444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil bunker fuel market represents a critical component of the nation’s maritime infrastructure, serving as the primary energy source for international shipping operations along Brazil’s extensive coastline. Bunker fuel, also known as marine fuel oil, encompasses various grades of heavy fuel oil used to power commercial vessels, cargo ships, and cruise liners operating in Brazilian ports and territorial waters. The market has experienced significant transformation in recent years, driven by evolving international maritime regulations and Brazil’s strategic position as a major shipping hub in South America.

Brazil’s maritime sector benefits from over 7,400 kilometers of coastline and numerous major ports including Santos, Rio de Janeiro, Paranaguá, and Itajaí. The country’s bunker fuel market has demonstrated steady growth of approximately 4.2% annually, reflecting increased international trade activities and the expansion of Brazil’s export-oriented economy. Environmental regulations have particularly influenced market dynamics, with the International Maritime Organization’s sulfur content restrictions driving demand for cleaner, low-sulfur bunker fuel alternatives.

Market participants include major oil refineries, international fuel suppliers, and specialized marine fuel distributors who serve both domestic and international vessels. The sector has adapted to accommodate various fuel specifications, from traditional heavy fuel oil to marine gas oil and emerging alternative fuels. Port infrastructure development continues to enhance Brazil’s capacity to serve as a regional bunker fuel supply center, with investments in storage facilities and fuel handling equipment supporting market expansion.

The Brazil bunker fuel market refers to the comprehensive ecosystem of marine fuel supply, distribution, and consumption within Brazilian territorial waters and ports. This market encompasses the procurement, storage, blending, and delivery of various grades of marine fuels used by commercial shipping vessels for propulsion and auxiliary power generation. Bunker fuel serves as the lifeblood of international maritime trade, enabling cargo transportation, passenger services, and offshore operations.

Marine fuel specifications in Brazil align with international standards, including heavy fuel oil, marine gas oil, and intermediate fuel oil grades. The market operates under strict regulatory oversight, ensuring fuel quality standards meet both Brazilian maritime authority requirements and international shipping regulations. Fuel suppliers must maintain sophisticated logistics networks to deliver bunker fuel to vessels at designated ports and anchorages throughout Brazil’s coastal regions.

Market dynamics are influenced by global crude oil prices, refinery capacity, environmental regulations, and shipping traffic patterns. The sector plays a vital role in supporting Brazil’s position as a major commodity exporter, facilitating the transportation of agricultural products, minerals, and manufactured goods to international markets. Technological advancement in fuel management systems and environmental compliance measures continues to shape market evolution.

Brazil’s bunker fuel market stands as a cornerstone of the nation’s maritime economy, supporting extensive international shipping operations and contributing significantly to trade facilitation. The market has demonstrated remarkable resilience and adaptability, particularly in response to evolving environmental regulations and changing fuel specifications. Recent market analysis indicates sustained growth momentum driven by increased cargo throughput and expanding port infrastructure.

Key market drivers include Brazil’s strategic geographic position, robust export economy, and ongoing investments in port modernization. The implementation of IMO 2020 sulfur regulations has accelerated the transition toward cleaner marine fuels, with low-sulfur fuel oil adoption reaching approximately 78% of total bunker fuel consumption. Major suppliers have invested heavily in refinery upgrades and blending facilities to meet evolving fuel specifications.

Market challenges encompass price volatility, regulatory compliance costs, and infrastructure limitations at certain ports. However, opportunities abound in alternative fuel development, digital fuel management solutions, and regional supply hub expansion. Industry stakeholders are increasingly focused on sustainability initiatives and operational efficiency improvements to maintain competitive positioning in the global maritime fuel market.

Strategic market insights reveal several critical trends shaping Brazil’s bunker fuel landscape. The market exhibits strong correlation with international shipping volumes and commodity export patterns, particularly for agricultural products and mineral resources. Port concentration remains significant, with the top five ports accounting for substantial market share in bunker fuel sales.

