions within engine cylinders. These engines utilize various fuel types including gasoline, diesel, natural gas, and alternative fuels, providing power solutions for vehicles, machinery, generators, and industrial equipment across the regional market landscape.

Market scope encompasses original equipment manufacturer sales, aftermarket services, spare parts distribution, and maintenance solutions. The regional market serves multiple stakeholders including automotive manufacturers, industrial equipment producers, power generation companies, and end-users across various economic sectors requiring reliable engine-powered solutions.

Geographic coverage includes major Middle Eastern countries such as Saudi Arabia, UAE, Iran, and Iraq, alongside significant African markets including South Africa, Nigeria, Egypt, and Kenya. Each sub-region presents unique market characteristics, regulatory environments, and application requirements that influence engine specifications and market dynamics.

Market performance across the Middle East and Africa internal combustion engines sector demonstrates resilient growth patterns supported by diversified industrial applications and expanding automotive markets. The region benefits from substantial oil and gas reserves, creating sustained demand for specialized engines in energy sector applications while simultaneously driving economic development that increases general engine demand across multiple industries.

Key market drivers include infrastructure development initiatives, with 72% of regional governments prioritizing transportation and industrial infrastructure projects that require extensive engine-powered equipment. Mining sector expansion, agricultural mechanization, and power generation requirements contribute significantly to market growth, particularly in sub-Saharan African markets where electrification rates remain below global averages.

Competitive landscape features both international manufacturers and regional players, with global companies establishing local assembly operations to serve regional markets more effectively. Market leaders focus on developing engines optimized for regional operating conditions, including extreme temperatures, dust exposure, and varying fuel quality standards that characterize many Middle Eastern and African environments.

Future prospects indicate continued market expansion driven by economic diversification efforts, particularly in Gulf Cooperation Council countries seeking to reduce oil dependency through industrial development. African markets present substantial growth opportunities as infrastructure development accelerates and mechanization increases across agricultural and industrial sectors.

Market segmentation reveals diverse application areas with distinct growth patterns and requirements. The following key insights characterize the regional market landscape:

Regional variations significantly impact market dynamics, with Middle Eastern markets emphasizing high-performance applications while African markets prioritize durability and cost-effectiveness. These differences create distinct market segments requiring tailored product strategies and distribution approaches.

Economic diversification initiatives across the Middle East create substantial demand for internal combustion engines as countries develop manufacturing, logistics, and industrial sectors beyond traditional oil and gas activities. Government investment programs focus on infrastructure development, creating sustained demand for construction equipment, transportation vehicles, and industrial machinery powered by internal combustion engines.

Infrastructure development projects represent a primary market driver, with major transportation networks, industrial complexes, and urban development initiatives requiring extensive engine-powered equipment. Road construction, port development, and airport expansion projects create immediate demand for heavy-duty engines while establishing long-term maintenance and replacement markets.

Agricultural mechanization trends drive significant engine demand across African markets where farming productivity improvements become essential for food security and economic development. Tractor sales, irrigation equipment, and processing machinery require reliable engines capable of operating in challenging environmental conditions while providing cost-effective performance.

Mining sector expansion creates specialized engine demand for extraction equipment, transportation vehicles, and power generation systems. Both surface and underground mining operations require engines designed for continuous operation under demanding conditions, driving premium segment growth and aftermarket service opportunities.

Power generation requirements increase across the region due to growing electricity demand and grid reliability challenges. Backup generators for commercial and industrial applications, along with primary power generation for remote locations, create sustained engine demand with 43% of installations requiring regular maintenance and eventual replacement.

Economic volatility presents significant challenges for the internal combustion engines market, particularly in oil-dependent Middle Eastern economies where commodity price fluctuations impact government spending and private sector investment. Currency instability and reduced capital expenditure during economic downturns directly affect engine sales and infrastructure projects.

Environmental regulations increasingly restrict internal combustion engine applications, with emission standards becoming more stringent across major regional markets. Compliance costs and technology requirements create barriers for smaller manufacturers while potentially limiting market growth in applications where electric alternatives become viable.

Fuel quality variations across the region create technical challenges for engine manufacturers and operators. Inconsistent fuel specifications, contamination issues, and availability constraints require specialized engine designs and maintenance procedures that increase costs and complexity for market participants.