Market segmentation reveals distinct patterns across fuel grades, with marine gas oil experiencing particularly strong demand growth. Customer preferences increasingly favor suppliers offering comprehensive service packages including fuel testing, delivery scheduling, and regulatory compliance support.

Primary market drivers propelling Brazil’s bunker fuel sector include the country’s expanding role in global trade and strategic investments in maritime infrastructure. Export growth in key commodities such as soybeans, iron ore, and petroleum products has increased shipping traffic through Brazilian ports, directly boosting bunker fuel demand. The nation’s position as a gateway to South American markets further enhances its attractiveness as a bunker fuel supply destination.

Port modernization initiatives represent another significant driver, with government and private sector investments improving fuel handling capabilities and storage capacity. Santos Port expansion and similar projects at other major facilities have enhanced Brazil’s ability to serve larger vessels requiring substantial fuel quantities. These infrastructure improvements support market growth by accommodating increased shipping volumes and vessel sizes.

Environmental regulations paradoxically serve as both a challenge and driver, creating demand for higher-quality, lower-sulfur marine fuels. The transition to IMO-compliant fuels has opened new market segments and encouraged innovation in fuel blending and alternative energy sources. Regulatory compliance requirements have also strengthened relationships between suppliers and customers, as vessel operators seek reliable partners for meeting environmental standards.

Economic factors including favorable exchange rates and competitive fuel pricing have positioned Brazil advantageously in the regional bunker fuel market. Refinery capacity utilization improvements and operational efficiency gains have enabled suppliers to offer competitive pricing while maintaining quality standards. The development of regional trading relationships has further supported market expansion and customer base diversification.

Market restraints affecting Brazil’s bunker fuel sector include significant price volatility linked to global crude oil markets and currency fluctuations. Exchange rate instability creates challenges for both suppliers and customers in pricing negotiations and long-term contract arrangements. These economic uncertainties can impact investment decisions and operational planning across the supply chain.

Infrastructure limitations at certain ports constrain market growth potential, particularly for smaller facilities lacking adequate storage capacity or modern fuel handling equipment. Regulatory complexity surrounding environmental compliance and fuel quality standards requires substantial investment in testing facilities and certification processes. These requirements can create barriers for smaller suppliers seeking to enter or expand within the market.

Competition from alternative fueling locations in neighboring countries presents ongoing challenges, as vessel operators may choose different routes or supply points based on cost considerations and operational convenience. Logistical constraints including port congestion and limited berth availability can impact fuel delivery schedules and customer satisfaction levels.

Environmental concerns and increasing pressure for sustainable shipping practices may limit long-term demand for traditional bunker fuels. Technological disruption from alternative propulsion systems and renewable energy sources could reshape market dynamics over time. Additionally, skilled workforce shortages in specialized areas such as fuel testing and quality assurance may constrain operational capabilities for some market participants.

Significant opportunities exist within Brazil’s bunker fuel market, particularly in the development of sustainable marine fuel alternatives and advanced fuel management technologies. Biofuel integration presents substantial potential, leveraging Brazil’s expertise in renewable energy and agricultural resources to create environmentally friendly marine fuel options. The country’s established ethanol and biodiesel industries provide a foundation for expanding into marine biofuel production.

Digital transformation initiatives offer opportunities for enhanced customer service and operational efficiency. Fuel management platforms incorporating real-time pricing, inventory tracking, and automated ordering systems can differentiate suppliers and improve customer relationships. These technological solutions address growing demand for transparency and operational optimization in fuel procurement processes.

Regional expansion opportunities emerge from Brazil’s potential to serve as a bunker fuel hub for South American shipping operations. Strategic partnerships with neighboring countries and international shipping companies could expand market reach and create new revenue streams. The development of specialized fuel blending capabilities for niche applications represents another growth avenue.

Infrastructure development projects including new port facilities and storage terminals create opportunities for market participants to establish strategic positions in emerging locations. Government initiatives supporting maritime sector development and environmental compliance may provide favorable conditions for investment and expansion. The growing cruise ship industry also presents opportunities for specialized marine fuel services and premium product offerings.

Market dynamics in Brazil’s bunker fuel sector reflect the complex interplay between global shipping patterns, regulatory requirements, and local economic conditions. Supply and demand balance fluctuates based on seasonal shipping patterns, with peak periods corresponding to major commodity export seasons. The market demonstrates price sensitivity of approximately 15-20% to crude oil price movements, though local factors can moderate these impacts.

Competitive dynamics have intensified as suppliers adapt to changing customer requirements and regulatory standards. Service differentiation has become increasingly important, with successful companies offering comprehensive solutions beyond basic fuel supply. Quality assurance, delivery reliability, and technical support services now play crucial roles in customer retention and market positioning.

Regulatory dynamics continue to shape market evolution, with environmental standards driving innovation and investment in cleaner fuel alternatives. Compliance costs have increased operational expenses but also created opportunities for companies investing in advanced capabilities. The regulatory environment favors established players with resources to meet evolving requirements while potentially creating barriers for new entrants.

Technology adoption is accelerating across the market, with digital solutions improving operational efficiency and customer service delivery. Automation in fuel handling and inventory management reduces costs and enhances safety standards. These technological advances support market growth by enabling suppliers to serve larger customer bases more effectively while maintaining quality standards.

Comprehensive research methodology employed for analyzing Brazil’s bunker fuel market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry stakeholders, including fuel suppliers, port operators, shipping companies, and regulatory officials. These interactions provide valuable insights into market trends, operational challenges, and future development plans.

Secondary research encompasses analysis of government statistics, industry reports, trade publications, and regulatory documents. Data triangulation methods verify information accuracy by cross-referencing multiple sources and identifying consistent patterns across different data sets. This approach ensures robust analytical foundations for market assessments and projections.

Quantitative analysis utilizes statistical modeling techniques to identify market trends, growth patterns, and correlation relationships. Market sizing methodologies incorporate bottom-up and top-down approaches, analyzing port-specific data and aggregating to national market levels. Time series analysis helps identify seasonal patterns and long-term growth trajectories.

Qualitative research components include expert interviews, focus groups, and case study development to understand market dynamics and competitive positioning. Industry validation processes ensure research findings align with practical market realities and stakeholder experiences. Regular updates and monitoring maintain research currency and relevance for decision-making purposes.

Regional analysis of Brazil’s bunker fuel market reveals significant geographic concentration along the southeastern and southern coastlines, where major ports and industrial centers drive demand. São Paulo state, anchored by Santos Port, commands approximately 35% of national bunker fuel consumption, reflecting its position as Brazil’s primary export gateway and largest container port.

Rio de Janeiro region represents another critical market segment, serving both commercial shipping and offshore oil industry operations. The area’s bunker fuel market benefits from proximity to Petrobras refineries and established fuel distribution infrastructure. Port activity levels in Rio de Janeiro have shown steady growth, supporting consistent fuel demand patterns.

Southern Brazil, including ports in Rio Grande do Sul, Santa Catarina, and Paraná states, accounts for significant bunker fuel consumption driven by agricultural export activities. Paranaguá Port serves as a major soybean and corn export facility, generating substantial shipping traffic and corresponding fuel demand. The region’s bunker fuel market exhibits seasonal patterns aligned with harvest and export cycles.

Northeastern Brazil presents emerging opportunities, with ports like Suape and Salvador expanding their roles in international trade. Infrastructure investments in these regions are creating new bunker fuel demand centers and supply opportunities. The area’s strategic position for trans-Atlantic shipping routes enhances its long-term market potential.

Northern Brazil, while representing a smaller market segment, shows growth potential linked to mineral export activities and Amazon region development. Port infrastructure improvements and increased commodity production could drive future bunker fuel demand in these areas.

Competitive landscape in Brazil’s bunker fuel market features a mix of international oil companies, domestic refiners, and specialized marine fuel suppliers. Market leadership is distributed among several key players, each leveraging distinct competitive advantages and strategic positioning approaches.