Infrastructure limitations in many African markets constrain engine applications and service capabilities. Poor transportation networks, limited service facilities, and spare parts availability challenges create operational difficulties that may discourage engine adoption in certain applications and geographic areas.

Competition from alternative technologies intensifies as electric and hybrid solutions become more viable for certain applications. Solar power systems, battery storage, and electric vehicles present increasing competition, particularly in applications where operational cost advantages and environmental benefits favor alternative technologies.

Renewable energy integration creates opportunities for internal combustion engines in hybrid power systems and backup applications. As solar and wind installations expand across the region, engines provide essential grid stability and backup power capabilities, creating new market segments with specialized requirements and service opportunities.

Smart city development initiatives across major regional urban centers require sophisticated engine solutions for transportation, waste management, and emergency services. These applications demand advanced engines with electronic controls, emission compliance, and integration capabilities that command premium pricing and ongoing service contracts.

Industrial automation trends drive demand for specialized engines in manufacturing and processing applications. Automated systems require precise power delivery, consistent performance, and integration capabilities that create opportunities for advanced engine technologies and comprehensive service solutions.

Export market development presents opportunities for regional engine manufacturers and assemblers to serve broader markets. Strategic location advantages, cost competitiveness, and growing technical capabilities enable regional companies to compete in international markets while serving domestic demand.

Aftermarket service expansion offers substantial revenue opportunities as the installed engine base grows. Maintenance services, spare parts distribution, and performance upgrades create recurring revenue streams with 67% higher profit margins compared to original equipment sales, making service network development a strategic priority.

Supply chain considerations significantly influence market dynamics, with regional manufacturers balancing local assembly capabilities against imported component requirements. Global supply chain disruptions highlight the importance of regional manufacturing capacity and supplier diversification strategies for maintaining market stability and competitive positioning.

Technology transfer initiatives between international manufacturers and regional partners create dynamic market conditions. Joint ventures, licensing agreements, and local assembly operations enable technology access while developing regional capabilities, influencing competitive dynamics and market structure evolution.

Regulatory harmonization efforts across regional markets create opportunities for standardized products while requiring compliance with diverse national requirements. Emission standards, safety regulations, and import policies vary significantly between countries, creating complex market dynamics that favor companies with comprehensive regulatory expertise.

Customer financing solutions become increasingly important market dynamics as capital equipment purchases require flexible payment terms and financing options. Leasing programs, maintenance contracts, and performance-based agreements create new business models that influence purchasing decisions and market competition patterns.

Digital transformation trends impact market dynamics through connected engines, predictive maintenance capabilities, and data analytics applications. These technologies create new value propositions while requiring investments in digital infrastructure and capabilities that influence competitive positioning and customer relationships.

Primary research activities encompass comprehensive industry interviews with key stakeholders including manufacturers, distributors, end-users, and regulatory authorities across major regional markets. Direct engagement with market participants provides insights into current trends, challenges, and future requirements that shape market development and competitive dynamics.

Secondary research sources include industry publications, government statistics, trade association reports, and company financial statements to establish market baselines and validate primary research findings. Comprehensive data collection ensures accurate market characterization and reliable trend analysis for strategic decision-making purposes.

Market sizing methodologies utilize multiple approaches including top-down analysis based on economic indicators and bottom-up calculations from application-specific demand patterns. Cross-validation techniques ensure accuracy while accounting for regional variations and market segment differences that characterize the diverse Middle East and Africa market landscape.

Forecasting models incorporate economic indicators, demographic trends, and industry-specific factors to project market development scenarios. Sensitivity analysis accounts for various economic and regulatory scenarios while providing confidence intervals for key market projections and growth estimates.

Quality assurance procedures include data verification, expert review, and consistency checks to ensure research reliability and accuracy. MarkWide Research methodology standards ensure comprehensive coverage while maintaining objectivity and analytical rigor throughout the research process.

Middle East markets demonstrate strong demand for high-performance engines across oil and gas applications, with Saudi Arabia and UAE leading regional consumption patterns. These markets emphasize reliability and performance in extreme operating conditions, creating opportunities for premium engine technologies and comprehensive service solutions with 34% market share concentrated in energy sector applications.

Gulf Cooperation Council countries present sophisticated market requirements driven by industrial diversification and infrastructure development initiatives. Advanced emission standards, quality requirements, and performance specifications create favorable conditions for technology leaders while establishing barriers for lower-cost alternatives.

North African markets including Egypt, Morocco, and Algeria demonstrate growing demand across automotive and industrial applications. Economic development programs and infrastructure investments drive market expansion while creating opportunities for both international manufacturers and regional assembly operations.

Sub-Saharan African markets offer substantial growth potential with 28% annual growth rates in agricultural and mining applications. South Africa leads regional market development with established manufacturing capabilities, while Nigeria, Kenya, and Ghana present emerging opportunities driven by economic development and industrialization trends.

East African markets benefit from regional economic integration and infrastructure development initiatives. Transportation corridor projects, mining investments, and agricultural modernization create sustained engine demand while establishing service network requirements across multiple countries and applications.

Market leadership involves both global manufacturers and regional specialists, each serving distinct market segments with different competitive strategies. The competitive environment emphasizes product reliability, service capabilities, and local market knowledge as key differentiating factors.

Competitive strategies emphasize local assembly capabilities, service network development, and product adaptation for regional operating conditions. Market leaders invest in regional manufacturing facilities and technical centers to serve local markets more effectively while reducing costs and improving customer support capabilities.

Partnership approaches between international manufacturers and regional distributors create comprehensive market coverage while leveraging local market knowledge and customer relationships. These partnerships enable technology transfer and capability development while providing market access and service support across diverse geographic markets.

By Engine Type:

By Application:

By Power Range:

Automotive segment represents the largest market category with diverse requirements across passenger and commercial vehicle applications. Light-duty gasoline engines dominate passenger vehicle applications while heavy-duty diesel engines serve commercial transportation needs. Market trends favor fuel efficiency improvements and emission compliance technologies.

Industrial applications demonstrate steady growth driven by manufacturing sector expansion and industrial automation trends. These applications require specialized engines with precise control capabilities, consistent performance, and integration with automated systems. Service requirements emphasize reliability and minimal downtime.

Construction equipment engines experience cyclical demand patterns linked to infrastructure development and economic conditions. Heavy-duty diesel engines dominate this category with requirements for high torque, durability, and operation in challenging environmental conditions. Rental market growth creates additional service opportunities.

Agricultural machinery engines show strong growth potential across African markets where mechanization rates remain below global averages. Tractor engines represent the largest sub-segment, with 45% market concentration in medium-power applications suitable for diverse farming operations and crop types.

Power generation engines serve both backup and primary power applications with distinct requirements for each use case. Backup generators emphasize reliability and quick start capabilities while primary power applications require fuel efficiency and extended operation capabilities. Grid instability drives market expansion.

Manufacturers benefit from diverse market opportunities across multiple application segments and geographic regions. Regional market development enables production scale optimization while serving local customer requirements more effectively. Technology leadership creates competitive advantages and premium pricing opportunities.

Distributors and dealers gain from comprehensive product portfolios and service capabilities that create customer loyalty and recurring revenue streams. Exclusive territory agreements and manufacturer support programs enhance profitability while building sustainable competitive positions in local markets.

End-users receive improved productivity, operational efficiency, and cost-effectiveness through advanced engine technologies and comprehensive service support. Local manufacturing and service capabilities reduce total ownership costs while improving equipment availability and performance reliability.

Service providers benefit from growing installed base requirements for maintenance, repair, and upgrade services. Specialized technical capabilities and parts availability create competitive advantages while generating higher-margin revenue streams compared to equipment sales.

Government stakeholders achieve economic development objectives through industrial capability building, employment creation, and technology transfer initiatives. Local engine manufacturing and assembly operations contribute to economic diversification while reducing import dependencies and foreign exchange requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization trends transform engine technologies through electronic control systems, connectivity features, and data analytics capabilities. Smart engines provide performance optimization, predictive maintenance, and remote monitoring capabilities that create new value propositions and service business models with 52% adoption rates in new installations.

Fuel efficiency improvements drive technology development across all engine categories as operational costs become increasingly important. Advanced fuel injection systems, turbocharging technologies, and engine management systems deliver significant efficiency gains while meeting emission requirements and performance expectations.