Competitive strategies emphasize service quality, delivery reliability, and regulatory compliance support. Market differentiation increasingly focuses on environmental performance, with suppliers investing in cleaner fuel alternatives and sustainability initiatives. Strategic partnerships and long-term customer relationships play crucial roles in maintaining market position and growth.

Innovation initiatives include digital fuel management platforms, automated delivery systems, and alternative fuel development programs. Operational excellence in fuel quality assurance and customer service delivery serves as a key competitive differentiator in this mature market segment.

Market segmentation analysis reveals distinct patterns across multiple dimensions, providing insights into customer preferences and growth opportunities. By fuel type, the market encompasses heavy fuel oil, marine gas oil, intermediate fuel oil, and emerging alternative fuels, each serving specific vessel requirements and operational needs.

By application:

By sulfur content:

By port size:

Heavy fuel oil category continues to represent a substantial portion of Brazil’s bunker fuel market, though its share has declined following environmental regulation implementation. Traditional heavy fuel oil remains popular among vessels equipped with scrubber systems, offering cost advantages while meeting emission requirements. This category demonstrates price sensitivity and strong correlation with crude oil market movements.

Marine gas oil segment has experienced significant growth, driven by its compliance with sulfur content regulations and operational flexibility. Premium pricing for marine gas oil reflects its refined characteristics and environmental benefits. This category attracts customers prioritizing regulatory compliance and operational simplicity over cost optimization.

Low sulfur fuel oil category represents the market’s fastest-growing segment, with adoption rates exceeding 75% across major Brazilian ports. Blended fuel products in this category offer balanced performance and environmental compliance, making them attractive to diverse vessel types. Suppliers have invested heavily in blending capabilities to serve this expanding market segment.

Alternative fuel category remains nascent but shows promising development potential. Biofuel blends and synthetic alternatives are gaining attention from environmentally conscious operators and regulatory bodies. This category represents long-term growth opportunities as the maritime industry transitions toward sustainable fuel sources.

Specialty fuel products serve niche applications including offshore operations, fishing vessels, and government maritime services. Customized fuel specifications and specialized delivery services characterize this category, often commanding premium pricing for tailored solutions.

Industry participants in Brazil’s bunker fuel market enjoy several strategic advantages stemming from the country’s geographic position and economic fundamentals. Fuel suppliers benefit from access to domestic refining capacity, reducing supply chain risks and enabling competitive pricing strategies. The integrated nature of Brazil’s energy sector provides operational synergies and cost efficiencies.

Port operators gain revenue diversification through bunker fuel services, enhancing overall port profitability and customer value propositions. Fuel handling capabilities attract shipping lines and support port competitiveness in regional markets. These services create additional revenue streams while strengthening customer relationships and loyalty.

Shipping companies benefit from Brazil’s strategic location for South American trade routes and competitive fuel pricing. Reliable fuel supply and quality assurance services reduce operational risks and support schedule adherence. The availability of various fuel grades and specifications enables fleet optimization and regulatory compliance.

Government stakeholders benefit from increased tax revenues, employment generation, and enhanced maritime sector competitiveness. Environmental compliance initiatives support Brazil’s sustainability commitments while maintaining economic growth. The sector’s contribution to trade facilitation strengthens Brazil’s position in global commerce.

Local communities benefit from employment opportunities in fuel handling, logistics, and support services. Economic multiplier effects from bunker fuel operations support broader regional development and business activity. Environmental improvements from cleaner fuel adoption contribute to coastal area sustainability and quality of life.

Strengths:

Weaknesses:

Opportunities:

Threats:

Environmental sustainability emerges as the dominant trend shaping Brazil’s bunker fuel market, with increasing focus on low-carbon alternatives and emission reduction technologies. Biofuel integration represents a particularly significant trend, leveraging Brazil’s renewable energy expertise to develop marine-grade biofuel blends. This trend aligns with global shipping industry commitments to carbon neutrality and environmental stewardship.

Digital transformation continues accelerating across the market, with suppliers implementing advanced fuel management systems and automated delivery processes. Real-time monitoring capabilities enable better inventory management and customer service delivery. These technological trends improve operational efficiency while enhancing transparency and reliability in fuel supply operations.

Service integration represents another key trend, with suppliers expanding beyond basic fuel delivery to offer comprehensive maritime services. Value-added services including fuel testing, regulatory compliance support, and technical consulting differentiate suppliers and strengthen customer relationships. This trend reflects market maturation and increasing customer sophistication.

Quality standardization trends emphasize consistent fuel specifications and enhanced testing protocols. Certification programs and quality assurance systems build customer confidence and support regulatory compliance. These trends particularly benefit established suppliers with robust quality management capabilities.

Regional consolidation trends include strategic partnerships and market concentration among major suppliers. Operational synergies from consolidation enable improved service delivery and cost efficiency. This trend may reshape competitive dynamics while potentially creating barriers for smaller market participants.

Recent industry developments highlight the dynamic nature of Brazil’s bunker fuel market and ongoing adaptation to changing requirements. Infrastructure expansion projects at major ports including Santos and Rio de Janeiro have enhanced fuel storage capacity and delivery capabilities. These developments support market growth while improving service quality and operational efficiency.

Regulatory developments include implementation of enhanced environmental standards and fuel quality requirements. Brazilian maritime authorities have strengthened oversight and compliance monitoring, ensuring alignment with international standards. These regulatory changes drive market evolution toward cleaner, higher-quality fuel products.

Technology implementations across the industry include digital fuel management platforms and automated inventory systems. MarkWide Research analysis indicates that technology adoption has improved operational efficiency by approximately 12-15% among leading suppliers. These developments enhance customer service while reducing operational costs and environmental impact.

Strategic partnerships between fuel suppliers and shipping companies have created long-term supply agreements and collaborative service development. Joint ventures in alternative fuel development demonstrate industry commitment to sustainability and innovation. These partnerships strengthen market relationships while sharing development costs and risks.

Investment announcements in biofuel production facilities and blending capabilities signal market confidence in alternative fuel development. Government support programs for sustainable maritime fuel development provide additional momentum for industry transformation and environmental compliance.

Strategic recommendations for Brazil’s bunker fuel market participants emphasize the importance of environmental compliance and service differentiation. Investment in low-sulfur fuel capabilities remains essential for maintaining market competitiveness and meeting customer requirements. Suppliers should prioritize quality assurance systems and regulatory compliance infrastructure to support long-term growth.

Technology adoption represents a critical success factor, with digital fuel management systems offering significant competitive advantages. Automation investments can improve operational efficiency while enhancing customer service delivery and satisfaction. Companies should evaluate technology solutions that integrate with existing operations while providing scalability for future growth.

Alternative fuel development presents substantial long-term opportunities, particularly in biofuel blending and synthetic fuel alternatives. Research and development partnerships with academic institutions and technology companies can accelerate innovation while sharing development costs. Early investment in alternative fuel capabilities may provide competitive advantages as market demand evolves.

Customer relationship management should focus on comprehensive service offerings beyond basic fuel supply. Value-added services including technical support, regulatory compliance assistance, and fuel optimization consulting can differentiate suppliers and strengthen customer loyalty. Long-term partnership approaches may provide more stable revenue streams than transactional relationships.

Regional expansion strategies should consider Brazil’s potential as a South American bunker fuel hub. Strategic partnerships with international shipping companies and regional port operators can expand market reach while sharing investment requirements. Geographic diversification may reduce market concentration risks while capturing growth opportunities.

Future outlook for Brazil’s bunker fuel market appears positive, supported by continued growth in international trade and ongoing infrastructure development. Market expansion is expected to continue at a steady pace of 4-5% annually over the next five years, driven by increased shipping volumes and port capacity enhancements. The market’s evolution toward cleaner fuel alternatives will create new opportunities while potentially disrupting traditional supply patterns.