Hybrid system integration creates opportunities for internal combustion engines in combination with electric motors and energy storage systems. These applications provide operational flexibility while optimizing fuel consumption and emission performance across various duty cycles and operating conditions.

Service transformation emphasizes comprehensive support solutions including maintenance contracts, performance guarantees, and outcome-based agreements. Manufacturers develop service capabilities that ensure equipment availability and performance while creating recurring revenue streams and stronger customer relationships.

Localization initiatives increase regional manufacturing and assembly capabilities to serve local markets more effectively. Technology transfer, joint ventures, and local partnerships enable cost reduction while building regional capabilities and reducing import dependencies across major markets.

Manufacturing investments by major international companies establish regional production capabilities and technology transfer initiatives. These developments include assembly facilities, component manufacturing, and technical centers that serve regional markets while building local capabilities and employment opportunities.

Technology partnerships between global manufacturers and regional companies accelerate market development and capability building. Joint ventures, licensing agreements, and strategic alliances enable technology access while developing local market expertise and customer relationships.

Regulatory developments across major regional markets establish emission standards, safety requirements, and quality specifications that influence product development and market competition. Harmonization efforts create opportunities for standardized products while requiring compliance investments.

Infrastructure projects including transportation networks, industrial complexes, and power generation facilities create immediate engine demand while establishing long-term service requirements. Major projects influence market development and competitive positioning across multiple market segments.

Digital platform development enables new business models including remote monitoring, predictive maintenance, and performance optimization services. MarkWide Research analysis indicates these platforms create competitive advantages while generating additional revenue streams for manufacturers and service providers.

Market entry strategies should emphasize local partnerships and gradual capability building rather than immediate large-scale investments. Understanding regional market characteristics, regulatory requirements, and customer preferences enables more effective market development while reducing investment risks and operational challenges.

Product development priorities should focus on regional operating conditions including extreme temperatures, dust exposure, and fuel quality variations. Engines designed specifically for regional requirements command premium pricing while building customer loyalty and competitive advantages in local markets.

Service network development represents a critical success factor requiring strategic investment in technical capabilities, parts availability, and geographic coverage. Comprehensive service support creates competitive advantages while generating recurring revenue streams that improve business model sustainability.

Technology investment should balance advanced features with cost-effectiveness and reliability requirements. Regional markets often prioritize proven technologies and operational simplicity over cutting-edge features, requiring careful product positioning and feature selection strategies.

Partnership strategies enable market access and capability development while sharing investment requirements and market risks. Successful partnerships require clear agreements, aligned objectives, and complementary capabilities that create mutual benefits and sustainable competitive positions.

Market expansion prospects remain positive across most regional markets driven by continued economic development, infrastructure investment, and industrialization trends. Growth rates are expected to maintain 6.2% annually over the forecast period, with particular strength in African markets where mechanization and infrastructure development create sustained demand.

Technology evolution will emphasize efficiency improvements, emission reduction, and digital integration capabilities. Advanced engine management systems, hybrid technologies, and connectivity features become standard requirements while maintaining reliability and cost-effectiveness priorities that characterize regional market preferences.

Competitive dynamics will favor companies with comprehensive regional strategies including local manufacturing, service capabilities, and customer relationships. Market consolidation may occur as smaller players struggle to meet investment requirements for technology development and market coverage expansion.

Regulatory environment development will influence market structure through emission standards, safety requirements, and import policies. Harmonization efforts across regional markets create opportunities for standardized products while requiring compliance investments and technology upgrades.

Application evolution will create new market segments while transforming existing applications through automation, digitalization, and integration requirements. MWR projections indicate that smart city development, renewable energy integration, and industrial automation will drive premium market segments with specialized requirements and service needs.

The Middle East and Africa internal combustion engines market presents substantial opportunities for growth and development across diverse applications and geographic regions. Market dynamics favor companies with comprehensive regional strategies, local capabilities, and customer-focused approaches that address specific regional requirements and operating conditions.

Success factors include technology adaptation for regional conditions, service network development, and partnership strategies that enable market access while building sustainable competitive positions. The market rewards reliability, cost-effectiveness, and comprehensive support capabilities over purely technological sophistication.

Future prospects remain positive despite challenges from alternative technologies and regulatory requirements. Continued economic development, infrastructure investment, and industrialization trends create sustained demand while digital technologies and efficiency improvements provide opportunities for value creation and competitive differentiation in this dynamic regional market.

What is Internal Combustion Engines?

Internal combustion engines are machines that convert fuel into mechanical energy through combustion. They are widely used in various applications, including automobiles, industrial machinery, and power generation.

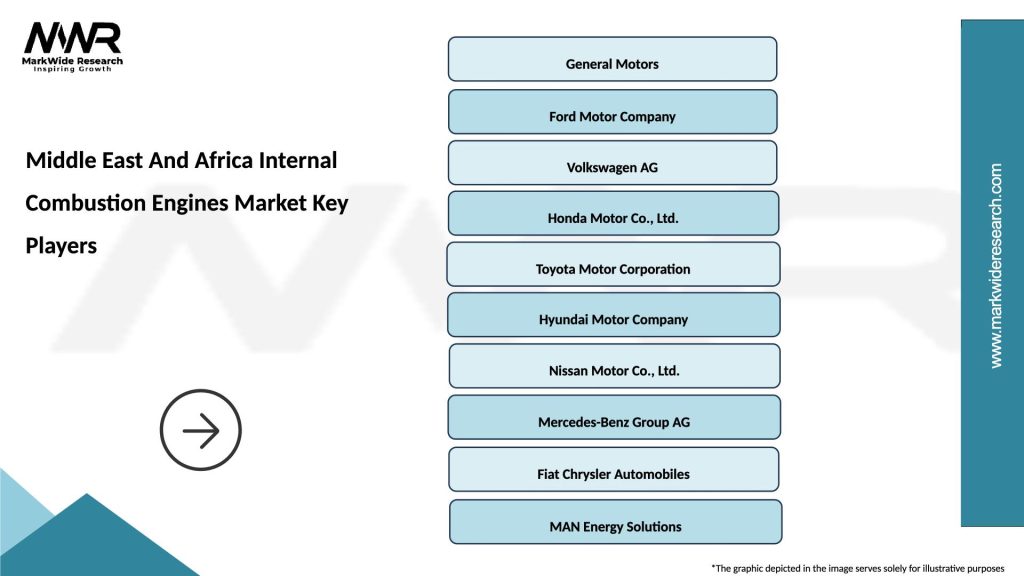

What are the key players in the Middle East And Africa Internal Combustion Engines Market?

Key players in the Middle East And Africa Internal Combustion Engines Market include companies like Toyota, Cummins, and MAN Energy Solutions, among others.

What are the growth factors driving the Middle East And Africa Internal Combustion Engines Market?

The growth of the Middle East And Africa Internal Combustion Engines Market is driven by increasing demand for transportation, industrialization, and advancements in engine technology. Additionally, the rise in construction activities and mining operations contributes to market expansion.

What challenges does the Middle East And Africa Internal Combustion Engines Market face?

The Middle East And Africa Internal Combustion Engines Market faces challenges such as stringent environmental regulations, fluctuating fuel prices, and competition from alternative energy sources. These factors can hinder market growth and innovation.

What opportunities exist in the Middle East And Africa Internal Combustion Engines Market?

Opportunities in the Middle East And Africa Internal Combustion Engines Market include the development of more efficient and eco-friendly engines, as well as the potential for growth in electric and hybrid vehicle segments. Additionally, increasing investments in infrastructure can boost demand.

What trends are shaping the Middle East And Africa Internal Combustion Engines Market?

Trends in the Middle East And Africa Internal Combustion Engines Market include the shift towards hybrid and electric vehicles, advancements in engine efficiency, and the integration of smart technologies. These trends are influencing consumer preferences and industry standards.

Middle East And Africa Internal Combustion Engines Market

| Segmentation Details | Description |

|---|---|

| Product Type | Passenger Cars, Commercial Vehicles, Motorcycles, Marine Engines |

| Fuel Type | Gasoline, Diesel, Ethanol, Biodiesel |

| End User | OEMs, Aftermarket Providers, Fleet Operators, Government Agencies |

| Technology | Turbocharged, Hybrid, Direct Injection, Variable Valve Timing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East And Africa Internal Combustion Engines Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at