Environmental regulations will continue shaping market dynamics, with stricter emission standards driving demand for premium fuel products and alternative energy sources. Biofuel integration is expected to accelerate, potentially reaching 15-20% market penetration within the next decade. This transition will require substantial investment in production facilities and supply chain infrastructure.

Technology advancement will transform operational practices, with digital solutions becoming standard across the industry. Artificial intelligence and machine learning applications may optimize fuel blending, inventory management, and delivery scheduling. These technological developments will improve efficiency while reducing costs and environmental impact.

Market consolidation trends may continue, with strategic partnerships and acquisitions reshaping competitive dynamics. Economies of scale and operational synergies will favor larger, integrated suppliers while potentially creating challenges for smaller market participants. However, niche opportunities in specialized services and alternative fuels may support diverse market participation.

MarkWide Research projections indicate that Brazil’s position as a regional bunker fuel hub will strengthen, supported by infrastructure investments and competitive advantages. Long-term sustainability will depend on successful adaptation to environmental requirements and customer evolving needs. The market’s future success will require continued innovation, investment, and strategic positioning to capture emerging opportunities while managing traditional challenges.

Brazil’s bunker fuel market represents a dynamic and evolving sector that plays a crucial role in supporting the nation’s maritime economy and international trade operations. The market has demonstrated resilience and adaptability in responding to changing regulatory requirements, environmental standards, and customer needs. Strategic positioning along major shipping routes and substantial port infrastructure provide strong foundations for continued growth and development.

Key success factors for market participants include environmental compliance, service quality, and technological innovation. The transition toward cleaner fuel alternatives presents both challenges and opportunities, requiring strategic investment and operational adaptation. Market leaders will be those who successfully balance traditional fuel supply excellence with emerging alternative fuel capabilities and comprehensive customer service offerings.

Future market evolution will be shaped by environmental regulations, technological advancement, and changing customer preferences. Sustainability initiatives and digital transformation will continue driving industry change while creating new competitive dynamics. The market’s long-term success will depend on stakeholder collaboration, continued investment, and strategic adaptation to evolving requirements and opportunities in Brazil’s bunker fuel market.

What is Bunker Fuel?

Bunker fuel refers to the fuel used aboard ships, primarily for propulsion and power generation. It is a crucial component in the maritime industry, impacting shipping operations and costs.

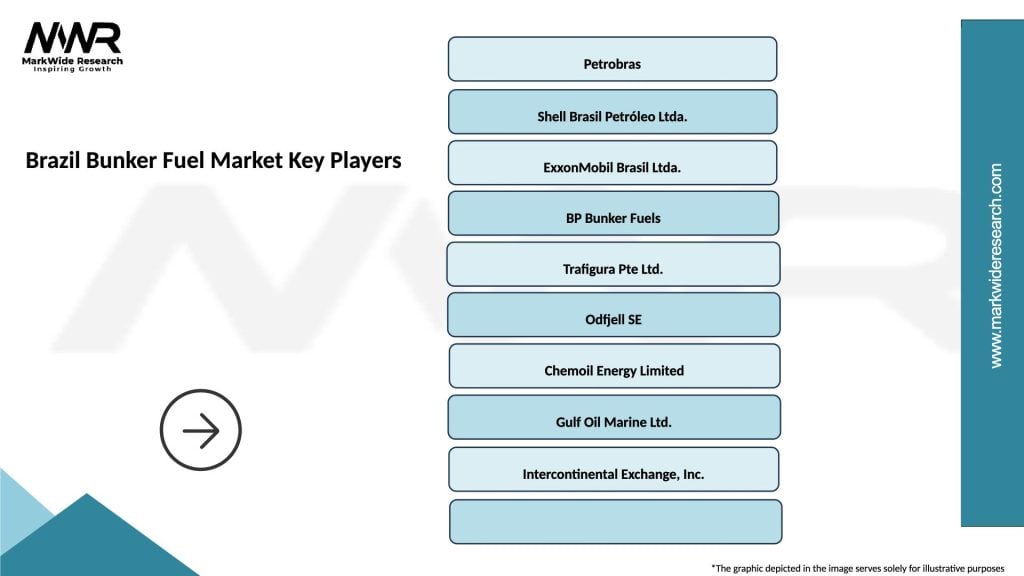

What are the key players in the Brazil Bunker Fuel Market?

Key players in the Brazil Bunker Fuel Market include Petrobras, Shell, and Trafigura, which are involved in the production and distribution of bunker fuels. These companies play significant roles in meeting the fuel demands of the shipping industry, among others.

What are the growth factors driving the Brazil Bunker Fuel Market?

The Brazil Bunker Fuel Market is driven by the increasing maritime trade and the growth of the shipping industry. Additionally, the rise in oil prices and the demand for efficient fuel solutions contribute to market expansion.

What challenges does the Brazil Bunker Fuel Market face?

The Brazil Bunker Fuel Market faces challenges such as stringent environmental regulations and the shift towards cleaner fuels. These factors can impact the availability and pricing of traditional bunker fuels.

What opportunities exist in the Brazil Bunker Fuel Market?

Opportunities in the Brazil Bunker Fuel Market include the development of alternative fuels and the adoption of new technologies for fuel efficiency. The growing focus on sustainability also opens avenues for innovation in fuel production.

What trends are shaping the Brazil Bunker Fuel Market?

Trends in the Brazil Bunker Fuel Market include the increasing use of low-sulfur fuels and the implementation of digital technologies for fuel management. These trends are driven by regulatory changes and the need for operational efficiency.

Brazil Bunker Fuel Market

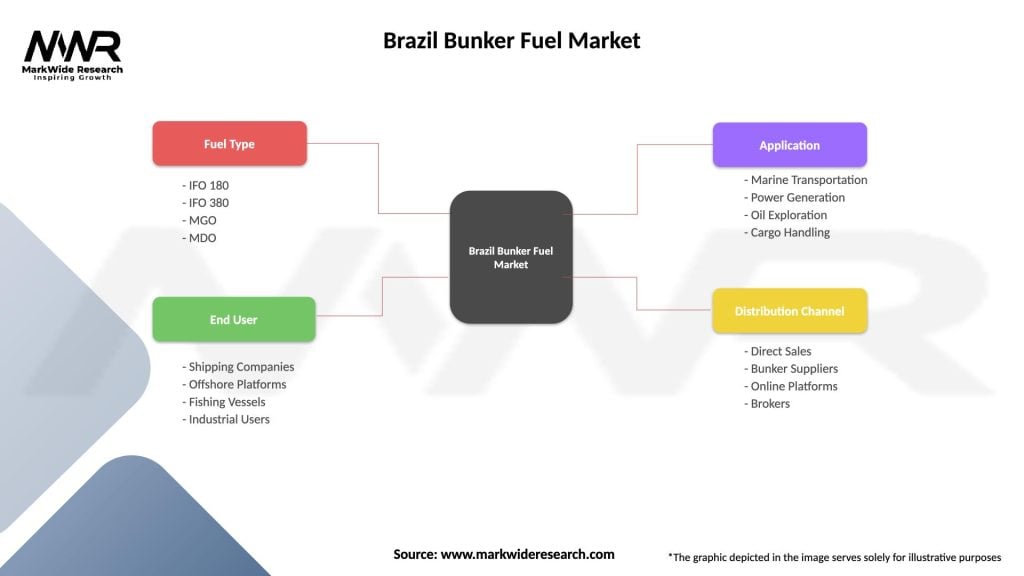

| Segmentation Details | Description |

|---|---|

| Fuel Type | IFO 180, IFO 380, MGO, MDO |

| End User | Shipping Companies, Offshore Platforms, Fishing Vessels, Industrial Users |

| Application | Marine Transportation, Power Generation, Oil Exploration, Cargo Handling |

| Distribution Channel | Direct Sales, Bunker Suppliers, Online Platforms, Brokers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Bunker Fuel Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at